TIDMEAAS

RNS Number : 2023K

eEnergy Group PLC

04 May 2022

4 May 2022

eEnergy Group plc

("eEnergy" or "the Group")

eEnergy Trading update and Board Change

eEnergy (AIM: EAAS), the digital energy services company, today

publishes an update in respect of the current financial year to 30

June 2022.

Summary

-- The Board is pleased with the strategic progress to date

o Integration of UtilityTeam on track to be delivered by end of

the financial year

o Record contract signings (including renewals) in Q3 of GBP8.6

million

o Recent launches of Solar and EV Charging solutions generating

higher than expected levels of customer engagement

o Strong revenue and earnings trajectory in the business, with

the exception of Ireland

o Robust long-term market opportunity with increased focus on

renewables

-- The Board is now expecting revenue and Adjusted EBITDA to be

behind current market expectations for the current financial year

as a result of:

-- Ireland business has experienced longer Covid lockdowns with

slower than expected recovery post first half results

-- Customers are entering into larger multi-service contracts

resulting in longer conversion times from signing to

installation

-- The Board expects to deliver approximately GBP23.0 million of

Revenue and approximately GBP3.0 million Adjusted EBITDA for

FY22

Trading update

In Q3 FY22, the Group delivered strong new customer wins across

its two core divisions of Energy Efficiency and Energy Management,

signing GBP8.6 million of contract value across a broad range of

Education, other Public Sector and C&I customers. This momentum

has continued into the start of Q4 with further increases in the

new business pipeline expected as commercial energy users seek to

mitigate price increases through smart procurement, onsite

generation and reducing consumption through energy efficiency

measures.

At 31 March, contracted forward revenues had increased to

GBP23.0 million from GBP18.0 million at 31 December 2021. GBP19.6

million of this related to energy management and GBP3.4 million

related to energy efficiency contracts. Of the GBP23.0 million,

approximately GBP8.3 million is expected to be recognised in

FY23.

The Group is pleased to announce that the recent launch of

eCharge, its EV charge point operating business which is aiming to

create the UK's largest public sector charging network, has

exceeded management's early expectations, with a strong pipeline of

opportunities from existing group customers built within the first

30 days of launch.

Demand from both existing and new customers for onsite solar

generation has been significant given the sharply improved spread

between implied cost per KwH for onsite generation and grid energy

prices. The Group is developing its solar capability in response.

During Q3 and Q4 to date, Heads of Terms have been signed for

GBP7.8m contract value of onsite solar with existing customers

which the Board expects will convert to revenues during H1

FY23.

Outlook

The Group continues to have a growing pipeline of new business

opportunities across both Energy Management and Energy Efficiency

which the Group expects to convert during H1 FY23.

As previously reported, H1 FY22 revenues suffered from the

negative impacts of Covid lockdowns on the pipeline in Energy

Efficiency, in addition to disruption caused by the energy crisis

sparked by the conflict in Ukraine, which impacted Energy

Management. Ireland, in particular, has suffered from harsher and

longer lockdowns during the period. At the same time, lead times

from sale to revenue have increased as the Group expands the value

and breadth of its contracts, due in part to the increased interest

from customers seeking more than one of its services.

As a result, the Board is now expecting revenue and Adjusted

EBITDA to be behind current market expectations for the current

financial year with revenue of approximately GBP23 million (up c.

70% from GBP13.6 million in FY21) and Group Adjusted EBITDA of

approximately GBP3.0 million (up c. 250% from GBP0.8 million in

FY21).

In FY23 the Board plans to increase operational investment, in

particular through eCharge and onsite solar generation, to

capitalise on enhanced long-term growth opportunities presented by

the energy crisis. As a result, the Board expects lower Adjusted

EBITDA margins in FY23 than current market expectations whilst

still delivering improved margins over FY22.

Management and Directorate changes

Ric Williams, Chief Financial Officer, has advised the Board of

his intention to step down from the Board to pursue other

opportunities. Ric will leave the Company on 31 July 2022 following

an orderly handover process. The Board would like to thank Ric for

his contributions to the growth of the business and its transition

to an integrated energy services business and wishes him well in

his future ventures.

