M&G Credit Income Investment Trust plc (MGCI)

2023 Interim Results

21-Sep-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

LEI: 549300E9W63X1E5A3N24

M&G Credit Income Investment Trust plc

Half Year Report and unaudited Condensed Financial Statements

for the six months ended 30 June 2023

The full version of the Half Year Report and unaudited Condensed Financial Statements can be obtained from the

following website: www.mandg.co.uk/creditincomeinvestmenttrust

Chairman's statement

Performance

Your Company delivered a positive NAV total return of 3.58% for the six months to 30 June 2023. This compared

favourably with the performance of investment grade fixed income indices such as the ICE BofA Sterling Corporate and

Collateralized Index (-0.97%) and the ICE BofA 1-3 Year BBB Sterling Corporate & Collateralized Index (+0.49%).

The first half of the year saw forward-looking policy rate expectations continue to drive pricing in risk assets.

Combined with a highly uncertain economic outlook this has resulted in persistent and elevated market volatility,

although lower than was the case in 2022. There have been some issuer specific instances of deterioration in credit

quality in the portfolio as the effects of higher interest rates and tightening financial conditions have started to

materialise. In particular, our investment in the bonds of the French supermarket group, Casino, has had to be written

down to a nominal amount (prior to the write down it represented 0.5% of the portfolio). This has been an outlier: our

Investment Manager has constructed a diversified portfolio which is designed to protect long-run performance against

idiosyncratic risk and credit incidents since inception have been limited.

The year began with speculation that central banks might be approaching the end of their rate hiking cycles, which

sparked a renewed appetite for risk and fuelled a strong market rally across bonds and equities. However, optimism over

a possible reprieve from interest rate hikes faded as the quarter progressed, with central banks remaining resolute in

their fight to curb inflation. This was evident as interest rates were raised again in March despite pronounced market

volatility arising from fears about the health of the global banking system.

By comparison, the second quarter was relatively calm as the feared contagion in the banking sector failed to

materialise: this led to diminished volatility in bonds and equities and a tightening in credit spreads even though

interest rates continued to rise. Volatility in sovereign bond markets and rate weakness persisted although the

Investment Manager continued to hedge interest rate risk and maintain low portfolio duration which mitigated the effect

on your Company's performance. The first half of the year closed on a positive note for financial markets as opinion

began to shift to the view that a future economic downturn would be less severe than previously feared.

Share buybacks and discount management

Your board remains committed to seeking to ensure that the Ordinary Shares trade close to NAV in normal market

conditions through buybacks and issuance of Ordinary Shares. During the half year, the Company bought back 100,000

shares pursuant to the 'zero discount' policy initially announced on 30 April 2021. The Company's Ordinary Shares

traded at an average discount to NAV of 0.83% during the period ended 30 June 2023. On 30 June 2023 the Ordinary Share

price was 89.5p, representing a 4.9% discount to NAV as at that date. As at 30 June 2023, 2,612,749 shares were held in

treasury with an additional 158,783 repurchased since the period end.

Amendment of Articles of Association

The success to date of our 'zero discount' policy gave our shareholders the confidence to defer the opportunity to

realise the value of some or all of their Ordinary Shares at NAV per Ordinary Share less costs (the 'Liquidity

Opportunity') in 2023 as set out in your Company's Articles of Association (the 'Articles'). The Articles were duly

amended at a general meeting on 15 June and the next Liquidity Opportunity will now occur at, or within the twelve

months prior to, the 2028 annual general meeting unless shareholders direct by way of a special resolution not to offer

such Liquidity Opportunity. Our Investment Manager thus now has an extended window in which to take account of the

attractive opportunities it expects to continue to occur in volatile markets.

Dividends

Your Company is currently paying four, quarterly interim dividends at an annual rate of SONIA plus 4%, calculated by

reference to the adjusted opening NAV as at 1 January 2023. The Company paid dividends of 1.77p and 1.93p per Ordinary

Share in respect of the quarters to 31 March 2023 and 30 June 2023 respectively. Together with the dividends of 1.14p

and 2.43p per Ordinary Share paid by the Company in respect of the quarters to 30 September 2022 and 31 December 2022

respectively, the Company's shares offer a yield (based on share price at the time of writing) of 8.1%. Your Company's

Investment Manager continues to believe that an annual total return, and thus ultimately a dividend yield, of SONIA

plus 4% will continue to be achievable although there can be no guarantee that this will occur in any individual year.

