NewRiver REIT PLC Final disposals within Napier 50/50 Joint Venture (1176E)

28 Junio 2023 - 1:00AM

UK Regulatory

TIDMNRR

RNS Number : 1176E

NewRiver REIT PLC

28 June 2023

NewRiver REIT plc

("NewRiver" or the "Company")

Final disposals within Napier 50/50 Joint Venture

NewRiver and PAF Lux SCA, SICAV RAIF, acting on behalf of its

compartment PAF - Bravo III Compartment ("BRAVO") are pleased to

announce the completion of the disposal of Kittybrewster Retail

Park in Aberdeen and Glendoe and Telford Retail Parks in Inverness

for GBP62.6 million (NRR share: GBP31.3 million) to RI UK 1

Limited. The assets generated net rental income of GBP5.7 million

(NRR share: GBP2.9 million) during FY23 and had a gross asset value

of GBP64.4 million (NRR share: GBP32.2 million) at 31 March 2023.

The sale proceeds will be used to reduce NewRiver's net debt as at

31 March 2023 by GBP31.8 million (net cash receipt of GBP19.8

million and repayment of secured debt of GBP12.0 million) to

GBP169.5 million on a proforma basis which reduces NewRiver's LTV

as at 31 March 2023 to 30.3% on a proforma basis.

The disposal comprises the final properties in the Napier Joint

Venture, bringing the total sale receipts from Napier to GBP76.0

million, reflecting a blended net initial yield of 7.4%. Total

receipts are 26% higher than the price paid when NewRiver and BRAVO

acquired the portfolio in June 2019 from a UK Institution for

GBP60.5 million, which reflected a blended net initial yield of

9.8%. Since acquisition the Napier Joint Venture has generated an

IRR of 16% and following the disposal of Napier, NewRiver and BRAVO

continue to own two assets within a separate venture.

Allan Lockhart, Chief Executive commented: "The Napier Joint

Venture is a great example of why we like retail parks and working

in capital partnerships. Over our four years of ownership and

management, we have been able to crystallise compelling returns for

ourselves and our partner by utilising our specialist retail

platform at each stage of the process, all the way from disciplined

stock selection to successful delivery of asset management plans in

order to secure a successful exit. In addition, the disposal means

that the strength of NewRiver's balance sheet position is further

improved, with proforma LTV now at 30.3% and significant cash

resources giving maximum flexibility and optionality around capital

allocation."

NewRiver has completed several successful initiatives across the

portfolio, with highlights including:

Kittybrewster Retail Park, Aberdeen

-- Let 10,000 sq ft unit which was vacant at acquisition to Wren Kitchens

on 10 year lease

-- Following Harveys administration in 2020, quickly re-let 10,000

sq ft unit to Dreams on 10 year term

-- Introduced JD Sports to the park in a 9,600 sq ft unit on a 10

year lease

-- Secured new 10 year term at lease renewal with TK Maxx lease on

16,700 sq ft

-- Actioned historic Halfords rent review shortly after acquisition

increasing rent by 34%

-- Increased McDonald's rent by 11% at rent review

-- Re-geared Oak Furnitureland on new 10 year lease, extending expiry

from 2024 to 2030

Glendoe and Telford Retail Parks, Inverness

-- Surrendered Curry's lease (not trading from unit at acquisition)

on 20,000 sq ft unit, for a significant premium and simultaneously

completed new lettings to Bensons for Beds and Food Warehouse,

having secured planning consent for food, on 10 year terms

-- Actioned landlord break on Poundstretcher and re-let 15,000 sq

ft unit to Poundland on new 5 year lease

-- Completed a reversionary lease with B&M adding 10 years to their

existing term resulting in a June 2034 expiry

-- Let 10,000 sq ft void unit at acquisition to the Department for

Work & Pensions

-- Re-geared Oak Furnitureland and Go Outdoors on new 10 year leases

Units at Kingsway East Retail Park, Dundee (Sold in March

2021)

-- Sold property to a special purchaser, an existing tenant, at premium

pricing having agreed a deal with an alternative tenant to occupy

their unit. The property also included a 34,500 sq ft unit let

to B&M

Wakes Retail Park, Newport, Isle of Wight (Sold in March

2022)

-- Downsized Curry's from 30,000 to 15,000 sq ft in return for a surrender

premium, extending their term by 5 years with the remainder, on

which food planning consent was obtained, re-let to Food Warehouse

on a 10 year term

-- Completed a lease re-gear with Pets at Home, extending their lease

term by 5 years

For further information

+44 (0)20 3328

NewRiver REIT plc 5800

Allan Lockhart (Chief Executive)

Will Hobman (Chief Financial Officer)

Lucy Mitchell (Communications

& Investor Relations)

+44 (0)20 7251

FGS Global 3801

Gordon Simpson

James Thompson

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

the law of England and Wales by virtue of the European Union

(Withdrawal) Act 2018. This announcement has been authorised for

release by the Board of Directors.

About NewRiver

NewRiver REIT plc ('NewRiver') is a leading Real Estate

Investment Trust specialising in buying, managing and developing

resilient retail assets throughout the UK.

Our GBP0.6 billion UK wide portfolio covers 7 million sq ft and

comprises 26 community shopping centres and 14 conveniently located

retail parks occupied by tenants predominately focused on essential

goods and services. Our objective is to own and manage the most

resilient retail portfolio in the UK, focused on retail parks, core

shopping centres, and regeneration opportunities in order to

deliver long-term attractive recurring income returns and capital

growth for our shareholders.

NewRiver has a Premium Listing on the Main Market of the London

Stock Exchange (ticker: NRR). Visit www.nrr.co.uk for further

information.

LEI Number: 2138004GX1VAUMH66L31

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISDGGDLIDDDGXR

(END) Dow Jones Newswires

June 28, 2023 02:00 ET (06:00 GMT)

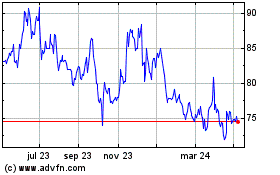

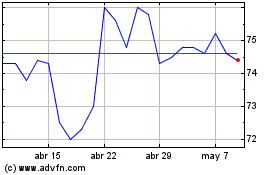

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024