TIDMIGP

RNS Number : 0563U

Intercede Group PLC

21 November 2023

21 November 2023

INTERCEDE GROUP plc

('Intercede', the 'Company' or the 'Group')

Interim Results for the Six Months Ended 30 September 2023

Record financial performance in H1 and results for the year

ending 31 March 2024 are now expected to be ahead of previous

market expectations

Intercede, the leading specialist in digital identity,

credential management and secure mobility, today announces its

interim results for the six months ended 30 September 2023.

Financial Highlights

H1 FY24 H1 FY23 % Change

GBP million GBP million

------------ ---------

Revenue 7.0 6.1 15%

------------ ------------ ---------

Gross profit 6.9 5.6 23%

----------------------------- ------------ ------------ ---------

Profit before Tax 1.1 0.6 83%

------------ ------------ ---------

Net Profit 1.6 1.2 33%

----------------------------- ------------ ------------ ---------

EPS - basic 2.7p 2.1p 29%

------------ ------------ ---------

EPS - diluted 2.5p 2.0p 25%

------------ ------------ ---------

Gross Margin 99% 92% 7%

----------------------------- ------------ ---------

Net Margin 22% 20% 10%

----------------------------- ------------ ---------

Cash and cash equivalents 9.7 10.0 -3%

Deferred revenue 5.4 4.4 23%

Total Assets 16.8 14.0 20%

Total Equity 8.7 6.9 26%

Adjusted EBITDA 1.5 1.0 50%

------------ ------------ ---------

Less:

Amortisation of intangibles 0.1 -

Right of use depreciation 0.1 0.1

Acquisition costs 0.1 0.3

Employee Share/Unit 0.1 -

incentive & option

plan charges/(credits)

Exceptional costs 0.1 -

----------------------------- ------------ ------------ ---------

Operating Profit 1.0 0.6 67%

------------ ------------ ---------

Revenue highlights for the period include:

-- Record revenues for the six months ended 30 September 2023

(H1) totalling GBP7.0 million are 15% higher on a reported basis

(2022: GBP6.1 million). On a constant currency basis revenue was up

by 10%

-- Multiple MyID PIV licence orders including from the US

Department of State (DoS) for its Identity Management System (IDMS)

solution totalling $0.9 million. A large north American

telecommunications company increased its licence deployment,

including an upgrade

-- Several major customers have chosen to upgrade their existing

MyID deployments including, but not limited to, a major global

aerospace and defence manufacturer, a large north American

telecommunications company, a key US government agency and US

Department of Transportation

-- New 3- year licence order for MyID MFA from a global

aluminium producer in the Middle East as well as key subscription

renewals for MyID PSM and MyID MFA

-- Professional services continue to grow and embeds the

symbiotic relationship with our clients and cadence of upgrades and

new deployments. The Group will maintain the high quality service

we provide by increasing investment and training as and when

required

Operating Highlights

-- Increased adjusted EBITDA margin for the period of 21% (2022:

16%) as a result of continued tight cost control in conjunction

with targeted project expenditure to support revenue growth and

internal infrastructure upgrade

-- The integration of Authlogics Ltd continues across the Group with the launch of Multi Factor Authentication (MFA) and Password Security Management (PSM) capabilities with MyID CMS, and to be showcased in Q4 FY24

-- The M&A programme continues, focussed on targets that add

substantial recurring revenues, compliment or is adjacent to

current product portfolio and reasonably priced

-- Performance to date across the Group has been very

encouraging and we continue to win prestigious new clients

-- The Group's strong balance sheet (with no debt) and good cash

generation enables it to invest further both in the existing

business and in M&A to accelerate its longer-term growth

ambitions

Board Changes

During the period Chuck Pol retired from the Board and John

Linwood was appointed as a Non-Executive Director. After the period

end Dan O'Brien was also appointed as a Non-Executive Director and

as Audit Chair with immediate effect, with Tina Whitley moving to

the Remuneration Chair and John Linwood as Nominations Chair.

