Press Release

Results 2023VANTIVA

ACHIEVES ITS OBJECTIVES

Strong margin resilience in a difficult

environmentAdjusted EBITDA of 142 million eurosAdjusted EBITDA

margin up 1 point to 6.8% of sales Adjusted EBITA at 57 million

eurosPositive FCF (before interest and tax) of 13 million euros The

group confirms the potential of synergy resulting from Home

Networks acquisition

Paris – March 26, 2024 – Vantiva (Euronext Paris:

VANTI), announces its financial results for the year 2023.

These results were approved by the Board of Directors today.

The audit procedures on the consolidated financial statements

have been completed, and the certification report will be issued

once the verification of the management report and the due

diligence relating to the electronic ESEF format of the 2023

financial statements have been finalized.

Results for the 2023 financial year are in line with

targets, despite the difficult economic

climate.

- Sales fell by 25.3% to 2,075 million euros (-23.3% at constant

exchange rates).

- Adjusted EBITDA totaled 142 million euros (-11.7%), with the

margin rising to 6.8% of sales from 5.8% in 2022.

- Adjusted EBITA rose slightly to 57 million euros (versus 55

million euros in 2022).

- Net income from continuing operations was a loss of 283 million

euros, compared with a loss of 529 million euros in 2022, which

took into account a negative contribution of 311 million euros from

equity-accounted earnings resulting from the impairment of the

value of TCS shares.

- Group net income was a loss of 285 million euros, compared with

a profit of 151 million euros, which included a profit of 680

million euros from "discontinued operations", mainly due to the

distribution of TCS shares.

- Free cash flow, before interest

and taxes, was positive at 13 million euros, down by 75 million

euros compared with 2022, due to the decline in EBITDA and above

all to the negative impact of changes in working capital.

- At year-end, Vantiva held cash

and cash equivalents of 133 million euros and an undrawn credit

line of 76 million euros.

- Total net debt (excluding asset

leases) amounted to 366 million euros (nominal).

Luis Martinez-Amago, Chief Executive

Officer of Vantiva, said:

"We are proud to have achieved our targets against a backdrop of

reduced customer orders in both our Connected Home where customers

are still holding excess inventories and Supply Chain Solutions

where the new diversified offer is still not compensated the

natural decline in Disks. The strong resilience shown by our

improved adjusted EBITDA margin, despite the significant drop in

sales, demonstrates the company's agility and responsiveness in

responding to a highly volatile environment in a context of cost

inflation. This performance gives me particular confidence in the

successful integration of the acquisition of CommScope's Home

Networks business. This acquisition is a strategic turning point

for Vantiva and ideally positions the group to meet the challenges

of our industry and achieve unprecedented financial results for the

company. I would like to thank all our teams for their commitment,

without which these results would not have been possible".

I- Key points 2023 and

outlook 2024

| |

|

|

|

|

|

In € million, continuing operations |

2023 |

2022 |

Real exchange rates |

Constant exchange rates |

| Sales

figures |

2,075 |

2,776 |

(25.3)% |

(23.3)% |

| Adjusted

EBITDA |

142 |

161 |

(11.7)% |

(9.2)% |

|

As % of sales |

6.8% |

5.8% |

105 bps |

106 bps |

| Adjusted

EBITA |

57 |

55 |

2.9% |

6.1% |

|

Free cash flow before interest and taxes |

13 |

88 |

(75) |

(74) |

Key points 2023

The group's business was penalized by the general economic

environment and the reduction in investment budgets by major

telecom network and cable operators, against a backdrop of high

inventories. The company's responsiveness to this situation enabled

it to limit the decline in adjusted EBITDA in absolute terms, and

to improve the margin as a percentage.

Vantiva sales totaled 2,075 million euros, down 25.3% (-23.3% at

constant exchange rates). "Connected Home" contributed 1,563

million, down 26.3% (-24.2% at constant exchange rates), while

"Supply Chain Solutions" sales fell by 21.9% to 512 million euros

(-20.3% at constant exchange rates).

Adjusted EBITDA came to 142 million euros for the group. The

decline in this indicator was limited to 19 million euros. This

decline was mainly due to the impact of lower sales in both

divisions, largely but not totally offset by cost-cutting measures

and tight control of central costs. The contribution of "Connected

Home" is 120 million euros (compared with 135 million in 2022) and

that of "Supply Chain Solutions" 45 million euros (compared with 56

million in 2022).

