TIDMJAY

RNS Number : 0718O

Bluejay Mining PLC

29 September 2023

Bluejay Mining plc / EPIC: JAY / Market: AIM / Sector:

Mining

29 September 2023

Bluejay Mining plc ('Bluejay' or the 'Company')

Interim Results

Bluejay Mining plc, the AIM and FSE listed, and OTCQB traded,

exploration company with projects in Greenland and Finland, is

pleased to announce its Interim Results for the six months ended 30

June 2023 (the 'Period').

Highlights in H1 2023

-- Executive Chairman, Robert Edwards, released a strategic

review of Bluejay and its current portfolio of assets and new

development strategy

-- Positive results from the 2022 airborne geophysical survey at

Kangerluarsuk refined existing suite of drill-ready targets

-- Drill programme at Enonkoski consisting of follow-up drilling at the Laukunlampi target

-- Drilling commenced at Hammaslahti with assays underway

-- GBP1.3 million (US$1.65 million) raised through the issuance

of shares to new and existing shareholders primarily for the

advancement of Hammaslahti

Post Period

-- Finland strategy update where Bluejay retains 100% of Enonkoski Project

-- Director equity subscription of GBP30,000

-- Metals One commences trading on AIM

-- Placing to raise GBP600,000

-- Dundas project no longer deemed core to Bluejay portfolio

-- Supportive analytical results from the 2022 field-season at Disko

Chairman's Statement

The half year under review saw the Company assess its strategy,

and upon further reflection of the relative merits of the assets

within the portfolio and the results achieved to date, Bluejay

aligned its focus on those assets that it felt offered the best

risk/reward profile, of particular importance in a market

environment that is not cyclically supportive for mineral explorers

and developers. Our key objective is to enhance shareholder value

by developing commercial critical mineral discovery opportunities

in Greenland and Finland. I am both encouraged and assured in the

knowledge that Bluejay is fortunate to have more than one

opportunity within its current asset base to achieve this.

Realising value from such world class prospects like the

Disko-Nuussuaq Nickel-Copper-Cobalt-Platinum Group Metals Joint

Venture ('JV') Project ('Disko') with KoBold Metals and the

Kangerluarsuk Zinc-Lead-Silver+/-Cu-Ge Project ('Kangerluarsuk') in

Greenland, and the "re-discovery" of previously exploited licences

like the Hammaslahti Copper-Zinc-Silver-Gold Project

('Hammaslahti'), the Enonkoski Nickel-Copper-Cobalt Project

('Enonkoski') and the Outokumpu

Copper-Nickel-Cobalt-Zinc-Gold-Silver Project in Finland are all

opportunities which we aim to demonstrate. We are, by definition of

our broad base and critical metals exposure, now very much part of

the energy transition value chain. This in itself can and will

illicit very capable and credible partners given the global focus

on security of supply of such elements. Whilst we retain exposure

to illmenite (titanium feedstock) through our ownership of the

Dundas Ilmenite (Titanium) Project ('Dundas'), this can now be

considered "non-core". We can only express regret that this clarity

was not achieved earlier in the life of the project, but studies

needed to be concluded in order to determine whether the project

would work economically or not.

During our strategic review published in February 2023, both

Kangerluarsuk and Hammaslahti (both 100% held by Bluejay) strongly

met the technical criteria to be able to drive shareholder value

within a relatively short time frame. We can report that we were

able to progress one of these projects in the period under

review.

Following the publication of positive results from the previous

year's airborne survey and the release of a detailed technical

presentation for Bluejay's exciting Kangerluarsuk Project, where we

believe that we are dealing with a large-scale mineralised system ,

the prospect of conducting a maiden drill campaign was compelling.

Historical chip sample results of 41.1% zinc and 45.5% lead and

grab samples of 9.3% lead, 1.2% copper and 596 grams per tonne

('g/t') silver confirm that we have a very high potential district

under our control, hosting what we believe to be a major

palaeoproterozoic sedimentary basin immediately to the house and

hosted within this basin is the former Black Angel Zinc-Lead-Silver

Mine. This mine produced 11 million tonnes of ore grading at 12.6%

zinc, 4.1% lead and 29 g/t silver for its former operators, Cominco

(now Teck Resources) and Boliden.

In addition, the Geological Survey of Denmark and Greenland

('GEUS') has acknowledged Kangerluarsuk as containing the strongest

cluster of stream sediment zinc anomalies in Greenland, with

samples up to 2,200 parts per million zinc.

Sadly, unseasonal weather constraints prevented the commencement

of the field-season as we would have wished. Nonetheless, and as a

direct demonstration of our portfolio's flexibility, the Company

was subsequently able to pivot greater operational focus onto

Hammaslahti, and our other brownfield assets in Finland.

