Vantiva - First Half 2024 Results

Press Release

First half 2024 Results

Fast and successful integration of Home Networks

H1 RESULTS in line with group’s anticipations

GUIDANCE 2024 CONFIRMED

REVENUE: €1,004 million (vs €1,038 million in

H1 2023)

ADJUSTED EBITDA: €23 million (vs €49 million in H1

2023)

Free Cash Flow 1: -€19 million (vs

-€104 million in H1 2023) and this FCF positive at €14 million

before restructuring cash out

Lars Ilhen becomes interim CEO following the

announcement of Luis Martinez Amago retirement

Paris (France) – July 24, 2024 - Vantiva (Euronext

Paris: VANTI) is announcing its results for the first half

of 2024. These results have been approved by the Board of Directors

today. Limited review procedures on the consolidated condensed

financial statements have been carried out, and the statutory

auditors’ report will be issued once the verification of the

management report for the first half of 2024 have been

finalized.

Vantiva's results for the first half of 2024 show a

decrease compared to the previous year but are in line with the

group's anticipations. This stems mainly from weaker activity for

CH due to lower demand from the operators, orders timing issues and

duplicate operating costs structures related to Home Networks

integration before extracting full synergies.

Supply Chain Solutions (SCS) continues to

see a decline in the optical disc volumes mitigated by the growth

in new activities.

Globally Q2 marks an improvement over Q1, and this positive

trend should be confirmed in H2. In addition, the speed and the

success of the integration of Home Networks activities in Connected

Home are driving synergies at the top end of our expectations.

Vantiva confirms its guidance for the year.

- Revenues decreased by 3.4% to €1,004 million

(-2.9% at constant exchange rate) after the consolidation of Home

Networks.

- Adjusted EBITDA at €23 million vs €49 million

in H1 2023, representing 2.3% of revenues (vs 4.7% in H1 2023)

largely explained by lower volumes and duplicated cost structure

from the integration of Home Networks before the synergies are

taken out in full.

- Adjusted EBITA at -€23 million (vs €9 million

in H1 2023) after a €6 million increase in D&A.

- Net result from continuing

operations was negative at -€166 million vs -227 million

in H1 2023.

- Group net result was negative at -€167 million

vs -€229 million in H1 2023 after negative non-recurring items of

-€61 million.

- Capex stood at €26 million (vs €44 million)

after taking into account the disposal of a real estate asset in

Poland.

- Free Cash Flow,

before financial and tax, was positive at €30 million vs -€74

million in H1 2023 largely due to the change in working capital and

the payment terms alignment between Connected Home

and Home Networks.

- Free Cash Flow,

after financial and tax, was at -€19 million vs - €104 million in

H1 2023. Before restructuring, FCF was positive at €14

million.

- At the end of the semester,

Vantiva’s cash position stood at €39 million, same

level as on June 30th, 2023.

- Total net debt

(w/o capital lease) amounted to €410 million in nominal terms vs

€378 million on June 30th, 2023.

Luis Martinez-Amago, Chief Executive Officer of Vantiva,

said:

“Despite a challenging Q1, we’ve seen improvements in Q2.

This environment explains largely our financial performance, which

is in line with our expectations for the H1. What is more important

is that our swift integration of Home Networks, thanks to our

team’s competence and excellence in execution, is making us

progress at a pace twice as fast as any comparable integration. We

are now ready for fully leveraging the demand recovery for

connecting devices that should materialize by the end of the

year.”

I- H1 2024 Key

Highlights & 2024 Outlook

| |

|

|

|

|

|

In € million, continuing operations |

H1 2024 |

H1 2023 |

Change at

current rate |

Change at

constant rate |

|

Revenues |

1,004 |

1,038 |

(3.4)% |

(2.9)% |

| Adjusted

EBITDA |

23 |

49 |

(52.3)% |

(51.1)% |

|

As a % of revenues |

2.3% |

4.7% |

(240)bps |

(235)bps |

| Adjusted

EBITA |

(23) |

9 |

nm |

nm |

|

Free Cash Flow before Financial & Tax |

30 |

(74) |

104 |

|

2024 with Home Networks

H1 2024 Key Highlights

The demand for Connected Home has been hampered

by strict capex policy from telco and cable operators still holding

too high inventories. This has been particularly true in the North

America and LATAM regions. But the consolidation of Home Networks

activities has mitigated the negative impact of this change.

Diversification businesses (retail and services) have started to

contribute to the P&L. One positive note is the start of

recovery in Q2, which showed 21% growth over last year.

