TIDMREVB

RNS Number : 3021T

Revolution Beauty Group PLC

14 November 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

REVOLUTION BEAUTY GROUP PLC

("Revolution Beauty", the "Group" or the "Company")

INTERIM RESULTS FOR THE SIX MONTHSED 31 AUGUST 2023

H1 24 revenue up 20%, driven by volume growth across all regions

and softer prior year comparatives.

Strong improvement in EBITDA, up GBP14.3m, due to higher sales

volumes, gross margins and cost reduction initiatives.

New CEO, CMO and COO appointed, bringing considerable industry

experience.

Upgrade to FY24 full year EBITDA guidance.

Revolution Beauty Group plc (AIM: REVB), the multi-channel mass

beauty innovator, today announces its unaudited Half Year Results

for the six months ended 31 August 2023 ('H1 24').

Financial Highlights

Group results

(Unaudited) H1 24 H1 23 Change Change

GBP'M GBP'M GBP'M %

Revenue 90.4 75.3 15.1 20%

-------- -------- --------- ---------

Gross Profit 44.7 31.2 13.5 43%

-------- -------- --------- ---------

Gross Margin 49.4% 41.4% 8.0pt 19%

-------- -------- --------- ---------

Adjusted EBITDA* 6 .4 (7.9) 14.3 181%

-------- -------- --------- ---------

Adjusted EBITDA

% 7.1% (10.5%) 17.6% n/a

-------- -------- --------- ---------

Operating (Loss) (0.5) (12.5) 12.0 96%

-------- -------- --------- ---------

Profit/(Loss)

before tax 0.4 (13.7) 14.1 n/a

-------- -------- --------- ---------

Gross inventory 58.6 97.5 (38.9) (40%)

-------- -------- --------- ---------

Cash 8.0 11.8 (3.8) (32%)

-------- -------- --------- ---------

Net (debt) (23.8) (15.9) (7.9) (50%)

-------- -------- --------- ---------

*Adjusted EBITDA is an alternative performance measure used by

management to gauge the underlying performance of the business,

adjusting for certain non-cash, non-recurring and normalising items

that are not considered to form part of underlying performance

(note 8).

-- Group revenue increased by 20% driven by growth across all

regions and softer H1 23 comparatives.

-- Gross margin improved to 49%, with significant improvement in

freight rates, improving stock control and more focused New Product

Development ('NPD').

-- Adjusted EBITDA of GBP6.4m, increased by GBP14.3m due to

sales performance, improved gross margin and cost control.

-- Operating loss decreased to GBP0.5m (H1 23: GBP12.5m loss),

due to improved performance and a lower level of exceptional

costs.

o GBP2.3m gain on the revaluation of deferred consideration

relating to the acquisition of Medichem in October 2021. The

amendment to the terms of the payment of the deferred consideration

was announced on 7 March 2023 (see note 6).

-- Gross inventory reduced by GBP38.9m due to improved controls

over product assortment, alongside a discontinued stock clearance

programme.

-- As at 10 November 2023, cash balances were GBP12.3m, with net debt of GBP19.7m.

o Cash outflow from operations in H123 was GBP0.4m, including

GBP4.2m of exceptional legal and professional costs and GBP8.2m of

payments principally relating to legacy supplier debts.

o Net bank debt was GBP23.5m at the end of H1 23, with GBP32.0m

drawn on the RCF and GBP8.0m of cash.

o Significant headroom on covenants remains.

Operational Highlights

-- Strengthened and refreshed Board and management team.

o Lauren Brindley appointed Group Chief Executive Officer,

bringing significant leadership expertise across retail, beauty,

and brands.

o Alison Hollingsworth appointed Chief Marketing Officer,

bringing beauty brand development and marketing expertise.

o Steve Vanoli appointed Chief Operating Officer, bringing

merchandising and operational experience in the retail sector.

o After engagement with major shareholders, four new

Non-Executive Directors have been appointed, bringing relevant and

complementary experience to the Board.

-- Increased number of doors worldwide through new retail relationships, expansion of existing relationships and entry into new territories.

o US store revenue grew 8% due to a new partnership with

Walmart.

o UK stores revenue grew 13% with strong performances across

Boots and Superdrug.

o Rest of the world stores revenue up 58%, with growth primarily

due to weak H1 23 comparative revenue in Germany and Turkey.

o Distributer revenue grew 65% primarily due to weak prior year

comparatives related to overstocking, and new distribution in

Middle East.

o Digital wholesale revenue grew 12% reflecting recovery from

previous overstocking issues in H1 23. Own web sales declined 18%

following strategic reallocation of marketing investment.

