TIDMPIRI

RNS Number : 0795B

Pires Investments PLC

29 September 2022

29 September 2022

Pires Investments PLC

("Pires" or the "Company")

Unaudited interim results for the six months ended 30 June

2022

Pires Investments plc (AIM: PIRI), the investment company

focused on next-generation technology, is pleased to announce its

unaudited interim results for the six-month period ended 30 June

2022.

Highlights

Company highlights

-- Profit of GBP992,000 during the period (six months ended 30

June 2021: profit before taxation of GBP1.53 million)

-- Net asset value ("NAV") of GBP8,702,000 as at the period end

(31 December 2021: GBP7,223,000), equating to an increase of 20%

since 31 December 2021

-- Pires is now trading at a 41% discount to its NAV per share of 5.23 pence

-- Warrants exercised over 12,211,425 ordinary shares in the

Company at 4 pence per share with total net proceeds to the Company

of GBP488,457

Portfolio highlights

-- Portfolio valuation increased to GBP9,398,000 from

GBP7,390,000, an increase of 27% since 31 December 2021

-- Significant increase in the valuation of the Company's

holdings in Getvisibility as a result of a EUR10 million fundraise

by this company in March 2022

-- The first Sure Valley Ventures fund ("SVV1") has increased its NAV by 10.7% over the period

-- Sure Ventures plc ("SV plc") grew its NAV by 6.2% to 125.8p

per share and its share price increased by 11.4% over the period to

107.5p

-- GBP5 million commitment over the 10-year life of the fund to

invest in a new Sure Valley Ventures fund ("SVV2") alongside the

British Business Bank, an investment arm of the British

Government

-- Smarttech247, a recent portfolio investment, is actively progressing a stock market listing

-- Merger of Admix with LandVault Inc

Post-period end highlights

-- Placing to raise GBP500,000 before expenses, completed in August 2022

Nicholas Lee, Director of Pires, commented:

"The Company has made strong progress during this period, with a

significant uplift in the valuation of its portfolio, driven by the

increasing valuation of Getvisibility, in which it has both direct

and indirect interests via SVV1 and SV plc. Given the growth in

NAV, the Company is now trading at a 41% discount to its NAV.

"The Company has also invested a further GBP300,000 in SVV1

during the period. SVV1 includes a number of companies, such as

Getvisibility, Admix and CameraMatics, which have grown materially

in value as a result of both organic growth and new investment

resulting in upward revaluations. Furthermore, SVV1 has now almost

completed its initial investment phase and we are now looking

forward to further increases in the value of the portfolio

companies and subsequent exits, resulting in cash returns to the

Company.

"In March 2022, Pires invested GBP90,000 in SVV2 alongside the

British Business Bank, which has committed to invest GBP50 million

in this new fund. In March 2022, SVV2 led a seed round raising GBP2

million for RETìníZE Limited, the award-winning creative-tech

company based in Belfast, Northern Ireland, marking this fund's

first investment. We look forward to following further developments

from SVV2 in due course.

"Going forward, t he Company has a clear and proven strategy of

investing in next-generation technology and realising returns from

its investments which it will continue to implement. Our portfolio

of investments remains well-poised to achieve significant growth,

delivering value to Pires and its shareholders."

Investment overview

Summary

The Company's principal investment portfolio categories are

summarised below:

Category Cost or Cost or

valuation valuation

at 30 June at 31 December

2022 2021

GBP000s GBP000s

------------ ----------------

Investment in Sure Valley

Ventures 5,104 4,146

------------ ----------------

Direct investments 3,694 2,835

------------ ----------------

Cash/other listed securities 600 409

------------ ----------------

Total 9,398 7,390

------------ ----------------

Investment in Sure Valley Ventures

Pires has exposure to the Sure Valley Ventures funds via:

- a 13% direct investment in SVV1

- a 23.3% holding in Sure Ventures plc, the principal

investments of which comprise a 25.9% interest in SVV1 and a

holding in VividQ

- a 5.9% interest in SVV2 alongside the British Business Bank

Pires therefore has an aggregate direct and indirect interest in

SVV1 of circa 20%.

As at the period end, SVV1 had a portfolio of 14 investee

companies at different stages of development, spanning a range of

sectors. The portfolio provides Pires with exposure to a number of

key, cutting-edge and rapidly growing technology sectors. Further

details of the portfolio companies and recent developments are set

out below:

Artificial Description Recent developments

intelligence

Ambisense Provides an Artificial Intelligence New major contract

platform to deliver environmental to assess mine gas

risk assessment to allow ingress and helping

real-time gas and environmental The Lower Thames Crossing

monitoring using both IoT project stay green.

and sensor solutions.