On SCS side, the decrease in optical discs demand

has been in line with our anticipations and less severe than a year

ago. The “Growth activities” have continued to develop well and

offset part of the structural decline in optical disc.

But the key achievement of the first half has been the success and

the speed of the integration of the business acquired from

CommScope. In less than 6 months, we have almost completed the

operational merger of Home Networks and Vantiva’s Connected

Home operations and have exited from most of the

Transitional Service Agreements put in place in January.

Vantiva revenues totaled €1,004 million, down -3.4% (-2.9% at

constant exchange rate).

Connected Home revenues amounted to €797 million

for the half, a 1.2% decrease (-0.7% at constant exchange rate).

SCS revenues were €206 million, down 10.9% (-10.6%

at constant exchange rate).

Adjusted EBITDA has been negatively impacted by this volume

decline and dual cost structure, but benefited from the first

positive impacts of the combined business with Home Networks. It

was down to €23 million in the semester vs €49 million in H1

2023.

Connected Home, including Home Networks and

Diversifications, contributed €33 million (versus €56 million in

the previous year) to adjusted EBITDA while SCS

contributed €2 million (versus €7 million in H1 last year).

FCF, before financial and tax for the half was positive by €30

million, showing a €104 million improvement over last year, despite

a lower EBITDA, thanks to a favorable change in working

capital.

Capex is €18 million below last year reflecting our strict policy,

the first fruits of the combined business with Home Networks and

the disposal of a real estate asset in Poland.

The working capital development which was more strictly managed by

Vantiva than Home Networks, has benefited from Vantiva’s

management.

Outlook 2024

We expect the recovery, which started in the second quarter, to

accelerate in the second part of the year.

Therefore, the second half should benefit from better volumes of

demand and positive impact from the synergies.

In this context, Vantiva confirms its guidance for the year.

- EBITDA > €140m

- FCF 2 > €0m

II- Segment Review – H1

2024 Results Highlights

Connected Home

Revenues breakdown by product

|

In € million |

H1 2024 |

H1 2023 |

Change at current rate |

Change at constant rate |

|

Revenues |

797 |

807 |

(1.2)% |

(0.7)% |

| o/w by

product |

|

|

|

|

|

Broadband |

476 |

647 |

(26.5)% |

(26.2)% |

|

Video |

287 |

160 |

79.6% |

81.0% |

|

Diversification |

34 |

|

nm |

nm |

| EBITDA

adj |

33 |

56 |

(41.2)% |

(40.2)% |

|

As a % of revenues |

4.2% |

7.0% |

|

|

Connected Home revenues contributed 79% of

Group revenues (78% in H1 23) and totaled €797 million in the

semester, down 1.2%. At constant exchange rate, the decrease would

have been -0.7% compared with H1 2023. The integration of Home

Networks and Diversification activities have almost compensated for

the negative impact of the lower demand in a context of inventory

adjustments by our customers. North America has been the most

penalized market, as well as LATAM. Eurasia and APAC regions have

resisted better, notably thanks to Video products.

Adjusted EBITDA of the division amounted to €33

million (vs €56 million in H1 23), or 4.2% of revenues (vs 7.0% in

H1 23). The drop in revenues and the dual operational cost

structure due to the acquisition (HN) are the main reasons for the

margin decline.

Supply Chain Solutions

|

In € million |

H1 2024 |

H1 2023 |

Change at

current rate |

Change at

constant rate |

|

Revenues |

206 |

231 |

(10.9)% |

(10.6)% |

| o/w by

activity |

|

|

|

|

| Disc |

153 |

193 |

(21.1)% |

(20.9)% |

| Growth

activities |

53 |

38 |

42.0% |

42.3% |

|

EBITDA |

2 |

7 |

(77.9)% |

(77.3)% |

|

As a % of revenues |

0.7% |

3.0% |

|

|

SCS revenues totaled €206 million in the

period, down 10.9% from H1 2023. At constant exchange rate the

decline would have been 10.6%. The volume decline of the optical

disc activity has normalized and has been partly offset by

continuing price actions. Logistics activities have continued to

develop well, but the Freight business is still suffering from

overcapacity. Vinyl records production has grown strongly as

expected. Thus, it is in line with our plan in the US, meanwhile we

have higher expectations in Europe where competition is more

fragmented.

Adjusted EBITDA of the division amounted to €2

million (vs €7m in H1 23), or 0.7% of revenues (3.0% in H1 23). The

margin decline came from the lower volumes of optical discs.