-- Total D2C contactable database increased 16% year-on-year to

1.98 million; total customer base increased 3%, with returning

customers increasing by 6%.

-- The Group continued to focus on its distinctive social media

presence and successfully leveraged its existing Revolution branded

channels, delivering global social channel follower growth of 6%

year on year with an increase in engagement rate across all

cosmetics channels of 27% year on year.

Outlook

-- The strength of the Revolution brand and the beauty markets

in which we operate underpins our global growth ambitions.

-- The Group has sufficient cash resources and covenant headroom

to finance its current organic growth plans.

-- Revolution Beauty has made a good start to the second half of

FY 24, with revenue and adjusted EBITDA in line with internal

forecasts.

-- While the crucial Christmas trading period is still to come,

the Group is upgrading its guidance for the full year and now

expects adjusted EBITDA to be not less than double-digit millions

for FY 24 (an increase from the previously guided high single digit

millions). The Group continues to expect revenue growth to be in

the high single digits in FY 24.

-- New CEO to present three-year strategic plan for the Group at

a capital markets event early in the new year.

Lauren Brindley, Group Chief Executive Officer, said:

"Since joining Revolution Beauty, I have seen first-hand the

strength of the Revolution brand, the brilliance of my colleagues

and the enduring relevance of our product offer. It is these

aspects which have supported the business over the past 18 months,

and which I am confident will unlock future opportunities.

"With improved internal controls and the right leadership in

place with clearer roles and responsibilities, momentum has built

across the business in the first half of the year. Our strengthened

financial performance and the return to positive EBITDA represents

a significant milestone in the next phase of this business, while

new retail partnerships in the US and strengthened retail

partnerships elsewhere around the world are representative of our

operational progress.

"Looking ahead, I believe there are significant and compelling

opportunities for Revolution Beauty within a large and attractive

market. While there is still lots to do, we are on the right

trajectory, and I am developing a strategic plan with our new

executive leadership team to ensure we are best-placed to deliver

future growth. I look forward to sharing this vision and more

detail on our plans early in the new year."

Presentation

A recorded management presentation from Lauren Brindley, CEO and

Elizabeth Lake, CFO is available here:

https://stream.brrmedia.co.uk/broadcast/65524fd57cc5473d88694591

For further information please contact:

Investor Relations Investor.Relations@revolutionbeautyplc.com

Lauren Brindley, CEO

Elizabeth Lake, CFO

Joint Corporate Brokers

Zeus (NOMAD): Nick Cowles /Jamie Tel: +44 (0) 161 831 1512

Peel /Jordan Warburton Tel: +44 (0) 203 100 2222

Liberum: Dru Danford / Edward

Thomas / John More / Miquela

Bezuidenhoudt

Media enquiries Tel: +44 (0)20 3805 4822

Headland Consultancy Revolutionbeauty@headlandconsultancy.com

Matt Denham / Will Smith / Antonia

Pollock

About Revolution Beauty

Revolution Beauty is a global mass beauty and personal care

business which operates a multi brand, multi category strategy and

sells its products both direct-to-consumer (DTC) via its e-commerce

operations, and in physical and digital retailers through wholesale

relationships.

Today, the Group has a retail footprint of c.17,500 doors across

leading retail chains in the UK, USA and other international

markets. Revolution Beauty has access to a wide customer base,

predominantly aged between 16 and 35, through its digital partners

and own DTC platform. It has established and invested to streamline

its supply chain with its own manufacturing facility in the UK, and

third-party warehousing facilities across the UK, USA and

Australia. The Group has offices in the UK, USA, New Zealand and

Germany. Revolution Beauty currently employs 411 people.

The total mass beauty market was worth $218bn in 2022 and is

expected to grow to $255bn over the next 3 years ( source:

Euromonitor ). Revolution Beauty has been a leading innovator

building a significant global following across social channels,

enabling it to spot trends and respond quickly to consumer demand,

and translating this to mass market beauty retail.

Chief Executive Officer's Review

This review follows the very recent publication of our FY 23

Annual Report and Accounts on 31 August 2023, and the period under

review in this report, H1 24, was before the start of my tenure at

Revolution Beauty. However, I am pleased with the financial

performance and the operational progress that these results

demonstrate. These are figures which underline the resilience and

attractiveness of the Revolution brand during a period of

well-publicised upheaval for the Group. In addition, the progress

achieved during the period represents a step-forward for the Group,

strengthening our position as we look towards sustainable future

growth.

