TIDMCSH

RNS Number : 3083E

Civitas Social Housing PLC

29 June 2023

29 June 2023

CIVITAS SOCIAL HOUSING PLC

ANNUAL FINANCIAL REPORT

YEAR TO 31 MARCH 2023

Civitas Social Housing PLC ("Civitas" or the "Company"), the

UK's leading care-based and healthcare REIT, presents its full year

results for the year ended 31 March 2023.

Performance Highlights

Property Valuation and Performance Mar 23 Mar 22 Change

Investment property (GBPm) 978.1 968.8 1.0%

NAV per share (diluted) (p) 109.16 110.30 (1.03)%

Financial Performance

Annualised contracted rent

roll (GBPm) 56.3 53.2 5.83%

Net rental income (GBPm) 52.7 50.7 3.94%

EPRA earnings (GBPm) 26.9 29.8

Operating Cash Flow (GBPm) 39.5 39.1 1.02%

IFRS earnings per share (diluted)

(p) 4.19 7.23

EPRA earnings per share (diluted)

(p) 4.43 4.82

Dividends per share (p) 5.70 5.55 2.70%

NAV Total return since IPO

(%) 41.8 37.2 +4.6 pts

Financing

Loan to value ratio (%) 35.6 34.4

Weighted average interest

cost of debt (%) 3.4 2.5 +0.9 pts

Full Year Highlights

-- Annualised contracted rent roll increased by c.6% to GBP56.3million

-- Portfolio value increased to GBP978.1million from GBP968.8million (IFRS)

-- NAV decreased slightly to 109.16 pence per share as at 31

March 2023 (2022: 110.30 pence per share)

-- IFRS valuation average net initial yield (NIY) of 5.55%

-- EPRA earnings per share (basic and diluted) 4.43 pence per

share (2022: 4.82 pence per share)

-- Dividends of 5.70 pence per share to 31 March 2023 (2022:

5.55p) fully paid in four dividend distributions

-- In December 2022 the Company signed a new five-year GBP70.8

million facility with a European bank lender

-- Maintained a high quality investment credit rating from Fitch

Ratings of "A-" (stable) and "A" Secured

-- Continuation of share buybacks, with the Company acquiring

6,050,000 shares at an average of 76.89 pence per share for a total

investment of GBP4.65 million, enhancing the NAV by 0.30%

Operational Highlights

-- Diversified portfolio of 697 properties providing homes to 4,594 residents

-- Providing lifelong homes to mostly working age adults with

disabilities and complex care needs

-- High acuity focused portfolio with 40% of residents living in

Civitas properties receiving over 50 hours of care per week

-- Phase two of the Company's work with E.ON continues across

identified properties, targeting a 25% reduction in carbon

emissions

-- CIM continues to engage actively with the Company's Approved

Provider partners and care providers, offering advice and shared

learning

-- CIM continues to closely and proactively asset manage the

largest portfolio of specialist care based housing in the UK

Post Year End Highlights

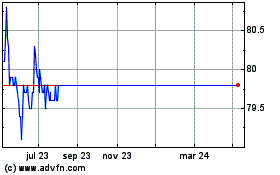

-- On 9 May 2023 the Board announced a recommended offer for the

Company at 80p in cash, from Wellness Unity Limited, a subsidiary

of CK Asset Holdings Limited (CKA)

-- On 22 May 2023 the Offer Document was made available. It is

intended that Civitas Investment Management ("CIM") is maintained

as the Investment Adviser to Civitas so that the day-to-day

management of the Civitas portfolio will continue uninterrupted,

and Civitas be re -- registered as a private limited company as

soon as practicable following the cancellation of the listing and

trading of Civitas shares

-- On 23 June 2023 the Offer became unconditional

Please find the full 2023 Annual Report on the Civitas Social

Housing plc website .

For further information, please contact:

Civitas Investment Management

Limited

Andrew Dawber Tel: +44 (0) 20 3058 4846

Paul Bridge Tel: +44 (0) 20 3058 4844

Panmure Gordon

Sapna Shah Tel: +44 (0) 20 7886 2783

Tom Scrivens Tel: +44 (0) 20 7886 2648

Liberum Capital Limited

Chris Clarke / Darren Vickers Tel: +44 (0) 20 3100 2000

/ Owen Matthews

Buchanan

Helen Tarbet / Henry Wilson Tel: +44 (0) 20 7466 5000

Hannah Ratcliff / Verity Parker civitas@buchanan.uk.com

Notes:

Civitas Social Housing PLC (CSH) was created in 2016 by Civitas

Investment Management Limited as the first dedicated London listed

REIT to raise long-term, sustainable, institutional capital to

invest in care-based social homes and healthcare facilities across

the UK. CSH's portfolio has been independently valued at GBP978.1

million (31 March 2023). CSH now provides homes for 4,594 working

age adults with long-term care needs, in 697 bespoke properties

that are supported by 131 specialist care providers, 19 approved

providers and working with over 178 individual local authority

partners.

Chairman's Statement

From the Chairman:

"Since November 2016, Civitas Social Housing PLC has provided

vital homes and healthcare facilities across the UK, for those

working age adults with significant and typically life-long care

needs.

I am pleased to report that, despite a difficult economic

backdrop in the UK, our portfolio has continued to

perform strongly."

This is our sixth Annual Report, covering the year to 31 March

2023. I am pleased to report that, despite a difficult economic

backdrop in the UK, our portfolio has continued to perform

strongly, delivering on average a 5% increase in rental income

derived from our inflation adjusted leases.

Our Investment Adviser, Civitas Investment Management Limited

("CIM"), has continued to work closely with our Approved Providers

to enhance further the quality of the portfolio and to assist where

needed in the process of ensuring our rental income is received on

a timely basis. The net asset value of the Company at 31 March 2023

was 109.16 pence, a small decrease of 1.03% from 110.30 pence per

share as at 31 March 2022.

The Board declared a final dividend of 1.425p, bringing the full

year dividend to 5.70p, in line with the minimum stated

intention.

A difficult challenge during the year was the sharp increase in

interest rates. I am pleased that in February 2023 the Company

entered into a new debt facility for GBP70.9m, which was partly

used to repay the loan facility with Lloyds. In addition, we also

fixed our interest rate exposure to provide greater certainty.

However, the overall re-financing was achieved at a material

increase in ongoing interest costs. Full details are included in

the Investment Adviser's Report.

Our share price has been disappointing over the year under

review, reflecting in part the broad derating of real estate

investments, higher interest rates and investor concern about our

sector. The Board has been reviewing a number of possible actions

to address this position. The Company has continued to buy back

shares - over the past 12 months it has acquired 6,050,000 shares

at an average of 76.89 pence per share for a total investment of

GBP4.65 million. This has enhanced the NAV by 0.30% and benefited

the EPRA earnings.

Continuation Vote

At the annual general meeting on 15 September 2022, 98.85% of

those shareholders who voted have voted in favour of the

continuation of the Company.

Offer for the Company

Following the year end, on 9 May 2023 the Board announced a

recommended offer for the Company at 80p per share in cash, from a

subsidiary of CK Asset Holdings Limited (CKA).

