TIDMREVB

RNS Number : 9402K

Revolution Beauty Group PLC

31 August 2023

T his announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

REVOLUTION BEAUTY GROUP PLC

("Revolution Beauty", the "Group" or the "Company")

AUDITED FINAL RESULTS FOR THE YEARED 28 FEBRUARY 2023

Improving trading performance during period of change

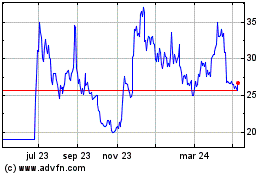

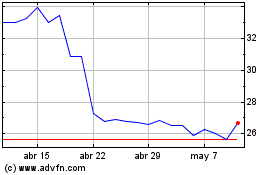

Suspension of shares traded on the London Stock Exchange

successfully lifted post period end

Revolution Beauty Group plc (AIM: REVB), the multi-channel mass

beauty innovator, today announces its Full Year Results for the

year ended 28 February 2023 ("FY23" or the "Period").

The Group delivered a resilient performance during the Period,

despite continuing to be impacted by previously flagged issues

Identified around stock, revenue and the carrying value of

Revolution Labs.

Nonetheless, trading improved as the year progressed, with the

return of top line revenue growth and positive EBITDA in H2; this

follows operational and commercial changes made by the new

management team.

Since the year end, this trend has continued, and the Group is

pleased to be performing ahead of internal expectations.

Key financials

Group results Year ended 28 Year ended 28

February 2023 February 2022

Restated Change YoY

GBP'M GBP'M GBP'M

Revenue 187.8 184.6 3.2

---------------- ---------------- --------------

Gross profit 75.9 71.0 4.9

---------------- ---------------- --------------

Gross profit

% 40.4% 38.5% 1.9%

---------------- ---------------- --------------

Adj EBITDA (7.5) (0.8) (6.7)

---------------- ---------------- --------------

Operating loss (30.6) (39.9) 9.3

---------------- ---------------- --------------

Net finance costs (3.3) (6.0) 2.7

---------------- ---------------- --------------

Loss before tax (33.9) (45.9) 12.0

---------------- ---------------- --------------

Income tax credit 0.2 1.6 (1.4)

---------------- ---------------- --------------

Loss for the

year (33.6) (44.3) 10.7

---------------- ---------------- --------------

Gross Cash 11.0 15.6 (4.6)

---------------- ---------------- --------------

Net Debt (21.0) (8.4) (12.6)

---------------- ---------------- --------------

Financial Highlights

-- Group revenue increased by 1.7% to GBP187.8m (2022:

GBP184.6m) primarily due to the reopening of physical stores. Store

revenue increased by 8.1%; Online sales were lower by 12.1%

-- Gross profit margin increased by 190bps to 40.4%, primarily

due to improved stock management and reduced freight costs

-- Adjusted EBITDA loss widened to GBP7.5m (FY22: GBP0.8m) due

to increased marketing expenses and higher staffing costs due

primarily to increased headcount, partly offset by improved margin;

loss after tax narrowed to GBP33.6m (FY22: GBP44.3m)

-- Significant improvement in year-on-year operating cash flow.

Cash balance at year end of GBP11m. Banking facility fully drawn at

GBP32.0m, GBP8.0m of which was drawn in the Period, resulting in

net debt balance of GBP21.0m at the year end

-- New inventory provisioning methodology adopted by the Group

in FY22, tight inventory control introduced during H2, resulting in

the reduction in the inventory provision for FY23 of GBP6.0m (FY22

increase: GBP11.3m)

Operational Highlights

-- Rigorous new internal controls and protocols introduced

across Group functions and departments; suspension of Group's

shares successfully lifted post period-end

-- Improving trading performance and maintained strong

stakeholder relationships during a period of significant and

well-publicised upheaval for the Group

-- Continued to successfully fulfil consumer demand for

Revolution Beauty's relevant, affordable and multichannel offer

-- Growth in store revenues driven by new distribution in Boots in UK and Walgreen in US

-- Rationalisation of product range, with focus redoubled on

successful core products and attractive 'Make Up Revolution'

brand

-- Appointment of the Group's first Chief Marketing Officer post

period end, demonstrating strategic intent to grow across core

markets of US, UK and Germany

-- The Group will be announcing imminently the appointment of a

new CEO. They will replace Bob Holt, who as previously announced,

stands down today. Alistair McGeorge will become the Non-Executive

Chair when the new CEO joins the business

-- On March 2023 the Group announced it secured an amended

facility agreement with its banking partners which runs through to

October 2024. The overall size of the facility was agreed at

GBP32m, reduced from GBP40m, and is fully drawn. Revised covenants

remain in place and the Group continues to enjoy the support of its

banking partners

Current Trading and Outlook

-- Post period-end, trading has continued to perform ahead of

expectations. As previously announced, sales in Q1 FY24 increased

by 60% on the prior year (Q1 FY23 sales were particularly weak due

to customers previously overstocking) with EBITDA at GBP3.5m (Q1

FY23: GBP7.4m loss)

-- While the Board is mindful of the external environment, it

remains confident in the future opportunities open to Revolution

Beauty, given its relevant, affordable and multichannel offer. As

previously disclosed, the current expectation for FY24 is high

single digit growth in revenue, and adjusted EBITDA in the high

single digit millions

-- The Group currently has a cash balance of GBP10.5m, and remains fully drawn on its facility

Alistair McGeorge, Executive Chairman, commented:

"This solid Group trading performance has been achieved during a

period of well-publicised upheaval for the business. To that end, I

would like to thank my predecessor Derek Zissman, Bob Holt and

Elizabeth Lake for their efforts over the past twelve months.

Firstly in maintaining the commercial performance of the Group

while also overseeing the implementation of new internal protocols

and the lifting of the suspension of the Group's shares which are

traded on AIM.

"While I have only been with Revolution Beauty for a short

period, it is clear to me that the business has the right

attributes in place. The expertise of colleagues, combined with the

relevance, affordability and strength of the Revolution brand gives

me confidence that we can achieve continued growth across our core

markets. .

"While there is still a lot of work to be done, I look forward

to supporting our new CEO, to build on recent momentum within the

business, and achieve long-term sustainable growth within what is a

large and attractive beauty market."

For further information please contact:

Investor Relations Investor.Relations@revolutionbeautyplc.com

Elizabeth Lake

Joint Corporate Brokers

Zeus (NOMAD): Nick Cowles /Jamie Tel: +44 (0) 161 831 1512

Peel /Jordan Warburton Tel: +44 (0) 203 100 2222

Liberum: Clayton Bush / Edward

Thomas / Miquela Bezuidenhoudt

Media enquiries Tel: +44 (0)20 3805 4822

Headland Consultancy Revolutionbeauty@headlandconsultancy.com

Matt Denham / Will Smith / Antonia

Pollock

About Revolution Beauty

Revolution Beauty is a global mass beauty and personal care

business which operates a multi brand, multi category strategy and

sells its products both direct-to-consumer (DTC) via its e-commerce

operations, and in physical and digital retailers through wholesale

relationships.

Today, the Group has a retail footprint of c.17,000 doors across

leading retail chains in the UK, USA and other international

markets. Revolution Beauty has access to a wide customer base,

predominantly aged between 16 and 35, through its digital partners

and own DTC platform. It has established and invested to streamline

its supply chain with its own manufacturing facility in the UK, and

third-party warehousing facilities across the UK, USA and

Australia. The Group has offices in the UK, USA, New Zealand and

Germany. Revolution Beauty currently employs 347 people.

