TIDMEDV

EAVOUR EXPECTS SIGNIFICANT GROWTH IN 2024 WITH BOTH PROJECTS SET TO

START UP IN Q2-2024

FY-2023 production of 1.1Moz at AISC of $964/oz l FY-2023

shareholder returns of $266m l FY-2023 growth investment of

$542m

OPERATIONAL AND FINANCIAL HIGHLIGHTS (for continuing

operations)

-- Q4-2023 production of 280koz was flat over Q3-2023,

while AISC decreased by $31/oz or 3.2% to $936/oz

despite a $24/oz increase in royalty costs

-- FY-2023 production of 1,072koz, marking the 11th

consecutive year of achieving or beating production

guidance, with production set to increase by up to

18% in FY-2024 to 1,130-1,270koz due to project

start-ups in Q2-2024

-- Industry low AISC of $964/oz for FY-2023, achieving

near the top end of guidance which is in line with

the previously disclosed outlook, albeit 1.5% above

as royalty costs were $18/oz higher; FY-2024 AISC to

remain low at $955-1,035/oz

-- Strong financial position with $757m of available

liquidity, comprised of $517m in cash and $240m in

undrawn credit facilities, while Net Debt stood at a

healthy $555m at year-end with two key growth

projects approaching completion

ROBUST SHAREHOLDER RETURNS

-- H2-2023 dividend of $100m declared, totalling $200m

for FY-2023, which is 14% above the minimum committed

dividend

-- Share buyback programme continued with $26m worth of

shares repurchased in Q4-2023, totalling $66m for

FY-2023

-- Cumulative shareholder returns declared of greater

than $900m since 2021, 77% above the minimum

commitment

ATTRACTIVE ORGANIC GROWTH

-- Sabodala-Massawa expansion on budget and on schedule

for start-up in Q2-2024, increasing its expected

production up to 400koz in FY-2024 at an AISC of less

than $850/oz

-- Lafigué project construction on budget and ahead

of schedule with expected start-up in Q2-2024, rather

than Q3-2024, expecting to contribute up to 110koz of

production in FY-2024 at an AISC of less than $975/oz

-- Significant exploration success achieved in FY-2023

with Tanda-Iguela discovery increasing to 4.5Moz of

Indicated resources and near-mine exploration

success; continued exploration focus in FY-2024 with

$65m budget

London, 22 January 2024 -- Endeavour Mining plc (LSE:EDV,

TSX:EDV, OTCQX:EDVMF) ("Endeavour" or the "Group" or the "Company")

is pleased to announce its unaudited preliminary financial and

operating results for the fourth quarter and full year 2023, with

highlights provided in Table 1 below.

Table 1: Preliminary Financial and Operating Results

Highlights(1,2)

THREE MONTHSED YEARED

<DELTA>

(In US$m unless 31 30 31 31 31 FY-2023

otherwise December September December December December vs.

specified) 2023 2023 2022 2023 2022 FY-2022

-------- --------- -------- -------- -------- -------

PRODUCTION AND

AISC HIGHLIGHTS

Gold Production,

koz 280 281 294 1,072 1,161 (8)%

Gold Sold, koz 285 278 290 1,084 1,150 (6)%

All-in

Sustaining

Cost(3) , $/oz 936 967 885 964 850 +13%

SHAREHOLDER

RETURNS

Shareholder

dividends paid -- 100 -- 200 170 +18%

Share buyback 26 20 24 66 99 (34)%

-------- --------- -------- -------- -------- -------

Total

shareholder

returns paid 26 120 24 266 269 (1)%

-------- --------- -------- -------- -------- -------

ORGANIC GROWTH

Growth capital

spend(3) 155 116 55 447 127 +252%

Exploration

spend(3) 16 27 14 95 82 +20%

-------- --------- -------- -------- -------- -------

Total

investments in

organic

growth(3) 171 143 69 542 209 +161%

-------- --------- -------- -------- -------- -------

FINANCIAL

POSITION

HIGHLIGHT

(Net debt) / Net

Cash(3) (555) (445) 121 (555) 121 n.a

-------- --------- -------- -------- -------- -------

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

Endeavour's expected results as at the date of this press release.

(2) Production and AISC highlights from continuing operations (3)

This is a non-GAAP measure.

Ian Cockerill, CEO of Endeavour, commented: "I am honoured to

assume the role of CEO at a pivotal time for Endeavour as strong

foundations are in place to unlock significant value as we deliver

on our organic growth pipeline. I look forward to continuing to

implement the strategy approved by the Board and lead the Company

forward for the benefit of all our stakeholders.

2023 was another successful year for Endeavour during which we

continued to focus on improving the quality of our portfolio

through asset optimisation initiatives, the divestment of non-core

Boungou and Wahgnion mines, construction of our two high-margin,

long life growth projects, and continue to deliver significant

exploration success.

On the operational front, we are pleased to have met production

guidance for the eleventh consecutive year and to remain one of the

lowest all-in sustaining cost producers within the sector, allowing

us to generate robust cash flow to fund both our organic growth and

shareholder returns programmes. Moreover, we achieved record

production at both Ity and Houndé in 2023 where production exceeded

300koz. As we look forward to continuing to optimise and explore

these two mines with the goal of sustaining such levels of

production over the long-term, Endeavour's other flagship asset,

Sabodala-Massawa, is well positioned to produce up to 400koz in

2024.

Regarding our near-term growth plans, we are very pleased to

report that both the Sabodala-Massawa expansion and the Lafigué

development project are progressing well, with both projects on

budget and on, or ahead of, schedule for first production in the

second quarter of 2024. Our longer-term organic growth pipeline is

equally attractive, following the delineation of a 4.5 million

ounce Indicated resource at our Tanda-Iguela greenfield property in

Côte d'Ivoire. This represents one of the most significant

discoveries in West Africa over the past decade and we have

launched a preliminary feasibility study that we expect to finalise

by year end, as we continue to focus on increasing its size.

Throughout last year, we continued to execute on our commitment

to deliver attractive shareholder returns, returning $200 million

of dividends for the year and having repurchased $66 million worth

of shares, which combined is equivalent to $226 for every ounce of

gold produced from all operations. Importantly, since we began the

shareholder returns programme in 2021, we have returned over $900

million to shareholders representing 77% more than the minimum

commitment for the period. Looking ahead, our goal is to increase

returns further once our two ongoing organic growth projects are

complete.

I would like to thank our team for their continued hard work. I

look forward with excitement to 2024 and beyond as we will benefit

from the efforts undertaken over recent years to improve the

quality of our portfolio and strengthen the resilience of our

business."

SHAREHOLDER RETURNS PROGRAMME

-- In line with Endeavour's capital allocation framework, the Company is

pleased to continue to deliver attractive shareholder returns by

declaring a H2-2023 dividend of $100.0 million, or approximately $0.41

per share. As such, the FY-2023 dividend amounts to $200.0 million, which

represents $25.0 million or 14% more than the minimum dividend commitment

of $175.0 million for the year, reiterating Endeavour's strong commitment

to paying supplemental shareholder returns.

