TIDMPAT

RNS Number : 2348O

Panthera Resources PLC

29 September 2023

29 September 2023

Panthera Resources Plc

("Panthera", "PAT" or "the Company")

Audited Financial Results and Management Update for the 12

Months Ended March 31, 2023

Panthera Resources PLC (AIM: PAT), the gold exploration and

development company with assets in India and West Africa, is

pleased to provide a summary of the Company's audited financial

results for the year ended March 31, 2023.

Highlights of 2022-23 Financial Year

Panthera Resources PLC has navigated its fifth full year as an

AIM-quoted exploration and mining company. During this period, we

have focused the Company on advancing its gold projects in West

Africa while continuing our efforts to unlock the significant

potential value of the Bhukia Project ("Bhukia") in Rajasthan,

India.

Bhukia Project (Rajasthan, India)

-- On 28 February 2023 the Company announced that Indo Gold Pty

Ltd ("IGPL"), a subsidiary of the Company, executed a conditional

arbitration funding agreement (the "AFA") for up to US$10.5 million

in arbitration financing (the "Facility") with Litigation Capital

Management Limited ("LCM"), a firm quoted on the AIM Market of the

London Stock Exchange. LCM is a leading global litigation financier

with significant expertise in international arbitration and

cross-border disputes, including bilateral investment treaty claims

over mineral resource assets. On 25 August 2023, post the financial

year ended 31 March 2023 ("FY 2023" or the "2022-23 Financial

Year"), the Company announced that LCM had successfully completed

its due diligence resulting in the AFA becoming unconditional and

accordingly now available to IGPL and that the Facility has been

increased from US$10.5 million to US$13.6 million.

-- On 27 September 2023, the Company announced that the High

Court of Rajasthan ("HCR") had dismissed the writ petition to

reinstate the Company's PL application.

-- Subject to any earlier mutually acceptable resolution, the

Company will now pursue a claim against the Republic of India

("RoI") for breaches of its obligations under the Australia India

Bilateral Investment Treaty through, inter alia, international

arbitration.

Growing High Potential West Africa Gold Portfolio

Cascades (Burkina Faso)

-- During the 2022-23 Financial Year, two drilling campaigns

were completed at the Cascades Project. This follows the

announcement by the Company of a maiden mineral resource estimate

in October 2021 comprising an indicated resource of 264,000 ounces

and estimated inferred resource of 371,000 ounces.

-- Highlights from the June 2022 Cascades drilling programme, as

announced by the Company 7 September 2022 include:

- Confirmed the presence of a significant new gold zone at the

TT-13 target and that assay results include:

CS22-RC027 45-55m, 10m@ 1.55 g/t Au

CS22-RC028 25-29m, 4m@ 2.10 g/t Au

CS22-RC028 38-54m, 16m@ 1.26g/t Au

CS22-RC029 27-36m, 9m @ 1.08 g/t Au

CS22-RC029 56-66m, 10m@ 1.81g/t Au

- Infill drilling has added definition to the geological model

with high-grade mineralisation intersected in the Western Zone at

Daramandougou. Assay results including 3 metres @ 12.52g/t Au;

and

- Recent metallurgical test work confirms that the gold is free

milling

-- Highlights from the February 2023 Cascades drilling

programme, as announced by the Company on 25 May 2023, include:

- Two significant new zones confirmed with resource potential

from first pass drilling at Sina Yar and Far East Targets

- Intersections at Sina Yar included 34m@ 1.83 g/t Au and 18

metres @ 1.13g/t Au

- Extension of the 2022 discovery zone from step-out drilling at

the TT13 target.

Bido (Burkina Faso)

-- On 12 October 2022, the Company announced the results of the

induced polarisation ("IP") geophysical survey over an area of

approximately 15km2, in the Beredo and the Somika areas. The

Company targeted this volcanic centre with its maiden geophysical

survey at Bido, where previous geochemical work, including recent

rock sampling, had returned very promising results. These areas

also host extensive active artisanal workings.

-- The survey has identified a total of 47 anomalies, of which

28 are regarded as high-priority. Results indicate multiple targets

where strong/moderate IP axes defining both resistive and

conductive structures defined by the IP survey are coincident with

mapped vein structures, gold in rock samples and artisanal

workings.

Bassala (Mali)

-- On 5 September 2022, the Company completed 2,601m geochemical

drilling in 50 drill holes at the Bassala Project. Highlights:

- Five significant prospects defined from initial and follow-up

geochemical drilling campaigns. The most significant prospect is

the Tabakorole Prospect, which has a 2km strike length and where

drilling has identified wide zones of mineralisation.

- Significant silica-chlorite-sulphide alteration and associated

quartz veining were observed over most of the targeted

intervals.

- Drill assay results (based on 5m composite sampling)

include:

5 metres at 5.60 g/t from 40m ;

5 metres at 4.68 g/t from 10m ; and

5 metres at 3.73 g/t from 35m .

Chairman's Statement

Dear Shareholder,

It is with renewed pleasure that I present the annual report for

the 2022-23 Financial Year for Panthera Resources PLC. For many

years, Panthera's strategic objective has remained to create a

mid-tier mining company by building a strong portfolio of

high-quality, low-cost gold assets in West Africa and India. During

the financial year the Company has continued to focus on adding

value to our West African gold projects, while also seeking a

resolution to the impasse over the permitting of the Bhukia project

in Rajasthan, India (Bhukia).

