TIDMCSFS

RNS Number : 0796M

Cornerstone FS PLC

12 September 2023

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain .

12 September 2023

Cornerstone FS plc

("Cornerstone" or the "Company" or the "Group")

Interim Results

Significant revenue growth, maiden six-month period of

profitability and cash generation

On track for FY 2023 to be significantly ahead of

expectations

Cornerstone FS plc (AIM: CSFS), a foreign exchange and payments

solutions company offering multi-currency accounts to businesses

and individuals through its proprietary technology platform, is

pleased to announce its unaudited interim results for the six

months ended 30 June 2023.

Financial Highlights

-- Revenue increased by 90% to GBP3.6m (H1 2022: GBP1.9m)

through the continued expansion of the Group's payments

capabilities and offering, and on-going investment in the sales

function

-- Gross margin broadly stable at 61.0% (H1 2022: 61.7%)

-- Maiden half-year adjusted(1) EBITDA of GBP0.2m (H1 2022:

GBP0.5m loss) driven by both revenue growth and careful management

of the Group's cost base

-- Operating profit of GBP0.1m (H1 2022: GBP3.0m loss)

-- Profit before tax of GBP23k (H1 2022: GBP3.0m loss)

-- Cash generated from operations of GBP0.1m (H1 2022: cash used in operations of GBP0.1m)

-- Cash and cash equivalents increased to GBP816k at 30 June 2023 (31 December 2022: GBP682k)

Operational Highlights

-- Proportion of revenue accounted for by direct clients

increased to 91% (H1 2022: 74%) reflecting the strategic decision

to rationalise the majority of the historic white label

business

-- Active customers(2) increased to 874 (period to 30 June 2022: 697)

-- New counterparty partnerships established to broaden the

number of currencies and countries where the Group can transact -

the Group can now pay out to over 150 countries in 58

currencies

-- Completed preparation for the introduction of the Consumer Duty regulation in July 2023

Current trading and outlook

-- The strong trading momentum experienced in the first half of

the year has continued into the second half

-- With the continued advancements being made across the

business and a clear focus on Cornerstone's strategic growth

priorities, the Group now expects to report results for its full

year 2023 significantly ahead of market expectations, including

achieving its first full year of positive adjusted EBITDA

-- The Board is confident that the Group's funding position is

comfortable and sufficient to support its existing growth plans

James Hickman, CEO of Cornerstone, said:

"It has been an excellent six months for Cornerstone, delivering

substantial revenue growth and achieving our first half-year period

of profitability and operating cash generation. This has been

driven by our enhanced sales efforts and focus on more fully

commercialising our platform alongside important action to

carefully manage our cost base as we grow.

"We have also continued to execute on our strategy to augment

our capabilities by establishing further counterparty relationships

and partnerships, and we're particularly excited about the progress

we've made towards expanding our payment methods.

"With the strong trading momentum having continued into the

second half of the year, and with the benefits from our operational

improvements still coming through, we expect to report full year

results significantly ahead of market expectations, representing

substantial year-on-year growth as well as a maiden full year

adjusted EBITDA.

"When combined with a large and supportive market backdrop, as

global digital payment transaction values expand and the on-going

shift of payment transactions away from banks to specialist firms

continues, the Board has great confidence in the future of the

Group."

(1) Adjusted to exclude share-based compensation and transaction

costs of GBP0.2m and other operating income and profit on a

disposal of a subsidiary of GBP0.4m (H1 2022: GBP2.3m and

GBPnil)

(2) Calculated as customers who traded through Cornerstone in

the 12 months to 30 June 2023

Enquiries

Cornerstone FS plc +44 (0)203 971 4865

James Hickman, Chief Executive Officer

Judy Happe, Chief Financial Officer

SPARK Advisory Partners Limited (Nomad) +44 (0)203 368 3550

Mark Brady, Adam Dawes

Shore Capital (Broker) +44 (0)207 408 4090

Daniel Bush, Tom Knibbs (Corporate

Advisory)

Guy Wiehahn (Corporate Broking)

Gracechurch Group (Financial PR) +44 (0)204 582 3500

Harry Chathli, Claire Norbury

About Cornerstone FS plc

Cornerstone FS plc (AIM: CSFS) is a foreign exchange and

payments company offering multi-currency accounts and payment

solutions to businesses and individuals. Headquartered in the City

of London, Cornerstone combines a proprietary technology platform

with a high level of personalised service to support clients with

payments in over 150 countries in 58 currencies. With a track

record of over 12 years, Cornerstone has the expertise, experience

and expanding global partner network to be able to execute complex

cross-border payments. It is fully regulated by the Financial

Conduct Authority as an Electronic Money Institution.

www.cornerstonefs.com

Investor Presentation

James Hickman, CEO, and Judy Happe, CFO, will be presenting via

Investor Meet Company on 12 September 2023 at 11.00am BST.

