TIDMCFX

RNS Number : 7106I

Colefax Group PLC

09 August 2023

AIM: CFX

COLEFAX GROUP PLC

("Colefax" or the "Group")

Preliminary Results for the year ended 30 April 2023

Colefax is an international designer and distributor of

furnishing fabrics & wallpapers and owns a leading interior

decorating business. The Group trades under five brand names,

serving different segments of the soft furnishings marketplace;

these are Colefax and Fowler, Cowtan & Tout, Jane Churchill,

Manuel Canovas and Larsen.

Key Points

-- Sales increased by 3% to GBP104.80m (2022 - GBP101.8m) but

down by 3% on a constant currency basis due to lower Decorating

Division sales

-- Pre-tax profit decreased by 21% to GBP8.54m (2022 -

GBP10.82m) - mainly due to lower Decorating Division profits

following an exceptional performance in the prior year

-- Earnings per share decreased by 13% to 89.7p (2022 - 102.5p)

-- Share buyback returned GBP5.4m of surplus capital to shareholders in September 2022.

-- Cash at 30 April 2023 of GBP19.8m (2022 - GBP21.8m)

-- Fabric Division sales increased by 9.5% to GBP92.51m (2022 -

GBP84.51m) and by 1.5% on a constant currency basis

- US sales down by 1%, UK sales up by 1% and Europe sales up by

7% (on a constant currency basis)

-- Decorating Division sales decreased by 35% to GBP9.52m (2022

- GBP14.63m) following an exceptional prior year performance.

Pre-tax loss of GBP96,000 (2022 - GBP1.47m profit)

-- Board is proposing a final dividend of 2.8p (2022 - 2.7p)

making a total for the year of 5.4p (2022 - 5.2p)

David Green, Chief Executive of Colefax Group plc, said:

" The Group has delivered another strong performance achieving

record Fabric Division sales against a record prior year. We

benefitted from a strong US Dollar and a continuation of the home

decorating boom triggered by the pandemic but have also had to deal

with high levels of cost inflation in all areas of the

business.

"The performance of the Group lags activity in the high-end

housing market and we do expect trading conditions to become

progressively more challenging as steep interest rate increases

start to have an impact in the US and the UK. These expectations

are factored into our current year market forecast ."

Enquiries:

Colefax Group plc David Green, Chief Tel: 020 7318

Executive 6021

Rob Barker, Finance

Director

KTZ Communications Katie Tzouliadis, Robert Tel: 020 3178

Morton 6378

Peel Hunt LLP Adrian Trimmings, Andrew Tel: 020 7418

(Nominated Advisor Clark 8900

and Broker)

COLEFAX GROUP PLC

CHAIRMAN'S STATEMENT

Financial Results

Group sales increased by 3% to GBP104.82 million (2022 -

GBP101.80 million) but decreased by 3% on a constant currency

basis. Pre-tax profits decreased by 21% to GBP8.54 million (2022 -

GBP10.82 million). Earnings per share decreased by 13% to 89.7p

(2022 - 102.5p). The Group ended the year with net cash of GBP19.8

million (2022 - GBP21.8 million).

Trading conditions in the Group's core Fabric Division remained

mostly favourable throughout the year despite rising interest rates

and a slowdown in housing market activity. Sales increased by 2% on

a constant currency basis against record prior year sales but

pre-tax profits declined by 9% due to cost increases caused by high

levels of inflation. The Group benefitted from a very strong US

Dollar average rate of $1.20 compared to $1.35 for the prior year

but the resulting margin boost was largely offset by above average

increases in operating expenses. Although Fabric Division profits

decreased by 9% the main reason for the 21% decrease in Group

profit was a 35% reduction in Decorating Division sales which

resulted in a loss of GBP96,000 for the year compared to a profit

of GBP1.47 million in the prior year. Fluctuations in Decorating

Division sales are a feature of the business and depend on the

timing of project completions.

In September 2022 the Group returned GBP5.4 million of surplus

cash to shareholders by way of a share buyback. The Group purchased

and cancelled 700,000 shares representing 8.8% of the issued

ordinary share capital at a price of 765p per share.

The Board is proposing to pay a final dividend of 2.8p (2022 -

2.7p) making a total for the year of 5.4p (2022 - 5.2p). This will

be paid on 12 October 2023 to shareholders on the register at the

close of business on 15 September 2023.