------------------------------------ -------------------------------

Buymie An artificial intelligence-based Partnership with Asda

same day grocery delivery in Leeds and Bristol

company operating in both launched in March 2022.

the UK and Ireland working

with companies such as Tesco,

Lidl, Asda and the Co-op.

------------------------------------ -------------------------------

Security

------------------------------------ -------------------------------

Nova Leah An Artificial Intelligence Multiple new pilot

cyber-security assessment schemes recently established.

and protection platform

for connected medical devices.

------------------------------------ -------------------------------

Getvisibility An Artificial Intelligence In March 2022, it raised

security company addressing additional funds at

the substantial problem a significant premium

faced by corporations in and has been voted

storing, sorting, accessing as one of Ireland's

and protecting data. top 18 start-ups. Revenue

growing significantly.

------------------------------------ -------------------------------

PreCog A security solution platform New contracts and trials

company that provides data established.

intelligence to combat crime,

terrorism and protect vulnerable

people. Customers include

leading law enforcement

and security agencies and

transport infrastructure

groups.

------------------------------------ -------------------------------

Smarttech247 A global artificial intelligence The company has recently

based cyber security cloud won a number of new

business that protects enterprises clients and has just

from cyber-attacks. Smarttech247 launched a new MDR

has over 100 technology product, Vision X.

partners, including IBM It is also actively

and Microsoft, and more progressing a stock

than 50 clients based in market listing.

Europe and the US.

------------------------------------ -------------------------------

Immersive

Technologies

------------------------------------ -------------------------------

Engage XR A developer of Virtual Reality Revenue grew by 41%

and immersive experiences in the first half of

with a specific focus on 2022. Currently developing

education and enterprise its metaverse offering

learning and development. which is expected to

The company is listed on launch in Q4. Partners

AIM. include HTC and the

Virtual Human Interaction

Lab at Stanford University.

------------------------------------ -------------------------------

Admix A platform enabling the The company is rapidly

monetisation of interactive growing its revenues

programmatic brand placements and, in June 2022,

in applications such as announced a merger

video games and other AR/VR with LandVault, a builder

applications. of virtual experiences

in metaverse worlds.

------------------------------------ -------------------------------

Warducks A game development studio Has been getting good

known for the production traction for its new

of leading games. It is mapping platform that

currently developing a major can use real-world

new AR mobile game that geographical locations

is in the same category to create 3D virtual

as Pokémon Go. worlds.

------------------------------------ -------------------------------

VividQ A deep tech software company Partnered with Zemax

which has developed a framework Optics Studio in April

for real-time 3D holographic 2022. In May 2022,

displays for use in heads-up they launched their

displays and AR headsets proprietary Alpha Optical

and glasses. Engine Demonstrator

and in July 2022 appointed

a new Chairman, Francois

Auque.

------------------------------------ -------------------------------

Volograms An Augmented Reality capture It is currently trialling

and volumetric video company. a new app which has

had positive feedback

to date.

------------------------------------ -------------------------------

Virtex A company building a platform It is actively developing

for the next-generation its new Stadium app.

of live, immersive entertainment

within the virtual reality

("VR") gaming and e-sports

industries.

------------------------------------ -------------------------------

Internet of

things

------------------------------------ -------------------------------

CameraMatics CameraMatics is a disruptive The company is growing

technology for fleet and revenues significantly

driver risk management. in the UK and US.

The CameraMatics SaaS-based

full-stack platform is a

modular software platform

based on camera technology,

vision systems, AI, machine

learning and telematics,

combined with fleet safety

modules that help fleet

operators drive to new safety

standards across their fleet

and drivers.

------------------------------------ -------------------------------

Wia Wia is an Internet of Things The company is actively

(IoT) company with a cloud progressing new contracts.

platform, enabling developers

to turn any type of sensor

device quickly into a secure,

smart and useful application.

Wia's end-to-end platform

provides full device and

application management,

security, data capture and

storage, analysis, control,

as well as the integration

of enterprise systems.

------------------------------------ -------------------------------

Getvisibility is a leader in data visibility and control, using

state-of-the-art Artificial Intelligence ("AI") to classify and

secure unstructured information. Getvisibility also provides risk

and compliance assessments as well as enforcing protection on

sensitive data. The company operates across the US, Europe, the

Middle East and North Africa with a presence in several industry

sectors including banking, healthcare and the public sector.