The total mass beauty market was worth $218bn in 2022 and is

expected to grow to $255bn over the next 3 years (source:

Euromonitor). Revolution Beauty has been a leading innovator

building a significant global following across social channels,

enabling it to spot trends and respond quickly to consumer demand,

and translating this to mass market beauty retail.

CHAIR'S STATEMENT

I am delighted to present my first report as Executive Chair of

Revolution Beauty. This is an exciting time for the business as we

seek to capitalise on its undoubted strengths.

As has been well publicised, the business has suffered a number

of significant commercial and financial shortcomings. These have

been outlined in detail in the FY22 annual report. Most of these

are now behind us and this is due to the successful actions of my

predecessor as Chair, Derek Zissman, outgoing CEO Bob Holt and the

wider executive team. With a new Board now in place we can look

forward to driving sustainable profitable growth.

LIFTING OF SHARE SUSPENSION

Over the past year, the over-riding priority for the business,

its shareholders and stakeholders has been to lift the suspension

of trading in the Group's shares.

As set out in our FY22 annual report and accounts, the Company's

shares were suspended on 1 September 2022. The focus of the Board

from then was to work tirelessly to restore trading in the

Company's shares for the benefit of all stakeholders.

The hurdles to getting the suspension lifted were,

-- the completion of the FY22 audit (annual report and accounts published 26 May 2023).

-- the publication of the FY23 interims (published 2 June 2023).

-- completion of a report on the Group's working capital carried

out by KPMG and similarly a report on the updated Financial

Position and Prospects Procedures (FPPP).

-- a fully constituted Board with four independent non-executive directors (27 June 2023).

With the publication of the interim results on 2 June 2023, the

Company had met the conditions for re-listing, and it also gave

notice of the date of the AGM 27 June 2023.

Following considerable work from the whole Revolution Beauty

team, the Company's shares were restored to trading on AIM

(Alternative Investment Market) on 28 June 2023

CORPORATE GOVERNANCE, BOARD AND MANAGEMENT CHANGES

The Group has adopted the Quoted Companies Alliance Corporate

Governance Code 2018 (QCA Code) and the Board remains committed to

upholding the highest levels of corporate governance. The Board

acknowledges that in some areas this was not historically the case,

and has taken significant measures to address these historic and

complex matters which were the subject of an Independent

Investigation.

Between the start of FY23 and the request from boohoo Group Plc

for Board representation, there have been a number of significant

changes to the Board and management of the business:

Andrew Clark announced his intention to step down as a director

and CFO of the Company on 12 May 2022. On the same date, we

welcomed Elizabeth Lake as director and Chief Financial

Officer.

In November 2022, it was announced that due to the events since

IPO and the transition from a private company to a public company,

Chief Executive Officer Adam Minto resigned as a Director of the

Group and stepped down from the business with immediate effect. Bob

Holt had been appointed as Interim Chief Operating Officer in

October and was subsequently appointed Chief Executive Officer and

a Director on 28 November 2022.

In December 2022, Gita Samani and Edward Rumsey also resigned

from the Board.

On completion of the FY22 audit, Tom Allsworth resigned as a

Director of the Group on 24 May 2023.

Under the leadership of Bob Holt, two Non-Executive Directors

("NEDs") with significant listed company and commercial experience

(Rachel Maguire and Matthew Eatough) were appointed to strengthen

the Board and help stabilise it at a time of intense corporate

activity. Following the settlement announcement with boohoo Group

Plc, three further NEDs were appointed (Peter Hallett, Neil Catto

and Rachel Horsefield) to reflect the change in leadership,

bringing with them experience closely aligned to the direction of

the new leadership team.

Following these appointments, as at the date of this Report, the

Board has six NEDs and this will increase to seven imminently once

the new CEO is appointed and I become a non-executive Chair.

Since the board changes referred to above, the Board and the

Nominations Committee have been conducting a search for a new CEO

and for non executive Directors to replace Jeremy Schwartz, Rachel

Maguire and Matthew Eatough, who, having played their part in the

restoration of the Company's trading on AIM and the transition to

the new leadership team, have each decided that they will not put

themselves forward for election at the forthcoming AGM. This search

process is well progressed and we intend to announce a series of

appointments in the near future. I would like to thank each of

Jeremy, Rachel and Matthew for their responsive and professional

service and guidance during this transitional period.

REGULATOR ACTION

The Company informed the shareholders on 21 July that the

Financial Conduct Authority (the "FCA") had notified Revolution

Beauty that it had commenced an investigation into potential

breaches of the Market Abuse Regulation (EU) 596/2014 (as it forms

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018) in relation to certain matters in the period

from July 2021 to September 2022. Revolution Beauty is cooperating

fully with the FCA and will provide updates in due course.

OUR PEOPLE

I would like to take this opportunity to express my thanks to

all the employees of Revolution Beauty for their efforts during

what has been a challenging and busy period.

LOOKING FORWARD

The business is well placed to move forward and continue to

deliver topline growth and improving profitability under the

leadership of its new CEO. The business operates within a growing

sector and is positioned to take advantage of the

opportunities.

Alistair McGeorge

Executive Chair

31 August 2023

CHIEF EXECUTIVES REVIEW

INTRODUCTION

The Company was listed on the AIM in July 2021 and was suspended

from trading in September 2022. I was appointed to the Board in

November 2022 to bring stability to the business following a period

of significant turmoil.

The results presented herewith recognise significant change in

the business, Elizabeth Lake the CFO was appointed in May 2022 and

was instrumental in bringing the Company out of suspension in July

2023.

As stated in the Chair's report I will be leaving the business

at the end of August 2023.

I am proud of what has been achieved under my short tenure and

take satisfaction from achieving what I was brought in to achieve,

the stabilisation of the business and the lifting of the share

suspension.

We are pleased to report the results for the year ended 28

February 2023. Turnover grew by 1.7% to GBP187.8m (FY22 GBP184.6m)

and losses before tax reducing to GBP33.9m (FY22 GBP45.9m).

Adjusted EBITDA for the period was a loss of GBP7.5m compared to

a loss of GBP0.8m in FY22. All of this loss was in H1 and was due

to lower sales and increasing overheads particularly within

marketing and people costs. In H2 cost saving measures were put in

place and revenue grew.

Both Elizabeth Lake our Chief Financial Officer and I were

appointed during the year being reported, and the results include

significant changes to those envisaged when the company was floated

in July 2021.

Underlying cashflows have improved, however during the period

exceptional legal and professional fees (c.GBP3.8m) and costs of

restructuring have been paid (c.GBP1.3m), impacting cash

generation. Without these one off costs the business would have

generated cash through its operating activities. The cash balance

at the end of the year is GBP11m, and the GBP32m facility is fully

drawn, resulting in a net debt balance of GBP21.0m. The cash

balance at 30 August was GBP10.5m.

UPDATE ON INDEPENT INVESTIGATION

As announced on 23 September 2022, the Company's auditor wrote

to the Board on 21 September 2022 to identify a number of serious

concerns that had arisen during the course of its work on the audit

of the Company's accounts for FY22. The detail of the findings can

be found in the FY22 Annual Report and Accounts.

The Board appointed independent external advisors to undertake

an Independent Investigation, Macfarlanes (lawyers) and FRA

(forensic accountants).

