TIDMEOG

RNS Number : 1741I

Europa Oil & Gas (Holdings) PLC

13 April 2022

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG /

Sector: Oil & Gas

13 April 2022

Europa Oil & Gas (Holdings) plc

("Europa" or "the Company")

Interim Results

Europa Oil & Gas (Holdings) plc, the AIM traded UK, Morocco

and Ireland focused oil and gas exploration, development, and

production company, announces its interim results for the six-month

period ending 31 January 2022.

Financial performance

-- Strongest interim financial performance since H1 2014 with

significant revenue and profit as a result of asset performance and

a strengthening oil price

-- Revenue GBP2.2 million (H1 2021: GBP0.5 million)

-- Pre-tax profit of GBP0.7 million (H1 2021: pre-tax loss GBP0.7 million)

-- Net cash from operating activities GBP0.9 million (H1 2021:

net cash used in operating activities GBP0.2 million)

-- Unrestricted cash balance at 31 January 2022: GBP0.6 million (31 July 2021: GBP0.6 million)

Operational Highlights

Onshore UK - Wressle oilfield moving from strength to strength

and new possibilities for West Firsby

Wressle Oil Field

-- Wressle exceeded initial gross projections of 500 barrels of

oil per day ("bopd") in August, which increased to instantaneous

flow rates in excess of 884 bopd and 480,000 cubic feet ("Mcf") of

gas by September following successful proppant squeeze and coiled

tubing operations. This more than doubled Europa's total net oil

production to 208 bopd during H1 and provided a major boost to

revenues against a backdrop of rising oil prices.

-- ERCE Equipoise Ltd ("ERCE"), an independent energy consulting

group, concluded from analysis of downhole pressure data that

higher rates of up to 1,543 bopd can be realised if the facilities

constraints on gas production can be alleviated.

-- Further resources in the Wingfield Flags and Penistone Flags

reservoirs are being reviewed for development and have the

potential to increase net reserves.

West Firsby Oil Field

-- CausewayGT and geothermal project partner Baker Hughes

identified Europa's West Firsby oil field in the Midlands as a

suitable candidate for developing a closed-loop geothermal

system.

-- Future potential for West Firsby to continue delivering

revenue and for additional well stock to be repurposed to generate

emission-free geothermal energy is in line with the Company's ESG

strategy.

Offshore Morocco - high-impact exploration opportunity

-- The farm out initiative of the Inzegane Offshore permit

located in the Agadir Basin was formally launched in August. Europa

has a 75% interest in Inzegane and operatorship of the License

covering an area of 11,228 sq. km

o Inzegane represents a high-impact exploration opportunity in a

highly underexplored area of the world - complementing Europa's

strategy of building a balanced portfolio of assets.

o Recent evaluation identified a significant volume of unrisked

recoverable resources, in excess of 1 billion barrels (oil

equivalent), in the top five ranked prospects alone.

o Morocco offers a highly attractive investment opportunity with

excellent fiscal terms. Several major and mid-cap companies already

hold acreage there, including ENI, Hunt, Genel and

ConocoPhillips.

Offshore Ireland - Low risk / high reward infrastructure-led

exploration in the proven Slyne Basin gas play

o Farmout initiative is continuing on Licence FEL 4/19 which

holds the flagship 1.5 tcf Inishkea prospect adjacent to existing

infrastructure at the producing Corrib gas field.

Post period

-- Exercise of rights by DNO North Sea (UK) Limited to terminate

the Sale and Purchase Agreement for acquisition by Europa of Irish

exploration licence FEL 3/19.

-- Successfully raised gross proceeds of GBP7.02m, approved by

shareholders at the General Meeting on 25 March.

-- Proposed acquisition of a 25% interest in the Serenity

discovery in the North Sea as part of the Company's strategy to

build a balanced portfolio of assets.

Simon Oddie, CEO said :

"We are delighted to bring you our outstanding financial results

for the first half, which saw revenue quadruple to GBP2.2 million

and a swing back to profitability from recent years.

