Anonymous Trader Buys $344 Million Worth of Bitcoin

28 Febrero 2018 - 12:10PM

InvestorsHub NewsWire

Bitcoin Global News (BGN)

February 28, 2018 -- ADVFN Crypto NewsWire -- The highest high

roller in Las Vegas is putting chump change on the table compared

with a wager from latest Bitcoin whale to surface. A bitcoin buyer

with address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 nearly doubled down

on their holdings, adding 41,000 bitcoins to an existing stash of

55,000 bitcoins that had been bought in December 2017.

The anonymous buyer took advantage of the recent cryptocrash

where industry leader Bitcoin dipped below $6,000 per coin in early

February. The mystery buyer spent $344,000,000 USD at a blended

bitcoin cost basis of $8,400 from February 9 - 12. On February 9th

the buyer bought 46,000 bitcoins, and then added another 9,000

bitcoins on February 12th, for a new total holdings of 96,000

bitcoins worth around $1 billion at today’s price.

The buyer impacted the cryptocurrency industry at large.

Telegram channels and social media were abuzz with theories about

who the buyer might be. Most guesses were that the buyer was either

a corporate investor adding bitcoins to its larger holdings, a deep

pocketed and highly risk tolerant speculator, or maybe even the

Winklevoss twins. It was later determine that the buyer was not the

twins, but in the meantime news quickly spread on social media and

chat forums, convincing other risk-takers that the volatile bitcoin

had settled down into a new steady low.

The top cryptocurrencies slumped to their lowest levels in

months in early February. But the price dump was not the

cryptocurrency bubble pop that many wary analysts have predicted.

With the recent surge in valuations, a total cryptocurrency market

capitalization of $1 trillion again does not seem out of reach.

Indeed, bitcoin has since surged above $10,000, helped by signs

from officials in Washington and Asia of a growing recognition of

the legitimacy of digital currencies. Cryptocurrency markets tend

to noticeably surge anytime there is a significant improvement in

regulatory clarity.

The anonymous entity that bought $344 million in bitcoins from

February 9 – 12 added an unquantifiable amount of fuel to the

rebound by proving that experienced traders are watching the market

and are set to leap in when they sense that a cryptoasset’s value

has bottomed out.

By: BGN Editorial Staff

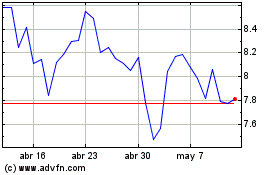

VeChain (COIN:VENUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

VeChain (COIN:VENUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024

Real-Time news about VeChain (Criptodivisas): 0 recent articles

Más de Vechain Artículos de Noticias