The delayed completion of the FY22 results subsequently had a

knock-on effect to the timetable for the publication of these FY23

results. In addition, these results also reflect the impact of the

issues previously identified, particularly around stock and revenue

and the carrying value of Revolution Labs.

The report highlighted a number of accounting irregularities and

control issues, which have now been dealt with.

FY23 PERFORMANCE

During the year, we achieved a small increase in Group sales, up

1.7%% to GBP187.5m as compared to the same 12-month period last

year. This is a solid performance given the turmoil within the

business during the year and the impact of certain customers being

overstocked and therefore reducing their buying, particularly in

the digital wholesale channel.

I want to highlight the future opportunities for the Group

rather than continuing to dwell on the control weaknesses of the

past. As part of the restructure we implemented, all global sales

heads reported into me and for the first time were accountable for

controlling the costs of their individual departments and

headcount. We feel more comfortable now with the ability of the

teams to forecast sales and costs attributable to them than at any

time since joining.

Due to the previous lack of control around new product

development, we typically produced over one thousand new products

each year into an already saturated product offering. Our sales

teams, in conjunction with our customers, are now working to a more

controlled product range. We have in the past been recognised as

being able to bring innovative products to market more efficiently

and speedier than our mass market competitors. We continue to

deliver that flexibility.

Our gross margin in the year improved to 40.4% from 38.5% in

FY22. The improvement was mainly driven by reducing freight costs

and reduced stock provision charges.

Since entering the US market, we have seen strong growth. Work

remains ongoing to further strengthen relationships, streamline the

product range and improve service levels on stock supply. These

measures will ensure continued focus on fulfilling the brand's full

potential in the US market.

Our trading throughout our other major markets, in the UK,

Germany, the Nordics and Australasia have performed well, and we

look forward to building further on those markets whilst opening

new territories which offer long term attractive opportunities for

profitable growth. The global cosmetics market continues to grow

and offers significant rewards for those brands with established

relationships and the ability to be innovative and proactive to

ever evolving market opportunities.

What became very evident during the early part of my appointment

was the underperformance of a number of newly developed brands and

sub brands. We have subsequently reduced significantly the product

ranges on Revolution Man, Tanning, BH cosmetics and Fragrance.

Again, our focus is on our core range of products and in the

categories we are successful in, with some variation by country or

individual customer need. To reiterate, we continue to provide a

flexible approach to give customers products that excite whilst

maintaining a commercially viable approach to future partnership

discussions.

POST-PERIOD AND CURRENT TRADING

The post year end trading has continued to perform ahead of our

internal expectations We are seeing increasing demand for our

products in our key markets, and our sales teams are confident of

hitting their forecast sales targets.

It would be remiss of me to fail to mention the significant

management effort which was needed to rescue the business from the

errors of the recent past. I would like to thank the slimmed down

management team for the successful turnaround in the business in

such a short period of time.

I also should like to thank all stakeholders for their support

in the period reported.

OUTLOOK

We are proud of the progress that has been made in the business

over the past year, and that we were able to secure the lifting of

the share suspension.

We have been focused on reinforcing internal controls and

processes to ensure that we are in a position to achieve consistent

operational excellence at a global scale, and in line with the

required standards. I know I am handing over to an experienced team

who will continue from here.

The business is poised for the next stage of its growth story,

and I wish Alistair and the rest of the team well as they take the

business to the next level.

Bob Holt OBE

Chief Executive Officer

31 August 2023

FINANCIAL REVIEW

Following the publication of the FY22 Annual Report and Accounts

and the H1 FY23 interims, the suspension on the Company's shares

was lifted and the shares have been trading as normal since 28 June

2023.

FY23 is a story of two halves, in H1 Group revenue decreased by

4.2% and adjusted EBITDA was a loss of GBP7.5m. The second half of

the year saw a return to top line revenue growth due to the changes

that were made by the new management team both operationally and

commercially.

REVENUE

Year ended Year ended

28 February 28 February

2023 2022

Change

GBP'M GBP'M GBP'M %

Revenue 187.8 184.6 3.2 1.7%

Gross margin 75.9 71.0 4.9 6.9%

Adjusted EBITDA (7.5) (0.8) (6.7) (834%)

================== ============ ============= ======== ========

Revenue in the year increased by GBP3.2m or 1.7%, with the

opening of stores following the closures during the pandemic,

consumers switched back very quickly from online to physical

stores. Overall we saw a rapid decline in online sales of 12% year

on year, whilst revenue from our own websites increased 2%, revenue

from digital partners fell 23% as they de-stocked following the

fall in demand.

Gross margin for the year ended 28 February 2023 improved

significantly to 40.4%/GBP75.9m (FY2022: 38.5%/GBP71.0m) as a

result of improved stock management, and reduced freight costs as

freight rates returned to near pre-pandemic levels.

Adjusted EBITDA loss increased from a loss of GBP0.8m in FY22 to

a loss of GBP7.5m in FY23. The main reason for this increased loss

was the marketing spend on stand updates which was significantly

higher than FY22 which had been impacted by lockdowns and low spend

in stores. In addition, the business had increased staffing levels

in FY22 in anticipation of significantly higher revenue and this

resulted in higher people costs, particularly in the first half of

FY23.

Year Year

ended ended

28 28 Change %

February February GBP'000

2023 2022

GBP'M GBP'M

========================

By business channel: 51.0 27% 58.0 31% (7.0) (12.1%)

Digital Stores 136.8 73% 126.6 69% 10.2 8.1%

======================== ==================== =============== ==================== =============== ========== ==================

Total revenue 187.8 100% 184.6 100% 3.2 1.7%

======================== ==================== =============== ==================== =============== ========== ==================

By region:

UK 67.0 36% 71.5 39% (4.5) (6.3%)

US 51.9 28% 48.0 26% 3.9 8.2%

ROW 68.9 36% 65.1 35% 3.8 5.9%

======================== ==================== =============== ==================== =============== ========== ==================

Total revenue 187.8 100% 184.6 100% 3.2 1.7%

======================== ==================== =============== ==================== =============== ========== ==================

As shown in the table above, Group revenue increased by GBP3.2m

to GBP187.8m in the year ended 28 February 2023 (2022: GBP184.6m).

This revenue growth was achieved during a year in which the

business went through significant change as a result of the issues

that arose from the Investigation as set out in the CEO report.

Store revenue increased by GBP10.2m or 8.1% to GBP136.8m (2022:

GBP126.6m), with both the US and UK store groups growing at 8% and

9% respectively, driven by new distribution in Boots in the UK and

new distribution in Walgreen in the US.

An increased number of customers returned to the stores when

Covid-19 related trading restrictions were lifted, and this

resulted in a decline in digital sales in the year of GBP7m

compared with the prior year. Within this we saw growth of 2% from

our own websites, however revenue from our digital partners

declined 23% as they implemented significant destocking measures

which resulted in a drop in order levels.

Most of the impact of the decline in revenue from our digital

partners was in the UK market which resulted in UK sales reducing

by GBP4.5m despite increased store distribution in Boots and a good

performance in Superdrug.

US revenue increased by GBP3.8m due to new distribution in

Walgreen, and the recovery of US retailer performance following the

pandemic.

In the Rest of the World (ROW) we saw 5.9% growth overall, which

included 14% growth in revenue from our distributers.