Royston Hoggarth, Chairman, said:

"The Group has continued to deliver on its stated goals of

double-digit growth, continued strategic investment internally and

the expansion of the MyID product portfolio.

Building on the growth in 2023, the Board is pleased to see such

a focused approach to Phase 2 in the first half. As always, our

colleagues in the Group have continued to maintain the momentum

which we, as a Board, are grateful for.

The strong performance we achieved in the first half of 2023 has

continued. The benefit of tight cost controls and a strong pipeline

of future opportunities means that I am pleased to report that we

now expect the Group to achieve financial performance for FY2024

ahead of previous market expectations*. Whilst the volatility in

the global macroeconomic environment has increased in the last few

weeks, with our strong pipeline and balance sheet we remain well

positioned for the future."

* The current market forecast for the year ended 31 March 2024

is revenue of GBP13.3m and adjusted EBITDA of GBP1.0m

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455 558 111

Klaas van der Leest, CEO

Nitil Patel, CFO

Cavendish Capital Markets Limited Tel. +44 (0)20 7220 0500

Simon Hicks/Fergus Sullivan, Corporate Finance

Tim Redfern/Charlotte Sutcliffe, ECM

About Intercede

Intercede is a cybersecurity software company specialising in

digital identities, and its innovative solutions enable

organisations to protect themselves against the number one cause of

data breach: compromised user credentials.

The Intercede suite of products allows customers to choose the

level of security that best fits their needs, from Secure

Registration and ID Verification to Password Security Management,

One-Time Passwords, FIDO and PKI. Uniquely, Intercede provides the

entire set of authentication options from Passwords to PKI,

supporting customers on their journey to passwordless and stronger

authentication environments. In addition to developing and

supporting Intercede software, the Group offers professional

services and custom development capabilities as well as managing

the world's largest password breach database.

For over 20 years, global customers in government, aerospace and

defence, financial services, healthcare, telecommunications, cloud

services and information technology have trusted Intercede

solutions and expertise in protecting their mission critical data

and systems at the highest level of assurance.

For more information visit: www.intercede.com

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law

by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and

is disclosed in accordance with the company's obligations under

Article 17 of MAR.

The period in review

The Group entered FY24 with the clear goals of double-digit

growth and to maintain the momentum from FY23, to invest internally

in our colleagues, infrastructure, sales and marketing functions

and to refresh the Board. H1 has shown that the Group is delivering

on all these aims and will continue to do so in H2.

Market Opportunity and Growth Strategy

Following the initial turn around in Phase 1, the Group is now

well placed in Phase 2 with the overarching goal of continued

double-digit growth, both organic and inorganic. Good progress has

been made across both strategies as outlined below.

Intercede's MyID CMS platform is the leading credential

management system (CMS) and identification and verification

(ID&V) solution that integrates and manages a broad range of

PKI (Public Key Infrastructure) and FIDO (Faster Identity Online)

technologies.

MyID CMS meets the needs of large organisations, from public

sector such as government agencies or departments to private sector

corporates like the Aerospace & Defence conglomerates who are

prepared to invest in military grade security and cope with the

more complex infrastructure required.

The Group has traditionally offered a perpetual licence model,

often as requested by its client base. For the growth to be

sustained over a longer period, Intercede has selectively

introduced subscription licence pricing for specific opportunities.

This will be extended across the entire client base in the coming

months. For the foreseeable future, both a perpetual as well as a

subscription pricing model will be maintained for MyID CMS.

Since the acquisition of Authlogics in October 2022, the Group

has expanded and broadened MyID's functionality as it moves down

the authentication pyramid and increase its addressable market.

This lies at the heart of the growth plans of the Group and enables

it to offer customers and prospects solutions that span the entire

authentication pyramid, as shown in Diagram 1 below. MyID PSM and

MyID MFA are exclusively offered through a subscription licence

model.

Phase 1 was all about the business turn around (e.g. product

repositioning and investment, go-to-market model, profitability and

cash generation). Phase 2 now focuses on sustainable growth,

addressable market, enhanced distribution, a strong balance sheet,

and continuing inorganic growth following the successful maiden

acquisition of Authlogics.