Getvisibility's clients include a leading global producer of energy

and chemicals, a major airport group, one of the largest financial

institutions in the Middle East as well as US government entities

in the pharmaceutical and manufacturing sectors.

Getvisibility is continuing to rapidly build revenue whilst

taking on new clients, retaining existing clients and signing a

number of multi-year contracts. The company has also expanded its

pipeline by US$6 million and has onboarded 31 new channel partners

across seven countries.

In March 2022, Getvisibility raised EUR10 million from new

investors including Alpha Intelligence Capital, a global venture

capital firm which invests in deep artificial intelligence/machine

learning technology-based companies, and Fortino Capital Partners,

a leading B2B software venture capital and growth equity firm.

Pires made its original investment of EUR250,000 in March 2020,

with a follow-on investment of EUR62,000 in June 2021. Since then,

Getvisibility has made significant progress such that, based on the

post-funding round valuation, Pires' direct stake in Getvisibility

(including its additional investment) is now valued at circa

EUR1,500,000 or over 4 times its total investment cost to date

since it made its first investment two and a half years ago. In

addition, Pires has a further interest in Getvisibility via its 13%

interest in SVV1 and an indirect interest through its holding in SV

plc, which together are now valued at circa EUR1,337,000. Pires'

effective interest in Getvisibility, in aggregate, is therefore now

valued at circa EUR2,837,000.

CameraMatics is a disruptive technology for fleet and driver

risk management. The CameraMatics SaaS-based full-stack platform is

a modular software platform based on camera technology, vision

systems, AI, machine learning and telematics, combined with fleet

safety modules that help fleet operators to drive new safety

standards across their fleet and drivers. The company is growing

revenues significantly in the UK and US and has recently been

shortlisted for the Fleet Safety Product Award as part of the UK

Fleet Champions Award 2022.

VividQ, a leading software and IP developer for holography has

developed a framework for real-time 3D holographic displays for use

in heads-up displays and AR headsets and glasses. In April 2022,

the company announced that it was partnering with Zemax Optics

Studio to demonstrate how computer-generated holography has become

an accessible display for original design manufacturers who want to

release high performance AR products and to showcase the

prototyping of miniaturised optical engines for AR devices. In May

2022, the company launched its proprietary Alpha Optical Engine

Demonstrator aimed at manufacturers of high-end augmented reality

headsets. In July 2022, the company appointed a new Chairman,

Francois Auque. He is a partner at InfraVia Capital, a leading

independent European private equity firm and also serves as a

member of the Board of Directors of Rexel, a wholesale electrical

distributor. His experience in dealing with large corporations,

paired with his knowledge as an investor in deep tech start-ups

will prove valuable in supporting the company in its continued

advancement of breakthrough technology.

Admix, the leading In-Play monetisation company that bridges the

gap between gaming content and brands, announced on 20 June 2022,

that it is merging with LandVault Inc ("LandVault"), a builder of

virtual experiences in metaverse worlds like The Sandbox and

Decentraland, aimed at attracting people into blockchain and

metaverse ecosystems, in order to enter into Web3.

By merging with LandVault, Admix aims to become a go-to service

provider for major intellectual property holders and brands,

enabling large companies across all industries to enter the

metaverse and be monetised with its in-game advertising technology.

The combined company, which will be known as LandVault, will be

able to access US$25 million in growth capital from Admix's Series

B round in October 2021. Samuel Huber, Founder and Chief Executive

Officer of Admix, will remain as Chief Executive Officer of the

combined business.

Smarttech247 is a global artificial intelligence-based cyber

security cloud business that protects enterprises from

cyber-attacks. Smarttech247 has over 100 technology partners,

including IBM and Microsoft, and more than 50 clients based in

Europe and the US. The company has recently won a number of new

clients and has just launched a new MDR product, Vision X. It is

also actively progressing a stock market listing.

SV plc grew its NAV by 6.2% to 125.8p per share and its share

price increased by 11.4% over the period to 107.5p. SV plc's

principal investment is a 25.9% stake in SVV1 and a shareholding in

VividQ.

During the period, the Company also invested in a second SVV

fund, SVV2. The principal investor in SVV2 is the British Business

Bank ("BBB"), an investment arm of the UK Government. The first

close of this fund amounted to GBP85 million, with BBB investing up

to GBP50 million and other investors ("Private Investors"),

including Pires, investing up to GBP35 million over the 10-year

life of the fund.