Corporate & Other

|

In € million |

H1 2024 |

H1 2023 |

Change at

current rate |

Change at

constant rate |

|

Revenues |

0 |

0 |

|

|

|

EBITDA |

(11) |

(14) |

nm |

nm |

|

As a % of revenues |

ns |

ns |

|

|

“Corporate & Other” have no revenue anymore and the

corporate costs explain the EBITDA negative contribution of -€11

million vs -€14 million in H1 2023. This is nonetheless delivering

a €3 million saving year-on-year.

III- Results

analysis

P&L analysis

|

In € million |

H1 2024 |

H1 2023 |

Change at current rate |

Change at constant rate |

|

Revenues from continuing operations |

1,004 |

1,038 |

(3.4)% |

(2.9)% |

| Adjusted

EBITDA from continuing operations |

23 |

49 |

(52.3)% |

(51.1)% |

| As a % of

revenues |

2.3% |

4.7% |

(240)bps |

(235)bps |

|

D&A & Reserves1, w/o PPA amortization |

(46) |

(40) |

15.5% |

16.1% |

| Adjusted

EBITA from continuing operations |

(23) |

9 |

nm |

nm |

| As a % of

revenues |

(2.3%) |

0.9% |

(315)bps |

(310)bps |

|

PPA amortization |

(15) |

(13) |

(10.2)% |

(10.6)% |

|

Non-recurring items |

(61) |

(146) |

nm |

nm |

|

EBIT from continuing operations |

(98) |

(150) |

nm |

nm |

| As a % of

revenues |

(9.8)% |

(14.5)% |

na |

na |

| Net financial

income (loss) |

(58) |

(55) |

(6.9)% |

(7.6)% |

| Income tax |

(9) |

3 |

nm |

nm |

|

Gain (loss) from associates |

(1) |

(25) |

nm |

nm |

| Profit

(loss) from continuing operations |

(166) |

(227) |

nm |

nm |

|

Net gain (loss) from discontinued operations |

(1) |

(2) |

nm |

nm |

|

Net income (loss) |

(167) |

(229) |

nm |

nm |

1Risk, litigation and warranty reserves

H1 Revenues stood at €1,004 million,

representing a 3.4% decrease (-2.9% at constant exchange rate). The

decrease for Connected Home (-1.2%) resulted from

the consolidation of Home Networks business and the lower demand

from our main customers due to market conditions.

SCS revenues were down 10.9% reflecting the

structural decline of the optical disc demand, partly offset by the

growth of the other activities.

H1 Adjusted EBITDA amounted to €23 million,

down €26 million year-on-year. This stems from the decline in

volume but also largely from the dual cost structure coming with

the integration of Home Networks.

H1 Adjusted EBITA of -€23 million represented a

€32 million year-on-year decrease, explained by lower EBITDA and

higher depreciation and amortization.

PPA amortization was slightly up at -€15

million versus -€13 in H1 2023.

Non-recurring items amounted to -€61 million

versus -€146 million a year ago which was largely impacted by the

impairment of SCS goodwill.

EBIT from continuing operations was a -€98

million loss compared to -€150 million.

The financial result totaled -€58 million in

the first half, compared to -€55 million in H1 2023.

Income tax is a negative of €9 million, versus

a positive of €3 million.

Result from associates is negative of -€1

million versus -€25 million last year (depreciation of our stake in

TCS from the first of January to the deconsolidation date).

Net loss from continued operations amounted to

-€166 million compared to -€227 million in H1 2023.

Result of discontinued operations showed a

small loss of €1 million.

Group net result therefore is a loss of -€167

million in the half, compared to a loss of -€229 million in H1

2023.

FCF and debt analysis

|

In € million |

H1 2024 |

H1 2023 |

Change at current rate |

Change at constant rate |

| Adjusted

EBITDA from continuing operations |

23 |

49 |

(52.3)% |

(51.1)% |

| Capex |

(26) |

(44) |

(40.7)% |

(40.4)% |

| Non-recurring

items (cash impact) |

(58) |

(26) |

nm |

nm |

|

Change in working capital and other assets and liabilities |

91 |

(54) |

nm |

nm |

|

Free Cash Flow from continuing operations before

Tax & Financial |

30 |

(74) |

104 |

105 |

|

|

|

|

|

|

|

30/06/2024 |

31/12/2023 |

|

Nominal Gross Debt (including IFRS 16 Lease debt)* |

516 |

544 |

|

Cash and Cash Equivalent |

(39) |

(133) |

| Net

financial debt at nominal value (non IFRS) |

477 |

411 |

|

IFRS adjustments** |

4 |

(4) |

|

Net financial debt (IFRS) |

481 |

407 |

*

Nominal Gross Debt

considers PIK interest at nominal value and excludes exit fees

accruals

** IFRS adjustments

consider PIK at IFRS value and exit fees and deduct original

discount fees (OID)

Capex decreased by 40.7% thanks to strict

control of spending, first fruits of the merger and the disposal of

a real estate asset in Poland.

