UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-41225

VIZSLA SILVER CORP.

(Registrant)

Suite 1723, 595 Burrard Street

Vancouver, British Columbia V7X 1J1 Canada

(Address of Principal Executive Offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the Registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the Registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VIZSLA SILVER CORP. |

| |

(Registrant) |

| |

|

|

| Date: February 21, 2024 |

By |

/s/ Michael Konnert |

| |

|

Michael Konnert |

| |

|

Chief Executive Officer |

EXHIBIT INDEX

FORM 51-102F3

MATERIAL CHANGE REPORT

Item 1 Name and Address of Company

Vizsla Silver Corp.

Suite 1723, 595 Burrard Street

Vancouver, British Columbia, V7X 1J1

(the "Company" or "Vizsla")

Item 2 Date of Material Change

February 21, 2024

Item 3 News Release

The news release was disseminated on February 21, 2024 through GlobeNewswire and filed on SEDAR+.

Item 4 Summary of Material Change

The Company announced that it has entered into an agreement with PI Financial Corp. as sole bookrunner and lead underwriter, on its own behalf and on behalf of a syndicate of underwriters (the "Underwriters"), pursuant to which the Underwriters have agreed to purchase, on a "bought deal" basis, 20,000,000 common shares (the "Shares") of the Company at a price of $1.50 per Share for aggregate gross proceeds of $30,000,000.

Item 5 Full Description of Material Change

5.1 Full Description of Material Change

The Company announced that it has entered into an agreement with PI Financial Corp. as sole bookrunner and lead underwriter, on its own behalf and on behalf of a syndicate of underwriters (the "Underwriters"), pursuant to which the Underwriters have agreed to purchase, on a "bought deal" basis, 20,000,000 common shares (the "Shares") of the Company at a price of $1.50 per Share for aggregate gross proceeds of $30,000,000 (the "Offering"), excluding additional proceeds raised from the exercise of the Over-Allotment Option (defined below).

The Company has agreed to grant the Underwriters an option to cover over-allotments (the "Over-Allotment Option"), which will allow the Underwriters to purchase up to an additional 15% of the Shares sold pursuant to the Offering, on the same terms as the Offering. The Over-Allotment Option may be exercised in whole or in part at any time, for a period of 30 days after the Closing Date (as defined herein).

The net proceeds from the Offering will be used to advance the exploration, drilling and development of the Company's Panuco Project, as well as for working capital and general corporate purposes. The Shares will be offered in each of the provinces and territories of Canada (other than the Province of Quebec) by way of a prospectus supplement to the Company's base shelf prospectus dated March 31, 2023, which will be filed with the securities regulators in each of the provinces and territories of Canada, and may also be offered by way of private placement in the United States and such other jurisdictions as agreed between the parties.

The closing of the Offering is anticipated to occur on or about February 29, 2024 (the "Closing Date") and is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory approvals, including the acceptance of the TSX Venture Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

5.2 Disclosure for Restructuring Transactions

Not applicable.

Item 6 Reliance on subsection 7.1(2) or (3) of National Instrument 51-102

Not applicable.

Item 7 Omitted Information

Not applicable.

Item 8 Executive Officer

For further information, contact:

Michael Konnert

Chief Executive Officer

Telephone: (604) 364-2215

Item 9 Date of Report

February 21, 2024

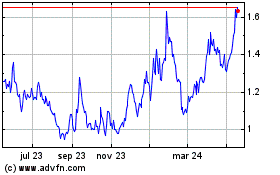

Vizsla Silver (AMEX:VZLA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

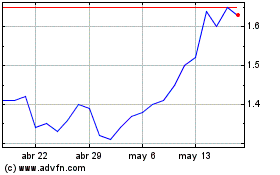

Vizsla Silver (AMEX:VZLA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025