The ambition over the next 3-4 years is to double revenues with

resilient cash generation and further entrenching Intercede as the

leading digital identity specialist in the authentication space.

The steps taken in the prior years have provided a solid foundation

and the business KPIs underpin these ambitions.

Diagram 1 -Authentication Pyramid resulting in increased product

portfolio & addressable market

M&A

Intercede continues to pursue its corporate development program

and during the period has had in depth discussions with more than

twenty possible acquisition targets. Many of these targets are

focused on the zero trust and access management sector, and their

addition would form a natural extension to our existing MyID

product portfolio.

The Group has a healthy revenue pipeline in these product areas

but has also turned its attention to larger targets that would help

extend the business on both a geographic and sector basis.

The new EU cybersecurity NIS2 (Network and Information Security)

regulation is being passed into statute in several EU countries and

will form a key catalyst on cybersecurity purchasing patterns

across the EU in the years ahead, particularly for the small and

medium business market.

This new regulation is intended to reduce cybersecurity risk in

certain areas and has aspects in common with the US NIST zero trust

regulations (and associated Presidential Executive Order).

During the period, the Group was engaged in discussions with a

zero trust acquisition target based in North America. Following

detailed due diligence Intercede decided not to pursue the

opportunity.

Financial Review - Income Statement

Revenue and operating results

The Group's revenue from continuing operations increased by 15%

to GBP7.0 million (2022: GBP6.1 million) and gross profit increased

by 23% to GBP6.9 million (2022: GBP5.6 million). Gross margin

increased from 92% to 99% as license sales in the prior period

included third party product.

The Group's operating profit was GBP1.0 million (2022: GBP0.6

million), after non-cash depreciation charge for property, plant

and equipment in the period of GBP0.04 million (2022: GBP0.03

million) and a right-of-use depreciation charge of GBP0.1 million

(2022: GBP0.1 million). Acquisition costs for the period were

GBP0.1 million (2022: GBP0.3 million). During the period, no

acquisitions were completed, and the Group continues to pursue a

disciplined approach to deal pricing, due diligence and in taking

the time to ensure the right strategic fit(s) to ensure continued

scalability and accelerated revenue growth. Operating expenses

increased by 18% to GBP6.0m (2022: GBP5.1m). Tight cost control

continues to be a focus for the Group in conjunction with

considered project expenditure and new hires to support revenue

growth.

Staff costs continue to represent the main area of expense

representing 79% of total operating costs (2022: 86%). Intercede

had 99 employees and contractors as at 30 September 2023 (94 as at

31 March 2023). The average number of employees and contractors

during the period was 96 (2022: 85).

The statutory profit before tax for the period was GBP1.1

million (2022: GBP0.6 million) and profit for the period was GBP1.6

million (2022: GBP1.2 million).

Taxation

The Group has a tax credit of GBP0.5 million for the period due

to amounts receivable from HMRC in respect of R&D claims and US

corporation tax payable (2022: tax credit of GBP0.6 million). The

Group brought forward unused tax losses of GBP7.0 million (2022:

GBP6.4 million). The Group assessed the deferred tax impact in the

period and did not recognise any assets or liabilities.

Earnings per share

Earnings per share from continuing operations in the period was

2.7 pence for basic and 2.5 pence for diluted (2022: 2.1 pence for

basic and 2.0 pence for diluted) and were based on the profit for

the period of GBP1.6 million (2022: GBP1.2 million) with a basic

weighted average number of shares in issue during the period of

58,231,712 (2022: 57,648,980 shares). For diluted the weighted

average number was 62,429,062 (2022: 58,943,357).

Adjusted earnings per share from continuing operations in the

period was 2.6 pence for basic and 2.5 pence for diluted (2022:

basic and diluted of 1.7 pence) and were based on an Adjusted

EBITDA for the period of GBP1.5 million (2022: GBP1.0 million).

