JZ Capital Ptnrs Ltd JZCP Agrees New Senior Facility

26 Enero 2022 - 12:07PM

UK Regulatory

TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

JZCP AGREES NEW SENIOR FACILITY

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) NO. 596/2014, WHICH FORMS PART OF UK LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

26 January 2022

JZ Capital Partners Limited, the London listed fund that invests in US and

European microcap companies and US real estate, is pleased to announce that it

has entered into an agreement with WhiteHorse Capital Management, LLC (the "New

Senior Lender") providing for a new five year term senior secured loan facility

(the "New Senior Facility Agreement"). The new facility made available pursuant

to the New Senior Facility Agreement (the "New Senior Facility") replaces the

Company's existing senior facility (the "Existing Senior Facility") with

clients and funds advised and sub-advised by Cohanzick Management, LLC and

CrossingBridge Advisors, LLC (the "Existing Senior Lenders").

The New Senior Facility consists of a US$45.0 million first lien term loan (the

"Closing Date Term Loan"), fully funded as of the closing date (being 26

January 2022), and up to US$25.0 million in first lien delayed draw term loans

(the "DDT Loans"), which remains undrawn as of the closing date. The Company

can draw down the DDT Loans from time to time in its discretion in the 24 month

period following the closing date. Customary fees and expenses were payable

upon the drawing of the Closing Date Term Loan.

The proceeds of the Closing Date Term Loan, together with cash at hand, will be

used by the Company for the repayment of the Existing Senior Facility of

approximately US$52.879 million due 12 June 2022 and for the payment of fees

and expenses related to the New Senior Facility. The proceeds of the DDT Loans

(if drawn) will be used by the Company to, among other purposes, fund certain

permitted investments in accordance with the Company's investment policy and

for the payment of related fees and expenses.

The New Senior Facility will mature on 26 January 2027, being the date falling

5 years from the closing date. All existing and future direct and indirect

subsidiaries of the Company (together, the "Guarantors") guarantee the payment

and performance of the Company's secured obligations under the New Senior

Facility Agreement, including the payment of principal and interest on the

same.

The interest payable under the New Senior Facility Agreement will differ

according to the choice of loan elected by the Company. If a 'Base Rate Loan'

is selected, interest will accrue at the sum of (a) the 'Alternate Base Rate',

being the rate last quoted by The Wall Street Journal as the 'Prime Rate' in

the United States for such day (with a floor of 2.00 per cent. per annum), plus

(b) the 'Applicable Margin' (as described below). If a 'LIBO Rate Loan' is

selected, interest will accrue at the sum of (a) the 'LIBO Rate', being the

rate as published on the applicable Bloomberg page for the relevant interest

period (with a floor of 1.00 per cent. per annum), plus (b) the 'Applicable

Margin'. The 'Applicable Margin' will be scaled as provided for in the terms of

the New Senior Facility Agreement by reference to the asset coverage ratio for

the relevant interest period and will range from 6.00 per cent. to 7.00 per

cent. for Base Rate Loans and from 7.00 per cent. to 8.00 per cent. for LIBO

Rate Loans. In addition, the Company may elect to pay a portion of the interest

in kind by adding it to the outstanding principal balance in exchange for

paying a 1.00 per cent. or 2.00 per cent. higher total interest rate. The

Closing Date Loans are subject to a prepayment penalty if they are repaid

before yielding a 15 per cent. return and each DDT Loan is subject to a

prepayment penalty ranging from 3.00 per cent. to 1.00 per cent. depending on

whether it is repaid within 1 year, 2 years or 3 years of funding.

The New Senior Facility Agreement includes covenants from the Company customary

for an agreement of this nature, including (a) maintaining a minimum asset

coverage ratio (calculated by reference to eligible assets, subject to

customary ineligibility criteria and concentration limits, plus unrestricted

cash) of not less than 4.00 to 1.00, and (b) ensuring the Company retains an

aggregate amount of unrestricted cash and cash equivalents of not less than

US$12.5 million. The concentration limits under the New Senior Facility

Agreement limit the size of various types of individual investments for the

purpose of inclusion in the minimum asset coverage ratio calculation.

Breach of the above-mentioned covenants constitutes an event of default under

the New Senior Facility Agreement. Furthermore, the failure by the Company to

(a) repay the Subordinated Loan Notes (as defined and described below) when

they mature on 11 September 2022, or (b) redeem in full the Company's ZDP

Shares, being its zero dividend redeemable preference shares of no par value in

the capital of the Company when they mature on 1 October 2022, which represent

a subordinated debt obligation of the Company as compared to the New Senior

Facility, will also constitute an event of default under the New Senior

Facility. The New Senior Facility Agreement also includes certain other events

of default customary for an agreement of this nature.