Questions can be submitted pre-event via the Investor Meet

Company platform up until 9.00am BST the day before the meeting or

at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Cornerstone via:

https://www.investormeetcompany.com/cornerstone-fs-plc/register-investor

Operational Review

The six months to 30 June 2023 was a very strong period for the

Group, with revenue increasing by 90% to GBP3.6m (H1 2022: GBP1.9m)

and the Group achieving its maiden half-year profit and positive

adjusted EBITDA. Importantly, the Group also delivered its first

interim cash inflow from operating activities. This reflects the

strategic and operational changes that were implemented during the

second half of 2022 and which continued into the current period.

The Group's focus has been on driving direct sales and fully

commercialising the platform, while maintaining tight control over

costs. Key elements of this have been growing the sales team and

enhancing and expanding the Group's offering, particularly through

increasing the number of counterparties to broaden the number of

currencies and countries where it can transact, with the objective

of increasing the number of active customers, through customer

acquisition and retention, and value of payment transactions

managed by the Group.

Performance

The Group delivered significant growth in revenue to GBP3.6m (H1

2022: GBP1.9m), reflective of a substantial increase in revenue

generated by clients that the Group serves directly. The proportion

of total revenue that was accounted for by direct clients was 91%,

being GBP3.3m (H1 2022: GBP1.4m), compared with 74% in H1 2022.

Revenue generated through the Group's white label partners

accounted for total revenue of GBP319k (H1 2022: GBP501k). This is

in line with the Group's strategic decision to manage down almost

all its historic white label business - only maintaining a small

number of accounts that meet appropriate profitability thresholds.

This commenced towards the end of 2022, but primarily took place in

the first half of the current year.

Active customers, calculated as customers who traded during the

12 months ending 30 June 2023, increased to 874 compared with 697

for the 12 months to 30 June 2022, as the Group has continued its

strategy of investing in its sales team and payment

capabilities.

By client type, there was an increase in revenue generated by

both private clients (primarily high net worth individuals) and

corporate accounts. Particularly strong growth was seen from

private clients, with the proportion of total revenue accounted for

by private clients increasing to 62% (H1 2022: 45%) with corporate

accounts contributing 38% (H1 2022: 55%). However, for the majority

of private client revenue, whilst the underlying transaction is

with an individual, the relationship is via a corporate that

provides services to the individual.

During the first half of 2023, transactions were conducted

between 43 different currency pairs (H1 2022: 43), with 88% of

transactions being between various combinations of Sterling, Euros

and US Dollars (H1 2022: 86%).

Enhancing our offer

A key strategic focus is the enhancement of the Group's offer,

primarily through growing its counterparty and partner network to

expand its product capabilities. At the same time, internal

technology development continues, to enhance the Group's platform

as well as its service provision.

Expanding our product

A core element of the Group's strategy is to establish a global

payments network that will enable Cornerstone customers to be able

to pay in from, and pay out to, any jurisdiction and via any

payment method. While it is still relatively early days, important

steps have been taken in implementing this strategy.

New counterparty partnerships have been established, which

enables the Group to broaden the number of currencies and countries

where it can transact, as well as expanding the business sectors

that it can serve. The Group can now pay out to over 150 countries

in 58 currencies.

To further support the expansion of its offer, the Group has

established a new offering, Cornerstone Solutions, that will focus

on providing solutions to clients that are harder to service, due

to, for example, the sector in which they operate. This will allow

the Group to leverage some of its competitive strengths - such as

the high level of experienced, personalised service - and open

access to a further cohort of potential clients.

The Group has also made significant progress towards expanding

its payment method offering and is at an advanced stage with a

potential partner. The Group expects to be able to launch its first

initiative in this respect during the first quarter of next

year.

To be able to support customers with more of their business

needs, the Group has also formed strategic partnerships with

specialised and alternative lenders to offer a range of funding

solutions. In particular, the Group launched a lending platform in

partnership with Swoop Finance ("Swoop"), which enables the Group

to seamlessly refer customers to a lending partner that it has

pre-vetted to ensure that they can meet the customers'

requirements. This service increases the Group's value to its

customers while also providing commission on referrals. It also

enhances the Group's competitive offer to potential customers who

want to utilise Cornerstone's FX services (rather than those of

their traditional bank), but who are hesitant to move away from

their traditional bank as they require their lending

facilities.

Improving our service

Cornerstone is committed to continuously improving the service

that it provides to its customers. During the period, this included

making enhancements to the user interface and user experience of

the Group's platform. The Group is also continuing development work

to increase the automation in transactional processes to increase

the speed of payments as well as working on enhancements to the

onboarding process.