Whilst the Board believes that the Offer undervalues the

long-term prospects of Civitas as expressed by net asset value, we

also recognise that Civitas, and its sector as a whole, faces a

number of challenges in sentiment which the public markets are

unlikely to overcome in the short to medium term.

The Offer provides liquidity to shareholders with the

opportunity to exit in full and in cash at a significant premium to

the current share price, in a time of macroeconomic

uncertainty.

Moreover, CKA, as a current investor in the social housing

sector, has a detailed understanding of the attractive fundamentals

of the real estate and the expertise of the management team. CKA

does not expect there to be any disruption to tenants as a result

of the Offer and will be focused on the continuation of

relationships with Approved Providers, care providers and the

Regulator of Social Housing following the completion of the Offer.

The Board therefore considers the terms of the Offer to be fair and

reasonable and we have recommended it to our shareholders.

Outlook

Demand for the type of properties within the Company's portfolio

remains strong with independent forecasts predicting that there

will be continued growth for many years to come in the need for

additional units of adapted accommodation. The Board remains

confident in the strength of the portfolio and its potential

revenue generation.

Michael Wrobel

Chairman

28 June 2023

Growth

Growing Base of Global Investors

Civitas invests on behalf of a wide range of global, national

and local investors seeking exposure to sustainable long-term

income together with measurable social impact and high levels of

ESG delivery.

Four Continents... ...over 60 Locations

1. Amsterdam 13. Chichester 25. Heerlen 37. New Jersey 49. Smithfield

2. Bath 14. Columbus 26. Hong Kong 38. New York 50. Surrey

3. Beijing 15. Denver 27. Jersey 39. New Zealand 51. Sydney

4. Birmingham 16. Dublin 28. Leeds 40. Oslo 52. Tallinn

5. Blackpool 17. Edinburgh 29. Liverpool 41. Paris 53. Tauranga

6. Bolton 18. Espoo 30. London 42. Philadelphia 54. The Hague

7. Boston 19. Exeter 31. Los Angeles 43. Radnor 55. Tokyo

8. Bournemouth 20. Fort Lauderdale 32. Luxembourg 44. Rotterdam 56. Toronto

9. Bradford 21. Frankfurt 33. Manchester 45. Sacramento 57. Tunbridge

Wells

10. Bristol 22. Geneva 34. Melbourne 46. San Francisco 58. Vancouver

11. Brussels 23. Guernsey 35. Montreal 47. Seattle 59. Windsor

12. Chicago 24. Halifax 36. Munich 48. Singapore 60. Zurich

Our Strategy for Growth

Demand for the accommodation provided by Civitas is strong and

expected to remain so over the long-term. The pandemic has further

evidenced the need for safe and secure homes for the most

vulnerable people in society.

Civitas is a go-to partner for an increasing range of major

vendors and counterparties.

Civitas is the market leader with the largest portfolio and

deeply ingrained relationships with care providers, local

authorities, Approved Providers and charities across the UK.

The Company continues to work closely with The Social Housing

Family CIC to enable it to expand and play a broader role in the

sector, and becoming part of critical local authority pathways,

leading to many opportunities in specialist supported living and

advanced homelessness.

Civitas now works with a broader range of counterparties

including charities and other not-for-profit organisations, to

expand into significant markets across the UK, now including

Scotland and Northern Ireland.

Our Portfolio

By UK Region as at 31 March 2023

Region Funds invested Annualised rent

Properties (percentage) roll (percentage)

------------------- ----------- --------------- -------------------

South West 120 15.5 14.3

London 26 12.8 13.8

West Midlands 101 11.3 11.6

Yorkshire and the

Humber 96 10.8 10.7

Wales 34 11.0 10.6

North West 101 10.1 10.1

South East 65 10.1 9.8

East Midlands 58 8.6 8.8

North East 64 5.8 6.4

East of England 32 4.0 3.9

Total 697

Market Value (%)

Region Market Value

-------------------------- -------------

South West 14.3%

London 13.3%

West Midlands 11.7%

Wales 11.3%

Yorkshire and the Humber 10.7%

North West 9.9%

South East 9.8%

East Midlands 8.8%

North East 6.3%

East of England 3.9%

Total GBP978.1m

Tenancies

Region Tenancies

-------------------------- ----------

South West 759

Yorkshire and the Humber 610

North West 607

West Midlands 502

North East 462

South East 417

East Midlands 374

Wales 364

London 338

East of England 161

Total 4,594

Our Portfolio

By Approved Provider as at 31 March 2023

Annualised Contracted Rent Roll (%)

Approved Provider Annualised Contracted Rent Roll

(%)

--------------------- --------------------------------

Falcon 19.1%

Auckland(1) 16.5%

BeST 12.6%

Inclusion 9.4%

Qualitas Housing(1) 8.4%

Westmoreland 5.6%

Trinity 5.2%

Encircle 5.2%

Pivotal 4.0%

Chrysalis 3.7%

New Walk 2.6%

Harbour Light 2.3%

My Space 1.3%

Other 1.1%

IKE 1.0%

Hilldale 1.0%

Windrush 0.7%

Lily Rose 0.2%

Blue Square 0.1%

Total GBP56.3m

Properties

Approved Provider Properties

--------------------- -----------

Falcon 116

Auckland(1) 101

Inclusion 81

BeST 74

Qualitas Housing(1) 54

Trinity 42

Westmoreland 41

New Walk 41

Chrysalis 28

Pivotal 27

Harbour Light 26

Encircle 16

Hilldale 15

Windrush 13

IKE 10

My Space 9

Blue Square 1

Lily Rose 1

Other 1

Total 697

Tenancies

Approved Provider Tenancies

--------------------- ----------

Falcon 850

BeST 591

Auckland(1) 547

Inclusion 507

Qualitas Housing(1) 370

Trinity 242

Westmoreland 239

Pivotal 238

Encircle 205

New Walk 194

Harbour 182

Chrysalis 151

My Space 71

IKE 68

Windrush 51

Hilldale 39

Other 32

Lily Rose 13

Blue Square 4

Total 4,594

Market Value (%)

Approved Provider Market Value (%)

--------------------- -----------------

Falcon 19.1%

Auckland(1) 16.4%

BeST 13.2%

Inclusion 9.1%

Qualitas Housing(1) 8.6%

Westmoreland 5.7%

Trinity 5.1%

Encircle 4.9%

Pivotal 3.9%

Chrysalis 3.8%

New Walk 2.6%

Harbour Light 2.3%

My Space 1.1%

Other 1.1%

IKE 1.1%

Hilldale 1.0%

Windrush 0.8%

Blue Square 0.1%

Lily Rose 0.1%

Total GBP978.1m

(1) Auckland and Qualitas Housing are both members of the Social

Housing Family C.I.C and subject to common control.

Investment Adviser's Report

Consistent Performance

In the year to March 2023, CIM continued to work closely with

the Board to manage a high-performing portfolio.

Portfolio

-- 40% of residents living in Civitas properties receive over 50 hours of care per week.

