CMO Group PLC Half Year Trading Update (1241I)

03 Agosto 2023 - 1:00AM

UK Regulatory

TIDMCMO

RNS Number : 1241I

CMO Group PLC

03 August 2023

CMO Group PLC

Half Year Trading Update (unaudited)

Progress on key strategic priorities and trading update

CMO Group PLC ("CMO" or the "Group"), the UK's largest

online-only retailer of building materials, today announces an

update on trading for the half year to 30 June 2023.

As reported in May, at the time of our preliminary results, we

expected the economic situation to remain challenging and the

timing of recovery in consumer confidence uncertain. In response,

we laid out our key strategic priorities for 2023 which were to

make cost reductions, improve margins, address carriage costs and

adapt to current slower sales growth. We are pleased to report on

progress to date and that, despite ongoing market volatility, the

Board expects EBITDA to be in line with market expectations for the

year of GBP2.5m, albeit with sales lower at c.GBP80m.

Our focus on driving profitable sales has been underpinned

by:

-- Improvement in Product margins : Product margins excluding

carriage have trended upwards in the first six months and improved

by 2.2 percentage points compared to full year 2022.

-- Carriage Cost Control : We have seen a 55% improvement in

carriage loss versus the first half 2022.

-- Overhead Efficiency : Overheads have reduced in accordance

with our plan, including the headcount reductions announced for the

first quarter.

Balance sheet: The Group continues to have a sound financial

position with sufficient headroom in its facilities for its ongoing

development. Net cash at the end of the period was GBP1.0m, a

reduction since the year end of GBP0.4m. The movement includes the

payment of deferred consideration of GBP1.0m offset by a benefit of

c. GBP0.9m, following a temporary pause in the Group's VAT

payments, as requested by HMRC, as it works to bring the Group

together under one VAT registration . Cash on the balance sheet was

GBP4.7m at the period end (FY2022 GBP6.2m), with drawn facilities

of GBP3.7m (Y/E 2022 GBP4.6m).

Revenue: Sales in the first half of GBP36.9m represent a one

year like-for-like decline of 12%, 15% up on pre-Covid

like-for-like and representing an increase for the Group of 57% on

a four-year view. We remain focused on continuing to drive

profitable sales and with an underlying improvement in sales trend

towards the end the end of H1 which has continued into July, we

expect to see a return to sales growth in the second half of the

year.

Trading: Across our business we have seen underlying robustness

in our Trade customers with improved KPI's in revenue per session

growing 15% YTD and the number of repeat customers up 21%. Our

program to integrate JTM Plumbing and Clickbasin into PLUMBING

SUPERSTORE and the integration of Total Tiles into TILE SUPERSTORE

is progressing well.

Dean Murray, CEO of CMO Group PLC, said:

"We continue to forge ahead with our strategy to disrupt and

build market share in the Building Materials market. The full

integration of our two most recent acquisitions into PLUMBING

SUPERSTORE and the launch of the GOOD BUILD SUPERSTORE mark

further, great progress in our mission to provide our customers

with everything they need to build or maintain a home, and I look

forward to the launch of another exciting, specialised superstore

in the coming months.

We have seen good progress on the strategic objectives and

actions for 2023 outlined at the last results, which are delivering

improved margins and, combined with overhead efficiencies, are

expected to deliver improving profitability in the second half and

full year results in line with our expectations."

3 August 2023

Enquiries:

CMO Group PLC Via Instinctif

Dean Murray, CEO

Jonathan Lamb, CFO

Liberum Capital Limited (Nominated Tel: +44 20 3100 2000

Adviser & Broker)

Andrew Godber

Lauren Kettle

Cara Murphy

Instinctif Partners (Financial PR) Tel: +44 20 7457 2020

Justine Warren

Matthew Smallwood

Joe Quinlan

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTMZGGRVZLGFZM

(END) Dow Jones Newswires

August 03, 2023 02:00 ET (06:00 GMT)

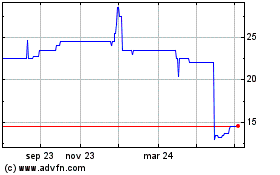

Cmo (LSE:CMO)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

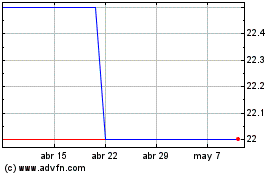

Cmo (LSE:CMO)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025