Pensana Plc Update on Finance for the Longonjo and Saltend Projects

31 Octubre 2023 - 1:16AM

UK Regulatory

TIDMPRE

31 October 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Pensana Plc ("Pensana" or the "Company")

Update on Finance for the Longonjo and Saltend Projects

The Company is pleased to provide the following update on the financing of both

the Longonjo and Saltend projects.

Highlights

· The engineering team has successfully completed a modular redesign of the

Longonjo mine and processing facility, with a total Capex of US$200 million.

· The technical and economic due diligence review of the redesign by South

African mining consultants, The Mineral Corporation, on behalf of ABSA Bank, is

scheduled for completion in November.

· ABSA which has been mandated as the lead arranger for a US$120 million loan

facility has provided high level commercial debt terms which include South

African export credit agency support.

· FSDEA and a pan-African Multilateral Development Financial Institution are

working to provide the US$80 million equity investment required to support the

debt facility.

· FSDEA has provided a $15 million bridging loan facility towards the US$80

million investment, which is available to meet operating cash flow requirements

to facilitate early-stage development and the route to main finance.

· The Company is aiming to fully-fund the Longonjo project at the subsidiary

level, Ozango Minerais(84% Pensana),which owns 100% of the Longonjo project and

as a result the Company's holding in Ozango Minerais is expected to reduce from

84% to 64% at a read-through valuation of 66 pence per share.

· An updated MIC is currently being worked on, which could potentially include

various additional tax incentives as a result of amendments to the private

investment legislation in Angola, including a reduction in the rate and deferral

in the payment of Corporate Income Tax rate along with a reduction in the tax

applicable to the distribution of profits and dividends.

· The Company is in advanced discussion with a number of parties for the

offtake of the highly marketable, radionuclide-free mixed rare earth carbonate

(MREC) and expects to be in a position to sign up to 100% of the production of

the high value, clean MREC from the Longonjo Processing facility.

· The proposed funding arrangements for the Saltend rare earth separation

facility remain largely as previously advised, with ABG Sundal Collier recently

confirming that it will place a bond for circa US$150 million and are

independent of the Longonjo financing.

· The Company is in early discussions with the UKIB and with other potential

equity partners for the balance of the funding, namely circa US$100 million

equity requirement at the subsidiary level and has received a UK Government

grant of up to £4,000,000 towards the funding requirement.

Paul Atherley Chairman commented: "The completion of the engineering redesign

together with the technical and economic sign off by The Mineral Corporation

during November is a very important step towards the execution of the financing.

We are grateful for the ongoing support from FSDEA which is working closely with

us and the team at ABSA to secure the funding to allow the commencement of

construction at Longonjo in the first quarter of next year.

We have been pleased with the strong interest in the high value radionuclide

-free MREC product from Longonjo and are advancing a number of offtake

agreements as part of the financing.

We continue to progress the financing for the Saltend project which will be

independent of the Longonjo financing and as previously advised will be a bond

finance, however now with support from the UK Government."

Longonjo

The engineering team has successfully completed a modular redesign of the

processing facility, with a total Capex of US$200 million.

The redesign has been led by Project Manager Kevin Botha working with a team of

contractors including ADP, part of Lycopodium group and specialist in modular

minerals processing unit installation, with extensive experience in Angola,

ProProcess a hydrometallurgical specialist with extensive expertise in modular

processing plants throughout Africa and mining consultant Practara which has

completed the detailed mine redesign and scheduling.

South African mining consultants, The Mineral Corporation, is undertaking a

technical and economic review of the redesign on behalf of ABSA, which is

scheduled to be completed in November.

As previously announced ABSA Bank, the South African based multinational banking

and financial services conglomerate has been mandated as the lead arranger for a

US$120 million loan facility.

ABSA which has existing exposure to Angola's oil and gas sector and is looking

to expand its interest in the country has identified the Longonjo project as an

opportunity to gain exposure to the green energy sector.

High level commercial debt terms have been drafted which include South African

export credit agency support. These terms are expected to be finalised once the

sign off from independent consultants The Minerals Corporation has been

received.

The Company continues to work closely with major shareholder, the Angola

Sovereign Wealth Fund FSDEA. FSDEA is working with a pan-African Multilateral

Development Financial Institution to provide the US$80 million equity investment

required to support the debt facility.

FSDEA has provided a $15 million bridging loan facility towards the US$80

million investment, which is available to meet operating cash flow requirements

to facilitate early-stage development and route to main finance.

The Company is aiming to fully-fund the Longonjo project at the subsidiary level

Ozango Minerais(84% PRE)which owns 100% of the Longonjo project.

It is intended that the US$80 million equitywill be invested

attheOzangoMineraislevel by FSDEA andan African multilateralagency and as a

result Pensana's holding in Ozango Minerais will reduce from 84% to 64% at a

read-through valuation of 66 p per share at the Pensana level.

The valuation has been based on the independent third-party valuation prepared

in March of this year at the time of the proposed US$220 million strategic

equity investment by a multinational mining company.

Further tax incentives

The current Fiscal Terms currently in place under the Mining Investment Contract

(MIC) include:

· 2% royalty on revenue;

· 20% Corporate Income Tax rate and a 5% municipal tax on taxable net

profits following an initial six-year tax holiday;

· Custom duties exemption on imported equipment;

· Full 5-year capital repayment allowance;

· Dividend tax exemption for 3 years.