My involvement commenced by co-founding the group in 2005,

originally to focus on gold exploration in India, and I acted as

Managing Director and Executive Chairman until its admission to

trading on AIM in 2017. For more than 3 years following the

commencement of our exploration at Bhukia in 2005, the Company

operated very successfully in India, reported a maiden mineral

resource estimate by applying a new exploration model and

introduced a deeper understanding of the metallurgical properties

of the mineralisation. It grew very rapidly and raised sufficient

capital from international financiers to complete feasibility

studies, then was denied its rightful follow-on mineral title in

2008. Over the years since, there have been many attempts to settle

matters with governments in India over obstacles to Bhukia

permitting, especially since floating on AIM in December 2017. None

of which were successful.

It goes without saying that our objective all along was to have

continued to invest heavily in the major gold discovery at Bhukia

and to have put it into production many years ago.

Since 2008, the Company has actively sought the approval of its

prospecting licence over Bhukia (the "PL") through the domestic

Indian legal system. In March 2021, the Government of India ("GoI")

amended the Mines and Minerals (Development and Regulation) Act

("MMDR2021") resulting in the immediate lapse of the preferential

right to a prospecting licence and a subsequent mining lease. As a

consequence of the introduction of the MMDR2021, on 27 September

2023, the Company announced that the High Court of Rajasthan

("HCR") had dismissed the writ petition to reinstate the Company's

PL application. The decision by the HCR adds to the act of

expropriation, and the Republic of India ("RoI") has again breached

its obligations to provide investment protections to IGPL and its

investment under the Australia India Bilateral Investment Treaty

("ABIT", "BIT" or the "Treaty"). Subject to any earlier mutually

acceptable resolution, the Company will now pursue a claim against

the RoI for breaches of its obligations under the Treaty through,

inter alia, international arbitration.

A claim for compensation pursuant to the Treaty will involve an

assessment of the market value of the Bhukia project immediately

before the expropriation. The Company believes that the market

value of Bhukia is substantial with the project ranking among the

top undeveloped gold projects in the world.

In order to support a damages claim against the Republic of

India for breaches of its obligations under the Treaty, the Company

has successfully secured US$13.6 million in arbitration financing

from Litigation Capital Management. LCM is a leading global

litigation financier with significant expertise in international

arbitration and cross-border disputes, including bilateral

investment treaty claims over mineral resource assets.

I would like to thank the executive team, the Panthera board of

directors (the "Board" or the "Directors") and Fasken for their

dedicated pursuit and achievement of what we hope and expect will

be, eventually, a very positive outcome for the Company.

In West Africa, the Company will continue its efforts to

generate value from its operations whilst being mindful of dilution

of the unrealised intrinsic value of Bhukia. It is presently

reviewing its strategic direction here, which process will involve

a careful assessment of portfolio quality and renewal, commodity

trends, the allocation of capital needed for exploration success,

and also understanding (from our shared exploration success

experiences) that a potential significant gold discovery is often

just one more drill campaign away. The agreement over Cascades

whereby DFR Gold Inc ("DFR") is spending up to US$18 million to

earn 80% interest in Cascades is an example of risk sharing that

comes into this changing strategic approach.

I commend this report to all shareholders and would like to

again thank all those involved in getting us to this point,

including the full Panthera board of directors, the executive team

and the Fasken team.

Michael Higgins

Non-Executive Chairman

29 September 2023

The audited Annual Report and Financial Statements for the year

ended 31 March 2023 will shortly be sent to shareholders and

published at: pantheraresources.com

Group statement of comprehensive income for the year ended 31

March 2023

2023 2022

$ USD $ USD

----------------------------------------------------- ----------- -----------

Continuing operations

Revenue - -

----------------------------------------------------- ----------- -----------

Gross profit - -

Other Income 12 76

Exploration costs expensed (940,028) (1,421,695)

Administrative expenses (1,320,934) (1,015,005)

Share of losses in Investment in Associate

and Joint Venture (896,216) (682,224)

----------------------------------------------------- ----------- -----------

Loss from operations (3,157,166) (3,118,848)

Investment revenues 24 -

Loss on sale of investments (294) -

----------------------------------------------------- ----------- -----------

Loss before taxation (3,157,436) (3,118,848)

Taxation - -

Other comprehensive income

Items that may be reclassified to profit or

loss:

Exchange differences (55,547) (31,505)

----------------------------------------------------- ----------- -----------

Loss and total comprehensive income for the

year (3,212,983) (3,150,353)

----------------------------------------------------- ----------- -----------

Total loss for the year attributable to:

- Owners of the parent Company (3,141,084) (3,082,722)

- Non-controlling interest (16,352) (36,126)

----------------------------------------------------- ----------- -----------

(3,157,436) (3,118,848)

----------------------------------------------------- ----------- -----------

Total comprehensive income for the year attributable

to:

* Owners of the parent Company (3,196,631) (3,114,227)

* Non-controlling interest (16,352) (36,126)

----------------------------------------------------- ----------- -----------

(3,212,983) (3,150,353)

----------------------------------------------------- ----------- -----------

Loss per share attributable to the owners

of the parent

Continuing operations (undiluted/diluted) (0.03) (0.03)

