TIDMPAT

RNS Number : 6270F

Panthera Resources PLC

11 July 2023

11 July 2023

Panthera Resources Plc

("Panthera" or "the Company")

Executive Service Agreement Variation

Gold exploration and development company Panthera Resources Plc

(AIM: PAT), with gold assets in West Africa and India, announces

that the Company has today agreed to vary certain incentivisation

terms of the existing executive services agreement in place with

the Company's CEO, Mark Bolton and the Company (the "Executive

Service Agreement").

Background

On appointment, Mark Bolton entered into the Executive Service

Agreement with Company, which contained, inter alia, certain terms

and conditions outlining his entitlements under the Company's

executive director incentive arrangements. These incentive

arrangements have subsequently expired. The Board recognises the

importance of aligning the executive directors' long-term interests

with that of the Company's shareholders, including through, amongst

other ways, the encouragement of increasing long-term shareholder

value.

As a result, the Company has agreed to vary the terms of Mark

Bolton's Executive Service Agreement, as such that Mark Bolton

shall be entitled to the automatic grant of three (3) million

options, subject to certain condition precedents outlined below,

over new ordinary shares of GBP0.01 each in the capital of the

Company (the "Ordinary Shares").

If the condition precedents outlined below are met, the options

to be granted are exercisable into one new Ordinary Share at a

strike price of GBP0.10 (the "Strike Price") per Ordinary Share up

until 31 March 2024. The strike price of GBP0.10 represents

approximately a 32 per cent premium to the closing mid-market price

of the Company's Ordinary Shares on 10 July 2023.

Accordingly, a total of 3 million options, representing

approximately 1.9 per cent. of the Company's issued share capital

could be granted to Mark Bolton under the revised Executive Service

Agreement.

Grant of options condition precedents

The grant of the options are subject to certain criteria:

a) the grant of the Bhukia Prospecting Licence and securing the

follow-on permits required to commence drilling; or, if earlier

b) securing committed litigation finance (that is available for

drawdown by the Company) for a minimum of US$5 million to pursue a

claim under the Australia India Bilateral Investment Treaty.

Furthermore, under the amended Executive Service Agreement,

partial automatic grant of these options over new Ordinary Shares

can occur earlier if in any month the weighted average share price

exceeds GBP0.20 in which case, Mark Bolton will be entitled to the

grant and subsequent exercise of 150,000 options over new Ordinary

Shares out of the 3 million for that month at the Strike Price.

Name of Director m aximum

options currently number of

held over options that

Ordinary Shares can be granted

as a percentage m aximum as a percentage

Options currently of current number of of current

held over issued share options that issued share

Ordinary Shares capital can be granted capital

Mark Bolton 250,000 0.16% 3,000,000 1.94%

------------------ ------------------ ---------------- -----------------

Related party transaction

The variation to the Executive Service Agreement and inclusive

of the entitlement to the potential future grant of the options to

Mark Bolton, subject to certain condition precedents, (the

"Variation and Grant of Options") is deemed to be a related party

transaction pursuant to rule 13 of the AIM Rules for Companies. The

directors of the Company, with the exception of Mark Bolton, having

consulted with the Company's nominated adviser, Allenby Capital

Limited, that the terms of the transaction are fair and reasonable

insofar as the Company's shareholders are concerned.

The FCA notification, made in accordance with the requirements

of the UK Market Abuse Regulation is appended further below.

Contacts

Panthera Resources PLC

Mark Bolton (Managing Director) +61 411 220 942

contact@pantheraresources.com

Allenby Capital Limited (Nominated Adviser & Joint Broker) +44 (0) 20 3328 5656

John Depasquale / Vivek Bhardwaj (Corporate Finance)

Kelly Gardiner / Stefano Aquilino (Sales & Corporate

Broking)

Novum Securities Limited (Joint Broker) +44 (0) 20 7399 9400

Colin Rowbury

Subscribe for Regular Updates

Follow the Company on Twitter at @PantheraPLC

For more information and to subscribe to updates visit:

pantheraresources.com

UK Market Abuse Regulation (UK MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information for the purposes of

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310. Upon the publication of this announcement via a

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

Forward-looking Statements

This news release contains forward-looking statements that are

based on the Company's current expectations and estimates.

Forward-looking statements are frequently characterised by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise. Forward-looking statements are not guarantees of future

performance and accordingly, undue reliance should not be put on

such statements due to the inherent uncertainty therein.

**S**

Annexure

Notification and public disclosure of transactions by

1. persons discharging managerial responsibilities and persons

closely associated with them.

a) Name: Mark Bolton

---------------------------- -------------------------------------

b) Position/Status: Executive Director

---------------------------- -------------------------------------

c) Initial notification/ Initial notification

Amendment:

---------------------------- -------------------------------------

Details of the transaction(s): section to be repeated

2 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted:

-------------------------------------------------------------------

a) Description of the Ordinary shares of GBP 0.01 each in

financial instrument, Panthera Resources Plc

type of instrument:

Identification code:

2138001B98EG6736XN82

---------------------------- -------------------------------------

b) Nature of the transaction: Amendment to incentive plan pursuant

to Executive Service Agreement

---------------------------- -------------------------------------

c) Price(s) and Volume(s): Strike Price: GBP0.10

Maximum volume: 3,000,000

---------------------------- -------------------------------------

d) Aggregated Information: N/A

- Aggregated Volume

---------------------------- -------------------------------------

e) Date of the transaction: 11 July 2023

---------------------------- -------------------------------------

f) Place of the transaction: Outside a trading venue

---------------------------- -------------------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCQFLBFXDLEBBZ

(END) Dow Jones Newswires

July 11, 2023 03:00 ET (07:00 GMT)

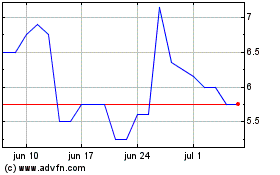

Panthera Resources (LSE:PAT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Panthera Resources (LSE:PAT)

Gráfica de Acción Histórica

De May 2023 a May 2024