Actions such as these, which stem from one of the Group's core

values of always putting customers first, meant that the Group was

well prepared for the introduction of the Financial Conduct

Authority's Consumer Duty regulation in July 2023. During the

period, the Group undertook a review of its operations to ensure

that it was fully compliant with the new regulation, which sets

higher and clearer standards for consumer protection across

financial services.

Financial Review

Revenue for the six months to 30 June 2023 increased by 90% to

GBP3.6m compared with GBP1.9m for the first half of the previous

year. This growth reflects the strategic and operational changes

that were implemented during the second half of 2022 and which

continued into the current period focusing on driving direct sales

and fully commercialising the platform. The Group also benefited

from full six-month contributions from Capital Currencies and

Pangea FX, which were acquired in H1 2022 and H2 2022,

respectively.

Gross margin for the first half of 2023 was 61.0% (H1 2022:

61.7%). Whilst the proportion of revenue derived from white label

partners has declined to 9% (from 26% in H1 2022), the gross margin

benefit of this was offset by a change in commission arrangements

with Robert O'Brien, the General Manager APAC and Middle East,

which were previously agreed at enhanced levels in 2023 compared

with the prior year. As announced on 8 March 2023, Mr. O'Brien

agreed to vary and extend certain elements of his compensation

package, decreasing his commission share on certain established

revenue streams and increasing his share of the profitability of

the Dubai office. This was immediately beneficial for the Group

and, as a result of this change, the Group generated stronger gross

margin in the second quarter of 2023 compared with the first

quarter.

As a result of gross margin remaining at a broadly consistent

level, combined with the significant growth in revenue, gross

profit increased by 88% to GBP2.2m (H1 2022: GBP1.2m).

Operating expenses were reduced to GBP2.2m in H1 2023 compared

with GBP4.1m for the first half of the previous year. This

primarily reflects a reduction of GBP2.1m in share-based (non-cash)

compensation to GBP173k (H1 2022: GBP2.2m) following the Company

reaching an agreement in H2 2022 with Mr. O'Brien and the Asia team

to vary the terms of their incentivisation agreement pursuant to

which they received GBPnil share-based compensation during the

period (H1 2022: GBP2.1m). The Group also recognised a GBP0.2m

profit during the period from the disposal of its subsidiary, Avila

House Ltd. ("Avila House"), with the share purchase agreement

having been entered in December 2022 and completed during the

period under review. Together with the reduced share-based

compensation, this more than offset the increase in other

administrative expenses to GBP2.0m (H1 2022: GBP1.7m) and

amortisation of intangible assets to GBP0.3m (H1 2022: GBP0.2m).

The Group has maintained tight control over operating costs and the

increase in other administrative expenses primarily relates to

additional sales team hires and the impact of the acquisitions of

Capital Currencies and Pangea FX. Amortisation was higher due to

the acquired customer lists from the 2022 acquisitions, combined

with the cumulative impact of internally developed software

additions that have been capitalised since 2020 with an

amortisation period of three years.

The Group generated other operating income of GBP0.2m (H1 2022:

GBPnil) based on interest on client cash balances (see note 3 to

the financial statements).

As a result of the increased gross profit and other operating

income and reduced operating expenses, the Group generated a profit

from operations of GBP0.1m compared with a loss from operations of

GBP3.0m for the first half of 2022.

Net finance costs were GBP115k (H1 2022: GBP49k), which was

primarily related to interest on loan notes due to Mr. O'Brien

(principal balance of GBP2.0m) and in respect of the Pangea FX

acquisition (principal balance of GBP0.2m), both of which have a

fixed coupon rate of 6% p.a.

As a result, the Group generated a maiden profit before tax of

GBP23k in the six-month period compared with a loss before tax of

GBP3.0m for the first half of 2022. Earnings per share on a basic

and diluted basis were 0.06 pence (H1 2022: loss of 13.05 pence per

share), which was achieved despite an increase in the weighted

average number of ordinary shares in issue to 55,791,324 (H1 2022:

23,143,117).

On an adjusted basis (to exclude share-based compensation and

transaction costs, as well as the other operating income and profit

from the disposal of Avila House), the Group generated a first

half-year period of positive EBITDA of GBP0.2m, compared with an

adjusted EBITDA loss of GBP0.6m for H1 2022.

The Group was cash flow positive for the first six months of

2023. Cash generated by operating activities was GBP0.1m (H1 2022:

GBP0.1m used in operating activities) based on the improved trading

performance. Cash generated by investing activities was GBP85k (H1

2022: GBP0.8m used in investing activities) as the proceeds from

the disposal of Avila House offset the acquisition of intangible

assets, property, plant and equipment principally associated with

the continued investment in developing the Group's proprietary

platform. Cash from operating and investing activities more than

offset cash used in financing activities, which consisted of GBP66k

in interest and similar charges (H1 2022: GBPnil).