Free Cash Flow3

went from -€74 million to €30 million. This significant improvement

despite the lower EBITDA

(-€26 million) came from lower capex (€18 million) and positive

change in working capital (€144 million) explained by better

payment terms with some suppliers, following the acquisition.

The cash position at the end of June 2024 was

€39 million not including the Wells Fargo Credit Line of €66

million.

Appendix

Debt details

In € million

|

Line |

Characteristics |

Nominal |

IFRS amount |

Nominal Rate |

IFRS Rate |

|

Barclays |

Cash: Euribor 3M + 2.50% & PIK |

258 |

258 |

10.2% |

13.5% |

|

Angelo Gordon |

Cash: Euribor 3M + 4.00% & PIK |

131 |

131 |

13.2% |

17.8% |

|

Barclays AG short term loans |

PIK: E+ 10% |

11 |

11 |

13.7% |

21.3% |

|

Wells Fargo |

WF Prime +2.0% |

31 |

31 |

10.3% |

10.3% |

|

Operating Lease |

|

67 |

67 |

15.8% |

15.8% |

|

Capital Lease |

|

2 |

2 |

11.2% |

11.2% |

|

Other |

|

16 |

20 |

NA |

NA |

|

Total Debt |

|

516 |

520 |

11.4% |

14.3% |

|

Cash & Cash Equivalents |

|

39 |

39 |

|

|

|

Net Debt |

|

477 |

481 |

|

|

IFRS 16 impact

|

|

|

|

|

|

Actual H1 24 (incl IFRS 16) |

|

|

|

Actual H1 24

(excl. IFRS16) |

|

|

|

IFRS16 impact |

|

|

|

|

In € million

|

|

|

Actual |

|

|

|

Actual |

|

|

|

Actual |

|

|

|

|

|

|

Current rate |

|

|

|

Current rate |

|

|

|

Current rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES |

|

|

1,004 |

|

|

|

1,004 |

|

|

|

+0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA ADJ |

|

|

23 |

|

|

|

7 |

|

|

|

+16 |

|

|

|

|

In % of sales |

|

|

2.3% |

|

|

|

0.7% |

|

|

|

1.6% |

|

|

|

|

EBITA |

|

|

(23) |

|

|

|

(27) |

|

|

|

+4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Cash Flow |

|

|

(36) |

|

|

|

(52) |

|

|

|

+16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FCF before Financial & Tax |

|

|

30 |

|

|

|

11 |

|

|

|

+19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FCF after Financial & Tax |

|

|

(19) |

|

|

|

(33) |

|

|

|

+14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of adjusted

operating indicators

In addition to published results, and with the aim of providing

a more comparable view of the evolution of its operating

performance in H1 2024 compared to last year, Vantiva is presenting

a set of adjusted indicators which exclude the following items as

per the statement of operations of the group’s consolidated

financial statements:

- net restructuring costs;

- net impairment charges;

- other income and expenses (other

non-current items).

|

In € million |

H1 2024 |

H1 2023 |

Change1 |

|

EBIT from continuing operations |

(98) |

(150) |

52 |

| Restructuring

charges, net |

(69) |

(8) |

(61) |

| Net impairment

gain (losses) on non-current operating assets |

(4) |

(135) |

131 |

| Other income

(expense) |

12 |

(4) |

16 |

| PPA

amortization |

(15) |

(13) |

(1) |

|

Adjusted EBITA from continuing operations |

(23) |

9 |

(32) |

| Depreciation and

amortization (“D&A”) |

(46) |

(40) |

(6) |

|

Adjusted EBITDA from continuing operations |

23 |

49 |

(26) |

|

1 Variation at current

rates |

|

|

|

The caption “Adjusted EBITDA” corresponds to the profit

(loss) from continuing operations before tax and net financial

income (expense), net of other income (expense), depreciation and

amortization (including impact of provision for risks, litigation

and warranties).

The caption “Adjusted EBITA” corresponds to the profit

(loss) from continuing operations before tax and net financial

income (expense), net of other income (expense) and amortization of

purchase accounting items.

