Harvest Minerals Limited Q1 2023 KP Fértil(R) Sales Update (5232W)

18 Abril 2023 - 1:00AM

UK Regulatory

TIDMHMI

RNS Number : 5232W

Harvest Minerals Limited

18 April 2023

Harvest Minerals Limited / Index: LSE / Epic: HMI / Sector:

Mining

18 April 2023

Harvest Minerals Limited

('Harvest' or the 'Company')

Q1 2023 KP Fértil(R) Sales Update

Harvest Minerals Limited, the AIM listed fertiliser producer, is

pleased to provide an update on Q1 2023 sales of its organic,

multi-nutrient, direct application fertiliser, KP Fértil(R), from

its 100% owned Arapua Fertiliser Project in Brazil ('Arapua').

HIGHLIGHTS

-- Sales orders received total 16,755 tonnes versus budget of 12,000 tonnes

-- Sales orders invoiced and delivered total 3,560 tonnes

Brian McMaster, Chairman of Harvest, said: "The start to 2023 is

consistent with our internal planning expectations but notably a

slower start than 2022, where concerns over the situation in the

Ukraine accelerated buying decisions. This "normalising" of buying

patterns seems consistent throughout the industry and not specific

to us. The fundamentals of our position in the market have not

changed: we have a unique, highly effective, 100% organic

fertiliser and we continue to grow our customer base and order

book. As such, we maintain our view that we will deliver our 2023

year-end invoiced sales target of KP Fértil 200,000 tonnes."

REVIEW OF OPERATIONS

Q1, 2023, Harvest has received sales orders for 16,755 tonnes of

its KP Fértil(R) produced at its Arapua Fertiliser Project in

Brazil. Whilst the sales orders for Q1, 2023 are lower than Q1,

2022, it is clear that the war in the Ukraine had accelerate buying

decisions during 2022, (as was speculated). Accordingly, as the

Company returns to previously established buying cycles, it remains

on track to achieve its 2023 year-end invoiced sales target of

200,000 tonnes of KP Fértil(R), which is a 33% increase over that

recorded in 2022. During Q1, the Company also witnessed a decrease

in prices for conventional fertiliser products. To date, this has

not impacted Harvest's selling price, but the Company anticipates

that as the year progresses prices will become a more critical part

of the buying decision than during 2022; the Company is monitoring

this and will respond to the market conditions as required.

**ENDS**

For further information, please visit www.harvestminerals.net or

contact:

Harvest Minerals Limited Brian McMaster Tel: +44 (0)20 3940

(Chairman) 6625

Strand Hanson Limited Ritchie Balmer Tel: +44 (0)20 7409

Nominated & Financial James Spinney 3494

Adviser

T avira Securities J onathan Evans Tel: +44 (0)20 3 192

Broker 1733

St Brides Partners Ltd A na Ribeiro harvest@stbridespartners.co.uk

Financial PR I sabel de Salis

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUWOAROBUSARR

(END) Dow Jones Newswires

April 18, 2023 02:00 ET (06:00 GMT)

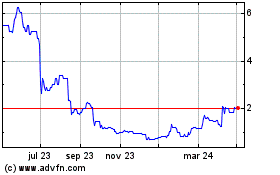

Harvest Minerals (LSE:HMI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

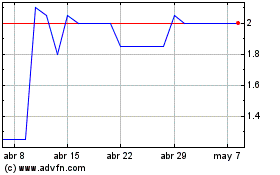

Harvest Minerals (LSE:HMI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024