Bitcoin Open Interest Takes Second Largest Dump Of 2021

08 Diciembre 2021 - 11:00AM

NEWSBTC

Bitcoin has recorded significant losses in just the first week of

December. The digital asset has taken some of the largest hits for

the year in just last week alone following liquidations over the

weekend. This has expectedly had a huge impact on the amount of

open interest in bitcoin. Following the dump, BTC denominated open

interest took a nosedive. The dip in open interest was significant

enough to near-record levels for 2021. With bitcoin losing more

than $10,000 in value, open interest had declined rapidly. This is

worrying given that open interest had dropped not too long ago and

another drop this time around does not spell good news for the

market. Related Reading | Majority Of Bitcoin Investors Got In

This Year, Says Grayscale Bitcoin Open Interest Records

Second-Largest Decline With the drop from $54,000 to as low as

$40,000 on some exchanges, open interest figures plummeted. The

liquidations of future positions opened the asset up to a cascade

of further liquidations and open interest dropped 26% in this time

frame. BTC dominated open interest volumes fell from 390,000 BTC to

330,000, as reported by Arcane Research. BTC Open Interests sees

shart decline | Source: Arcane Research Saturday saw the

second-largest daily drop in open interest as it lost 58,000 BTC in

one day alone. It is the largest decline in a six-month period as

the last time the market recorded such a sharp decline in open

interest was on May 19th, which admittedly recorded a larger

decline than that witnessed on Saturday. The drop in BTC

denominated open interest correlates with the drop in price. OI

(open interest) had peaked in April during the height of the first

bitcoin bull rally but has repeatedly failed to attain the same

high despite bitcoin recording a new high of $69,000 last month.

Another dip sends BTC price to $49K | Source: BTCUSD on

TradingView.com What Caused The Decline? Violent sell-offs in the

market following the bitcoin price crash had been the main culprit

behind the decline in open interest. The sell-offs greatly

deleveraged the market, leading to losses to the tune of billions.

Although the futures market has now been thrown into a healthier

state following the sell-off. Related Reading | Number Of

Bitcoin Lightning Network Nodes Jumps 23% In Three Months The

massive deleveraging saw crypto exchanges Binance and ByBit lose a

significant portion of their open interest share. Both exchanges

saw their shares of this market plunge 11% to its current position

at 30%. Binance recorded a 40% fall in OI on its platform and ByBit

recorded an even higher decline with a 45% crash in OI. Open

interest is now $3.3 billionaire and $1.6 billion respectively on

both exchanges. Bitcoin denominated open interest has not recorded

much recovery since the December 4th crash. Currently, open

interest sits at 325,000 BTC, about 5,000 BTC lower than the

330,000 crash point on Saturday. Featured image from The Spruce,

charts from Arcane Research and TradingView.com

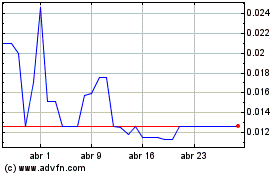

Rally (COIN:RLYUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

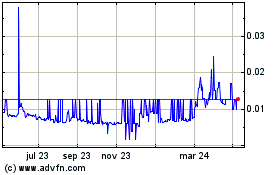

Rally (COIN:RLYUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024

Real-Time news about Rally (Criptodivisas): 0 recent articles

Más de Rally Artículos de Noticias