TIDMBMY

RNS Number : 3157R

Bloomsbury Publishing PLC

26 October 2023

BLOOMSBURY PUBLISHING PLC

("Bloomsbury" or "the Company")

Unaudited Interim Results for the six months ended 31 August

2023

Record first half earnings

Fourth consecutive double-digit growth in revenue and profit in

the first half

Interim dividend increased

Bloomsbury Publishing Plc (LSE: BMY), the leading independent

publisher, today announces unaudited results for the six months

ended 31 August 2023.

Commenting on the results, Nigel Newton, Chief Executive,

said:

"Bloomsbury achieved our fourth consecutive double-digit growth

in revenue and profit in the first half. These are also our highest

ever first half results, with year-on-year revenue growth of 11% to

GBP136.7 million and profit growth of 11% to GBP17.7 million. These

results demonstrate the strength of our strategy of publishing for

both the consumer and academic markets.

Fantasy is a huge and increasingly popular genre which has

driven forward our consumer division. Sales of Sarah J. Maas and

Samantha Shannon grew 79% and 169% respectively in the period and

demand for Harry Potter, 26 years after publication, remains

strong.

The Consumer division revenue grew by 17%, achieving a 26%

increase in profit before tax and highlighted items(1) to GBP11.2

million. Bloomsbury Digital Resources ("BDR") consolidated last

year's exceptional growth and increased subscription revenue to

47%. The Non-Consumer division's resilient performance with 2%

revenue growth and GBP5.9 million of profit before tax and

highlighted items(1) continued to demonstrate the strength of our

long term academic strategy.

Since the period end, Bloomsbury author Jon Fosse won the most

important prize in the literary world, The Nobel Prize in

Literature, becoming the eighth Nobel Prize winner on Bloomsbury's

Methuen Drama list.

Bloomsbury's successful strategy of diversifying across formats,

markets and territories has created a stronger and more balanced

business and a smoother earnings profile across the year.

Recognising this, and in view of a better balance between sales in

the first and second halves of the year than in the past when we

were more heavily weighted to the second half and the Christmas

market, we are increasing the proportion of the full year dividend

paid at the interim. In line with this rebalancing and our dividend

policy, the Board has increased the interim dividend to 3.70 pence

per share, compared to 1.41 pence per share for the six months

ended 31 August 2022. We maintain our overall dividend guidance for

the full year.

The strong first half performance means that we are confident of

achieving the Board's expectations for the year ending 29 February

2024. Our strong financial position, with net cash of GBP39.1

million, gives us significant opportunities for further

acquisitions and investment in organic growth.

Note

The Board considers current consensus market expectation for the

year ending 29 February 2024 to be revenue of GBP273.1 million and

profit before taxation and highlighted items of GBP32.5

million.

Financial Highlights

2023 2022 2021 Growth Growth

2023 2023

vs 2022 vs 2021

GBP136.7 GBP122.9 GBP100.7

Revenue million million million 11% 36%

----------------- ------------- ------------- --------- ---------

Profit before taxation

and highlighted items GBP15.9 GBP12.9

(1) GBP17.7 million million million 11% 37%

----------------- ------------- ------------- --------- ---------

GBP12.9 GBP11.1

Profit before taxation GBP14.0 million million million 8% 26%

----------------- ------------- ------------- --------- ---------

Diluted earnings per

share, excluding highlighted

items(1) 17.47 pence 15.30 pence 12.82 pence 14% 36%

----------------- ------------- ------------- --------- ---------

Diluted earnings per

share 13.66 pence 12.30 pence 10.41 pence 11% 31%

----------------- ------------- ------------- --------- ---------

GBP41.5 GBP43.7

Net cash GBP39.1 million million million (6)% (10)%

----------------- ------------- ------------- --------- ---------

3.70 pence 1.41 pence 1.34 pence

Interim dividend per share per share per share 162% 176%

----------------- ------------- ------------- --------- ---------

Operational Highlights

Consumer Division

-- Strong Consumer revenue growth of 17% to GBP89.4 million (2022: GBP76.3 million)

-- Consumer profit before taxation and highlighted items (1)

increased by 26% to GBP11.2 million (2022: GBP8.9 million)

-- Adult Trade revenue up 8% to GBP27.6 million (2022: GBP25.7

million) and profit before taxation and highlighted items(1) of

GBP0.1 million (2022: GBP0.2 million)

-- Children's Trade revenue growth of 22% to GBP61.7 million

(2022: GBP50.6 million) and profit before taxation and highlighted

items (1) up 29% to GBP11.1 million (2022: GBP8.7 million)

-- Sales growth of Sarah J. Maas' titles of 79%; Harry Potter

sales were strong 26 years after it was first published

Non-Consumer Division

-- Non-Consumer revenue growth of 2% to GBP47.3 million (2022: GBP46.6 million)

-- Non-Consumer profit before taxation and highlighted items(1)

of GBP5.9 million (2022: GBP7.1 million)

-- Academic & Professional revenue of GBP36.4 million (2022:

GBP36.5 million) and profit before taxation and highlighted

items(1) of GBP5.9 million (2022: GBP7.3 million)

-- Bloomsbury Digital Resources ("BDR") revenue of GBP13.3 million (2022: GBP13.6 million)

-- On track for our new BDR target of 40% organic revenue growth over the five years to 2027/28

Notes

(1) Highlighted items comprise amortisation of acquired

intangible assets and legal and other professional costs relating

to ongoing and completed acquisitions and restructuring costs.

For further information, please contact:

Bloomsbury Publishing Plc

Nigel Newton, Chief Executive nigel.newton@bloomsbury.com

Penny Scott-Bayfield, Group penny.scott-bayfield@bloomsbury.com

Finance Director

Hudson Sandler +44 (0) 20 7796 4133

Dan de Belder / Emily Brooker bloomsbury@hudsonsandler.com

The information in this announcement has not been audited or

otherwise independently verified and no representation or warranty,

express or implied, is made as to, and no reliance should be placed

on, the fairness, accuracy, completeness or correctness of the

information or opinions contained herein. None of the Company or

any of its affiliates, advisors or representatives shall have any

liability whatsoever (in negligence or otherwise) for any loss

whatsoever arising from any use of this announcement, or its

contents, or otherwise arising in connection with this

announcement.

Certain statements, statistics and projections in this

announcement are or may be forward looking. By their nature,

forward--looking statements involve a number of risks,

uncertainties or assumptions that may or may not occur and actual

results or events may differ materially from those expressed or

implied by the forward-looking statements. Accordingly, no

assurance can be given that any particular expectation will be met

and reliance should not be placed on any forward-looking statement.

Accordingly, forward-looking statements contained in this

announcement regarding past trends or activities should not be

taken as representation that such trends or activities will

continue in the future. You should not place undue reliance on

forward-looking statements, which are based on the knowledge and

information available only at the date of this announcement's

preparation.

The Company does not undertake any obligation to update or keep

current the information contained in this announcement, including

any forward--looking statements, or to correct any inaccuracies

which may become apparent and any opinions expressed in it are

subject to change without notice.

References in this announcement to other reports or materials,

such as a website address, have been provided to direct the reader

to other sources of information on Bloomsbury Publishing Plc which

may be of interest. Neither the content of Bloomsbury's website nor

any website accessible by hyperlinks from Bloomsbury's website nor

any additional materials contained or accessible thereon, are

incorporated in, or form part of, this announcement.

