Why Are Traders Super Bearish On Chainlink, Solana, and Bitcoin?

10 Octubre 2024 - 2:00PM

NEWSBTC

As the crypto market struggles to shake off the weakness of last

week, the latest sentiment data from Santiment shows that token

holders and traders are bearish on some of the top altcoins.

According to their recent analysis, token holders are bearish the

most on Chainlink–a middleware solution that powers DeFi and NFTs,

Ethereum, Solana, and Bitcoin. Out of their assessment, it is

interesting to note that these coins on focus are those in the top

10, except for Chainlink that is still perched outside the top 20.

While Chainlink tops the list, others, mainly Ethereum, Solana, and

Bitcoin, are in the top 5. Chainlink Struggling Despite CCIP

Success, Ethereum Disappoints Although Santiment didn’t provide a

reason to explain why the community is bearish on these tokens,

there are fundamental factors that prop up this outlook. Despite

being a leader in DeFi through their Oracle solution and

Cross-Chain Interoperability Protocol (CCIP), Chainlink still

struggles for momentum. Related Reading: Analyst Warns Of Bitcoin

Market Shift: Are We Near A Major Sell-Off? LINK, the native token,

rose to as high as $22, which is below the 2021 highs and is

currently down 53% from the 2024 highs. Considering its role in

DeFi and NFTs, holders expected the token to float higher,

outperforming the market. This was especially so after the launch

of the CCIP solution, which has found adoption among some of the

top DeFi and TradFi platforms. Pessimism about Ethereum’s outlook

could also stem from disappointment following the approval of the

first batch of spot Ethereum ETFs. Unlike Bitcoin, whose prices

ripped higher, breaking above $70,000 to as high as $74,000, spot

Ethereum ETFs have not been as successful. As of October 10, Soso

Value shows that all issuers in the United States managed just over

$6.6 billion. Even so, there are massive outflows from Grayscale’s

ETHE, heaping massive pressure on ETH prices. The second most

valuable coin is still trading below $2,800 and is moving sideways

in a possible distribution. Solana Suffers As Meme Coin Momentum

Fades, Impact Of FTX Asset Distribution Solana, on the other hand,

is also under pressure. The success of Pump.fun, which saw hundreds

of thousands of meme coins deployed, supported prices. However, as

Tron gains market share, the momentum is fading, negatively

impacting prices. Related Reading: Why Is Bitcoin Price Stagnating?

Investment Firm CEO Answers Moreover, in the coming few months, FTX

trustees will distribute nearly $16 billion of assets to victims.

Even though some might continue to HODL, others will choose to

liquidate–a negative for the coin. Feature image from DALLE, chart

from TradingView

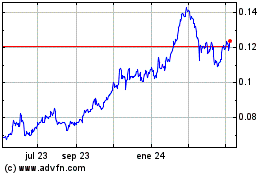

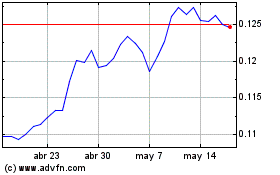

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025