PROFITS

Year ended Year ended

28 February 28 February

2023 2022 Change

Restated

GBP'000 GBP'000 GBP'000

Gross profit 75,884 71,028 4,856

Marketing and distribution costs (57,469) (49,546) (7,923)

Administrative expenses (42,161) (35,038) (7,123)

Impairment losses on financial assets (204) (1,428) 1,224

Impairment of property, plant and equipment (2,177) (1,948) (229)

Impairment of goodwill (3,388) (13,000) 9,612

Provision for legal cases (1.066) (1,018) (48)

Exceptional item - IPO costs - (8,936) 8,936

Other income - 5 (5)

============================================== ============= ============= ================

Operating loss (30,581) (39,881) 9,300

Net finance costs (3,293) (6,034) 2,741

============================================== ============= ============= ================

Loss before taxation (33,874) (45,915) 12,041

Gross profit margin 40.4% 38.5% 1.9ppt

============================================== ============= ============= ================

Gross profit margin for the year ended 28 February 2022

increased from 38.5% to 40.4%. The improvement in margin was driven

primarily by the reduction in freight rates following their

historical highs due to the pandemic. The margin at H1 was higher

at 41.4% due to seasonality, with higher seasonal promotions in

H2.

Whilst there will be ongoing changes to the stock provision

based on New Product Development (NPD), Net Realisable Value (NRV)

and slow-moving stock, the movement between FY22 and FY23 has

reduced due to the actions taken by new management to manage stock

purchasing, establish exit routes for slow moving stock and focus

NPD on fewer better products.

Operating loss for the year ended 28 February 2023 of GBP30.6m

reduced by GBP9.3m (2022: GBP39.9m). This was due to a number of

factors:

Improvement in gross profit (GBP4.9m) driven by reduction in

stock provision charges and lower freight rates following record

levels during the pandemic.

-- Reduction in one off costs incurred in FY22, impairment of

assets (GBP10.6m, mostly from the acquisition of Medichem), IPO

costs (GBP8.9m)

-- Increase in spend on stand updates (GBP5m) catching up with

updates missed during the pandemic, and additional marketing and

distribution spend (GBP2.9m)

-- Increase in People costs (GBP2m), resulting from scaling up

for expected increase in revenue, loss on foreign exchange on

revaluation of US balances (GBP1.5m) and other overheads

(GBP2.9m)

Loss before taxation for the year reduced to GBP33.9m (2022:

Loss before taxation GBP45.9m), an improvement of GBP12.0m.

TAXATION

The Group's tax credit decreased year on year by GBP1.4m

primarily due to the prior year including tax refunds totalling

GBP1.6m arising from historic overpayments and loss carry back,

resulting in an overall credit of GBP1.6m in FY22 compared with a

credit of GBP0.2m in FY23.

LOSS AFTER TAXATION

Loss after taxation decreased to GBP33.6m (2022: Loss after

taxation GBP44.3m).

ADJUSTED PROFITS

The Group uses a number of Alternative Performance Measures

("APMs") in addition to those measures reported in accordance with

IFRS. Such APMs are not defined terms under IFRS and are not

intended to be a substitute for any IFRS measure. The Directors

believe that the APMs are important when assessing the underlying

financial and operating performance of the Group. Full details of

the exceptional charges incurred during the year are presented in

Note 5 to the financial statements.

The exceptional items identified as non-recurring in nature are

set out below and were considered in calculating the adjusted

profits. Exceptional Items are defined in Note 2

Year ended Year ended

28 February 28 February

2023 2022 Change

GBP'000 GBP'000 GBP'000

==========================================

(30,581) (39,881) 9,300

Operating loss 15,867 22,560 (6.693)

Depreciation, amortisation & impairment

Share-based payment 303 3,534 (3,231)

Loss on disposal of asset 62 -

Exceptional items: 62

========================================== =============== =============== ===========

IPO related costs - 8,936 (8,936)

Acquisition costs 262 621 (359)

Restructuring costs 1,310 261 1,049

Provision for legal cases 1,474 1,018 456

Legal and professional fees 3,528 3,528

Audit Fees 300 2,150 (1,850)

========================================== =============== =============== ===========

Total exceptional items added back 6,874 12,986 (6,112)

Adjusted EBITDA (7,475) (801) (6,674)

Adjusted EBITDA decreased by GBP6.7m to a loss of GBP7.5m during

the year (2022: GBP0.8m loss). The reduction in EBITDA was

primarily due to additional stand marketing costs and higher People

costs as the business had scaled up for high levels of growth at

the end of FY22 and the first half of FY23.

Depreciation, amortisation and impairment was significantly

lower as a result of the impairments to stands and goodwill made in

FY22. The remaining amount of goodwill and assets acquired for

Medichem were impaired in FY23, bringing the carrying value to

zero, as a result in changes to forecasts.

As part of the changes the new management team made, teams were

restructured which resulted in one off costs associated with the

restructure.

Significant one off legal and professional fees were incurred in

relation to the Independent Investigation and the work required to

enable the suspension on the Company's shares to be lifted.

FINANCIAL POSITION AND RESOURCES

As at As at

28 February 28 February

2023 2022 Restated Change

GBP'000 GBP'000 GBP'000

Intangible assets 5,728 9,837 (4,109)

Property, plant and equipment 7,928 8,215 (287)

Right of use asset 2,310 4,150 (1,840)

Reimbursement asset - 3,267 (3,267)

Non-current assets 15,966 25,469 (9,503)

Current assets excluding cash 104,393 101,401 2,992

Liabilities excluding borrowings (112,817) (98,507) (14,310)

================================== ============= =============== ==========

Cash and cash equivalents 11,044 15,619 (4,575)

Borrowings (31,721) (23,551) (8,170)

================================== ============= =============== ==========

Net debt (20,677) (7,932) (12,745)

================================== ============= =============== ==========

Net assets (13,135) 20,431 (33,566)

================================== ============= =============== ==========

NON-CURRENT ASSETS

The Group states property, plant and equipment at cost, less

depreciation or provision for impairment. Non-current assets as at

28 February 2023 reduced to GBP16.0m (2022: GBP25.5m), mainly due

to a further impairment of the acquisition of Medichem, resulting

in no residual carrying value and the movement of the reimbursement

asset to current assets due to Management's view that the legal

case will be settled within 12 months.

CURRENT ASSETS

Current assets increased to GBP104.4m as at 28 February 2023

(2022: GBP101.4m). The inventory balance was higher at GBP47.6m

(2022: GBP44.7m) which was due to business requirements. There was

an increase in Trade Receivables of GBP3.0m consistent with higher

sales. As the US business has grown, there is an impact on trade

debtor balances caused by typically longer payment terms. Other

receivables also increased by GBP3.2m representing the

reimbursement asset on a copyright infringement legal case (see

Note 4).

LIABILITIES

The increase in total liabilities excluding borrowings as at 28

February 2023 of GBP14.3m relates mainly to an increase in trade

payables of GBP9m due to stock purchases, impact of foreign

exchange, audit fees, and accruals and contract liabilities mainly

due to fixture accruals for Walmart and marketing deductions for

new and existing US retail customers.

LIQUIDITY

At 28 February 2023, the Group had GBP11.0m cash, with gross

borrowing of GBP32m fully drawn from the RCF.

The face value of the Group net debt is GBP21.0m. The reported

net debt of GBP20.7m is after deducting GBP0.3m of prepaid fees.