An updated MIC is currently being worked on, which is potentially expected to

include various additional tax incentives as a result of amendments to the

private investment legislation in Angola most notably:

· Reduction in the Corporate Income Tax rate, applicable for a period of

up to fifteen years;

· Deferral of the payment of taxes for a period of up to six years;

· Investment Tax reduction applicable to the distribution of profits and

dividends, for a period of fifteen years;

· An Investment premium (uplift) corresponding to the cost recoverable

and tax deductible in terms of the investment to be made for mining and product

marketing.

Offtake

The global market for radionuclide-free mixed rare earth carbonate (MREC) is

increasing. Demand from the rest of the world ex China is increasing due to the

expansion plans of existing downstream facilities in Europe, India and Asia and

the establishment of new separation capacity in the US and Australia.

To meet this increased demand the Company is in advanced discussion with a

number of parties for the offtake of the highly marketable, radionuclide-free

mixed rare earth carbonate (MREC) and has signed letters of intent for up to

100% of the Longonjo offtake.

Site based activities

Approximately 25% of the US$15 million FSDEA loan has been deployed over the

past three months on the following site-based activities:

· the continuation of onsite activities with earthworks contractors Grupo Nov

and electrical contractor, Elektra in preparation of commencement of main

construction;

· finalization of the preferred vendor re-pricing for the revised equipment

schedule;

· finalization of redesign of the monthly mine schedule and Run-of-Mine

blending strategy for years 1-5 to meet the redesign throughput rates;

· finalization of the optimized Tailings Storage Facility re-design;

· finalization of execution of the Livelihood Restoration Programme with the

local community under the Relocation Action Plan.

Saltend Update

Whilst the immediate focus is on the financing of the Longonjo project, progress

continues with the financing for the Saltend rare earth separation facility.

Rather than financing both projects contemporaneously as previously proposed the

Saltend financing will follow the Longonjo financing. The financings are

independent of each other with no financier in common between the two projects.

The capital cost for the Saltend facility has been revised up to US$250 million

from the previous estimate of US$195 million in May 2022. The increase in the

estimate is primarily due to the impact of inflation and a number of design

changes.

The engineering design has been completed, the site cleared, the preparatory

infrastructure works completed and the early-works contractors identified. The

project is ready to commence construction once the finance has been arranged.

The proposed funding arrangements remain largely as previously advised, with ABG

Sundal Collier recently confirming that it will place a bond for circa US$150

million with its institutional investor clients for which the Company has

received green bond accreditation by Shades of Green (formerly part of CICERO,

now a part of S&P Global).

The Company is in early discussions with UKIB and with other potential equity

partners for the balance of the funding, namely circa US$ 100 million equity

requirement.

As with the Longonjo financing, it is intended to finance the Saltend project at

the subsidiary level as a stand-alone business with its own feedstock and

offtake arrangements rather than at the Pensana corporate level.

To this end and as previously announced Pensana has entered into an MOU with

offtake partners for 30% of the Saltend NdPr oxide production. These

arrangements recognize that Longonjo will initially be producing MREC and allow

for the ability to convert MREC offtake to oxide offtake in the future. The

Company is also in direct discussions with OEM's in the automotive and wind

sectors including Siemens, JLR, Volvo, Mercedes, GE and tier 1 suppliers to the

automotive sectors.

UK Government Support

By 2030 the UK is expected to transition from a being a major producer of

internal combustion engines to a world leader in electricdrive units (EDUs),

producing three million EDUs annually, with a large proportion for export.

Without a secure magnet metal supply chain this is under threat.

As recently announced Nusrat Ghani, Minister of State at the Department for

Business and Trade and Cabinet Office, highlighted that the Saltend project

would be an important step in supporting the UK automotive industry which

employs 780,000 people and has offered the Company a Grant of up to £4,000,000

towards the funding required to build a rare earth oxide separation facility in

the `Humber Freeport' at Saltend.

Pensana has been nominated by the UK Government as a partner under the Minerals

Security Partnership (MSP) between the US and its international allies.

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under the Market Abuse

Regulations (EU) No.596/2014. Upon the publication of this announcement via a

Regulatory Information Service, this inside information will be considered to be

in the public domain. The person responsible for arranging for the release of

this announcement on behalf of the Company is Paul Atherley, Chairman.

- ENDS -

For further information, please contact: Shareholder/analyst enquiries:

Pensana Plc

Paul Atherley, Chairman

IR@pensana.co.uk

Tim George, Chief Executive Officer

Rob Kaplan, Chief Financial Officer

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

October 31, 2023 03:16 ET (07:16 GMT)

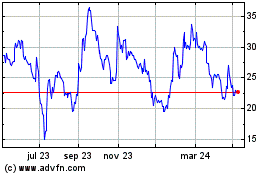

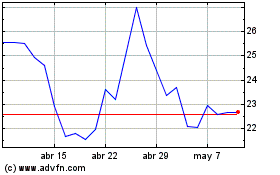

Pensana (LSE:PRE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Pensana (LSE:PRE)

Gráfica de Acción Histórica

De May 2023 a May 2024