-- High acuity portfolio

-- Provide homes to those who need long-term quality accommodation

-- Largest portfolio of SSH in England & Wales

-- Premium Fitch rating retained at "A" secured and "A-" unsecured

-- Average rental growth of c.5%

Social Impact

-- 4,594 high quality bed spaces

-- GBP127.0 million savings to the public purse(1)

-- 5 charitable relationships

Phase two work with E.ON

-- Continued work across identified properties

-- Targeting 25% reduction in carbon emissions

-- Continued access to government grant funding sources

-- Targeting minimum EPC "A-C" by 2030

Highly Experienced Team

The asset management team set up to work with and assist our

Approved Providers have

specialisms from:

-- Local authority commissioning of specialist supported housing

-- Senior level rents and housing benefit advisers

-- Housing management and compliance

-- Property asset management

-- Commissioning of care

1. Source: The Good Economy, Civitas Social Housing PLC, Annual

Impact Report 2021, June 2021.

"For over six years CIM has been working with the CSH Board to

invest in high-quality assets to deliver long-term affordable homes

for life for the most vulnerable in society.

We have developed in-depth knowledge of the sector along with

extensive relationships with Approved Providers, care providers and

local authorities, which has directly led to improvements in the

sector."

Paul Bridge - CEO, Social Housing - Civitas Investment

Management Limited

Introduction

Civitas Investment Management Limited ("CIM") is the Investment

Adviser to Civitas Social Housing PLC ("CSH") and is the leading

provider of care-based housing in the UK. CIM comprises a team of

39 individuals with a range of expertise in specialist supported

housing, real estate management and complex care needs CIM has the

capacity and specialist knowledge to manage the CSH portfolio at a

granular level and has cultivated strong professional relationships

across the sector over the last decade.

Overview of Results

In the UK prior to the launch of the Company, equity and private

capital played a very small part in the social housing sector. Over

time, UK demographics changed and the number of adults with

long-term, complex care needs has been steadily increasing.

This is reflected in a number of institutional investors

including aspects of social housing within their

investment strategies.

Results Highlights

-- Six years of consistent rental growth and progressive

dividend payments that have increased from an initial 3.00p per

share to 5.70p per share for the year ended 31 March 2023.

-- A retained high-quality investment credit rating from Fitch

Ratings of A secured and A- unsecured since March 2021, which CSH

was the first to secure in this sector.

-- An actively managed portfolio of operational real estate with

a sector-leading team of professionals assisting and enabling high

quality and longevity of homes and income.

-- Professional support to enable Approved Providers to enhance

the quality of their delivery and demonstrate long-term financial

and operational independence.

-- Targeting investments and homes which enable the delivery of

higher end care as this is where the greatest need exists and where

the applicability of exempt rents is clearly demonstrated.

-- An active and continuing programme working with E.ON to

permanently reduce carbon emissions across the portfolio, leading

to lower energy costs for residents and a more carbon neutral

portfolio.

-- Sector leading partnerships with national and local charities

delivering real change and continuing to enhance CSH's reputation

as the most experienced investor in social infrastructure in the

UK.

-- CIM has a highly experienced asset management team which has

overseen some GBP25 million of physical improvements to the

portfolio since inception largely paid for by the vendors of the

properties.

Sector Leading Social Outcomes

ESG

Our ESG Policy is located at www.civitassocialhousing .com. It

provides an overview of the Company's

investment procedures and sets out the Board's commitment to a

continuous improvement process in its

approach to ESG integration.

ESG Rating Providers

CIM engages with the leading ESG rating providers to set out the

activities that are undertaken by CSH and to ensure these are

profiled and evaluated correctly. Notably, active participation in

the 2022 GRESB Public Disclosure Assessment has resulted in CSH

retaining an A score previously attained in 2021, whilst the peer

group average score has moved up to B. CSH is up to second position

within its Comparison Group (UK Residential). Meanwhile, the Risk

Rating Score for CSH by Sustainalytics remains at 14.9 (Low Risk)

as was reported in February 2023.

The latest independent report by The Good Economy on CSH was

published in November 2022 and notes

CSH's continued progress in delivering measurable social impact.

Social value analysis by The Good Economy, carried out in March

2021, found that, overall, the portfolio generated GBP127 million

of social value per year, including fiscal savings to public

budgets of GBP75.9 million per year.

Of particular note with respect to the portfolio:

-- 41% of CSH's 697 properties have been brought into the

specialist housing sector for the first time

-- CSH continues regular engagement with its Approved Providers

to monitor the quality of its stock

-- Improvement works have enhanced the energy efficiency of homes

-- 87% of respondents to the survey of residents carried out by

CIM in March 2021 reported that they were satisfied with the

quality of their home

-- CSH Approved Provider partners have reported 99% statutory

compliance - considerably better than the wider affordable housing

sector

Environmental: Carbon Reduction/ Energy Cost Savings

CIM continues to work with E.ON (a leading UK energy and

solutions company) under a national framework agreement in

partnership with CSH tenants, to improve the environmental

performance of the portfolio. The "fabric first" approach to

reducing the portfolio's carbon footprint includes the installation

of cavity wall insulation, loft insulation, external wall

insulation, air source heat pumps and solar PV and battery storage

to identified properties within the portfolio. The installation of

these energy efficient measures, utilising available government

grants and other funding sources, will optimise value for the

Company, our counterparties and our shareholders. The collaboration

with E.ON is delivering significant environmental enhancements

without any cost to our Approved Providers.

The Phase 2 retrofit surveys will help to refine the

implementation programme and identify the best method for reducing

the total carbon dioxide emissions (and fuel costs) associated with

individual properties over the medium or long term. The overall

energy performance of the portfolio, as identified on Environmental

Performance Certificates ("EPC") reports data has improved over the

last 12 months. The proportion of properties with EPC Rating A-C is

currently c.55% and the carbon footprint (estimated from property

characteristics) has reduced by 2% per Civitas tenancy (from 2.65

tonnes of CO(2) /tenancy in March 2022 to 2.61 tonnes of CO(2)

/tenancy). The whole social housing sector, and indeed the whole

housing sector, continues to require significant public investment

if it is to meet the current government guidelines on achieving net

zero carbon emissions by 2050.

Government Policy and Regulation

Reforming the Mental Health Act

Current mental health legislation results in many people with

mental health issues or learning disability needs being detained in

large institutions that are often inappropriate for the

individuals. It is estimated by NHS Digital that there was a rise

in annual mental health detentions from 45,864 in 2016/2017 to over

53,239 in 2020/2021.

Once people are sectioned into an institution it becomes very

difficult and costly to move them into a supported living community

setting.

As a result of these concerns, the Government commissioned an

independent body chaired by Professor Sir Simon Wessley in 2017.

Currently in draft form in the Houses of Parliament, the Mental

Health Reform Act seeks to raise the threshold for detaining people

with a learning disability and/or autism unless they have a

coexisting psychiatric disorder.

We believe that this Act will drive even more demand for

community housing and care settings which are already in short

supply, further securing the value and importance of the CSH

portfolio.

The CSH portfolio will further benefit from the following

broader market dynamics:

Social Housing Regulation Bill 2023

The overall regulation of social housing is under review with

the main objective of delivering transformational change for social

housing residents and fulfilling the Government's 2019 manifesto

pledge to "empower residents, provide greater redress, better

regulation and improve the quality of social housing".