These figures exclude the deferred consideration.

BANKING FACILITIES

As at 28 February 2023 the Group had a GBP40.0m RCF in place. In

September 2022, the Group breached its facility agreement as a

result of not publishing its audited accounts by 31 August 2022.

Following on from this, there was uncertainty as to what the

adjusted EBITDA numbers would be for FY21 and FY22, until these

statements were finalised. Therefore, the Group was unable to

certify its results to the Banks. As a result, the banks agreed a

short-term liquidity covenant and the facilities operated under

this arrangement until a new suite of covenants was agreed on 29

March 2023 with the first quarterly test at the end of May 2023

which the Group cleared. As at the date of signing this report, the

Group has an amended and restated credit facility of GBP32.0m of

which the full GBP32.0m is drawn and has cash balances of

c.GBP11.0m as at the end of July which provides sufficient

liquidity to the Group for its current requirements.

Due to the qualifications in the audit report, the Group

received a waiver from its banking partners prior to the signing of

the financial statements for the provision in the RCF which

classifies a qualified audit opinion as an Event of Default.

Therefore, the Group remains within all the requirements of the

facility agreement, see note 2.

CASH FLOW

Year ended

Year ended 28 February

28 February Restated Change

2023 2022 GBP'000

GBP'000 GBP'000

================================================

Net cash (used in) generated from operations (1,959) (17,841) 15,882

Income tax 1,898 (890) 2,788

Net cash generated from operating activities (61) (18,731) 18,670

================================================ =============== =============== ===========

Purchase of intangible assets (1,018) (3,066) 2,048

Purchase of property, plant and equipment (7,496) (4,968) (2,528)

Purchase of subsidiary - (6,630) 6,630

Others 1 (509) 510

================================================ =============== =============== ===========

Net cash used in investing activities (8,513) (15,173) 6,660

================================================ =============== =============== ===========

Interest paid (1,175) (5,000) 3,825

Drawdown of borrowings 8,000 29,000 (21,000)

Repayment of borrowings - (78,665) 78,665

(Repayment)/Proceeds of debt instruments - (6,000) 6,000

Issue of new shares - 105,775 (105,775)

Others (2,127) (983) (1,144)

================================================ =============== =============== ===========

Net cash generated from financing activities 4,698 44,127 (39,429)

================================================ =============== =============== ===========

Net increase/(decrease) in cash during the

year (3,876) 10,223 (14,099)

================================================ =============== =============== ===========

Net cash used in operations improved in FY23 and reduced by

GBP15.9m. Without the level of exceptional costs incurred in the

year particularly relating to legal and professional fees

surrounding the Independent Investigation, and activities to secure

the lifting of the suspension on the Company's shares, together

with significant restructuring costs, the Group would have

generated significant operating cash inflows.

ISSUE OF NEW SHARES

In FY22, in conjunction with the Company's IPO, new shares with

a total value of GBP105.8m were issued at GBP1.60 per share during

the year. The IPO also involved the repayment of borrowings

amounting to GBP82.4m. No new shares were issued in FY23.

ACQUISITION OF MEDICHEM

In July 2021, the Revolution Beauty Group was granted a call

option to acquire 100% of the issued share capital of Medichem. The

Group exercised the call option in October 2021. Total purchase

consideration of GBP27.5m comprises an initial cash consideration

of GBP7.0m which was paid in October 2021, with the balance of

GBP20.5m to be paid in 4 equal instalments from October 2022 net of

the repayment of a GBP1.5m loan from Medichem to a company owned by

the seller of Medichem. As at the date of signing the Board are in

negotiations with the previous owner of Medichem to reach a revised

agreement on the amount of consideration due and the payment terms

for any further consideration payable.

Since the year end, a deed of variation to the original sale and

purchase agreement has been signed on 7 March 2023, confirming that

no consideration will be demanded until 21 October 2025. See Note

34 for details of the deferment schedule.

DIVID

No ordinary dividends were paid during the year under review.

The Directors do not recommend payment of a final ordinary dividend

for the year (2022: GBPnil). Consistent with the guidance provided

at IPO, the Group does not envisage paying dividends in the

foreseeable future and intends to re-invest surplus funds in the

development of the Group's business.

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RESPECT OF THE

ANNUAL REPORT AND ACCOUNTS

The Directors are responsible for preparing the Annual Report

and the Group and parent Company financial statements in accordance

with applicable law and regulations.

Company law requires the Directors to prepare Group and parent

Company financial statements for each financial year. Under that

law the Directors are required to prepare the Group financial

statements in accordance with UK adopted International Accounting

Standards ('IFRSs') and have elected to prepare the parent Company

financial statements in accordance with United Kingdom Generally

Accepted Accounting Practice (United Kingdom Accounting Standards

and applicable law), including FRS 101 'Reduced Disclosure

Framework'. Under company law the Directors must not approve the

accounts unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Company and of the

profit or loss of the Group for that period.

In preparing the Group financial statements, International

Accounting Standard 1 requires that Directors:

-- properly select and apply accounting policies;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in IFRSs are insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance; and

-- make an assessment of the Group's ability to continue as a

going concern.

-- In preparing the Parent Company financial statements, the

Directors are required to:

-- select suitable accounting policies and then apply them

consistently;

-- make judgements and accounting estimates that are reasonable

and prudent;

-- state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy, at any time,

the financial position of the Company and enable them to ensure

that the financial statements comply with the Companies Act 2006.

They are also responsible for safeguarding the assets of the

Company and for taking reasonable steps for the prevention and

detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions.

Alistair McGeorge

Executive Chair

31 August 2023

Consolidated Statement of Profit or Loss and Other Comprehensive

Income

For the year ended 28 February 2023

Year ended

Year ended 28 February

28 February 2022

Note 2023 Restated

GBP'000 GBP'000

=================================================

187,842 184,579

Revenue Cost of sales 7 (111,958) (113,551)

================================================= ======== ================= ===============

Gross profit 75,884 71,028

Marketing and distribution costs (57,469) (49,546)

Administrative expenses

- General administrative expenses (42,161) (35,038)

- Impairment losses on financial assets (204) (1,428)

- Impairment of property, plant and equipment

and right-of-use assets 17,18 (2,177) (1,948)

- Impairment of goodwill and other intangibles 16 (3,388) (13,000)

- Provision for legal cases 27 (1,066) (1,018)

- IPO related costs 5 - (8,936)

================================================= ======== ================= ===============

Total administrative expenses (48,996) (61,368)

Other operating income 10 - 5

================================================= ======== ================= ===============

Operating loss 10 (30,581) (39,881)

Finance income 12 1 76

Finance costs 13 (3,294) (6,110)

================================================= ======== ================= ===============

Loss before taxation (33,874) (45,915)

Income tax credit/(expense) 14 228 1,606

================================================= ======== ================= ===============

Loss for the year (33,646) (44,309)

================================================= ======== ================= ===============

Other comprehensive income net of taxation

Exchange differences on translation of foreign

operations - may be reclassified to profit

and loss (223) 158

================================================= ======== ================= ===============

Total comprehensive loss for the year (33,869) (44,151)

================================================= ======== ================= ===============

Earnings per share (p) 15 (10.9) (15.7)

Diluted earnings per share (p) 15 (10.9) (15.7)

Adjusted EBITDA* 5 (7,475) (801)

* Adjusted EBITDA is a non-GAAP measure and is defined as

Operating Loss adjusted for depreciation and amortisation,

impairments and reversals of impairment, profits and losses on the

disposal of assets, share based charges and releases and operating

exceptional items as disclosed in note 5.