-- Endeavour's H2-2023 dividend will be paid on 25 March 2024, with an

ex-dividend date of 22 February 2024, to shareholders of record on 23

February 2024. Shareholders of shares traded on the Toronto Stock

Exchange will receive dividends in Canadian Dollars ("CAD"), but can

elect to receive United States Dollars ("USD"). Shareholders of shares

traded on the London Stock Exchange will receive dividends in USD, but

can elect to receive Pounds Sterling ("GBP"). Currency elections and

elections under the Company's dividend reinvestment plan ("DRIP") must be

made by shareholders prior to 17:00 GMT on 4 March 2024. Dividends will

be paid in the default or elected currency on the Payment Date, at the

prevailing USD:CAD and USD:GBP exchange rates on 6 March 2024. This

dividend does not qualify as an "eligible dividend" for Canadian income

tax purposes. The tax consequences of the dividend will be dependent on

the particular circumstances of a shareholder.

-- Shareholder returns are being supplemented through the Company's share

buyback programme. A total of $65.7 million, or 3.0 million shares were

repurchased during FY-2023, of which $25.7 million or 1.3 million shares

were repurchased in Q4-2023.

-- As shown in Table 2 below, Endeavour has returned $266.0 million to

shareholders for FY-2023 through dividends and share buybacks, 52% above

the $175.0 million minimum dividend commitment for the year, and

equivalent to $226 per ounce produced from all operations. Since the

shareholder returns programme began to be paid in 2021, Endeavour has

returned $903.0 million to shareholders in the form of dividends and

buybacks, inclusive of the H2-2023 dividend, which represents $393.0

million or 77% more than its minimum commitment over the period.

Table 2: Actual Shareholder Returns vs. Minimum Commitment

MINIMUM ACTUAL SHAREHOLDER RETURNS SUPPLEMENTAL

(All amounts in DIVID BUYBACKS TOTAL SHAREHOLDER

US$m) COMMITMENT DIVIDS COMPLETED RETURNS RETURNS

---------- --------- ---------- ----------- ------------

FY-2020 60 60 -- 60 --

FY-2021 125 140 138 278 +153

FY-2022 150 200 99 299 +149

FY-2023(1) 175 200 66 266 +91

---------- --------- ---------- ----------- ------------

TOTAL 510 600 303 903 +393

---------------- ---------- --------- ---------- ----------- ------------

(1) H2-2023 dividend declared on 22 January 2024, to be paid on

or about 25 March 2024.

-- As previously stated, Endeavour implemented a dividend policy in 2021,

with the goal of supplementing its minimum dividend commitment with

additional dividends and share buybacks provided that the prevailing

higher gold prices remained above $1,500/oz and its leverage remained

below 0.5x Net Debt / adj EBITDA. Endeavour's goal is to increase its

shareholder returns programme once its organic growth projects are

completed, along with the strengthening of its balance sheet, thereby

ensuring that its efforts to unlock growth immediately benefit all its

stakeholders. Endeavour's next semi-annual dividend is expected to be

announced in early August, along with its Q2 and H1-2024 financial

results.

FY-2023 OPERATIONAL PERFORMANCE OVERVIEW

-- Q4-2023 production from continuing operations amounted to 280koz and was

flat over Q3-2023 as the anticipated decrease at Houndé was offset

by increases at Sabodala-Massawa (albeit by less than anticipated due to

the lower grades encountered in the Sabodala pit as it enters its final

phase of mining) and Mana, while Ity remained flat. The all-in sustaining

costs ("AISC") decreased by $31/oz or 3.2% over Q3-2023 to approximately

$936/oz despite a $24/oz increase in royalty costs linked to the higher

realised gold price and the impact of the change in the sliding scale

royalty rates in Burkina Faso, which came into effect in November 2023.

The AISC benefitted from reductions at Sabodala-Massawa and Mana, which

was offset by the increase at Houndé (following record Q3-2023

performance) while Ity remained flat.

-- As shown in Table 3 below, the FY-2023 production from continuing

operations amounted to 1,072koz, achieving the guided 1,060-1,135koz

range and marking the 11th consecutive year of achieving or beating

production guidance. The AISC from continuing operations amounted to an

industry-leading $964/oz for FY-2023. In line with the previously

disclosed outlook, Endeavour achieved near the top-end of guided

$895-950/oz AISC range, albeit 1.5% (representing $14/oz) above due to

royalties being $18/oz higher than anticipated due to a higher realised

gold price ($1,952/oz compared to guidance of $1,750/oz) and the

aforementioned increase in the Burkina Faso royalty rate which came into

effect in November 2023.

Table 3: Group Production and All-In Sustaining Cost from

Continuing Operations Compared to Guidance(1)

2023

ACTUALS 2023 GUIDANCE

------- ------------------------

PRODUCTION FROM CONTINUING OPERATIONS 1,072 1,060 -- 1,135

------------------------------------------------------ ------- ------------- -----

AISC FROM CONTINUING OPERATIONS BEFORE ROYALTY COSTS,

$/oz 841 790 -- 845

Royalty cost, $/oz(2) 123 105

------------------------------------------------------ ------- ------------------------

AISC FROM CONTINUING OPERATIONS, $/oz 964 895 -- 950

------------------------------------------------------ ------- ------------- -----

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

Endeavour's expected results as at the date of this press release.

(2) 2023 AISC guidance was based on a gold price of $1,750/oz

compared to the realised gold price of $1,952/oz

-- FY-2023 production from continuing operations amounted to 1,072koz, which

represents a decrease of 89koz or 8% over the 1,161koz produced in

FY-2022 due to lower production at Mana (due to the transition from an

open-pit to an underground operation at the Wona deposit) and at

Sabodala-Massawa (due to mining and processing of lower grade ore), while

both Houndé and Ity achieved record annual production. FY-2023 AISC

from continuing operations increased by $114/oz, from $850/oz in FY-2022

to approximately $964/oz in FY-2023, as AISC increased at Houndé,

Mana, Sabodala-Massawa and at Corporate, in addition to a $15/oz increase

in royalty costs (from $108/oz in FY-2022 to $123/oz in FY-2023), which

was partially offset by decreased AISC at Ity.

-- The Group's realised gold price from continuing operations, excluding the

impact of realised gains on gold hedges and inclusive of the

Sabodala-Massawa gold stream, was $2,034/oz and $1,952/oz for Q4-2023 and

FY-2023 respectively. Including the impact of the gold hedges, the

Group's realised gold price from continuing operations was $1,945/oz and

$1,919/oz for Q4-2023 and FY-2023 respectively.

Table 4: Consolidated Group Production(1)

THREE MONTHSED YEARED

(All amounts in

koz, on a 100%

basis) 31 December 2023 30 September 2023 31 December 2022 31 December 2023 31 December 2022

----------------- ---------------- ----------------- ---------------- ---------------- ----------------

Houndé 84 109 63 312 295

Ity 74 73 82 324 313

Mana 37 30 46 142 195

Sabodala-Massawa 85 69 103 294 358

----------------- ---------------- ----------------- ---------------- ---------------- ----------------

PRODUCTION FROM

CONTINUING

OPERATIONS 280 281 294 1,072 1,161

----------------- ---------------- ----------------- ---------------- ---------------- ----------------

Boungou(2) -- -- 26 33 116

Wahgnion(2) -- -- 36 68 124

Karma(3) -- -- -- -- 10

----------------- ---------------- ----------------- ---------------- ---------------- ----------------

GROUP PRODUCTION 280 281 355 1,173 1,410

----------------- ---------------- ----------------- ---------------- ---------------- ----------------

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

Endeavour's expected results as at the date of this press release.