Europa's positive H1 performance was driven by excellent

production result at our Wressle oil field in North Lincolnshire,

which saw our average daily production more than double compared to

H1 2021 and coupled with elevated oil prices, which are now

exceeding US$100 a barrel.

With the raising of GBP7.02 million and the p roposed

acquisition of a 25% interest in the Serenity discovery in the UK

North Sea post reporting period, we have now also put in place the

third leg of the business, the acquisition of a near-term appraisal

and development opportunity. The year is shaping up to be

transformational for both our diversified energy portfolio and our

financial position."

For further information please visit www.europaoil.com or

contact:

Simon Oddie Europa mail@europaoil.com

Murray Johnson Europa

Christopher Raggett / +44 (0) 20 7220

Simon Hicks finnCap Ltd 0500

Oonagh Reidy / Ana Ribeiro St Brides Partners +44 (0) 20 7236

/ Max Bennett Ltd 1177

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

Chairman's Statement

"It has been a very eventful and truly game changing time for

Europa. Our standout performer in the UK portfolio - Wressle -

delivered and exceeded all expectations and the period also saw our

ESG strategy gain momentum with the West Frisby oil field

identified as a possible site for a closed loop geothermal project.

The most material and transformational event came post period end

with the raising of GBP7.02 million to fund the farm-in for 25% of

North Sea block 13/23c which includes the Serenity oil discovery.

This has the combined benefits of balancing our portfolio and

offering the potential for significant short term value upside to

Europa. We are now delivering on our stated strategy of developing

a balanced portfolio of multi-stage hydrocarbon assets encompassing

production, development, and exploration.

Wressle's outstanding production performance during H1 saw

average daily output more than double to over 200 bopd (net) -

quadrupling revenues to GBP2.2 million, compared to H1 2021, amid a

surging oil price environment. The average realised oil price

increased by 75%, -compared to H1 2021, to US$77.84 per barrel

during the first half. Our net cash figure was also positive versus

a year ago. Also, there is further upside potential available for

our standout asset as flagged by a report conducted by ERCE

Equipoise Ltd ("ERCE"), an independent energy consulting group,

which highlighted significant upside potential in production to

1,543bopd - provided certain conditions are met. The operator is

currently working on satisfying these conditions to enable further

increased production.

The farm out initiative of our Inezgane Offshore permit in

offshore Morocco launched during the period also paves the way for

additional growth vis a vis a high-impact exploration opportunity

in a highly underexplored area. This is a high potential

exploration licence where we have already mapped unrisked

prospective oil resources in excess of 1 billion barrels.

Finally, on behalf of the Board I would like to thank the

management, employees and consultants for their hard work over the

course of the reporting period and beyond. I also want to thank our

shareholders for their continued support during the period and look

forward to updating the market on further developments during this

exciting period for the Company."

Mr Brian O'Cathain (non-executive Chairman)

13 April 2022

Operational review

Financials

Average daily H1 2022 production was 208 boepd compared to 86

boepd in H1 2021. There was a 75% increase in average realised oil

price to US$77.84 per barrel (H1 2021: US$44.45). Foreign exchange

movements had a negligible impact on revenues as US Dollar sales

converted to Sterling at US$1.35 (H1 2020: US$1.34).

-- Revenue was GBP2.2 million (H1 2021: GBP0.5 million)

-- Net cash received from operating activities was GBP0.9

million (H1 2021: cash spent GBP0.2 million)

-- The Group's unrestricted cash balance as at 31 January 2022 was GBP0.6 million

Based upon the Group cashflow forecasts, the Directors have

concluded that there is a reasonable expectation that the Group

will be able to continue in operational existence for the

foreseeable future, which is deemed to be at least 12 months from

the date of signing the consolidated financial information. Further

comments on going concern are included in note 1.

Conclusion and Outlook

Our first half financial performance was solid owing to

outstanding operations in the period. A quadrupling of revenue

compared to H1 2021, a dramatic turnaround in our profitability

from a loss of GBP0.7m to a profit of GBP0.7m, our net cash

position closing higher compared to that as at January 2021-

thanks, in the main, to our 30% interest in Wressle oil field in

North Lincolnshire. The asset has delivered beyond our expectations

with still further upside potential ahead.