Previous work conducted by the Company several years ago

delineated the high potential E-lode which is located parallel to

historical mine workings. Historically, Hammaslahti produced a

total of seven million tonnes of high-grade copper-zinc-silver-gold

ore between 1971 and 1986, with all ore lodes remaining open at

depth. The discovery and expansion of E-lode makes for a compelling

exploration and development platform. At the end of May, the

Company commenced drilling at Hammaslahti. A 2,000 metre ('m')

drill programme conducted on the E-Lode confirmed the continuity of

the high-grade copper-zinc-silver-gold ore lode. Further indication

of the high-grade mineralisation present at Hammaslahti is the

presence of polymetallic mineralisation which is interpreted to be

a partially re-mobilised volcanogenic massive sulphide ('VMS'). The

historical high-grade production, coupled with the presence of

polymetallic mineralisation, indicates the potential of the project

to enhance shareholder value, in accordance with the Company's new

strategy. Elsewhere in Finland at Enonkoski, a total of 951m was

drilled out of the planned 1,000-1,500m campaign, and was

followed-up by another drilling programme consisting of a single

drill depth of 400m targeting the Laukunlampi intrusion all funded

by our then partner, Rio Tinto. However, post period end, the JV

agreement with Rio-Tinto at Enonkoski ended, with Bluejay retaining

100% of the project. The JV enabled Bluejay to significantly

advance its knowledge of the project through US$4.65 million in

exploration expenditure and it has opened up the potential of

targets along the Enonkoski belt. Specifically, the Company, when

appropriate, will focus on assessing the wealth of the

as-yet-untested targets at Makkola.

In addition, as part of our strategic review, Outokumpu was

deemed a potentially short term value producing prospect. Bluejay

recently increased its licence areas and is now the largest

landholder on the highly prospective Outokumpu belt, that hosts

three past producing high-grade, polymetallic mines. Low-cost

ground gravity and magnetic surveys are the next stage of work to

be completed, after which Bluejay will develop an optimal strategy

for development. Low-cost ground gravity and magnetic surveys to

progress the high-priority Haapovaara target are the next stage of

work to be completed, subject to funding, after which Bluejay will

develop an optimal strategy for the development of the project.

Haapovaara is located only a few kilometres along strike, to the

North East, of Boilden's Kylylahti Mine. The target is coincident

with two gravity highs in existing regional gravity data that have

never been drill tested.

In the post period the conditional divestment of the Company's

Black-Shales assets to Metals One was concluded with the successful

IPO of Metals One plc, in which Bluejay is now a significant equity

investor holding c. 29% of the listed equity.

Moving forward in 2023 and into 2024, Bluejay will continue to

use its new strategy to explore and develop its projects with the

aim to increase their value to, in turn, maximise value for its

shareholders.

Financial

In February, Bluejay announced an equity subscription where up

to US$6 million would be received from Towards Net Zero ('TNZ'),

consisting of three tranches of US$2 million. However, shortly

following the receipt of the first tranche, the Company took the

decision with the pragmatic agreement from TNZ, to terminate the

arrangement. The decision to return US$2 million of capital in

April 2023 was not taken lightly but was driven by the view that

the original benefits of the structure were outweighed by the risks

created by entering into it in the first place, and a simpler

funding route was pursued thereafter.

In June 2023, following the unforeseen weather conditions that

prevented workable access to Kangerluarusuk, the Company

successfully raised GBP1.3 million in new equity from new, and

importantly, existing shareholders, to instead further the

development of Hammaslahti. These funds immediately went towards

finalising a Mineral Resources Estimate ('MRE') on Hammaslahti's

E-Lode as well as general corporate purposes. At this time,

executive management agreed to take significant cuts to salaries

and non-executive directors have taken no fees whatsoever in the

form of cash or shares. This was followed in the post period with a

further capital increase raising GBP600,000 to ensure that the

Company is best positioned to ensure it can deliver on its strategy

for the second half of 2023, setting us up for what we believe

could be a transformational 2024. Bluejay has received credit notes

from some suppliers that were paid during the period under review

but for which Bluejay could not take delivery of goods or services

due to delayed exploration programmes. The Company continues to

scrutinise its cost base and have cut costs wherever possible

without damaging the core technical competencies of the

business.

With respect to the recent management and Board decision to

curtail activities at Dundas, the obligatory impairment test will

be carried out on Dundas at the appropriate time to determine the

extent, if any, of any impairment that is due. In the interim and

in line with our public disclosure, the Company will seek

commercial alternatives for the project and will be better placed

to make a judgement on book value once this initiative has been

progressed.