(2) Divested on 30 June 2023. (3) Divested on 10 March 2022.

Table 5: Consolidated All-In Sustaining Costs(1,2)

THREE MONTHSED YEARED

31 30 31 31 31

(All amounts in December September December December December

US$/oz) 2023 2023 2022 2023 2022

Hounde 901 787 969 943 809

Ity 865 864 847 809 812

Mana 1,301 1,734 999 1,380 994

Sabodala-Massawa 700 840 661 767 691

Corporate G&A 54 40 52 51 43

AISC FROM

CONTINUING

OPERATIONS 936 967 885 964 850

----------------- ---------- --------- ---------- ---------- ----------

Boungou(3) -- -- 1,118 1,639 1,065

Wahgnion(3) -- -- 1,376 1,566 1,525

Karma(4) -- -- -- -- 1,504

----------------- ---------- --------- ---------- ---------- ----------

GROUP AISC 936 967 954 1,019 933

----------------- ---------- --------- ---------- ---------- ----------

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

Endeavour's expected results as at the date of this press release.

(2) This is a non-GAAP measure.(3) Divested on 30 June 2023. (4)

Divested on 10 March 2022.

2024 OUTLOOK

-- As shown in Tables 6 and 7 below, the production guidance for FY-2024

amounts to 1,130-1,270koz which marks an increase of up to nearly 200koz

or 18.5% over the FY-2023 production from continuing operations of

1,072koz, which is largely due to the commissioning of the

Sabodala-Massawa expansion and the Lafigué projects in Q2-2024. The

AISC is expected to remain consistent with that achieved over recent

quarters at an industry-low $955-1,035/oz.

-- Group production is expected to be more heavily weighted towards H2-2024

while AISC is also expected to be lower in H2-2024 as the Group's organic

growth projects are expected to significantly increase the quality of

Endeavour's portfolio.

-- More details on individual mine guidance have been provided in the below

sections.

Table 6: 2024 Production Guidance for Continuing

Operations(1)

(All amounts in koz, on a 100%

basis) 2023 ACTUALS 2024 FULL-YEAR GUIDANCE

----------------------------------- ------------ ---------------------------

Houndé 312 260 -- 290

Ity 324 270 -- 300

Lafigué(2) -- 90 -- 110

Mana 142 150 -- 170

Sabodala-Massawa(2) 294 360 -- 400

----------------------------------- ------------ ---------- ---- ---------

GROUP PRODUCTION 1,072 1,130 -- 1,270

----------------------------------- ------------ ---------- ---- ---------

(1) All FY-2023 numbers are preliminary and reflect Endeavour's

expected results as at the date of this press release. (2)

Production for Lafigué and production contributions from the

Sabodala-Massawa Expansion include pre-commercial production

period.

Table 7: 2024 AISC Guidance for Continuing Operations(1,2)

(All amounts in US$/oz) 2023 ACTUALS 2024 FULL-YEAR GUIDANCE

------------------------ ------------ ---------------------------

Houndé 943 1,000 -- 1,100

Ity 809 850 -- 925

Lafigué(3) -- 900 -- 975

Mana 1,380 1,200 -- 1,300

Sabodala-Massawa(3) 767 750 -- 850

Corporate G&A 51 40

GROUP AISC 964 955 -- 1,035

------------------------ ------------ ---------- ---- ---------

(1) This is a non-GAAP measure. Refer to the non-GAAP measure

section of the most recent MD&A for Endeavour. All FY-2023

numbers are preliminary and reflect Endeavour's expected results as

at the date of this press release. (2) FY-2024 AISC guidance is

based on an assumed average gold price of $1,850/oz and USD:EUR

foreign exchange rate of 1.10. (3) AISC for Lafigué and the

Sabodala-Massawa Expansion are for the post-commercial production

period.

-- Total mine capital expenditure for FY-2024, consisting of both sustaining

and non-sustaining capital spend, is expected to be approximately $315.0

million, which marks a decrease of $32.7 million or 9% compared to the

FY-2023 expenditure, as detailed in the tables below. More details on

individual mine capital expenditures have been provided in the mine

sections below.

Table 8: Mine Capital Expenditure for Continuing Operations 2024

Guidance(1)

(All amounts in US$m) 2023 ACTUALS 2024 FULL-YEAR GUIDANCE

------------ -----------------------

Houndé 34 40

Ity 10 10

Lafigué -- 25

Mana 24 15

Sabodala-Massawa 24 35

------------ -----------------------

TOTAL SUSTAINING MINE CAPITAL

EXPITURES 92 125

--------------------------------------- ------------ -----------------------

Houndé 38 20

Ity 103 45

Lafigué -- 5

Mana 60 30

Sabodala-Massawa 41 40

Sabodala-Massawa Solar Plant 6 45

Non-mining 8 5

------------ -----------------------

TOTAL NON-SUSTAINING MINE CAPITAL

EXPITURES 256 190

--------------------------------------- ------------ -----------------------

TOTAL MINE CAPITAL EXPITURES 348 315

--------------------------------------- ------------ -----------------------

(1) All FY-2023 numbers are preliminary and reflect Endeavour's

expected results as at the date of this press release.

-- Growth capital spend for FY-2024 is expected to amount to approximately

$245.0 million, which marks a decrease of $202.1 million or 45% compared

to the FY-2023 expenditure of $447.1 million. The FY-2024 expenditure is

expected to consist of approximately $75.0 million of remaining growth

capital for the Sabodala-Massawa BIOX(R) Expansion project and

approximately $170.0 million of remaining growth capital for the

Lafigué project. Further details are provided in the sections below.

-- As detailed in Table 9 below, exploration will continue to be a strong

focus in FY-2024 with a company-wide exploration budget of $65.0 million.

For FY-2024, approximately $15.0 million will be spent on the highly

prospective Tanda-Iguela property in Côte d'Ivoire, which already

ranks as one of the most significant discoveries made in West Africa over

the last decade.

Table 9: Exploration 2024 Guidance for continuing operations

(All amounts in US$m) 2023 ACTUALS(1) 2024 GUIDANCE 2024 ALLOCATION

--------------- ------------- ---------------

Houndé mine 8 7 11%

Ity mine 16 10 15%

Mana mine 7 2 3%

Lafigué mine 2 4 6%

Sabodala-Massawa mine 19 21 32%

Tanda-Iguela project 37 15 23%

Other greenfield projects 6 6 9%

--------------- ------------- ---------------

Total 95 65 100%

-------------------------- --------------- ------------- ---------------

(1) All FY-2023 numbers are preliminary and reflect Endeavour's

expected results as at the date of this press release.

