TIDMJCGI

RNS Number : 5900J

JPMorgan China Growth & Income PLC

13 December 2022

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN CHINA GROWTH & INCOME PLC

FINAL RESULTS FOR THE YEARED 30TH SEPTEMBER 2022

Legal Entity Identifier: 549300S8M91P5FYONY25

Information disclosed in accordance with DTR 4.2.2

The Directors announce the Company's results for the year ended

30th September 2022.

CHAIRMAN'S STATEMENT

Our Company has navigated several periods of extreme volatility

during the 28 years since its launch. Unfortunately, the year ended

30th September 2022 has proved to be one of the most challenging of

these periods, in terms of the Chinese economy, its stock markets

and our Company. Market sentiment had already been shaken by

concerns about China's slowing economic growth, its commitment to

its 'zero-COVID' policy and heightened tensions between China and

the US. It deteriorated further, amidst news of draconian localised

COVID lockdowns and China's interventionist policies. At the same

time, sentiment was buffeted by broader concerns about global

challenges in the aftermath of the COVID pandemic and the Russian

invasion of Ukraine, particularly in terms of inflation, interest

rates, and global supply chains, as well as more local concerns

about China's relationship with Taiwan. Against this backdrop,

growth stocks, which dominate our portfolio, fell sharply out of

favour.

Faced with these challenges, the Company's total return on net

assets fell -36.7% over the year, underperforming the MSCI China

Index, which declined 22.0% The Company delivered a return to

Ordinary shareholders of -38.5%, reflecting a widening in the

discount at which the shares traded over the 12 month period. While

this short-term performance is disappointing, we are encouraged

that over the longer term, our Company has made positive absolute

returns, comfortably outperforming the benchmark over three, five

and ten years. Our Company generated an annualised return of 10.7%

in terms of net asset value over the last ten years. UK based

shareholders may be interested to note that, over the same period,

the FTSE All-Share Index generated an annualised return of

6.0%.

Full details of investment performance, changes to the portfolio

and the outlook can be found in the Investment Managers' Report in

the Annual Report.

The Board was unable to visit Asia this year because of COVID

regulations, so once again we held a three day virtual China visit.

We had detailed discussions with economists and political

commentators, and with JP Morgan's analysts in Shanghai, Hong Kong

and Taiwan covering key sectors of our portfolio. The Board expects

to visit Asia in May 2023.

Environment, Social and Governance ('ESG') considerations

The Manager believes that sustainable companies are more

attractive investments, able to deliver superior returns over time,

so the consideration of ESG factors has long been a critical part

of the investment process. The Investment Managers' Report in the

Annual Report describes the developments in the ESG process that

have taken place during the year together with examples of how

these are implemented in practice. There is also a separate ESG

section in the Annual Report which explains JP Morgan's overall

approach to ESG. We provide a standalone, comprehensive report

covering ESG metrics in the Documents section on our website.

Dividend

In line with the Company's dividend policy, for the year ended

30th September 2022, four quarterly dividends of 5.70 pence were

paid to shareholders. For the year to 30th September 2023, in the

absence of unforeseen circumstances, a quarterly dividend of 3.42

pence per share will be paid. This represents an annual dividend of

4% of the Company's NAV as at 30th September 2022.

Gearing

In July 2021, the Company extended its GBP50 million loan

facility (with an option to increase to GBP60 million) with

Scotiabank for a further two years. In November 2021 the Board

decided to exercise the accordion facility, thereby increasing the

loan facility to GBP60 million. During the financial year the

Company had to repay some of the commitment to avoid breach of loan

covenants created by the decline in net assets, amidst periods of

extreme market volatility.

At the year-end the Company was 17.2% geared, having averaged

approximately 15.6% throughout the year and, at the time of

writing, was 14.0%. The Investment Managers have the flexibility to

manage the gearing facility within a range set by the Board of 10%

net cash to 20% geared, subject to daily market movements.

Share Issues and Repurchases

At last year's Annual General Meeting ('AGM'), shareholders

granted the Directors authority to allot new shares and to

repurchase the Company's shares for cancellation or to be held in

Treasury. During the year, the Company did not repurchase or allot

any shares. As in previous years, the Board's objective is to use

share repurchase and share issuance authorities to help reduce the

volatility in discounts and premiums by managing imbalances between

supply and demand. We are therefore seeking approval from

shareholders to renew the share issuance and repurchase authorities

at the AGM.

The Board

Following the retirement of John Misselbrook after the AGM in

January 2022, the size of the Board returned to five Directors, who

offer a diverse range of skills, experience, gender and ethnicity.

In July 2022, the Board, through its Nomination Committee, carried

out a comprehensive evaluation of the Board, its Committees, the

individual Directors and the Chairman. Topics evaluated included

the size and composition of the Board, Board information and

processes, shareholder engagement, training and accountability. The

evaluation confirmed the efficacy of the Board.

In accordance with good corporate governance, all Directors will

stand for reappointment at the forthcoming AGM.

Review of services provided by the Manager

During the year, the Board, through its Management Engagement

Committee, carried out a thorough review of the investment

management, secretarial and marketing services provided to the

Company by the Manager, as well as the Depositary and Registration

services provided to the Company by the outsourced service

providers. Following this review, the Board has concluded that the

continued appointment of the Manager and the outsourced service

providers on the terms agreed is in the interests of the

shareholders as a whole.

The Company's ongoing charges for the financial year, as a

percentage of the average of the daily net assets during the year,

were 1.09% (2021: 0.99%). This small increase reflected the decline

in net assets during the period, combined with the relatively high

proportion of fixed costs.

Shareholder Engagement

Over the last five years, our Company's shareholder base has

changed significantly, with retail investors now representing 84.0%

of our register. The Board understands that retail investors hold

their shares in different ways, direct, through wealth managers and

on investment platforms and not all of these make it easy to

participate through voting at the Annual General Meeting. We are

actively trying to find ways to improve this. I would urge you all

to ensure your voice is heard by ensuring your holding is voted at

the AGM.

Continuation of the Company

In accordance with the Company's Articles of Association, an

ordinary resolution will be put to shareholders at the forthcoming

AGM that the Company continues in existence as an investment trust

for a further five-year period.

While all investment styles will deliver returns that vary over

time, the Board believes that the Manager's approach remains

appropriate for the Company and that JPMorgan Asset Management has

the appropriate resources to continue to manage the Company

successfully. Over the last five years, the Company's total return

on net assets has increased +25.0%, significantly outperforming its

benchmark, the MSCI China Index, which declined -9.7% during the

same period. While short-term challenges remain, the Board believes

that continued investment in China offers attractive long-term

growth opportunities. The Investment Managers continue to find

attractively priced, quality companies that offer long-term growth,

consistent with the Company's investment strategy.

Accordingly, the Board believes that the continuation of the

Company is in the best interests of all shareholders and strongly

recommends that shareholders vote in favour of the resolution at

the AGM on 6th February 2023 as the Directors intend to do so in

respect of their own holdings. Given the importance of this

resolution, shareholders are encouraged to vote, either in person

at the AGM, or by completing a Form of Proxy/Voting Instruction

Form.