Dividend

The Board is not proposing a dividend (2022: GBPnil).

Financial Position

Assets

Non-current assets of GBP3.4 million (2022: GBP0.4 million)

mainly comprise goodwill arising on acquisition of GBP2.4 million

(2022: GBPnil) and other intangible assets of GBP0.7 million (2022:

GBPnil) both arising from the acquisition of Authlogics Limited

("Authlogics") in early October 2022. There is also property, plant

and equipment of GBP0.2 million (2022: GBP0.1 million) and IFRS 16

right of use assets of GBP0.1 million (2022: GBP0.3 million).

Trade and other receivables of GBP3.6 million is very comparable

to the prior period (2022: GBP3.6 million) reflecting the

seasonality that Intercede tends to experience as US Federal

customers get to the end of their fiscal year on 30 September.

Liabilities

Current liabilities increased by GBP0.3 million to GBP7.1

million (2022: GBP6.8 million) reflecting contingent consideration

(created on the acquisition of Authlogics) and increased deferred

revenue at the period end.

Non-current liabilities rose by GBP0.6 million to GBP1.0 million

(2022: GBP0.4 million), which also reflects contingent

consideration from the Authlogics acquisition and increased

deferred revenue at the period end. Some larger customers prefer to

contract their support and maintenance renewal for terms longer

than 12 months which creates spikes in non-current liabilities.

Deferred Consideration Change

After the period end, the Group agreed with the vendors of

Authlogics to extend the earnout by an additional year with the

targets and thresholds remaining intact. By doing so the amount due

currently for earnout year ending 30 June 2024 will now be assessed

in the year ending 30 June 2025 and 2025 earnout is deferred to

2026. No deferred consideration is due now for year ending 30 June

2024.

Capital and Reserves

Total equity increased by GBP1.8 million to GBP8.7 million

(2022: GBP6.9 million), reflecting the profit for the period.

Liquidity and capital resources

The Group remains in a good financial position, with gross cash

balances of GBP9.7 million as at 30 September 2023 compared to

GBP8.3 million held at 31 March 2023 and GBP9.9 million held at 30

September 2022. This is after a cash outflow following the

acquisition of Authlogics in October 2022 for an initial

consideration of GBP2.0 million and related acquisition costs

expensed to the Income Statement of GBP0.2 million. The Group had

no debt at the period end (2022: GBPnil).

During the period there has been a net cash inflow from

operating activities of GBP1.7 million (2022: GBP2.1 million) which

reflects continued good management of working capital and the

receipt of the FY23 R&D claims.

Outlook

The integration of Authlogics continues and has expanded the

product portfolio has been expanded, a key reason for the

acquisition. Intercede is encouraged with the performance to date

and with the recently announced new clients wins in the US, EMEA

and APAC regions.

This strong performance means the Group now expects to achieve

financial performance for FY2024 ahead of previous market

expectations.

The Group's financial position and cash generation is a solid

foundation for it to maintain and fund its internal investment

plans and M&A opportunities to accelerate the delivery on the

medium and long term aims.

By order of the Board

Klaas van der Leest Nitil Patel

Chief Executive Officer Chief Financial Officer

21 November 2023

Consolidated Statement of Comprehensive

Income- unaudited

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 6,993 6,065 12,110

Cost of sales (66) (417) (403)

__________ __________ __________

Gross profit 6,927 5,648 11,707

Operating expenses (5,967) (5,051) (11,136)

__________ __________ __________

Operating profit 960 597 571

Finance income 149 41 130

Finance costs (12) (21) (75)

__________ __________ __________

Profit before tax 1,097 617 626

Taxation 453 590 685

__________ __________ __________

Profit for the period 1,550 1,207 1,311

__________ __________ __________

Total comprehensive income attributable

to owners of the parent company 1,550 1,207 1,311

__________ __________ __________

Earnings per share (pence)

- basic 2.7p 2.1p 2.3p

- diluted 2.5p 2.0p 2.2p

__________ __________ __________

Consolidated Financial Position

- unaudited

As at As at As at

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill arising on acquisition 2,442 - 2,442