Outlook

So far in 2023, financial markets have been far less volatile than they were over the course of last year, which has

been supportive for credit spreads. The Company's positive performance has been driven by the portfolio's low interest

rate sensitivity as well as the additional income generated by higher yielding private assets. The pipeline of private

asset opportunities looks healthy and our Investment Manager has been able to use its ability to invest across both

public and private markets to improve the yield of the portfolio.

Your Company's portfolio (including irrevocable commitments) is now 57% invested in private assets, with additional

investments of approximately 9% in illiquid publicly listed assets which are intended to be held to maturity. The

Investment Manager will continue to deploy capital into both public and private areas of the fixed income market,

depending on where it sees the most attractive relative value. The Company's revolving credit facility was fully repaid

over the period and as at 30 June 2023 remained undrawn and ready to be utilised to take advantage of any future

episodes of market volatility.

Your board believes that the Company remains well positioned to achieve its return and dividend objectives, as set out

above in the section entitled 'Dividends'.

David Simpson

Chairman

20 September 2023

Financial highlights

Key data

As at As at

30 June 2023 31 December 2022

(unaudited) (audited)

Net assets (GBP'000) 133,828 135,109

Net asset value (NAV) per Ordinary Share 94.16p 94.99p

Ordinary Share price (mid-market) 89.5p 92.1p

Discount to NAVa 4.9% 3.0%

Ongoing charges figurea 1.23% 1.22%

Return and dividends per Ordinary Share

Six months ended Year ended

30 June 2023 31 December 2022

(unaudited) (audited)

Capital return 0.7p (6.0)p

Revenue return 2.6p 4.2p

NAV total returna 3.6% (1.7)%

Share price total returna 1.6% (2.8)%

Total dividends declaredb 3.70p 5.35p

a Alternative performance measure. Please see pages 31 to 32 in

the full Half Year Report for further information.

b The total dividends declared in respect of each period equated

to a dividend yield of SONIA plus 4% on the adjusted opening NAV of

the relevant period.

Investment manager's report

We are pleased to provide commentary on the factors that have

had an impact on our investment approach since the start of the

year. In particular we discuss the performance and composition of

the portfolio.

In the first half of 2023 investors were forced to navigate

volatile market conditions as central banks pressed ahead with the

sharpest and most aggressive interest rate hiking cycles seen since

the 1980s. The year started positively, with optimism about China's

reopening and hopes that inflation might be slowing fuelling a

market rally. Into this strength, we sold investment grade bonds

which had been purchased at significantly wider spreads, many in

the wake of the mini-budget crisis. We redeployed proceeds into

financial credits which priced with an attractive new issue premium

and also paid down the outstanding loan balance on the Company's

credit facility as we looked to reduce portfolio risk. Share prices

retreated and bond yields increased in February amid concerns that

central banks would keep raising interest rates to tackle

persistently high inflation. In March, volatility spiked as the

collapse of Silicon Valley Bank in the US and the emergency rescue

of Credit Suisse in Switzerland sparked turmoil in the global

banking sector. The diversified nature of the portfolio and

relatively low allocation to debt issued by banks mitigated the

effects of this stress episode on the Company's performance. We

remained active in the private part of the fixed income market,

reducing exposure to the M&G European Loan Fund and using

redemption proceeds to fund a GBP2 million subscription in M&G

Lion Credit Opportunity Fund IV ('Lion IV'). This was a strategic

decision to take advantage of wider spreads and attractive yields

available in the mezzanine ABS space in

which Lion IV invests. Additional private activity in the early

part of the year saw us add to an existing senior secured loan

holding on a luxury, business-to-business retail asset, whilst we

also purchased the mezzanine loan in a commercial real estate

transaction secured over a freehold office building. An additional

GBP1.2 million of commitments to existing private loans was also

funded over the first quarter.

The impact of inflation and higher interest rates on economic

activity remained in focus in the second quarter of the year. Core

inflation (excluding food and energy) continued to prove stubbornly

persistent whilst labour markets remained at undesirably tight

levels. The European banking sector showed no signs of contagion

following events in March which meant market volatility reduced and

paved the way for investor sentiment to improve. At this time we

took the opportunity to exit positions in troubled issuers Intu SGS

and Boporan, both of which had materially underperformed. In May,

CPI data in the US and Europe provided a downside surprise as

disinflationary trends began to materialise, however the UK

remained an outlier as its headline CPI reading came in notably

higher than expected at 8.7%. This sparked a fresh sell-off in UK

government bonds which continued to underperform peers, although

the portfolio's duration hedge did its job and mitigated the drag

on performance from the climb higher in risk-free rates. Portfolio

activity increased as we rotated out of tighter yielding bonds,

redeploying proceeds into comparable or higher rated asset backed

securities (ABS) and collateralised loan obligations (CLOs) at new

issue. This provided a significant spread pick-up and improved both

the overall yield and credit quality of the portfolio. We continued

to add attractively priced private assets into the portfolio as the

pipeline of opportunities improved. Pleasingly, these included two

secondary market loans in the infrastructure space, a sector where

we are less active due to the lower returns typically on offer in

primary market transactions. The first is an investment grade

quality waste-to-energy (utility) asset, the second, a senior

secured loan issued by a prominent player in the UK's fibre

broadband space which we purchased at a notable discount to par,

meaning the loan will return significantly in excess of our target

return over its term.