Following the continuation vote at the AGM in January 2018, to

confirm the Board's continuing commitment to its objective of

long-term capital growth by investment in 'Greater China'

companies, the Board agreed an obligation to put forward proposals

for a tender offer for up to 15% of the Company's issued share

capital at a price equal to the net asset value ('NAV') less costs,

if, over the five years (from 1st October 2017) the Company's NAV

underperforms its benchmark. As the Company's NAV outperformed its

benchmark significantly during this period, this tender offer has

not been triggered.

Annual General Meeting

We are delighted that this year we are able to invite

shareholders to join us in person for the Company's twenty-eighth

AGM to be held on Monday, 6th February 2023 at 11.30 a.m. at 60

Victoria Embankment, London EC4Y 0JP. The Board hopes to welcome as

many shareholders as possible.

As with previous years, you will have the opportunity to hear

from the Investment Managers. Their presentation will be followed

by a question and answer session. There will also be refreshments

afterwards, when shareholders will be able to meet members of the

Board. Shareholders wishing to follow the AGM proceedings but

choosing not to attend will be able to view them live and ask

questions through conferencing software. Details on how to register

together with access details can be found on the Company's website:

www.jpmchinagrowthandincome.co.uk, or by contacting the Company

Secretary at invtrusts.cosec@jpmorgan.com.

In accordance with normal practice, all voting on the

resolutions will be conducted on a poll. Due to technological

reasons, shareholders viewing the meeting via conferencing software

will not be able to vote on the poll and we therefore encourage all

shareholders, and particularly those who cannot attend physically,

to submit their proxy votes in advance of the meeting, so that they

are registered and recorded at the AGM. Proxy votes can be lodged

in advance of the AGM either by post or electronically: detailed

instructions are included in the Notes to the Notice of Annual

General Meeting in the Annual Report. In addition, shareholders are

encouraged to send any questions ahead of the AGM to the Board via

the Company Secretary at the email address above. We will endeavour

to answer relevant questions at the meeting or via the website

depending on arrangements in place at the time.

If there are any changes to the above AGM arrangements, the

Company will update shareholders through its website and, as

appropriate, through an announcement on the London Stock

Exchange.

Outlook

After hitting lows in October 2022, Chinese stock markets have

made up some lost ground, following President Xi's meeting with

President Biden at the G20 session, indications of a gradual

relaxation of China's 'zero-COVID' policy, and China's easing of

its monetary and fiscal policies. Since the year-end, as at 8th

December 2022, the Company's total return on net assets increased

+9.6% over the period, outperforming the MSCI China Index, which

rose +3.9%. In addition, the Company's return to Ordinary

shareholders increased +13.4%, reflecting a narrowing in the

discount at which the shares traded over since the year-end. As a

Board, we believe markets are likely to remain volatile, as long as

China's 'zero-COVID' policy is in place, and risks remain of

increased COVID cases once this policy ends. Other challenges,

ranging from the uncertainties in the Chinese property market and

the financial health of the nation's regional governments to global

supply chains and China's relations with Taiwan and the US, may

also impact short-term performance.

Nevertheless, we share our Investment Managers' optimism about

the long-term prospects for the Chinese economy, and the

opportunities that this will provide the patient investor, and we

believe our Company deserves a place within any fully diversified

global portfolio. Over the years, our disciplined Investment

Managers have demonstrated their skills in navigating turbulent

markets by focusing on investing in attractively priced, quality

companies that offer sustainable long-term growth. We remain

confident that our investment strategy, combined with the skills

and experience of our well resourced investment team, will enable

our Company to deliver superior returns over the longer term.

Alexandra Mackesy

Chairman 13th December 2022

INVESTMENT MANAGERS' REPORT

Introduction

During the financial year ended 30 September 2022, the Company's

net assets declined 36.7% (in sterling terms) compared to a

benchmark decline of 22.0%. This performance is a disappointment to

us, but we remind shareholders that it is not unusual for the

Company to experience volatility in performance over short periods.

In our view, it is more meaningful to assess performance over

longer timeframes. On this basis, the Company has made positive

absolute returns and outperformed the benchmark over three, five

and ten years. Over the ten years to end September 2022, it

generated an annualised return of 10.7%, in NAV terms, and 10.9% on

a share price basis, compared to a market return of 6.3%.

Setting the scene

The past year has been an especially challenging one for global

equity markets for several reasons. Inflation pressures kindled by

the COVID-19 pandemic, including supply shortages of electronic

components essential to the production of electric vehicles and a

wide range of consumer goods, were fuelled by Russia's invasion of

Ukraine, which drove up energy and other commodity prices. The

determination of the US Federal Reserve and other central banks to

quash inflation with a series of aggressive interest rate increases

and hawkish forward guidance raised the spectre of recession and

global equity markets fell sharply. The valuations of long-term

growth - so-called long duration - stocks in the technology and

related sectors were hit especially hard.

The Chinese markets were not immune to these developments, but

investor sentiment was further damaged by several other adverse

developments unique to China. Key amongst these was the sharp

deterioration in China's growth outlook. China's GDP is now

expected to rise by only 3% in 2022, less than half its growth rate

over the past few years, due partially to the government's pursuit

of its 'zero-COVID' policy. Unlike most countries, which have opted

to live with the virus now vaccines are widely available, China has

persevered with strict prevention measures, including lockdowns, to

eliminate outbreaks. These actions severely curtailed economic

activity in many regions, and it is uncertain when the government's

approach will relent. These actions severely curtailed economic

activity in many regions during the review period. More recently,

however, the government has relaxed its COVID policies, which

should lead to more normalisation in 2023.

The review period has also seen a significant correction in

China's residential property market, sparked by government

restrictions on borrowing by developers and home buyers. New home

sales have fallen 30% in the past year. This sector accounts for

about a quarter of China's economic output, so this sharp decline

is also weighing on near-term growth prospects.

Uncertainties about growth and the near-term prospects of the

property sector have been exacerbated by mounting geo-political

tensions between China and the West, and by questions about the

implications of the expected appointment of President Xi to an

unprecedented third term in office. As a result, even though

Chinese inflation pressures have been limited, and the authorities

are now easing both monetary and fiscal policy, China's stock

market sustained heavy losses over the review period.

Performance commentary

This sell-off hit portfolio performance. The Company had an

average gearing of 15.6% throughout the financial year and this

additional exposure to the declining market was the single largest

source of performance detraction, after stock selection.

The Company's large exposure to growth sectors and stocks,

particularly Health Care, Technology, and Communication companies,

was a key drag on performance, as was the structural underweight

position in low-growth sectors, in particular Energy and

Financials, as these sectors outperformed over the period.

Performance attribution

Year ended 30th September 2022

% %

Contributions to total returns

------ ------

Benchmark return -22.0

------ ------

Sector allocation 3.6

------ ------

Stock selection -10.9

------ ------

Currency -1.7

------ ------

Gearing/net cash -5.1

------ ------

Investment Manager contribution -14.1

------ ------

Dividend/residual 0.5

------ ------

Portfolio total return -35.6

------ ------

Management fee/Other expenses -1.1

------ ------

Net asset value total return -36.7

------ ------

Ordinary share price total return -38.5

------ ------

Source: Factset, JPMAM, Morningstar.