As a result, as of 30 June 2023, the Group had increased cash

and cash equivalents of GBP816k (31 December 2022: GBP682k).

As announced on 8 March 2023, the Group agreed to further vary

the incentivisation arrangement with Mr. O'Brien as well as the

settlement arrangement with Craig Strong, Director of Capital

Currencies. The repayment date of Mr. O'Brien's loan note has been

extended to 31 July 2026 and the payment dates of Mr. Strong's

earn-out consideration have both been extended by a year.

The Group's emerging adjusted EBITDA, and profit generation,

together with its current cash balances give the Board confidence

in the strength of the Company's balance sheet and is comfortable

that the Group has sufficient resources to support its existing

growth plans.

Outlook

The strong trading momentum that was experienced in the first

half of the year has continued into the second half.

The strong growth being generated reflects the advancements

being made across the business as the Group realises the benefits

of the enhancements made to its operations and offering towards the

end of 2022 and to date in 2023. With the continued strengthening

of its sales team, and a clear focus on Cornerstone's strategic

growth priorities, the Group expects this revenue trend to be

sustained throughout the year.

As a result, and with the continued careful management of the

cost base, the Group now expects to report results for its full

year 2023 significantly ahead of market expectations, including

achieving its first full year of positive adjusted EBITDA.

Cornerstone FS plc

Consolidated Statement of Comprehensive Income

Unaudited Unaudited Audited

6 months 6 months 12

to 30 June to 30 June months

2023 2022 to 31 Dec

2022

Notes GBP GBP GBP

Revenue 3,601,842 1,896,073 4,821,996

Cost of sales (1,405,919) (727,081) (1,885,503)

------------ ------------ ------------

Gross profit 2,195,923 1,168,992 2,936,493

Share-based compensation 5 (172,679) (2,243,258) (4,284,039)

Further adjustments to adjusted

EBITDA (see below) (63,306) (183,509) (500,529)

Other administrative expenses (2,005,647) (1,718,910) (3,805,812)

------------ ------------ ------------

Total administrative expenses (2,241,632) (4,145,677) (8,590,380)

Other operating income 1 183,506 - 30,647

Adjusted EBITDA / (EBITDA

loss) 190,275 (549,918) (869,319)

Stated after the add-back

of:

- other operating income (183,506) - (30,647)

- share-based compensation 5 172,679 2,243,258 4,284,039

- transaction costs 4,500 12,600 99,365

- (profit) on disposal of

subsidiary 7 (207,480) - -

- amortisation of intangible

assets 6 256,707 166,046 386,542

- depreciation of property,

plant and equipment 9,579 4,863 14,622

Profit / (loss) from operations 2 137,797 (2,976,685) (5,623,240)

Finance and other income 3 - 10 18

Finance costs 3 (114,550) (49,280) (163,975)

------------ ------------ ------------

Profit / (loss) before

tax 23,247 (3,025,955) (5,787,197)

Income tax 11,699 6,699 175,365

------------ ------------ ------------

Profit / (loss) for the

financial period 34,946 (3,019,256) (5,611,832)

Total comprehensive profit

/ (loss) for the period 34,946 (3,019,256) (5,611,832)

============ ============ ============

Profit / (loss) per share

from continuing operations:

Basic & diluted (pence) 4 0.06 (13.05) (17.26)

Cornerstone FS plc

Consolidated Statement of Financial Position

Unaudited Unaudited Audited

as at 30 as at 30 as at

June 2023 June 2022 31 Dec

2022

Notes GBP GBP GBP

ASSETS

Non-current assets

Intangible assets and

goodwill 6 2,180,104 2,106,268 2,315,637

Tangible assets 30,923 34,256 39,677

2,211,027 2,140,524 2,355,314

------------- ------------- -------------

Current assets

Trade and other receivables 8 1,503,464 415,216 1,339,110

Cash and cash equivalents 816,176 283,075 682,346

2,319,640 698,291 2,021,456

------------- ------------- -------------

TOTAL ASSETS 4,530,667 2,838,815 4,376,770

============= ============= =============

Equity

Share capital 5 574,171 236,837 480,362

Share premium 6,191,748 3,906,533 5,496,829

Share-based payment reserve 620,006 4,635,968 1,489,765

Merger relief reserve 5,557,645 5,557,645 5,557,645

Contingent consideration

reserve 999,859 891,784 950,920

Reverse acquisition reserve (3,140,631) (3,140,631) (3,140,631)

Retained earnings (10,406,693) (10,847,482) (10,924,791)

-------------

TOTAL EQUITY 396,105 1,240,654 (89,901)