Chief Executive's statement

Overview

Bloomsbury delivered a strong first half performance, with

revenue growth of 11% to GBP136.7 million (2022: GBP122.9 million),

and an 11% increase in profit before taxation and highlighted items

to GBP17.7 million (2022: GBP15.9 million). Profit before taxation

grew by 8% to GBP14.0 million (2022: GBP12.9 million).

The strength of demand for Bloomsbury titles reflects our

long-term growth strategy and the breadth of our diversified

portfolio.

Our strategy of diversification, across channels and markets,

continues successfully. Our international revenues increased to 76%

of total revenue - our highest ever. Our digital strategy ensures

increasing publishing sales through digital channels, and we

continue to expand our consumer and academic markets.

We consolidated last year's exceptional 69% growth in Bloomsbury

Digital Resources ("BDR") with GBP13.3 million revenue, and

increased our BDR subscription revenue to 47% of the total (2022:

45%). The continued growth of subscription revenue underlines the

strength of our long term digital strategy of building high margin,

repeatable revenues. Our strategy enables us to continue to deliver

growth from the ongoing and accelerating shift to digital learning,

with the breadth and depth of our excellent digital products and

ebooks. We are pleased to have maintained renewal rates above 90%

and remain confident in our BDR target to achieve 40% organic

revenue growth over the five years to 2027/28, to reach

approximately GBP37 million turnover.

The highlighted items of GBP3.7 million (2022: GBP3.0 million)

consist of the amortisation of acquired intangible assets of GBP2.5

million (2022: GBP2.7 million), one-off legal and other

professional fees relating to ongoing and completed acquisitions

and restructuring costs of GBP1.2 million (2022: GBP0.3 million).

The effective rate of tax for the period was 20% (2022: 22%). The

adjusted effective rate of tax, excluding highlighted items, was

19% (2022: 21%). Diluted earnings per share for the period,

excluding highlighted items, grew by 14% to 17.47 pence (2022:

15.30 pence). Including highlighted items, profit before taxation

grew by 8% to GBP14.0 million (2022: GBP12.9 million) and diluted

earnings per share grew by 11% to 13.66 pence (2022: 12.30

pence).

Strategy

Bloomsbury's long-term growth strategy is aimed at continuing

our success in investing in high-value intellectual property and

building digital channels, increasing quality revenues and

earnings. To achieve this, we are focused on the following

long-term strategic objectives:

-- Non-Consumer

o Goal: Grow Bloomsbury's portfolio in Non-Consumer publishing.

Non-Consumer publishing is characterised by higher, more

predictable margins and greater digital and global

opportunities.

Achieved - H1 2023/24: delivered GBP47.3 million revenue,

growing both Academic & Professional and Special Interest

revenues.

o Goal: BDR target is to achieve 40% organic revenue growth over

the five years to 2027/28, to reach approximately GBP37 million

turnover.

Achieved - On track to deliver new BDR target.

-- Consumer

o Goal: Discover, nurture, champion and retain high-quality

authors and illustrators, while looking at new ways to leverage

existing title rights.

Achieved - H1 2023/24: Delivered 17% growth in Consumer revenue.

Bestsellers included Day of Fallen Night by Samantha Shannon, The

Earth Transformed by Peter Frankopan, Tom Lake by Ann Patchett and

Pub Kitchen by Tom Kerridge.

o Goal: Grow our key authors through effective publishing across

all formats alongside strategic sales and marketing.

Achieved - H1 2023/24: 79% growth in sales of Sarah J. Maas'

titles.

o Goal: As the originating publisher of J.K. Rowling's Harry

Potter, to ensure that new children discover and read it for

pleasure every year.

Achieved - H1 2023/24: Sales of Harry Potter titles remain

strong, 26 years after first publication. Harry Potter and the

Philosopher's Stone was the 4(th) bestselling children's book of

the year to date on UK Nielsen Bookscan.

-- International Expansion

o Goal: Expand international revenues. Continuing our

international growth and take advantage of the biggest academic

market in the US.

Achieved - H1 2023/24: increased overseas revenues to 76% of

Group revenue (2022/23 H1: 73%). US revenues increased to 46% of

Group revenue (2022/23 H1: 36%).

-- Employee Experience and Engagement; Diversity, Equity and Inclusion

Our success is driven by the expertise, passion and commitment

of our employees, highlighting the importance of attracting,

supporting and engaging our colleagues. We value diversity of

thought, perspectives and experience in shaping our culture and

strategy, driving our long-term success and informing the ways in

which we fulfil our social purpose.

o Goal: Be an attractive employer for individuals seeking a

career in publishing, regardless of background or identity, adding

cultural value to our business operations and performance.

o Goal: Focus on initiatives to create an environment that

promotes diversity, nurtures talent, stimulates creativity and

collaboration, supports well-being and is inclusive and respectful

of difference.

o Goal: Implement Bloomsbury's Diversity, Equity and Inclusion

Action Plan ("DEIAP").

Achieved - H1 2023/24:

o In recognition for our work, we won the Small Cap Diversity

& Inclusion Award;

o Delivered a new, comprehensive medical insurance plan for UK

employees;

o Launched the Bloomsbury Mentorship Programme, to support

unpublished, underrepresented fiction writers as they work to

establish careers in publishing;

o Launched the Academic & Professional Widening Access Fund

pilot, to provide financial support for authors who may not

otherwise be able to publish with us.

-- Sustainability

o Goal: Maximise our use of sustainable resources while seeking

to reduce carbon emissions in line with our science-based targets.

We recognise our responsibility to conserve the Earth's resources

and we are committed to monitoring and improving the environmental

impact of our operations.

Achieved - H1 2023/24:

o Implemented improvements including reducing plastic shrinkwrap

and components and increasing the sustainability of Osprey Games,

and changing the paper used in some Adult hardbacks to reduce raw

material and production resource, without affecting the quality of

our print titles;

o Increased engagement with our print suppliers to gather more

granular data on the paper used to produce our books, to enable

better oversight of our emissions as well as our impact on nature

and biodiversity;

o Supporting the Woodland Trust for three years.

Non-Consumer Division

The Non-Consumer division consists of Academic &

Professional, including BDR, and Special Interest. Revenues in the

division grew by 2% to GBP47.3 million (2022: GBP46.6 million).

Profit before taxation and highlighted items for the Non-Consumer

division was GBP5.9 million (2022: GBP7.1 million). Profit before

taxation was GBP3.6 million (2022: GBP4.6 million).

Academic & Professional

Academic & Professional revenues were GBP36.4 million (2022:

GBP36.5 million) and profit before taxation and highlighted items

was GBP5.9 million (2022: GBP7.3 million). Profit before taxation

was GBP3.7 million (2022: GBP4.9 million). Digital sales

accelerated, with ebook revenue growth of 23%.

The Academic & Professional profit margin was 16%, in line

with 2022/23 full year margin. This reflects a normalised level of

staff investment including the cost of living increases in the

second half of last year. Last year's first half margin of 20%

benefitted from positive exchange rate movements as well as lower

staffing.

Our BDR growth strategy is to build high margin, high quality,

repeatable digital revenue from our market leading Academic and

Professional IP. We consolidated last year's exceptional 69% growth

in the first half of the year and increased subscription revenue to

47% of the total (2022: 45%). Subscriptions to our high margin BDR

products deliver repeatable revenue, with renewal rates maintained

at over 90%.