Since joining the Group in September 2023, I have been impressed

by the strength of the brand, the engagement we enjoy with our

global customer base, the quality of our retail partner

relationships, the pipeline of new product and the passion of our

employees.

During my time with the Group, I have been getting to know the

business across all the markets in which we operate and focused on

developing a growth strategy, which will be anchored in a

three-year plan. This is being created in tandem with the wider

leadership team and we will provide more detail on this in early

2024.

It is clear there are significant opportunities for growth and

for operating excellence across Revolution Beauty, but there is

work to be done. We have already taken action to ensure that we can

begin to deliver on our potential. This has included: optimising

our brand and product portfolio, with a clearer focus on our core

products and a reduction in ongoing replenishable SKU count by

c.50%; putting in place a more effective operating model, under a

new Chief Operating Officer, and taking steps to improve our global

supply chain; refreshing the Executive Team, so that we have the

right leadership team in place with clearer roles and

responsibilities; and evaluating cost saving initiatives which will

help to increase profitability and cash generation.

While the crucial Christmas trading period is still to come, the

Group is upgrading its guidance for the full year and now expects

adjusted EBITDA to be not less than double-digit millions for FY 24

(an increase from the previously guided high single digit

millions). The Group continues to expect revenue growth to be in

the high single digits in FY 24.

As we look further ahead, we will provide a comprehensive update

on the future opportunities we see for Revolution Beauty to all our

stakeholders in early 2024.

Financial Review

As previously announced the Directors have determined that a

provision which was previously disclosed as a contingent liability

should have been recognised as a provision during the period ended

31 August 2022. The impact of the correction is set out in note

3.

Revenue

Revenue for H1 24 was GBP90.4m, up 20% on H1 23. This growth

rate is ahead of the global beauty market and is driven by strong

performances in retail globally and the distributer revenue

channel. Year on year growth in H2 24 is expected to be lower due

to stronger prior year comparatives in H2 23.

Global store group revenue contributed just over half of the

growth, with UK store revenue increasing 12% year-on-year through

strong sales to Superdrug and Boots, and US store group performance

benefitting from new distribution in Walmart.

The growth in distributer revenue accounted for just under half

of overall Group revenue growth in the period. This was achieved

through extended distribution in the Middle East coupled with

stronger performances across a number of distributer customers

where the prior year comparisons were particularly weak.

International store groups also performed strongly contributing

c.25% of the growth, with Turkey and Germany performing

particularly well following overstocking in H1 2023.

Digital wholesale revenue grew 12% reflecting recovery from

previous overstocking issues in H1 23. Own web sales declined 18%

following strategic reallocation of marketing investment.

Gross Margin

Gross margin in the period was 49.4%, significantly ahead of the

41.4% achieved in H1 23.

Approximately half of this increase is due to the reduction in

freight rates which has reduced landed costs significantly. Freight

rates are now back to pre-pandemic levels.

The gross margin further improved as a result of changes in the

value of the stock provision. Approximately 2 percentage points of

this improvement is attributable to a more focused approach to new

product development, designed to improve quality, relevance, and

customer satisfaction as well as stock management and

profitability. A further 1 percentage point is due to achieving a

selling price above the provisioned cost of slow moving and

obsolete stock.

Due to the timing of stock flows in and out of the Group it is

anticipated that some of the gains resulting from the release of

stock provision will reverse in H2 24 and have a lower positive

impact on margin by year end. At the same time the Group remains

focussed on clearing old stock and improving buying patterns. Going

forward, it is anticipated that margin increases will be driven by

price and product mix.

Adjusted EBITDA and Operating Loss

The adjusted EBITDA for the period was GBP6.4m (H1 23 EBITDA

loss GBP7.9m), an improvement of GBP14.3m.

The increase is due to revenue and margin growth, coupled with

reductions in year-on-year marketing costs, particularly in stand

updates, and improvements in direct costs associated with

distribution.

Operating loss was GBP0.5m, against a loss of GBP12.5m in H1 23.

There were material exceptional restructuring and legal and

professional costs in the statement of comprehensive income

(c.GBP2.8m, see note 8). In addition, there was an increase in

share-based payment charges as a result of the grant of relisting

awards as announced on 28 June with the Group's readmission to

AIM.