------------- ------------- -------------

Non-current liabilities

Loan notes 10 2,172,578 - 2,172,578

Deferred tax liability 88,117 57,608 99,816

------------- ------------- -------------

2,260,695 57,608 2,272,394

------------- ------------- -------------

Current liabilities

Trade and other payables 9 1,873,867 1,524,477 1,969,277

Loan notes 10 - - 225,000

Deferred tax liability - 16,076 -

------------- ------------- -------------

1,873,867 1,540,553 2,194,277

------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 4,530,667 2,838,815 4,376,770

============= ============= =============

Cornerstone FS plc

Consolidated Statement of Changes in Equity

Share Share Share-based Merger Contingent Reverse Retained Total

capital premium payment relief consideration acquisition earnings

reserve reserve reserve reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2022 202,776 3,074,355 2,392,710 5,557,645 - (3,140,631) (7,828,230) 258,625

-------- ---------- ------------ ---------- -------------- ------------ ------------- ------------

Issue of

shares 34,061 868,538 - - - - - 902,599

Cost of

raising

equity - (36,360) - - - - - (36,360)

Deferred

equity-based

consideration - - - - 891,784 - - 891,784

Share-based

payments - - 2,243,258 - - - (2,243,258) -

Other

comprehensive

loss - - - - - - (775,994) (775,994)

At 30 June

2022 236,837 3,906,533 4,635,968 5,557,645 891,784 (3,140,631) (10,847,482) 1,240,654

-------- ---------- ------------ ---------- -------------- ------------ ------------- ------------

Share-based

payments 176,362 1,036,696 - - - - - 1,213,058

Cost of

raising

equity - (50,950) - - - - - (50,950)

Deferred

equity-based

consideration - - - - 59,136 - - 59,136

Share-based

payments - - 2,040,781 - - - - 2,040,781

Settlement

of

equity-based

incentives 67,163 604,550 (5,186,984) - - - 2,515,271 (2,000,000)

Other

comprehensive

loss - - - - - - (2,592,580) (2,592,580)

At 31 December

2022 480,362 5,496,829 1,489,765 5,557,645 950,920 (3,140,631) (10,924,791) (89,901)

======== ========== ============ ========== ============== ============ ============= ============

Issue of

shares 35,299 194,143 - - - - - 229,442

Deferred

equity-based

consideration - - - - 48,939 - - 48,939

Share-based

payments - - 172,679 - - - - 172,679

Settlement

of

equity-based

incentives 58,510 500,776 (1,042,438) - - - 483,152 -

Other

comprehensive

income - - - - - - 34,946 34,946

At 30 June

2023 574,171 6,191,748 620,006 5,557,645 999,859 (3,140,631) (10,406,693) 396,105

======== ========== ============ ========== ============== ============ ============= ============

Cornerstone FS plc

Consolidated Cash Flow Statement

Unaudited Unaudited Audited

six months six months 12 months

to 30 June to 30 June to 31 Dec

2023 2022 2022

GBP GBP GBP

Profit / (loss) before tax 23,247 (3,025,955) (5,787,197)

------------ ------------ ------------

Adjustments to reconcile profit

before tax to cash generated

from operating activities:

Finance income - (10) (18)

Finance costs 114,550 49,280 163,975

Share-based compensation 172,679 2,243,258 4,284,039

Other equity settled share-based

payments - 32,595 32,595

Profit on disposal of subsidiary (207,480) - -

Depreciation and amortisation 266,286 170,909 401,164

(Increase) / decrease in trade

and other receivables (164,354) 78,028 (845,866)

(Decrease) / increase in trade

and other payables (90,969) 312,676 757,250

------------ ------------ ------------

Cash generated / (used) in

operations 113,959 (139,219) (994,058)

Income tax received - - 158,188

Cash generated / (used) in

operating activities 113,959 (139,219) (835,870)

------------ ------------ ------------

Investing activities

Acquisition of property, plant

and equipment (824) (2,994) (17,198)

Acquisition of intangible assets (213,694) (228,484) (422,713)

Proceeds from disposal of subsidiary 300,000 - -

Acquisition of subsidiary, net

of cash acquired - (527,984) (552,128)

------------ ------------ ------------

Cash generated / (used) in investing

activities 85,482 (759,462) (992,039)

------------ ------------ ------------

Financing activities

Shares issued (net of costs) - 833,644 1,992,694

Loans received - - 225,000

Interest and similar income - 10 18

Interest and similar charges (65,611) - (55,559)