-- The Company's previously implemented revenue protection programme is

expected to continue to provide cash flow visibility during the

construction phase of the Company's two development projects and during

the subsequent debt reduction phase. Outstanding contracts for FY-2024

include a zero cost collar with a put price of $1,807 per ounce and a

call price of $2,400 per ounce for a total of 450,000 ounces, or 112,500

ounces per quarter and forward sales contracts for 70,000 ounces of

production in H1-2024, or 35,000 ounces per quarter, at an average gold

price of $2,033 per ounce. Outstanding contracts for FY-2025 include a

zero cost collar with a put price of $1,992 per ounce and a call price of

$2,400 per ounce for a total of 200,000 ounces, or 50,000 ounces per

quarter.

OPERATIONAL DETAILS BY ASSET

Houndé Mine, Burkina Faso

Table 10: Houndé Performance Indicators(1)

For The

Period

Ended Q4-2023 Q3-2023 Q4-2022 FY-2023 FY-2022

-------------- -------------- -------------- -------------- --------------

Tonnes ore

mined, kt 1,499 1,209 1,912 5,420 5,754

Total tonnes

mined, kt 11,993 10,603 12,901 47,680 45,490

Strip ratio

(incl.

waste cap) 7.00 7.77 5.75 7.80 6.91

Tonnes

milled, kt 1,360 1,400 1,359 5,549 5,043

Grade, g/t 2.15 2.68 1.55 1.92 1.92

Recovery

rate, % 90 91 92 91 93

Production,

koz 84 109 63 312 295

-------------- -------------- -------------- -------------- --------------

Total cash

cost/oz 837 704 793 835 701

AISC/oz 901 787 969 943 809

-------------- -------------- -------------- -------------- --------------

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

Endeavour's expected results as at the date of this press

release.

Q4-2023 vs Q3-2023 Insights

-- Production decreased due to lower processed grades and slightly lower

throughput and recoveries.

-- Total tonnes mined increased due to higher utilisation of the

mining fleet following the end of the wet season. Tonnes of ore

mined increased as a higher volume of ore was mined in the

Vindaloo Main pit, following waste stripping activity that was

completed in Q3-2023, which was partially offset by the lower

volumes of ore mined from the Kari Pump and Kari West pits, which

was in-line with mine sequencing.

-- Tonnes milled decreased slightly due to a higher proportion of

harder transitional and fresh ore in the mill feed.

-- Processed grades decreased due to lower grade oxide ore sourced

from the Kari Pump pit as well as a greater proportion of lower

grade Kari West and Vindaloo Main ore.

-- Recovery rates decreased slightly due to a higher proportion of

transitional and fresh ore, with lower associated recoveries in

the mill feed.

-- AISC increased mainly due to lower production and sales, driven by the

lower average grade in the ore blend.

FY-2023 Performance

-- FY-2023 production totalled a record 312koz, exceeding the guided

270-285koz range, due to higher than expected grades from the Kari Pump

pit as well as better than expected mill performance following the

completion of processing plant optimisation initiatives that improved

mill availability and reduced blockages. FY-2023 AISC amounted to

approximately $943/oz, which was above the $850-925/oz guided range due

to higher royalty payments, in addition to increases in consumable costs

and longer waste hauling distances during the year.

-- FY-2023 production increased from 295koz in FY-2022 to 312koz in FY-2023

due to increased mill throughput, driven by optimisation initiatives,

which was partially offset by slightly lower recoveries due to changes in

the ore blend. FY-2023 AISC increased from $809/oz in FY-2022 to

approximately $943/oz in FY-2023 due to higher royalty costs, higher

sustaining capital expenditure and higher mining and processing costs

following fuel and consumable cost increases.

2024 Outlook

-- Houndé is expected to produce between 260-290koz in FY-2024 at AISC

of $1,000-1,100/oz.

-- Mining activities are expected to continue to focus on the Vindaloo Main,

Kari Pump, and Kari West pits. In H1-2024, ore is expected to be

primarily sourced from the Kari West pit while stripping activities focus

on the Kari Pump and Vindaloo Main pits, while in H2-2024, a greater

volume of ore is expected to be mined from the higher grade Kari Pump

pit. Production is expected to be weighted towards H2-2024 with greater

volumes of higher grade ore from the Kari Pump pit expected to be mined

in H2-2024. Tonnes of ore milled are expected to decrease in FY-2024 as a

lower proportion of soft oxide ore from the Kari West pit is anticipated

in the ore blend as the Kari West pit advances into harder transitional

and fresh ore. The increase in the proportion of harder transitional and

fresh material in the ore blend is expected to result in a slight

decrease in grades and processing recoveries in addition to slightly

higher mining and processing unit costs, driving higher AISC compared to

FY-2023. In addition, royalty costs are expected to be higher due to the

higher prevailing current gold price and the change in the sliding scale

royalty rates that became effective in November 2023 in Burkina Faso

(with the new rate resulting in a $28/oz increase at a gold price of

$1,850/oz).

-- Sustaining capital expenditure is expected to increase from $33.9 million

in FY-2023 to approximately $40.0 million in FY-2024, and primarily

relates to waste stripping at the Kari Pump and Kari West pits, mining

fleet component rebuilds and replacements, processing plant equipment

upgrades and dewatering borehole drilling.

-- Non-sustaining capital expenditure is expected to decrease from $38.3

million in FY-2023 to approximately $20.0 million in FY-2024, and

primarily relates to stripping activity associated with a push back at

the Vindaloo Main pit, the stage 8/9 TSF raise and land compensation for

the third TSF cell.

Ity Mine, Côte d'Ivoire

Table 11: Ity Performance Indicators(1)

For The

Period

Ended Q4-2023 Q3-2023 Q4-2022 FY-2023 FY-2022

------------- ------------- ------------- -------------- --------------

Tonnes ore

mined, kt 1,721 1,246 1,662 6,790 7,044

Total tonnes

mined, kt 7,349 6,020 6,043 27,891 23,946

Strip ratio

(incl.

waste cap) 3.27 3.83 2.64 3.11 2.40

Tonnes

milled, kt 1,593 1,494 1,710 6,714 6,351

Grade, g/t 1.63 1.60 1.73 1.63 1.80

Recovery

rate, % 91 93 87 92 85

Production,

koz 74 73 82 324 313

------------- ------------- ------------- -------------- --------------

Total cash

cost/oz 829 826 816 777 769

AISC/oz 865 864 847 809 812

------------- ------------- ------------- -------------- --------------

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

Endeavour's expected results as at the date of this press

release.

Q4-2023 vs Q3-2023 Insights

-- Production remained flat as higher tonnes milled and higher processed

grades were offset by lower recoveries.

-- Total tonnes mined increased, as anticipated, due to increased

mining rates following the wet season in the prior quarter and

increased stripping activities at the Walter pit cutback.

Similarly, tonnes of ore mined increased following the end of the

wet season as ore mining focussed on the Ity, Walter, Bakatouo and

Le Plaque pits, with supplemental contributions from the Verse

Ouest pit and stockpiles.

-- Tonnes milled increased due to higher crusher availability

following the wet season impact in the prior quarter.

-- Processed grades increased slightly due to higher volumes of

higher grade ore sourced from the Ity and Bakatouo pits in the

mill feed, which was partially offset by lower grade ore sourced

from the Walter and Le Plaque pits during the quarter.