Our strategy and acquisitions mean that we have been well placed

to capitalise on the market growth to date as Academic Institutions

pivoted at pace to digital learning, including in the US, where

Academic Institutions received one-off benefits of additional

government funding to support this. Notwithstanding the evolving

funding environment for Academic Institutions, including the

normalisation of funding in the US after the additional government

support during the pandemic, we are confident in demand from the

structural shift to digital learning and our BDR growth target of

further 40% organic revenue growth over the five years to 2027/28,

to reach approximately GBP37 million of sales.

Since the period end, Bloomsbury author Jon Fosse won The Nobel

Prize in Literature. We are proud to publish six collections of his

plays in the UK and US, making him the eighth Nobel Prize winner on

Bloomsbury's Methuen Drama list, joining Peter Handke, Dario Fo,

Toni Morrison, Wole Soyinka, Luigi Pirandello, John Galsworthy and

George Bernard Shaw.

Special Interest

Special Interest revenue increased by 7% to GBP10.9 million

(2022: GBP10.1 million) and generated a small profit before

taxation and highlighted items of GBP0.04 million (2022: GBP0.1

million loss before taxation and highlighted items). Bestsellers

during the period included Wisden Cricketers Almanack , Reeds

Nautical Almanac, Undaunted: Battle of Britain and The War Came To

Us by Christopher Miller.

Consumer Division

The Consumer division consists of Adult and Children's trade

publishing. The Consumer division achieved strong revenue growth of

17% to GBP89.4 million (2022: GBP76.3 million). Profit before

taxation and highlighted items increased by 26% to GBP11.2 million

(2022: GBP8.9 million). Profit before taxation increased by 27% to

GBP11.0 million (2022: GBP8.7 million). This strong performance was

driven by the Children's division, across backlist and frontlist

titles.

Adult Trade

The Adult division achieved revenue growth of 8% to GBP27.6

million (2022: GBP25.7 million) and profit before taxation and

highlighted items of GBP0.1 million (2022: GBP0.2 million). Loss

before taxation was GBP0.1 million (2022: GBP0.1 million profit).

Revenue growth was driven by the strength of the frontlist and

backlist.

Sunday Times bestsellers in the period included A Day of Fallen

Night and The Bone Season by Samantha Shannon, Tom Lake by Ann

Patchett, I Want to Die But I Want to Eat Tteokbokki by Baek Sehee,

The Book of Wilding by Isabella Tree and Charlie Burrell and

Trespasses by Louise Kennedy. New York Times bestsellers included A

Day of Fallen Night by Samantha Shannon.

Recognition for our authors continued with The House of Doors by

Tan Twan Eng longlisted for the Booker Prize, I Saw Death Coming by

Kidada E. Williams longlisted for the National Book Awards in

Nonfiction and Trespasses by Louise Kennedy winning the McKitterick

Prize as well as the British Book Awards 2023 Book of the Year -

Debut Fiction.

Children's Trade

Children's revenue increased by 22% to GBP61.7 million (2022:

GBP50.6 million). Profit before taxation and highlighted items

increased by 29% to GBP11.1 million (2022: GBP8.7 million). Profit

before taxation increased by 29% to GBP11.1 million (2022: GBP8.7

million). High demand for our strong titles continued the momentum

from last year, with excellent sales of Sarah J. Maas' titles.

Sales of the Harry Potter titles were strong. Harry Potter and

the Philosopher's Stone was the 4(th) bestselling children's book

of the year to date on UK Nielsen Bookscan, 26 years after it first

began, showing the enduring appeal of this classic series.

Sarah J. Maas sales grew by 79%, reflecting strong backlist

sales across all three series: Court of Thorns and Roses, Throne of

Glass and Crescent City. The Throne of Glass series were New York

Times bestsellers during the period. All 15 of Sarah J. Maas'

titles have been published by Bloomsbury since her first novel,

Throne of Glass, in 2012.

Revenues for the rest of the Children's division were also good.

Other h ighlights in the Children's list included Sunday Times

bestseller We're Going on an Egg Hunt by Martha Mumford and Laura

Hughes and New York Times bestsellers She is a Haunting by Trang

Thanh Tran and You're Not Supposed to Die Tonight by Kalynn

Bayron.

Cash and Financing

Bloomsbury's cash generation continued to be strong with cash at

31 August 2023 of GBP39.1 million (2022: GBP41.5 million).

The Group has an unsecured revolving credit facility with Lloyds

Bank Plc. The facility comprises a committed revolving loan

facility of GBP10.0 million and an uncommitted incremental term

loan facility of up to GBP6.0 million. At 31 August 2023, the Group

had no draw down (2022: GBPnil) of this facility.

Acquisitions

Bloomsbury has a successful track record in strategic

acquisitions, with 19 completed since 2008. We are actively

targeting and assessing further acquisition opportunities in line

with our long-term growth strategy, particularly in Academic and

Professional.

Dividend

The Group has a progressive dividend policy aiming to keep

dividend earnings cover in excess of two times, supported by strong

cash cover.

Bloomsbury's successful strategy of diversifying across formats,

markets and territories has created a stronger and more balanced

business and a smoother earnings profile across the year.

Recognising this, and in view of a better balance between sales in

the first and second halves of the year than in the past, when we

were more heavily weighted to the second half and the Christmas

market, we are increasing the proportion of the full year dividend

paid at the interim. This new balance of the two halves is one of

Bloomsbury's greatest strategic achievements of recent years and is

powered by our academic publishing.

In line with this rebalancing, the Board has declared an interim

dividend of 3.70 pence per share, compared to 1.41 pence per share

for the six months ended 31 August 2022.

The dividend will be paid on 1 December 2023 to Shareholders on

the register on the record date of 3 November 2023.

Executive Committee - Adrienne Vaughan

In August, we suffered the terrible blow of the death of

Adrienne Vaughan, President of Bloomsbury USA and member of

Bloomsbury's Executive Committee. Adrienne was a natural business

leader with a great future ahead of her. She was deeply loved by

colleagues due to her combination of great personal warmth with a

fierce determination to make the business succeed and grow. Her

business instincts were outstanding and she loved authors, readers

and her colleagues equally.

Our hearts go out to Adrienne's husband and children, parents,

family and friends. Bloomsbury continues to do everything possible

to support them.

Future Publishing

In Non-Consumer, we are focused on driving our digital - BDR and

ebook - growth as the Academic pivot from print to digital content

accelerates. Within BDR, we are continuing to expand the customer

base for ABC-CLIO's databases globally, expand Bloomsbury

Collections to include ABC-CLIO titles as well as Bloomsbury

frontlist, and expand BDR products with ABC-CLIO content.

Our strong Consumer publishing list for the second half includes

the next new Sarah J. Maas novel, House of Flame and Shadow, the

third in the Crescent City series, which will be published in

January 2024. The Harry Potter Wizarding Almanac, the official

magical companion to J.K. Rowling's Harry Potter books, is

published in October 2023. The second half also includes Pub

Kitchen by Tom Kerridge, Impossible Creatures by Katherine Rundell,

The Rest is History by Tom Holland and Dominic Sandbrook, Ghosts,

the companion book to the BBC's much loved television series, and

the next title in our bestselling children's series, We're Going on

a Ghost Hunt, by Martha Mumford and Cherie Zamazing.

Outlook

Bloomsbury is on solid foundations with significant financial

resources available to augment organic growth and invest in

acquisitions. Diversification in channels and markets continues to

serve us well. We have continued to expand globally, with 76% of

our revenue now generated outside the UK.