The New Senior Facility will be a secured debt obligation, with the security

taking the form of a first lien granted over substantially all of the assets of

the Company and the Guarantors, as set out in various security documents (the

"New Facility Security Documents") entered into by, among others, the Company,

the Guarantors and the New Senior Lender, which will be senior in right of

payment to the lien previously granted to secure the subordinated 6 per cent.

loan notes maturing on 11 September 2022 (the "Subordinated Loan Notes") issued

to affiliates of David W. Zalaznick and John (Jay) Jordan II (together, being

the "Subordinated Noteholders"). The New Senior Lender and the Subordinated

Noteholders, among others, have also entered into a subordination and

intercreditor agreement (the "New Subordination and Intercreditor Agreement")

which, among other things, governs the ranking of payments and the security

under the note purchase agreement relating to the Subordinated Loan Notes (the

"Note Purchase Agreement") and the New Senior Facility Agreement and provides

that indebtedness and liens under the Note Purchase Agreement will, as they

were with the Existing Senior Lenders, be fully subordinated to the

indebtedness and liens under the New Senior Facility, including restrictions on

the ability of secured parties under the Note Purchase Agreement to exercise

remedies whilst the New Senior Facility is outstanding. The New Security

Documents and the New Subordination and Intercreditor Agreement are in

substantially the same form as the corresponding documents previously entered

into with the Existing Senior Lenders.

The terms of the New Senior Facility represent a substantial improvement to

those of the Existing Senior Facility. As noted above, the stated maturity of

the Company's senior loans pursuant to the New Senior Facility will be extended

out to 26 January 2027 from the maturity date of 12 June 2022 under the

Existing Senior Facility. Furthermore, the New Senior Facility significantly

reduces the Company's cost of funded debt. Specifically, the interest rate

charged with respect to the New Senior Facility as of the closing date,

assuming the Company selects a 'LIBO Rate Loan', would be (i) the LIBO Rate

plus 7.00 per cent., or (ii) if the Company elects for a portion of the

interest to be paid in kind as explained above, the LIBO Rate plus 9.00 per

cent., of which 4.00 per cent. would be charged as payment-in-kind (PIK)

interest. As noted above, the interest payable by the Company can fluctuate

over time based on the Company's underlying asset coverage. For reference, the

interest rate charged with respect to the Existing Senior Facility was the LIBO

Rate plus 9.75 per cent. for the US$16.0 million of 'First Out' loan

borrowings, whereas the rate on approximately US$36.3 million of 'Last Out'

loan borrowings was the LIBO Rate plus 15.00 per cent., of which 4.00 per cent.

was charged as PIK interest.

For completeness, the Company notes that following completion of the New Senior

Facility Agreement and the repayment of the Existing Senior Facility, the

Company's approximate key outstanding debt obligations will be as follows: (i)

the Subordinated Loan Notes of approximately US$31.5 million (due 11 September

2022), (ii) the Company's ZDP Shares of approximately US$75.2 million (due 1

October 2022), and (iii) senior secured debt of approximately US$45 million

pursuant to the New Senior Facility with the New Senior Lender (due 26 January

2027). As noted above, the terms of the New Senior Facility allow for, subject

to compliance with the New Senior Facility's financial covenants, the repayment

of the Subordinated Loan Notes and the ZDP Shares on their respective stated

maturities. The Company's ability to repay these debt obligations does however

remain dependent upon the Company achieving sufficient realisations of its

assets within the relevant timeframes.

Market Abuse Regulation

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under MAR. Upon the publication

of this announcement, this inside information is now considered to be in the

public domain. The person responsible for arranging the release of this

announcement on behalf of the Company is David Macfarlane, Chairman.

For further information:

Ed Berry +44 (0)7703 330 199

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

Important Notice

This announcement also includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters that are not

historical facts. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements are not

guarantees of future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, policies and the

development of its strategies may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the investment performance, result of operations, financial condition,

liquidity and policies of the Company and development of its strategies, are

consistent with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or developments

in subsequent periods. These forward-looking statements speak only as at the

date of this announcement. Subject to their legal and regulatory obligations,

each of the Company, Jordan/Zalaznick Advisers, Inc. and their respective

affiliates expressly disclaims any obligations to update, review or revise any

forward-looking statement contained herein whether to reflect any change in

expectations with regard thereto or any change in events, conditions or

circumstances on which any statement is based or as a result of new

information, future developments or otherwise.

END

(END) Dow Jones Newswires

January 26, 2022 13:07 ET (18:07 GMT)

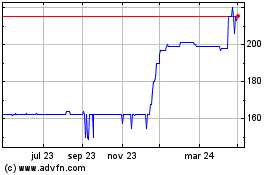

Jz Capital Partners (LSE:JZCP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

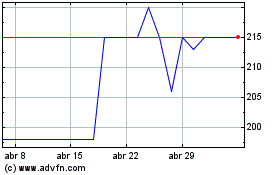

Jz Capital Partners (LSE:JZCP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024