-- Recoveries decreased due to a higher proportion of fresh ore, with

lower associated recoveries, in the mill feed.

-- AISC remained flat as higher royalty rates associated with higher gold

prices were offset by lower processing unit costs associated with

increased processing volumes following the end of the wet season.

FY-2023 Performance

-- FY-2023 production totalled a record 324koz, exceeding the guided

285-300koz range, due to higher than expected throughput as a high

proportion of soft oxide ore was mined, largely from the Le Plaque pits,

which was supported by the continued use of the surge bin, and higher

than expected recoveries. FY-2023 AISC amounted to approximately $809/oz,

which was below the guided $840-915/oz range, largely due to higher than

expected gold sales volumes in addition to lower than expected mining and

processing unit costs as a result of higher than expected volumes of ore

mined and processed.

-- FY-2023 production increased from 313koz in FY-2022 to 324koz in FY-2023

following an increase in throughput rates due to the processing of a

greater proportion of softer oxide ore and an increase in recovery rates

related to the cessation of mining at the Daapleu pit in early 2023,

which was partially offset by lower average processed grades. FY-2023

AISC decreased slightly from $812/oz in FY-2022 to approximately $809/oz

in FY-2023 due to the increase in gold sales volumes and lower sustaining

capital expenditure.

2024 Outlook

-- Ity is expected to produce between 270-300koz in FY-2024 at an AISC of

between $850-925/oz.

-- Ore mining activities are expected to focus on the Ity, Bakatouo, Walter,

Le Plaque and Daapleu pits, which will be supplemented with ore from the

Verse Ouest pit and stockpiles. Production is expected to be slightly

higher in the first half of the year due to greater availability of high

grade ore from the Ity and Bakatouo pits in the mine plan and the wet

season impact in H2-2023 on mining and milling rates. Throughput is

expected to be slightly higher than in FY-2023, due to the commissioning

of the Mineral Sizer in H2-2024, which is expected to increase throughput

rates during the wet season. Milled grades and recoveries are expected to

decrease slightly compared to FY-2023, due to the introduction of lower

grade semi-refractory ore from the Daapleu pit. AISC is expected to

increase in FY-2024 due to the guided lower levels of production and gold

sales.

-- Sustaining capital expenditure is expected to be consistent with the

prior year at approximately $10.0 million in FY-2024 and is primarily

related to waste stripping activities across several pits, de-watering

borehole drilling and processing plant upgrades and replacements.

-- Non-sustaining capital expenditure is expected to decrease from $102.8

million in FY-2023 to approximately $45.0 million in FY-2024, and is

primarily related to pre-stripping activity at the Daapleu pit, TSF 2

earthworks and site infrastructure, in addition to the ongoing Mineral

Sizer and other smaller optimisation initiatives. The Mineral Sizer,

which was launched in 2023 for a total capex of $19.0 million, is

expected to be commissioned in late Q4-2024, and will add an additional

primary crusher for the oxide ores in order to sustain higher plant

throughput rates regardless of the ore blend.

Mana Mine, Burkina Faso

Table 12: Mana Performance Indicators(1)

For The

Period

Ended Q4-2023 Q3-2023 Q4-2022 FY-2023 FY-2022

------------ ------------- ------------- ------------- -------------

OP tonnes

ore mined,

kt 169 297 338 1,298 1,260

OP total

tonnes

mined, kt 805 1,508 1,057 6,001 3,615

OP strip

ratio

(incl.

waste cap) 3.77 4.08 2.13 3.62 1.87

UG tonnes

ore mined,

kt 432 349 299 1,314 944

Tonnes

milled, kt 515 643 643 2,443 2,607

Grade, g/t 2.59 1.66 2.33 2.01 2.49

Recovery

rate, % 89 88 93 91 92

Production,

koz 37 30 46 142 195

------------ ------------- ------------- ------------- -------------

Total cash

cost/oz 951 1,599 941 1,218 943

AISC/oz 1,301 1,734 999 1,380 994

------------ ------------- ------------- ------------- -------------

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

Endeavour's expected results as at the date of this press

release.

Q4-2023 vs Q3-2023 Insights

-- Production increased due to higher average grades processed and recovery

rates, which were partially offset by lower mill throughput.

-- Total open pit tonnes mined decreased, in-line with the mine plan,

as mining activities began to ramp-down at the Maoula open pit.

-- Total underground tonnes of ore mined increased as total ore

tonnes from Wona increased by 36% with a 40% increase in stope

tonnes mined. Total underground development at Wona Underground

and Siou Underground increased compared to the prior quarter with

3,017 meters developed, a 16% increase compared to Q3-2023.

-- Tonnes milled decreased as tonnes of ore mined from the Maoula

open pit decreased and the plant was limited by available ore from

underground sources.

-- The average processed grade increased due to a higher proportion

of higher grade ore from the Wona underground deposit in the mill

feed following an increase in stope tonnes mined.

-- Recovery rates increased slightly due to changes in the ore blend.

-- AISC decreased due to higher volumes of gold sold and lower underground

mining unit costs associated with the continued ramp-up of underground

mining volumes.

FY-2023 Performance

-- FY-2023 production totalled 142koz which, as previously disclosed, was

below the guided 190-210koz range and FY-2023 AISC amounted to

approximately $1,380/oz which, as previously disclosed, was above the

guided $950-$1,050/oz range, due to a slower than expected ramp up by a

new underground mining contractor at the Wona underground deposit

resulting in lower than expected ore tonnes mined and consequently

processed grades and throughput.

-- FY-2023 production decreased from 195koz in FY-2022 to 142koz in FY-2023

largely due to lower average grades processed as a result of lower grade

Maoula ore in the mill feed, and a slower than expected ramp-up of the

new mining contractor at the Wona underground deposit. FY-2023 AISC

increased from $994/oz in FY-2022 to approximately $1,380/oz in FY-2023

primarily due to the lower volumes of gold sold, higher underground

mining unit costs as the underground operations at Wona expanded with the

addition of two new portals.

2024 Outlook

-- Mana is expected to produce between 150-170koz in FY-2024 at an AISC of

$1,200-1,300/oz.

-- Ore is expected to be primarily sourced from the Siou and Wona

underground deposits as the Maoula open pit is expected to be fully

depleted by the end of Q1-2024. Throughput is expected to be slightly

lower than FY-2023 as the mine transitions to becoming solely reliant on

underground ore for the feed. Average grades are expected to increase

compared to FY-2023 as higher grade ore from stope production at the Wona

Underground deposit is expected to displace lower grade Maoula open pit

ore. Recoveries are expected to decrease compared to FY-2023 as the Wona

underground ore has lower associated recoveries. Mana AISC is expected to

decrease in FY-2024 due to the expected increase in underground mining

volumes driving lower underground mining costs, which is expected to be

partially offset by the higher royalty costs due to the higher prevailing

current gold price and the change in the sliding scale royalty rates that

became effective in November 2023 in Burkina Faso (new rate results in a

$28/oz increase at a gold price of $1,850/oz).

-- Sustaining capital expenditure is expected to decrease from $23.6 million

in FY-2023 to approximately $15.0 million in FY-2024, and is primarily

related to waste development in the Wona underground deposit in addition

to processing plant and infrastructure maintenance and upgrades.