Our digital strategy anticipated the structural change in the

academic market from print to digital learning; a trend which has

accelerated and which gives us further confidence in our BDR

strategy. Our strategy and acquisitions mean that we have been well

placed to capitalise on the market growth to date as academic

institutions pivoted at pace to digital learning. Notwithstanding

the evolving funding environment for academic institutions,

including the normalisation of funding in the US after the

additional government support during the pandemic, we remain on

track and confident in our BDR growth target of further 40% organic

revenue growth over the five years to 2027/28, to reach

approximately GBP37 million turnover.

The combination of all these factors underpins the confidence we

have in the future. The strength of our first half performance

means that we are confident of achieving market expectations for

the year ending 29 February 2024.

The Board considers current consensus market expectation for the

year ending 29 February 2024 to be revenue of GBP273.1 million and

profit before taxation and highlighted items of GBP32.5

million.

Condensed Consolidated Interim Income Statement

For the six months ended 31 August 2023

6 months 6 months Year

ended ended ended

31 August 31 August 28 February

2023 2022 2023

Notes GBP'000 GBP'000 GBP'000

------------------------------------- ------ ----------- ------------ -------------

Revenue 3 136,682 122,910 264,102

Cost of sales (58,982) (56,804) (119,191)

------------------------------------- ------ ----------- ------------ -------------

Gross profit 77,700 66,106 144,911

Marketing and distribution costs (17,322) (14,886) (32,529)

Administrative expenses (46,798) (38,041) (86,551)

Share of result of joint venture - (67) (228)

Operating profit before highlighted

items 17,268 16,091 31,286

Highlighted items 4 (3,688) (2,979) (5,683)

------------------------------------- ------ ----------- ------------ -------------

Operating profit 13,580 13,112 25,603

Finance income 563 46 270

Finance costs (169) (213) (458)

------------------------------------- ------ ----------- ------------ -------------

Profit before taxation and

highlighted items 17,662 15,924 31,098

Highlighted items 4 (3,688) (2,979) (5,683)

------------------------------------- ------ ----------- ------------ -------------

Profit before taxation 3 13,974 12,945 25,415

Taxation (2,781) (2,834) (5,171)

------------------------------------- ------ ----------- ------------ -------------

Profit for the period attributable

to owners of the Company 11,193 10,111 20,244

------------------------------------- ------ ----------- ------------ -------------

Earnings per share attributable

to owners of the Company

Basic earnings per share 6 13.81p 12.49p 24.94p

Diluted earnings per share 6 13.66p 12.30p 24.54p

------------------------------------- ------ ----------- ------------ -------------

The accompanying notes form an integral part of this condensed

consolidated interim financial report.

Condensed Consolidated Interim Statement of Comprehensive

Income

For the six months ended 31 August 2023

6 months 6 months Year

ended ended ended

31 August 31 August 28 February

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------------- ----------- ----------- -------------

Profit for the period 11,193 10,111 20,244

Other comprehensive income

Items that may be reclassified to

the income statement:

Exchange differences on translating

foreign operations (5,136) 10,270 7,464

Items that may not be reclassified

to the income statement:

Remeasurements on the defined benefit - - -

pension scheme

------------------------------------------- ----------- ----------- -------------

Other comprehensive income for the

period net of tax (5,136) 10,270 7,464

------------------------------------------- ----------- ----------- -------------

Total comprehensive income for the

period attributable to owners of the

Company 6,057 20,381 27,708

------------------------------------------- ----------- ----------- -------------

Items in the statement above are disclosed net of tax.

Condensed Consolidated Interim Statement of Financial

Position

At 31 August 2023

Notes 31 August 31 August 28 February

2023 2022 2023

GBP'000 GBP'000 GBP'000

---------------------------------- ------ ---------- ---------- ------------

Assets

Goodwill 48,259 48,868 48,656

Other intangible assets 35,105 40,329 38,243

Investments - 161 -

Property, plant and equipment 2,190 2,562 2,503

Right-of-use assets 8,371 10,022 9,126

Deferred tax assets 11,188 8,953 7,928

Trade and other receivables 7 833 1,008 934

---------------------------------- ------ ---------- ---------- ------------

Total non-current assets 105,946 111,903 107,390

---------------------------------- ------ ---------- ---------- ------------

Inventories 40,385 44,324 43,364

Trade and other receivables 7 121,660 114,921 112,819

Cash and cash equivalents 39,109 41,451 51,540

---------------------------------- ------ ---------- ---------- ------------

Total current assets 201,154 200,696 207,723

---------------------------------- ------ ---------- ---------- ------------

Total assets 307,100 312,599 315,113

---------------------------------- ------ ---------- ---------- ------------

Liabilities

Deferred tax liabilities 3,411 3,830 3,115

Lease liabilities 7,434 9,191 8,570

Provisions 348 318 334

---------------------------------- ------ ---------- ---------- ------------

Total non-current liabilities 11,193 13,339 12,019

---------------------------------- ------ ---------- ---------- ------------

Trade and other liabilities 108,326 112,797 111,620

Lease liabilities 2,373 2,388 2,082

Current tax liabilities 902 999 790

Provisions 851 982 764

---------------------------------- ------ ---------- ---------- ------------

Total current liabilities 112,452 117,166 115,256

---------------------------------- ------ ---------- ---------- ------------

Total liabilities 123,645 130,505 127,275

---------------------------------- ------ ---------- ---------- ------------

Net assets 183,455 182,094 187,838

---------------------------------- ------ ---------- ---------- ------------

Equity

Share capital 1,020 1,020 1,020

Share premium 47,319 47,319 47,319

Translation reserve 10,455 18,397 15,591

Other reserves 9,942 11,064 10,870

Retained earnings 114,719 104,294 113,038

---------------------------------- ------ ---------- ---------- ------------

Total equity attributable to

owners of the Company 183,455 182,094 187,838

---------------------------------- ------ ---------- ---------- ------------

Condensed Consolidated Interim Statement of Changes in

Equity

At 31 August 2023

Own

Capital Share-based shares

Share Share Translation Merger redemption payment held by Retained Total

capital premium reserve reserve reserve reserve the EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------- -------- ------------ --------- ----------- ------------ -------- --------- ---------

At 1 March 2023 1,020 47,319 15,591 1,803 22 10,727 (1,682) 113,038 187,838

Profit for the

period - - - - - - - 11,193 11,193

Other

comprehensive

income

Exchange

differences

on

translating

foreign

operations - - (5,136) - - - - - (5,136)

Total

comprehensive

income for the

period - - (5,136) - - - - 11,193 6,057

Transactions with

owners

Dividends to

equity

holders of

the Company - - - - - - - (8,336) (8,336)

Purchase of

shares by the

Employee

Benefit Trust - - - - - - (2,814) - (2,814)

Share options

exercised - - - - - - 1,317 (1,283) 34

Deferred tax

on

share-based

payment

transactions - - - - - - - 107 107

Share-based

payment

transactions - - - - - 768 - - 768

Share-based

payment

cancellations - - - - - (199) - - (199)

------------------- -------- -------- ------------ --------- ----------- ------------ -------- --------- ---------

Total transactions

with owners of

the Company - - - - - 569 (1,497) (9,512) (10,440)

------------------- -------- -------- ------------ --------- ----------- ------------ -------- --------- ---------

At 31 August 2023 1,020 47,319 10,455 1,803 22 11,296 (3,179) 114,719 183,455

------------------- -------- -------- ------------ --------- ----------- ------------ -------- --------- ---------

