Coinbase And Ripple Playing Game Of Poker With The SEC, CNBC Correspondent

17 Mayo 2023 - 4:30AM

NEWSBTC

Amid deep regulatory uncertainty in the United States, several

cryptocurrency firms consider sailing to more welcoming

atmospheres. Top US-based firms Ripple and Coinbase, who’ve been

cross-chairs with the Securities and Exchanges Commission (SEC),

have already hinted at possible relocation. Reacting to the issues,

two CNBC correspondents, Ryan Browne, and Arjun Kharpal, weighed

in. According to the journalists, crypto companies like Ripple and

Coinbase are playing a poker game with the SEC. Crypto Firms

Threaten Relocation To Ease Regulatory Pressure The regulatory

atmosphere in the US crypto space has become supercharged over the

past few months as the SEC accelerated their crackdown moves

against crypto companies. The SEC turned its attention to Coinbase,

Binance, Bittrex, and Kraken amid long-running litigation with

Ripple. Related Reading: Why Litecoin Is The Most Undervalued Asset

in Crypto These firms aren’t comfortable with the increased

enforcement threats from the regulators as they complain the SEC

has taken the regulation-by-enforcement approach without providing

any clear guidelines for them. Coinbase and Ripple even

threatened to relocate their business outside the US, hoping

regulators would reconsider their hawkish stance. The CNBC

correspondents further noted that Ripple executives joined forces

to publicly criticize the SEC and gain support from the broader

crypto community. Prioritizing Politics Over Policy Is

Unfavourable for the Economy, Ripple CEO Says In their report,

Browne and Kharpal quoted Ripple CEO Brad Garlinghouse, who, as a

US citizen, expressed his disappointment with the situation.

In a statement, Garlinghouse said, “The US is getting passed not

just by a little bit but by a lot.” Garlinghouse claims more

challenging is the fact that the US considers politics over policy,

an unfavorable decision for investors. On most occasions, the SEC

repeatedly argued that nearly all crypto tokens in the market

constitute securities. Related Reading: Power Play: Top 5

Cryptos Set To Ignite The Week With Decent Gains That was why the

regulator sued Ripple in December 2020, accusing the firm of

offering XRP as an unregistered security. However, Ripple has

continued to contest this issue in court with the SEC, hoping to

get a favorable ruling soon. The SEC did not only point fingers at

Ripple, as it recently came at Coinbase, issuing a Wells Notice

alleging possible securities law violation. Crypto exchange

Kraken suffered the same fate and had no choice but to discontinue

its staking services in the US with a settlement of $30

million. The SEC claims its moves are to protect Americans

from crypto investment risks. However, pro-XRP lawyer, John

Deaton, asked the SEC chief, Gary Gensler, to stop claiming to

protect the American public against crypto. These regulatory

actions have attracted reactions from industry figureheads,

including Cardano founder Charles Hoskinson. Hoskinson urged crypto

enthusiasts to support pro-crypto policies in the next elections to

stop regulatory issues. Featured image from Pixabay and chart from

TradingView

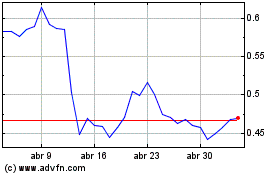

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

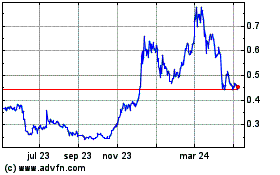

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024