Oxford Tech 2 VCT Offer For Subscription - Update

16 Febrero 2023 - 1:00AM

UK Regulatory

TIDMOXH

Oxford Technology 2 VCT Plc (the "Company")

Legal Entity Identifier: 2138002COY2EXJDHWB30

16 February 2023

Offer for Subscription -- Update

Further to the announcement made by the Company on the 18 May

2022 with regards to the offer for subscription ("Offer") of up to

20,000,000 Leisure Shares, details of which were set out in a

prospectus published by the Company dated 18 May 2022

("Prospectus"), the Board of the Company ("Board") regrets to

announce that it has withdrawn the Offer with immediate effect.

The Board has been in regular contact with the Offer's promoter,

Edition Capital Investments Limited ("Edition") since the Offer was

launched. Until recently, Edition has been confident that

sufficient funds could be raised in the current tax year to launch

the new Leisure Share class. However, there remains a large amount

of capacity in the wider VCT marketplace, especially from

established players, and this has made it difficult to have

certainty that Edition will be able to launch a new share class

able to deliver its investment strategy in a timely manner (and in

any event before the end of the current tax year).

In order to ensure investors are not unfairly impacted by this

uncertainty, we have decided to withdraw the Offer. Any funds

already received from prospective investors will be promptly

returned as set out in the terms and conditions of the

Prospectus.

The Board is disappointed that it has not been able to further

expand the asset base of the Company at this time, which has long

been one of its stated objectives. The merger of the four Oxford

Technology VCTs in June 2022 leaves the Company in a much stronger

position to successfully allot shares in due course. It gives the

Company greater critical mass (net assets of GBP9.1m at 31 August

2022 compared to GBP1.3m at 28 February 2022), reduces operating

costs for each share class and ensures the Company can continue to

meet all the VCT Qualifying Test requirements, which were getting

increasingly difficult with the reducing size of the separate VCTs.

Moreover, had the new Leisure Share Class been issued, there would

have been a further step reduction in costs payable by the existing

share classes, which will no longer happen in the short term. All

costs payable by the Company linked to the merger have already been

expensed, so there is no further impact expected on the

P&L.

As a result of the withdrawal of the Offer there will be no

change of manager, nor name change of the VCT at this time and

Oxford Technology Management Ltd (OTM) will continue to advise the

Board under the current agreements.

The Board hopes to be able to work again with Edition. The Board

still believes that a future offer (i.e. raising new VCT funds in a

new share class) with either Edition or another manager remains the

way forward. This should allow the further cost savings previously

outlined for existing shareholders whilst the portfolios continue

to mature before ultimate asset realisations and distributions to

shareholders. Any potential future offer would require the advance

approval of the Company's shareholders.

Edition has been an active investor in the tax efficient space

for six years, with a focus on EIS investment. Edition looked to

provide access to its EIS investment strategy through a VCT to

enable more investors to participate and has worked with the

Company to create an attractive investment proposition since late

2021 which worked for the existing investor base as well as new

investors.

Edition commented 'Whilst it is disappointing to be unable to

complete the process now, we believe the work done to date

(including the completion of the merger) leaves the Company in a

strong position to successfully allot shares next year. We remain

confident in the underlying investment strategy and the Edition EIS

fund remains open and actively making investments in the leisure

sector, having deployed over GBP50m into 30+ leisure

businesses.'

For further information, please contact:

Lucius Cary, Andrea Mica and Richard Roth via

https://www.globenewswire.com/Tracker?data=P_T6AYuDGt8Q6SqwdPupFbtgrx1ZEAWFC2EPFc4-XgH6_46uaIHeEp6WnAsUHTEzTB9q0x6ViJP3HDC6t0E0EPCNyFas4E0ua-_RZO1ASH-61CWJoKVXnLEsYtJYwV0Y

vcts@oxfordtechnology.com

Edition:

https://www.globenewswire.com/Tracker?data=WzUVxmXwcLw3-LJDWGd1d9zRwn1vDLbgHTcAIcxjr_tjgI_TBxJ4vMiC05PAcjXdmQ5nXoPOMLNfUa85if2Esdh4suQfUqXIFi6Vrx917pk1AOIs_NJtCgz9CrHmybWR

enquiries@editioncapital.co.uk or 0203 145 1851

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. Upon the publication of this announcement via

a Regulatory Information Service, this information is now

considered to be in the public domain.

(END) Dow Jones Newswires

February 16, 2023 02:00 ET (07:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

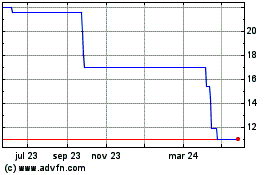

Oxford Technology 2 Vent... (LSE:OXH)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Oxford Technology 2 Vent... (LSE:OXH)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025