Own

Capital Share-based shares

Share Share Translation Merger redemption payment held by Retained Total

capital premium reserve reserve reserve reserve the EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- -------- ------------ --------- ----------- ------------ -------- --------- --------

At 1 March 2022 1,020 47,319 8,127 1,803 22 9,492 (2,552) 103,738 168,969

Profit for the

period - - - - - - - 10,111 10,111

Other

comprehensive

income

Exchange

differences

on

translating

foreign

operations - - 10,270 - - - - - 10,270

Total

comprehensive

income for the

period - - 10,270 - - - - 10,111 20,381

Transactions with

owners

Dividends to

equity

holders of

the Company - - - - - - - (7,604) (7,604)

Purchase of

shares by

the Employee

Benefit

Trust - - - - - - (375) - (375)

Share options

exercised - - - - - - 2,015 (2,014) 1

Deferred tax

on

share-based

payment

transactions - - - - - - - 63 63

Share-based

payment

transactions - - - - - 659 - - 659

------------------ -------- -------- ------------ --------- ----------- ------------ -------- --------- --------

Total

transactions

with owners of

the Company - - - - - 659 1,640 (9,555) (7,256)

------------------ -------- -------- ------------ --------- ----------- ------------ -------- --------- --------

At 31 August 2022 1,020 47,319 18,397 1,803 22 10,151 (912) 104,294 182,094

------------------ -------- -------- ------------ --------- ----------- ------------ -------- --------- --------

Own

Capital Share-based shares

Share Share Translation Merger redemption payment held by Retained Total

capital premium reserve reserve reserve reserve the EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- -------- ------------ --------- ----------- ------------ -------- --------- --------

At 1 March 2022 1,020 47,319 8,127 1,803 22 9,492 (2,552) 103,738 168,969

Profit for the

year - - - - - - - 20,244 20,244

Other

comprehensive

income

Exchange

differences

on

translating

foreign

operations - - 7,464 - - - - - 7,464

Total

comprehensive

income for the

year - - 7,464 - - - - 20,244 27,708

Transactions with

owners

Dividends to

equity

holders of

the Company - - - - - - - (8,752) (8,752)

Purchase of

shares by

the Employee

Benefit

Trust - - - - - - (1,669) - (1,669)

Share options

exercised - - - - - - 2,539 (2,273) 266

Deferred tax

on

share-based

payment

transactions - - - - - - - 81 81

Share-based

payment

transactions - - - - - 1,235 - - 1,235

------------------ -------- -------- ------------ --------- ----------- ------------ -------- --------- --------

Total

transactions

with owners of

the Company - - - - - 1,235 870 (10,944) (8,839)

------------------ -------- -------- ------------ --------- ----------- ------------ -------- --------- --------

At 28 February

2023 1,020 47,319 15,591 1,803 22 10,727 (1,682) 113,038 187,838

------------------ -------- -------- ------------ --------- ----------- ------------ -------- --------- --------

Condensed Consolidated Interim Statement of Cash Flows

For the six months ended 31 August 2023

6 months 6 months Year

ended ended ended

31 August 31 August 28 February

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------------- ---------- ---------- ------------

Cash flows from operating activities

Profit for the period 11,193 10,111 20,244

Adjustments for:

Depreciation of property, plant and

equipment 414 314 659

Depreciation of right-of-use assets 1,026 902 2,114

Amortisation of intangible assets 4,825 4,774 9,687

Loss on disposal of property, plant

and equipment - - 13

Loss on disposal on intangible assets 3 - 107

Finance income (563) (46) (270)

Finance costs 169 213 458

Share of loss of joint venture - 67 228

Share-based payment charges 882 874 1,601

Tax expense 2,781 2,834 5,171

------------------------------------------- ---------- ---------- ------------

20,730 20,043 40,012

Decrease/(increase) in inventories 861 (6,886) (7,557)

Increase in trade and other receivables (12,712) (4,351) (3,226)

Increase in trade and other liabilities 77 3,640 4,033

------------------------------------------- ---------- ---------- ------------

Cash generated from operating activities 8,956 12,446 33,262

Income taxes paid (4,676) (3,970) (6,640)

------------------------------------------- ---------- ---------- ------------

Net cash generated from operating

activities 4,280 8,476 26,622

------------------------------------------- ---------- ---------- ------------

Cash flows from investing activities

Purchase of property, plant and equipment (131) (485) (818)

Purchases of intangible assets (2,582) (2,301) (5,165)

Purchase of business, net of cash

acquired - - (72)

Purchase of rights to assets - - (633)

Purchase of share in a joint venture - (182) (183)

Interest received 563 46 253

Net cash used in investing activities (2,150) (2,922) (6,618)

------------------------------------------- ---------- ---------- ------------

Cash flows from financing activities

Equity dividends paid (8,336) (7,604) (8,752)

Purchase of shares by the Employee

Benefit Trust (2,814) (375) (1,669)

Proceeds from exercise of share options 34 1 266

Cancellation of share options (199) - -

Repayment of lease liabilities (1,113) (990) (2,226)

Lease liabilities interest paid (169) (187) (390)

Other interest paid - (26) -

Net cash used in financing activities (12,597) (9,181) (12,771)

------------------------------------------- ---------- ---------- ------------

Net (decrease)/increase in cash

and cash equivalents (10,467) (3,627) 7,233

Cash and cash equivalents at beginning

of period 51,540 41,226 41,226

Exchange (loss)/gain on cash and

cash equivalents (1,964) 3,852 3,081

------------------------------------------- ---------- ---------- ------------

Cash and cash equivalents at end

of period 39,109 41,451 51,540

------------------------------------------- ---------- ---------- ------------

Notes to the Condensed Consolidated Interim Financial

Statements

1. Reporting entity

Bloomsbury Publishing Plc (the "Company") is a Company domiciled

in the United Kingdom. The condensed consolidated interim financial

statements of the Company as at and for the six months ended 31

August 2023 comprise the Company and its subsidiaries (together

referred to as the "Group"). The Group is primarily involved in the

publication of books and other related services.

2. Significant accounting policies

a) Basis of preparation

These condensed consolidated interim financial statements have

been prepared in accordance with International Accounting Standard

("IAS") 34 'Interim Financial Reporting'. They are unaudited and do

not constitute statutory accounts. Selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in financial position and

performance of the Group since the last annual consolidated

financial statements as at and for the year ended 28 February

2023.

Except as described below, the condensed set of financial

statements have been prepared on a consistent basis with the

financial statements for the year ended 28 February 2023 and should

be read in conjunction with the Annual Report 2023. The annual

consolidated financial statements of the Group are prepared in

accordance with UK-adopted International Accounting Standards and

the requirements of the Companies Act 2006. The 2023 Annual Report

refers to other new standards effective from 1 March 2023. None of

these standards have had a material impact in these financial

statements.

The comparative financial information for the year ended 28

February 2023 does not constitute statutory accounts for that

financial year. This information was extracted from the statutory

accounts for the year ended 28 February 2023, a copy of which has

been delivered to the Registrar of Companies. The auditor's report

on those accounts was unqualified and did not include a reference

to any matters to which the auditor drew attention by way of

emphasis of matter and did not contain a statement under section

498(2) or (3) of the Companies Act 2006.

The condensed consolidated interim financial statements were

approved and authorised for issue by the Board of Directors on 25

October 2023.

b) Going concern

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for at

least 12 months from the date of approval of the condensed

consolidated interim financial statements, being the period of the

detailed going concern assessment reviewed by the Board, and

therefore continue to adopt the going concern basis of accounting

in preparing the condensed consolidated interim financial

statements.

