JPMorgan Global Core Real Assets Ld Monthly Net Asset Value (Replacement) (8188G)

17 Noviembre 2022 - 10:07AM

UK Regulatory

TIDMJARA TIDMJARU TIDMJARE

RNS Number : 8188G

JPMorgan Global Core Real Assets Ld

17 November 2022

The following amendment has been made to the 'Monthly Net Asset

Value' announcement released on 9 November 2022 at 07:00 under RNS

No 7491F.

Date of price for the Liquid Strategy changed to 31 October

2022.

All other details remain unchanged.

The full amended text is shown below.

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN GLOBAL CORE REAL ASSETS LIMITED

(the 'Company')

MONTHLY NET ASSET VALUE

Legal Entity Identifier: 549300D8JHZTH6GI8F97

The Company announces the unaudited net asset value ('NAV') as

at 31 October 2022.

The unaudited NAV is 106.10 pence per share.

A breakdown of the prices used in the calculation of the above

NAV is provided below:

Strategies

Name Date of price for % of JARA's NAV

Strategy as at 31 October

2022

Real Estate Equity

US 30 September 2022 22.6%

------------------- ------------------

Real Estate Equity

Asia 30 June 2022 18.2%

------------------- ------------------

Real Estate Debt 30 June 2022 7.2%

------------------- ------------------

Transportation 30 June 2022 18.9%

------------------- ------------------

Infrastructure 30 June 2022 16.7%

------------------- ------------------

Liquid Strategy 31 October 2022 16.4%

------------------- ------------------

Exchange rates - as at 31 October 2022. (The GBP/USD exchange

rate was 1.15135 as at 31 October 2022).

9 November 2022

Emma Lamb

JPMorgan Funds Limited - Company Secretary

Telephone 0207 742 4000

Notes

The Company aims to provide holders of the Ordinary Shares with

a stable income and constant currency capital appreciation through

exposure to a globally diversified portfolio of Core Real Assets in

accordance with the Company's investment policy. The Company is

seeking exposure to Core Real Assets through various real asset

strategies, namely: Global Infrastructure, Global Real Estate,

Global Transport and Global Liquid Real Assets. J.P. Morgan's

Alternative Solutions Group has the primary responsibility for

managing the Company's portfolio.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVGZMMMVNMGZZM

(END) Dow Jones Newswires

November 17, 2022 11:07 ET (16:07 GMT)

Jpmorgan Global Core Rea... (LSE:JARE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

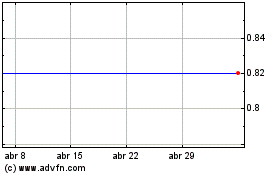

Jpmorgan Global Core Rea... (LSE:JARE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024