U.S. Dollar Lower Against Majors

17 Junio 2024 - 10:54AM

RTTF2

The U.S. dollar weakened against its major counterparts in the

New York session on Monday, as investors awaited central bank

decisions and comments from Federal Reserve officials for clues

about the central bank's likely monetary policy moves.

On Sunday, Minneapolis Fed President Neel Kashkari said that

it's a "reasonable prediction" that the U.S. central bank will cut

interest rates once this year, waiting until December to do so.

While Federal Reserve officials forecast just one interest rate

cut this year following last Wednesday's monetary policy meeting,

traders remain hopeful the predictions will turn out to be overly

conservative if inflation continues to slow in the coming

months.

Reports on retail sales and industrial production, due this

week, are likely to provide some clues about interest rates.

In economic releases, the Federal Reserve Bank of New York's

report showed New York manufacturing activity contracted at a

notably slower rate in the month of June.

The New York Fed said its general business conditions index

climbed to a negative 6.0 in June from a negative 15.6 in May,

although a negative reading still indicates contraction. Economists

had expected the index to rise to a negative 9.0.

Despite the continued contraction in current activity, the New

York Fed said optimism about the six-month outlook picked up to its

highest level in more than two years.

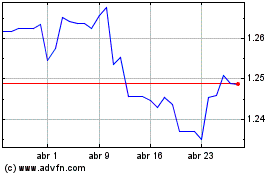

The greenback fell to 1.0737 against the euro and 1.2709 against

the pound, from its early highs of 1.0686 and 1.2658, respectively.

The currency is seen finding support around 1.10 against the euro

and 1.31 against the pound.

The greenback eased to 0.8897 against the franc. This may be

compared to a previous 10-day low of 0.8890. On the downside, 0.87

is likely seen as its next support level.

The greenback touched 1.3721 against the loonie, setting a 4-day

low. The greenback is likely to face support around the 1.34

region, if it falls again.

The greenback retreated to 0.6616 against the aussie and 0.6134

against the kiwi, off its early 1-week highs of 0.6585 and 0.6104,

respectively. The currency may locate support around 0.69 against

the aussie and 0.63 against the kiwi.

The greenback was down against the yen, at 157.70. The greenback

is poised to challenge support around the 146.00 level.

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De May 2024 a Jun 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Jun 2023 a Jun 2024