TIDMKIBO

RNS Number : 4685O

Kibo Energy PLC

01 February 2023

Kibo Energy PLC (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

('Kibo' or 'the Company')

Dated: 7am 01 February 2023

Kibo Energy PLC ('Kibo' or the 'Company')

Operational Update: 2023

Kibo Energy PLC (AIM: KIBO; AltX: KBO), the

renewable-energy-focused development company, is pleased to provide

an operational update, following an eventful but productive year of

dedicated hard work amidst extraordinary challenges.

In accordance with the Company's existing operational policy,

the Kibo Executive Management team conducted an extensive review of

the Company's project portfolio at the end of 2022, which included

an operations review. The key elements of said operational review

are discussed below.

Portfolio

The Kibo Group strategy, as previously announced in a Company

RNS dated 19 April 2021, is focused on developing, owning and

operating sustainable energy solutions that can immediately and

progressively address the acute energy challenges in sub-Saharan

Africa, the United Kingdom and Ireland. The Company achieves this

by acquiring and developing energy assets that can be brought into

production within an 18-to-24-month timeline. This strategy is

evident from the comprehensive project portfolio set out in the Q4

2022 Corporate Presentation on the Company's website and which

should be read in conjunction with this RNS.

The table below indicates the status of Kibo's Project Portfolio

to date. This does not include project opportunities that are

currently the subject of advanced due diligence and commercial

consideration.

Kibo Group Project Portfolio

Entity Kibo Strategic Projects Development High-Level

Equity Domain Status Indicative

Milestone

-------- --------------- ------------------------------------ ----------------- ----------------

MAST Energy 57.86% Reserve Pyebridge (9 MW) Operational

Developments Power and generating

(UK) revenue

-------- --------------- ------------------------------------ ----------------- ----------------

Bordesley (5 MW) Advanced Financial

project close -

development Q1 2023

Installation

of gas

and grid

connection

- December

2023

Commercial

operation

- March

2024

-------- --------------- ------------------------------------ ----------------- ----------------

Rochdale (4.4 MW) Advanced Renewed

project and updated

development planning

consent

- Q1 2023

Financial

close -

end Q2

2023

------------------------------------ ----------------- ----------------

Hindlip Lane (7.5 Concept Updated

MW) stage EPC and

O&M contracts

- Q3 2023

Financial

close -

Q4 2023

------------------------------------ ----------------- ----------------

Stather Road (2.5 Concept Determine

MW) stage date at

which grid

connection

is available

- Q1 2023

Rest of

milestones

TBD once

the above

has been

established

-------- --------------- ------------------------------------ ----------------- ----------------

Sustineri 65% Waste CHP project Phase 1 Advanced Feasibility

(SA) to Energy to supply (2.7 MW project study update

base-load + study development on oil

electricity on synthetic stage production

generation oil production) addition

in South - Q1 2023

Africa with

4 revenue Completion

streams: of integration

electricity, study and

gate fees finalization

and potentially of off-take

from heat agreement

and steam for oil

output as production

well as the - Q2 2023

production

of synthetic Financial

oil. close -

Q3 2023

-------- --------------- ----------------- ----------------- ----------------- ----------------

Phase 2 Pre-concept Milestones

(targeted stage TBD once

20 MW) Phase 1

has been

executed

-------- --------------- ----------------- ----------------- ----------------- ----------------

National 51% Long Simultaneous Projects

Broadband Duration 12.3 MW in development concept to be announced

Solutions Energy and commercial as off-take

(SA) Storage development agreements

are finalized

with

finalization

of first

agreements

expected

during

Q1 2023

-------- --------------- ------------------------------------ ----------------- ----------------

36.32 MW target for Under

development development

-------- --------------- ------------------------------------ ----------------- ----------------

Mbeya Power 100% Biofuel 300 MW short-term Original Completion

Project ("MPP") conversion to renewable project. of concept

(TZ) energy biofuel Fully permitted study for

with Bankable conversion

Feasibility of MCPP

Study completed project

to

bio-coal

- Q2 2023

Completion

of Power

Purchase

Agreement

with TANESCO

- Q3 2023

-------- --------------- ------------------------------------ ----------------- ----------------

UK Portfolio 100% Waste Southport (10 MW, Completion

to Energy 2MW long duration of front-end

energy storage and engineering

and design

5.5m m(3) bio-methane) (FEED)

study -

Q1 2023

Submission

of

environmental

permit

application

- Q2 2023

Submission

of green

gas supply

scheme

application

- Q2 2023

Financial

close -

Q2/Q3 2023

-------- --------------- ------------------------------------ ----------------- ----------------

Katoro Gold 20.88% Precious katorogold.com

and strategic

minerals

-------- --------------- -------------------------------------------------------------------------

Notes

The notes below address the most recent announced initiatives in

the interest of providing additional context.