Crispin Goldsmith, a member of the Group Executive team and

currently Chief Strategy & Commercial Officer, has been

appointed by the Board as Interim CFO.

Crispin has over 20 years of experience in corporate finance and

M&A and substantial board level experience across a range of

businesses. His previous roles include Director of Strategy and

Corporate Development at Dixons Carphone, Investment Director at

Duke Street, a leading UK private equity firm and Director at Royal

Bank Equity Finance, the manager of the GBP1.1 billion RBS Special

Opportunities Fund. Crispin started his career at PwC where he

qualified as a Chartered Accountant.

The Board expects to confirm Crispin's permanent appointment as

CFO and as a Group Board Director once customary due diligence by

the Company's nominated adviser is completed.

Harvey Sinclair, CEO of eEnergy Group plc, said, "As announced

in our Half Year results, the financial performance of the Group

was broadly in line with our expectations and Q3 saw record

contract signings with customers responding to higher energy

prices. We are pleased to see this momentum continuing with a

strong start to Q4 and a robust sales pipeline to take us into

FY23.

"Despite these gains, the impact of covid lockdowns in H1 has

continued in Ireland which has seen a slower than expected

recovery. Adding to this, we are seeing longer lead times between

signing and project completion for the larger, multi service

contracts we are now winning. Whilst this is inherently a positive,

the longer lead times means certain contracted revenues will now

fall after the financial year end.

"The Board is pleased with the new business pipeline momentum

which is not only seeing cross selling of services to existing

clients but also to new customers seeking multiservice Net Zero

strategies across our energy efficiency and energy management

divisions. We continue to invest in new products and services and

are excited by the launch of eCharge and our onsite solar power

generation offering which has met with strong demand."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014. The person responsible for

arranging for the release of this announcement on behalf of eEnergy

is Harvey Sinclair, Chief Executive Officer.

--- END ---

Contacts:

eEnergy Group plc Tel: +44 20 7078

9564

Harvey Sinclair, Chief Executive Officer info@eenergyplc.com

Ric Williams, Chief Financial Officer ; www.eenergyplc.com

Singer Capital Markets (Nominated Adviser Tel: +44 20 7496

and Joint Broker) 3000

Justin McKeegan, Mark Taylor, Asha Chotai

(Corporate Finance)

Tom Salvesen (Corporate Broking)

Turner Pope Investments (Joint Broker) Tel: +44 20 3657

0050

Andy Thacker, James Pope info@turnerpope.com

Tavistock Tel: +44 207 920

3150

Jos Simson, Heather Armstrong, Katie Hopkins eEnergy@tavistock.co.uk

About eEnergy Group plc

eEnergy (AIM: EAAS) is a digital energy services company,

empowering organisations to achieve net zero by tackling energy

waste and transitioning to clean energy, without the need for

upfront investment. It is making net zero possible and profitable

for all organisations in four ways:

-- Transition to the lowest cost clean energy through our

digital procurement platform and energy management services.

-- Tackle energy waste with granular data and insight on energy

use and dynamic energy management.

-- Reduce energy use with the right energy efficiency solutions without upfront cost.

-- Reach net zero with onsite renewable generation and electric vehicle (EV) charging.

eEnergy is a Top 5 B2B energy company, currently managing 4.2TWh

of energy for 1,800 customers across the public and private

sectors.

eEnergy has been awarded The Green Economy Mark by London Stock

Exchange.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUPURUAUPPPWW

(END) Dow Jones Newswires

May 04, 2022 02:02 ET (06:02 GMT)

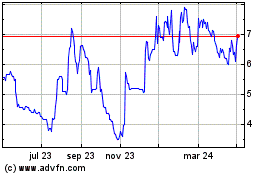

Eenergy (LSE:EAAS)

Gráfica de Acción Histórica

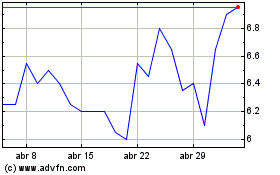

De Mar 2024 a Abr 2024

Eenergy (LSE:EAAS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024