U.S. Dollar Strengthens After New Home Sales Data

25 Septiembre 2024 - 8:46AM

RTTF2

The U.S. dollar advanced against its major counterparts in the

New York session on Wednesday, after a data showed that new home

sales beat forecasts in the month of August.

Data from the Commerce Department showed that new home sales

came in at 716,000 in August, down 4.7 percent from a revised rate

of 751,000 in July. Economists had forecast a reading of

700,000.

U.S. treasury yields rose on hopes of a soft landing for the

economy.

Investors await Fed Chair Jerome Powell's remarks on Thursday

and U.S. inflation data on Friday for further policy moves.

Traders are looking for clarity over the size of rate cut after

the Federal Reserve decided to begin lowering interest rates last

week.

The greenback climbed to 0.6826 against the aussie, 1.3475

against the loonie and 0.6269 against the kiwi, from an early

1-1/2-year low of 0.6908, 7-1/2-month low of 1.3419 and a 9-month

low of 0.6355, respectively. The currency is seen finding

resistance around 0.64 against the aussie, 1.38 against the loonie

and 0.60 against the kiwi.

The greenback appreciated to 1.1132 against the euro and 144.60

against the yen, from an early more than 1-year low of 1.1214 and a

5-day low of 142.88, respectively. The currency is likely to locate

resistance around 1.09 against the euro and 147.00 against the

yen.

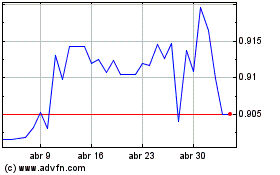

The greenback touched 2-day highs of 0.8500 against the franc

and 1.3327 against the pound, up from an early 1-week low of 0.8415

and a 2-1/2-year low of 1.3429, respectively. The currency is

poised to challenge resistance around 0.90 against the franc and

1.31 against the pound.

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Oct 2024 a Nov 2024

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Nov 2023 a Nov 2024