The Board has modelled a severe but plausible downside scenario.

This assumes:

-- Print revenues are reduced by 20%, with recovery during 2025/2026;

-- Digital revenues are reduced by 20%, with recovery during 2025/2026;

-- Print costs are increased by 3% from 2023/2024 and staff

costs are increased by 3% from 2023/2024;

-- Downside assumptions about extended debtor days, with recovery during 2025/2026;

-- Cash preservation measures implemented and variable costs reduced.

At 31 August 2023, the Group had available liquidity of

GBP49.1m, comprising central cash balances and its undrawn GBP10.0m

Revolving Credit Facility (RCF). The RCF agreement is to October

2024. Under the severe but plausible downside scenario, the Group

would maintain sufficient liquidity headroom even before modelling

the mitigating effect of actions that management would take in the

event that these downside risks were to crystallise.

The Group has an unsecured revolving credit facility with Lloyds

Bank Plc. At 31 August 2023, the Group had GBPnil draw down (2022:

GBPnil) of this facility with GBP10.0 million of undrawn borrowing

facilities (2022: GBP10.0 million) available. The facility

comprises a committed revolving credit facility of GBP10 million,

and an uncommitted incremental term loan facility of up to GBP6

million. The facilities are subject to two covenants, being a

maximum net debt to EBITDA ratio of 2.5x and a minimum interest

cover covenant of 4x.

c) Uses of estimates and judgments

The preparation of condensed consolidated interim financial

statements requires management to make judgments, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets liabilities, income and expenses.

Actual results may differ from these estimates. Critical judgments

and areas where the use of estimates is significant are set out in

the 2023 Annual Report.

3. Segmental analysis

The Group is comprised of two worldwide publishing divisions:

Consumer and Non-Consumer, reflecting the core customers for our

different operations. The Consumer division is further split out

into two operating segments: Children's Trade and Adult Trade.

Non-Consumer is split between two operating segments: Academic

& Professional and Special Interest.

Each reportable segment represents a cash-generating unit for

the purpose of impairment testing. We have allocated goodwill

between reportable segments.

These divisions are the basis on which the Group primarily

reports its segment information. Segments derive their revenue from

book publishing, sale of publishing and distribution rights,

management and other publishing services. The analysis by segment

is shown below:

Children's Adult Consumer Academic Special Non-Consumer Unallocated Total

Trade Trade & Interest

Professional

Six months GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

ended 31 August

2023 GBP'000 GBP'000 GBP'000

---------------- ----------- --------- --------- ------------- --------- ------------- ------------ ---------

External

revenue 61,734 27,630 89,364 36,435 10,883 47,318 - 136,682

Cost of sales (27,858) (14,268) (42,126) (11,327) (5,529) (16,856) - (58,982)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Gross profit 33,876 13,362 47,238 25,108 5,354 30,462 - 77,700

Marketing and

distribution

costs (8,848) (4,214) (13,062) (2,825) (1,435) (4,260) - (17,322)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Contribution

before

administrative

expenses 25,028 9,148 34,176 22,283 3,919 26,202 - 60,378

Administrative

expenses

excluding

highlighted

items (13,826) (9,022) (22,848) (16,395) (3,867) (20,262) - (43,110)

Share of joint - - - - - - - -

venture result

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Operating

profit/(loss)

before

highlighted

items/ segment

results 11,202 126 11,328 5,888 52 5,940 - 17,268

Amortisation of

acquired

intangible

assets - (180) (180) (2,197) (107) (2,304) - (2,484)

Other

highlighted

items - - - - - - (1,204) (1,204)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Operating

profit/(loss) 11,202 (54) 11,148 3,691 (55) 3,636 (1,204) 13,580

Finance income - - - 21 - 21 542 563

Finance costs (57) (46) (103) (49) (17) (66) - (169)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Profit/(loss)

before

taxation

and

highlighted

items 11,145 80 11,225 5,860 35 5,895 542 17,662

Amortisation of

acquired

intangible

assets - (180) (180) (2,197) (107) (2,304) - (2,484)

Other

highlighted

items - - - - - - (1,204) (1,204)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Profit/(loss)

before

taxation 11,145 (100) 11,045 3,663 (72) 3,591 (662) 13,974

Taxation - - - - - - (2,781) (2,781)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Profit/(loss)

for the period 11,145 (100) 11,045 3,663 (72) 3,591 (3,443) 11,193

---------------- ----------- --------- --------- ------------- --------- ------------- ------------ ---------

Children's Adult Consumer Academic Special Non-Consumer Unallocated Total

Trade Trade & Interest

Professional

Six months GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

ended 31 August

2022 GBP'000 GBP'000 GBP'000

---------------- ----------- --------- --------- ------------- --------- ------------- ------------ ---------

External

revenue 50,607 25,685 76,292 36,481 10,137 46,618 - 122,910

Cost of sales (26,453) (13,809) (40,262) (11,529) (5,013) (16,542) - (56,804)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Gross profit 24,154 11,876 36,030 24,952 5,124 30,076 - 66,106

Marketing and

distribution

costs (6,567) (3,995) (10,562) (2,929) (1,395) (4,324) - (14,886)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Contribution

before

administrative

expenses 17,587 7,881 25,468 22,023 3,729 25,752 - 51,220

Administrative

expenses

excluding

highlighted

items (8,863) (7,617) (16,480) (14,739) (3,843) (18,582) (35,062)

Share of joint

venture result - - - - - - (67) (67)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Operating

profit/(loss)

before

highlighted

items/ segment

results 8,724 264 8,988 7,284 (114) 7,170 (67) 16,091

Amortisation of

acquired

intangible

assets - (175) (175) (2,381) (107) (2,488) - (2,663)

Other

highlighted

items - - - - - - (316) (316)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Operating

profit/(loss) 8,724 89 8,813 4,903 (221) 4,682 (383) 13,112

Finance income - - - 26 - 26 20 46

Finance costs (70) (37) (107) (59) (21) (80) (26) (213)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Profit/(loss)

before

taxation

and

highlighted

items 8,654 227 8,881 7,251 (135) 7,116 (73) 15,924

Amortisation of

acquired

intangible

assets - (175) (175) (2,381) (107) (2,488) - (2,663)

Other

highlighted

items - - - - - - (316) (316)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Profit/(loss)

before

taxation 8,654 52 8,706 4,870 (242) 4,628 (389) 12,945

Taxation - - - - - - (2,834) (2,834)

---------------- ----------- --------- --------- ------------- --------- ------------ ---------

Profit/(loss)

for the period 8,654 52 8,706 4,870 (242) 4,628 (3,223) 10,111

---------------- ----------- --------- --------- ------------- --------- ------------- ------------ ---------

Children's Adult Consumer Academic Special Non-Consumer Unallocated Total

Trade Trade & Interest

Professional

Year ended 28 February 2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- --------------------- --------- --------- ------------- --------- ------------- ------------ ----------

External revenue 108,897 57,796 166,693 75,749 21,660 97,409 - 264,102

Cost of sales (56,205) (30,473) (86,678) (22,578) (9,935) (32,513) - (119,191)

------------------------------------- --------------------- --------- --------- ------------- --------- ------------ ----------

Gross profit 52,692 27,323 80,015 53,171 11,725 64,896 - 144,911

Marketing and distribution

costs (14,882) (9,455) (24,337) (5,364) (2,828) (8,192) - (32,529)