Other intangible assets 698 - 785

Property, plant and equipment 190 98 125

Right of use assets 144 309 262

___________ ___________ __________

3,474 407 3,614

___________ ___________ __________

Current assets

Trade and other receivables 3,600 3,609 5,489

Cash and cash equivalents 9,724 9,999 8,334

___________ ___________ __________

13,324 13,608 13,823

___________ ___________ __________

Total assets 16,798 14,015 17,437

___________ ___________ __________

Equity

Share capital 584 584 584

Share premium 5,430 5,430 5,430

Merger reserve 1,508 1,508 1,508

Accumulated profit/(deficit) 1,149 (640) (492)

___________ ___________ __________

Total equity 8,671 6,882 7,030

___________ ___________ __________

Non-current liabilities

Lease liabilities 143 278 204

Contingent consideration 151 - 174

Deferred revenue 703 121 550

___________ ___________ __________

997 399 928

___________ ___________ __________

Current liabilities

Lease liabilities 121 336 261

Contingent consideration 282 - 313

Trade and other payables 2,007 2,166 1,918

Deferred revenue 4,720 4,232 6,987

___________ ___________ __________

7,130 6,734 9,479

___________ ___________ __________

Total liabilities 8,127 7,133 10,407

___________ ___________ __________

Total equity and liabilities 16,798 14,015 17,437

___________ ___________ __________

Consolidated Statement

of Changes in Equity- unaudited

Merger Accumulated Total

Share capital Share premium reserve (deficit)/profit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2023 584 5,430 1,508 (492) 7,030

Purchase of own shares (27) (27)

Employee share option plan

charge - - - 95 95

Employee share incentive

plan charge - - - 23 23

Profit for the period and

total comprehensive income - - - 1,550 1,550

________ ________ ________ __________ _______

At 30 September 2023 584 5,430 1,508 1,149 8,671

________ ________ ________ __________ _______

At 1 April 2022 577 5,268 1,508 (1,842) 5,511

Purchase of own shares (27) (27)

Issue of new shares 7 162 - - 169

Employee share incentive

plan charge - - - 22 22

Profit for the period and

total comprehensive income - - - 1,207 1,207

________ ________ ________ __________ _______

At 30 September 2022 584 5,430 1,508 (640) 6,882

________ ________ ________ __________ _______

At 1 April 2022 577 5,268 1,508 (1,842) 5,511

Purchase of own shares - - - (54) (54)

Issue of new shares 7 62 - - 169

Employee share option plan

charge - - - 50 50

Employee share incentive

plan charge - - - 43 43

Profit for the period and

total comprehensive income - - - 1,311 1,311

________ ________ ________ __________ _______

At 31 March 2023 584 5,430 1,508 (492) 7,030

________ ________ ________ __________ _______

Consolidated Cash Flow Statement-

unaudited

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit for the period 1,550 1,207 1,311

Taxation (453) (590) (685)

Finance income (149) (41) (130)

Finance costs 12 21 75

Depreciation of property, plant &

equipment 38 31 66

Depreciation of right of use assets 118 122 246

Amortisation 87 - 83

Exchange (profits) / losses on foreign

currency lease liabilities (1) 59 40

Employee share option plan charge 95 - 50

Employee share incentive plan charge 23 22 43

Employee unit incentive plan charge (5) (60) (51)

Employee unit incentive plan payment - - (3)

Decrease / (increase) in trade and

other receivables 1,882 1,439 (831)

Increase in trade and other payables 41 762 334

(Decrease) / increase in deferred

revenue (2,114) (849) 1,668

____________ ____________ __________

Cash generated from operations 1,124 2,123 2,216

Finance income 145 30 116

Finance costs on leases (18) (21) (44)

Tax received / (paid) 453 (14) 574

____________ ____________ __________

Net cash generated from operating

activities 1,704 2,118 2,862

____________ ____________ __________

Investing activities

Purchases of property, plant and

equipment (102) (12) (70)