Waste to Energy

The plastic-to-syngas project in South Africa, Sustineri, as

announced in an RNS dated 17 January 2023, has commenced with an

optimisation and integration study into the production of synthetic

oil from non-recyclable plastic waste, thereby adding a potential

accelerated additional revenue stream to the project. Since

synthetic oil is formed as part of the plastic-to-waste pyrolysis

process to produce syngas, the production thereof would require a

slight amendment to the process as was designed in the feasibility

study phase for syngas in the electricity generation process. This

implies that the Project can be developed for execution in two

distinct phases, with a first phase being the production of

synthetic oil and a second phase the production of syngas and

electricity.

The decision to pursue the production of synthetic oil as part

of phase 1 is expected to have a positive impact on the Project's

profitability and provides the Company with the opportunity to

generate revenue much earlier than initially projected.

Additionally, it provides an opportunity to construct and

commission the pyrolysis plant and related infrastructure earlier,

thereby facilitating early revenue. Finally, it also contributes

materially to de-risking the Project and will make the Project

significantly more attractive to a wider spectrum of interested

funders, thereby reducing the funding risk and improving the

ability to secure said financing.

As the optimisation study is already underway, it is believed

that a technical conclusion may already be reached by end of Q1

2023. As the major project technical and commercial milestones have

already been achieved, this will allow the accelerated completion

of the funding discussions and commencement of project

execution.

Biofuel

The Company, after determining the technical feasibility of the

production of bio-coal from biomass, is currently determining the

commercial viability of this process under a variety of industrial

scale applications. In this regard, the company is undertaking both

due diligence investigations and participating in advanced

discussions on several projects.

Apart from potentially providing a sustainable fuel source for

the Mbeya Power Project and subsequently potentially for the two

remaining 300MW projects in the Kibo portfolio (i.e. MCIPP and

Benga) as well, there is an opportunity to source and/or cultivate

biomass to produce bio-coal at strategically placed biofuel

production plants for various leading international companies in

the manufacturing industry. The Company is working closely with

these manufacturers, who operate a significant number of

manufacturing plants in Southern Africa, to complete extensive

feasibility studies at identified operating plants. To this extent

the Company has already determined and agreed on a roll-out plan to

supply some of these operating plants with their total fuel

requirement in the form of biofuel, completely replacing their

current dependence on coal.

Immediate and Short-Term Focus

In executing the Company's strategy referred to above, the

Company continues to actively execute the following strategic work

streams:

-- Exit coal by a disposal process of its coal assets, all of

which are in southern and eastern Africa (RNS dated 16 June 2021).

This process is still underway, and the Company has entertained

various approaches/offers since and is currently considering a

definitive term sheet in this regard which, should it be agreed,

the Company expects to announce. The Company's various coal assets

are however faced with some fundamental challenges, of which the

following are the most important:

o Funding for the construction of new coal mines is not readily

available, especially for thermal coal deposits;

o All the Kibo coal assets are situated in very remote areas

with very little to no existing infrastructure, far away from any

export port (more than 800 km) and with no significant local coal

market; and

o The Kibo coal assets are thermal coal deposits and, although

thermal coal is in big demand now, it does not command a premium

price, which makes such deposits less attractive for exporters,

especially when considered in conjunction with the above two

points.

-- Convert its African electricity-generating asset fuel supply

from coal to biofuel technology, subject to proven technical and

commercial feasibility (RNS dated 25 August 2022).

-- Identify and secure South African and United Kingdom Waste to

Energy ("WtE") and flexible/reserve-power projects (RNSs dated 18

May 2021 and 19 April 2021, respectively).