The implication of this review for CSH's portfolio is expected

to be positive as it aims to bring landlords closer to their

tenants and more focused on addressing their needs quickly. Our

Approved Providers are very close to their residents' needs and

work in partnership with care providers to ensure good quality

service outcomes, all supported by the granular asset management

provided by CIM every day.

Supported Housing (Regulatory Oversight) Bill

This bill, which is under review, seeks to improve the

regulation and outcomes of supported exempt accommodation. This

follows reported cases, particularly of temporary housing, that

should not qualify as

exempt accommodation.

Financial Review

As at 31 March 2023 the Net Asset Value of the Company was

GBP661.9 million, being 109.16 pence per share, a 1.03% decrease on

the 110.30 pence per share at 31 March 2022. A net fair value gain

on investment properties of GBP2.6 million (2022: GBP12.3 million)

was recorded in the year.

Operational cash flows increased moderately to GBP39.5 million

(2022: GBP39.1 million). Ongoing rental collections throughout the

year supported the Company's healthy operating cash flows despite

further increases to the cost of debt as all facilities were put

onto a fixed basis.

Rental Growth and Dividend

The portfolio generated rental income (excluding any insurance

and service charge rechargeables) of GBP53.1

million, representing c.5% increase over the corresponding

period last year.

The contracted rent roll now increases through indexation only

as no new equity has been raised and therefore no new investments

have been made in the period.

During the year, the Company declared and paid four dividend

distributions including one dividend of 1.3875p and three

instalments of 1.4250p.

Debt Fixing and Reducing Risk

CIM arranged the following debt facilities which fixes debt on

the portfolio at an average rate of 3.92% until August 2024 as is

prudent in the current interest rate environment.

Remaining

Term at Loan

31 Mar 23 Principal

Lenders Facility (years) GBP'000 All in rate

----------------- ------------ ----------- ------------ -------------

Scottish Widows Fixed 4.59 52,500 2.99%

----------------- ------------ ----------- ------------ -------------

Deutsche Bank

AG, London

Branch Fixed 4.85 70,875 5.69%

----------------- ------------ ----------- ------------ -------------

Fixed by

Interest

HSBC rate cap 2.67 100,000 4.60%

----------------- ------------ ----------- ------------ -------------

Fixed by

Interest

NatWest rate swap 1.38 60,000 2.60%

----------------- ------------ ----------- ------------ -------------

M&G Fixed 4.91 84,550 3.14%

----------------- ------------ ----------- ------------ -------------

3.67 367,925 3.92%

------------------------------ ----------- ------------ -------------

We have received terms from lenders to refinance the NatWest

facility which is due to expire in August 2024.

Governance

CIM continues to engage actively with the Company's Approved

Provider partners and care providers, offering advice and shared

learning.

The Board, comprised of five independent non-executive

Directors, carries out an annual Board performance evaluation

exercise and hosts periodic strategy sessions in addition to

regular planned Board meetings.

Summary

CIM continues to closely and proactively asset manage the

largest portfolio of specialist care-based housing in the UK.

There is demonstrable demand in excess of supply and significant

further legislation that is likely to

continue to increase demand for the properties in the Company's

portfolio.

We continue to undertake our work with a view to both enhancing

the value of the portfolio and protecting the interest of our

underlying tenants.

Civitas Investment Management Limited

Investment Adviser

28 June 2023

Asset Management Initiatives

As part of the ongoing active management of the CSH portfolio,

CIM has developed an extensive asset management resource that

covers all the key disciplines that are apparent within specialist

supported housing and the residential care sectors.

Capital works are undertaken on a rolling basis with much of the

work being undertaken around the time of initial acquisition and

paid for by the original vendors as part of the purchase agreement.

This ensures that appropriate adaptations are made to deliver a

bespoke property that is suitable for the user's needs over the

long term. Capital works are also undertaken, from time to time,

during the life of the property where it is deemed appropriate to

undertake improvement works or repositioning of the asset. In some

cases this also leads to an immediate uplift in contracted rent

roll and a commensurate increase in capital values.

Set out below are some examples of projects that have been

undertaken.

The Asset Management Team understand the value of a good home.

With nearly 100 years' experience between them working in the

housing field, there is a lot of knowledge we can share.

As part of our active asset management of the CSH portfolio, we

work with and support our partners tackling issues and finding

solutions to help sustain the tenancies of the most vulnerable

people living in our homes.

A recent example of this was with Cole Street and Hampden Road.

These properties are managed by Trinity Housing Association and are

popular properties with long standing residents. However, Trinity

had struggled to meet its housing benefit potential. Officers from

the team worked closely with Trinity and supported them to put the

information and evidence together for tribunal. Trinity won the

tribunal and the matter was resolved with a full backdate and rent

agreed. This was a great result for the team and for the tenants at

the schemes.

Case Study

York Mews, Clacton-on-Sea

A detached two storey block of seven self-contained flats

constructed around the 1950's. Some external works were identified

as being required and a review was undertaken at the asset.

Assessment reports obtained suggested that replacing the heaters

within the flats and other minor works would improve the energy

efficiency and, in most cases, improve the EPC ratings at the same

time. We therefore tendered a programme of works over two phases -

the first phase just before the previous Winter period to replace

the existing heaters with high heat retention storage heaters - the

second phase during the following Spring/Summer period was to

undertake the external works to remove the existing render, replace

and

decorate to improve the exterior of the building.

Before After

------- ------- ------

Flat 1 D D

Flat 2 D C

Flat 3 D C

Flat 4 D D

Flat 5 D C

Flat 6 D C

Flat 7 E D

Corporate Social Responsibility Report

Sustainability

The business model of the Company is to provide long--term

suitable homes for individuals with care needs; acting in a

sustainable manner is key to achieving this aim. Properties that

are owned by the Company are tailored to meet the future needs of

the tenants and, where required, are actively asset managed to

provide long-term functionality and value to the wider

community.

Environment

During the investment due diligence phase, the Company looks

closely at the environmental impact of each potential acquisition,

and encourages a sustainable approach for maintenance and upgrading

properties. Through collaborating with specialist developers and

vendors, the high standards the Company expects from each

investment in the care-based housing sector is adopted by other

companies in the sector.

Once within the portfolio, the properties of the Company are

actively managed, and the Investment Adviser assesses whether there

are opportunities to improve the environmental efficiency of the

properties, in addition to other asset management initiatives. The

Company has an Environment, Social and Governance Policy which can

be found on the Company's website. This goes into further detail

about the Company's ESG approach and how it integrates with

investment strategy. Further details on the Company's ESG approach

can also be found in the full Annual Report.

The Board has considered the requirements to disclose the annual

quantity of emissions; further detail on this is included in the

Report of the Directors as set out in the full Annual Report.

Diversity

The Company does not have any employees or office space and, as

such, the Company does not operate a diversity policy with regards

to any administrative and management functions.

Whilst recognising the importance of diversity in the boardroom,

the Company does not consider it to be

in the interest of the Group and its shareholders to set

prescriptive diversity criteria or targets. The Board has adopted a

diversity policy in respect of appointments to be made to the Board

and will continue to monitor diversity, taking such steps as it

considers appropriate to maintain its position as a meritocratic

and diverse business. The Board's objective is to maintain

effective decision-making, including the impact of succession

planning. All Board appointments will be made on merit and have

regard to diversity regarding factors such as gender, ethnicity,

skills, background and experience. This includes Director

appointments to the Audit and Management Engagement Committee and

Nomination and Remuneration Committee. See Corporate Governance

Statement in the full Annual Report.