Performance attribution analyses how the Company achieved its

recorded performance relative to its benchmark.

By sector, the Company's overweight exposure to Health Care

detracted from performance. WuXi Biologics, a contract research

company, was negatively affected by supply chain disruption

resulting from increasing geopolitical headwinds. In addition,

Broncus Holding Corp and Venus Medtech, producers of medical

devices, were negatively affected by pricing pressure from the

Chinese government's procurement programme. We have trimmed our

positions in WuXi Biologics during the year, but it remains a top

10 holding given its continued competitiveness and the current

valuation.

Technology is another sector that hurt performance. Key

detractors over the period included Silergy Corp, a semiconductor

manufacturer, Sunny Optical Technology, a producer of optical

products and scientific instruments, and Kingdee International

Software Group, which provides business software. However, we have

largely maintained our positions in these names due to their

positive long-term prospects, which are supported by increasing

import substitution and market share gains.

Within Communication, the Company's position in Bilibili, a

gaming and multimedia company, was a key performance detractor. It

was hit by delays to approvals for new on-line games and by a

slower than expected advertising business ramp-up, due to weak

macro-economic conditions. We therefore reduced our exposure.

Although we remain underweight in Real Estate, an overweight

position in Country Garden Services, a property management company,

detracted from returns due to concerns about slower new property

sales and the solvency of its parent company, Country Garden.

Financials also detracted from performance. We have avoided

exposure to large state-owned banks such as China Construction Bank

Corporation and Bank of China because their long-term growth

prospects are not promising. However, these names tend to trade

more defensively than the overall market, given their undemanding

valuations and dividend support, and this helped their relative

performance over the review period.

Relative Stock return Impact

weight

Top 10 Detractors Company description (%) (%) (%)

----------------------- ------------------------------------------- --------- ------------- -------

Country Garden Residential property management

Services company 1.8 -77.2 -1.3

Video sharing platform

that is also involved in

mobile gaming,

Bilibili e-commerce and live broadcasting 1.9 -70.2 -1.3

Leading contract development

WuXi Biologics and manufacturing organisation

(Cayman) in the biologics space 2.5 -55.0 -0.9

Medical device company

that focuses on the development

of interventional pulmonology

Broncus Holding products 0.5 -85.1 -0.7

Leading enterprise software

provider specializing in

Kingdee International finance, accounting and

Software broader ERP solutions 2.1 -52.8 -0.6

China Construction One of the largest banks

Bank in China -2.9 4.6 -0.6

Leading medical device

maker involved in transcatheter

Venus Medtech structural heart valvular

(Hangzhou) therapies in China 0.8 -72.7 -0.6

Manufacturer of power management

Silergy integrated circuits 1.4 -56.3 -0.5

One of the largest China-based

contract development and

manufacturing companies

providing fully integrated

solutions in the chemical-pharmaceutical

Asymchem Laboratories and biologic sectors 0.9 -58.8 -0.5

One of the largest banks

Bank of China in China -1.3 20.5 -0.4

----------------------- ------------------------------------------- --------- ------------- -------

Positioning decisions that enhanced returns over the period

included our significant overweight positions in Renewable Energy.

Tongwei, a producer of polysilicon used in solar panels, and Suzhou

Maxwell, a solar cell manufacturing equipment maker, were amongst

key performance contributors thanks to strong demand and technology

innovation in the sector.

Two Consumer businesses, Pinduoduo, an ecommerce platform, and

Meituan, China's largest food delivery service provider, also

contributed positively thanks to their improved profitability,

despite the tough market environment.

The Company exited Alibaba on the view that the company is

unlikely to return to its previous high growth territory, due to

some tightening in the sector's regulatory environment. This

underweight position contributed to performance over the year.

Top 10 Positive Company description Relative Stock return Impact

Contributors weight (%) (%) (%)

Leading e-commerce company

that offers a comprehensive

digital infrastructure to

Alibaba empower digitalization -7.3 -28.9 0.7

Largest producer of polysilicon

and cells used in solar

Tongwei panels 2.4 2.3 0.6

Solar equipment manufacturer

Suzhou Maxwell with a focus on heterojunction

Technologies solar cell technology 0.7 52.4 0.4

Leader Harmonious Industrial robot equipment

Drive Systems manufacturer 0.5 83.9 0.4

Leading Chinese smartphone

maker offering various hardware

Xiaomi and software products -1.2 -49.7 0.4

Leading provider of self-developed

mobile and PC games along

NetEase with multimedia services 1.5 10.4 0.4

Niche analog IC design company

supplying high-speed server

Montage Technology DRAM modules 1.4 -3.5 0.3

One of the largest private

energy groups in China involved

in distribution of natural

ENN Energy gas 1.5 0.1 0.3

One of the largest process

Zhejiang Supcon automation control system

Technology providers in China 1.0 1.9 0.3

Engages in production of

Shenzhen Inovance electric control industrial

Technology automations 1.5 -0.3 0.2

-------------------- ------------------------------------ ------------ ------------- -------

Transactions and sector allocation

Despite the challenging macro environment and geopolitical

uncertainties, we continue to focus on identifying bottom-up stock

opportunities that can provide the Company's shareholders long-term

growth and return.

The most noteworthy increase in exposure over the past year has

been to Industrial names. The portfolio's overweight exposure to

this sector has almost doubled to around 13% as we expect it to

benefit from China's push to upgrade its manufacturing performance

and realise its ambitions to achieve carbon neutrality and

self-sufficiency. We initiated new positions in several industrial

companies, including Suzhou Maxwell, as mentioned previously,

ZhuZhou CRRC Times, a manufacturer of railway equipment, Beijing

Haufeng Test & Control, a semiconductor testing equipment

producer, and DBAPP Security, a supplier of cybersecurity software

and solutions.

The market volatility over the past year has not been entirely

bad news, as it has created opportunities for us to purchase other

companies across various sectors where we see structural growth

opportunities at particularly attractive levels. Examples include

e-commerce operator JD.com, which is now a top 10 holding, ZTO

Express, a freight and logistics company, and Trip.com, an

accommodation and travel services provider. We also took advantage

of low valuations to top up existing holdings in a number of

companies we favour, including software supplier Beijing Kingsoft

Office, Kanzhun Ltd, a staffing and employment services company,

Zhejiang Supcon Technology, which provides automation and IT

products, and Advanced Micro-Fabrication, a producer of

semiconductor equipment and materials.

In terms of sales, in addition to reducing the sizes of several

holdings mentioned above, we sold our entire positions in companies

that are likely to be adversely impacted by China's growth

slowdown. In addition to the entire sale of our stake in Alibaba,

other disposals included restaurant owner Jiumaojiu, auto

manufacturer Nio and toy maker Pop Mart International, all of which

are likely to feel the effects of weaker consumer spending.

However, the portfolio's overall underweight to the consumer

discretionary sector remained broadly unchanged over the year. The

challenging outlook for the real estate sector also prompted exits

from Xinyi Glass and Skshu Paint Co.