Pires has initially invested circa GBP90,000, in SVV2 and

expects to invest up to GBP5 million in total over the 10-year life

of the fund which would provide it with a circa 5.9% interest. SVV2

will invest in a range of private UK software companies with a

focus on companies in the Metaverse, Artificial Intelligence and

Cybersecurity sectors. This fund has already made its first

investment in RETi ni ZE Limited, a technology company based in

Belfast which is developing an innovative software product called

Animotive which is harnessing the latest VR technologies to

transform the 3D animation production process.

SVV2 is being managed by the same team which, to date, has been

highly successful in achieving a number of cash realisations from,

and upward revaluations of, companies in SVV1. The profit share

arrangements within SVV2 are designed to encourage the involvement

of the private investors alongside the BBB, meaning that Pires and

the other private investors would expect to receive a significantly

enhanced share of the total return generated by the fund compared

to industry standard.

Direct investments

Low6

Low6 has developed a next-generation sports gaming technology

platform that powers franchises with their own branded gaming

experiences to engage their digital fanbases .

The company's current focus is to charge customers, typically

iGaming operators and sporting franchises, for developing and

licensing digital free-to-play games that they embed in their

mobile apps/websites as a way of driving users to their core

operations. The current financial year is progressing well with

signed contracts, signed term sheets or advanced contractual

negotiations being achieved in respect of a significant portion of

that year's revenue which, due to the investment made in the

company's technology platform, is expected to be high margin. At

the same time the company's cost base and burn rate have been

reduced significantly. The company is currently working with its

advisers and cornerstone investors to raise more capital for the

business to support revenue growth and the move towards

breakeven.

PreCog

A security solution platform company that provides data

intelligence to combat crime, terrorism and protect vulnerable

people. Customers include leading law enforcement and security

agencies and transport infrastructure groups. The company is busy

establishing new contracts and trials.

Getvisibility

Pires' direct stake in Getvisibility (including its additional

investment) is now valued at circa EUR1,500,000 or over 4 times its

total investment cost to date since it made its first investment

two years ago. See above for further detail.

Pluto Digital

Pluto Digital PLC ("Pluto") is a Web3 technology company with a

focus on the Metaverse, blockchain gaming and NFTs. During the

period, Pluto has been working with Maze Theory Limited ("Maze

Theory"), a London-based digital entertainment studio, with a view

to developing high-quality games that incorporate token economics.

Pluto is working on a corporate transaction which will include

Emergent Games, a new Web3 gaming studio which is a joint venture

with Maze Theory. A further announcement on the progress of this

transaction is expected in Q4 2022.

As at 30 June 2022, the Company's equity holding in Pluto was

valued at almost GBP2 million based on a price of 6 pence per

share, which is the price at which the company's most recent

fundraising took place and the price at which Pluto's corporate

transaction with Maze is expected to take place. This represents a

very significant uplift on the Company's initial investment in this

sector.

Key financial indicators

The key unaudited performance indicators are set out below:

Performance indicator 30 June 2022 31 December Change

2021

-------------------------------- ------------- ----------- ------

GBP000s GBP000s

Profit attributable GBP992 GBP1,491

Net asset value GBP 8,702 GBP 7,223

Net asset value - fully diluted

per share 5.23p 4.57p

The Company has generated significant profits during the period

driven by increases in value of its investment portfolio. Whilst

the Company's net assets have continued to increase, we do not

believe that the Company's net asset value fairly represents its

financial potential, given the scope for significant valuation

uplift for the companies within the portfolio. This is clearly

demonstrated by a series of gains, both realised and unrealised,

that have been achieved to date from its investment portfolio.

Furthermore, realisations that are achieved within the SVV

portfolio result in cash distributions to the Company and are not

retained within the fund thereby delivering a real cash return to

the Company.

During the period, the holders of warrants over 12,211,425

ordinary shares in the Company exercised their warrants at 4 pence

per share with total net proceeds to the Company of GBP488,457. All

warrants issued in June 2020 have now been exercised or have

expired by 30 June 2022.

In July 2022, the recommended offer for Pires by Tern plc,

whilst being supported by the majority of Pires shareholders voting

both by number of shareholders and number of shares held, was not

approved by the requisite number to effect a scheme of arrangement,

and therefore lapsed.

Post the period end, the Company raised an additional GBP500,000

before expenses and a further 6,250,000 warrants were issued

exercisable at 8 pence, in conjunction with 12,500,000 shares

issued as part of the placing on 26 August 2022.