Elsewhere, we have advanced our ESG strategy with the West

Firsby legacy oilfield in the West Midlands, which is being

assessed as a suitable site for closed loop geothermal energy by

Baker Hughes and CausewayGT. If successful, this could have

positive implications for our other ageing oil wells and the

renewable energy sector more broadly. We expect further momentum as

studies progress in H2.

In offshore Ireland, we are continuing our technical studies and

farmout initiative on our flagship Irish project - FEL 4/19, which

holds the 1.5 tcf Inishkea prospect located in the Corrib Basin. We

remain enthusiastic for this asset given Ireland's heavy dependence

on the Corrib gas field for its gas supply and rising concerns

around energy security. This, coupled with increasing gas prices,

means the market fundamentals are becoming even more

favourable.

We continue to advance our activity in offshore Morocco and look

forward to reporting on progress ahead. With oil prices currently

over US$100 a barrel, as a result of the recent geopolitical

situation and the banning of Russian oil and gas by several

countries - the focus for UK and European governments is now on

sourcing alternative sources of fossil fuels, including a strong

preference to increase domestic supply across EU and the UK.

The post period acquisition of a 25% interest in Serenity is in

line with Europa's previously stated intention to acquire an

appraisal asset, adding to its existing producing and high impact

exploration assets and thus creating a more balanced asset

portfolio for investors. Serenity is expected to be drilled during

2022 at a gross cost of GBP14 million. Europa will pay 46.25% of

the appraisal well cost, equating to a 1.85 to 1 carry. The carry

is capped at a gross well cost of GBP15 million, of which the

Company's interest will be GBP6.94 million. Thereafter, each party

will fund its interests proportionally. It is strategically located

near existing infrastructure in the North Sea, however the

appraisal well could provide sufficient recoverable volumes for a

standalone development.

Europa is now well positioned to capitalise on its diversified

and high potential energy portfolio which is an effective balance

of exploration, appraisal and production with substantial

additional development potential.

Simon Oddie

CEO

13 April 2022

Qualified Person Review

This release has been reviewed by Alastair Stuart, engineering

advisor to Europa, who is a petroleum engineer with over 35 years'

experience and a member of the Society of Petroleum Engineers and

has consented to the inclusion of the technical information in this

release in the form and context in which it appears.

Licence Interests Table

Country Area Licence Field/ Operator Equity Status

Prospect

Slyne Basin FEL 4/19 Inishkea, Corrib Europa 100% Exploration

North

---------------- ---------- ------------------- ------------- ------- ------------

South Porcupine FEL 1/17 Ervine, Edgeworth, Europa 100% Exploration

Ireland Egerton

---------------- ---------- ------------------- ------------- ------- ------------

UK East Midlands DL 003 West Firsby Europa 100% Production

---------------- ---------- ------------------- ------------- ------- ------------

DL 001 Crosby Warren Europa 100% Production

---------------- ---------- ------------------- ------------- ------- ------------

PL199/215 Whisby-4 BPEL 65% Production

199/215

---------- ------------------- ------------- ------- ------------

PEDL180 Wressle Egdon 30% Development

---------- ------------------- ------------- ------- ------------

PEDL181 Europa 50% Exploration

---------- ------------------- ------------- ------- ------------

PEDL182 Broughton North Egdon 30% Exploration

---------- ------------------- ------------- ------- ------------

PEDL299 Hardstoft Ineos 25% Appraisal

---------- ------------------- ------------- ------- ------------

PEDL343 Cloughton Third Energy 35% Appraisal

---------------- ---------- ------------------- ------------- ------- ------------

Morocco Agadir Basin Inezgane Falcon & Turtle Europa 75% Exploration

-------- ---------------- ---------- ------------------- ------------- ------- ------------

Financials

Unaudited condensed consolidated statement of comprehensive

income

Year to

31 July

2021

6 months 6 months

to 31 January to 31 January

2022 2021 (audited)

GBP000 GBP000 GBP000

Continuing

operations

Revenue 2,191 516 1,372

----------------- --------------------------------------------- --------------------------------------------- ------------------------------------------