Product Division

-- Fabric Division - Portfolio of Five Brands: "Colefax and

Fowler", "Cowtan and Tout", "Jane Churchill", "Manuel Canovas" and

"Larsen"

Sales in the Fabric Division, which represent 88% of Group

turnover, increased by 10% to GBP92.51 million (2022 - GBP84.51

million) and by 1.5% on a constant currency basis. Pre-tax profit

decreased by 9% to GBP8.40 million (2022 - GBP9.29 million). All

our major markets performed well against strong prior year

comparatives. Sales in the Fabric Division are linked to the level

of housing market activity but there is a time lag of up to a year

or more between customers moving house and spending on home

improvement. Housing transactions in the US and the UK peaked

during the Covid pandemic and we believe this has been the main

driver of sales over the last two years.

During the first eight months of the year we experienced

significant increases in the cost of goods mainly driven by

unprecedented increases in energy prices. Managing cost inflation

was the biggest challenge for the business during the year but in

recent months energy prices have fallen and the inflation outlook

has improved.

Sales in the US, which represent 63% of the Fabric Division's

turnover, increased by 11% but decreased by 1% on a constant

currency basis. Sales in the US are around 28% higher than they

were prior to the start of the Covid pandemic demonstrating the

strength of the home decorating boom that has taken place as a

result. Rising interest rates in the US have inevitably led to a

sharp decline in housing transactions and as expected trading

conditions started to get more challenging towards the end of the

year. We continue to look for opportunities to strengthen our US

distribution network and in the autumn we will be opening a new

showroom in Dallas to take advantage of growth opportunities in

this territory.

Sales in the UK, which represent 16% of the Fabric Division's

turnover, increased by 1% against record prior year sales. The UK

market at the high end has been reasonably resilient although as in

the US rising interest rates are starting to have an adverse impact

on housing transactions which are a key driver of sales. Sales in

the second half of the year were flat following a 4% increase in

the first half of the year.

Sales in Continental Europe, which represent 19% of the Fabric

Division's turnover, increased by 9% and by 7% on a constant

currency basis. In terms of sales growth Europe was the best

performing market during the year. This is partly due to an

increase in contract orders linked to a strong post covid recovery

in the high-end hotels sector. Although Brexit does not appear to

have adversely impacted sales in Europe it has resulted in

increased bureaucracy and costs which have reduced the

profitability of sales in Europe. In particular, fabrics purchased

from EU manufacturers are now subject to import duty when shipped

from our UK warehouse to EU customers. France remains our largest

market in Europe and together with Germany and Italy these three

countries accounted for 52% of European sales.

Sales in the Rest of the World, which represent just 2% of the

Fabric Division's turnover, increased by 31% during the year mainly

due to a significant recovery in Middle East sales. Our major

markets in the Rest of the World are the Middle East, China and

Australia and whilst we will continue to pursue growth

opportunities in specific countries, the Rest of the World will

remain a small proportion of total Fabric Division sales.

-- Furniture - Kingcome Sofas

Sales of Kingcome furniture, which represent 3% of Product

Division sales, increased by 5% to GBP2.78 million (2022 - GBP2.66

million). Pre-tax profit increased by GBP160,000 to GBP240,000

(2022 - GBP80,000) The improved profit partly reflects the absence

of one-off marketing costs in the prior year but also demonstrates

the high level of operational gearing in this business where

relatively small changes in sales can have a significant impact on

profits. During the year we completed a major investment in our

freehold factory in Devon which has increased operational and

energy efficiency. In September we opened a new trade showroom

adjoining our Colefax showroom in Chelsea Harbour and are starting

to see the benefits of this investment.

Interior Decorating Division

Decorating sales, which represent 9% of Group turnover,

decreased by 35% to GBP9.52 million (2022 - GBP14.63 million)

resulting in a pre-tax loss for the year of GBP96,000 (2022 -

GBP1.47 million profit). The reduction in sales was in line with

expectations and follows an exceptional performance in the prior

year. The profit on decorating projects is recognised on invoicing

and as a result sales and profits can fluctuate significantly

depending on the timing of completion of projects. Lead times

increased markedly during the pandemic and labour shortages

continue to impact the duration and timing of projects. The

Decorating Division is starting the new year with a high level of

deposits which are up by 90% compared to the prior year.

Prospects

The Group has delivered another strong performance achieving

record Fabric Division sales against a record prior year

comparative. We benefitted from a strong US Dollar and a

continuation of the home decorating boom triggered by the pandemic

but have also had to deal with high levels of cost inflation in all

areas of the business. The performance of our core Fabric Division

lags activity in the high-end housing market and we do expect

trading conditions to become progressively more challenging as

steep interest rate increases start to have an impact in the US and

the UK. These expectations are factored into our current year

market forecast. The Group has a very strong balance sheet with

cash of GBP19.8 million and we will continue to invest with

confidence in our portfolio of brands.

The Group's performance over the last year reflects the talent

and hard work of all our staff and I would like to thank them for

their loyalty and support.