In addition, we sold the Company's holdings in IT infrastructure

company Sangfor Technologies, and electronic components

manufacturer BOE Technology Group. The Company also exited several

health care names, including Everest Medicines, a biotech company,

and Suzhou Basecare Medical, a medical devices company. The

portfolio's overweight positions in Information Technology and

Health Care remain, although they are less significant than

previously. We have maintained the portfolio's substantial

underweight to financials and its smaller underweight to

Communications Services.

The portfolio continues to have no exposure to traditional

Energy producers, reflecting both our concerns about ESG factors

and these companies' poor long-term growth prospects. However, we

increased our exposure to utilities modestly, in part via a new

position in hydropower company China Yangtze Power, because of its

stable operations and the expected asset injection that is earnings

accretive.

These portfolio adjustments have resulted in some changes to the

Company's top 10 holdings over the past year. Tencent remains our

largest holding, comprising 8.4% of our portfolio at 30th September

2022. This positioning is underpinned by our belief that the

company's core competitiveness in social media and gaming remains

unchanged despite regulatory and macroeconomic challenges. On-line

retailers Meituan and Pinduoduo, along with WuXi Biologics and

China Merchants Bank, also continue to feature amongst our largest

holdings, but there are several new names. In addition to JD.com

and Suzhou Maxwell, mentioned above, the Company's top 10 holdings

now include NetEase, a gaming and multimedia company, and Beijing

Kingsoft Office Software, a leading software and internet services

company.

Ten largest investments

As at 30th September

2022 2021

Valuation Valuation

Company Description of Activities GBP'000 %(1) GBP'000 %(1)

----------------- ------------------------------------------------------ -------- ----- -------- -------

Tencent is a Chinese technology company

focusing on internet services. It is the

world's largest video game vendor. It owns

WeChat, among the largest Chinese and therefore

global, social media apps as well as a

number of music, media and payment service

providers. Its venture capital arm has

holdings in over 600 companies with a focus

Tencent on technology start-ups across Asia. 28,091 8.4 46,411 8.9

Meituan is an e-commerce company that offers

services like food, dining and delivery

among others on its platform throughout

Meituan China. 20,417 6.1 20,561 4.0

Founded in 2015, it started as an online

fresh produce vendor before expanding into

a leading social commerce platform serving

close to 900 million users. Pinduoduo pioneered

'Team Purchase' and 'C2M' (consumer to

manufacturer) processes to aggregate user

demand and share the information with manufacturers

to tailor make products according to users'

Pinduoduo preferences. 13,325 4.0 17,451 3.4

JD.com is China's leading one-stop e-commerce

platform, providing 588.3 million active

customers with direct access to a wide

selection of products to tap into China's

fast-growing e-commerce market through

JD.com its mobile applications and websites. 11,940 3.6 - -

NetEase is a leading China-based technology

company involved in developing and operating

online games. Its online gaming services

cover both mobile and personal computer

NetEase games. 8,921 2.7 10,848 2.1

Founded in 2010, WuXi Biologics has become

a leading global Contract Research, Development

and Manufacturing Organization (CRDMO)

offering end-to-end solutions that enable

WuXi Biologics partners to discover, develop and manufacture

(Cayman) biologics from concept to commercialisation. 8,281 2.5 25,758 4.9

CMB is China's first joint-stock commercial

bank wholly owned by corporate legal entities

and the first pilot bank as China promoted

reform in the banking industry with endeavors

outside the government. Since its inception,

CMB has been leading the trends of China's

China Merchants banking industry through a series of pioneering

Bank efforts. 7,766 2.4 11,760 2.3

Shanghai Baosight Software provides information

technology services. Founded 40 years ago,

Baosight is now China's leading provider

of industrial solutions. So far, Baosight

has long been committed to the combination

of information and industrialisation, with

the purpose of assisting iron & steel enterprises

in achieving intelligent manufacturing.

The Company develops automation and information

Shanghai computer software for metallurgy, transportation,

Baosight electric power generation, banking, and

Software other industries. 7,485 2.3 12,262 2.30

Suzhou Maxwell Technologies is principally

engaged in the design, development, production

and sales of intelligent manufacturing

equipment. One of the Company's main products

are solar cell screen printing equipment.

Suzhou The Company distributes its products domestically

Maxwell and overseas. 6,976 2.1 - -

Kingsoft is a leading software and Internet

services company based in China and listed

in Hong Kong. Its two subsidiaries Seasun

and Kingsoft Office develop and distribute

office and anti virus software. With more

Beijing than 5,000 employees worldwide and R&D

Kingsoft centres in Beijing, Zhuhai, Wuhan, Chengdu,

Office Dalian and Hong Kong, the Company enjoys

Software a large market share in China. 6,241 1.8 - -

Ten Largest

Investments 119,443 35.9

------------------------------------------------------------------------- -------- ----- -------- -------

1 Based on total investments of GBP333.2m (30th September 2021:

GBP521.6m). Top ten investments at September 2021 comprised

GBP292.8m with 36.7% of total investments.

Gearing

In terms of gearing, attractive valuations and the opportunities

they represented in some sectors led us to increase portfolio

gearing to 17.2% at the end of the period, up from 10.2% a year

ago. The valuation of Chinese equities became more attractive over

the period, on both traditional valuation metrics such as

price-to-book (P/B) and Price Earnings (P/E), as well as our

internal valuation signal with an average five year expected return

surpassing 20%. We have taken the opportunities of distressed

valuation in some areas, such as Chinese internet, and used gearing

to increase positions in names including Meituan, Pinduoduo, and

JD.com. We have also used the gearing to increase positioning and

add new names in structural growth areas such as high-end

manufacturing, renewable energy, and national security.

ESG Engagement over the year

Our investment philosophy centres on identifying quality

companies with sustainable growth potential. We have a strong

conviction that Environmental, Social and Governance (ESG)

considerations (particularly Governance) should be the foundation

of any long-term investment process. In our view, corporate

policies at odds with such considerations are not sustainable over

time. We therefore believe that integrating ESG factors into the

investment process is critical to its success. To this end, we work

closely with JPMAM's dedicated Sustainable Investment (SI) team,

which pro-actively engages with existing portfolio names on ESG

matters.

Examples of how we have worked with the SI team over the past

year to address ESG issues in our portfolio companies and

information regarding how ESG matters are integrated into our

investment process are detailed in the ESG Report in the Annual

Report. This report includes case studies relating to our ESG

engagement with NetEase, China Merchants Bank and Meituan and our

engagement with NetEase, WuXi Biologics and ENN Energy about proxy

voting.

Outlook

We expect a lot of the macro headwinds discussed above, in

particular the property sector slowdown and the government's

'zero-COVID' policy, to linger in the short term. However, the

Chinese authorities are likely to continue loosening monetary and

fiscal policy in an effort to ease pressures on the property sector

and to counter the disruptions caused by their stringent COVID

policies. These measures will take time to feed through to the real

economy, as consumer and business confidence, and activity, will

not recover until the COVID restrictions are terminated and some

level of normality returns to daily life across the country.

Despite the negative developments over the past year, we remain

optimistic about the long-term prospects for the Chinese economy,

which will continue to be bolstered by the strong entrepreneurial

ethos of China's private businesses and by growing demand from the

country's burgeoning middle class. Furthermore, the government

remains determined to ensure the continued upgrade of Made in

China, a government initiative intended to make the manufacturing

industry more advanced. It will also continue its pursuit of carbon

neutrality and greater self-sufficiency, as mentioned above. These

efforts should underpin sustainable growth and productivity

improvements over the medium term. As such, in our view, Chinese

equities demand a meaningful allocation within any fully

diversified global portfolio.