The following notes are an integral part of these financial

statements.

Consolidated Statement of Financial Position

As at 28 February 2023

As at

As at 28 February

28 February 2022

2023 Restated

Note GBP'000 GBP'000

Non-current assets

Intangible assets 16 5,728 9,837

Property, plant and equipment 17 7,928 8,215

Right-of-use assets 18 2,310 4,150

Reimbursement asset - 3,267

Total non-current assets 15,966 25,469

======================================== ====== ============= =============

Current assets

Inventories 19 47,606 44,683

Trade and other receivables 20 52,708 55,334

Reimbursement asset 4,079 -

Corporation tax recoverable - 1,384

Cash and cash equivalents 21 11,044 15,619

======================================== ====== ============= =============

Total current assets 115,437 117,020

======================================== ====== ============= =============

Current liabilities

Lease liabilities 18 (2,060) (1,915)

Trade and other payables 22 (82,707) (69,924)

Deferred consideration 24 (10,910) (4,889)

Provisions 27 (7,060) -

Borrowings 23 (31,721) (23,551)

Corporation tax payable (28) (48)

======================================== ====== ============= =============

Total current liabilities (134,486) (100,327)

======================================== ====== ============= =============

Net current assets/(liabilities) (19,049) 16,693

======================================== ====== ============= =============

Total assets less current liabilities (3,083) 42,162

======================================== ====== ============= =============

Non-current liabilities

Lease liabilities 18 (954) (2,732)

Deferred consideration 24 (9,098) (13,504)

Deferred tax liabilities 26 - -

Provisions 27 - (5,495)

======================================== ====== ============= =============

Total non-current liabilities (10,052) (21,731)

======================================== ====== ============= =============

Net assets/(liabilities) (13,135) 20,431

======================================== ====== ============= =============

Equity

Share capital 29 3,097 3,097

Share premium 103,487 103,487

Warrant reserve 7,239 7,239

Merger reserve 14,860 14,860

Translation reserve 446 669

Retained earnings (142,264) (108,921)

======================================== ====== ============= =============

Total (deficit)/ equity (13,135) 20,431

======================================== ====== ============= =============

The following notes are an integral part of these financial

statements.

Refer to Note 4 for detailed information on the correction of

prior period errors.

These financial statements were approved and authorised for

issue by the Board of Directors on 31 August 2023 and were signed

on its behalf by:

Alistair McGeorge

Director

Consolidated Statement of Changes in Equity

For the year ended 28 February 2023

Share Share Warrant Merger Translation Retained Total

capital premium reserve reserve reserve earnings equity

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

March

2021 - - - 14,860 511 (64,989) (49,618)

========

Loss for the

year -

as restated - - - - - (44,309) (44,309)

========

Other

comprehensive

income net of

taxation:

Foreign

operations

- foreign

currency

translation

differences - - - - 158 - 158

================= ======== =========== ============= ========= ========= ============= =========== ===========

Total

comprehensive

income/expense

for

the year - as

restated - - - - 158 (44,309) (44,151)

Transactions

with

owners in their

capacity

as owners:

Issue of

shares, net

of transaction

costs

of

GBP4,940,241 28 696 105,080 - - - - 105,776

Capital

reorganization 28 2,416 - - - - (2,416) -

Repurchase of

shares 28 (15) - - - - 15 -

Share-based

payments - - - - - 2,778 2,778

Issue of

warrants 29 - (1,593) 7,239 - - - 5,646

================= ======== =========== ============= ========= ========= ============= =========== ===========

Total

transactions

with owners 3,097 103,487 7,239 - - 377 114,200

================= ======== =========== ============= ========= ========= ============= =========== ===========

Balance at 28

February

2022 - as

restated 3,097 103,487 7,239 14,860 669 (108,921) 20,431

================= ======== =========== ============= ========= ========= ============= =========== ===========

Loss for the

year - - - - - (33,646) (33,646)

Other

comprehensive

income net of

taxation:

========

Foreign

operations

- foreign

currency

translation

differences - - - - (223) - (223)

================= ======== =========== ============= ========= ========= ============= =========== ===========

Total

comprehensive

income/expense

for

the year - - - - (223) (33,646) (33,869)

Transactions

with

owners in their

capacity

as owners:

Share-based

payments - - - - - 303 303

Total

transactions

with owners - - - - - 303 303

================= ======== =========== ============= ========= ========= ============= =========== ===========

Balance at 28

February

2023 3,097 103,487 7,239 14,860 446 (142,264) (13,135)

================= ======== =========== ============= ========= ========= ============= =========== ===========

The following notes are an integral part of these financial

statements.

Consolidated Statement of Cash Flows

For the year ended 28 February 2023

Year ended Year ended

28 February 28 February

2023 2022

Restated

Note GBP'000 GBP'000

Loss for the period (33,646) (44,309)

Adjustments for:

Taxation charge/(credit) 14 (228) (1,606)

Finance costs 13 3,294 6,110

Finance income 12 (1) (76)

Depreciation of property, plant and equipment

and right-of-use assets 17,18 8,369 6,310

Impairment of property, plant and equipment

and right-of-use assets 17,18 2,177 1,948

Amortisation of intangible assets 16 1,933 1,303

Impairment of intangible assets 16 3,388 13,000

Loss/(profit) on disposal of property, plant

and equipment - (34)

Loss on disposal of intangible assets 16 62 -

Equity settled share-based payment expense 303 2,778

Issue of warrants 30 - 5,645

Provisions movement 27 1,565 2,228

Movements in working capital:

Movement in inventories (2,923) (5,708)

Movement in receivables 1,814 (1,666)

Movement in payables 11,934 (3,764)

==================================================== ======= ============= =============

Cash used in operations (1,959) (17,841)

=======

Income taxes received/(paid) 1,898 (890)

==================================================== ======= ============= =============

Net cash used in operating activities (61) (18,731)

==================================================== ======= ============= =============

Cash flows from investing activities

=======

Purchase of intangible assets (1,018) (3,066)

=======

Purchase of property, plant and equipment (7,496) (4,968)

Proceeds on disposal of property, plant and - -

equipment

Finance income 1 1

Payment of financial derivatives - (510)

Purchase of subsidiaries (net of cash acquired) - (6,630)

==================================================== ======= ============= =============

Net cash generated by/(used in) investing

activities (8,513) (15,173)

==================================================== ======= ============= =============

Cash flows from financing activities

=======

Interest paid (1,175) (5,000)

=======

Proceeds from borrowings 8,000 29,000

Proceeds from issue of shares, net of transaction

costs - 105,775

Repayment of debt instruments - (6,000)

Repayment of borrowings - (78,665)

Payment of lease liabilities (1) (2,127) (534)

Loan issue fees - (449)

==================================================== ======= ============= =============

Net cash generated by financing activities 4,698 44,127

==================================================== ======= ============= =============

Consolidated Statement of Cash Flows

For the year ended 28 February 2023

Year ended Year ended

28 February 28 February

2023 2022

Note GBP'000 GBP'000

Cash and cash equivalents

===============

Net (decrease)/increase in the year (3,876) 10,223

At 1 March 15,619 5,581

Effects of exchange rate changes on cash

and cash equivalents (699) (185)

At 28 February 11,044 15,619

============================================================ ============= =============

(1) Payment of lease liabilities includes GBP115k (2022: GBP45k)

of interest payments and GBP2,012k (2022: GBP489k) of principal

lease payments.