-- Non-sustaining capital expenditure is expected to decrease from $60.4

million in FY-2023 to approximately $30.0 million in FY-2022, and is

primarily related to Wona underground development as the mine ramps up to

full stope production capacity, the stage 5 TSF lift and site

infrastructure.

Sabodala-Massawa Mine, Senegal

Table 13: Sabodala-Massawa Performance Indicators(1)

For The

Period

Ended Q4-2023 Q3-2023 Q4-2022 FY-2023 FY-2022

-------------- -------------- -------------- -------------- --------------

Tonnes ore

mined, kt 1,884 1,745 1,727 6,205 6,449

Total tonnes

mined, kt 11,319 11,989 12,645 45,943 49,259

Strip ratio

(incl.

waste cap) 5.01 5.87 6.32 6.40 6.64

Tonnes

milled, kt 1,255 1,175 1,154 4,755 4,289

Grade, g/t 2.31 2.06 3.16 2.15 2.88

Recovery

rate, % 89 91 88 89 89

Production,

koz 85 69 103 294 358

-------------- -------------- -------------- -------------- --------------

Total cash

cost/oz 686 758 559 688 577

AISC/oz 700 840 661 767 691

-------------- -------------- -------------- -------------- --------------

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

Endeavour's expected results as at the date of this press

release..

Q4-2023 vs Q3-2023 Insights

-- Production increased due to an increase in processed grade and throughput,

which was partially offset by a slight decrease in recovery rates.

-- Total tonnes mined decreased due to a decrease in mining

activities at the Bambaraya pits in-line with the mine plan, and

lower waste stripping at the Sabodala pit following stripping

activities earlier in the year. The decrease was partially offset

by increased stripping activities at the Massawa Central Zone pits

to access higher-grade refractory ore zones ahead of the expected

startup of the BIOX(R) Expansion project in Q2-2024, and higher

mining volumes from the Niakafiri East and Sofia North Extension

pits. Tonnes of ore mined increased as stripping activities

earlier in the year provided greater access to ore zones at the

Sabodala pit.

-- Tonnes milled increased as the ore blend contained a higher

proportion of softer oxide ore from the Niakafiri East pit and

stockpiles.

-- Average grade processed increased due to higher grade ore sourced

from the Sabodala, Massawa Central Zone and Sofia North Extension

pits, displacing the comparatively lower grade ore from the

Bambaraya pits.

-- Recovery rates decreased slightly due to an increased proportion

of transitional ore from the Massawa Central Zone pits in the mill

feed impacting recoveries.

-- AISC decreased largely due to increased gold sales driven by higher

average grades and throughput, in addition to lower sustaining capital

incurred during the period.

FY-2023 Performance

-- FY-2023 production totalled 294koz, which was below the 315-340koz

guidance range due to lower production than expected in Q4-2023, as lower

than anticipated tonnage of high-grade ore was extracted from the

Sabodala pit as mining rates decreased with the deeper elevations in the

pit ahead of its final phase of mining. FY-2023 AISC amounted to

approximately $767/oz, near the lower end of the $760-$810/oz guided

range, due to lower than planned sustaining capital incurred in the year.

-- FY-2023 production decreased from 358koz in FY-2022 to 294koz in FY-2023

due to lower average grades milled, partially offset by increased

throughput due to an increased proportion of oxide ore in the mill feed.

FY-2023 AISC increased from $691/oz to approximately $767/oz due largely

to lower volumes of gold sold and higher mining unit costs due to

increased fuel and consumable costs, partially offset by lower processing

unit costs.

2024 Outlook

-- Sabodala-Massawa is expected to produce between 360-400koz in FY-2024 at

a post BIOX(R) Expansion commercial production AISC of $750-850/oz.

-- Ore for the existing CIL plant is expected to be primarily sourced from

the Sabodala, Sofia North Extension and Niakafiri East pits, with

supplementary ore expected to be sourced from the Kiesta pit in H2-2024.

Throughput in the CIL plant is expected to decrease slightly compared to

the prior year due to a higher proportion of fresh ore from the Sabodala

and Sofia North Extension pits expected in the mill feed. Average

processed grades in the CIL plant are expected to decrease slightly

compared to the prior year, in-line with mine sequencing, with an

increased proportion of the mill feed sourced from the lower grade

Niakafiri East pit and stockpiles. Recovery rates in the CIL plant are

expected to be largely consistent with the prior year.

-- Refractory ore for the BIOX(R) plant is expected to be primarily sourced

from the Massawa Central and Massawa North Zone pits. Refractory ore

mined in H1-2024 is expected to be stockpiled ahead of the startup of the

BIOX(R) Expansion project, expected in Q2-2024, and will result in

H2-2024 weighted production for Sabodala-Massawa.

-- Sustaining capital expenditure is expected to increase from approximately

$23.8 million in FY-2023 to $35.0 million in FY-2024 and is primarily

related to capitalised waste stripping as well as mining fleet upgrades

and re-builds and process plant upgrades.

-- Non-sustaining capital expenditure is expected to decrease from

approximately $46.2 million in FY-2023 to $40.0 million in FY-2024 and is

primarily related to infrastructure for the deposition of tailings in the

Sabodala pit which is expected to commence in FY-2025, advanced grade

control activities at Kiesta, the TSF 1 embankment raise, purchases of

new mining equipment, mine infrastructure and haul roads for the Kiesta

mining area.

-- As announced on 2 August 2023, in order to significantly reduce fuel

consumption and greenhouse gas emissions, and lower power costs at

Sabodala-Massawa, the construction of a 37MWp photovoltaic ("PV") solar

facility and a 16MW battery system at the Sabodala-Massawa mine, is

expected to amount to non-sustaining capital of $45.0 million for

FY-2024. The initial capital cost for the solar project is expected to

amount to $55.0 million, of which $5.5 million was incurred in FY-2023

mainly related to detailed engineering and design. and down payments for

the procurement of long-lead items. The solar plant construction is

expected to be completed by Q1-2025.

-- Growth capital expenditure is expected to be approximately $75.0 million

and is related to the BIOX(R) Expansion project as detailed below.

Plant Expansion

-- Construction of the Sabodala-Massawa expansion project was launched in

April 2022 and remains on budget and on schedule for completion in

Q2-2024.

-- Growth capital expenditure for the expansion project is approximately

$290.0 million with $218.3 million, or 75%, of the growth capex incurred

to date, of which, $166.1 million was incurred in FY-2023 and

approximately $75.0 million is expected to be incurred in FY-2024.

-- Approximately $259.8 million or 90% of the total growth capital has now

been committed, with pricing in line with expectations.

-- The construction progress regarding critical path items is detailed

below:

-- Processing plant construction is well advanced and remains on

schedule. All civil works have been completed with structural

concrete completed and civil contractors are currently

demobilising from site. Dry commissioning of the primary crusher

was successfully completed during Q4-2023. Structural, mechanical

and piping works are progressing well to connect the grinding,

BIOX(R), flotation and CIL circuits on schedule.

-- Over 50 cubic metres of BIOX(R) inoculum has been produced on site,

with a population transferred from the pilot plant to the BIOX(R)

reactors within the processing plant, where it will continue to

grow.