Cost-containment measures improved EBITDA margin, which rose by

105 basis points to 6.8% of sales.Free cash flow before financial

expenses and taxes is positive at €13 million, compared with €88

million in 2022. This deterioration is largely explained by lower

EBITDA and the negative impact of changes in working capital.

Outlook

The beginning of the year confirms that 2024 should be another

challenging year for Connected Home business. Major telco operators

are cutting their capex program for the year and this will weigh on

demand for CPE. We are expecting the market to start to recover by

the end of 2024.

For Supply Chain Solutions, Vantiva anticipates a natural

decline in demand for optical discs, and an increase in sales for

"growth activities". The increase in vinyl records production

capacity should continue to be one of the main growth drivers in

this area.

Against this backdrop, Vantiva management will be focused on the

success of Home Networks’ integration and will continue to make the

needed structural adjustments for preserving the profitability.

For the fiscal year 2024, the group aims to achieve the

following:

- Adjusted EBITDA > €140 million

- FCF(1)> €0 million

(1)After financial expenses and taxes and before restructuring

and integration costs related to HN acquisition.

This outlook is based on a €/$ parity assumption of 1.08.

By 2026, the management is confident that

Vantiva will generate a sustainable and healthy positive FCF, after

interest, tax and restructuring costs.

II- Analysis by division

- Highlights of 2023 resultsConnected

Home

Breakdown of sales by product

| |

|

|

|

|

|

In € million |

2023 |

2022 |

Real exchange rates |

Constant exchange rates |

| Sales

figures |

1,563 |

2,120 |

(26.3)% |

(24.2)% |

| Of which |

|

|

|

|

|

Broadband |

1,262 |

1,598 |

(21.1)% |

(19.0)% |

|

Video |

301 |

522 |

(42.3)% |

(39.9)% |

|

|

|

|

|

|

| Adjusted

EBITDA |

120 |

135 |

(10.4)% |

(8.3)% |

|

As % of sales |

7.7% |

6.3% |

|

|

The contribution of the Connected Home division

accounted for 75% of group sales (versus 76% in 2022) and totaled

1,563 million euros, down 26.3%. At constant exchange rates, the

decline would have been -24.2% compared with 2022. This is

primarily the result of falling volumes in all regions where the

group is active, due to reduced investment programs by telecom and

cable network operators. Broadband products, especially fiber, held

up better than video products, which were particularly hard hit,

notably in North America, by the decline in Android TV products.

Broadband accounted for over 80% of the division's sales, compared

with 75% the previous year.

The division's adjusted EBITDA represented 85%

of the group total, versus 84% in 2022. It amounted to 120 million

euros for 2023 versus 135 million in 2022, or 7.7% of sales (6.3%

in 2022). This increase in the margin rate illustrates the

cost-cutting measures rapidly deployed to offset the decline in

activity.

Supply Chain Solutions

Sales and EBITDA

|

In € million |

2023 |

2022 |

Real exchange rates |

Constant exchange rates |

| Sales

figures |

512 |

655 |

(21.9)% |

(20.3)% |

|

Adjusted EBITDA |

45 |

56 |

(20.4)% |

(18.4)% |

|

As % of sales |

8.8% |

8.6% |

|

|

Sales for the “Supply Chain Solutions” division

amounted to €512 million in 2023, down 21.9% on 2022. At constant

exchange rates, the decline would have been -20.3%. The structural

decline in optical disc sales was amplified by the downturn in

consumer discretionary spending, particularly in North America, but

partially offset by price increases. Other logistic activities

remained relatively stable despite this unfavorable environment.

Vinyl record sales rose following the commissioning of new

production capacity.

The division's adjusted EBITDA amounted to 45

million euros (vs. 56 million in 2022), representing 8.8% of sales

vs. 8.6% in 2022. The decline was limited thanks to cost

reductions, price increases and the ramp-up of the vinyl record

business. As a result, adjusted EBITDA margin improved by 17 basis

points.