----------------------------------------------------- ----------- -----------

Group statement of financial position for the year ended 31

March 2023

2023 2022

$ USD $ USD

--------------------------------------------- ------------ ------------

Non-current assets

Intangible Assets 1,251,457 1,251,457

Property, plant and equipment 2,288 2,860

Investments 654,357 1,527,426

Financial assets at fair value through other

comprehensive income - -

--------------------------------------------- ------------ ------------

1,908,102 2,781,743

Current assets

Trade and other receivables 65,826 198,378

Cash and cash equivalents 126,275 175,925

--------------------------------------------- ------------ ------------

192,101 374,303

--------------------------------------------- ------------ ------------

Total assets 2,100,203 3,156,046

Non-current liabilities

Provisions 42,508 43,712

--------------------------------------------- ------------ ------------

42,508 43,712

Current liabilities

Provisions 27,160 25,249

Trade and other payables 799,293 666,290

--------------------------------------------- ------------ ------------

Total liabilities 868,961 735,251

--------------------------------------------- ------------ ------------

Net assets 1,231,242 2,420,796

--------------------------------------------- ------------ ------------

Equity

Share capital 1,721,441 1,408,715

Share premium 22,125,397 20,510,881

Capital reorganisation reserve 537,757 537,757

Other reserves 980,604 1,117,139

Retained earnings (23,755,864) (20,791,958)

--------------------------------------------- ------------ ------------

Total equity attributable to owners of the

parent 1,609,334 2,782,536

Non-controlling interest (378,092) (361,740)

--------------------------------------------- ------------ ------------

Total equity 1,231,242 2,420,796

--------------------------------------------- ------------ ------------

Group statement of changes of equity for the year ended 31 March

2023

Share Capital

Share premium re-organisation Other Retained Total Non-controlling

capital account reserve reserves earnings equity interest Total

$ USD $ USD $ USD $ USD $ USD $ USD $ USD $ USD

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Balance at

1 April 2021 1,216,198 18,836,758 537,757 1,454,157 (18,021,219) 4,023,651 (325,614) 3,698,037

Year ended

31 March 2022:

Loss for the

year - - - - (3,082,722) (3,082,722) (36,126) (3,118,848)

Foreign

exchange

differences

realised

during

the year - - - - (31,505) (31,505) - (31,505)

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Total

comprehensive

income for

the year - - - - (3,114,227) (3,114,227) (36,126) (3,150,353)

Share

Application

moneys

received - - - (45,658) - (45,658) - (45,658)

Share Options

Issued - - - 17,356 - 17,356 - 17,356

Share Options

Lapsed - - - (343,488) 343,489 - - -

Issue of

shares

during period 192,517 1,674,123 - - - 1,866,641 - 1,866,641

Foreign

exchange

differences

on

translation

of currency - - - 36,715 - 36,715 - 36,715

Loss on

remeasurement

of financial

assets at

FVOCI - - - (1,942) - (1,942) - (1,942)

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Total

transactions

with owners,

recognised

directly in

equity 192,517 1,674,123 - (337,018) 343,489 1,873,111 - 1,873,111

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Balance at

31 March 2022 1,408,715 20,510,881 537,757 1,117,139 (20,791,957) 2,782,536 (361,740) 2,420,796

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Capital re-organisation reserve is the balance of share capital

remaining after the Company purchased all shares in its subsidiary

IGPL. Other reserves is the combined balance of the Share Option

Reserve, Unrealised gain on investments reserve and foreign

exchange translation reserve.

Share Capital

Share premium re-organisation Other Retained Total Non-controlling

capital account reserve reserves earnings equity interest Total

$ USD $ USD $ USD $ USD $ USD $ USD $ USD $ USD

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Balance at

1 April 2022 1,408,715 20,510,881 537,757 1,117,139 (20,791,957) 2,782,536 (361,740) 2,420,796

Year ended

31 March 2023:

Loss for the

year - - - - (3,141,084) (3,141,084) (16,352) (3,157,436)

Foreign

exchange

differences

realised

during

the year - - - - (55,547) (55,547) - (55,547)

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Total

comprehensive

income for

the year - - - - (3,196,631) (3,196,631) (16,352) (3,212,983)

Share Options

Issued - - - 16,902 - 16,902 - 16,902

Share Options

Exercised - - - (124,952) 124,952 - - -

Share Options

Lapsed - - - (107,771) 107,771 - - -

Issue of

shares

during period 303,319 1,612,747 - - - 1,916,066 - 1,916,066

Exercised

share

options

during

the period 9,406 97,047 - - - 106,453 - 106,453

Share issuance

costs - (95,279) - - - (95,279) - (95,279)

Foreign

exchange

differences

on

translation

of currency - - - 79,288 - 79,288 - 79,288

Total

transactions

with owners,

recognised

directly in

equity 312,726 1,614,516 - (136,535) 232,724 2,023,429 - 2,023,429

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Balance at

31 March 2023 1,721,441 22,125,397 537,757 980,604 (23,755,864) 1,609,335 (378,092) 1,231,243

--------------- ---------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Group statement of cash flows for the year ended 31 March

2023

2023 2022

$ USD $ USD

---------------------------------------------- ------------ ------------

Cash flows from operating activities

Cash used in operations (1,847,133) (2,130,850)

Income taxes paid - -

---------------------------------------------- ------------ ------------

Net cash outflow from operating activities (1,847,133) (2,130,850)

