TIDMCSSG

RNS Number : 7188B

Croma Security Solutions Group PLC

06 June 2023

Croma Security Solutions Group Plc

("CSSG", "Croma", "the "Company" or the "Group")

Proposed Disposal of Vigilant for GBP6.5 million

Croma Security Solutions Group plc (AIM:CSSG) is pleased to

announce it has entered into a conditional agreement to sell the

entire issued share capital of its subsidiary Vigilant Security

(Scotland) Limited ("Vigilant") to M&W Security Limited for a

total consideration of GBP6.5 million plus inter-company balances

of GBP1.07 million repayable to the Company.

Highlights

-- Sale of Vigilant follows the Company's strategy to focus on

its higher margin Croma Locksmiths and Croma Security Systems

businesses.

-- Proceeds from the sale will be used to support the successful

nationwide roll-out of the Company's retail chain of modern

security centres.

-- Vigilant is being acquired by two previous Directors of the

Company, Sebastian Morley and Paul Williamson who stepped down from

the Board in December 2022 to prepare a bid.

-- The Consideration to be received for the Disposal of GBP6.5

million represents approximately 91.8 per cent. of the Company's

market capitalisation of GBP7.1 million as at the close of business

on 2 June 2023. For the year ended 30 June 2022 Vigilant generated

approximately 42 per cent. of the Croma Group's EBITDA and for the

six months ended 31 December 2022 Vigilant generated approximately

29 per cent. of the Croma Group's EBITDA.

-- The Disposal is subject to shareholder approval and is

expected to be completed on 30 June 2023.

Roberto Fiorentino, CEO of CSSG, said : 'We are delighted to be

announcing the proposed sale of Vigilant which is a good business

but no longer fits with the future of our Group. The funds from the

sale will accelerate our ability to drive our Locks and Systems

business through the roll out of our modern Security Centres.

Separately, the Group has continued to trade well and we have had a

strong second half to the year which ends in June 2023 and we

expect to report overall trading comfortably ahead of last year. We

look forward to completing the sale and demonstrating to existing

and new shareholders the true value of our core businesses."

Background

On 6 December 2022, the Company announced its decision to sell

Vigilant in order to re-focus the Group's future strategy around

the development of Croma Locksmiths Limited and Croma Security

Systems Limited to take advantage of higher margins, good cash

generation and opportunities for future growth. Vigilant's

management team, led by its Operations Director Paul Williamson and

supported by its Managing Director, Sebastian Morley, indicated

their desire to acquire Vigilant from the Group and stepped down

from their respective Board roles in order to prepare a bid.

Overview

The Consideration will be satisfied as to (i) GBP1,073,314

payable in cash on Completion; (ii) GBP4,126,686 by the issue of

the Loan Notes; and (iii) either (at the Buyer's sole discretion)

the payment of an additional GBP1,300,000 in cash on Completion or

the issue of the Redeemable Share on Completion. In addition,

inter-company balances of GBP1,067,913 owed by Vigilant to the

Company will be settled on Completion. Therefore on Completion the

Company will receive in aggregate cash of either GBP2,141,227 if

the Redeemable Share is issued or GBP3,441,227 if the Redeemable

Share is not issued.

M&W Security Limited, is owned and controlled by Sebastian

Morley and Paul Williamson, both former directors of the Company

who stepped down from the Board at the annual general meeting held

on 6 December 2022 to pursue a buy-out of Vigilant from the

Company. In order to part fund the cash consideration, Messrs

Morley and Williamson wish to sell all of the shares they hold in

the Company, being in aggregate 798,422 Ordinary Shares. The

Company has agreed to buy-back these shares at a price of 47.5

pence pursuant to the Buy-Back Agreement.

In view of the size of Vigilant relative to the existing size of

the Croma Group, it is a requirement of the AIM Rules that the

Disposal be approved by Shareholders at a general meeting of the

Company. The Disposal is therefore conditional on, inter alia,

shareholder approval at the General Meeting.

The Buy-Back represents a purchase of own shares by the Company

in an off-market transaction pursuant to Section 694 of the Act. As

a result, the Act requires that such a transaction be authorised by

a special resolution and the Act also provides that the parties

from which the shares are proposed to be purchased must not

exercise the voting rights attached to those shares on that

resolution. The Buy-Back is therefore conditional on shareholder

approval at the General Meeting.