Outlook

We remain encouraged by the progress made to date by our

investee companies and the outlook for the respective sectors in

which they operate.

We expect that in the coming months we will see some additional

realisations or liquidity events from the investment portfolio.

Furthermore, it is important to note that, as previously mentioned,

the SVV1 fund has now substantially completed its deployment phase

and so is moving towards a realisation phase which is expected to

generate further cash inflows for the Company.

In summary, we believe that our investment strategy in the

technology sector has already proven successful. Going forward, the

Company is well positioned to become a leading next-generation

technology investment company with an exciting portfolio of

technology companies that have the potential for significant growth

and the ability to deliver real returns for shareholders.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation. The person who arranged the

release of this information is Nicholas Lee, Director of the

Company.

Enquiries:

Pires Investments plc

Nicholas Lee, Director Tel: +44 (0) 20 3368 8961

Nominated Adviser

Cairn Financial Advisers LLP Tel: +44 (0) 20 7213 0880

Liam Murray/Ludovico Lazzaretti

Broker

Peterhouse Capital Limited Tel: +44 (0) 20 7469 0935

Lucy Williams/Duncan Vasey

Financial media and PR

Yellow Jersey Tel: +44 (0) 20 3004 9512

Sarah Hollins

Henry Wilkinson

Annabelle Wills

Notes to Editors

About Pires Investments plc

Pires Investments plc (AIM: PIRI) is an investment company

providing investors with access to a portfolio of next-generation

technology businesses with significant growth potential.

The Company is building an investment portfolio of high-tech

businesses across areas such as Artificial Intelligence, Internet

of Things, Cyber Security, Machine Learning, Immersive Technologies

and Big Data, which the Board believes demonstrate evidence of

traction and the potential for exponential growth, due to

increasing global demand for development in these sectors.

For further information, visit: https://piresinvestments.com/

.

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2022

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30-Jun 30-Jun 31-Dec

2022 2021 2021

Continuing activities GBP000s GBP000s GBP000s

Notes

Revenue

Investment income - - -

Other income - - 1

Total revenue - - 1

Gains on investments held

at fair value through profit

or loss 1,422 1,802 2,081

Operating expenses (430) (270) (590)

---------- ---------- -----------

Operating profit from continuing

activities 992 1,532 1,491

Profit before taxation

from continuing activities 992 1,532 1,491

Tax - - -

Profit for the period from

continuing activities 992 1,532 1,491

---------- ---------- -----------

Profit for the period and

total comprehensive income

attributable to equity holders

of the Company 992 1,532 1,491

========== ========== ===========

Basic profit per share 3

Equity holders

Basic and diluted 0.58p 1.07p 1.00p

UNAUDITED STATEMENT OF FINANCIAL POSITION

As at 30 June 2021

Unaudited Unaudited Audited

As at As at As at

30-Jun 30-Jun 31-Dec

2022 2021 2021

GBP000s GBP000s GBP000s

Notes

CURRENT ASSETS

Investments 8,810 6,800 7,016

Trade and other

receivables 9 4 8

Cash and cash equivalents 588 360 374

---------- ---------- ---------

TOTAL CURRENT ASSETS 9,407 7,164 7,398

---------- ---------- ---------

TOTAL ASSETS 9,407 7,164 7,398

========== ========== =========

EQUITY

Called up share

capital 416 12,214 396

Shares to be issued 10 - -

Share premium account 8,176 7,701 7,874

Share premium account 155 - -

for shares to be

issued

Retained earnings (12,050) (13,000) (13,042)

Capital redemption

reserve 11,995 165 11,995

---------- ---------- ---------

TOTAL EQUITY 4 8,702 7,080 7,223

LIABILITIES

CURRENT LIABILITIES

Trade creditors

and other liabilities 705 84 175

---------- ---------- ---------

TOTAL LIABILITIES

AND CURRENT LIABILITIES 705 84 175

TOTAL EQUITY AND

LIABILITIES 9,407 7,164 7,398

========== ========== =========

UNAUDITED CASH FLOW STATEMENT

For the six months ended 30 June 2022

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30-Jun 30-Jun 31-Dec

2022 2021 2021

GBP000s GBP000s GBP000s

Cash flows from operating

activities - Profit for

the period 992 1,532 1,491

Depreciation - - -

Realised (gain) on disposal

of investments (14) - (61)

Fair value movement in

investments (1,408) (1,802) (2,020)