Outlook

The first half of the year marked a significant change in

strategy for the Company. One that I have no doubt in my mind will

take Bluejay on an upward trajectory. We still find ourselves at

the early stages of the shift, but we are already realising the

value it is creating. Value that will continue to grow as we

continue to implement our new ideas.

Although the strategy has taken a new turn, the metals in which

our portfolio of projects are associated with continue to be

essential to the global energy transition and the jurisdictions in

which they are found continue to be world class. With all of this

considered, Bluejay is still extremely well positioned to deliver

on its strategy.

Prior to our JV with Rio Tinto, Enonkoski was one of the least

visible projects within Bluejay's portfolio. The value in which

that partnership has provided means the Company now has a project

that is significantly further up the value curve, and one where it

can utilise its own inhouse expertise to further develop.

These in house expertise are currently being deployed at

Hammaslahti, where we believe the development of a MRE is the first

milestone of many, as we continue to seek short term value creating

opportunities. Kangerluarsuk is another short term value creating

opportunity for the Company and remains a high priority with

planning activities aiming for exploration at the project in 2024

underway.

Our ability to pivot and focus on other promising projects when

events arise that are out of our control speaks volumes of the

strength of Bluejay's project portfolio.

The updated results at Disko increase our confidence that the

Company is in possession of a potential world class asset and we

will know more in 2024.

Bluejay is progressing positive discussions with four strategic

entities with complimentary attributes which we believe have the

ability to strengthen both the financial and technical capabilities

of the business as we explore and develop our portfolio of

projects. This is aimed to both financially de - risk the business

as well as create a unique and powerful combination of skills.

Despite the positive discussions, and as previously mentioned,

there can be no certainty that any binding agreements will be

entered into, although we hope to conclude at least one of these

before the end of the year.

As always, I would like to thank those who have supported the

Company both internally and externally, as we continue to steer

Bluejay in a direction that should see significant progression

across the entire business. The rest of the year will see us

deliver further on our strategic goals, as we ensure the Company is

well positioned going into 2024. I look forward to updating

shareholders in that respect.

Robert Edwards

Non-Executive Chairman

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018.

For further information please visit www.bluejaymining.com or

contact:

Kevin Sheil Bluejay Mining plc enquiry@bluejaymining.com

----------------------------- ---------------------------

SP Angel Corporate Finance

LLP

Ewan Leggat / Adam (Nominated Adviser and

Cowl Broker) +44 (0) 20 3470 0470

----------------------------- ---------------------------

Tim Blythe / Megan BlytheRay

Ray / Said Izagaren (Media Contact) +44 (0) 20 7138 3205

----------------------------- ---------------------------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Notes 6 months 6 months

to 30 June to 30 June

2023 Unaudited 2022 Unaudited

GBP (Restated

(1) )

GBP

------------------------------------------------ ------- ----------------- -----------------

Continuing operations

Revenue - -

Cost of sales (32,033) -

------------------------------------------------ ------- ----------------- -----------------

Gross (loss) (32,033) -

------------------------------------------------ ------- ----------------- -----------------

Administration expenses (932,792) (868,573)

Other gains 34,467 25,624

Foreign exchange (70,355) (15,828)

Operating loss (1,000,713) (858,777)

------------------------------------------------ ------- ----------------- -----------------

Other income 8 165,851 836,361

Net finance income/(expense) 7,372 (887)

Increase in share of net assets on joint

venture 7 177,810 555,803

Share of (losses) from joint venture 7 (9,455) (7,776)

------------------------------------------------ ------- ----------------- -----------------

(Loss)/Profit before income tax (659,135) 524,724

------------------------------------------------ ------- ----------------- -----------------

Income tax expense - -

------------------------------------------------ ------- ----------------- -----------------

(Loss)/Profit for the period (659,135) 524,724

------------------------------------------------ ------- ----------------- -----------------

Other comprehensive income

Items that may be reclassified to profit

or loss

Currency translation differences (906,600) 521,187

------------------------------------------------ ------- ----------------- -----------------

Total comprehensive (loss)/profit for

the period (1,565,735) 1,045,911

------------------------------------------------ ------- ----------------- -----------------

Earnings per share from continuing operations

attributable to the equity owners of the

parent

------------------------------------------------ ------- ----------------- -----------------

Basic and diluted (pence per share) 9 (0.06)p 0.05p

------------------------------------------------ ------- ----------------- -----------------

(1) Refer to Note 7

CONDENSED CONSOLIDATED BALANCE SHEET

Notes 30 June 31 December 30 June

2023 Unaudited 2022 Audited 2022 Unaudited

GBP GBP (Restated

(1) )