Vantiva Announces Resignation of CEO Mr.

Luis Martinez Amago

After 9 years of dedicated service and exemplary

leadership, Mr. Martinez Amago has decided to retire and therefore

step down from his position as Chief Executive Officer and director

of Vantiva, effective August 15, 2024.

The Board of Directors warmly thanks Mr.

Martinez Amago for his leadership and significant contributions to

Vantiva.

The Board is pleased to announce that Mr. Lars

Ihlen, currently Chief Financial Officer of Vantiva, has agreed to

step in as interim CEO while remaining Chief Financial Officer of

Vantiva, until the Board’s Governance & Social Responsibility

Committee and Remuneration & Talent Committee finalize the

appointment of Vantiva’s next Chief Executive Officer.

Mr. Ihlen brings extensive experience and a deep

understanding of Vantiva’s operations, having served as Chief

Financial Officer of Connected Home for the past 11 years, after

having served in various financial management positions at Alcatel

Lucent in Norway, France and China for 10 years.

A smooth transition plan is in place and Mr.

Martinez Amago will continue to work closely with Mr. Ihlen

over the coming weeks to ensure continuity and stability of

Vantiva’s business operations and the realization of the synergy

plan.

Mr. Brian Shearer, Chairman of the Board:

“We thank Luis Martinez Amago for his leadership and

significant contributions to Vantiva and wish him all the best in

his future endeavors. We are confident in Lars Ihlen’s ability to

lead the group during this transition period.”

Mr. Luis Martinez Amago, Chief Executive

Officer: “It has been a tremendous honor to lead Vantiva over

the past years. I am incredibly proud of what we have achieved

together and grateful for the dedication and hard work of Vantiva’s

talented team. I am confident that Vantiva will continue to thrive

and succeed in the years to come.”

###

Warning: Forward Looking Statements

This press release contains certain statements that

constitute "forward-looking statements", including but not limited

to statements that are predictions of or indicate future events,

trends, plans or objectives, based on certain assumptions or which

do not directly relate to historical or current facts. Such

forward-looking statements are based on management's current

expectations and beliefs and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from the future results expressed, forecasted, or implied by such

forward-looking statements. For a more complete list and

description of such risks and uncertainties, refer to Vantiva’s

filings with the French Autorité des marchés financiers (AMF). The

Universal Registration Document (Document d’enregistrement

universel) for fiscal year 2023 was filed with the Autorité des

marchés financiers on April 30, 2024, under no. D.24-0375.

###

About Vantiva

Pushing the Edge

Vantiva shares are admitted to trading on the regulated market

of Euronext Paris (VANTI).

Vantiva, formerly known as Technicolor, is headquartered in

Paris, France. It is an independent company which is a global

technology leader in designing, developing and supplying innovative

products and solutions that connect consumers around the world to

the content and services they love – whether at home, at work or in

other smart spaces. Vantiva has also earned a solid reputation for

optimizing supply chain performance by leveraging its decades-long

expertise in high-precision manufacturing, logistics, fulfillment

and distribution. With operations throughout the Americas, Asia

Pacific and EMEA, Vantiva is recognized as a strategic partner by

leading firms across various vertical industries, including network

service providers, software companies and video game creators for

over 25 years. The group’s relationships with the film and

entertainment industry goes back over 100 years by providing

end-to-end solutions for its clients.

Following the acquisition of CommScope’s Home Networks in

January 2024, Vantiva continues its 130-year legacy as a global

leader in the connected home market.

Vantiva is committed to the highest standards of corporate

social responsibility and sustainability across all aspects of

their operations.

For more information, please visit vantiva.com and follow

Vantiva on LinkedIn and X (Twitter).

Contacts

Vantiva Investor

Relations Image

7 for Vantiva – Corporate

investor.relations@vantiva.com vantiva.press@image7.fr

1 After financial charges, tax and excluding Home networks

integration costs.

2 After interest and tax and excluding restructuring and

integration costs for HN.

3 Before interest and tax and excluding Home Networks

integration costs.

- 2024-07-24 PR H1 2024 V12-CLEAN

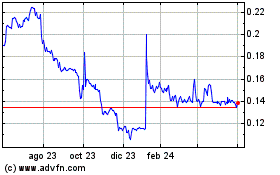

Vantiva (EU:VANTI)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

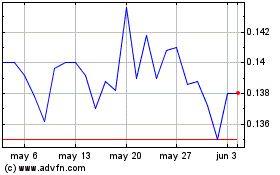

Vantiva (EU:VANTI)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024