The Board comprises three male and two female non-executive

Directors. Throughout the year, the Company complied with the

Hampton-Alexander Review's target of a minimum 33% representation

of women on FTSE 350 boards.

The Board is aware of the recommendations of the Parker Review,

which will be taken into consideration as part of the Board's

succession planning. See Corporate Governance Statement as set out

in the full Annual Report

The Board of Directors of the Company's subsidiaries, which are

non-operational, each comprise one female and up to four male

directors.

Human Rights

Given the Company's turnover for the year under review, it now

falls within the scope of the Modern Slavery Act 2015. The Company

published its modern slavery statement on 22 September 2021.

The Board is satisfied that, to the best of its knowledge, the

Company's principal advisers, which are listed in the Company

Information section, comply with the provisions of the UK Modern

Slavery Act 2015.

The Company's business is solely in the UK and therefore is

considered to be low risk with regards to human rights abuses.

Community and Employee

The Company's properties enable the provision of care to some of

the most vulnerable people in the community, ensuring safe and

secure accommodation, tailored to meet individual care needs. The

Company has increased the provision of care-based housing, bringing

new supply to the sector and providing homes to over 4,500 people.

All of the Company's properties enable the provision of high levels

of care, generating local jobs and helping to support local

economies.

The Company has no employees and accordingly no requirement to

separately report on this area.

The Investment Adviser is an equal opportunities employer who

respects and seeks to empower each individual and the diverse

cultures, perspectives, skills and experiences within its

workforce.

Section 172(1) Statement and stakeholder engagement

Overview

The Directors' overarching duty is to act in good faith and in a

way that is most likely to promote the success of the Company as

set out in section 172 of the Companies Act 2006. In doing so,

Directors must take into consideration the interests of the various

stakeholders of the Company, the impact the Company has on the

community and the environment, take a long-term view on

consequences of the decisions they make, as well as aim to maintain

a reputation for high standards of business conduct and fair

treatment between the members of the Company.

Fulfilling this duty naturally supports the Company in achieving

its investment objective and helps to ensure that all decisions are

made in a responsible and sustainable way. In accordance with the

requirements of the Companies (Miscellaneous Reporting) Regulations

2018, the Company explains how the Directors have discharged their

duties under section 172 below.

To ensure that the Directors are aware of, and understand, their

duties, they are provided with the pertinent information when they

first join the Board as well as receiving regular and ongoing

updates and training on the relevant matters. Induction and access

to training is provided for new Directors. They also have continued

access to the advice and services of the Company Secretary and,

when deemed necessary, the Directors can seek independent

professional advice at the Company's expense. The Schedule of

Matters Reserved for the Board, as well as the Terms of Reference

of its committees, are reviewed regularly and further describe

Directors' responsibilities and obligations and include any

statutory and regulatory duties. The Audit and Management

Engagement Committee has the responsibility for the ongoing review

of the Company's risk management systems and internal controls and,

to the extent that they are applicable, risks related to the

matters set out in section 172 are included in the Company's risk

register and are subject to periodic and regular reviews and

monitoring.

Long-term Success

The strategy of the Company can be found below. Any deviation

from, or amendment to, that strategy is subject to Board and, if

necessary, shareholder approval. The Company's business model,

which can be found below, provides that the Board considers the

long-term consequences of its investment decisions.

The Company grants long-term leases, generally 20 years in

length, to its tenants. The Company seeks to maintain lasting

relationships with its tenants and supports its tenants in adapting

properties to meet their needs, particularly improving and

enhancing properties. Further details can be found in the full

Annual Report.

Stakeholders

A company's stakeholders are normally considered to comprise its

shareholders, its employees, its customers and its suppliers as

well as the wider community in which the company operates and

impacts. The Company is different in that as an investment trust it

has no employees and, in terms of suppliers, the Company receives

professional services from a number of different providers,

principal among them being the Investment Adviser.

Through regular engagement with its stakeholders, the Board aims

to gain a rounded and balanced understanding of the impact of its

decisions. Feedback from stakeholders is gathered by the Investment

Adviser in the first instance and communicated to the Board in its

regular quarterly meetings and otherwise as required.

The importance of stakeholders is taken into account at every

Board meeting, with discussions involving careful consideration of

the longer-term consequences of any decisions and their

implications for stakeholders. The following section explains why

these stakeholders are considered of importance to the Company and

the actions taken to ensure that their interests are taken into

account by the Board as part of its decision making.

Our Key areas How we engage

stakeholders of interest

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Shareholders The Board welcomes shareholders' views

Continued * Current and future financial performance on both a and places great importance on communication

shareholder NAV and share price basis with the shareholders of the Company.

support and The Board is responsible for the content

engagement of communication regarding corporate

are critical * Strategy and business model issues and for communicating its views

to the to shareholders. The Board aims to

existence ensure that shareholders are provided

of the * Corporate governance with sufficient information to understand

business the risk/reward balance to which they

and the are exposed by the holding of shares

delivery * ESG performance and sustainability in the Company. Active engagement with

of the shareholders is carried out throughout

long-term the year and regular communication

strategy of * Climate Change is undertaken to ensure that they understand

the business. the performance of the business. The

Board is committed to maintaining open

* Dividend channels of communication and to engaging

with shareholders in a manner which

they find most meaningful, in order

to gain an understanding of the views

of shareholders. These channels include:

Annual General Meeting - The Company

welcomes and encourages attendance,

voting and participation from shareholders

at the AGM, at which shareholders have

the opportunity to meet the Directors

and Investment Adviser and to address

questions to them directly. The Investment

Adviser attends the AGM and provides

a presentation on the Group's performance

and its future outlook. The Company

values any feedback and questions it

may receive from shareholders ahead

of and during the AGM and takes action,

as appropriate. The Board was pleased

to note that all resolutions proposed

at the Company's AGM on 15 September

2022 were approved by shareholders.

Publications - The Annual Report and

Half-Year Results are made available

on the Company's website. These reports

provide shareholders with a clear understanding

of the Group's portfolio and financial

position. In addition to the Annual

and Half-Year Reports, regularly updated

information is available on the Company

website, including quarterly factsheets,

key policies, the investor relations

policy and details of the investment

property portfolio. Feedback and/ or

questions the Company receives from

the shareholders help the Company evolve

its reporting aiming to render the

reports and updates transparent and

understandable.

Shareholder meetings - Shareholders

are able to meet with the Investment

Adviser and the Company's Joint Brokers

throughout the year and the Investment

Adviser provides information on the

Company on the Company's website. Feedback

from all shareholder meetings with

the Investment Adviser and/or the Joint

Brokers, and shareholders' views, are

shared with the Board on a regular

basis. The Chairman and other members

of the Board, including the Senior

Independent Director and Chair of the

Audit and Management Committee, are

available to meet with shareholders

to understand their views on governance

and the Company's performance where

they wish to do so.