GBP

------------------------------------ ------- ----------------- --------------- -----------------

Non-current assets

Property, plant and equipment 5 1,582,916 1,718,337 1,874,805

Intangible assets 6 33,740,931 31,850,128 28,471,523

Investments in Joint Venture 7 4,609,875 4,470,787 2,633,172

------------------------------------ ------- ----------------- --------------- -----------------

39,933,722 38,039,252 32,979,500

------------------------------------ ------- ----------------- --------------- -----------------

Current assets

Trade and other receivables 1,561,964 995,129 841,338

Cash and cash equivalents 80,964 1,996,957 4,950,800

------------------------------------ ------- ----------------- --------------- -----------------

1,642,928 2,992,086 5,792,138

------------------------------------ ------- ----------------- --------------- -----------------

Total assets 41,576,650 41,031,338 38,771,638

------------------------------------ ------- ----------------- --------------- -----------------

Non-current liabilities

Deferred tax liabilities 496,045 496,045 496,045

------------------------------------ ------- ----------------- --------------- -----------------

496,045 496,045 496,045

Current liabilities

Trade and other payables 1,144,753 524,286 495,092

1,144,753 524,286 495,092

------------------------------------ ------- ----------------- --------------- -----------------

Total liabilities 1,640,798 1,020,331 991,137

------------------------------------ ------- ----------------- --------------- -----------------

Net assets 39,935,852 40,011,007 37,780,501

------------------------------------ ------- ----------------- --------------- -----------------

Capital and reserves attributable

to

equity holders of the Company

Share capital 7,493,002 7,492,041 7,492,041

Share premium 61,083,615 60,903,995 60,903,995

Shares to be issued 11 1,310,000 - -

Other reserves (6,541,770) (5,635,169) (6,692,087)

Retained losses (23,408,995) (22,749,860) (23,923,448)

------------------------------------ ------- ----------------- --------------- -----------------

Total equity 39,935,852 40,011,007 37,780,501

------------------------------------ ------- ----------------- --------------- -----------------

(1) Refer to Note 7

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

Share Share Shares Other Retained Total

capital premium to be reserves losses GBP

GBP GBP issued GBP GBP

GBP

----------- ------------ ----------- ------------- -------------- -------------

Balance as at 1

January 2022 7,484,355 55,705,882 - (7,213,274) (24,448,172) 31,528,791

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Loss for the period - - - - (1,588,679) (1,588,679)

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Other comprehensive

income for the year

Items that may be -

subsequently reclassified

to profit or loss

Currency translation

differences - - - 521,187 - 521,187

Total comprehensive

income for the year - - - 521,187 (1,588,679) (1,067,492)

Proceeds from share

issues 7,686 5,372,313 - - - 5,379,999

Issue costs - (174,200) - - - (174,200)

Total transactions

with owners, recognised

in equity 7,686 5,198,113 - - - 5,205,799

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Balance as at 30

June 2023 (as reported

in 2022 interims) 7,492,041 60,903,995 - (6,692,087) (26,036,851) 35,667,098

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Prior year adjustment

(note 7) - - - - 2,113,403 2,113,403

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Balance as at 30

June 2022 (Restated

(1) ) 7,492,041 60,903,995 - (6,692,087) (23,923,448) 37,780,501

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Balance as at 1

January 2023 7,492,041 60,903,995 - (5,635,169) (22,749,860) 40,011,007

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Loss for the period - - - - (659,135) (659,135)

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Other comprehensive

income for the year

Items that may be

subsequently reclassified

to profit or loss

Currency translation

differences - - - (906,600) - (906,600)

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Total comprehensive

income for the year - - - (906,600) (659,135) (1,565,735)

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Proceeds from share

issues 580 - - - - 580

Share based payment 380 179,620 10,000 - - 190,000

Shares to be issued

(refer to Note 11) - - 1,300,000 - - 1,300,000

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Total transactions

with owners, recognised

in equity 960 179,620 1,310,000 - - 1,490,580

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

Balance as at 30

June 2023 7,493,002 61,083,615 1,310,000 (6,541,770) (23,408,995) 39,935,852

----------------------------- ----------- ------------ ----------- ------------- -------------- -------------

(1) Refer to Note 7

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

6 months 6 months

to 30 June to 30 June

2023 Unaudited 2022 Unaudited

GBP (Restated

(1) )

GBP

------------------------------------------------- ---- ----------------- -----------------

Cash flows from operating activities

(Loss)/Profit before taxation (659,135) 524,724

Adjustments for:

Depreciation 178,286 183,963

Share based payments 180,000 -

Loss on sale of property, plant and equipment 4,706 -

Net finance (costs)/income (7,372) 887

Foreign exchange loss/(gain) (40,642) -

Share of loss from JV 7 9,455 7,776

Increase in share of net asset on joint

venture 7 (148,543) (555,803)

Decrease/(Increase) in trade and other

receivables 738,165 (187,438)

Increase/(Decrease)in trade and other payables 621,438 (637,182)

Net cash generated/(used in) from operations 876,358 (663,073)

------------------------------------------------- ---- ----------------- -----------------

Cash flows from investing activities

Purchase of property, plant and equipment (90,228) (243,514)

Proceeds from sale of property, plant and

equipment (49) 24,119

Interest received 6,378 634

Purchase of intangible assets (2,759,158) (2,075,719)

Net cash (used in) investing activities (2,843,057) (2,294,480)

------------------------------------------------- ---- ----------------- -----------------

Cash flows from financing activities

Proceeds from share issues 580 5,380,000

Cost of share issues - (174,330)

Interest paid (10) (95)

Proceeds from borrowings 10 1,647,616 -

Repayment of borrowings 10 (1,601,973) -

Net cash used in financing activities 46,213 5,205,575

------------------------------------------------- ---- ----------------- -----------------

Net (decrease)/increase in cash and cash

equivalents (1,920,486) 2,248,022

Cash and cash equivalents at beginning

of period 1,996,957 2,701,792

Exchange gains on cash and cash equivalents 4,493 986

------------------------------------------------- ---- ----------------- -----------------

Cash and cash equivalents at end of period 80,964 4,950,800

------------------------------------------------- ---- ----------------- -----------------

(1) Refer to Note 7

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

The principal activity of Bluejay Mining plc (the 'Company') and

its subsidiaries (together the 'Group') is the exploration and

development of precious and base metals. The Company's shares are

listed on the AIM Market of the London Stock Exchange ('AIM'), the

Frankfurt Stock Exchange and the OTCQB exchange. The Company is

incorporated and domiciled in the UK.

The address of its registered office is 6 Heddon Street, London,

W1B 4BT.

2. Basis of Preparation

The condensed consolidated interim financial statements have

been prepared in accordance with the requirements of the AIM Rules

for Companies. As permitted, the Company has chosen not to adopt

IAS 34 "Interim Financial Statements" in preparing this interim

financial information. The condensed consolidated interim financial

statements should be read in conjunction with the annual financial

statements for the year ended 31 December 2022. The interim

financial statements have been prepared in accordance with UK

adopted International Accounting Standards.

The interim financial information set out above does not

constitute statutory accounts within the meaning of the Companies

Act 2006. It has been prepared on a going concern basis in

accordance with the recognition and measurement criteria of UK

adopted International Accounting Standards.

Statutory financial statements for the year ended 31 December

2022 were approved by the Board of Directors on 29 June 2023 and

delivered to the Registrar of Companies. The report of the auditors

on those financial statements was unqualified with material

uncertainty related to going concern.

Going concern

The Consolidated Financial Statements have been prepared on a

going concern basis. The Group's business activities, together with

the factors likely to affect its future development, performance

and position are set out in the Chairman's Statement and the

Strategic Report.

As at 30 June 2023, the Group had cash and cash equivalents of

GBP80,964, which did not include the GBP1.3 million (gross) from

the placing announced on 28 June 2023 and was received post-period

end. The Directors have prepared cash flow forecasts to 30

September 2024, which take account of the cost and operational

structure of the Group and parent company, planned exploration and

evaluation expenditure, licence commitments and working capital

requirements. These forecasts indicate that the Group and parent

company's cash resources are not sufficient to cover the projected

expenditure for the period for a period of 12 months from the date

of approval of these financial statements. These forecasts indicate

that the Group and parent company, in order to meet their

operational objectives, and meets their expected liabilities as

they fall due, will be required to raise additional funds within

the next 12 months.

In common with many exploration and evaluation entities, the

Company will need to raise further funds within the next 12 months

in order to meet its expected liabilities as they fall due, and

progress the Group into definitive feasibility and then into

construction and eventual production of revenues. The Directors are

confident in the Company's ability to raise additional funds as

required, from existing and/or new investors, within the next 12

months. The Company has demonstrated its access to financial

resources, as evidenced by the successful completion of a Placing

in July 2023 raising gross proceeds of GBP1.3 million and August

raising gross proceeds of GBP600,000.

Given the Group and parent company's current cash position and

its demonstrated ability to raise capital, the Directors have a

reasonable expectation that the Group and parent company has

adequate resources to continue in operational existence for the

foreseeable future.