------------ ------------ ------------

Cash (used in) / generated

from financing activities (65,611) 833,654 2,162,153

------------ ------------ ------------

Increase / (decrease) in cash

and cash equivalents 133,830 (65,027) 334,244

------------ ------------ ------------

Cash and cash equivalents at beginning

of period 682,346 348,102 348,102

------------ ------------ ------------

Cash and cash equivalents at

end of period 816,176 283,075 682,346

============ ============ ============

Cornerstone FS plc

Notes to the financial statements

1. General information and basis of preparation

Cornerstone FS plc is a public limited company, incorporated and

domiciled in England. T he Company was admitted to trading on AIM,

London Stock Exchange's market for small and medium size growth

companies, on 6 April 2021 . The registered office of the Company

is The Old Rectory, Addington, Buckingham, England, MK18 2JR, and

its principal business address is 75 King William Street, London,

EC4N 7BE. Cornerstone FS plc is a foreign exchange and payments

company offering multi-currency accounts to businesses and

individuals using a proprietary cloud-based multi-currency payments

platform. These services are primarily delivered directly on a SaaS

basis to UK-based SMEs and high-net worth individuals (private

clients).

The consolidated financial information contained within these

financial statements is unaudited and does not constitute statutory

accounts within the meaning of Section 434 of the Companies Act

2006. While the financial figures included in this interim report

have been prepared in accordance with IFRS applicable to interim

periods, this interim report does not contain sufficient

information to constitute an interim financial report as defined in

IAS 34. Financial information for the year ended 31 December 2022

has been extracted from the audited financial statements for that

year. With the exception of an additional accounting policy for

other operating income included below, the accounting policies

applied by the Group in this consolidated interim financial report

are the same as those applied by the Group in its consolidated

financial statements as at and for the year ended 31 December

2022.

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiary undertakings. Entities

are accounted for as subsidiary undertakings when the Group is

exposed to or has rights to variable returns through its

involvement with the entity and it has the ability to affect those

returns through its power over the entity.

Details of subsidiary undertakings and % shareholding:

Cornerstone Payment Solutions Ltd - 100% owned by the Company

Cornerstone Middle East FZCO - 100% owned by the Company

Capital Currencies Limited - 100% owned by the Company

Pangea FX Limited - 100% owned by the Company

On 26 April 2023, the Group completed the sale of Avila House

Ltd (formerly 100% owned by Cornerstone Payment Solutions Ltd). The

results of Avila House were consolidated up to the date of

disposal.

Other operating income

Other operating income represents interest generated from client

cash balances. The recent changes to the interest rate environment

has meant that these accounts can be interest bearing, whilst

maintaining the safeguarding requirements. Under the terms of the

Group's Electronic Money Licence, the Group is not able to pass any

of the interest earned back to the clients.

Whilst the increased interest stream is a positive boost for the

Group and a natural by-product of its increasingly diversified

product offering, the Group is mindful that aspects of its dynamics

are driven by macroeconomics beyond its control. The Group has

therefore chosen to recognise interest income on client balances as

'other operating income', not revenue on the face of the

Consolidated Statement of Comprehensive Income. For the same

reason, interest income has been excluded from the presentation of

adjusted EBITDA.

Interest earned on Cornerstone's own cash is recognised within

finance and other income in the Consolidated Statement of

Comprehensive Income.

Going concern

During the period ended 30 June 2023, the Group made a profit of

GBP34,946; its maiden period of profitability. As at 30 June 2023,

the Group's Statement of Financial Position showed cash and cash

equivalents of GBP816,176 . The trading position of the Group has

strengthened during 2023 with continued revenue growth coupled with

a strong focus on cost control. As a result, the Group expects to

begin generating a recurring cash inflow before financing

activities during the second half of 2023.

The Board continues to closely monitor the Group's performance

and considers a range of risks that could affect the future

performance and position of the Group. The Board considers the

Group has a reasonable expectation that it has adequate resources

to continue to operate for the foreseeable future and therefore the

financial statements are prepared on a going concern basis.

2. Profit / (loss) from operations

Unaudited Unaudited Audited

six months six months 12 months

to 30 June to 30 June to 31 Dec

2023 2022 2022

GBP GBP GBP

Profit / (loss) from operations

is stated after charging:

Share-based compensation 172,679 2,243,258 4,284,039

Transaction costs 4,500 12,600 99,365

Expensed software development

costs 33,189 53,473 86,941

Depreciation of property, plant

and equipment 9,579 4,863 14,622

Amortisation of intangible assets 256,707 166,046 386,541

Short-term (2018 IAS 17 operating)