Cost of sales (1,246) (607) (1,249)

Impairment of

producing fields - (51) -

----------------- --------------------------------------------- --------------------------------------------- ------------------------------------------

Total cost of

sales (1,246) (658) (1,249)

------------------------------------- ------------------------------------- -------------------------------------

Gross

profit/(loss) 945 (142) 123

Exploration write

back/(write off)

(note 3) 360 - (12)

Administrative

expenses (463) (417) (717)

Finance income 20 3 3

Finance expense (119) (131) (242)

------------------------------------- ------------------------------------- -------------------------------------

Profit/(loss)

before taxation 743 (687) (845)

Taxation (note 5) - 127 127

------------------------------------- ------------------------------------- -------------------------------------

Profit/(loss) for

the period 743 (560) (718)

Other

comprehensive

income

Items that will

not be

reclassified

to profit/(loss),

net of tax

Loss on

investment

revaluation (17) (10) (2)

------------------------------------- ------------------------------------- -------------------------------------

Total

comprehensive

income/(loss)

for the period

attributed to

the

equity

shareholders of

the parent 726 (570) (720)

======================== ======================== ========================

Pence per Pence per Pence per

share share share

Earnings per

share (EPS)

attributable

to the equity

shareholders of

the

parent

Attributable to

the equity

shareholders

of the

Basic EPS (note

4) 0.13p (0.13)p (0.15)p

Diluted EPS (note

4) 0.13p - -

Unaudited condensed consolidated statement of financial

position

31 July

2021

31 January 31 January

2022 2021 (audited)

GBP000 GBP000 GBP000

Assets

Non-current assets

Intangible assets (note 6) 2,960 5,391 6,438

Property, plant and

equipment (note

7) 4,006 358 369

Restricted cash - 233 -

------------------------------------- ------------------------------------- -------------------------------------

Total non-current assets 6,966 5,982 6,807

------------------------------------- ------------------------------------- -------------------------------------

Current assets

Investments 25 35 42

Inventories 50 29 23

Trade and other receivables 822 480 522

Restricted cash 238 - 230

Cash and cash equivalents 624 269 641

------------------------------------- ------------------------------------- -------------------------------------

1,759 813 1,458

------------------------------------- ------------------------------------- -------------------------------------

Total assets 8,725 6,795 8,265

==================== ==================== ========================

Liabilities

Current liabilities

Borrowing (note 8) (10) (231) (10)

Trade and other payables (1,177) (1,218) (1,556)

------------------------------------- ------------------------------------- -------------------------------------

Total current liabilities (1,187) (1,449) (1,566)

------------------------------------- ------------------------------------- -------------------------------------

Non-current liabilities

Borrowings (note 8) (35) (44) (40)

Trade and other payables (11) (23) (17)

Long-term provisions (note

9) (3,510) (3,278) (3,393)

---------------------------------- ---------------------------------- -------------------------------------

Total non-current

liabilities (3,556) (3,345) (3,450)

---------------------------------- ---------------------------------- -------------------------------------

Total liabilities (4,743) (4,794) (5,016)

----------------------------------- ----------------------------------- -------------------------------------

Net assets 3,982 2,001 3,249

==================== ==================== ========================

Capital and reserves

attributable

to equity holders of the

parent

Share capital 5,665 4,447 5,665

Share premium 21,157 21,010 21,157

Merger reserve 2,868 2,868 2,868

Retained deficit (25,708) (26,324) (26,441)

---------------------------------- ---------------------------------- -------------------------------------

Total equity 3,982 2,001 3,249

===================== ======================== =======================

Unaudited condensed consolidated statement of changes in

equity

Share Share Merger Retained

capital premium reserve deficit Total equity

GBP000 GBP000 GBP000 GBP000 GBP000

Unaudited

Balance at 1

August

2021 5,665 21,157 2,868 (26,441) 3,249

Comprehensive

income

for the period

Profit for the

period

attributable

to the

equity

shareholders

of the parent - - - 743 743

Other

comprehensive

loss

attributable

to the equity

shareholders

of the parent - - - (17) (17)