We are currently seeing a healthy and diverse pipeline of

private investment opportunities across a range of sectors. The

funded private asset portion of the portfolio increased marginally

over the period to 57.72% (versus 57.02% at 31 December 2022) as

new private asset purchases were offset by repayments approximating

5% since the start of the year. We actively monitor the portfolio

for signs of distress and currently have two assets, amounting to

0.2% of the latest NAV, which are either in technical default or at

some stage of a restructuring process. This is after a notable

deterioration in bonds issued by French supermarket retailer Casino

(written down by approximately 0.5% of NAV since purchase), for

which recovery prospects at this stage look bleak. The position is

already marked to market within your Company's latest NAV.

Outlook

Risk sentiment in markets remains fragile, driven by a number of

economic indicators which are closely watched by central banks to

inform decision making on the path of interest rates. Two competing

market narratives have been established. A 'hard landing' - in

tightening rates to curb inflation a recession is triggered, and a

'soft landing' - economic growth slows enough to control inflation

but remains high enough to avoid a recession. At present, the

pricing of risk assets is being driven by perceived changes in the

probability of each outcome.

Early summer optimism from a swifter than expected deceleration

in inflation has now given way to concerns over the length of time

it will take to return to the two percent average targeted by

central banks. This has led to a growing acceptance by the market

that interest rates will remain higher for longer and pushed out

investor expectations for rate cuts. Recent key data points to

divergent economic performance between Europe and the US. The

former showing signs of a worse than expected contraction in both

goods and services, whilst the latter proves more resilient and

better positioned to engineer the much fabled 'soft landing'. The

combination of deteriorating economic growth and expectations for a

prolonged period of elevated interest rates has led to weakening

macro sentiment as the third quarter has progressed.

Fundamentals in credit are generally supportive for now but look

set to come under further pressure in the latter part of year as

the effects of aggressive rate hiking cycles become more evident in

the real economy and the capital structures of issuers are tested

by the higher interest rate environment. Recent supply in

investment grade has pushed credit spreads wider although they

remain close to the tights of the year and the overall technical

remains strong given the relative attractiveness of all-in bond

yields.

Looking ahead, we anticipate interest rate volatility to

continue as central banks struggle to return inflation to their

desired two percent target in the face of a fundamental shift in

price dynamics. We expect this to be driven by longer term

structural trends including deglobalisation, a reduced labour

supply, and decarbonisation which should support policy rates

staying higher for longer. Ultimately, that would also see the

Company's dividend (which has risen in line with SONIA) remain

higher, with the dividend yield (based on share price at the time

of writing) currently 8.1%. Uncertainty over monetary policy looks

set to persist with central bank decisions remaining data dependent

and markets seeking clearer signalling on the economic outlook.

Against this backdrop the portfolio is cautiously positioned as we

approach the latter part of the year, however we remain poised to

add risk selectively when either issuer specific or wider market

volatility presents itself.

We believe that the Company's investment strategy is well suited

to the wider regime shift in financial conditions that we are

witnessing. Sharp increases in interest rates retain the ability to

hinder performance, hence we mitigate this risk by maintaining low

portfolio duration. Furthermore, the additional yield that private

assets have provided to our portfolio has boosted income returns.

Prior to the onset of Covid-19, strong risk asset performance was

driven by ultra- accommodative monetary policy, benefitting greatly

from 'a rising tide lifts all boats' economic backdrop.

Waters are now far more choppy. Constructing bottom- up

portfolios based on fundamental credit analysis is at the core of

our investment philosophy. We see clear strategic advantages in

this approach for navigating financial markets in the changing

times ahead where there will be a far clearer demarcation between

winners and losers within asset classes, sectors and regions.

Maintaining flexibility to invest across both public and private

markets whilst remaining sector agnostic will, in our opinion, be

essential to pursuing the most attractive relative value

opportunities.