Investing activities - (409)

Sale of property, plant and equipment - (409)

Sale/(Purchase) of investments - (687,809)

Additional investment in joint venture (23,305) -

Net cash generated /(used) in investing

activities (23,305) (688,218)

Financing activities

Proceeds from issue of shares net

of issue costs 1,820,788 1,403,815

Effect of exchange rate on cash - 1

---------------------------------------------- ------------ ------------

Net cash generated from financing

activities 1,820,788 1,403,816

Net decrease in cash and cash equivalents (49,650) (1,415,252)

Cash and cash equivalents at beginning

of year 175,925 1,591,177

Cash and cash equivalents at end of

year 126,275 175,925

---------------------------------------------- ------------ ------------

The following are the noncash transactions

during the year:

2023 2022

$ USD $ USD

---------------------------------------------- ------------ ------------

Noncash investing and financing transactions

Settlement of director's fee through 42,592 -

issuance of shares

Settlement of payables through issuance 59,971 -

of shares

Issuance of warrants to advisors in 16,902 -

lieu of services

Notes to the 2023 Financial Statements (Extract)

1 Accounting policies

Group information

Panthera Resources PLC is a public Company limited by shares incorporated

in the United Kingdom. The registered office is Salisbury House,

London Wall, London EC2M 5PS.

The Group consists of Panthera Resources PLC and its subsidiaries,

as listed in note 24.

1.1 Basis of preparation

The Group's and Company's financial statements for the year ended

31 March 2023 have been prepared in accordance with UK adopted

international accounting standards (IFRS) and in accordance with

the requirements of the Companies Act 2006.

The financial statements have been prepared on a historical cost

basis, except for the valuation of investments at fair value through

profit or loss and any fair value assessment made upon the acquisition

of assets. The principal accounting policies adopted are set out

below.

The functional currency of the Company is British Pounds (GBP).

This is due to the Company being registered in the U.K and being

listed on AIM, a London based market. Additionally, a large proportion

of its administrative and operative costs are denominated in GBP.

The financial statements are prepared in United States Dollars

($), which is the reporting currency of the Group. Monetary amounts

in these financial statements are rounded to the nearest whole

dollar. This has been selected to align the Group with accounting

policies of other major gold-producing Companies, the majority

of whom report in $.

As permitted by section 408 of the Companies Act 2006, the Company

has not presented its own statement of comprehensive income and

related notes. The Company's loss for the year was $2,461,074

(2022: loss of $2,766,876).

1.2 Basis of consolidation

The consolidated financial statements comprise the financial statements

of Panthera Resources PLC and its subsidiaries as at 31 March

2023.

Panthera Resources PLC was incorporated on 8 September 2017. On

21 December 2017, Panthera Resources PLC acquired the entire share

capital of IGMPL by way of a share for share exchange. The transaction

has been treated as a Group reconstruction and has been accounted

for using the reverse merger accounting method. This transaction

does not satisfy the criteria of IFRS 3 Business Combinations

and therefore falls outside the scope of the standard. Accordingly,

the financial information for the current year and comparatives

have been presented as if IGMPL has been owned by Panthera Resources

PLC throughout the current and prior years.

On 26 October 2021, IGMPL acquired Metal Mines India Private Limited

by way of cash and share exchange. The transaction has been treated

as an asset acquisition. This transaction does not satisfy the

criteria of IFRS 3 Business Combinations and therefore falls outside

the scope of the standard. Accordingly, the financial information

for the current year has been presented as if Metal Mines India

Private Limited has been owned by IGMPL throughout the current

year.

A controlled entity is any entity Panthera Resources PLC has the

power to control the financial and operating policies of, so as

to obtain benefits from its activities. Details of the subsidiaries

are provided in note 24. The assets, liabilities and results of

all subsidiaries are fully consolidated into the financial statements

of the Group from the date on which control is obtained by the

Group. The consolidation of a subsidiary is discontinued from

the date that control ceases. Intercompany transactions, balances

and unrealised gains or losses on transactions between Group entities

are fully eliminated on consolidation. Accounting policies of

subsidiaries have been changed and adjustments made where necessary

to ensure uniformity of the accounting policies adopted by the

Group.

Equity interests in a subsidiary not attributable, directly or

indirectly, to the Group are presented as "non-controlling interests".

The Group initially recognises non-controlling interests that

are present ownership interests in subsidiaries either at fair

value or at the non-controlling interests' proportionate share

of the subsidiary's net assets when the holders are entitled to

a proportionate share of the subsidiary's net assets on liquidation.

All other components of non-controlling interests are initially

measured at their acquisition-date fair value. Subsequent to initial

recognition, non-controlling interests are attributed their share

of profit or loss and each component of other comprehensive income.

Non-controlling interests (when applicable) are shown separately

within the equity section of the statement of financial position

and statement of comprehensive income.

Associates are entities over which the Group has significant influence

but not control over the financial and operating policies. Investments

in associates are accounted for using the equity method of accounting

and are initially recognised at cost. The Group's share of its

associates' post-acquisition profits or losses is recognised in

profit or loss, and its share of post-acquisition movements in

reserves is recognised in other comprehensive income. The cumulative

post acquisition movements are adjusted against the carrying amount

of the investment. Accounting policies of equity-accounted investees

have been changed where necessary to ensure consistency with the

policies adopted by the Group.