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Total

comprehensive

income for

the period - - - 726 726

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Contributions

by

and

distributions

to owners

Share-based

payments - - - 7 7

---------------------------------- ---------------------------------- ---------------------------------- --------------------------------- ------------------------------

Total

transactions

with owners - - - 7 7

----------------------------------- ----------------------------------- ----------------------------------- ----------------------------------- -----------------------------------

Balance at 31

January

2022 5,665 21,157 2,868 (25,708) 3,982

======================= ======================= ======================= ======================= =======================

Unaudited

Balance at 1

August

2020 4,447 21,010 2,868 (25,838) 2,487

Loss for the

period

attributable

to the

equity

shareholders

of the parent - - - (560) (560)

Other

comprehensive

loss

attributable

to the equity

shareholders

of the parent - - - (10) (10)

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Total

comprehensive

loss for the

period - - - (570) (570)

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Contributions

by

and

distributions

to owners

Share-based

payments - - - 84 84

---------------------------------- ---------------------------------- ---------------------------------- --------------------------------- ------------------------------

Total

transactions

with owners - - - 84 84

----------------------------------- ----------------------------------- ----------------------------------- ----------------------------------- -----------------------------------

Balance at 31

January

2021 4,447 21,010 2,868 (26,324) 2,001

======================= ======================= ======================= ======================= =======================

Audited

Balance at 1

August

2020 4,447 21,010 2,868 (25,838) 2,487

Loss for the

year

attributable

to the

equity

shareholders

of the parent - - - (718) (718)

Other

comprehensive

loss

attributable

to the equity

shareholders

of the parent - - - (2) (2)

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Total

comprehensive

loss for the

year - - - (720) (720)

--------------------------------- --------------------------------- -------------------------------- ------------------------------ -------------------------------

Contributions

by

and

distributions

to owners

Issue of share

capital 1,218 225 - - 1,443

Issue of share

warrants - (78) - 78 -

Share-based

payments - - - 39 39

---------------------------------- ---------------------------------- ---------------------------------- --------------------------------- ------------------------------

Total

transactions

with owners 1,218 147 - 117 1,482

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Balance at 31

July

2021 5,665 21,157 2,868 (26,441) 3,249

================================== ================================== ================================== =============================== ==============================

Unaudited condensed consolidated statement of cash flows

Year to

31 July

6 months 6 months

to to 2021

31 January 31 January

2022 2021 (audited)

GBP000 GBP000 GBP000

Cash flows

generated/(used in)

operating

activities

Profit/(loss) after

taxation 743 (560) (718)

Adjustments for:

Share-based payments 7 84 39

Depreciation 627 67 107

Taxation credit

recognised in

profit

and loss - (127) (127)

Impairment of

producing fields - 51 -

Exploration write

off - - 12

Reversal of cost

accrual on

relinquishment

of licences (360) - -

Finance income (20) (3) (3)

Finance expense 119 131 242

(Increase)/decrease

in trade and

other receivables (300) 24 (288)

Increase in

inventories (27) (17) (11)

Decrease/(increase)

in trade and

other payables 90 (5) 85

----------------------------------- ----------------------------------- -------------------------------------

Net cash generated

from/(used in)

operations 879 (355) (662)

Income taxes repayment

received - 127 127

----------------------------------- ----------------------------------- -------------------------------------

Net cash generated

from/(used in)

operating activities 879 (228) (535)

======================== ======================== ========================

Cash flows used in

investing activities

Purchase of property,

plant & equipment (406) - -

Purchase of intangibles (487) (470) (985)

Cash guarantee re Morocco - (3) (4)

Interest received - 3 3

------------------------------------- ------------------------------------- -----------------------------------------------

Net cash used in

investing activities (893) (470) (986)

======================== ======================== ========================

Cash flows (used in)/from

financing

activities

Gross proceeds from issue

of share

capital - - 1,583

Costs incurred on issue

of share

capital - - (140)

Proceeds from borrowings - 225 225

Repayment of borrowings (5) - (225)