David Green

Chairman

8 August 2023

GROUP INCOME STATEMENT

For the year ended 30 April 2023

2023 2022

GBP'000 GBP'000

Revenue 104,818 101,796

Cost of sales (45,085) (47,237)

Gross profit 59,733 54,559

Operating expenses (50,214) (42,665)

Other income - -

------------------------------------------------------------------ ----------------- ------------------

Profit from operations 9,519 11,894

Finance income 26 -

Finance expense (1,001) (1,071)

Profit before taxation 8,544 10,823

Tax expense (1,857) (2,330)

Profit for the year attributable to equity holders of the parent 6,687 8,493

Basic and diluted earnings per share 89.7p 102.5p

GROUP STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 April 2023

2023 2022

GBP'000 GBP'000

Profit for the year 6,687 8,493

Other comprehensive (expense) / income:

Items that will or may be reclassified to profit and loss:

Exchange differences on translation of foreign operations (93) 522

Tax relating to items that will or may be reclassified to profit and loss - -

--------------------------------------------------------------------------- ----------------- -----------------

Total other comprehensive (expense) / income (93) 522

Total comprehensive income for the year attributable to 6,594 9,015

equity holders of the parent

--------------------------------------------------------------------------- ----------------- -----------------

GROUP STATEMENT OF FINANCIAL POSITION

At 30 April 2023

Notes 2023 2022

GBP'000 GBP'000

Non-current assets:

Property, plant and equipment 8,231 7,423

Right of use asset 23,464 25,621

Deferred tax asset 23 22

31,718 33,066

Current assets:

Inventories and work in progress 2 19,487 17,031

Trade and other receivables 3 9,153 6,976

Cash and cash equivalents 4 19,746 21,785

Current corporation tax 144 115

48,530 45,907

------------------------------------------------------------ ------ ------------------ ------------------

Current liabilities:

Trade and other payables 5 20,003 17,582

Lease liabilities 3,085 4,176

23,088 21,758

------------------ ------------------

Net current assets 25,442 24,149

------------------ ------------------

Total assets less current liabilities 57,160 57,215

------------------------------------------------------------ ------ ------------------ ------------------

Non-current liabilities:

Lease liabilities 22,977 23,807

Deferred tax liability 223 261

Net assets 33,960 33,147

------------------------------------------------------------ ------ ------------------ ------------------

Capital and reserves attributable to equity holders of the

Company:

Called up share capital 724 794

Share premium account 11,148 11,148

Capital redemption reserve 2,150 2,080

ESOP share reserve (113) (113)

Foreign exchange reserve 1,619 1,712

Retained earnings 18,432 17,526

Total equity 33,960 33,147

------------------------------------------------------------ ------ ------------------ ------------------

GROUP STATEMENT OF CASH FLOWS

For the year ended 30 April 2023

2023 2022

GBP'000 GBP'000

Operating activities

Profit before taxation 8,544 10,823

Finance income (26) -

Finance expense 1,001 1,071

Loss/(Profit) on disposal of property, plant

and equipment 47 (9)

Depreciation 2,748 2,274

Depreciation on right of use assets 4,952 4,609

--------------------------- ---------------------------

Cash flows from operations before changes

in working capital 17,266 18,768

---------------------------------------------- --------------------------- ---------------------------

Increase in inventories and work in progress (2,462) (898)

(Increase) / decrease in trade and other

receivables (2,099) 1,789

Increase / (decrease) in trade and other

payables 2,239 (1,736)

Cash generated from operations 14,944 17,923

---------------------------------------------- --------------------------- ---------------------------

Taxation paid

UK corporation tax paid (699) (1,595)

Overseas tax paid (1,103) (488)

(1,802) (2,083)

--------------------------- ---------------------------

Net cash inflow from operating activities 13,142 15,840

---------------------------------------------- --------------------------- ---------------------------

Investing activities

Payments to acquire property, plant and

equipment (3,580) (2,255)

Receipts from sales of property, plant and

equipment - 13

Net cash outflow from investing (3,580) (2,242)

---------------------------------------------- --------------------------- ---------------------------

Financing activities

Purchase of own shares (5,382) (6,779)

Principal paid on lease liabilities (4,846) (4,061)

Interest paid on lease liabilities (999) (1,073)

Interest paid - 3

Equity dividends paid (399) (197)

--------------------------- ---------------------------

Net cash outflow from financing (11,626) (12,107)

---------------------------------------------- --------------------------- ---------------------------

Net (decrease)/increase in cash and cash

equivalents (2,064) 1,491

Cash and cash equivalents at beginning of

year 21,785 19,344

Exchange gains/(losses) on cash and cash

equivalents 25 950

---------------------------------------------- --------------------------- ---------------------------