------------------------------------- --------------------- --------- --------- ------------- --------- ------------ ----------

Contribution before administrative

expenses 37,810 17,868 55,678 47,807 8,897 56,704 - 112,382

Administrative expenses excluding

highlighted items (20,497) (16,835) (37,332) (35,296) (8,240) (43,536) - (80,868)

Share of joint venture result - - - - - - (228) (228)

------------------------------------- --------------------- --------- --------- ------------- --------- ------------ ----------

Operating profit/(loss) before

highlighted items/ segment

results 17,313 1,033 18,346 12,511 657 13,168 (228) 31,286

Amortisation of acquired intangible

assets - (352) (352) (4,660) (214) (4,874) - (5,226)

Other highlighted items - - - - - - (457) (457)

------------------------------------- --------------------- --------- --------- ------------- --------- ------------ ----------

Operating profit/(loss) 17,313 681 17,994 7,851 443 8,294 (685) 25,603

Finance income - - - 50 - 50 220 270

Finance costs (144) (81) (225) (125) (40) (165) (68) (458)

------------------------------------- --------------------- --------- --------- ------------- --------- ------------ ----------

Profit/(loss) before taxation

and highlighted items 17,169 952 18,121 12,436 617 13,053 (76) 31,098

Amortisation of acquired intangible

assets - (352) (352) (4,660) (214) (4,874) - (5,226)

Other highlighted items - - - - - - (457) (457)

------------------------------------- --------------------- --------- --------- ------------- --------- ------------ ----------

Profit/(loss) before taxation 17,169 600 17,769 7,776 403 8,179 (533) 25,415

Taxation - - - - - - (5,171) (5,171)

------------------------------------- --------------------- --------- --------- ------------- --------- ------------ ----------

Profit/(loss) for the year 17,169 600 17,769 7,776 403 8,179 (5,704) 20,244

------------------------------------- --------------------- --------- --------- ------------- --------- ------------ ----------

Children's Adult Consumer Academic Special Non-Consumer Unallocated Total

Trade Trade & Professional Interest

Six months GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

ended 31 August

2023 GBP'000 GBP'000 GBP'000

---------------- ----------- -------- --------- --------------- ---------- ------------- ------------ --------

Operating

profit/(loss)

before

highlighted

items /segment

results 11,202 126 11,328 5,888 52 5,940 - 17,268

Depreciation 482 370 852 465 123 588 - 1,440

Amortisation of

internally

generated

intangibles 244 377 621 1,556 164 1,720 - 2,341

---------------- ----------- -------- --------- --------------- ---------- ------------ --------

EBITDA before

highlighted

items 11,928 873 12,801 7,909 339 8,248 - 21,049

---------------- ----------- -------- --------- --------------- ---------- ------------ --------

Children's Adult Consumer Academic Special Non-Consumer Unallocated Total

Trade Trade & Professional Interest

Six months GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

ended 31 August

2022 GBP'000 GBP'000 GBP'000

---------------- ----------- -------- --------- --------------- ---------- ------------- ------------ --------

Operating

profit/(loss)

before

highlighted

items /segment

results 8,724 264 8,988 7,284 (114) 7,170 (67) 16,091

Depreciation 429 229 658 440 118 558 - 1,216

Amortisation of

internally

generated

intangibles 223 292 515 1,428 168 1,596 - 2,111

---------------- ----------- -------- --------- --------------- ---------- ------------ --------

EBITDA before

highlighted

items 9,376 785 10,161 9,152 172 9,324 (67) 19,418

---------------- ----------- -------- --------- --------------- ---------- ------------ --------

Children's Adult Consumer Academic Special Non-Consumer Unallocated Total

Trade Trade & Professional Interest

Year ended 28 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

February 2023 GBP'000 GBP'000 GBP'000

---------------- ----------- -------- --------- --------------- ---------- ------------- ------------ --------

Operating

profit/(loss)

before

highlighted

items/segment

results 17,313 1,033 18,346 12,511 657 13,168 (228) 31,286

Depreciation 930 659 1,589 950 234 1,184 - 2,773

Amortisation of

internally

generated

intangibles 487 629 1,116 3,023 322 3,345 - 4,461

---------------- ----------- -------- --------- --------------- ---------- ------------ --------

EBITDA before

highlighted

items 18,730 2,321 21,051 16,484 1,213 17,697 (228) 38,520

---------------- ----------- -------- --------- --------------- ---------- ------------ --------

External revenue by product type

Six months Six months Year

ended ended ended

31 August 31 August 28 February

2023 2022 2023

GBP'000 GBP'000 GBP'000

-------------------- ---------- ---------- ------------

Print 92,691 85,709 185,966

Digital 38,736 32,529 66,317

Rights and services 5,255 4,672 11,819

-------------------- ---------- ---------- ------------

Total 136,682 122,910 264,102

-------------------- ---------- ---------- ------------

Rights and services revenue includes revenue from copyright and

trademark licences, management contracts, advertising and

publishing services.

Total assets 31 August 31 August 28 February

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------- ---------- --------------------- ------------

Children's Trade 21,541 21,337 19,569

Adult Trade 13,422 15,061 14,493

Academic & Professional 72,293 80,141 77,918

Special Interest 12,657 13,267 14,381

Unallocated 187,187 182,793 188,752

------------------------- ---------- --------------------- ------------

Total assets 307,100 312,599 315,113

------------------------- ---------- --------------------- ------------

Unallocated primarily represents centrally held assets including

system development, property, plant and equipment, right-of-use

assets, receivables and cash.

4. Highlighted items

Six months Six months Year

ended ended ended

31 August 31 August 28 February

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------- ----------- ----------- -------------

Legal and other professional fees 131 111 93

Integration and restructuring

costs 1,073 205 364

Other highlighted items 1,204 316 457

Amortisation of acquired intangible

assets 2,484 2,663 5,226

------------------------------------- ----------- ----------- -------------

Total highlighted items 3,688 2,979 5,683

------------------------------------- ----------- ----------- -------------

Highlighted items charged to operating profit comprise

significant non-cash charges and major one-off initiatives, which

are highlighted in the income statement because, in the opinion of

the Directors, separate disclosure is helpful in understanding the

underlying performance and future profitability of the

business.

For the six months ended 31 August 2023 legal and other

professional fees of GBP131,000 were incurred as a result of

acquisitions including the ABC-CLIO, LLC acquisition . Integration

and restructuring costs of GBP1,073,000 were incurred as a result

of the integration of the ABC-Clio, LLC acquisition and

restructuring.

For the six months ended 31 August 2022 legal and other

professional fees of GBP111,000 were incurred as a result of the

acquisition of certain assets of Red Globe Press and the ABC-CLIO,

LLC acquisition. Integration and restructuring costs of GBP205,000

were incurred as a result of the integration of the above

acquisitions and the Head of Zeus Limited acquisition.

For the year ended 28 February 2023, legal and other

professional fees of GBP93,000 were incurred as a result of the

Group's acquisitions, including ABC-CLIO, LLC and certain assets of

UIT Cambridge. Integration and restructuring costs primarily relate

to the integration of the ABC-CLIO, LLC, Head of Zeus Limited

acquisitions and certain assets of Red Globe Press.