As the Disposal and Buy-Back are transactions with former

directors of the Company, they represent related party transactions

in accordance with AIM Rule 13. The Directors, all of whom are

independent, consider that, having consulted the Company's

nominated adviser, that the terms of the Disposal and the Buy-Back

are fair and reasonable in so far as Shareholders are

concerned.

The Board is also taking this opportunity to ask Shareholders to

approve the adoption by the Company of new articles of association

primarily for the purposes of updating the Company's existing

articles of association primarily to take account of changes in

English company law brought about by the Act . The New Articles

will be made available to view on the Company's website at

www.cssgplc.com/investors.

Notice of General Meeting and posting of Circular

A circular, which contains the notice of General Meeting, in

respect of the Disposal is expected to be posted to Shareholders

later today and will also be available on the Company's website

www.cssgplc.com/investors/ .

The General Meeting will take place at the offices of the

Company, Unit 7 & 8 Fulcrum 4, Solent Way, Whiteley, Fareham,

Hampshire PO15 7FT at 9.00 a.m. on 30 June 2023.

Capitalised terms have the meaning set out in Appendix I to this

Announcement.

For further information visit www.cssgroupplc.com or

contact:

Croma Security Solutions Group Plc Tel: +44 (0)1489 566 166

Roberto Fiorentino, CEO

Teo Andreeva, CFO

WH Ireland Limited Tel: +44 (0)207 220 1666

(Nominated Adviser and Broker)

Mike Coe

Sarah Mather

Novella Tel: +44 (0)203 151 7008

Tim Robertson

Claire de Groot

Safia Colebrook

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

1. Information on Vigilant

Vigilant provides manned guarding and reception services for

property assets and individuals and employs over 900 security

personnel throughout the UK.

For the year ended 30 June 2022, Vigilant generated sales of

GBP29.3 million (2021: GBP27.4 million), and operating profit of

GBP0.7 million (2021: GBP1.1 million), EBITDA 0.8 million (2021:

1.3 million). As at 30 June 2022 Vigilant had net assets of

approximately GBP4 million, including Goodwill.

For the six months ended 31 December 2022 ("H1 2022") Vigilant

recorded revenues up 7 per cent. to GBP15.92 million (H1 2021:

GBP14.86 million). However, profit before tax reduced to GBP0.13

million (H1 2021: GBP0.36 million) as it was held back by a number

of factors including non-recurring exceptional costs, up-front

investment in staff costs ahead of the start of a substantial

contract (that commenced successfully, as planned, in January 2023)

as well as general wage inflation which has impacted staff

retention and the ability to recruit. The increased wage costs are

beginning to be passed on in adjusted contract rates and will be

reflected in all new contracts. EBITDA for H1 2022 was GBP0.28

million.

2. Background and reasons for recommending the Disposal

On 6 December 2022, the Company announced that it had decided to

divest the Croma Group's manned guarding business, Vigilant.

The Directors believe that the sale of Vigilant is in the best

interests of Shareholders for the following reasons:

-- the strategy of combining Locks and Systems with Vigilant has

not generated the opportunities for cross marketing and cross sales

that had been expected;

-- it will enable the Continuing Group to focus its future

strategy around the development of Locks and Systems where margins

are high and cash generation remains strong and where the Board

believes there are good opportunities for profitable growth;

and

-- the cash to be received pursuant to the Disposal will enable

the Company to pursue acquisition opportunities for both Croma

Locks and Croma Systems.

The Directors consider that the Consideration to be received for

the Disposal from M&W Security Limited, fairly reflects the

value of Vigilant. In reaching this view, the Directors have taken

into account, factors including:

-- their expectations of Vigilant's trading performance for 30

June 2023 and for 30 June 2024; and

-- the fact that the market has been aware of the Company's

intention to dispose of Vigilant since 6 December 2022 and no other

offers of equivalent value have been received from third

parties.

The Consideration to be received for the Disposal of GBP6.5

million represents approximately 91.8 per cent. of the Company's

market capitalisation of GBP7.1 million as at the close of business

on 2 June 2023, being the latest practical date prior to this

announcement. For the year ended 30 June 2022 Vigilant generated

approximately 42 per cent. of the Croma Group's EBITDA and for the

six months ended 31 December 2022 Vigilant generated approximately

29 per cent. of the Croma Group's EBITDA.