Current depressed valuations suggest to us that the

deterioration in China's economic outlook and other potential risks

and uncertainties discussed above are now fully discounted by the

market. So now may be a particularly good time to invest in this

market in order to benefit from the country's still positive

long-term growth prospects. This view is supported by valuation

metrics. Our proprietary, five-year expected return model, as well

as familiar measures such as price-to-book (P/B) and Price Earnings

(P/E) ratios, have all reached historical lows, suggesting that a

sustained recovery in Chinese equity prices is likely soon.

We believe that the Company's long track record of outright

gains and outperformance of the market attests both to the

advantages of being on the ground here in China and to the

effectiveness of our bottom-up investment process. We are confident

that our approach will ensure we are in the vanguard of any

recovery in the Chinese equity market, seeking out the investment

opportunities best placed to benefit from China's secular trends

and continuing to deliver capital gains and reliable and rising

income to patient investors willing to ride out near-term

volatility.

Thank you for your ongoing support.

Rebecca Jiang

Howard Wang

Shumin Huang

Investment Managers 13th December 2022

PRINCIPAL AND EMERGING RISKS

Principal and Emerging Risks

The Directors confirm that they have carried out a robust

assessment of the principal and emerging risks facing the Company,

including those that would threaten its business model, future

performance, solvency or liquidity.

With the assistance of the Manager, the Audit Committee

maintains a risk matrix which identifies the principal risks to

which the Company is exposed and methods of mitigating against them

as far as practicable. The risks identified and the broad

categories in which they fall, and the ways in which they are

managed or mitigated are summarised below.

The AIC Code of Corporate Governance requires the Audit

Committee to put in place procedures to identify emerging risks. At

each meeting, the Board considers emerging risks which it defines

as potential trends, sudden events or changing risks which are

characterised by a high degree of uncertainty in terms of

occurrence probability and possible effects on the Company. As the

impact of emerging risks is understood, these risks may be entered

on the Company's risk matrix and mitigating actions considered as

necessary.

Principal risk Description Mitigating activities

Investment management and performance

Geopolitical Geopolitical risk can cause The Board meets advisers and

volatility in the markets gathers insights from both JP

in which the Company is invested; Morgan and independent sources

restrictions on the ability on a regular and ongoing basis

to invest and the free movement and takes advice from the Manager

of capital and also potentially and its professional advisers.

impact the ability of the

Manager and other service

providers to carry on business

as usual. Specifically in

China, we have seen instances

of the government interfering

in certain sectors of the

financial markets as well

as concerns arising from the

growing US-China trade tensions,

potential conflict involving

Taiwan and wider questions

about human rights in China.

These concerns have led to

international investors reducing

their investments in China,

and could risk damaging overseas

sentiment towards Chinese

equities further.

-------------------------------------- ------------------------------------------

Investment An inappropriate investment The Board manages this risk

Underperformance decision may lead to sustained by diversification of investments

underperformance against the through its investment restrictions

Company's benchmark index and guidelines which are monitored

and peer companies, resulting and reported on by the Manager.

in the Company's shares trading The Manager provides the Directors

on a wider discount. with timely and accurate management

information, including performance

data and attribution analyses,

revenue estimates and transaction

reports. The Board monitors

the implementation and results

of the investment process with

the investment managers, who

attend all Board meetings, and

reviews data which show statistical

measures of the Company's risk

profile.

-------------------------------------- ------------------------------------------

Strategy and An ill-advised corporate initiative, The Board discusses this on

Business Management for example an inappropriate a regular and ongoing basis

takeover of another company with the Manager and corporate

or an ill-timed issue of new advisers based on information

capital; misuse of the investment provided both at and between

trust structure, for example Board meetings (see above risk

inappropriate gearing; or regarding Investment Underperformance).

if the Company's business The Company states its strategy

strategy is no longer appropriate, clearly in its Half-Year and

may lead to a lack of investor Annual Reports and its website.

demand. The investment managers employ

the Company's gearing within

a strategic range set by the

Board.

-------------------------------------- ------------------------------------------

Loss of Investment A sudden departure of one The Board seeks assurance that

Team or Investment or more members of the investment the Manager takes steps to reduce

Manager management team could result the likelihood of such an event

in a deterioration in investment by ensuring appropriate succession

performance. planning and the adoption of

a team-based approach, as well

as special efforts to retain

key personnel. The Board engages

privately with the investment

managers on a regular basis.

-------------------------------------- ------------------------------------------

Share Price A disproportionate widening In order to manage the Company's

Discount of the discount relative to discount, which can be volatile,

the Company's peers could the Company operates a share

result in a loss of value repurchase programme. The Board

for shareholders. regularly discusses discount

policy and has set parameters

for the Manager and the Company's

broker to follow. The Board

receives regular reports and

is actively involved in the

discount management process.

-------------------------------------- ------------------------------------------

Corporate Governance Changes in financial, regulatory The Manager and the Auditor

or tax legislation may adversely make recommendations to the

affect the Company. Board on accounting, dividend

and tax policies and the Board

seeks external advice where

appropriate. The Board receives

regular reports from its broker,

depositary, registrar and Manager

as well as its legal advisers

and the Association of Investment

Companies on changes to governance

and regulations which could

impact the Company and its industry.

The Company monitors events

and relies on the Manager and

its other key third party providers

to manage this risk by preparing

for any changes. It also receives

updates from its advisors on

corporate governance issues

and reviews its related policies

regularly.

-------------------------------------- ------------------------------------------

Shareholder Details of the Company's compliance The Board receives regular reports

Relations with Corporate Governance from the Manager and the Company's

best practice, including information broker about shareholder communications,

on relations with shareholders, their views and their activity.

are set out in the Corporate In addition, the Board engages

Governance Statement in the directly with major shareholders

Annual Report. and encourages all shareholders

to engage with the Board and

Investment Managers at the AGM

and through the increased use

of webcasts and periodic meetings.

-------------------------------------- ------------------------------------------

Financial The financial risks faced Counterparties are subject to

by the Company include market daily credit analysis by the

price risk, interest rate Manager. In addition the Board

risk, currency risk, liquidity receives reports on the Manager's

risk and credit risk. monitoring and mitigation of

credit risks on share transactions

carried out by the Company.

Further details are disclosed

in notes 21 and 22 in the Annual

Report.

-------------------------------------- ------------------------------------------

Operational

risks

-------------------------------------- ------------------------------------------

Cyber crime Disruption to, or failure Details of how the Board monitors

of, the Manager's accounting, the services provided by the

dealing or payments systems Manager, its associates and

or the depositary's or custodian's depositary and the key elements

records may prevent accurate designed to provide effective

reporting and monitoring of internal control are included

the Company's financial position. within the Risk Management and

In addition to threatening Internal Control section of

the Company's operations, the Directors' Report in the

such an attack is likely to Annual Report. The threat of

raise reputational issues cyber attack, in all its guises,

which may damage the Company's is regarded as at least as important

share price and reduce demand as more traditional physical

for its shares. threats to business continuity

and security. The Company benefits

directly or indirectly from

all elements of JPMorgan's Cyber

Security programme. The information

technology controls around the

physical security of JPMorgan's

data centres, security of its

networks and security of its

trading applications are tested

independently.