lease rentals 137,236 93,363 252,308

============ ============ ===========

3. Interest and similar items

Unaudited Unaudited Audited

six months six months 12 months

to 30 June to 30 June to 31 Dec

2023 2022 2022

GBP GBP GBP

Total finance and other income

Bank interest receivable - 10 18

============== ============ ===========

Total finance costs

Unwinding of discount 48,939 49,280 108,416

Loan note interest 65,129 - 53,500

Other interest payable and charges 482 - 2,059

-------- ------- --------

114,550 49,280 163,975

======== ======= ========

In the audited financial statements for the year ended 31

December 2022, interest on client cash balances of GBP37,929 was

included within finance and other income and interest charges

related to client balances of GBP7,282 were included within finance

costs. As a result of the appreciation in interest rates, combined

with the continued growth of the Group's client balances following

its authorisation as an Electronic Money Institution in August 2021

and commensurate with its growth in revenue, interest on client

cash balances has materially grown since the year ended 31 December

2022. As a result, interest on client cash balances for the six

months ended 30 June 2023 of GBP183,506 has been classified as

other operating income. For consistency purposes, and to aid

comparison, the comparatives related to client balances for the

year ended 31 December 2022 have also been reclassified from

finance income and finance costs to other operating income. No

interest income or interest charges on client balances were

recognised in the six-month period ended 30 June 2022.

4. Earnings per share

The earnings per share of 0.06 pence is based upon the profit of

GBP34,946 (six months to June 2022: loss of GBP3,019,256; year

ended 31 December 2022: loss of GBP5,611,832) and the weighted

average number of ordinary shares in issue for the period of

55,791,324 (30 June 2022: 23,143,117; 31 December 2022:

32,506,335).

The prevailing share price of the Company's shares during the

period means that the effect of any outstanding warrants and

options would be considered anti-dilutive (due to their strike

price exceeding the average share price in the period), and is

ignored for the purposes of the loss per share calculation.

5. Share capital

Allotted, called up and fully paid Ordinary shares Share capital

No. GBP

Ordinary shares of GBP0.01 each as at 1

January 2022 20,277,582 202,776

Issue of new shares of GBP0.01 each 3,406,034 34,061

Ordinary shares of GBP0.01 each at 30

June 2022 23,683,616 236,837

Issues of new shares of GBP0.01 each 24,352,583 243,525

Ordinary shares of GBP0.01 each at 31

December 2022 48,036,199 480,362

Issues of new shares of GBP0.01 each 9,380,902 93,809

Ordinary shares of GBP0.01 each at 30

June 2023 57,417,101 574,171

The following changes in share capital have taken place in six

months ended 30 June 2023:

- On 13 January 2023, 806,182 ordinary shares were issued at a

price of GBP0.06501 settling the share-based remuneration for

former non-executive board members and company secretary in respect

of the year ended 31 December 2021

- On 3 February 2023, 5,113,182 ordinary shares were issued at a

price of GBP0.100 being the final equity settlement with Robert

O'Brien related to his share-based incentivisation agreement and

following receipt of approval from the Financial Conduct Authority

("FCA") for Mr. O'Brien to take his shareholding in the Company

above 10%

- On 3 February 2023, 3,461,538 ordinary shares were issued at a

price of GBP0.065 upon conversion of a loan note held by Mark

Horrocks and following receipt of approval from the FCA for Mr.

Horrocks to take his shareholding in the Company above 10%

Options

On 13 January 2023, the Company granted 3,049,180 options under

its equity-settled share-based remuneration schemes for employees

with a weighted average exercise price of GBP0.13 and a vesting

period between 1 and 3 years.

The Black-Scholes model was used for calculating the cost of

options. The model inputs for the options issued were:

Share price at grant date - GBP0.08

Risk-free rate - 2.7%

Expected Volatility - 129.5%

Contractual life - 5 years

During the period 248,360 options were forfeited (H1 2022:

200,000) at a weighted average exercise price of GBP0.20 per share.

Additionally, 63,114 warrants with an exercise price of GBP0.61

expired during the period (H1 2022: nil).

Share-based compensation charge

The Group's share-based compensation charge for the period ended

30 June 2023 of GBP172,679 (H1 2022: GBP2,243,258) consists of

GBP49,115 (H1 2022: GBP67,978) in respect of warrants (including

the impact of warrant expirations), GBP123,564 (H1 2022: credit of

GBP13,395) in respect of share options granted under the Company's

share option scheme (including the impact of option forfeitures)

and GBPnil in respect of the share-based incentivisation agreement

with Robert O'Brien & his team (H1 2022: GBP2,138,378) and

equity-settled share-based payments related to the non-executive

Board member's service agreements (H1 2022: GBP50,297).

