Regulatory News:

NHOA S.A. (EURONEXT PARIS: NHOA.PA) (“NHOA” or the

“Company”) announces that it has revised downward its

consolidated revenue and EBITDA 2025 targets and 2030 outlook, as

they were set in its 2023 Universal Registration Document (§ 11)

and as announced during NHOA’s Capital Markets Day 2023. This

follows NHOA’s press release of June 26, 2024 in which the Company

announced that this guidance was under review.

The table below summarizes the main short term financial targets

and long-term outlook for NHOA Group, on a consolidated basis and,

for revenues, for each business unit, i.e. the energy storage

business unit (“NHOA Energy”), the eMobility joint venture

with Stellantis Free2Move eSolutions (“Free2Move”) and the

fast and ultra-fast charging network of Atlante.

Revenues

EBITDA

2025

Consolidated revenues target of over

€500m, expected to be generated as follows:

- NHOA Energy: 60%

- Free2Move: 40%

- Atlante will have only a marginal contribution to the

consolidated revenues target

Consolidated EBITDA margin target of

3%

2026

Consolidated revenues target of over

€650m, expected to be generated as follows:

- NHOA Energy: 60%

- Free2Move: 35%

- Atlante: 5%

Consolidated EBITDA margin target of

7%

2030

Consolidated revenues outlook of over

€1,500m, expected to be generated as follows:

- NHOA Energy: 60%

- Free2Move: 35%

- Atlante: 5%

Consolidated EBITDA margin outlook of

12%

As indicated in NHOA’s June 26, 2024 press release, this

downward revision of the Company’s guidance stems from recent

unfavorable developments in both the electric vehicles’

(“EV”) and the energy storage markets, that have undermined

the underlying assumptions (“2023 Assumptions”) of the

guidance released with the Capital Markets Day 2023 and reflected

in the 2023 Universal Registration Document (“2023

Guidance”). More specifically:

- In the EV market, the growth in sales of EVs has significantly

slowed down compared to what was anticipated during the Capital

Markets Day 2023. In Italy for instance, where Atlante has 48% of

its points of charge, the 2023 Guidance was assuming 827 thousand

EVs in the country as at H1 2024, while today we stand at 243

thousand, meaning -71% less EVs than expected, with the consequent

impact on utilization rates and revenues generation for the Atlante

network. Similar situation in Spain (-63%), less negative in France

(-22%) while more reassuring in Portugal, where the EV fleet is

substantially in line with the 2023 Assumptions, but where Atlante

operates just 24% of its infrastructure. The new Bloomberg’s EV

Market Outlook published on June 12, 2024 reports an unexpected

negative trend in Italy (-24% EV sales year-on-year at Q1 2024) and

forecasts 450 thousand EVs in the country by 2025 and 833 thousand

in 2027, meaning a three years and a half delay of the market

compared the 2023 Assumptions. Indeed, several automakers have cut

their near-term goals – including Tesla, Mercedes-Benz, General

Motors and Ford – for electric vehicles. With the recent increases

in custom duties on Chinese EVs adding to these trends. This is

coupled with a growing uncertainty on the policy support for EVs,

compared to one year ago shown for example by the reductions in EV

incentives in some countries and postponement of the phase-out from

internal combustion sales in others, all in a period of important

elections, in which the outcome could reduce the pressure on the

sector to decarbonize, like for example European elections and ones

in the United States. While the outlook for Free2Move remains in

line with the 2023 Guidance, the impact on Atlante is very

significant. The lesser than expected utilization rate of 2.0% in

Q1 2024 (compared to 2.2% in the whole 2023) is the early sign of

the unfolding consequences of this state of events. One of the keys

to Atlante’s initially planned development was the capacity to fund

the rolling out of its ambitious operational goals thanks to a

combination of its own cash flows, outside debt (raised on the back

of the positive cash flows), public funding and a potential

strategic partner. With much lower cash flows expectation than

planned, this funding strategy cannot be implemented. As a result,

the revised guidance at this stage can only assume existing funding

for Atlante’s development. By 2025, Atlante would therefore plan to

reach 3,000 charging points online (reduced from the 5,000

initially planned). Without additional funding, for which NHOA does

not have any visibility at present, the new guidance can only

assume development of Atlante network until end of 2025. In other

words, the revised guidance assumes in 2030 substantially the same

number of points of charge targeted for end of 2025.

- In the energy storage market, over the last 6-9 months abrupt

oversupply of batteries (that normally represent 60-70% of project

costs) from China has led to a reduction in the nominal value of

contracts, as customers reasonably expect NHOA Energy and its

competitors to pass on the resulting batteries price reduction to

them. Furthermore, counterparty risk has increased on the supplier

side due to the strong margin compression for battery makers, and

NHOA Energy has therefore been more selective in the commercial

opportunities it is pursuing. This leads to foresee a delay of

approximately two years in the achievement of the medium-term

financial targets released with the Capital Markets Day 2023,

driven by a more cautious short-term outlook until market

rebalances.

NHOA will publish its First Half 2024 Results on July 25, 2024,

as planned.