Purchase of business (net of cash

acquired) - - (2,079)

____________ ____________ __________

Cash used in from investing activities (102) (12) (2,079)

____________ ____________ __________

Financing activities

Purchase of own shares (27) (27) (54)

Proceeds from issue of ordinary share

capital - 169 169

Principal elements of lease payments (199) (201) (409)

____________ ____________ __________

Cash used in financing activities (226) (59) (294)

____________ ____________ __________

Net increase / (decrease) in cash

and cash equivalents 1,376 2,047 489

Cash and cash equivalents at the

beginning of the period 8,334 7,787 7,787

Exchange gain / (loss) on cash and

cash equivalents 14 165 58

____________ ____________ __________

Cash and cash equivalents at the

end of the period 9,724 9,999 8,334

____________ ____________ __________

Notes to the Consolidated Accounts

For the period ended 30 September 2023

1 Preparation of the interim financial statements

These interim financial statements have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 and with those

parts of the Companies Act 2006 applicable to companies reporting

under International Financial Reporting Standards (IFRS).

The basis of preparation and accounting policies used in

preparation of these interim financial statements have been

prepared in accordance with the same accounting policies set out in

the Group's Annual Report for the year ended 31 March 2023, which

provides full details of significant judgements and estimates used

in the application of the Group's accounting policies. There have

been no significant changes to these judgements and estimates

during the period which included an assessment that the going

concern basis continues to be appropriate in preparing the interim

financial statements.

These interim financial statements have not been audited and do

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2023 have been delivered to the Registrar of Companies. The

Auditors' Report on those accounts was unqualified and did not

contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

This Interim Report is available on the website

(www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

2 Revenue

All of the Group's revenue, operating profits and net assets

originate from operations in the UK. The Directors consider that

the activities of the Group constitute a single business

segment.

The split of revenue by geographical destination of the end

customer can be analysed as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

UK 181 95 539

Rest of Europe 601 414 906

Americas 5,752 5,221 9,879

Rest of World 459 335 786

___________ ___________ __________

6,993 6,065 12,110

___________ ____________ __________

3 Taxation

Taxation represents the net effect of amounts receivable from

HMRC in respect of R&D claims and US corporation tax

payable.

4 Earnings per share

The calculations of earnings per ordinary share are based on the

profit for the period and the weighted average number of ordinary

shares in issue during each period.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Profit for the period 1,550 1,207 1,311

___________ ___________ __________

Number Number Number

Weighted average number of shares

- basic 58,231,712 57,648,980 57,939,548

- diluted 62,429,062 58,943,357 60,595,485

___________ ___________ __________

Pence Pence Pence

Earnings per share

- basic 2.7p 2.1p 2.3p

- diluted 2.5p 2.0p 2.2p

___________ ___________ __________

The weighted average number of shares used in the calculation of

basic and diluted earnings per share for each period were

calculated as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

Number Number Number

Issued ordinary shares at start

of period 58,363,357 57,743,357 57,743,357

Effect of treasury shares (131,645) (131,645) (131,645)

Effect of issue of ordinary

share capital - 37,268 327,836

___________ ___________ __________

Weighted average number of shares

- basic 58,231,712 57,648,980 57,939,548

___________ ___________ __________

Add back effect of treasury

shares 131,645 131,645 131,645

Effect of share options in issue 4,065,705 1,162,732 2,524,292

___________ ___________ __________

Weighted average number of shares

- diluted 62,429,062 58,943,357 60,595,485

___________ ___________ __________

5 Dividend

The Directors do not recommend the payment of a dividend.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FBLLLXFLLFBV

(END) Dow Jones Newswires

November 21, 2023 02:00 ET (07:00 GMT)

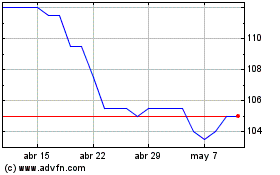

Intercede (LSE:IGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Intercede (LSE:IGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024