3. Principal terms of the Disposal

Under the terms of the Disposal Agreement, the Company has

agreed to sell the entire issued share capital of Vigilant to

M&W Security Limited for an aggregate consideration of GBP6.5

million. In addition, M&W Security Limited has agreed to

procure that Vigilant repays the debt of GBP1,067,913 which

Vigilant owes to the Company.

The Consideration will be satisfied as to (i) GBP1,073,314

payable in cash on Completion; (ii) GBP4,126,686 by the issue of

the Loan Notes; and (iii) either (at the Buyer's sole discretion)

the payment of an additional GBP1,300,000 in cash on Completion or

the issue of the Redeemable Share on Completion.

Warranties have only been given by the Company to the Buyer in

respect of good title to the shares of Vigilant, subject to certain

limitations on liability.

Completion of the Disposal is conditional upon of Resolutions to

be proposed at the General Meeting, and the Buy-Back being

completed in accordance with its terms.

4. Terms of the Loan Notes

On Completion of the Disposal, and as part of the Consideration,

the Company shall receive the Loan Notes pursuant to a loan note

instrument executed by the Buyer, the principal terms of which are

as follows:

-- the Loan Notes shall attract annual interest at a rate of 4.5 per cent. per annum;

-- the Loan Notes (being both capital amounts and accrued

interest), shall be repaid as follows:

a) the first payment shall be nine months following Completion;

b) thereafter payments shall be made on each quarter date for a further nine payments;

-- the Loan Notes shall be secured over the assets of the Buyer,

Vigilant and Vigilant's wholly-owned subsidiary, Croma Proception

Limited (registered number: SC695543);

-- if the Buyer defaults on the payment of any principal or

interest payable under the Loan Notes default interest will accrue

at a rate of 4 per cent. above the base interest rate of 4.5

percent. Such interest would accrue from day to day and be

compounded quarterly;

-- in the event that the Buyer defaults on any one payment due

to the Company under the Loan Notes the Company shall have step-in

rights to enable the Company to assume control of Vigilant at board

and shareholder level.

5. Terms of the Redeemable Share

On Completion of the Disposal, and as part of the Consideration,

at the Buyer's sole discretion, the Company will either receive an

additional payment of GBP1,300,000 in cash or the issue of the

Redeemable Share on Completion. If the Redeemable Share is issued

by the Buyer, then principal share rights will be as follows:

-- the date for the redemption of the Redeemable Share shall be

the earlier of: (i) 1 July 2024; and (ii) any debt or equity raise

by the Buyer. Upon such an event, the Redeemable Share shall

immediately become due for redemption and the Buyer shall pay the

Company GBP1,300,000 in cash;

-- after 1 July 2024, if the Redeemable Share has not yet been

redeemed in full, a fixed preferential dividend shall accrue at a

rate of 4.5 per cent.;

-- for so long as the Company holds the Redeemable Share and/or

any sums remain outstanding under the Loan Notes, the Company shall

have the right to appoint a director to the board of the Buyer (the

"A Director") and its group companies, such A Director cannot be

removed by the Buyer until such date as both the redemption of the

Redeemable Share has occurred and the Loan Note has been repaid in

full;

-- In the event that the Redeemable Share is not redeemed in

full on the redemption date or any of the default events set out in

condition 4.2 of the Loan Note have occurred the A Director may

serve notice on the Buyer which will cause the Company to be able

to take control at the board and shareholder level.

6. Terms of the Buy-Back Agreement

Prior to Completion, the Company shall enter into a Buy-Back

Agreement with Sebastian Morley and Paul Williamson to acquire in

aggregate 798,422 Ordinary Shares held by Sebastian Morley and Paul

Williamson at a price of 47.5 pence per Buy-Back Share, being the

five day average mid-market price, to 2 June 2023, being the latest

practical date prior to this announcement. The consideration

payable under the Buy-Back Agreement will be paid in cash out of

the Company's distributable reserves at Completion.

The Buy-Back Agreement will be made available on the Company's

website at www.cssgplc.com/investors.

7. Effect of the Disposal and use of proceeds

Once the Buy-Back Shares have been purchased pursuant to the

Buy-Back Agreement, the Company intends to hold the Buy-Back Shares

in treasury.

Immediately following Completion, the Company will have

15,898,656 Ordinary Shares in issue of which 1,794,936 Ordinary

Shares will be held in treasury. Therefore the number of voting

shares will be 14,103,720 immediately following Completion.