-------------------------------------- ------------------------------------------

Fraud/other The risk of fraud or other The Audit Committee receives

operating failures control failures or weaknesses independently audited reports

or weaknesses within the Manager or other on the Manager's and other service

service providers could result providers' internal controls,

in losses to the Company. as well as a report from the

Manager's Compliance function.

The Company's management agreement

obliges the Manager to report

on the detection of fraud relating

to the Company's investments

and the Company is afforded

protection through its various

contracts with suppliers, of

which one of the key protections

is the Depositary's indemnification

for loss or misappropriation

of the Company's assets held

in custody.

-------------------------------------- ------------------------------------------

Regulatory

risk

-------------------------------------- ------------------------------------------

Legal and Regulatory In order to qualify as an The Section 1158 qualification

investment trust, the Company criteria are continually monitored

must comply with Section 1158 by the Manager and the results

of the Corporation Tax Act reported to the Board each month.

2010 ('Section 1158'). Details The Company must also comply

of the Company's approval with the provisions of the Companies

are given under 'Structure Act 2006 and, since its shares

of the Company' in the Annual are listed on the London Stock

Report. Were the Company to Exchange, the UKLA Listing Rules,

breach Section 1158, it may Disclosure Guidance and Transparency

lose investment trust status Rules ('DTRs') and, as an Investment

and, as a consequence, gains Trust, the Alternative Investment

within the Company's portfolio Fund Managers Directive ('AIFMD').

would be subject to Capital A breach of the Companies Act

Gains Tax. 2006 could result in the Company

and/or the Directors being fined

or the subject of criminal proceedings.

Breach of the UKLA Listing Rules

or DTRs could result in the

Company's shares being suspended

from listing which in turn would

breach Section 1158. The Board

relies on the services of its

Company Secretary, JPMorgan

Funds Limited and its professional

advisers to ensure compliance

with the Companies Act 2006,

the UKLA Listing Rules, DTRs

and AIFMD.

-------------------------------------- ------------------------------------------

Economic and

geopolitical

-------------------------------------- ------------------------------------------

Global pandemics COVID-19 has highlighted the The Board receives reports on

speed and extent of economic the business continuity plans

damage that can arise from of the Manager and other key

a pandemic. While current service providers. The effectiveness

vaccination programme results of these measures have been

are hopeful, the risk remains assessed throughout the course

that new variants may not of the COVID-19 pandemic and

respond to existing vaccines, the Board will continue to monitor

may be more lethal and may developments as they occur and

spread as global travel opens seek to learn lessons which

up again. may be of use in the event of

In China, the government's future pandemics.

'zero-COVID' policy and the The Board is actively engaged

subsequent disruptions caused in monitoring the situation

by their stringent COVID policies with regular updates from the

continue to negatively impact investment managers.

the economy. With the additional

risk of increased COVID cases

once this policy ends, it

is likely that the market

will remain volatile for a

while.

Should the virus become more

virulent than is currently

the case, it may present risks

to the operations of the Company

and its Manager.

-------------------------------------- ------------------------------------------

Climate change Climate change is one of the The Manager's investment process

most critical issues confronting integrates consideration of

asset managers and their investors. environmental, social and governance

Climate change may have a factors into decision son which

disruptive effect on individual stocks to buy, hold or sell

investee companies and the (see the ESG report in the Annual

operations of the Manager Report). This includes the approach

and other major service providers. investee companies take to recognising

and mitigating climate change

risks. The Manager aims to influence

the management of climate related

risks through engagement and

voting and is a participant

of Climate Action 100+ and a

signatory of the United Nations

Principles for Responsible Investment.

As extreme weather events become

more common, in particular with

the typhoons, flooding and droughts

experienced in China, the resiliency,

business continuity planning

and the location strategies

of our services providers will

come under greater scrutiny.

-------------------------------------- ------------------------------------------

Emerging risk Description Mitigating activities

-------------------------------------- ------------------------------------------

Social unrest There is a risk that recent The Board and the Managers understand

within China sporadic demonstrations in the inherent risks associated

China against the government's with investing in emerging markets

'zero-COVID' policies could such as China. While focusing

escalate into more disruptive on the long term, the Manager

social unrest at a local or is mindful of these risks when

national level. Such disorder considering investment strategy

could disrupt the companies and portfolio construction,

in which our Company invests, and keeps the Board regularly

and negatively impact both informed about any issues that

our manager's operations within might impact China and the portfolio.

China and international sentiment

towards Chinese equities.

-------------------------------------- ------------------------------------------

TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES

Details of the management contract are set out in the Directors'

Report in the Annual Report. The management fee payable to the

Manager for the year was GBP3,399,000 (2021: GBP4,572,000).

Safe custody fees amounting to GBP72,000 (2021: GBP81,000) were

payable to JPMorgan Chase Bank N.A. during the year of which

GBP17,000 (2021: GBP41,000) was outstanding at the year end.

The Manager may carry out some of its dealing transactions

through group subsidiaries. These transactions are carried out at

arm's length. The commission payable to JPMorgan Securities Limited

for the year was GBP26,000 (2021: GBP28,000).

Handling charges on dealing transactions amounting to GBP52,000

(2021: GBP42,000) were payable to JPMorgan Chase Bank N.A. during

the year of which GBP6,000 (2021: GBP20,000) was outstanding at the

year end.

The Company also held cash in the JPMorgan US Dollar Liquidity

Fund, which is managed by JPMorgan. At the year end this was valued

at GBP8,085,000 (2021: GBPnil). Interest amounting to GBP59,000

(2021: GBP8,000) was received during the year.

Fees amounting to GBP434,000 (2021: GBP638,000) were receivable

from stock lending transactions during the year. JPMorgan Investor

Services Limited's commissions in respect of such transactions

amounted to GBP48,000 (2021: GBP71,000).

At the year end, total cash of GBP2,865,000 (2021: GBP36,000)

was held with JPMorgan Chase Bank, N.A. in a non-interest bearing

current account.