The Group is a party to a joint venture when there is a contractual

arrangement that confers joint control over the relevant activities

of the arrangement to the Group and at least one other party.

Joint control is assessed under the same principles as control

over subsidiaries.

The Group accounts for its interests in joint ventures in the

same manner as investments in Associates (i.e. using the equity

method). Any premium paid for an investment in a joint venture

above the fair value of the Group's share of the identifiable

assets, liabilities and contingent liabilities acquired is capitalised

and included in the carrying amount of the investment in joint

venture. Where there is objective evidence that the investment

in a joint venture has been impaired the carrying amount of the

investment is tested for impairment in the same way as other non-financial

assets.

1.3 Going concern

The financial statements have been prepared on a going concern

basis. The group incurred a net loss of $3,212,983 and incurred

operating cash outflows of $1,847,133 and is not expected to generate

any revenue or positive outflows from operations in the 12 months

from the date at which these financial statements were signed.

Management indicate that on current expenditure levels, all current

cash held will be used prior to the 12 months subsequent of the

signing of the financial statements.

The Directors are currently in talks with potential investors

to secure the necessary funding to ensure that the Group can continue

to fund its operations for the 12 months subsequent to the date

of the signing of the financial statements. While they are confident

that they will be able to secure the necessary funding, the current

conditions do indicate the existence of a material uncertainty

that may cast significant doubt regarding the applicability of

the going concern assumption and the auditors have made reference

to this in their audit report.

The Directors have, in the light of all the above circumstances,

a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

Thus, they continue to adopt the going concern basis of accounting

preparing the Group Financial Statements.

1.4 Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, which is responsible for allocating

resources and assessing performance of the operating segments,

has been identified as the Board of Directors that makes strategic

decisions.

1.5 Fair Value of Assets and Liabilities

The Group measures some of its assets and liabilities at fair

value on either a recurring or non-recurring basis, depending

on the requirements of the applicable Accounting Standard.

Fair value is the price the Group would receive to sell an asset

or would have to pay to transfer a liability in an orderly (i.e.

unforced) transaction between independent, knowledgeable and willing

market participants at the measurement date.

As fair value is a market-based measure, the closest equivalent

observable market pricing information is used to determine fair

value. Adjustments to market values may be made having regard

to the characteristics of the specific asset or liability. The

fair values of assets and liabilities that are not traded in an

active market are determined using one or more valuation techniques.

These valuation techniques maximise, to the extent possible, the

use of observable market data.

To the extent possible, market information is extracted from either

the principal market for the asset or liability (i.e. the market

with the greatest volume and level of activity for the asset or

liability) or, in the absence of such a market, the most advantageous

market available to the entity at the end of the reporting period

(i.e. the market that maximises the receipts from the sale of

the asset or minimises the payments made to transfer the liability,

after taking into account transaction costs and transport costs).

For non-financial assets, the fair value measurement also takes

into account a market participant's ability to use the asset in

its highest and best use or to sell it to another market participant

that would use the asset in its highest and best use.

The fair value of liabilities and the entity's own equity instruments

(excluding those related to share-based payment arrangements)

may be valued, where there is no observable market price in relation

to the transfer of such financial instruments, by reference to

observable market information where such instruments are held

as assets. Where this information is not available, other valuation

techniques are adopted and, where significant, are detailed in

the respective note to the financial statements.

1.6 Business combinations

Business combinations occur where an acquirer obtains control

over one or more businesses.

A business combination is accounted for by applying the acquisition

method, unless it is a combination involving entities or businesses

under common control. The business combination will be accounted

for from the date that control is attained, whereby the fair values

of the identifiable assets acquired and liabilities (including

contingent liabilities) assumed are recognised (subject to certain

limited exceptions).

When measuring the consideration transferred in the business combination,

any asset or liability resulting from a contingent consideration

arrangement is also included. Subsequent to initial recognition,

contingent consideration classified as equity is not remeasured

and its subsequent settlement is accounted for within equity.

Contingent consideration classified as an asset or a liability

is remeasured in each reporting period to fair value recognising

any change to fair value in profit or loss, unless the change

in value can be identified as existing at acquisition date.

All transaction costs incurred in relation to business combinations,

other than those associated with the issue of a financial instrument,

are recognised as expenses in profit or loss.

The acquisition of a business may result in the recognition of

goodwill or a gain from a bargain purchase.

Included in the measurement of consideration transferred is any

asset or liability resulting from a contingent consideration arrangement.

Any obligation incurred relating to contingent consideration is

classified as either a financial liability or equity instrument,

depending on the nature of the arrangement. Rights to refunds

of consideration previously paid are recognised as receivables.

Subsequent to initial recognition, contingent consideration classified

as equity is not re-measured and its subsequent settlement is

accounted for within equity.

Contingent consideration classified as an asset or a liability

is re-measured each reporting period to fair value through the

statement of comprehensive income, unless the change in value

can be identified as existing at acquisition date.

All transaction costs incurred in relation to the business combination

are expensed to the consolidated statement of comprehensive income.

The Group transferred the non-Indian assets from IGPL to the parent

company following the execution of the funding agreement with

Galaxy to invest directly in the equity of IGPL. The transfer

was completed on 28 March 2019.

During the prior year the Group formed a new wholly owned group

to hold Mali interests, Panthera Mali (UK) Limited and local company

Panthera Exploration Mali SARL.