Readers are reminded that, on June 13, 2024 TCC Group Holdings

Co., Ltd, NHOA’s indirect majority shareholder, has declared its

intention to file a simplified tender offer (to be followed by a

squeeze out if the legal conditions are met) on the shares of the

Company.

NHOA Group

NHOA S.A. (formerly Engie EPS), global player in energy storage,

e-mobility and EV fast and ultra-fast charging network, develops

technologies enabling the transition towards clean energy and

sustainable mobility, shaping the future of a next generation

living in harmony with our planet.

Listed on Euronext Paris regulated market (NHOA.PA), NHOA Group

forms part of the CAC® Mid & Small and CAC® All-Tradable

financial indices.

NHOA Group, with offices in France, Spain, Portugal, United

Kingdom, United States, Taiwan and Australia, maintains entirely in

Italy research, development and production of its technologies.

For further information, go to www.nhoagroup.com

Follow us on LinkedIn Follow us on Instagram

Forward looking statement

This release may contain forward-looking statements. These

statements are not undertakings as to the future performance of

NHOA. Although NHOA considers that such statements are based on

reasonable expectations and assumptions at the date of publication

of this release, they are by their nature subject to risks and

uncertainties which could cause actual performance to differ from

those indicated or implied in such statements. These risks and

uncertainties include without limitation those explained or

identified in the public documents filed by NHOA with the French

Financial Markets Authority (AMF), including those listed in the

“Risk Factors” section of the NHOA 2023 Universal Registration

Document, filed with the AMF on April 12, 2024 (under number

D.24-0279). Investors and NHOA shareholders should note that if

some or all of these risks are realized they may have a significant

unfavorable impact on NHOA.

These forward looking statements can be identified by the use of

forward looking terminology, including the verbs or terms

“anticipates”, “believes”, “estimates”, “expects”, “intends”,

“may”, “plans”, “build- up”, “under discussion” or “potential

customer”, “should” or “will”, “projects”, “backlog” or “pipeline”

or, in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward looking

statements include all matters that are not historical facts and

that are to different degrees, uncertain, such as statements about

the impacts of the war in Ukraine and the current economic

situation pandemic on NHOA’s business operations, financial results

and financial position and on the world economy. They appear

throughout this announcement and include, but are not limited to,

statements regarding NHOA’s intentions, beliefs or current

expectations concerning, among other things, NHOA’s results of

business development, operations, financial position, prospects,

financing strategies, expectations for product design and

development, regulatory applications and approvals, reimbursement

arrangements, costs of sales and market penetration. Important

factors that could affect performance and cause results to differ

materially from management’s expectations or could affect NHOA’s

ability to achieve its strategic goals, include the uncertainties

relating to the impact of war in Ukraine and the current economic

situation on NHOA’s business, operations and employees. In

addition, even if the NHOA’s results of operations, financial

position and growth, and the development of the markets and the

industry in which NHOA operates, are consistent with the

forward-looking statements contained in this announcement, those

results or developments may not be indicative of results or

developments in subsequent periods. The forward-looking statements

herein speak only at the date of this announcement. NHOA does not

have the obligation and undertakes no obligation to update or

revise any of the forward-looking statements.

Disclaimer

This press release has been prepared for information purposes

only. It does not constitute an offer to purchase or a solicitation

to sell NHOA shares in any country, including France. There is no

certainty that the simplified tender offer mentioned above will be

filed or opened. Under French law, the offer can only be made in

accordance with the offer documentation, which must contain the

full terms and conditions of the offer. The offer documentation

must be submitted to the AMF for review, and the offer may not be

opened until the AMF has issued a clearance decision (déclaration

de conformité). Any decision relating to the offer must be based

exclusively on the information contained in the offer

documentation.

The dissemination, publication or distribution of this press

release may be subject to specific regulations or restrictions in

certain countries. The offer will not be addressed to persons

subject to such restrictions, either directly or indirectly, and

will not be accepted from any country where the offer would be

subject to such restrictions. Accordingly, persons in possession of

this press release are required to inform themselves about and to

comply with any local restrictions that may apply. The Company

declines all responsibility for any breach of these restrictions by

any person whatsoever.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240705614151/en/

Press Office: Claudia Caracausi and Davide Bruzzese,

Image Building, +39 02 89011300, nhoa@imagebuilding.it Press

Office France: Roxane Planas, +33 6 37 05 84 42, Charlotte Le

Barbier, +33 6 78 37 27 60, and Renault Enguerand, Image7,

atlante@image7.fr Financial Communication and Institutional

Relations: Chiara Cerri, +39 337 1484534, ir@nhoagroup.com

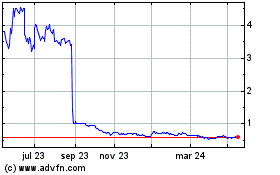

NHOA (EU:NHOA)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

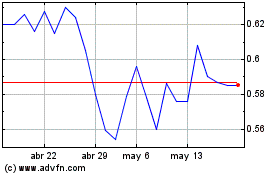

NHOA (EU:NHOA)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024