Corporate & Other

|

In € million |

2023 |

2022 |

Real exchange rates |

Constant exchange rates |

| Sales

figures |

1 |

1 |

Ns |

Ns |

|

Adjusted EBITDA |

(23) |

(30) |

Ns |

Ns |

|

As % of sales |

ns |

ns |

|

|

Corporate & Other recorded sales of 1

million euros, as in 2022. Adjusted EBITDA amounted to -23 million,

an improvement of 7 million euros in 2022 due to strict control of

central services operating expenses.

III- Income statement

analysisIncome statement

| |

|

|

|

|

|

In € million |

2023 |

2022 |

Real exchange rates |

Constant exchange rates |

|

Sales from continuing operations |

2,075 |

2,776 |

(25.3)% |

(23.3)% |

|

Adjusted EBITDA from continuing operations |

142 |

161 |

(11.7)% |

(9.2)% |

| % of

sales |

6.8% |

5.8% |

105 bps |

106 bps |

|

D&A & provisions1 (excluding amortization of intangible

assets acquired) |

(86) |

(106) |

19.2% |

17.2% |

| Adjusted

EBITA from continuing operations |

57 |

55 |

2.9% |

6.1% |

| % of

sales |

2.7% |

2.0% |

74 bps |

76 bps |

|

PPA Amortization |

(26) |

(31) |

16.7% |

14.7% |

|

Non-recurring items |

(167) |

(35) |

ns |

ns |

|

EBIT from continuing operations |

(136) |

(11) |

ns |

ns |

| % of

sales |

(6.5)% |

(0.4)% |

na |

na |

| Net financial

income (expense) |

(107) |

(177) |

39.7% |

39.0% |

| Income

tax |

(15) |

(30) |

48.9% |

48.0% |

|

Contribution from equity affiliates |

(25) |

(311) |

ns |

ns |

| Net

income from continuing operations |

(283) |

(529) |

ns |

ns |

|

Results of discontinued operations |

(2) |

680 |

ns |

ns |

|

Net income for the year |

(285) |

151 |

ns |

ns |

1 Provisions for risks, litigation and guarantees.

Sales for 2023 amounted to 2,075 million euros,

down 25.3% (-23.3% at constant exchange rates), due to the downturn

in our main markets for "Connected Home", notably in North America,

and for video decoders. The contribution of the "Supply chain

Solutions" division fell by a similar amount, due to the continuing

downturn in the DVD business, marginally offset by an increase in

growth activities.

Adjusted EBITDA totaled 142 million euros, down

11.7% and 9.2% at constant exchange rates. By contrast, adjusted

EBITDA margin improved by 105 basis points to 6.8% of sales. This

improvement, against a backdrop of a significant contraction in

business, reflects the impact of cost-cutting measures which were

implemented rapidly and effectively.

Adjusted EBITA of €57 million was up €2 million

despite the fall in adjusted EBITDA, due to lower depreciation and

provisions.

PPA amortization totaled -26 million euros,

compared with 31 million euros.

Non-recurring items showed a negative balance

of 167 million euros, due to:

- Restructuring costs

of -14 million euros, compared with -17 million in 2022, following

a drop in expenses for “Supply Chain Solutions” and Corporate,

while they increased by 2 million for “Connected Home";

- Other income and

expenses, which represented an expense of -14 million

euros versus -13 million euros the previous year, mainly due to

costs incurred in connection with the acquisition of Home

Networks;

- Impairment losses

on non-current assets of -139 million euros (vs. -5 million in

2022) following the impairment of "Supply Chain Solutions" goodwill

recorded in the first half of the year.

As a result, EBIT is negative by -136 million

euros, compared with a loss of -11 million in 2022.

Net financial expense amounted to -107 million

euros for 2023, compared with -177 million the previous year.

Net interest expense on debt (excluding asset leases) came to

-70 million euros, compared with -167 million euros in 2022. It

should be remembered that the cost of debt in 2022 was impacted by

the cost of early repayment of debt prior to completion of the

Spin-Off.

Other financial expenses of -37 million euros were mainly due to

impairment of TCS assets and an increase in pension

commitments.

Income tax amounted to -15 million euros,

compared with -30 million euros in 2022.

Equity-accounted income was a loss of -25

million euros versus -311 million euros in 2022, mainly due to the

impairment of the value of the 35% stake in TCS.