1.7 Taxation

Income tax expense represents the sum of the tax currently payable

and deferred tax.

Current tax

The tax currently payable is based on taxable profit for the year.

Taxable profit differs from profit as reported in the consolidated

statement of comprehensive income because of items of income or

expense that are taxable or deductible in other years and items

that are never taxable or deductible. The Group's liability for

current tax is calculated using tax rates that have been enacted

or substantively enacted by the end of the reporting period.

Deferred tax

Deferred tax is recognised on temporary differences between the

carrying amounts of assets and liabilities in the consolidated

financial statements and the corresponding tax bases used in the

computation of taxable profit. Deferred tax liabilities are generally

recognised for all taxable temporary differences. Deferred tax

assets are generally recognised for all deductible temporary differences

to the extent that it is probable that taxable profits will be

available against which those deductible differences can be utilised.

Such deferred tax assets and liabilities are not recognised if

the temporary difference arises from goodwill or from the initial

recognition (other than in a business combination) of other assets

and liabilities in a transaction that affects neither the taxable

profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences associated with investments in subsidiaries and associates,

and interest in joint ventures, except where the Group is able

to control the reversal of the temporary difference and it is

probable that the temporary difference will not reverse in the

foreseeable future. Deferred tax assets arising from deductible

temporary differences associated with such investments and interests

are only recognised to the extent that it is probable that there

will be sufficient taxable profits against which to utilise the

benefits of the temporary differences and they are expected to

reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at the

end of each reporting period and reduced to the extent that it

is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Deferred tax assets and liabilities are measured at the tax rates

that are expected to apply in the period in which the liability

is settled or asset is realised, based on tax rates (and tax laws)

that have been enacted or substantively enacted by the end of

the reporting period. The measurement of deferred tax liabilities

and assets reflects the tax consequences that would follow from

the manner in which the Group expects, at the end of the reporting

period, to recover or settle the carrying amount of its assets

and liabilities.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Group intends to settle

its tax assets and liabilities on a net basis.

Current and deferred tax for the year

Current and deferred tax are recognised in profit or loss, except

when they relate to items that are recognised in other comprehensive

income or directly in equity, in which case the current and deferred

tax are also recognised in other comprehensive income or directly

in equity, respectively. Where current tax or deferred tax arises

from the initial accounting for a business combination, the tax

effect is included for the business combination.

The purchase method of accounting is used for all acquisitions

of assets regardless of whether equity instruments or other assets

are acquired. Cost is measured as the fair value of the assets

given up, shares issued, or liabilities undertaken at the date

of acquisition plus incidental costs directly attributable to

the acquisition.

1.8 Acquisitions of assets

The purchase method of accounting is used for all acquisitions

of assets regardless of whether equity instruments or other assets

are acquired. Cost is measured as the fair value of the assets

given up, shares issued, or liabilities undertaken at the date

of acquisition plus incidental costs directly attributable to

the acquisition.

1.9 Revenue recognition

The Group currently is in the exploration and development phase

of its assets and has no directly attributable revenues. For any

one-off items transacted, revenues are recognised at fair value

of the consideration received, net of the amount of value added

tax ("VAT) or similar taxes payable to the taxation authority.

Exchanges of goods or services of the same nature and value without

any cash consideration are not recognised as revenues.

Interest income from a financial asset is recognised when it is

probable that the economic benefits will flow to the Group and

the amount of revenue can be measured reliably. Interest income

is accrued on a time basis, by reference to the principal outstanding

and the effective interest rate applicable.

1.10 Payables

A liability is recorded for goods and services received prior

to balance date, whether invoiced to the Group or not. Payables

are normally settled within 30 days.

1.11 Cash and cash equivalents

Cash and cash equivalents includes cash on hand, deposits held

at call with financial institutions, other short-term, highly

liquid investments with original maturities of three months or

less that are readily convertible to known amounts of cash and

which are subject to an insignificant risk of changes in value,

and bank overdrafts. The Group currently does not utilise any

bank overdrafts.

1.12 Exploration and Development Expenditure

Exploration and evaluation costs are expensed as incurred. Acquisition

costs will normally be expensed but will be assessed on a case

by case basis and if appropriate may be capitalised. These acquisition

costs are only carried forward to the extent that they are expected

to be recouped through the successful development or sale of the

area. Accumulated acquisition costs in relation to an abandoned

area are written off in full against profit in the year in which

the decision to abandon the area is made.

The carrying values of acquisition costs are reviewed for impairment

when events or changes in circumstances indicate the carrying

value may not be recoverable.

1.13 Financial Assets

The Group and Company has classified all of its financial assets

as loans and receivables. The classification depends on the purpose

for which the financial assets were acquired. Management determines

the classification of its financial assets at initial recognition.

Loans and receivables are non-derivative financial assets with

fixed or determinable payments that are not quoted in an active

market. They are included in current assets. The Group's loans

and receivables comprise trade and other receivables and cash

and cash equivalents in the Statement of Financial Position.

Loans and receivables are initially recognised at fair value plus

transaction costs and are subsequently carried at amortised cost

using the effective interest method, less provision for impairment.