Lease liability payments (7) (25) (35)

Lease liability interest

payments (1) (2) (2)

Finance costs (2) (3) (7)

------------------------------------- ------------------------------------- --------------------------------------

Net cash (used in)/from

financing

activities (15) 195 1,399

======================== ======================== ========================

Net decrease in cash and

cash equivalents (29) (503) (122)

Exchange gain/(loss) on

cash and

cash equivalents 12 4 (5)

Cash and cash equivalents

at beginning

of period 641 768 768

------------------------------------- ------------------------------------- -------------------------------------

Cash and cash equivalents

at end

of period 624 269 641

======================== ======================== ========================

Notes to the consolidated interim statement

1 Nature of operations and general information

Europa Oil & Gas (Holdings) plc ("Europa Oil & Gas") and

subsidiaries' ("the Group") principal activities consist of

investment in oil and gas exploration, development and

production.

Europa Oil & Gas is the Group's ultimate parent Company. It

is incorporated and domiciled in England and Wales. The address of

Europa Oil & Gas's registered office head office is 55 Baker

Street, London W1U 7EU. Europa Oil & Gas's shares are listed on

the London Stock Exchange AIM market.

Basis of preparation

The Group's condensed consolidated interim financial information

is presented in Pounds Sterling (GBP), which is also the functional

currency of the Parent Company.

The condensed consolidated interim financial information has

been approved for issue by the Board of Directors on 13April

2022.

The condensed consolidated interim financial statements have

been prepared in accordance with the requirements of the AIM Rules

for Companies. As permitted, the Group has chosen not to adopt IAS

34 "Interim Financial Statements" in preparing this interim

financial information.

The condensed consolidated interim financial information for the

period 1 August 2021 to 31 January 2022 is unaudited. In the

opinion of the Directors the condensed consolidated interim

financial information for the period presents fairly the financial

position, and results from operations and cash flows for the period

in conformity with the generally accepted accounting principles

consistently applied. The condensed consolidated interim financial

information incorporates unaudited comparative figures for the

interim period 1 August 2020 to 31 January 2021 and the audited

financial year to 31 July 2021.

The financial information contained in this interim report does

not constitute statutory accounts as defined by section 435 of the

Companies Act 2006. The report should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 31 July 2021.

The comparatives for the full year ended 31 July 2021 are not

the Group's full statutory accounts for that year. A copy of the

statutory accounts for that year has been delivered to the

Registrar of Companies. The auditors' report on those accounts was

unqualified and did not contain a statement under section 498 (2) -

(3) of the Companies Act 2006.

Going concern

The Directors have prepared a cash flow forecast for the period

ending 31 December 2022, which considers the continuing and

forecast cash inflow from the Group's producing assets, the cash

held by the Group at the half year end, less administrative

expenses and planned capital expenditure. The Directors have

concluded, at the time of approving the financial statements, that

there is a reasonable expectation, based on the Group's cash flow

forecasts, that the forecasts are achievable and accordingly the

Group will be able to continue as a going concern and meet its

obligations as and when they fall due. Accordingly, they continue

to adopt the going concern basis in preparing the condensed

consolidated interim financial information.

Critical accounting estimates

The preparation of condensed consolidated interim financial

information requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities at the

end of the reporting period. Significant items subject to such

estimates are set out in Note 1 of the Group's 2021 Annual Report

and Financial Statements. The nature and amounts of such estimates

have not changed significantly during the interim period.

2 Summary of significant accounting policies

The condensed consolidated financial information has been

prepared using policies based on UK adopted international

accounting standards. Except as described below, the condensed

consolidated financial information has been prepared using the

accounting policies which were applied in the Group's statutory

financial information for the year ended 31 July 2021.

(a) Accounting developments during 2021

The International Accounting Standards Board (IASB) issued

various amendments and revisions to International Financial

Reporting Standards and IFRIC interpretations. The amendments and

revisions were applicable for the period ended 31 January 2022 but

did not result in any material changes to the financial statements

of the Group.

