Why Ethereum Price Longs Might Profit Ahead Of “The Merge”

07 Septiembre 2022 - 3:25PM

NEWSBTC

Ethereum price is close to reclaiming the area lost during

yesterday’s downside action while Bitcoin slowly crawls back into

$19,000. The second cryptocurrency by market cap is about to

experience a major event with high potential to operate as a

bullish catalyst, “The Merge”. Related Reading: Miner Sends Bitcoin

To Binance, 4th Largest Transaction In 2 Months At the time of

writing, Ethereum price trades at $1,570 with a 3% profit over the

past week. As Bitcoin was pushed down by a fresh leg down, market

participants see ETH as the potential savior of the sector. Will

Bulls Or Bears Take Control Of The Ethereum Price? Due to its

importance, many experts are speculating about the potential for

“The Merge”, the transition from Proof-of-Work (PoW) to

Proof-of-Stake (PoS), to support a relief rally in the market.

Others believe the event will operate as a “Buy the rumor, sell the

news event”. The latter often happens when there is a widely

expected event in the sector which leads to a rally followed by a

sudden crash shortly after the hype dissipates. Next week, the U.S.

Federal Reserve will publish its Consumer Price Index (CPI) print,

a metric used to measure inflation. Economist Alex Krüger claims

the CPI print might provide support for risk-on assets to rally. In

the past, cryptocurrencies have trended to the upside after this

event. Together with “The Merge”, Ethereum price seems poised for

upside volatility. The expert said on the potential set-up for ETH

traders: If trading $ETH directionally for the merge probably want

to go long into the event with stops right above the August lows

and shoot for a 1700 break to take the price into the 1800-2100

range. Whether ETH’s price can sustain the bullish momentum post

“Merge”, Krüger believes that this will depend on the strength of

the price action. If Ethereum can run hot into the event, the price

might be able to flip key resistance levels into support. Can “The

Merge” Trigger A New Crypto Bull Run? Despite its importance,

Krüger believes “The Merge” might be unable to push the crypto

market into price discovery. Legacy financial markets are trending

downside, alongside cryptocurrencies. This is the most important

overhead resistance only a couple of days before this event. Krüger

added: Fundamentally the merge improves ETH attractiveness via

lower energy consumption and more importantly vastly improved

tokenomics (…). That is highly likely not enough to kickstart a

bull market by itself. Need a bull market in equities for that. To

me the idea of $ETH decoupling is what I call a pipedream. If

equities bounce with the CPI print, crypto will find further

support. However, macro conditions might continue to remain

unfavorable for the rest of 2022 as hinted by Fed Chair Jerome

Powell. Related Reading: Why Extreme Fear Is Back In Crypto In A

Big Way Presenting an opposite thesis, in the video below, our

Editorial Director Tony Spilotro looks into the current market

conditions and why a decline in Bitcoin dominance might hint at a

new Altcoin Season. This could have positive implications for

Ethereum price heading into “The Merge”. Take a look.

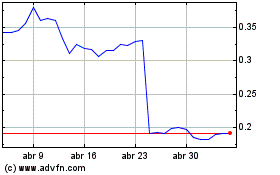

MIS (COIN:MISSUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

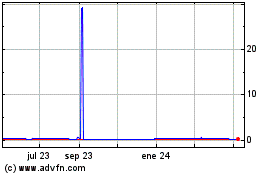

MIS (COIN:MISSUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024

Real-Time news about MIS (Criptodivisas): 0 recent articles

Más de MIS Artículos de Noticias