M&G Alternatives Investment Management Limited

20 September 2023

Portfolio analysis

Top 20 holdings

As at 30 June 2023 Percentage of portfolio of investmentsa

M&G European Loan Fund 11.25

Project Mercury Var. Rate 21 May 2024 1.86

Delamare Finance FRN 1.279% 19 Feb 2029 1.70

M&G Lion Credit Opportunity Fund IV 1.52

PE Fund Finance III Var. Rate 15 Dec 2023 1.51

RIN II FRN 1.778% 10 Sep 2030 1.44

Hammond Var. Rate 28 Oct 2025 1.41

Hall & Woodhouse Var. Rate 30 Dec 2023 1.39

Millshaw SAMS No. 1 Var. Rate 15 Jun 2054 1.39

Dragon Finance FRN 1.3665% 13 Jul 2023 1.34

Atlas 2020 1 Trust Var. Rate 30 Sep 2050 1.28

Regenter Myatt Field North Var. Rate 31 Mar 2036 1.27

Signet Excipients Var. Rate 20 Oct 2025 1.23

Grover Group Var. Rate 30 Aug 2027 1.20

Gongga 5.6849% 2 Aug 2025 1.16

Aria International Var. Rate 23 Jun 2025 1.15

Citibank FRN 0.01% 25 Dec 2029 1.15

Income Contingent Student Loans 1 2002-2006 FRN 2.76% 24 Jul 2056 1.14

STCHB 7 A Var. Rate 25 Apr 2031 1.13

Finance for Residential Social Housing 8.569% 04 Oct 2058 1.06

Total 36.58

a Including cash on deposit and derivatives.

Geographical exposure

Percentage of portfolio of investments

as at 30 June 2023a

United Kingdom 55.53%

Europe 32.37%

United States 7.11%

Australasia 2.65%

Global 2.34%

a Excluding cash on deposit and derivatives.

Source: M&G and State Street as at 30 June 2023

Portfolio overview

As at 30 June 2023 %

Cash on deposit 2.49

Public 39.50

Asset-backed securities 17.40

Bonds 22.10

Private 57.69

Asset-backed securities 5.16

Bonds 2.15

Investment funds 12.77

Loans 23.98

Private placements 2.19

Other 11.44

Derivatives 0.32

Debt derivatives (0.01)

Forwards 0.33

Total 100.00

Source: State Street.

Credit rating breakdown

As at 30 June 2023 %

Unrated 0.32

Derivatives 0.32

Cash and investment grade 77.46

Cash on deposit 2.49

AAA 2.83

AA+ 0.14

AA 4.94

AA- 0.28

A+ 1.37

A 1.47

A- 3.63

BBB+ 12.25

BBB 15.83

BBB- 23.46

M&G European Loan Fund (ELF) (see note) 8.77

Sub-investment grade 22.22

BB+ 5.31

BB 2.63

BB- 4.14

B+ 3.34

B 3.94

B- 0.12

CCC+ -

CCC -

CCC- -

CC 0.03

D 0.23

M&G European Loan Fund (ELF) (see note) 2.48

Total 100.00

Source: State Street.

Note: ELF is an open-ended fund managed by M&G that invests

in leveraged loans issued by, generally, substantial private

companies located in the UK and Continental Europe. ELF is not

rated and the Investment Manager has determined an implied rating

for this investment, utilising rating methodologies typically

attributable to collateralised loan obligations. On this basis, 78%

of the Company's investment in ELF has been ascribed as being

investment grade, and 22% has been ascribed as being sub-investment

grade. These percentages have been utilised on a consistent basis

for the purposes of determination of the Company's adherence to its

obligation to hold no more than 30% of its assets in below

investment grade securities.

Top 20 holdings %

Company description

as at 30 June 2023

Open-ended fund managed by M&G which invests in leveraged loans issued by, generally,

M&G European Loan Fund substantial private companies located in the UK and Continental Europe. The fund's objective

is to create attractive levels of current income for investors while maintaining relatively

11.25% low volatility of NAV. (Private)

Project Mercury Var. Rate Floating-rate, senior secured tranche of a real estate loan to fund the construction and

21 May 2024 development of a residential led luxury scheme in Bayswater, West London. (Private)

1.86%

Delamare Finance FRN Floating-rate, senior tranche of a CMBS secured by the sale and leaseback of 33 Tesco

1.279% 19 Feb 2029 superstores and 2 distribution centres. (Public)

1.70%

M&G Lion Credit Open-ended fund managed by M&G which invests primarily in high grade European ABS with on

Opportunity Fund IV average AA risk. The fund seeks to find value in credits which offer an attractive structure

or price for their risk profile. (Private)

1.52%

PE Fund Finance III Var. Senior secured commitment providing NAV facility financing to a private equity firm