(b) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

Standard Description Effective date

-------------------- ------------------------- ---------------

IFRS 3 Reference to Conceptual 1 January 2022

Framework

IAS 37 Onerous contracts 1 January 2022

IAS 16 Proceeds before intended 1 January 2022

use

Annual improvements Annual improvements 1 January 2022

2018-2020 2018-2020 Cycle

IAS 8 Accounting estimates 1 January 2023

IAS 1 Classification of 1 January 2023

Liabilities as Current

or Non-Current

The Group is evaluating the impact of the new and amended

standards above which are not expected to have a material impact on

the Group's results or shareholders' funds.

3 Exploration write back/(write off)

31 Jan 2022 31 Jan 2021 31 July 2021

GBP000 GBP000 GBP000

Release of cost

accrual on

relinquishment

of licences 360 - -

Exploration

write-off -

PEDL 299

Hardstoft - - (12)

----------------------------------- ----------------------------------- -----------------------------------

360 - (12)

=================================== =================================== ===================================

4 Earnings per share (EPS)

Basic EPS has been calculated on the loss after taxation divided

by the weighted average number of shares in issue during the

period. Diluted EPS uses an average number of shares adjusted to

allow for the issue of shares, on the assumed conversion of all

in-the-money options.

The Company's average share price for the period was 1.43p which

resulted in dilution of 3,286,966 shares. The weighted number of

shares for the diluted earnings per share is 569,753,951. There are

a further 5,180,000 options that were non-dilutive.(H1 2020: 2.30p

which was below the exercise price of all 23,453,458 outstanding

share options).

The calculation of the basic and diluted earnings per share is

based on the following:

6 months to 6 months to Year to

31 January 31 January 31 July 2021

2022 2021 (audited)

GBP000 GBP000 GBP000

Profit/(loss)

Profit/(loss) for the period attributable

to the equity shareholders of the

parent 743 (560) (718)

================== ================== ==================

Number of shares

Weighted average number of ordinary

shares for the purposes of basic

EPS 566,466,985 444,691,599 494,420,476

==== ===== ======= === ============

===== ==================== ======================== ===========

==========

=

Number of shares

Weighted average number of ordinary

shares for the purposes of diluted

EPS 569,753,951 444,691,599 494,420,476

==== ===== ======= === ============

===== ==================== ======================== ===========

==========

=

5 Taxation

Consistent with the year-end treatment, current and deferred tax

assets and liabilities have been calculated at tax rates which were

expected to apply to their respective period of realisation at the

period end.

6 Intangible assets

31 Jan 2022 31 Jan 2021 31 July 2021

GBP000 GBP000 GBP000

At 1 August 6,438 4,965 4,965

Additions 416 426 1,485

Transfer to

property,

plant &

equipment (3,894)

Exploration

write-off - - (12)

----------------------------------- ----------------------------------- -----------------------------------

At period

end 2,960 5,391 6,438

=================================== =================================== ===================================

Intangible assets comprise the Group's pre-production

expenditure on licence interests as follows:

31 Jan 2022 31 Jan 2021 31 July 2021

GBP000 GBP000 GBP000

Ireland FEL 4/19

(Inishkea) 1,698 1,606 1,662

Morocco Inezgane 1,037 314 657

UK PEDL180

(Wressle) - 3,234 3,893

UK PEDL181 105 118 113

UK PEDL182

(Broughton North) 34 29 34

UK PEDL299 - 12 -

(Hardstoft)

UK PEDL343

(Cloughton) 86 78 79

----------------------------- ----------------------------- --------------------------------

Total 2,960 5,391 6,438

============================ ================================ ================================

31 Jan 2022 31 Jan 2021 31 July 2021

GBP000 GBP000 GBP000

Transfer to

Property, plant &

equipment

UK PEDL180 3,894 - -

(Wressle)

----------------------------- ------------------------------- --------------------------------

Total 3,894 - -

============================ ================================ ================================

====== ====== =======

7 Tangible assets

Property, plant & equipment

Furniture Producing Right of Total

& computers fields use assets

GBP000 GBP000 GBP000 GBP000

Cost

At 1 August 2020 6 10,887 147 11,040

Disposals (1) - (80) (81)