If the Disposal and the Buy-Back are approved by Shareholders

and completes in accordance with their terms, on Completion the

Company will receive cash pursuant to the Disposal Agreement of

either GBP2,141,227 if the Redeemable Share is issued or

GBP3,441,227 if the Redeemable Share is not issued. The Directors

estimate that following receipt of the cash pursuant to the

Disposal Agreement and following the Buy-Back of GBP0.38 million,

the Company will have cash balances of approximately GBP2.06

million or GBP3.36 million if the Redeemable Share is not issued,

after paying certain expenses excluding any taxes relating to the

Disposal (stamp duty taxes in respect of the Disposal shall be

payable by the Buyer).

The Company intends to deploy these funds to advance the

Company's strategy, as set out in paragraph 9 below.

8. Current trading and prospects

On 14 March 2023, the Company announced its interim results to

31 December 2022. In those results, Locks and Systems were reported

as the continuing group and Vigilant as an asset held for

resale.

Trading across the Croma Group has been stronger so far in the

second half of the year ending 30 June 2023 than it was in the

first half of the year, being the six months ending 31 December

2022, and the Croma Group's overall trading performance is expected

to be comfortably ahead of last year. Reported results will however

be impacted by a number of one-off exceptional costs incurred in

relation to Vigilant and the Disposal.

9. Strategy and prospects

Following the Disposal the Continuing Group's business will

comprise Croma Locks and Croma Systems where margins are high

(relative to Vigilant) and cash generation remains strong and where

the Board believes there are good opportunities for profitable

growth.

The Board remains focused on creating a national chain of modern

security centres and believes there are opportunities to expand

further. The strategy is to be a leading British security brand and

to that end for the Continuing Group will carefully extend its

footprint of security centres across the country. The Continuing

Group currently operates through 14 security centres and the

objective is to acquire between three and five centres each year.

The market can be very generally split into locksmith and security

systems providers. Croma's strategy is to combine the traditional

offerings of each under one roof, providing comprehensive security

solutions in a broader security centre. To date these centres have

started as locksmiths but could also be systems providers and have

been relatively small acquisitions. The acquisition of large

systems and solution providers will also be considered where they

can complement and extend the Continuing Group's existing

offerings.

To complement and improve its range of services, the Continuing

Group will also consider engaging in strategic partnerships with

providers of innovative security solutions, such as the partnership

it currently has with its Scandinavian partner, iLOQ .

The cash proceeds of the Disposal will provide the Continuing

Group with additional financial stability and cash resources to

accelerate our development in line with the strategy for the

benefit of our shareholders.

10. New Articles

The Company's Current Articles were adopted in May 2000 and

primarily to take into account the changes in English company law

brought about by the Act, the Board are proposing the adoption of

New Articles . The proposed New Articles will be made available on

the Company's website at www.cssgplc.com/investors .

11. Recommendation

The Directors, having consulted with the Company's nominated

adviser, WH Ireland Limited, consider the terms of the Disposal and

Buy-Back are fair and reasonable insofar as Shareholders are

concerned and that the Disposal and Buy-Back are in the best

interests of Shareholders as a whole. Accordingly, the Directors

unanimously recommend Shareholders to vote in favour of the

Resolutions to be proposed at the General Meeting, as they intend

so to do in respect of their shareholdings amounting to 3,902,175

Ordinary shares representing 26.19 per cent. of the Company's total

voting rights..

Appendix I

DEFINITIONS

The following definitions apply throughout this announcement,

unless the context requires otherwise or unless it is otherwise

specifically provided:

"Act" the Companies Act 2006 (as amended)

"AIM" the market of that name operated by the London

Stock Exchange

"AIM Rules" the AIM Rules for Companies published by the

London Stock Exchange from time to time

"Announcement" the announcement of the Disposal made by the

Company on 6 June 2023

"Buy-Back" the buy-back of the Buy-Back Shares from Sebastian

Morley and Paul Williamson at a price of 47.5

pence which represents an off-market transaction

pursuant to Section 694 of the Act.