(2) The share based payment charge for the year is GBP303k

(2022: GBP3,534k), of which GBPNil (2022: GBP756k) was paid in

cash.

The following notes are an integral part of these financial

statements.

Notes to the Consolidated Financial Statements

For the year ended 28 February 2023

1 GENERAL INFORMATION

Revolution Beauty Group plc ("the Company") is a company limited

by shares, and is registered, domiciled and incorporated in England

and Wales. The Company listed on the Alternative Investment Market

(AIM) on 19 July 2021. The address of the registered office is 201

Temple Chambers, 3-7 Temple Avenue, London, EC4Y 0DT.

The Group ("the Group") consists of Revolution Beauty Group plc

and all of its subsidiaries as listed in note 4 to the Company

financial statements.

The Group's principal activity, business activities and other

factors likely affecting the Groups performance are set out in the

Chief Executive Officers Review.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

T his consolidated financial information for the year ended 28

February 2023 comprises the Company and its subsidiaries. The

financial information presented has been prepared applying the

accounting policies and presentation applied in the preparation of

the Group's consolidated financial statements for the year ended 28

February 2023. These preliminary results do not constitute the

Group's statutory accounts for the years ended 28 February 2023 and

28 February 2022. The statutory accounts for the year ended 28

February 2022 have been reported on by the Company's auditors and

delivered to the Registrar of Companies. The statutory accounts for

the year ended 28 February 2023, which have been approved by the

Directors, will be sent to shareholders in September 2023 and

delivered to the Registrar of Companies.

The auditor has reported on the Group and Company statutory

accounts for the year ended 28 February 2023. The reports were

qualified, and included a material uncertainty related to Going

Concern and have been reproduced in notes 37 and 38 of this

announcement.

Prior period adjustments made to the amounts reported in the

Group's 2022 financial statements have been set out in note 4.

Measurement convention

The financial statements have been prepared under the historical

cost convention except for, where disclosed in the accounting

policies, certain items shown at fair value. Historical cost is

generally based on the fair value of the consideration given in

exchange for goods, services and assets.

The preparation of financial statements in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of revenues, expenses, assets and liabilities,

and the disclosure of contingent liabilities at the reporting date.

If in the future, such estimates and assumptions which are based on

management's best judgement at the reporting date, deviate from the

actual circumstances, the original estimates and assumptions will

be modified as appropriate in the year in which the circumstances

change.

Critical accounting estimates and key sources of estimation

uncertainty in applying the accounting policies are disclosed in

note 3.

Basis of consolidation

The consolidated financial statements incorporate those of

Revolution Beauty Group plc and all of its subsidiaries.

Where the company has control over an investee, it is classified

as a subsidiary. The company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

De-facto control exists in situations where the company has the

practical ability to direct the relevant activities of the investee

without holding the majority of the voting rights. In determining

whether de-facto control exists the company considers all relevant

facts and circumstances, including:

-- The size of the company's voting rights relative to both the

size and dispersion of other parties who hold voting rights

-- Substantive potential voting rights held by the company and by other parties

-- Other contractual arrangements

-- Historic patterns in voting attendance.

The consolidated financial statements present the results of the

company and its subsidiaries ("the Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

Where necessary, adjustments are made to the financial

statements of subsidiaries to bring the accounting policies used

into line with those used by other members of the Group.

Business Combinations

The cost of a business combination is the fair value at

acquisition date of the assets given, equity instruments issued,

and liabilities incurred or assumed. The excess of the cost of a

business combination over the fair value of the identifiable

assets, liabilities and contingent liabilities acquired is

recognised as goodwill. Costs directly attributable to the business

combination are expensed to the profit or loss as incurred.

Going concern Base Case Forecast

Having achieved the lifting of the suspension of the Company's

shares on AIM on 28 June 2023 and performed above the previous

budget over recent months, the Group has updated its base case

forecast for the period through to August 2024 to reflect all

aspects of its current operational structure.

Following a comprehensive review and forecast exercise prior to

the lifting of the share suspension on AIM, the updated base case

forecast to August 2024 has evolved with the current FY24

performance to date, whilst largely consistent with expectations

earlier in the year upon release of the FY22 Financial Statements.

The current Board shares the more prudent outlook taken by the

previous Board in May 2023, whilst also planning for growth in

revenue and profitability. Immediately following the release of

these Financial Statements the Board intends to appoint a new CEO,

who will have time to develop and deliver a strategy intended to

grow from the current base, this process is not expected to result

in any significant change to plans or forecasts in the short

term.

Management have determined that the period to August 2024 is the

relevant period over which to consider the Groups performance for

the assessment of going concern and have therefore forecast

operational and financial performance over that period. Twelve

months has been selected as the going concern period because

forecasting over this period is the most accurate, the further out

the forecast is the greater likelihood of volatility. The five

months to 31 July 2023 have shown sales performing ahead of budget.

The updated base case to August 2024 forecasts that the Group will

generate cash as it builds sustainable growth from a solid core

business, growth is expected to be achieved through current sales

channels and some increased distribution, underpinned by marketing

and capital investment as set out in the Group's strategy.

In addition to sustainable growth in sales, the base case

forecasts that the management team's strategy will drive

improvements in working capital, with inventory and receivables

managed in line with trading volumes. Existing trading terms with

supplier and customers are forecast to be maintained under the base

case.

Cost reduction measures taken during FY23 have been adhered to

and the Group has demonstrated during the early months of FY24 that

it now has a more appropriate cost base from which it can achieve

its forecast revenue. The significant accounting changes made in

the prior year remain and form the basis of the Groups reporting

and forecast model.

The Groups gross inventory balance has reduced significantly,

resulting in a significant reduction in its inventory provision

since FY22. Inventory reductions have been driven by a more

rationalised purchasing program, which is more targeted to the

Group's demand forecast. In addition, significant amounts of older

inventory has been sold through the Groups outlet channels or

destroyed where no longer considered to be of any value.

Under the base case scenario, the lowest amount of headroom

against the minimum liquidity covenant is GBP4,632k in December

2023, the lowest test point in the EBITDA covenant is August 2023,

when there is GBP3,211k of headroom.

Lending Arrangements

On 30 March 2023 the Group announced that that it had secured an

amended facility agreement with its banking partners (the

"Lenders"). The amendment includes a waiver of breaches of the

terms of the original agreement. As part of the amended facility

agreement which runs through to October 2024, the overall size of

the facility was agreed at GBP32m, reduced from GBP40m, and is

fully drawn. The Directors are of the view that the reduced

facility provides the business with sufficient liquidity as it

continues delivering its strategy for the Going Concern period. The

facility matures in October 2024, it is the board's intention and

expectation that the facility will be refinanced during

FY24.Indeed, following the lifting of the share suspension, initial

discussions with the Group's banking partners have started

positively. The Group continues to enjoy the support of its banking

partners, management believe that recent progress in stabilising

net debt, generating cash, ensuring covenant compliance and

rationalising the cost base have positioned the Group well for

refinancing its debt facilities, and is confident of refinancing

beyond October 2024.