5. Dividends

Six months Six months Year

ended ended ended

31 August 31 August 28 February

2023 2022 2023

GBP'000 GBP'000 GBP'000

--------------------------------- ----------- ----------- ------------

Amounts paid in the period

Prior period final dividend 8,336 7,604 7,604

Interim dividend - - 1,148

--------------------------------- ----------- ----------- ------------

Total dividend payments in the

period 8,336 7,604 8,752

Amounts arising in respect of

the period

Interim dividend for the period 3,005 1,147 1,148

Final dividend for the year - - 8,397

Total dividend for the period 3,005 1,147 9,545

--------------------------------- ----------- ----------- ------------

The proposed interim dividend of 3.70 pence per ordinary share

will be paid to the equity Shareholders on 1 December 2023 to

Shareholders registered at close of business on 3 November

2023.

6. Earnings per share

The basic earnings per share for the six months ended 31 August

2023 is calculated using a weighted average number of Ordinary

Shares in issue of 81,058 ,723 (31 August 2022: 80,921,019 and 28

February 2023: 81,172,636) after deducting shares held by the

Employee Benefit Trust.

The diluted earnings per share is calculated by adjusting the

weighted average number of Ordinary Shares to take account of all

dilutive potential Ordinary Shares, which are in respect of

unexercised share options and the Performance share Plan.

6 months

ended 6 months ended Year ended

31 August 31 August 28 February

2023 2022 2023

Number Number Number

Weighted average shares in

issue 81,058,723 80,921,019 81,172,636

Dilution 890,550 1,314,336 1,336,878

------------------------------- ----------- --------------- ------------

Diluted weighted average

shares in issue 81,949,273 82,235,355 82,509,514

------------------------------- ----------- --------------- ------------

GBP'000 GBP'000 GBP'000

------------------------------- ----------- --------------- ------------

Profit after tax attributable

to owners of the Company 11,193 10,111 20,244

------------------------------- ----------- --------------- ------------

Basic earnings per share 13.81p 12.49p 24.94p

Diluted earnings per share 13.66p 12.30p 24.54p

------------------------------- ----------- --------------- ------------

Adjusted profit attributable

to owners of the Company 14,314 12,579 25,217

------------------------------- ----------- --------------- ------------

Adjusted basic earnings per

share 17.66p 15.54p 31.07p

Adjusted diluted earnings

per share 17.47p 15.30p 30.56p

------------------------------- ----------- --------------- ------------

Adjusted profit is derived as follows:

Profit before tax 13,974 12,945 25,415

Amortisation of acquired intangible

assets 2,484 2,663 5,226

Other highlighted items 1,204 316 457

------------------------------------- ------- ------- -------

Adjusted profit before tax 17,662 15,924 31,098

------------------------------------- ------- ------- -------

Tax expense 2,781 2,834 5,171

Deferred tax movements on

goodwill and acquired intangible

assets 368 484 631

Tax expense on other highlighted

items 199 27 79

Adjusted tax 3,348 3,345 5,881

----------------------------------- ------ ------ ------

Adjusted profit 14,314 12,579 25,217

----------------- ------- ------- -------

The Group includes the benefit of tax amortisation of intangible

assets in the calculation of adjusted tax as this more accurately

aligns the adjusted tax charge with the expected cash tax

payments.

7. Trade and other receivables

31 August 31 August 28 February

2023 2022 2023

Non-current GBP'000 GBP'000 GBP'000

------------------------------------ ----------- ----------- -------------

Accrued income 833 1,008 934

------------------------------------ ----------- ----------- -------------

Current

Gross trade receivables 77,207 75,666 72,549

Less: loss allowance (3,526) (3,463) (3,334)

------------------------------------ ----------- ----------- -------------

Net trade receivables 73,681 72,203 69,215

Income tax recoverable 1,205 1,967 2,332

Other receivables 2,923 2,645 2,497

Prepayments 2,429 2,469 2,653

Accrued income 6,073 3,992 6,579

Royalty advances 35,349 31,645 29,543

------------------------------------ ----------- ----------- -------------

Total current trade and other

receivables 121,660 114,921 112,819

------------------------------------ ----------- ----------- -------------

Total trade and other receivables 122,493 115,929 113,753

------------------------------------ ----------- ----------- -------------

Non-current receivables relate to accrued income on long-term

rights deals.

Trade receivables principally comprise amounts receivable from

the sale of books due from distributors. The majority of trade

debtors are secured by credit insurance and in certain territories

by third party distributors.

A provision is held against gross advances payable in respect of

published titles advances which may not be fully earned down by

anticipated future sales. As at 31 August 2023 GBP10,137,000 (31

August 2022 GBP8,909,000 and 28 February 2023 GBP7,745,000) of

royalty advances relate to titles expected to be published in more

than 12 months' time.

8. Related parties

The Group has no related party transactions in the current or

prior periods other than key management remuneration.

Responsibility Statement of the Directors in Respect of the

Interim Financial Statements

Directors

--------------------- -------------------------------------

Sir Richard Lambert Independent Non-Executive Chairman

Chair of the Nomination Committee

--------------------- -------------------------------------

Nigel Newton Chief Executive

--------------------- -------------------------------------

Leslie-Ann Reed Senior Independent Director

Chair of the Audit Committee

--------------------- -------------------------------------

John Bason Independent Non-Executive Director

Chair of the Remuneration Committee

--------------------- -------------------------------------

Baroness Lola Independent Non-Executive Director

Young of Hornsey

--------------------- -------------------------------------

Penny Scott-Bayfield Group Finance Director

--------------------- -------------------------------------

We confirm that to the best of our knowledge:

-- The condensed set of financial statements has been prepared

in accordance with UK-adopted International Accounting Standard 34

'Interim Financial Reporting'.

-- The interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last annual report that could do

so.

By order of the Board

Nigel Newton Penny Scott-Bayfield

26 October 2023

Principal risks and uncertainties

Bloomsbury has a systematic and embedded risk management process

for identifying, evaluating and managing risk, with the goal of

supporting the Group in meeting its strategic and operational

objectives.

The principal risks for the Group's business are summarised as

follows:

-- Market: including market volatility, impact of economic

instability, increased dependence on internet retailing, open

access, sales of used books and rental of textbooks;

-- Importance of digital publishing: BDR revenues and profit;

-- Acquisitions: return on investment;

-- Title acquisition (Consumer publishing): Commercial viability;

-- Information and technology systems: Cybersecurity and malware

attack, and internal access controls or security measures;

-- Financial valuations: Judgemental valuation of assets and provisions;

-- Intellectual property: Erosion of copyright and infringement of Group IP by third parties;

-- Reliance on key counterparties and supply chain resilience:

Failure of key counterparties or breakdown in key counterparty

relationships;

-- Talent management: Failure to attract and retain key talent

and create an inclusive and supportive environment in which the

Group's employees can thrive;

-- Legal and compliance: Breach of key contracts by the Group

and failure to comply with applicable regulations;

-- Reputation: Investor confidence; and

-- Inflation: Print supply costs and staff costs.

Further information about the principal risks and risk

management is included in the 2023 Annual Report and Accounts.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QELFLXBLEFBB

(END) Dow Jones Newswires

October 26, 2023 02:00 ET (06:00 GMT)

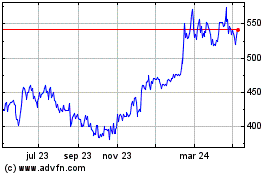

Bloomsbury Publishing (LSE:BMY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

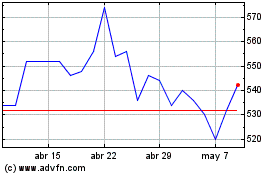

Bloomsbury Publishing (LSE:BMY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024