Full details of Directors' remuneration and shareholdings can be

found in the Director's Remuneration Report in the Annual

Report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report

and Financial Statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare Financial

Statements for each financial year. Under that law the Directors

have elected to prepare the Financial Statements in accordance with

applicable law and United Kingdom Accounting Standards, comprising

Financial Reporting Standard 102 'the Financial Reporting Standard

applicable in the UK and Republic of Ireland' (FRS 102). Under

company law the Directors must not approve the Financial Statements

unless they are satisfied that, taken as a whole, the Annual Report

and Financial Statements are fair, balanced and understandable,

provide the information necessary for shareholders to assess the

Company's performance, business model and strategy and that they

give a true and fair view of the state of affairs of the Company

and of the total return or loss of the Company for that period. In

preparing these Financial Statements, the Directors are required

to:

-- select suitable accounting policies and then apply them consistently;

-- state whether applicable UK Accounting Standards comprising

FRS 102, have been followed, subject to any material departures

disclosed and explained in the Financial Statements;

-- make judgments and accounting estimates that are reasonable and prudent; and

-- prepare the Financial Statements on a going concern basis

unless it is inappropriate to presume that the Company will

continue in business

and the Directors confirm that they have done so.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the Financial Statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The Financial Statements are published on the

www.jpmchinagrowthandincome.co.uk website, which is maintained by

the Company's Manager. The maintenance and integrity of the website

maintained by the Manager is, so far as it relates to the Company,

the responsibility of the Manager. The work carried out by the

Auditor does not involve consideration of the maintenance and

integrity of this website and, accordingly, the Auditor accepts no

responsibility for any changes that have occurred to the accounts

since they were initially presented on the website. The accounts

are prepared in accordance with UK legislation, which may differ

from legislation in other jurisdictions.

Under applicable law and regulations the Directors are also

responsible for preparing a Strategic Report, a Directors' Report

and a Directors' Remuneration Report that comply with that law and

those regulations.

Each of the Directors, whose names and functions are listed in

the Annual Report confirm that, to the best of their knowledge:

-- the Company's Financial Statements, which have been prepared

in accordance with applicable law and United Kingdom Accounting

Standards, comprising FRS102, give a true and fair view of the

assets, liabilities, financial position and profit of the Company;

and

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company, together with a description of the principal risks and

uncertainties that it faces.

The Directors consider that the Annual Report and Financial

Statements, taken as a whole, are fair, balanced and understandable

and provide the information necessary for shareholders to assess

the Company's performance, business model and strategy.

For and on behalf of the Board

Alexandra Mackesy

Chairman

13th December 2022

FINANCIAL STATEMENTS

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30th September 2022

2022 2021

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- -------- ----------- ----------- --------- --------- ---------

Net (losses)/gains on investments

held at

fair value through profit

or loss - (158,974) (158,974) - 3,485 3,485

Net foreign currency (losses)/gains(1) - (10,027) (10,027) - 1,364 1,364

Income from investments 3,693 - 3,693 2,966 - 2,966

Other income 493 - 493 646 - 646

---------------------------------------- -------- ----------- ----------- --------- --------- ---------

Gross return/(loss) 4,186 (169,001) (164,815) 3,612 4,849 8,461

Management fee (850) (2,549) (3,399) (1,143) (3,429) (4,572)

Other administrative expenses (605) - (605) (540) - (540)

---------------------------------------- -------- ----------- ----------- --------- --------- ---------

Net return/(loss) before

finance costs and taxation 2,731 (171,550) (168,819) 1,929 1,420 3,349

Finance costs (281) (845) (1,126) (195) (580) (775)

---------------------------------------- -------- ----------- ----------- --------- --------- ---------

Net return/(loss) before

taxation 2,450 (172,395) (169,945) 1,734 840 2,574

Taxation charges (199) - (199) (171) - (171)

---------------------------------------- -------- ----------- ----------- --------- --------- ---------

Net return after taxation 2,251 (172,395) (170,144) 1,563 840 2,403

---------------------------------------- -------- ----------- ----------- --------- --------- ---------

Return per share (note 2) 2.71p (207.20)p (204.49)p 1.97p 1.06p 3.03p

---------------------------------------- -------- ----------- ----------- --------- --------- ---------

(1) GBP11,660,000 due to an exchange loss on the loan which is

denominated in US dollars. GBP1,633,000 due to net exchange gain on

cash and cash equivalents (2021: GBP2,057,000 due to an exchange

gain on the loan which is denominated in US dollars. GBP693,000 due

to net exchange losses on cash and cash equivalents).

STATEMENT OF CHANGES IN EQUITY

For the year ended 30th September 2022

Called Exercised Capital

up share Share warrant redemption Other Capital Revenue

capital premium reserve reserve reserve(1) reserves(2) reserve(2) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ----------- -------- ----------- ------------ ----------- ------------ ----------- -----------

At 30th

September

2020 19,481 13,321 3 581 37,392 340,185 - 410,963

Issue of

Ordinary

shares 1,322 39,111 - - - - - 40,433

Issue of

shares

from Treasury - 28,613 - - - 9,007 - 37,620

Project costs

-

in relation to

issue

of new shares - (94) - - - - - (94)

Net return - - - - - 840 1,563 2,403

Dividend paid

in

the year

(note 3) - - - - - (16,360) (1,563) (17,923)

--------------- ----------- -------- ----------- ------------ ----------- ------------ ----------- -----------

At 30th

September

2021 20,803 80,951 3 581 37,392 333,672 - 473,402

Net

(loss)/return - - - - - (172,395) 2,251 (170,144)

Dividend paid

in

the year

(note 3) - - - - - (16,721) (2,251) (18,972)

--------------- ----------- -------- ----------- ------------ ----------- ------------ ----------- -----------

At 30th

September

2022 20,803 80,951 3 581 37,392 144,556 - 284,286

--------------- ----------- -------- ----------- ------------ ----------- ------------ ----------- -----------

(1) Created during the year ended 30th September 1999, following

a cancellation of the share premium account.

(2) These reserves form the distributable reserves of the

Company and may be used to fund distributions to investors.

STATEMENT OF FINANCIAL POSITION

At 30th September 2022

2022 2021

GBP'000 GBP'000

------------------------------------------------------- ---------- ----------

Fixed assets

Investments held at fair value through profit or loss 333,206 521,634

------------------------------------------------------- ---------- ----------

Current assets

Debtors 1,997 4,264

Cash and cash equivalents 10,950 36

------------------------------------------------------- ---------- ----------

12,947 4,300

Current liabilities

Creditors: amounts falling due within one year (61,867) (4,206)

------------------------------------------------------- ---------- ----------

Net current (liabilities)/assets (48,920) 94

------------------------------------------------------- ---------- ----------

Total assets less current liabilities 284,286 521,728

Creditors: amounts falling due after one year - (48,326)

------------------------------------------------------- ---------- ----------

Net assets 284,286 473,402

------------------------------------------------------- ---------- ----------

Capital and reserves

Called up share capital 20,803 20,803

Share premium 80,951 80,951

Exercised warrant reserve 3 3

Capital redemption reserve 581 581

Other reserve 37,392 37,392

Capital reserves 144,556 333,672

------------------------------------------------------- ---------- ----------

Total shareholders' funds 284,286 473,402

------------------------------------------------------- ---------- ----------

Net asset value per share 341.7p 569.0p

------------------------------------------------------- ---------- ----------

STATEMENT OF CASH FLOWS

For the year ended 30th September 2022

2022 2021

GBP'000 GBP'000

-------------------------------------------------------- ----------- -----------

Net cash outflow from operations before dividends and

interest (3,268) (5,140)

Dividends received 3,412 2,966

Interest received 59 8

Interest paid (920) (801)

-------------------------------------------------------- ----------- -----------

Net cash outflow from operating activities (717) (2,967)

-------------------------------------------------------- ----------- -----------

Purchases of investments (233,601) (385,098)

Proceeds from sale of investments 265,482 320,797

Settlement of foreign currency contracts (129) 51

-------------------------------------------------------- ----------- -----------

Net cash inflow/(outflow) from investing activities 31,752 (64,250)