Shareholder concerns - The Board gives

due consideration to any matters raised

by shareholders. In the event shareholders

wish to raise issues or concerns with

the Board or the Investment Adviser,

they are welcome to write to the Company

at the registered office address set

out in the full Annual Report.

In line with increasing shareholder

focus on Environmental, Social and

Governance ("ESG") matters, the Board

requests regular updates from the Investment

Adviser. The Board retains overall

responsibility for ESG issues and the

Company's operational performance.

Implementation of ESG matters are undertaken

by the Investment Adviser on behalf

of the Board.

Furthermore, ESG reporting has been

disclosed in the full Annual Report

and the Board is open to discussion

with shareholders on this topic if

requested.

Investor relations updates - The Board

regularly monitors the shareholder

profile of the Company. With the majority

of shareholders being a combination

of institutional investors and private

client brokers, the Board receives

regular updates on investors' views

and attitudes from the Company's Brokers

and the Investment Adviser. The results

of these meetings were reported to

the Board as part of the formal reporting

undertaken by both the Investment Adviser

and the Brokers.

Included in the Report of the Directors

in the full report are details of substantial

shareholdings in the Company.

On a regular basis (sometimes weekly)

and at Board meetings, the Directors

receive updates from the Company's

Brokers on the share trading activity,

share price performance and any shareholders'

feedback, as well as an update from

the Company's Investor Relations adviser,

Buchanan, and the Investment Adviser

on any publications or comments by

the press. To gain a deeper understanding

of the views of its shareholders and

potential investors, the Investment

Adviser maintains regular contact with

them and also undertakes investor roadshows.

Any relevant feedback is taken into

account when Directors discuss any

possible fundraising or the future

dividend policy.

Following the year end, the Board recommended

an offer to shareholders of 80 pence

for each share held in the Company

from Wellness Unity Limited (a wholly

owned subsidiary of CK Asset Holdings

Limited). During the Takeover process,

the Board engaged with shareholders

and received their views on the Takeover.

which it took into account during its

discussions. Further information on

the Board's decision in relation to

the Takeover Offer can be found in

the full Annual Report.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Investment The asset management of the Company's

Adviser * Current and future financial performance portfolio is delegated to the Investment

Holding the Adviser, which manages the assets in

Company's accordance with the Company's objectives

shares * Shared commercial objectives with the Company and policies. At each Board meeting,

offers representatives from the Investment

investors Adviser are in attendance to present

an investment * Operational excellence reports to the Directors covering the

vehicle Company's current and future

through activities, portfolio of assets and

which they * Long-term development of its business and resources its investment performance over the

can obtain preceding period.

exposure to

the Company's * ESG performance and sustainability Maintaining a close and constructive

portfolio of working relationship with the Investment

properties. Adviser is crucial as the Board and

The the Investment Adviser both aim to

Investment continue to achieve consistent long-term

Adviser's returns in line with the Company's

performance investment objective. Important components

is critical in the collaboration with the Investment

for the Adviser, representative of the Company's

Company culture are:

to

successfully * operating in a fully supportive, co-operative and

deliver its open environment and maintaining ongoing

investment communication with the Board between formal meetings;

strategy and

meet its

objective

to provide * encouraging open discussion with the Investment

shareholders Adviser, allowing time and space for original and

with an innovative thinking;

attractive

level of

income,

together with * recognising that the interests of stakeholders and

the potential the Investment Adviser are for the most part well

for capital aligned, adopting a tone of constructive challenge;

growth.

* drawing on Board members' individual experience and

knowledge to support the Investment Adviser in its

monitoring of and engagement with other stakeholders;

and

* willingness to make the Board members' experience

available to support the Investment Adviser in the

sound long-term development of its business and

resources, recognising that the long-term health of

the Investment Adviser is in the interests of

shareholders in the Company.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Other service The Company's main functions are delegated

providers * Current and future financial performance to a number of service providers, including

In order to the Administrator, the Company Secretary,

function as the AIFM, the Registrar, the Corporate

a REIT with * Shared commercial objectives with the Company Brokers and the Depositary, each engaged

a premium under separate contracts. The Board

listing maintains regular contact with its

on the London * Operational excellence key external providers and receives

Stock regular reporting from them, both through

Exchange, the Board and Committee meetings, as

the Company * Long-term development of the service providers' well as outside of the regular meeting

relies on a businesses cycle. Their advice, as well as their

diverse range needs and views, are routinely taken

of reputable into account. Through its Audit and

advisers for * Sustainability Management Engagement Committee, the

support in Board formally assesses their performance,

meeting all fees and continuing appointment at

relevant least annually to ensure that the key

obligations. service providers continue to function

at an acceptable level and are appropriately

remunerated to deliver the expected

level of service. The Audit and Management

Engagement Committee also reviews and

evaluates the control environment in

place at each key service provider.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Care At the outset, it is important to note

providers * Current and future performance that the Company does not have any

legal or operational responsibility

for the delivery of care in the properties

* Welfare of tenants within the portfolio. However, the

Board and the Investment Adviser have

taken the view that they wish to have

* Lease obligations a detailed understanding of the delivery

of care and the interaction with the

major care providers who deliver this

* Void management care. Accordingly, the Investment Adviser

maintains an active dialogue with many

of the care providers to build constructive

and informed relationships.

At the same time, as part of transaction

due diligence at the time of acquisition

of properties, the Investment Adviser

undertakes due diligence with respect

to the operational and financial performance

of all care providers who are proposed

to deliver care into the particular

properties. This includes the financial

standing of the care provider, its

CQC rating and the nature of the SLA

agreement covering voids between the

care provider and the Approved Provider.

The Investment Adviser is noted as

having demonstrated considerable expertise

and understanding of the care taking

place within its properties.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Tenants The Company's properties are adapted

* Greater independence for the use of individuals with long-term

care needs within a community setting

with the specific aim of achieving

* Maintaining high level of care better personal outcomes and independence

for the individuals.

* Improved personal outcome The sector in which the Company operates

is regarded as having achieved significant

success in delivering these positive

outcomes compared to long-term older

style remote institutional care.

On a regular basis, members of the

Investment Adviser visit properties

accompanied by Approved Provider and

care provider partners to see first

hand the nature of the housing and

care provision that is being delivered.

Whilst this process has slowed as a

result of the pandemic, the Investment

Advisor has continued to engage with

its tenants. This is supported by the

regular Approved Provider seminars

at which the wellbeing of tenants is

discussed in detail.

In addition, the Company undertakes

resident case studies and surveys through

careful and considered interaction

via the care provider to assess the

positive impact our properties and

associated specialised care have had

on the individual and their wellbeing.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Approved The Company's Approved Provider partners

Providers * Current and future performance are an important part of the investment

model as the responsibility for collection

of housing benefit and subsequent payment

* Sustainability of rent, the maintenance of the properties

under the full repairing and insuring

leases and, most importantly, the safeguarding

* Compliance and property management of the underlying tenants through the

above means, lies with the Approved

Providers.

* Welfare of tenants

The Investment Adviser works closely

with the Company's Approved Provider

* Lease obligations partners to improve standards and governance

and to introduce practices and procedures

that make the Company's investment

processes ever more robust.