-- The 18MW power plant expansion is now complete and has been handed

over to the operating team after being successfully energised

during Q4-2023.

-- Construction of TSF-1B cell one is complete, and earthworks on

cell two are completed with HDPE lining underway.

Lafigué Mine, Côte d'Ivoire

Project Construction Update

-- Construction of the Lafigué project in Côte d'Ivoire was

launched in early Q4-2022, following the completion of a DFS which

confirmed Lafigué's potential to be a cornerstone asset for

Endeavour. First gold production is expected ahead of schedule in

Q2-2024, rather than Q3-2024.

-- Growth capital expenditure for the project is approximately $448.0

million, with $278.6 million, or 62%, of the growth capex incurred to

date, of which $241.7 million was incurred in FY-2023 and approximately

$170.0 million is expected to be incurred in FY-2024 mainly related to

construction activities across the process plant, site infrastructure and

commissioning activities.

-- Approximately $377.2 million or 84% of the total growth capital has now

been committed, with pricing in line with expectations.

-- The construction progress regarding critical path items is detailed

below:

-- Construction activities are well advanced with the crushing area,

ball mills, HPGR installation, CIL tanks the elution area all

nearing completion.

-- Process plant engineering and drafting is now completed and

delivery of all the project shipments is over 95% complete with

all key items on site.

-- Site infrastructure including the gold room, dry screening

building and conveyor truss have been pre-assembled ahead of

concrete pouring, to reduce erection time, and will be erected in

H1-2024. The site camp facility is nearly completed, with the

completed buildings in use since December 2023.

-- The 225kV power substation is complete with the Dabakala

Switchyard and overhead power lines successfully energised during

December 2023. Electrical works on site are also progressing to

plan with underground high-voltage cable installation advancing on

schedule.

-- TSF earthworks is complete and HDPE lining of the TSF is well

advanced.

-- Mining equipment mobilisation has advanced well with mining

activities commencing during the quarter with approximately

2,906kt of material moved.

2024 Outlook

-- First gold production at Lafigué is expected ahead of schedule in

Q2-2024. Lafigué is expected to produce between 90-110koz in FY-2024

at a post commercial production AISC of $900-975/oz, which is in line

with the Definitive Feasibility Study ("DFS") assumptions.

-- Mining activities are expected in the western and eastern flanks of the

Lafigué pit, as well as the West pit. Total mined tonnes are

expected to ramp-up through the year as the fleet is progressively

mobilised. Ramp-up of the processing plant is expected to be completed in

H2-2024 and average processed grades are expected to increase through the

ramp-up period as mining advances into the Lafigué pit through the

year. Recovery rates are expected to be above 90%, while processing costs

are expected to decrease through the ramp-up period.

-- As per the DFS, sustaining capital expenditure is expected to amount to

$25.0 million in FY-2024 and is primarily related to capitalised waste

stripping activities, advanced grade control drilling and spare parts

purchases.

-- As per the DFS, non-sustaining capital expenditure is expected to amount

to $5.0 million in FY-2024 and is primarily related to the commencement

of a TSF lift in H2-2024, once there is sufficient waste rock available

from mining operations, and waste stripping activity in the eastern flank

of the Lafigué pit.

NON-CORE ASSET DIVESTMENT

-- On 30 June 2023, Endeavour closed the divestment of its 90% interests in

its non-core Boungou and Wahgnion mines in Burkina Faso to Lilium Mining

("Lilium"), a subsidiary of Lilium Capital which is an African and

frontier markets focused strategic investment vehicle led by West African

entrepreneurs.

-- The total consideration for the divestment is expected to exceed $300.0

million and is comprised of:

-- $130.0 million in the form of a reimbursement of historical

shareholder loans, of which a total of $33.0 million was received

to date. The remaining $97.0 million is outstanding as Lilium was

delayed in closing its debt refinancing due to delays in its

lending syndicate completing their credit approval process. Lilium

is expected to obtain credit approval, close the refinancing and

make the payments imminently.

-- $25.0 million in deferred cash consideration payable in two

instalments of $10.0 million, which became payable in January

2024, and $15.0 million, which will become payable in April 2024.

Both payments are expected to be received in the coming months.

-- Deferred cash consideration comprised of 50% of the net free

cashflow generated by the Boungou mine until $55.0 million has

been paid. No payments have thus far been received for this

deferred cash consideration as Lilium has not had any commercial

production from Boungou since their acquisition given their

election to place the mine on care and maintenance due to supply

chain challenges and security.

-- An NSR on Wahgnion commencing at closing for 4.0% of gold sold, of

which a total of approximately $2.6 million has been received as

at December 31, 2023.

-- An NSR on Boungou commencing at closing for 4.0% of gold sold, of

which a total of approximately $0.5 million has been received as

at December 31, 2023.

FINANCIAL POSITION & LIQUIDITY

-- As shown in Table 14 below, Endeavour ended FY-2023 with a net debt

position of $555.3 million, which represents a $110.2 million increase

compared to the prior quarter and $676.4 million increase over the

previous year. The increase in the Company's net debt position is due to

the ongoing investment in the Sabodala-Massawa Expansion and the

Lafigué Development project, with $447.1 million of growth capital

spent during the year, in addition the Company paid $200.0 million in

shareholder dividends and $65.7 million in share buybacks during the

year. Furthermore, following the divestment of the non-core Boungou and

Wahgnion mines to Lilium on 30 June 2023, the details of the outstanding

upfront proceeds of $97.0m and the deferred payment of $10.0m that were

expected to be received in Q4-2023, are included in the "Non-Core Asset

Divestment" section above.

Table 14: Net Debt Position(1)

In US$ million unless

otherwise specified. 31 December 2023 30 September 2023 31 December 2022

---------------- ----------------- ----------------

Cash and cash

equivalents 517 625 951

$500m Senior Notes (500) (500) (500)

$330m Convertible

Senior Notes -- -- (330)

$645m Revolving Credit

Facility (465) (535) --

$167m Lafigué Term

Loan (107) (35) --

NET CASH / (NET DEBT)

POSITION (555) (445) 121

----------------------- ---------------- ----------------- ----------------

(1) All Q4-2023 and FY-2023 numbers are preliminary and reflect

our expected results as of the date of this press release.

-- At 31 December 2023, Endeavour's available sources of liquidity remained

strong at approximately $756.5 million, which included approximately

$517.2 million of cash and cash equivalents, $180.0 million in undrawn

funds from its revolving credit facility and $59.5 million in undrawn

funds from the Lafigué Term Loan.

MANAGEMENT CHANGES

On 4 January, the Board of Directors announced the termination

of the President and Chief Executive Officer, Sébastien de

Montessus, for serious misconduct with effect from that date. Mr.

de Montessus was also removed from the Board of Directors. This

followed an investigation by the Board into an irregular payment

instruction issued by him in relation to an asset disposal

undertaken by the Company. The investigation arose from a review of

acquisitions and disposals. The investigation is ongoing and will

be progressed as quickly as possible, with further updates to be

provided as appropriate.