Notwithstanding the above, these circumstances indicate that a

material uncertainty exists that may cast significant doubt on the

Group and parent company's ability to continue as a going concern

and, therefore, that the Group and parent company may be unable to

realise their assets or settle their liabilities in the ordinary

course of business. As a result of their review, and despite the

aforementioned material uncertainty, the Directors have confidence

in the Group and parent company's forecasts and have a reasonable

expectation that the Group and parent company will continue in

operational existence for the going concern assessment period and

have therefore used the going concern basis in preparing these

consolidated and parent company financial statements.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Company's medium

term performance and the factors that mitigate those risks have not

substantially changed from those set out in the Company's 2022

Annual Report and Financial Statements, a copy of which is

available on the Company's website: www.bluejaymining.com . The key

financial risks are liquidity risk, credit risk, interest rate risk

and fair value estimation.

Critical accounting estimates

The preparation of condensed consolidated interim financial

statements requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities at the

end of the reporting period. Significant items subject to such

estimates are set out in Note 4 of the Group's 2022 Annual Report

and Financial Statements. The nature and amounts of such estimates

have not changed significantly during the interim period.

3. Accounting Policies

Except as described below, the same accounting policies,

presentation and methods of computation have been followed in these

condensed consolidated interim financial statements as were applied

in the preparation of the Group's annual financial statements for

the year ended 31 December 2022.

3.1 Changes in accounting policy and disclosures

(a) Accounting developments during 2023

The International Accounting Standards Board (IASB) issued

various amendments and revisions to International Financial

Reporting Standards and IFRIC interpretations. The amendments and

revisions were applicable for the period ended 30 June 2023 but did

not result in any material changes to the financial statements of

the Group or Company.

(b) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

Standards, amendments and interpretations that are not yet

effective and have not been early adopted are as follows:

Standard Impact on initial application Effective date

---------- ------------------------------- ----------------

IAS 1 Classification of Liabilities 1 January 2024

as Current or Non-Current.

------------------------------- ----------------

The Group is evaluating the impact of the new and amended

standards above which are not expected to have a material impact on

the Group's results or shareholders' funds.

4. Dividends

No dividend has been declared or paid by the Company during the

six months ended 30 June 2023 (2022: GBPnil).

5. Property, plant and equipment

Software Machinery Office Right Total

GBP & equipment equipment of use GBP

GBP GBP assets

GBP

------------------------- ---------- -------------- ------------ --------- -----------

Cost

As at 1 January 2022 53,817 3,203,738 76,155 - 3,333,710

Additions - 237,141 6,373 - 243,514

Disposals - (45,693) - - (45,693)

Exchange Differences - 71,389 - - 71,389

As at 30 June 2022 53,817 3,466,575 82,528 - 3,602,920

------------------------- ---------- -------------- ------------ --------- -----------

As at 1 July 2022 53,817 3,466,575 82,528 - 3,602,920

Additions 7,417 1,171 1,697 - 10,285

Disposals - (90,643) - - (90,643)

Exchange Differences - 94,917 266 - 95,183

------------------------- ---------- -------------- ------------ --------- -----------

As at 31 December 2022 61,234 3,472,020 84,491 - 3,617,745

------------------------- ---------- -------------- ------------ --------- -----------

As at 1 January 2023 61,234 3,472,020 84,491 - 3,617,745

Additions - 79,229 10,999 - 90,228

Disposals (43,819) (17,390) (39,507) - (100,716)

Exchange Differences - (95,900) (179) - (96,079)

------------------------- ---------- -------------- ------------ --------- -----------

As at 30 June 2023 17,415 3,437,959 55,804 - 3,511,178

------------------------- ---------- -------------- ------------ --------- -----------

Depreciation

------------------------- ---------- -------------- ------------ --------- -----------

As at 1 January 2022 45,381 1,432,010 53,940 - 1,531,331

Charge for the year 4,147 173,809 6,007 - 183,963

Disposals - (21,574) - - (21,574)

Exchange differences - 34,395 - - 34,395

As at 30 June 2022 49,528 1,618,640 59,947 - 1,728,115

------------------------- ---------- -------------- ------------ --------- -----------

As at 1 July 2022 49,528 1,618,640 59,947 - 1,728,115

Charge for the year 4,288 176,593 4,870 - 185,751

Disposals - (66,251) - - (66,251)

Exchange differences - 51,444 349 - 51,793

As at 31 December 2022 53,816 1,780,426 65,166 - 1,899,408

As at 1 January 2023 53,816 1,780,426 65,166 - 1,899,408

Charge for the year 3,499 167,381 4,818 - 175,698

Disposals (43,819) (14,886) (37,354) - (96,059)