(Increase)/decrease in

receivables (1) 10 7

Increase/(decrease) in

payables 530 (53) 38

Net cash absorbed by

operating activities 99 (312) (545)

Cash flows from investing

activities

Payments to acquire investments (440) (2,969) (1,066)

Proceeds of sale of investments 68 - 111

Net cash from investing

activities (372) (2,969) (955)

Cash flows from financing

activities

Net proceeds from shares

issued or to be issued 487 2,622 855

Net cash from financing

activities 487 2,622 855

Net increase /(decrease)

in cash and cash equivalents

during the period 214 (659) (645)

Cash and cash equivalents

at beginning of the period 374 1,019 1,019

Cash and cash equivalents

at end of the period 588 360 374

Notes to the Unaudited Interim Report

1. GENERAL INFORMATION

Pires Investments plc (the "Company") is a company domiciled in

England whose registered office address is 9(th) Floor, 107

Cheapside, London EC3V 6DN. The condensed interim financial

statements of the Company for the six months ended 30 June 2022 is

that of the Company only.

The condensed interim financial statements do not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006.

The financial information for the year ended 31 December 2021

has been extracted from the statutory accounts for that period

which were prepared in accordance with International Financial

Reporting Standards ("IFRS"). The auditors' report on the statutory

accounts was unqualified. A copy of those financial statements has

been filed with the Registrar of Companies.

The financial information for the six months ended 30 June 2021

and 30 June 2022 were also prepared in accordance with IFRS.

The condensed interim financial statements do not include all of

the information required for full annual financial statements.

The condensed interim financial statements were authorised for

issue on 28 September 2022.

2. BASIS OF ACCOUNTING

The financial statements are unaudited and have been prepared on

the historical cost basis in accordance with International

Financial Reporting Standards as adopted by the EU ("IFRS") using

the same accounting policies and methods of computation as were

used in the annual financial statements for the year ended 31

December 2021. As permitted, the interim report has been prepared

in accordance with the AIM rules for Companies and is not compliant

in all respects with IAS 34 Interim Financial Statements. The

condensed interim financial statements do not include all the

information required for full annual financial statements and hence

cannot be construed as in full compliance with IFRS.

3. PROFIT/LOSS PER SHARE

The calculation of the basic profit per share is based on the

following data:

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30-Jun 30-Jun 31-Dec

2022 2021 2021

GBP000s GBP000s GBP000s

Profit on continuing activities

after tax 992 1,532 1,491

Basic and fully diluted

Basic and fully diluted earnings per share have been computed

based on the following data:

Number of

shares

Weighted average number of ordinary

shares for the period 159,463,671 143,210,371 149,021,386

Basic earnings per share from

continuing activities (p) 0.6 1.07 1.00

There were no dilutive instruments that would give rise to diluted

earnings per share.

4. STATEMENT OF CHANGES IN EQUITY

Share Capital Shares Share Premium Capital Retained Earnings Total

to be issued Redemption

Reserve

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

At 1 January

2021 12,135 - 5,158 165 (14,532) 2,926

Issue of shares

(net of costs) 79 - 2,543 - 2,622

Loss for the

6 months ended

30 June 2021 - - - - 1,532 1,532

-------------

At 30 June

2021 12,214 - 7,701 165 (13,000) 7,080

Issue of shares

(net of costs) 11 - 173 - - 184

Cancellation

of deferred

shares (11,830) - 11,830 -

-------------

Loss for the

6 months ended

31 December

2021 - - - (41) (41)

-------------

At 31 December

2021 396 - 7,874 11,995 (13,042) 7,223

Issue of shares

(net of costs) 20 165 302 - - 487

Profit for the

6 months ended

30 June 2022 - - - - 992 992

-------------

At 30 June

2022 416 165 8,176 11,995 (12,050) 8,702

============= ------------- ============= =========== ================= =======

5. DISTRIBUTION OF INTERIM REPORT

Copies of the Interim Report for the six months ended 30 June

2022 are available on the Company's website,

www.piresinvestments.com .

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEWESAEESESU

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

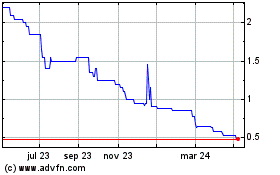

Mindflair (LSE:MFAI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

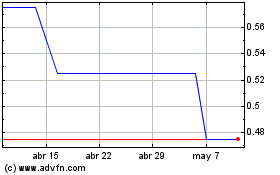

Mindflair (LSE:MFAI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024