Duke Royalty Limited Trading Update (9928X)

10 Mayo 2021 - 1:00AM

UK Regulatory

TIDMDUKE

RNS Number : 9928X

Duke Royalty Limited

10 May 2021

10 May 2021

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Trading Update

Duke Royalty, a provider of alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad, is pleased to provide the following trading and

operational update for its fourth financial quarter ended 31 March

2021 ("Q4 FY21"), and to provide guidance on trading for the first

quarter of the Company's financial year ended 30 June 2021 ("Q1

FY22").

Highlights:

-- Cash revenue for Q4 FY21, being cash distributions from

Duke's Royalty Partners and cash gains from sales of equity assets

was in line with expectations, totalling GBP2.5 million. This

represented a small like for like increase from the previous

quarter once the positive effects of redemptions premiums are

removed

-- In January, Duke completed a follow-on investment of GBP2.2

million into its existing royalty partner Step Investments Limited

("Step"). Duke's funds were used by Step to acquire a majority

equity stake in the Dublin-based private education subsidiary City

Education Group and to facilitate the acquisition of a majority

interest in Adtower Digital Media, a profitable Irish business

within the digital out of home advertising sector

-- In February, Duke announced the successful investment of

GBP6.2 million into a new royalty partner, Fabrikat, a long

standing, profitable fabricator of steel products supplying the UK

street lighting and guardrail markets

-- In March, Duke announced a follow-on investment of GBP4.5

million into its existing royalty partner United Glass Group

Limited ("UGG") to allow UGG to complete the acquisition of London

Architectural Glass, a UK supplier of bespoke architectural glass

to premium residential, educational and heritage projects

throughout the UK

-- Also in March, Duke announced the exit of its investment in

three river cruising vessels through the sale of its wholly-owned

subsidiary, Duke Royalty Switzerland, to Starling Fleet Holding AG.

Headline consideration for the sale was EUR11.6 million plus

interest

-- Based on current trading, Duke expects cash revenue for Q1

FY22 to increase to GBP2.8 million

Neil Johnson, CEO of Duke Royalty, said:

"I am pleased to report that Q4 FY21 was a positive and busy

quarter for Duke with several new investments completed and one

royalty partner exited. During the quarter we also successfully

transitioned Chief Investment Officers with Peter Madouros taking

over from Jim Webster, who remains an important part of Duke as the

new Chairman of the Investment Committee.

"Importantly, after quarter end Duke successfully raised GBP35

million in an oversubscribed equity placing. This fundraise gives

Duke over GBP70 million of available liquidity to deploy into its

expanding pipeline and to take advantage of the increasing

opportunities available in the alternative financing market. We

look forward to providing updates on this in due course. "

***ENDS***

For further information, please visit www.dukeroyalty.com or

contact:

Neil Johnson / Charlie

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 730 613

Cenkos Securities

plc Stephen Keys / Callum

(Nominated Adviser Davidson / Julian Morse

and Joint Broker) / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity Adam James / Georgina

(Joint Broker) McCooke +44 (0) 207 523 8000

SEC Newgate (PR) Elisabeth Cowell / Richard + +44 (0) 20 3757 6882

Bicknell / Megan Kovach dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFFDERIDIIL

(END) Dow Jones Newswires

May 10, 2021 02:00 ET (06:00 GMT)

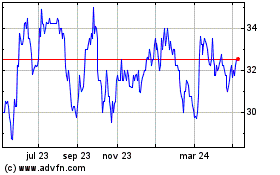

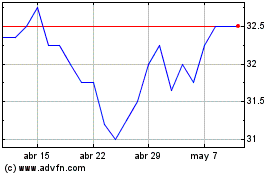

Duke Capital (LSE:DUKE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Duke Capital (LSE:DUKE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024