Net income from continuing operations for the

year was therefore -283 million euros, compared with -529 million

euros in 2022.

Group net income was a loss of -285 million

euros, compared with a profit of 151 million euros, which took into

account the gain on the valuation of TCS at the time of the

Spin-Off.

Cash flow and debt analysis

| |

|

|

|

|

|

In € million |

2023 |

2022 |

Real exchange rates |

Constant exchange rates |

|

Adjusted EBITDA from continuing operations |

142 |

161 |

(19) |

(15) |

|

Investments |

(77) |

(80) |

3 |

1 |

| Non-recurring

expenses (cash impact) |

(45) |

(50) |

5 |

5 |

|

Change in WCR and other assets and liabilities |

(8) |

57 |

(65) |

(65) |

|

Free cash flow before interest and taxes |

13 |

88 |

(75) |

(74) |

|

|

31/12/2023 |

31/12/2022 |

|

Gross nominal debt (including lease liabilities) |

555 |

449 |

|

Cash and cash equivalents |

(133) |

(167) |

| Net

nominal debt (non-IFRS) |

422 |

282 |

|

IFRS adjustments |

(15) |

(19) |

|

Net financial debt (IFRS) |

407 |

263 |

Free cash flow before interest and taxes fell

from +88 million euros to +13 million. This decline was due to

adjusted EBITDA (-19 million), and changes in working capital (-65

million), while capital expenditure and restructuring costs were

down by 3 and 4 million euros respectively.

The change in working capital requirements is

mainly due to the negative impact of lower sales and customer order

deferrals.

Pension commitments fell by 10 million euros after taking into

account payments made for 28 million euros, a negative actuarial

effect of 7 million euros and a net charge for the year of 12

million euros.

Cash out for restructuring amounted to -18

million euros versus -22 million euros.

Capital expenditure amounted to -77 million

euros, a decrease of 3 million euros compared to 2022. Most of this

was R&D capital expenditure.

The cash position at the end of December 2023

was 133 million euros, compared with 167 million euros a year

earlier.

Nominal net debt at the end of the year stood

at 422 million euros, an increase of 140 million due mainly to

negative FCF (after interest and tax cash out), non-cash interest

and new leases.

Under IFRS, net debt was €407 million at

December 31, 2023.

Post-closing event

On October 3, 2023, the group announced an agreement to acquire

CommScope's home connectivity business. This acquisition was

finalized on January 9, 2024. For further details, please refer to

the press releases published on these dates and available on our

website.

Appendice 1

Debt details

In € million

|

Line |

Features |

Nominal |

IFRS amount |

Nominal rates |

IFRS rates |

|

Barclays |

Cash: Euribor 3M + 2.50% & PIK |

258 |

249 |

10.4% |

13.7% |

|

Angelo Gordon |

Cash: Euribor 3M + 4.00% & PIK |

131 |

125 |

13.4% |

18.0% |

|

Angelo G Barclays STL |

PIK:E + 10% SALES |

85 |

85 |

14.0% |

31.4% |

|

Wells Fargo |

WF prime rate + 1.75 margin |

0 |

0 |

10.3% |

10.3% |

|

Lease commitments |

|

56 |

56 |

15.4% |

15.4% |

|

Leasing |

|

2 |

2 |

10.9% |

10.9% |

|

Accrued interest & Other |

|

24 |

24 |

0.0% |

0.0% |

|

Total debt |

|

555 |

541 |

11.7% |

17.0% |

|

Cash & Equivalents |

|

133 |

133 |

|

|

|

Net debt |

|

422 |

407 |

|

|

Appendice 2

Impact of IFRS 16

|

|

|

|

|

|

Year 2023 (incl. IFRS 16) |

|

|

|

Year 2023 (excl. IFRS

16) |

|

|

|

IFRS 16 impact |

|

|

|

|

In € million |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At real rates |

|

|

|

At real rates |

|

|

|

At real rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales figures |

|

|

2,075 |

|

|

|

2,075 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA ADJ |

|

|

142 |

|

|

|

111 |

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITA |

|

|

57 |

|

|

|

50 |

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating cash flow |

|

|

48 |

|

|

|

17 |

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FCF before financial expenses and taxes |

|

|

13 |

|

|

|

(18) |

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FCF after financial expenses and taxes |

|

|

(45) |

|

|

|

(66) |

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Appendice 3

Reconciliation of indicators

4

In addition to the published results, and to enable better

comparability of operating performance trends in 2023 versus 2022,

Vantiva presents a set of adjusted indicators which exclude the

following items as presented in the group's consolidated income

statement and financial statements:

- Net restructuring costs;

- Expenses net of asset impairment;

- Other income and expenses (other non-recurring items).

|

In € million |

2023 |

2022 |

Variation1 |

|

EBIT from continuing operations |

(136) |

(11) |

(125) |

| Restructuring

costs, net |

14 |

17 |

(4) |

| Impairment gains

(losses) on non-recurring operating assets |

139 |

5 |

134 |

| Other income

(expenses) |

14 |

13 |

1 |

| PPA

amortization |

26 |

31 |

(5) |

|

Adjusted EBITA from continuing operations |

57 |

55 |

2 |

| Depreciation,

amortization and impairment ("D&A") 2 |

86 |

106 |

(20) |

|

Adjusted EBITDA from continuing operations |

142 |

161 |

(19) |

|

1 Change at real exchange rates |

|

|

|

| 2

Excluding amortization of intangible assets arising on

acquisitions, and including provisions for risks, litigation and

warranties. |

Adjusted EBITDA corresponds to income from continuing operations

before tax and net financial income, excluding other income and

expenses, depreciation and amortization (including the impact of

provisions for risks, guarantees and litigation).

Adjusted EBITA corresponds to income from continuing operations

before tax and net financial income, excluding other income and

expenses and impairment of PPA items.

###

Warning: Forward Looking Statements

This press release contains certain statements that constitute

"forward-looking statements", including but not limited to

statements that are predictions of or indicate future events,

trends, plans or objectives, based on certain assumptions or which

do not directly relate to historical or current facts. Such

forward-looking statements are based on management's current

expectations and beliefs and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from the future results expressed, forecasted, or implied by such

forward-looking statements. For a more complete list and

description of such risks and uncertainties, refer to Vantiva’s

filings with the French Autorité des marchés financiers (AMF). The

Universal Registration Document (Document d’enregistrement

universel) for fiscal year 2022 was filed with the Autorité des

marchés financiers on April 26, 2023, under no. D.23-0337, and an

amendment was filed with the Autorité des marchés financiers on

December 8, 2023, under no. D.23-0337-A01.

###About

Vantiva

Pushing the Edge

Vantiva shares are admitted to trading on the regulated market

of Euronext Paris (VANTI).

Vantiva, formerly known as Technicolor, is headquartered in

Paris, France. It is an independent company which is a global

technology leader in designing, developing and supplying innovative

products and solutions that connect consumers around the world to

the content and services they love – whether at home, at work or in

other smart spaces. Vantiva has also earned a solid reputation for

optimizing supply chain performance by leveraging its decades-long

expertise in high-precision manufacturing, logistics, fulfillment

and distribution. With operations throughout the Americas, Asia

Pacific and EMEA, Vantiva is recognized as a strategic partner by

leading firms across various vertical industries, including network

service providers, software companies and video game creators for

over 25 years. The group’s relationships with the film and

entertainment industry goes back over 100 years by providing

end-to-end solutions for its clients.

Following the acquisition of CommScope’s Home Networks in

January 2024, Vantiva continues its 130-year legacy as a global

leader in the connected home market.

Vantiva is committed to the highest standards of corporate

social responsibility and sustainability across all aspects of

their operations.

For more information, please visit vantiva.com and follow

Vantiva on LinkedIn and Twitter.

Contacts

Vantiva Investor Relations

Image

7investor.relations@vantiva.com

vantiva.press@image7.fr

- 2024-03-26 PR FY2023 - EN

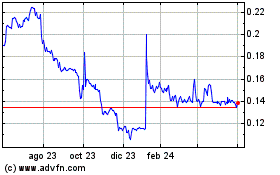

Vantiva (EU:VANTI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

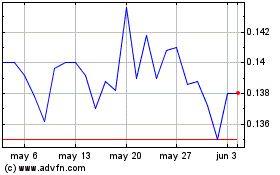

Vantiva (EU:VANTI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025