"Buy-Back Agreement" the agreement to be entered into on or around

the date of the General meeting between the

Company, Sebastian Morley and Paul Williamson

"Buy-Back Shares" 798,422 Ordinary Shares to be purchased by the

Company pursuant to the Buy-Back

"Buyer" M&W Security Limited a limited company number

incorporated in Scotland with registered number

SC753198 and with its registered office at 1st

Floor Left, 161 Brooms Road, Dumfries, United

Kingdom, DG1 2SH with Sebastian Jake Finch Morley

and Paul Williamson as directors

"Company" or Croma" Croma Security Solutions Group plc a public

limited company incorporated in England and

Wales with registered number 03184978 and with

its registered office at Unit 7 & 8, Fulcrum

4 Solent Way, Whiteley, Fareham, England, PO15

7FT

"Completion" completion of the Disposal on the terms set

out in the Disposal Agreement

"Consideration" the consideration payable by the Buyer to the

Company for the Disposal amounting in total

to GBP6.5 million comprised of the Initial Consideration

and the Loan Note Consideration

"Continuing Group" the Company together with its subsidiaries after

completion of the proposed Buyback and Disposal,

being Croma Locks and Croma Systems

"Croma Group" the Company together with its subsidiaries

which at the date of this announcement are Vigilant

and Croma Locks and Croma Systems

"Croma Locks" Croma Locksmiths and Security Solutions Limited,

a limited company incorporated in England and

Wales with registered number 03909669 and with

its registered office at Unit 7 & 8, Fulcrum

4 Solent Way, Whiteley, Fareham, England, PO15

7FT

"Croma Systems" CSS Total Security Limited, a limited company

incorporated in England and Wales with registered

number 02432869 and with its registered office

at Unit 7 & 8, Fulcrum 4 Solent Way, Whiteley,

Fareham, England, PO15 7FT

"Current Articles" the articles of association of the Company at

the date of this announcement

"Directors" or "Board" the directors of the Company or any duly authorised

committee thereof

"Disposal" the proposed sale of the entire issued share

capital of Vigilant (including Vigilant's wholly-owned

subsidiary, Croma Proception Limited (registered

number: SC695543) in accordance with the terms

of the Disposal Agreement

"Disposal Agreement" the agreement dated 5 June 2023 made between

the Company and M&W Security Limited

"EBITDA" Earnings Before Interest Tax and Depreciation

"Existing Share Capital" 15,898,656 Ordinary Shares, of which 996,514

Ordinary Shares are held in treasury

"Form of Proxy" the form of proxy for use in connection with

the General Meeting

"General Meeting" the general meeting of the Company convened

for 9.00 a.m. on 30 June 2023

"Initial Consideration" GBP1,073,314 in cash on Completion and (at the

sole discretion of the Buyer) the payment of

a further GBP1,300,000 in cash on Completion

or the issue of the Redeemable Share

"Loan Note Consideration" the balance of the Consideration, being the

Loan Notes

"Loan Notes" consideration loan notes of GBP4,126,686 issued

in the Buyer

"Locks and Systems" Croma Locks and Croma Systems

"M&W Security Limited" M&W Security Limited, a limited company registered

in Scotland (No. SC753198) with its registered

office at 1st Floor Left, 161 Brooms Road, Dumfries,

United Kingdom, DG1 2SH

"New Articles" the proposed new articles of association of

the Company, which will be proposed for adoption

by the Company at the General Meeting, in replacement

of the Current Articles

"Notice" the notice of the General Meeting of Shareholders

"Ordinary Shares" ordinary shares of 5 pence each in the capital

of the Company

"Redeemable Share" GBP0.01 redeemable consideration A ordinary

share issued in the capital of the Buyer, as

further described in paragraph 6

"Resolutions" the resolutions to be proposed to the Company's

members at the General Meeting

"Shareholders" the holders of Ordinary Shares

"Vigilant" Vigilant Security (Scotland) Limited, a limited

company number incorporated in Scotland with

registered number SC212151 and with its registered

office at 1st Floor Left, 161 Brooms Road, Dumfries,

Scotland, DG1 2SH

"WH Ireland" WH Ireland Limited, nominated adviser and sole

broker to the Company

"GBP", "pounds sterling", are references to the lawful currency of the

"pence" or "p" United Kingdom

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISVELFBXQLBBBB

(END) Dow Jones Newswires

June 06, 2023 02:00 ET (06:00 GMT)

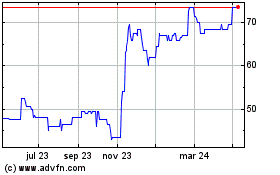

Croma Security Solutions (LSE:CSSG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

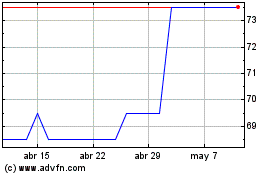

Croma Security Solutions (LSE:CSSG)

Gráfica de Acción Histórica

De May 2023 a May 2024