Exchange differences - (50,785) - - (50,785)

------------------------- ---------- -------------- ------------ --------- -----------

As at 30 June 2023 13,496 1,882,136 32,630 - 1,928,262

------------------------- ---------- -------------- ------------ --------- -----------

Net book value as at

30 June 2022 4,289 1,874,935 22,581 - 1,874,805

------------------------- ---------- -------------- ------------ --------- -----------

Net book value as at

31 December 2022 7,418 1,691,594 19,325 - 1,718,337

------------------------- ---------- -------------- ------------ --------- -----------

Net book value as at

30 June 2023 3,919 1,555,823 23,174 - 1,582,916

------------------------- ---------- -------------- ------------ --------- -----------

6. Intangible Assets

Intangible assets comprise exploration and evaluation costs and

goodwill. Exploration and evaluation costs comprise acquired and

internally generated assets.

Cost and Net Book Value Exploration & evaluation

assets

GBP

-------------------------------- --------------------------

Balance as at 1 January 2022 27,922,589

Exchange rate movements 558,362

Additions 2,075,719

Licenses transferred to JV at

NBV (2,085,147)

--------------------------------- --------------------------

As at 30 June 2022 28,471,523

--------------------------------- --------------------------

Balance as at 1 July 2022 28,471,523

Additions 2,668,971

Exchange rate movements 709,634

--------------------------------- --------------------------

As at 31 December 2022 31,850,128

--------------------------------- --------------------------

Balance as at 1 January 2023 31,850,128

Additions 2,759,158

Exchange rate movements (868,355)

As at 30 June 2023 33,740,931

--------------------------------- --------------------------

7. Investments in Joint Venture

During the 2021 financial year, Disko Exploration Ltd entered

into a joint venture agreement with Kobold Metals to drill in

Greenland for critical materials used in electric vehicles. On 1

February 2022, the joint venture company, Nikkeli Greenland AS

("Nikelli"), was incorporated and the specific licences were

transferred to Nikkeli.

Proportion of ownership

interest held

------------------------------------------------------- ----------- ---------------------------

Name Country of incorporation 30 June 2023 30 June 2022

--------------------------- ------------------------------ -------------------- --------------

Nikkeli Greenland A/S Greenland 49% 49%

--------------------------- ----------------------------------- --------------- --------------

GBP

Interest in joint venture 2,085,147

Share of loss in joint venture (7,776)

Increase in share of net asset 555,801

------------------------------------- -----------

As at 30 June 2022 (Restated (1) ) 2,633,172

------------------------------------- -----------

As at 1 July 2022 (Restated (1) ) 2,633,172

------------------------------------- -----------

Share of loss in joint venture (64,180)

------------------------------------- -----------

Increase in share of net asset 1,901,795

------------------------------------- -----------

As at 31 December 2022 4,470,787

------------------------------------- -----------

As at 1 January 2023 4,470,787

Share of loss in joint venture (9,455)

Foreign exchange differences (29,267)

Increase in share of net asset 177,810

-----------

As at 30 June 2023 4,609,875

-----------

Summarised financial information

Nikkeli Greenland A/S 6 months 6 months to

to 30 June 30 June 2022

2023 Unaudited Unaudited

Restated (1)

GBP GBP

Current assets 2,480 611,633

Non-current assets 9,513,942 5,360,158

Current liabilities 108,515 597,970

9,407,907 5,373,821

----------------- ---------------

6 months 6 months to

to 30 June 30 June 2022

2023 Unaudited Unaudited

Restated (1)

GBP GBP

Revenues - -

(Loss) after tax from continuing operations (19,296) (7,776)

----------------- ---------------

(19,296) (7,776 )

----------------- ---------------

6 months 6 months to

to 30 June 30 June 2022

2023 Unaudited Unaudited

Restated (1)

GBP GBP

Opening net assets 9,124,054 -

Assets acquired during the period 353,037 5,381,597

Loss for the period (9,455) (7,776)

Other comprehensive income - -

Foreign exchange differences (59,729) -

----------------- ---------------

Closing net assets 9,407,907 5,373,821

----------------- ---------------

Interest in joint venture at 49% 4,609,875 2,633,172

----------------- ---------------

Carrying value 4,609,875 2,633,172

----------------- ---------------

The financial statements of the JV are prepared for the same

reporting period as the Group. When necessary, adjustments are made

to bring the accounting policies in line with those of the Group.