The Investment Adviser has a constant

open dialogue with the Approved Provider

partners, liaising monthly on compliance,

health and safety, maintenance and

future-proofing schemes, as well as

hosting quarterly seminars to discuss

current themes/trends affecting the

sector, to troubleshoot. This serves

as an opportunity to build relationships

and share best practice.

The Investment Adviser is supported

by the establishment of The Social

Housing Family CIC, a not-for-profit

community interest company operated

independently of the Company whose

stated aim is to enable Approved Providers

holding the Company's leases to increase

skills and experience and to provide

funding to promote enhanced performance.

Membership is open to any Approved

Provider that holds Civitas leases

and the effect of membership is to

transfer ownership of the Approved

Provider to the social housing family.

Auckland Homes Solutions was the first

Approved Provider to join and has now

recruited a very experienced and senior

executive team and board of management.

Qualitas community benefit society

has also joined the CIC.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Regulator The Company is not itself regulated

of Social * Financial and operational viability by the RSH, but it is important to

Housing (RSH) maintain open and regular dialogue

to ensure that the Company and the

* Governance RSH are working together to improve

the sector.

* Compliance with health and safety, and regulatory The Investment Adviser has a regular

standards and ongoing dialogue with the RSH and

with the Housing Association partners

regulated by the RSH.

* Safety and wellbeing of underlying tenants

The Company also publishes responses

to the regulatory judgements of the

RSH regarding the Approved Providers

with the Company as part of the RSH's

general review of Approved Providers

engaged in the provision of property

services for vulnerable people as announced

in May 2018. This demonstrates the

Company's desire to maintain aa dialogue

with the RSH and its desire to see

that the positions improve where needed.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Other The Company regularly considers how

regulatory * Compliance with statutory and regulatory requirements it meets various regulatory and statutory

authorities obligations and follows voluntary and

The Company best practice guidance, and how any

can only * Governance based on best practice guidance governance decisions it makes can have

operate an impact on its shareholders and wider

with the stakeholders, both in the shorter and

approval * Better reporting to shareholders and other in the longer term.

of its stakeholders

regulators The Board receives quarterly regulatory

who have a compliance monitoring updates from

legitimate the Investment Adviser.

interest in The Board receives quarterly compliance

how the updates from the AIFM regarding the

Company Company's compliance with its investment

operates in policy and the Investment Adviser's

the market compliance with the Investment Management

and treats Agreement.

its The Board also has access to the advice

shareholders. of the Company Secretary who provides

updates and advice on regulatory, statutory

and governance matters for consideration

by the Board at its quarterly meetings

and as and when required.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Local It is important for the Company to

authorities * Provision of safe and secure properties of a high build and maintain relationships with

quality local authorities as they have an important

role in identifying areas of high demand,

agreeing rents and referrals to the

* Sustainability for long-term placements Company's asset management initiatives.

The Company will engage with the local

authority commissioner either directly,

or through specialist consultants,

Approved Provider and care provider

partners as part of the Company's due

diligence to ensure that each property

being acquired has been commissioned

by the relevant local authority and

that rent levels have been discussed

and agreed.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Lenders The Company has arranged debt facilities

Availability * Current and future financial performance of the from a wide range of lenders and engages

of funding business with these on a regular basis through

and liquidity regular meetings and presentations

are crucial to ensure they are informed on all

to the * Openness and transparency relevant areas of the business. The

Company's continual dialogue helps to support

ability to the credit relationships.

take * Proactive approach to communication

advantage The Company has reaffirmed its Investment

of investment Grade High Credit Quality Rating from

opportunities * Operational excellence Fitch Ratings Limited of "A" (senior

as they secured) and a Long-Term IDR (Issuer

arise. Default Rating) of "A-" with a Stable

Outlook.

This will enable the Company to pursue

its strategy in relation to debt funding,

in addition to continuing to work with

the Company's existing lenders, with

whom the Company has built strong relationships.

During the year, the Board considered

and closed a five year term debt facility

with Deutsche Bank AG. Further information

can be found in the full Annual Report.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Communities A key component of the Company's portfolio

The Company's * Acceptance of care in the community is that the properties within it are

assets rely set within community environments so

on a strong, that individuals are able as part of

positive * Availability of local facilities for tenants their care plan to interact with the

connection local community rather than being isolated.

with the

local This is achieved in consultation with

communities local authorities in determining that

in which its the initial settings are appropriately

business diversified within the respective community

operates. and are not clustered in a way that

would lead to isolation.

This assists the individuals and also

ensures appropriate integration within

the community. On a day-to-day basis,

care providers and Approved Providers

operate policies to ensure positive

relationships with neighbours and surrounding

dwellings. The activities within the

Company's properties create employment

within the local community for both

housing and care workers.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Charity The Company supports a number of organisations

Partners * Delivering needed support to vulnerable adults whose objectives are to provide improved

outcomes for vulnerable adults affected

by homelessness and other care needs.

* Improved wellbeing of vulnerable adults

The Company commits targeted financial

* ESG performance and sustainability support to fund specific programmes

which help those affected by homelessness

by teaching them skills and offering

support to prevent them from being

in that position again.

The Company ensures regular calls and

meetings with our charity partners

to update on progress and projects

being undertaken, as well as attending

events in support of their work.

-------------- ------------------------------------------------------------ ------------------------------------------------------------

Principal Decisions

Principal decisions have been defined as those that have a

material impact to the Group and its key stakeholders.

In taking these decisions, the Directors considered their duties

under section 172 of the Act. Principal decisions made during the

year were as follows:

New Regulatory Clause Initiative

In 2022, the Board considered and agreed a new approach to the

Company's lease model with the goal of supporting additional

regulatory compliance and addressing perceptions of risk. The new

regulatory clause enables Approved Providers to achieve greater

alignment between income receipts and lease liabilities, set

achievable capital solvency requirements against lease obligations

and demonstrate a further degree of risk sharing.

The new lease clause has, following detailed negotiation

including legal input, received approval from the board's of two

initial housing associations with whom it had been discussed. The

Company had previously sought and obtained formal written

confirmation from its valuers that the inclusion of a clause of

this type within the Company's new and existing leases will not of

itself cause a diminution in the value of those leases or in the

underlying assets.

Takeover Offer

As announced on 9 May 2023, the Board made the decision to

recommend to shareholders an all-cash offer of 80 pence for each

share of the Company by Wellness Unity Limited (a wholly owned

subsidiary of CK Asset Holdings Limited).

Although the Board believes the offer undervalues the long-term

prospects of the Company, the Board

recognises that the Company and the sector in which it operates

faces a number of challenges in light of the current macro

environment and outlook. This includes the considerable negative

sentiment in the public markets towards the Company and the social

housing sector which the Board believes are unlikely to be overcome

in the short to medium term and will continue to have a material

impact on the Company's share price prospects. In addition, despite

delivering on revenue, NAV and dividend growth since IPO, the

Company's shares have traded for some time at an entrenched

discount to NAV.

On 23 June 2023, the Offer became unconditional.

Updates to Debt Arrangements

During the year, the Board considered and closed a new five year

term debt facility of c.GBP71 million with a major European bank

lender.