As part of the Board's succession planning processes, the

directors appointed Ian Cockerill as Chief Executive Officer and

Executive Director. As a director and Chair of the Technical

Committee since May 2022 and Deputy Chair of the Board since

September 2023, Ian has extensive knowledge of the company and its

strategy. Ian was also a director of Endeavour between Q3-2013 and

Q1-2019. Ian has over four decades of experience in the global

natural resources industry. During his career he has held senior

roles covering operational, project and executive positions around

the world, including in Africa, having held executive roles at

major international mining companies, including Chief Executive

Officer of Gold Fields and Anglo Coal, a subsidiary of Anglo

American, as well as non-executive positions.

QUALIFIED PERSONS

Mark Morcombe, COO of Endeavour Mining PLC., a Fellow of the

Australasian Institute of Mining and Metallurgy, is a "Qualified

Person" as defined by National Instrument 43-101 - Standards of

Disclosure for Mineral Projects ("NI 43-101") and has reviewed and

approved the technical information in this news release.

CONTACT INFORMATION

For Investor Relations enquiries: For Media enquiries:

Martino De Ciccio Brunswick Group LLP in London

Deputy CFO and Head of Investor Relations Carole Cable, Partner

+442030112723 +442074045959

investor@endeavourmining.com ccable@brunswickgroup.com

ABOUTEAVOUR MINING PLC

Endeavour Mining is one of the world's senior gold producers and

the largest in West Africa, with operating assets across Senegal,

Cote d'Ivoire and Burkina Faso and a strong portfolio of advanced

development projects and exploration assets in the highly

prospective Birimian Greenstone Belt across West Africa.

A member of the World Gold Council, Endeavour is committed to

the principles of responsible mining and delivering sustainable

value to its employees, stakeholders and the communities where it

operates. Endeavour is admitted to listing and to trading on the

London Stock Exchange and the Toronto Stock Exchange, under the

symbol EDV.

For more information, please visit www.endeavourmining.com.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This document contains "forward-looking statements" within the

meaning of applicable securities laws. All statements, other than

statements of historical fact, are "forward-looking statements",

including but not limited to, statements with respect to

Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, the success of exploration activities, the

anticipated timing for the payment of a shareholder dividend and

statements with respect to future dividends payable to the

Company's shareholders, the completion of studies, mine life and

any potential extensions, the future price of gold and the share

buyback programme. Generally, these forward-looking statements can

be identified by the use of forward-looking terminology such as

"expects", "expected", "budgeted", "forecasts", "anticipates",

believes", "plan", "target", "opportunities", "objective",

"assume", "intention", "goal", "continue", "estimate", "potential",

"strategy", "future", "aim", "may", "will", "can", "could", "would"

and similar expressions .

Forward-looking statements, while based on management's

reasonable estimates, projections and assumptions at the date the

statements are made, are subject to risks and uncertainties that

may cause actual results to be materially different from those

expressed or implied by such forward-looking statements, including

but not limited to: risks related to the successful completion of

divestitures; risks related to international operations; risks

related to general economic conditions and the impact of credit

availability on the timing of cash flows and the values of assets

and liabilities based on projected future cash flows; Endeavour's

financial results, cash flows and future prospects being consistent

with Endeavour expectations in amounts sufficient to permit

sustained dividend payments; the completion of studies on the

timelines currently expected, and the results of those studies

being consistent with Endeavour's current expectations; actual

results of current exploration activities; production and cost of

sales forecasts for Endeavour meeting expectations; unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates; increases in

market prices of mining consumables; possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; extreme weather events,

natural disasters, supply

disruptions, power disruptions, accidents, pit wall slides,

labour disputes, title disputes, claims and limitations on

insurance coverage and other risks of the mining industry; delays

in the completion of development or construction activities;

changes in national and local government legislation, regulation of

mining operations, tax rules and regulations and changes in the

administration of laws, policies and practices in the jurisdictions

in which Endeavour operates; disputes, litigation, regulatory

proceedings and audits; adverse political and economic developments

in countries in which Endeavour operates, including but not limited

to acts of war, terrorism, sabotage, civil disturbances,

non-renewal of key licenses by government authorities, or the

expropriation or nationalisation of any of Endeavour's property;

risks associated with illegal and artisanal mining; environmental

hazards; and risks associated with new diseases, epidemics and

pandemics.

Although Endeavour has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Please refer to Endeavour's most recent Annual

Information Form filed under its profile at www.sedarplus.ca for

further information respecting the risks affecting Endeavour and

its business.

The declaration and payment of future dividends and the amount

of any such dividends will be subject to the determination of the

Board of Directors, in its sole and absolute discretion, taking

into account, among other things, economic conditions, business

performance, financial condition, growth plans, expected capital

requirements, compliance with the Company's constating documents,

all applicable laws, including the rules and policies of any

applicable stock exchange, as well as any contractual restrictions

on such dividends, including any agreements entered into with

lenders to the Company, and any other factors that the Board of

Directors deems appropriate at the relevant time. There can be no

assurance that any dividends will be paid at the intended rate or

at all in the future.

CAUTIONARY STATEMENTS REGARDING 2023 PRODUCTION AND AISC

Whether or not expressly stated, all figures contained in this

press release including production and AISC levels are preliminary

and reflect our expected 2023 results as of the date of this press

release. Actual reported fourth quarter and 2023 results are

subject to management's final review, as well as audit by the

company's independent accounting firm, and may vary significantly

from those expectations because of a number of factors, including,

without limitation, additional or revised information, and changes

in accounting standards or policies, or in how those standards are

applied. The fourth quarter and 2023 AISC include expected amounts

for year-end accrual and working capital adjustments. Endeavour

will provide additional discussion and analysis and other important

information about its 2023 production and AISC levels when it

reports actual results.

NON-GAAP MEASURES

Some of the indicators used by Endeavour in this press release

represent non-IFRS financial measures, including "all-in sustaining

cost", "net cash / net debt", "EBITDA", "adjusted EBITDA", "net

cash / net debt to adjusted EBITDA ratio", "cash flow from

continuing operations", "total cash cost per ounce", "sustaining

and non-sustaining capital". These measures are presented as they

can provide useful information to assist investors with their

evaluation of the pro forma performance. Since the non-IFRS

performance measures listed herein do not have any standardised

definition prescribed by IFRS, they may not be comparable to

similar measures presented by other companies. Accordingly, they

are intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. Please refer to the

non-GAAP measures section in this press release and in the

Company's most recently filed Management Report for a

reconciliation of the non-IFRS financial measures used in this

press release.

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

Attachments

-- EDV_Q4-23 Mine Statistics

https://ml-eu.globenewswire.com/Resource/Download/2bca3bba-9b23-4312-b193-f08f7b36c5ac

-- NR - EDV Q4 and FY-2023 Preliminary Results and 2024 Guidance

https://ml-eu.globenewswire.com/Resource/Download/8187631e-80e5-41b5-9abe-ba5d70a895c2

(END) Dow Jones Newswires

January 22, 2024 01:30 ET (06:30 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

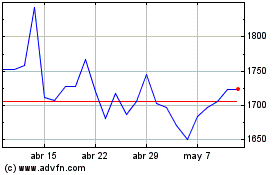

Endeavour Mining (LSE:EDV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Endeavour Mining (LSE:EDV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024