6. Intangible assets

Internally

developed Software Customer Regulatory

software costs relationships Goodwill licenses Total

GBP GBP GBP GBP GBP GBP

COST

As at 1 January

2023 1,070,198 15,611 615,756 1,086,262 92,520 2,880,347

Additions 213,694 - - - - 213,694

Disposal (note 8) - - - - (92,520) (92,520)

---------- ---------- --------------- --------- ---------- ---------

At 30 June 2023 1,283,892 15,611 615,756 1,086,262 - 3,001,521

AMORTISATION

As at 1 January

2023 458,691 15,611 90,408 - - 564,710

Charge for the

period 195,132 - 61,575 - - 256,707

---------------

As at 30 June 2023 653,823 15,611 151,983 - - 821,417

NET BOOK VALUE

At 30 June 2023 630,069 - 463,773 1,086,262 - 2,180,104

========== ========== =============== ========= ========== =========

At 30 June 2022 582,621 - 387,808 1,043,319 92,520 2,106,268

========== ========== =============== ========= ========== =========

At 31 December 2022 611,507 - 525,348 1,086,262 92,520 2,315,637

========== ========== =============== ========= ========== =========

7. Disposal of Avila House Ltd

On 26 April 2023, the Group completed the sale of Avila House

Ltd ("Avila House") to Aspire Commerce Ltd and received GBP300,000

in cash consideration following the receipt of regulatory approval

for the transaction from the FCA . Immediately prior to the

disposal, the net assets of Avila House were GBPnil (31 December

2022: net liabilities of GBP1,331), but upon its acquisition by the

Group in October 2020, the Group had previously recognised an

intangible asset of GBP92,520 related to the small e-money

institution license held by Avila House. The profit on disposal

recognised by the Group upon the sale of Avila House was therefore

GBP207,480.

8. Trade and other receivables

Unaudited Unaudited Audited

as at 30 as at 30 as at 31

June 2023 June 2022 Dec 2022

GBP GBP GBP

Trade receivables 347,655 94,182 221,669

Prepayments and accrued income 152,238 71,670 131,010

Derivative financial assets

at fair value 674,424 200,653 635,473

Other receivables 52,523 32,525 53,062

Taxes and social security 276,624 16,186 297,896

Total trade and other receivables 1,503,464 415,216 1,339,110

=========== =========== ==========

9. Trade and other payables

Unaudited Unaudited Audited

as at 30 as at 30 as at 31

June 2023 June 2022 Dec 2022

GBP GBP GBP

Trade payables 216,298 505,565 362,035

Derivative financial liabilities

at fair value 767,557 171,724 563,676

Other taxes and social security 391,513 237,651 515,750

Other payables and accruals 498,499 609,537 527,816

Total trade and other payables 1,873,867 1,524,477 1,969,277

=========== =========== ==========

10. Loan Notes

Unaudited Unaudited Audited

as at 30 as at 30 as at 31

June 2023 June 2022 Dec 2022

GBP GBP GBP

CURRENT

Convertible loan notes - - 225,000

============= =========== ==========

NON-CURRENT

Loan notes 2,172,578 - 2,172,578

========== ==========

As described in note 5, on 3 February 2023 the current

convertible loan note of GBP225,000, issued pursuant to the

Company's fundraising on 5 August 2022 , was converted to 3,461,538

ordinary shares at a price of GBP0.065 for Mr. Horrocks to take his

shareholding in the Company above 10%.

The non-current non-convertible loan notes comprise GBP2,000,000

issued to Robert O'Brien (repayable on 31 July 2026) and GBP172,578

of deferred consideration in relation to the acquisition of Pangea

FX Limited (repayable on 31 August 2024). Both loan notes have a 6%

coupon rate payable quarterly in arrears. The Pangea FX Limited

loan note is payable contingent upon achieving future revenue

targets over a period of two years from the acquisition date. Based

on current and forecast performance it has been assumed that the

loan notes will be paid in full.

11. Related party transactions

During the period ended 30 June 2023, the Group generated

revenue of GBP1,503,740 under a referral agreement with Atlantic

Partners Asia ("APA"), a significant shareholder in the Company (H1

2022: GBP625,499). As at 30 June 2023, APA owed the Group

GBP338,155 (30 June 2022: GBP82,978).

During the period ended 30 June 2023, the Group incurred charges

of GBP60,000 (H1 2022: GBPnil) under a computer services agreement

with JF Technology (UK) Ltd of whom Stephen Flynn (a former

Director of the Company and a significant shareholder) is a

director and a majority shareholder.

As at 30 June 2023, an amount of GBP8,750 remained due to the

Group from Terry Everson, a former director of Cornerstone Payment

Solutions Ltd (30 June 2022: GBP8,750).

The transactions with Robert O'Brien and Mark Horrocks are

disclosed in notes 5 and 10.

12. Events after the reporting date

None

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFSFAFEDSELU

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

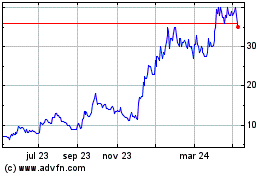

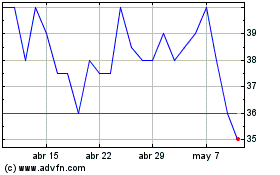

Cornerstone Fs (LSE:CSFS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Cornerstone Fs (LSE:CSFS)

Gráfica de Acción Histórica

De May 2023 a May 2024