Cash and cash equivalents at end of year 19,746 21,785

---------------------------------------------- --------------------------- ---------------------------

GROUP STATEMENT OF CHANGES IN EQUITY

For the year ended 30

April 2023

Share Capital ESOP Foreign

Share premium redemption share exchange Retained Total

capital account reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- ----------- -------- --------- --------- --------

At 30 April

2022 794 11,148 2,080 (113) 1,712 17,526 33,147

Profit for the

year - - - - - 6,687 6,687

Foreign

exchange - - - - (93) - (93)

Tax on other

comprehensive

income - - - - - -

Total

comprehensive

income for

the year - - - - (93) 6,687 6,594

Share buybacks (70) - 70 - - (5,382) (5,382)

Dividends paid - - - - - (399) (399)

At 30 April

2023 724 11,148 2,150 (113) 1,619 18,432 33,960

At 30 April

2021 902 11,148 1,972 (113) 1,190 16,009 31,108

Profit for the

year - - - - - 8,493 8,493

Foreign

exchange - - - - 522 - 522

Tax on other

comprehensive

income - - - - - - -

Total

comprehensive

income for

the year - - - - 522 8,493 9,015

--------------- -------- -------- ----------- -------- --------- --------- --------

Share buybacks (108) - 108 - - (6,779) (6,779)

Dividends paid - - - - - (197) (197)

At 30 April

2022 794 11,148 2,080 (113) 1,712 17,526 33,147

COLEFAX GROUP PLC

NOTES TO THE FINANCIAL INFORMATION

1. Earnings per share

Basic earnings per share have been calculated on the basis of

profit on ordinary activities after tax of GBP6,687,000 (2022 -

GBP8,493,000) and on 7,457,535 (2022 - 8,284,746) ordinary shares,

being the weighted average number of ordinary shares in issue

during the year. Shares owned by the Colefax Group Plc Employees'

Share Ownership Plan (ESOP) Trust are excluded from the basic

earnings per share calculation.

Diluted earnings per share are the same as basic earnings per

share as there are no outstanding share options in force at 30

April 2023.

2. Inventories and work in progress

2023 2022

GBP'000 GBP'000

--------- ---------

Finished goods for resale 16,508 14,961

Work in progress 2,979 2,070

--------- ---------

19,487 17,031

--------- ---------

3. Trade and other receivables

2023 2022

GBP'000 GBP'000

--------- ---------

Trade receivables 6,129 5,096

Less: provision for impairment of

trade receivables (516) (374)

Other receivables 1,403 607

Prepayments and accrued income 2,137 1,647

--------- ---------

9,153 6,976

--------- ---------

4. Cash and cash equivalents

2023 2022

GBP'000 GBP'000

--------- ---------

Cash at bank and in hand 19,746 21,785

--------- ---------

The fair value of cash and cash equivalents are considered to be

their book value.

5. Trade and other payables

2023 2022

GBP'000 GBP'000

--------- ---------

Trade payables 5,525 5,933

Accruals 7,167 6,402

Payments received on account 5,272 3,360

Other taxes and social security

costs 609 704

Other payables 1,430 1,183

--------- ---------

20,003 17,582

--------- ---------

6. Financial Information

The above financial information, which has been prepared in

accordance with international accounting standards in conformity

with the Companies Act 2006, does not constitute statutory accounts

as defined in Section 435 of the Companies Act 2006.

The financial information for the year ended 30 April 2023 has

been extracted from the statutory accounts which will be delivered

to the Registrar of Companies following the Company's annual

general meeting. The comparative financial information is based on

the statutory accounts for the financial year ended 30 April 2022

which have been delivered to the Registrar of Companies. The

Independent Auditors' Report on both of those financial statements

was unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under Section 498(2) and

Section 498(3) of the Companies Act 2006.

7. Copies of the Annual Report and full Financial Statements

will be available from the Group's website on

www.colefaxgroupplc.com. Copies will also be made available on

request to members of the public at the Company's registered office

at 19-23 Grosvenor Hill, London W1K 3QD.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPMRTMTTMBMJ

(END) Dow Jones Newswires

August 09, 2023 02:00 ET (06:00 GMT)

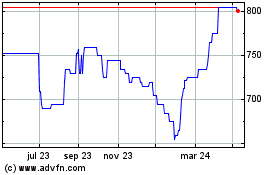

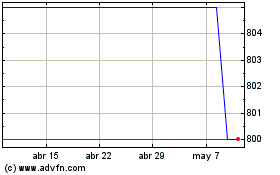

Colefax (LSE:CFX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Colefax (LSE:CFX)

Gráfica de Acción Histórica

De May 2023 a May 2024