Rate 15 Dec 2023 investing in debt and equity special situations across Europe. (Private)

1.51%

RIN II FRN 1.778% 10 Sep Mixed CLO (AAA). Consists primarily of senior secured infrastructure finance loans managed

2030 by RREEF America L.L.C. (Public)

1.44%

Hammond Var. Rate 28 Oct

2025 Secured, bilateral real estate development loan backed by a combined portfolio of 2 office

assets leased to an underlying roster of global corporate tenants. (Private)

1.41%

Hall & Woodhouse Var. Rate Bilateral loan to a regional UK brewer that manages a portfolio of 219 freehold and

30 Dec 2023 leasehold pubs. (Private)

1.39%

Millshaw SAMS No. 1 Var. Floating-rate, single tranche of an RMBS backed by shared-appreciation mortgages. (Public)

Rate 15 Jun 2054

1.39%

Dragon Finance FRN 1.3665% Floating-rate, subordinated tranche of a securitisation of the sale and leaseback of 10

13 Jul 2023 supermarket sites sponsored by J Sainsbury plc ('Sainsbury's'). (Public)

1.34%

Atlas 2020 1 Trust Var.

Rate 30 Sep 2050 Floating-rate, senior tranche of a bilateral RMBS transaction backed by a pool of Australian

equity release mortgages. (Private)

1.28%

Regenter Myatt Field North PFI (Private Finance Initiative) floating-rate, amortising term loan relating to the already

Var. Rate 31 Mar 2036 completed refurbishment and ongoing maintenance of residential dwellings and communal

infrastructure in the London borough of Lambeth. (Private)

1.27%

Signet Excipients Var.

Rate 20 Oct 2025 Fixed-rate loan secured against 2 large commercial premises in London, currently leased to 2

FTSE listed UK corporations. (Public)

1.23%

Grover Group Var. Rate 30 Floating-rate, senior tranche of a securitisation of receivables originated by a leading

Aug 2027 European technology subscription platform. (Private)

1.20%

Gongga 5.6849% 2 Aug 2025 Structured Credit trade by Standard Chartered referencing a USUSD2bn portfolio of loans to

companies domiciled in 36 countries. (Private)

1.16%

Aria International Var.

Rate 23 Jun 2025 Floating-rate, senior tranche of a securitisation of invoice receivables originated by a

specialist digital recruitment platform. (Private)

1.15%

Citibank FRN 0.01% 25 Dec

2029 Floating-rate, mezzanine tranche of a regulatory capital transaction backed by a portfolio

of loans to large global corporates, predominantly in North America. (Private)

1.15%

Income Contingent Student Floating-rate, mezzanine tranche of a portfolio comprised of income-contingent repayment

Loans 1 2002-2006 FRN student loans originally advanced by the UK Secretary of State for Education. (Public)

2.76% 24 Jul 2056

1.14%

STCHB 7 A Var. Rate 25 Apr Floating-rate, mezzanine tranche in a regulated capital securitisation where the portfolio

2031 consists of 36 loans, secured on the undrawn Limited Partner (LP) investor capital

commitments. (Private)

1.13%

Finance for Residential High grade (AA/Aa3), fixed-rate bond backed by cash flows from housing association loans.

Social Housing 8.569% 4 (Public)

Oct 2058

1.06%

Further Information

The full Half Year Report and unaudited Condensed Financial

Statements can be obtained from the Company's website at

www.mandg.co.uk/creditincomeinvestmenttrust or by contacting the

Company Secretary at mandgcredit@linkgroup.co.uk.

It has also been submitted in full unedited text to the

Financial Conduct Authority's National Storage Mechanism and is

available for inspection at

data.fca.org.uk/#/nsm/nationalstoragemechanism in accordance with

DTR 6.3.5(1A) of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BFYYL325, GB00BFYYT831

Category Code: IR

TIDM: MGCI

LEI Code: 549300E9W63X1E5A3N24

OAM Categories: 1.2. Half yearly financial reports and audit reports/limited reviews

Sequence No.: 272829

EQS News ID: 1730855

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1730855&application_name=news

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

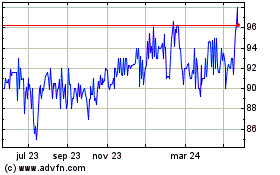

M&g Credit Income Invest... (LSE:MGCI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

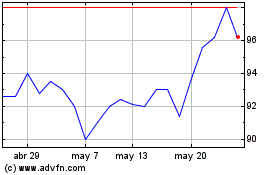

M&g Credit Income Invest... (LSE:MGCI)

Gráfica de Acción Histórica

De May 2023 a May 2024