Impairment of financial assets

The Group assesses, on a forward-looking basis, the expected credit

losses associated with its debt instruments carried at amortised

cost. The impairment methodology applied depends on whether there

has been a significant increase in credit risk. A financial asset,

or a group of financial assets, is impaired, and impairment losses

are incurred, only if there is objective evidence of impairment

as a result of one or more events that occurred after the initial

recognition of the asset (a "loss event"), and that loss event

(or events) has an impact on the estimated future cash flows of

the financial asset, or group of financial assets, that can be

reliably estimated.

The criteria that the Group and Company uses to determine that

there is objective evidence of an impairment loss include:

* significant financial difficulty of the issuer or

obligor;

* a breach of contract, such as a default or

delinquency in interest or principal repayments.

The amount of the loss is measured as the difference between the

asset's carrying amount and the present value of estimated future

cash flows (excluding future credit losses that have not been

incurred), discounted at the financial asset's original effective

interest rate. The asset's carrying amount is reduced, and the

loss is recognised in the profit or loss.

For trade receivables, the Group applies the simplified approach

permitted by IFRS 9, which requires expected lifetime losses to

be recognised from initial recognition of the receivables.

If, in a subsequent year, the amount of the impairment loss decreases

and the decrease can be related objectively to an event occurring

after the impairment was recognised (such as an improvement in

the trade and other receivables credit rating), the reversal of

the previously recognised impairment loss is recognised in the

Statement of Comprehensive Income.

1.14 Impairment of Assets

At each reporting date, the Group reviews the carrying values

of its tangible and intangible assets to determine whether there

is any indication that those assets have been impaired. If such

an indication exists, the recoverable amount of the asset, being

the higher of the asset's fair value less costs to sell and value

in use, is compared to the asset's carrying value. Any excess

of the asset's carrying value over its recoverable amount is expensed

to the income statement.

Impairment testing is performed annually for goodwill and intangible

assets with indefinite lives.

Where it is not possible to estimate the recoverable amount of

an individual asset, the Group estimates the recoverable amount

of the cash-generating unit to which the asset belongs.

1.15 Foreign currency transactions and balances

Transactions and balances

Foreign currency transactions are translated into functional currency

using the exchange rates prevailing at the date of the transaction.

Foreign currency monetary items are translated at the year-end

exchange rate. Non-monetary items measured at historical cost

continue to be carried at the exchange rate at the date of the

transaction. Non-monetary items measured at fair value are reported

at the exchange rate at the date when fair values were determined.

Exchange differences arising on the translation of monetary items

are recognised in the income statement, except where deferred

in equity as a qualifying cash flow or net investment hedge.

Exchange differences arising on the translation of non-monetary

items are recognised directly in equity to the extent that the

gain or loss is directly recognised in equity; otherwise the exchange

difference is recognised in the income statement.

Group companies

The financial results and position of foreign operations whose

functional currency is different from the Group's presentation

currency are translated as follows:

* assets and liabilities are translated at year-end

exchange rates prevailing at that reporting date;

* income and expenses are translated at average

exchange rates for the period; and

* equity and retained earnings balances are translated

at the exchange rates prevailing at the date of the

transaction.

1.16 Employee benefits

A liability is recognised for benefits accruing to employees in

respect of wages and salaries, annual leave, long service leave,

and sick leave when it is probable that settlement will be required

and they are capable of being measured reliably.

Liabilities recognised in respect of employee benefits expected

to be settled within 12 months are measured at their nominal values

using the remuneration rate expected to apply at the date of settlement.

Liabilities recognised in respect of employee benefits which are

not expected to be settled within 12 months are measured as the

present value of the estimated future cash outflows to be made

by the Group in respect of services provided to employees up to

reporting date.

1.17 Value Added Tax (VAT) and similar taxes

Revenues, expenses and assets are recognised net of the amount

of VAT or similar tax, except where the amount of tax incurred

is not recoverable from the relevant taxing authority. In these

circumstances the tax is recognised as part of the cost of acquisition

of the asset or as part of an item of the expense. Receivables

and payables in the consolidated statement of financial position

are shown inclusive of tax.

1.18 Provisions

Provisions are recognised when the Group has a legal or constructive

obligation, as a result of past events, for which it is probable

that an outflow of economic benefits will result and that outflow

can be reliably measured.

1.19 Plant and equipment

Each class of plant and equipment is carried at cost less, where

applicable, any accumulated depreciation and impairment losses.

Plant and equipment are measured on the cost basis less depreciation

and impairment losses. The carrying amount of plant and equipment

is reviewed annually by Directors to ensure it is not in excess

of the recoverable amount from these assets.

All other repairs and maintenance are charged to the income statement

during the financial period in which they are incurred.

The depreciable amount of all fixed assets is depreciated on a

diminishing value basis over the asset's useful life to the consolidated

Group commencing from the time the asset is held ready for use.

Class of Fixed Asset Depreciation rate

Property Plant and Equipment 10% - 50%

The assets' residual values and useful lives are reviewed, and

adjusted if appropriate, at each Statement of financial position

date.

An asset's carrying amount is written down immediately to its

recoverable amount if the asset's carrying amount is greater than

its estimated recoverable amount.

Gains and losses on disposals are determined by comparing proceeds

with the carrying amount. These gains or losses are included in

the income statement.

1.20 Financial assets at fair value through other comprehensive income

Financial assets at fair value through other comprehensive income

are non-derivative financial assets that are either not capable

of being classified into other categories of financial assets

due to their nature or they are designated as such by management.