-------------------------------------------------------- ----------- -----------

Dividends paid (18,972) (17,923)

Issue of Ordinary shares - 40,433

Reissue of shares from Treasury - 37,620

Project costs - in relation to issue of new shares - (94)

Repayment of bank loans (12,470) -

Drawdown of bank loans 9,995 6,800

Utilisation of bank overdraft (124) 124

-------------------------------------------------------- ----------- -----------

Net cash (outflow)/inflow from financing activities (21,571) 66,960

-------------------------------------------------------- ----------- -----------

Increase/(decrease) in cash and cash equivalents 9,464 (257)

-------------------------------------------------------- ----------- -----------

Cash and cash equivalents at start of year 36 343

Unrealised gains/(losses) on foreign currency cash and

cash equivalents 1,450 (50)

-------------------------------------------------------- ----------- -----------

Cash and cash equivalents at end of year 10,950 36

-------------------------------------------------------- ----------- -----------

Cash and cash equivalents consist of:

Cash at bank 2,865 36

Cash held in JPMorgan US Dollar Liquidity Fund 8,085 -

-------------------------------------------------------- ----------- -----------

10,950 36

-------------------------------------------------------- ----------- -----------

NOTES TO THE FINANCIAL STATEMENTS

1. Accounting policies

Basis of accounting

The Financial Statements are prepared under the historical cost

convention, modified to include fixed asset investments at fair

value, and in accordance with the Companies Act 2006, United

Kingdom Generally Accepted Accounting Practice ('UK GAAP'),

including FRS 102 'The Financial Reporting Standard applicable in

the UK and Republic of Ireland' and with the Statement of

Recommended Practice 'Financial Statements of Investment Trust

Companies and Venture Capital Trusts' (the 'SORP') issued by the

Association of Investment Companies in April 2021.

All of the Company's operations are of a continuing nature.

The Financial Statements have been prepared on a going concern

basis. In forming this opinion, the Directors have considered any

potential impact of COVID-19 pandemic on the going concern and

viability of the Company. They have considered the potential impact

of COVID-19 and the mitigation measures which key service

providers, including the Manager, have in place to maintain

operational resilience particularly in light of COVID-19. The

Directors have reviewed income and expense projections and the

liquidity of the investment portfolio in making their assessment.

The Directors have also considered the forthcoming continuation

vote at the 2023 AGM and, having made enquiries through the

Company's advisers, have a reasonable belief that the continuation

vote will be supported by the majority of shareholders.

The policies applied in these Financial Statements are

consistent with those applied in the preceding year.

2. Return/(loss) per share

2022 2021

GBP'000 GBP'000

--------------------------------------------------- ------------ -----------

Revenue return 2,251 1,563

Capital return (172,395) 840

--------------------------------------------------- ------------ -----------

Total (loss)/return (170,144) 2,403

--------------------------------------------------- ------------ -----------

Weighted average number of shares in issue during

the year 83,202,465 79,481,601

Revenue return per share 2.71p 1.97p

Capital (loss)/return per share (207.20)p 1.06p

--------------------------------------------------- ------------ -----------

Total (loss)/return per share (204.49)p 3.03p

--------------------------------------------------- ------------ -----------

3. Dividends

(a) Dividends paid and declared

2022 2021

GBP'000 GBP'000

------------------------------------------------------ -------- --------

Dividends paid

2022 first quarterly interim dividend of 5.7p (2021:

5.7p) 4,743 4,144

2022 second quarterly interim dividend of 5.7p

(2021: 5.7p) 4,743 4,366

2022 third quarterly interim dividend of 5.7p (2021:

5.7p) 4,743 4,671

2022 fourth quarterly interim dividend of 5.7p

(2021: 5.7p) 4,743 4,742

------------------------------------------------------ -------- --------

Total dividends paid in the period 18,972 17,923

------------------------------------------------------ -------- --------

In respect of the year ending 30th September 2023, the first

quarterly interim dividend of 3.42p per share amounting to

GBP2,846,000 (2022: 5.7p per share amounting to GBP4,743,000) has

been declared and paid. In accordance with the accounting policy of

the Company, this dividend will be reflected in the Financial

Statements for the year ending 30th September 2023.

(b) Dividend for the purposes of Section 1158 of the Corporation Tax Act 2010 ('Section 1158')

The requirements of Section 1158 are considered on the basis of

the dividend paid and declared in respect of the financial year.

For the year ended 30 September 2022, the dividends declared were

paid during the year, as shown above.

The aggregate of the distributable reserves is GBP144,556,000

(2021: GBP333,672,000). Please note that at the Annual General

Meeting ('AGM') in February 2020, shareholders approved an

amendment to the Company's Articles of Association to allow the

Company to distribute capital as income to enable the

implementation of the Company's revised dividend policy. (Please

see the Annual Report for further details).

The aggregate of the distributable reserves after the payment of

the first quarterly dividend for 2023 will amount to GBP141,710,000

(2021: GBP328,929,000).

4. Net asset value per share

2022 2021

--------------------------- ------------ -----------

Net assets (GBP'000) 284,286 473,402

Number of shares in issue 83,202,465 83,202,465

--------------------------- ------------ -----------

Net asset value per share 341.7p 569.0p

--------------------------- ------------ -----------

5. Status of results announcement

2021 Financial Information

The figures and financial information for 2021 are extracted

from the Annual Report and Financial Statements for the year ended

30th September 2021 and do not constitute the statutory accounts

for that year. The Annual Report and Financial Statements has been

delivered to the Registrar of Companies and included the Report of

the Independent Auditors which was unqualified and did not contain

a statement under either section 498(2) or section 498(3) of the

Companies Act 2006.

2022 Financial Information

The figures and financial information for 2022 are extracted

from the Annual Report and Financial Statements for the year ended

30th September 2022 and do not constitute the statutory accounts

for that year. The Annual Report and Financial Statements includes

the Report of the Independent Auditors which is unqualified and

does not contain a statement under either section 498(2) or section

498(3) of the Companies Act 2006. The Annual Report and Financial

Statements will be delivered to the Registrar of Companies in due

course.

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

13th December 2022

For further information:

Lucy Dina,

JPMorgan Funds Limited

020 7742 4000

ENDS

A copy of the 2022 Annual Report and Financial Statements will

shortly be submitted to the FCA's National Storage Mechanism and

will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The 2022 Annual Report and Financial Statements will also

shortly be available on the Company's website at

www.jpmchinagrowthandincome.co.uk where up-to-date information on

the Company, including daily NAV and share prices, factsheets and

portfolio information can also be found.

JPMORGAN FUNDS LIMITED

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UOONRUAUUAAA

(END) Dow Jones Newswires

December 13, 2022 11:33 ET (16:33 GMT)

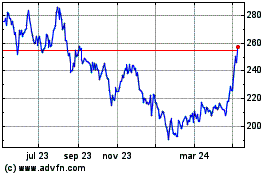

Jpmorgan China Growth & ... (LSE:JCGI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Jpmorgan China Growth & ... (LSE:JCGI)

Gráfica de Acción Histórica

De May 2023 a May 2024