------------------------------- ------------------------------- ------------------------------- -------------------------------

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 July 2021 5 10,887 67 10,959

Transfer from

intangible

assets - 3,894 - 3,894

Additions - 370 - 370

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 January

2022 5 15,151 67 15,223

==================== ==================== ================= ======================

Depreciation,

depletion and

impairment

At 1 August 2020 3 10,488 73 10,564

Charge for year 1 64 42 107

Disposal (1) - (80) (81)

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 July 2021 3 10,552 35 10,590

Charge for

period 1 617 9 627

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 January

2022 4 11,169 44 11,217

=================== ====================== ================= ====================

Net Book Value

At 31 January

2022 1 3,982 23 4,006

=============================== =============================== =============================== ===============================

At 31 July 2021 2 335 32 369

=============================== =============================== =============================== ===============================

Cost

At 1 August 2020 6 10,887 147 11,040

Disposal - - (80) (80)

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 January

2021 6 10,887 67 10,960

=================== ====================== ================= ====================

Depreciation,

depletion and

impairment

At 1 August 2020 3 10,488 73 10,564

Charge for

period 1 34 32 67

Impairment - 51 - 51

Disposal - - (80) (80)

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 January

2021 4 10,573 25 10,602

Net Book Value

At 31 January

2021 2 314 42 358

=============================== =============================== =============================== ===============================

8 Borrowings

31 Jan 2022 31 Jan 2021 31 July 2021

GBP000 GBP000 GBP000

Loans

repayable

in less

than

1 year

Director's - 225 -

loan

Bounce back

loan 10 6 10

----------------------------------- ----------------------------------- -----------------------------------

Total short

term

borrowings 10 231 10

================================== ================================== =================================

Loans

repayable

in 1 to 2

years

Bounce back

loan 10 10 10

Loans

repayable

in 2 to 5

years

Bounce back

loan 25 30 30

Loans

repayable

in over 5

years

Bounce back - 4 -

loan

----------------------------------- ----------------------------------- -----------------------------------

Total long

term

borrowings 35 44 40

================================== ================================== =================================

In June 2020 the Group received a Bounce Back loan for GBP50,000

under the Government's Covid 19 policies. The loan is to be repaid

within 6 years of drawdown but with a 12 month holiday so

repayments started July 2021 and the loan will be repaid over the

following 5 years. The annual rate of interest is 2.5%.

On 19th January 2021 Europa entered into a related party loan

agreement with CW Ahlefeldt-Laurvig (a Group Non-Executive director

and shareholder). Under this agreement, Europa Oil & Gas drew

funds of GBP225,000 on 20(th) January 2021 for a term of 4 months

(with the option of early repayment). The loan was unsecured and

interest accrued on a daily basis at an effective interest rate of

12.57% per annum. The loan and accrued interest was fully repaid in

March 2021.

9 Long term provisions

31 Jan 2022 31 Jan 2021 31 July 2021

GBP000 GBP000 GBP000

At 1 August 3,393 3,163 3,163

Charged to the

statement of

comprehensive

income 117 115 230

----------------------------------- ----------------------------------- -----------------------------------

At period end 3,510 3,278 3,393

=================================== =================================== ===================================

10 Post reporting date

-- Termination of License Sale and Purchase Agreement with DNO

North Sea the Frontier Exploration Licence ("FEL") located in

offshore Ireland.

-- Successfully raised gross proceeds of GBP7.02m, approved by

shareholders at the General Meeting on 25 March.

-- Proposed acquisition of a 25% interest in the Serenity

discovery in the North Sea as part of Company strategy to build a

more balanced portfolio.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKBBPPBKDAQD

(END) Dow Jones Newswires

April 13, 2022 02:00 ET (06:00 GMT)

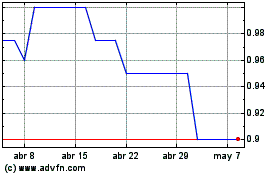

Europa Oil & Gas (holdin... (LSE:EOG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Gráfica de Acción Histórica

De May 2023 a May 2024