Revised covenants remain in place and include a minimum

liquidity threshold of GBP5.0 million and an Adjusted EBITDA

covenant. Certain non-financial covenants that applied following

the amendments of the agreement were complied with and are no

longer in place.

Adjusted EBITDA covenant is tested quarterly and the minimum

liquidity threshold is tested weekly.

The remaining non-financial covenants include a condition that

would result in an Event of Default occurring where the auditors

qualify the annual consolidated financial statements. The lenders

have provided a waiver in respect of the covenant relating to the

Auditors qualifications in their audit report for these financial

statements as was indicated in the FY22 financial statements.

The forecast results under the base case indicate that the Group

will remain in compliance with financial covenants throughout the

going concern period.

On 7 March 2023 the Group announced that it had reached an

agreement in respect of the timing of payments of deferred

consideration for its acquisition of Medichem Manufacturing

Limited. A Deed of Variation dated 6 March 2023 was signed which

amends the terms of the deferred consideration and completion net

asset adjustment, adjusting the timing of the payment, all of which

are now payable beyond the Going Concern assessment period.

Downside Scenarios

In addition to the base case scenario, the Group has considered

the potential impact of a severe but plausible downside scenario.

Under the severe but plausible scenario, a 10% reduction in total

sales from August 2023, driven by consumer demand in the beauty

market caused by wider economic factors has been modelled. Under

such circumstances the Group would need to take action to reduce

costs, which would include, but not be limited to, reducing capital

expenditure, marketing and general overheads including people

costs.

In such a scenario, if mitigating actions were taken, the Group

would remain in compliance with its covenants throughout the

forecast period. However, the sensitivity of the Adjusted EBITDA

performance under such circumstances suggests that there is a

realistic possibility that a prolonged reduction in sales of 10%

could result in the Group breaching its Adjusted EBITDA covenant.

Were the Group exposed to a similar scenario and no mitigating

actions taken, the Adjusted EBITDA covenant would be breached in

February 2024.

Under a scenario in which the Groups revenue reduced to 10%

below the forecast levels in the base case from September 2023

onward and no mitigating actions were taken, the Group would breach

its minimum liquidity threshold in February 2024. The Directors are

confident that under such a scenario, there would be sufficient

time for them to take actions within their control over the cost

base to prevent a breach occurring.

If the Group were to breach either of its covenants, it would be

reliant on the support of its lenders in order to be able to

continue to operate. The Group enjoys a good relationship with its

banking partners and is confident of their continued support. The

Group would have sufficient cash to continue operating under all

plausible scenarios modelled.

Conclusion

The Directors are pleased with the current performance of the

business particularly given the challenging economic outlook and

the disruption faced by the business in FY22 and FY23. Net sales

have increased since the balance sheet date, which reflects the

continued strength of the brand.

Steps taken with regard to the deferral and renegotiation of the

Medichem consideration and the amendment of the Groups lending

arrangements and reductions to the cost base are significant in

strengthening liquidity and providing a base from which to

grow.

Having considered the information available and recent changes

to the business, the Directors are satisfied that the base case

supports the application of the going concern assumption in

preparation of the financial statements.

However, the Directors also recognise the continuing challenges

the business has faced since its shares resumed trading on AIM,

including addressing legacy issues, as well as the underperformance

of sales versus previous expectations, as well as the uncertainty

in the wider economy. As noted above, the Directors have reset the

strategy with reductions in forecast expenditure and improvements

to the working capital cycle considered to be commensurate with the

level of revenues forecast. The current Board continue to believe

in this strategy and look to enhance the business further so that

it is well place to grow to deliver its full potential.

The Directors are confident that the adopted strategy and

actions taken to address the cost base and working capital cycle

can be successfully executed. In the event that revenue falls below

the level forecast in the base case scenario, the Directors are

also confident that they are able to take mitigating actions within

their control to reduce costs further on a timely basis, in order

to maintain compliance with the Adjusted EBITDA and minimum

liquidity covenant tests.

The Directors acknowledge that, in the event either a financial

or non-financial covenant were to be breached, due to either a

downturn in operational activity or the impact or timing of

settlement of any financial commitments, known or otherwise,

arising from legacy issues, the Group would be reliant on its

lenders not requiring immediate repayment of the outstanding loan

or obtaining alternative finance in order to continue to operate as

a going concern. The lenders have provided a waiver in respect of

the covenant relating to the Auditors qualifications of their audit

report on these financial statements. Notwithstanding that the

audit for the year ending 28 February 2024 had not yet commenced,

the Directors anticipate that certain qualifications will be

carried into the Auditors opinion on the FY24 financial statements.

The Lenders have also confirmed their present intention to waive

any further Event of Default which might occur as a result of the

audit report to be issued by the Parent's Auditor in respect of the

financial year of the Group ending 28 February 2024 containing

qualifications which are substantially the same as qualifications

on these financial statements.

These factors, in conjunction with the sensitivity identified in

the severe but plausible downside scenario with respect to the

Adjusted EBITDA covenant, represent material uncertainty which may

cast significant doubt over the Group's ability to continue to

operate as a going concern. The financial statements do not include

the adjustments that would be required should the going concern

basis of preparation no longer be appropriate.

New and revised standards in issue but not yet effective

The following standards and interpretations relevant to the

Group are in issue but are not yet effective and have not been

applied in the preparation of the financial statements.

Standard/amendment Effective

date

Amendments to IAS 1 - Classification of liabilities as 1 January

current or non-current 2023

Amendments to IAS 1 - Disclosure of accounting policies 1 January

2023

Amendments to IAS 8 - Definition of accounting estimates 1 January

2023

Amendments to IAS 12 - Deferred tax related to assets 1 January

and liabilities arising from a single transaction 2023

The above standards are not expected to impact the Group

materially.

Revenue recognition

Revenue represents invoiced sale of goods to customers net of

sales tax. Revenue is recognised when control of a good is

transferred to the customer, which is when the Group's performance

obligations are considered to have been met in line with its

contracts and is adjusted for returns and provisions for expected

returns, discounts, rebates and refunds.

Estimation is required in assessing concessions provided to the

customer such as refunds and returns. Such estimates are determined

using either the 'expected value' or 'most likely amount' method,

which are determined by assessing historic concessions made to

customers for refunds and returns. Provisions for refunds and

returns are recognised within trade and other payables. Returns are

an area of significant judgement, as set out below.

The Group sells its products via their own website and to third

party online retailers ("digital") and wholesale sales to retailers

and distributors ("store groups").

Digital

Revenue from the sale of goods sold through the Groups website

is recognised when the product is delivered to the customer.

Payment of the transaction price is due immediately when the

customer purchases the products. The Group's policy is to offer a

right of return if notified within a specified time period. The

Group therefore retains an insignificant risk of ownership through

a digital sale when a refund is offered or when return goods are

accepted if a customer is not satisfied. Revenue in such cases is

recognised at the point of delivery to the customer provided the

Group can reliably estimate future returns and the Group recognises

a liability for returns against revenue based on previous

accumulated experience and other factors.

Loyalty scheme

The Group operates a loyalty card scheme for 'digital' customers

where points are earned for products purchased online. The Group

accounts for loyalty points as a separately identifiable component

of the sales transaction in which they are granted. Deferred

revenue is recognised in relation to points issued but not yet

redeemed. Deferred revenue is subsequently recognised when the

loyalty points are redeemed or when they expire.

A portion of the transaction price is allocated to the loyalty

scheme points based on relative stand-alone selling price of the