-- Enter the Long Duration Energy Storage ('LDES') market,

comprising Battery Energy Storage Systems ('BESS') integrated with

utility-scale and microgrid renewable energy solutions (RNS dated

17 May 2022).

-- Realise shareholder value with the continuation of its

spinout strategy, whereby the Company's WtE and biofuel projects to

be potentially held in a new AIM-listed vehicle. Ultimate

Sustainable Energy LTD ('USE'), is being prepared for listing on

AIM via an initial public offering ('IPO'). (See RNS dated 29

September 2022). In this regard, as part of planning and

preparation of the IPO referred to above, the Company has

identified a Nomad and Broker and is in advanced negotiations

towards agreeing engagement and mandate letters with a view of

completing the IPO during Q2 2023.

Corporate Update

At the start of the new year, in an RNS dated 11 January 2023,

the Company announced the appointment of Beaumont Cornish Limited

('BCL') as its new Nominated Adviser (NOMAD). The Company

furthermore welcomed Ajay Saldanha as an independent non-executive

director to its Board of Directors. Ajay Saldanha (aged 47) is an

experienced banking and investment professional with more than 20

years of experience in the power, energy and utilities sector.

The Company is currently sufficiently funded through its

existing financing facilities, assuming deferral or otherwise

settlement in equity of the bridge loan facility announced on 16

February 2022 and GBP660,000 Convertible Loan Instrument held by

Kibo executive management and directors, to cover operational

expenditure for the short to medium term while the Company actively

pursues various funding opportunities. These include equity, debt

and project financing, to fund the ongoing development of the

various projects within the Kibo Group Project Portfolio and to

bring the advanced projects, as outlined above, to Financial Close

as soon as possible. Most of the projects included in the Project

Portfolio are in advanced stages of development and Kibo is working

towards achieving Financial Close for all the advanced projects

during the course of 2023, with the specific exclusion of the Mbeya

Power Project where Financial Close can realistically only be

achieved during 2024.

Louis Coetzee, Chief Executive Officer and Non-Executive

Chairman of Kibo Energy, says: "We are pleased with the progress we

have made since announcing our re-focused strategy to pivot to

renewable/alternative energy in 2021. In following this strategy,

Kibo has built a robust and diversified project pipeline and

bolstered its project development capacity. This diversified

portfolio sufficiently de-risks the Kibo strategy execution from

Management's perspective and has successfully propelled the Company

to a position where it currently has the realistic expectation of

seeing several projects in revenue generation status over the next

12 to 24 months.

The Company has furthermore strengthened its in-house capability

significantly with management and project teams that have extensive

skills, knowledge and experience in the renewable energy sector. In

this regard, the Company has also recently concluded negotiations

with a well-respected international executive in the long-duration

energy storage industry to join the Kibo team in heading up the

Company's renewable energy and long-duration storage business

division. Further announcements will be made in this regard as soon

as a commencement date has been finalized.

2023 promises to be an eventful year for Kibo and we look

forward to providing the market with further updates in due

course."

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014.

**ENDS**

For further information please visit www.kibo.energy or

contact:

Louis Coetzee info@kibo.energy Kibo Energy PLC Chief Executive

Officer

James Biddle +44 207 628 3396 Beaumont Cornish Nominated Adviser

Roland Cornish Limited

------------------------------ ----------------------- ----------------------

Claire Noyce +44 20 3764 2341 Hybridan LLP Joint Broker

------------------------------ ----------------------- ----------------------

Damon Heath +44 207 186 9952 Shard Capital Partners Joint Broker

LLP

------------------------------ ----------------------- ----------------------

Zainab Slemang zainab@lifacommunications.com Lifa Communications Investor and Media

van Rijmenant Relations Consultant

------------------------------ ----------------------- ----------------------

Johannesburg

01 February 2023

Corporate and Designated Adviser

River Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKFFDFFDEFA

(END) Dow Jones Newswires

February 01, 2023 02:00 ET (07:00 GMT)

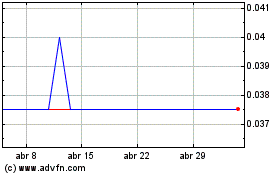

Kibo Energy (LSE:KIBO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Kibo Energy (LSE:KIBO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024