This adjustment is retrospective and therefore an amendment has

been made to the prior year interim figures to bring them in line

with the equity method accounting policy adopted in the Financial

Statements for the year end 31 December 2022.

Increase in share of net assets is a non-cash adjustment to

increase/(decrease) the Group's ownership in the Joint Venture to

49% from additional contributions by the JV Partner.

Nikkeli Greenland A/S had no contingent liabilities or

commitments as at 30 June 2023.

(1) Restatement of 30 June 2022 Balances

The variance observed in the comparative figures for June 30,

2022, can be attributed to the alignment of the accounting policies

between the Joint Venture and the Group during the 31 December 2022

audit. Specifically, the policies brought into alignment were in

respect to the capitalisation of expenses that meet the criteria

outlined in IFRS 6, as well as the accounting treatment of the

share of net assets.

Impact on statement of profit or loss ((increase/(decrease) in

profit)

6 months

to 30 June

2022 Unaudited

GBP

------------------------------------------------------------- -----------------

Period ended 30 June 2022 (as reported in 2022 interims) (1,588,679)

Adjustments made to align accounting polices:

Increase in share of net assets on joint venture 555,803

Share of loss in joint venture 1,557,600

------------------------------------------------------------- -----------------

Period ended 30 June 2022 (Restated) 524,724

------------------------------------------------------------- -----------------

8. Other income

6 months 6 months

to 30 June to 30 June

2023 Unaudited 2022 Unaudited

GBP GBP

------------------------------ ----------------- -----------------

Income from related parties 165,851 836,361

165,851 836,361

----------------- -----------------

9. Earnings per Share

The calculation of earnings per share is based on a loss of GBP

659,135 for the six months ended 30 June 2023 (profit for six

months ended 30 June 2022: GBP524,724) and the weighted average

number of shares in issue in the period ended 30 June 2023 of

1,058,677,266 ( six months ended 30 June 2022: 1,014,895,493 ).

The calculation of diluted earnings per share is based on a

profit of GBP 524,724 for the six months ended 30 June 2023, the

weighted average number of shares in issue in the period ended 30

June 2023 of 1,014,895,493 and the share options exercisable as at

30 June 2023 of 57,275,000. No diluted earnings per share is

presented for the six months ended 30 June 2023 as the effect on

the exercise of share options would be anti-dilutive.

10. Borrowings

On 14 February 2023, the Company received funding for

US$2,000,000 as a convertible loan note. On the same date, the

Company issued 5,800,000 Initial Placement shares at nominal value

and 3,798,911 Commencement shares issued a price of GBP0.047382 per

share to the convertible loan note holder.

On 25 April 2023, the Company mutually agreed to repay the

US$2,000,000 amount received for the convertible loan note.

11. Events after the Reporting Date

On 28 June 2023, the Company raised GBP1,300,000 via the issue

and allotment of 74,285,707 new Ordinary Shares at a price of 1.75

pence per share. On the same day, the Company issued and allotted

571,429 new Ordinary Shares at a price of 1.75 pence per share in

lieu of fees. The shares were admitted to trading on the AIM market

of the London Stock Exchange on 3 July 2023 and have therefore been

classified as "Shares to be Issued".

On 31 July 2023, Finland Investments Limited sold the Company's

Black-Shales assets to Metals One. The consideration for this

transaction is GBP150,000 in cash, due no later than 18 months and

1 day subsequent to the date of completion, the allotment of

62,500,000 new ordinary shares in Metals One for a total value of

GBP3,125,000 with a further allotment of new ordinary shares,

equating to GBP1,000,000 at any time following completion and a

warrant over 7,500,000 new ordinary shares at an exercise price of

GBP0.05 exercisable for a period of 5 years from Admission.

On 31 July 2023, the Company allotted 1,714,285 ordinary shares

of 0.01 pence each, for a total consideration of GBP30,000. The

participation of Robert Edwards, Michael Hutchinson and Peter

Waugh, Directors of the Company, in the Subscription is considered

a related party transaction for the purposes of AIM Rule 13 of the

AIM Rules for Companies.

On 23 August 2023, the Company allotted 60,000,000 shares of

0.01 pence each, at a price of 1.0 pence per share, for a total

consideration of GBP600,000.

12. Approval of interim financial statements

The Condensed interim financial statements were approved by the

Board of Directors on 28 September 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEMFWAEDSESU

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

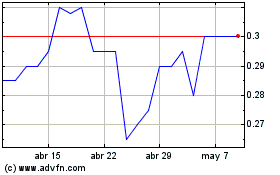

Bluejay Mining (LSE:JAY)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Bluejay Mining (LSE:JAY)

Gráfica de Acción Histórica

De May 2023 a May 2024