The facility was deployed in full to redeem the Company's

existing facility with Lloyds Bank of

GBP60 million as well as providing additional liquidity. As a

result, all of the Company's debt facilities are at 100% fixed or

capped rates.

Buyback Programme

During the year, the Board monitored the decline in the

Company's share price and in response, the Board agreed the

implementation of a share buyback programme under certain

parameters, which is being operated by the Company's Joint

Brokers.

Further information on the Company's buyback programme can be

found in the full Annual Report.

Strategic Overview

Purpose of the Company

The Company was established in 2016 with the purpose of

delivering long-term responsible, stable returns to investors and

achieving positive measurable social impact and ESG benefits on a

large scale. It should achieve this as a result of introducing

long-term equity capital into the social housing sector with a

particular focus on care-based community housing. By doing so, this

would form a bridge between equity investors and the social housing

sector and bring together aspects of healthcare with social

housing.

The Company has since developed the largest portfolio of

care-based community housing in the UK that provides long-term

homes for more than 4,500 individuals across half the local

authorities in England and Wales.

As a result of this success, the Company has recently extended

its mandate to be able to enter into transactions directly with the

NHS and with leading charities with an interest in the provision of

specialist housing that has a strong care or support element, is

consistent with public policy and whose costs are met by the public

purse for which it offers value for money.

Investment Objective

The Company's investment objective is to provide shareholders

with an attractive level of income, together with the potential for

capital growth from investing in a portfolio of Social Homes, which

benefits from inflation adjusted long-term leases or occupancy

agreements with Approved Providers and to deliver, on a fully

invested and geared basis, a targeted dividend yield of 5% per

annum(1) , which the Company expects to increase broadly in line

with inflation.

(1) The dividend yield is based on the original IPO price of 100

pence per Ordinary share. The target dividends are targets only and

do not represent a profit forecast. There can be no assurance that

the targets can or will be met and should not be taken as an

indication of the Company's expected or actual future results.

Accordingly, potential investors should not place any reliance on

these targets in deciding whether or not to invest in the Company

or assume that the Company will make any distributions at all, and

should decide for themselves whether or not the target dividend

yields are reasonable or achievable.

Investment Policy

The Company's investment policy is to invest in a diversified

portfolio of Social Homes throughout the United Kingdom. The

Company intends to meet the Company's investment objective by

acquiring, typically indirectly via Special Purpose Vehicles,

portfolios of Social Homes and entering into long-term inflation

adjusted leases or occupancy agreements for terms primarily ranging

from 10 years to 40 years with Approved Providers, where all

management and maintenance obligations will be serviced by the

Approved Providers. The Company will not undertake any development

activity or assume any development or construction risk. However,

the Company may engage in renovating or customising existing homes,

as necessary.

The Company may make prudent use of leverage to finance the

acquisition of Social Homes and to preserve capital on a real

basis.

The Company is focused on delivering capital growth and expects

to hold its Portfolio over the long-term and therefore it is

unlikely that the Company will dispose of any part of the

Portfolio. In the unlikely event that a part of the Portfolio is

disposed of, the Directors intend to reinvest proceeds from such

disposals in assets in accordance with the Company's investment

policy .

Investment Restrictions

The Company invests and manages the Portfolio with the objective

of delivering a high quality, diversified Portfolio through the

following investment restrictions:

-- the Company only invests in Social Homes located in the United Kingdom;

-- the Company only invests in Social Homes where the

counterparty to the lease or occupancy agreement is an Approved

Provider;

-- no lease or occupancy agreement shall be for an unexpired

period of less than 10 years, unless the shorter leases or

occupancy agreements represent part of an acquisition of a

portfolio which the Investment Adviser intends to reorganise such

that the average term of lease or occupancy agreement is increased

to 15 years or above;

-- the aggregate maximum exposure to any single Approved

Provider is 25% of the Gross Asset Value, once the capital of the

Company is fully invested;

-- no investment by the Company in any single geographical area,

in relation to which the houses and/or apartment blocks owned by

the Company are located on a contiguous or largely contiguous

basis, exceeds 20% of the Gross Asset Value of the Company;

-- the Company only acquires completed Social Homes and will not

forward finance any development of new Social Homes;

-- the Company does not invest in other alternative investment

funds or closed-end investment companies; and

-- the Company is not engaged in short selling.

The investment limits detailed above apply at the time of the

acquisition of the relevant investment in the Portfolio once fully

invested. The Company would not be required to dispose of any

investment or to rebalance the Portfolio as a result of a change in

the respective valuations of its assets.

Gearing Limit

The Directors seek to use gearing to enhance equity returns. The

level of borrowing is set on a prudent basis for the asset class

and seeks to achieve a low cost of funds, whilst maintaining the

flexibility in the underlying security requirements and the

structure of both the Portfolio and the Company.

The Company may, following a decision of the Board, raise debt

from banks and/or the capital markets and the aggregate borrowings

of the Company is always subject to an absolute maximum of 40% of

Gross Asset Value calculated at the time of drawdown. Current

gearing is 35.61% (2002: 34.43%).

Debt is secured at asset level, whether over a particular

property or a holding entity for a particular series of properties,

without recourse to the Company and also potentially at Company

level with or without a charge over the Portfolio (but not against

particular assets), depending on the optimal structure for the

Company and having consideration to key metrics including lender

diversity, cost of debt, debt type and maturity profiles. Otherwise

there will be no cross-financing between investments in the

Portfolio and the Company will not operate as a common treasury

function between the Company and its investments.

Use of Derivatives

The Company may choose to utilise derivatives for efficient

portfolio management. In particular, the Directors may engage in

full or partial interest rate hedging or otherwise seek to mitigate

the risk of interest rate increases on borrowings incurred in

accordance with the gearing limits as part of the management of the

Portfolio.

Cash Management

The Company invests in cash, cash equivalents, near cash

instruments and money market instruments.

REIT Status

The Directors conduct the affairs of the Company so as to enable

it to remain qualified as a REIT for the purposes of Part 12 of the

Corporation Tax Act 2010 (and the regulations made thereunder).

Culture

The Directors agree that establishing and maintaining a healthy

corporate culture among the Board and in its interaction with the

Investment Adviser, shareholders and other stakeholders will

support the delivery of its purpose, values and strategy. The Board

seeks to promote a culture of openness, debate and integrity

through ongoing dialogue and engagement with its service providers,

principally the Investment Adviser.

As detailed in the Corporate Governance Statement, the Company

has a number of policies and procedures in place to assist with

maintaining a culture of good governance, including those relating

to diversity and Directors' conflicts of interest. The Board

assesses and monitors compliance with these policies as well as the

general culture of the Board through Board meetings and, in

particular, during the annual evaluation process which is

undertaken by each Director (for more information, see the

performance evaluation section in the full Annual Report).

The Board's culture itself is one of openness, collaboration and

constructive debate to ensure the

effective contribution of all Directors, particularly in respect

of the Board's decision making. Consideration

of our Stakeholders is embedded in the Board's decision making

process. Please see our section 172 Statement above.

Key Performance Indicators ("KPIs")

Measure Explanation Result

----------------------------- --------------------------------- ----------------------------------------------------

Increase in NAV per Target to achieve capital IFRS NAV increase of 11.2p per share 11.4%