They comprise investments in the equity of other entities where

there is neither a fixed maturity nor fixed or determinable payments

and the intention is to hold them for the medium to long term.

They are subsequently measured at fair value with any re-measurements

other than impairment losses and foreign exchange gains and losses

recognised in Reserves. When the financial asset is derecognised,

the cumulative gain or loss pertaining to that asset previously

recognised in Reserves is reclassified into profit or loss.

The financial assets are presented as non-current assets unless

they matured, or the intention is to dispose of them within 12

months of the end of the reporting period.

1.21 Share-based payments

The Group operates equity-settled share-based payment option schemes.

The fair value of the options to which employees become entitled

is measured at grant date and recognised as an expense over the

vesting period, with a corresponding increase to an equity account.

The fair value of options is ascertained using a Black-Scholes

pricing model which incorporates all market vesting conditions.

The number of options expected to vest is reviewed and adjusted

at the end of each reporting date such that the amount recognised

for services received as consideration for the equity instruments

granted shall be based on the number of equity instruments that

eventually vest.

1.22 Critical accounting estimates and judgements

The Directors evaluate estimates and judgments incorporated into

the financial statements based on historical knowledge and best

available current information. Estimates assume a reasonable expectation

of future events and are based on current trends and economic

data, obtained both externally and within the Group.

Key estimates - Impairment of the carrying value of investments

& financial assets

The Group assesses impairment at the end of each reporting period

by evaluating the conditions and events specific to the Group

that may be indicative of impairment triggers. Recoverable amounts

of relevant assets are reassessed using value-in-use calculations

that incorporate various key assumptions.

Management make judgements in respect of the carrying value of

their investments both at a group and company level. In undertaking

this exercise management make estimations in respect of the projected

success of the associates projects at the period end based on

the information available at that time including, but not limited

to, the financing available to the associate to pursue its projects.

At the year end they consider the best estimate of the carrying

value of the associate to be same at both a Group and Company

level. Refer to note 13 for additional information.

Key estimates - Estimated fair value of certain financial assets

measured at fair value through other comprehensive income

The fair value of financial instruments that are not traded in

an active market are determined using judgement to make assumptions

that are mainly based on market conditions existing at the end

of each reporting period. Refer to note 14 for additional information.

Intangible exploration assets and legal rights to licence recorded

at costs on acquisition

The costs incurred to acquire legal rights to exploration licences

are recognised at costs. When the acquisition of an entity does

not qualify as a business, the Directors consider the excess of

the consideration over the acquired assets and liabilities is

attributed to the costs of the licence and capitalise these as

exploration and evaluation assets. These assets are subject to

periodic impairment reviews which require management estimation

and judgement. Refer to note 11 for information on these judgements.

Key estimates - Estimated fair value of share based payments

The fair value of share based payments is determined as the value

of services provided or the contracted amount. Options and warrants

issued are valued using the Black-Scholes pricing model using

the Company's share price, and the gold ETF volatility index.

Refer to note 8 for additional information.

Key estimates - assessment of level of control in joint venture

and associate

The assessment of the level of control over the joint venture

and associate is a key judgement. For the joint venture this has

been determined based on the agreed management committee representation

pursuant to the applicable agreement. Refer to note 13 for additional

information.

2 Adoption of new and revised standards and changes in accounting

policies

At the date of authorisation of these financial statements, there

are no new, but not yet effective, standards, amendments to existing

standards, or interpretations that have been published by the

IASB that will have a material impact on these financial statements.

Contacts

Panthera Resources PLC

Mark Bolton (Managing Director) +61 411 220 942

contact@pantheraresources.com

Allenby Capital Limited (Nominated Adviser & Joint Broker) +44 (0) 20 3328 5656

John Depasquale / Vivek Bhardwaj (Corporate Finance)

Guy McDougall / Kelly Gardiner (Sales & Corporate

Broking)

Novum Securities Limited (Joint Broker) +44 (0) 20 7399 9400

Colin Rowbury

Subscribe for Regular Updates

Follow the Company on Twitter at @PantheraPLC

For more information and to subscribe to updates visit:

pantheraresources.com

Qualified Person

The technical information contained in this disclosure has been

read and approved by Ian S Cooper (BSc, ARSM, Fausi MM, FGS), who

is a qualified geologist and acts as the Qualified Person under the

AIM Rules - Note for Mining and Oil & Gas Companies. Mr Cooper

is a geological consultant to Panthera Resources PLC.

UK Market Abuse Regulation (UK MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information for the purposes of

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310. Upon the publication of this announcement via a

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

Forward-looking Statements

This news release contains forward-looking statements that are

based on the Company's current expectations and estimates.

Forward-looking statements are frequently characterised by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise. Forward-looking statements are not guarantees of future

performance and accordingly, undue reliance should not be put on

such statements due to the inherent uncertainty therein.

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BUGDCIBDDGXC

(END) Dow Jones Newswires

September 29, 2023 11:20 ET (15:20 GMT)

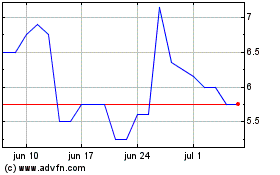

Panthera Resources (LSE:PAT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Panthera Resources (LSE:PAT)

Gráfica de Acción Histórica

De May 2023 a May 2024