Reported profit after tax was GBP0.3m against a loss of GBP13.8m

in H1 23. The finance income arises primarily from the revaluation

of the deferred consideration due from the acquisition of Medichem,

following the Deed of Variation signed on 6 March 2023 amending the

timing of the payments. This resulted in a financial gain which is

reported in finance income.

Cash

We ended the period with a cash balance of GBP8.0m and gross

borrowing amounted to GBP32.0m.

Whilst there was an operating cash outflow of GBP0.4m in the

period, the Group has paid material legal and professional

exceptional costs (c.GBP4.2m) and has paid down material amounts of

legacy stock supplier debts (c.GBP8.2m). A payment plan has been

agreed with these stock suppliers to ensure the situation is not

repeated in the future. Going forward the level of exceptional

costs is expected to materially reduce, and the outflow in working

capital is also expected to reduce as a result of actions that have

been taken to control stock management and cash collection.

The Group has sufficient cash resources and covenant headroom to

finance its current organic growth plans.

Regulator action

The Company informed shareholders on 21 July 2023 that the

Financial Conduct Authority had notified Revolution Beauty that it

had commenced an investigation into potential breaches of the

Market Abuse Regulation (EU) 596/2014 (as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018)

in relation to certain matters in the period from July 2021 to

September 2022. Revolution Beauty continues to cooperate fully with

the FCA and will provide updates as necessary.

REVOLUTION BEAUTY GROUP PLC

CONSOLIDATED CONDENSED STATEMENT OF COMPREHENSIVE INCOME

FOR THE HALF-YEARED 31 AUGUST 2023

6 months 6 months Year ended

Note ended 31 ended 31 28 February

August 2023 August 2023

2022 As

restated

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Revenue 5 90,399 75,273 187,842

Cost of sales (45,733) (44,088) (111,958)

Gross profit 44,666 31,185 75,884

Marketing and distribution

costs (22,845) (26,964) (57,469)

Administrative expenses

- General administrative

expenses (22,349) (16,682) (42,161)

- Impairment losses

on financial assets - - (204)

- Impairment of property,

plant and equipment - - (2,177)

- Impairment of goodwill - - (3,388)

- Provision for legal

cases - - (1,066)

Total administrative

expenses (22,349) (16,682) (48,996)

Operating loss (528) (12,461) (30,581)

Finance income 6 2,358 - 1

Finance costs (1,464) (1,192) (3,294)

Profit/(Loss) before

taxation 366 (13,653) (33,874)

Income tax credit/(expense) (21) (111) 228

Profit/(Loss) for the

year/period 345 (13,764) (33,646)

Other comprehensive

expense

for the period, net

of tax

Exchange differences 829 (1,433) (223)

Total comprehensive

income/(loss) for the

period 1,174 (15,197) (33,869)

Earnings per share (p) 7 0.0 (4.4) (10.9)

Diluted earnings per

share (p) 7 0.0 (4.4) (10.9)

Adjusted EBITDA 8 6,438 (7,867) (7,475)

The total comprehensive loss for the period is entirely

attributable to the owners of the parent company.

The above consolidated statement of comprehensive income should

be read in conjunction with the accompanying notes.

Refer to Note 3 for detailed information on the correction of

prior period errors.

REVOLUTION BEAUTY GROUP PLC (Company Number: 11666025)

CONSOLIDATED CONDENSED STATEMENT OF FINANCIAL POSITION

AS AT 31 AUGUST 2023

31 August 31 August 28 February

Notes 2023 2022 2023

As restated

Unaudited Unaudited

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 5,116 9,956 5,728

Property, plant and equipment 7,399 8,945 7,928

Right-of-use assets 1,501 3,602 2,310

Reimbursement asset 3 - 3,586 -

14,016 26,089 15,966

Current assets

Inventories 10 42,320 55,200 47,606

Trade and other receivables 11 43,370 53,144 52,708

Corporation Tax Receivable 340 - -

Reimbursement asset 3 4,079 - 4,079

Cash and cash equivalents 8,006 11,754 11,044

Total current assets 98,115 120,098 115,437

Current liabilities

Lease liabilities (1,204) (2,046) (2,060)

Trade and other payables 12 (65,889) (83,062) (82,707)

Deferred consideration 6 - (5,083) (10,910)

Provisions 3 (6,815) - (7,060)

Borrowings 9 (31,807) (27,637) (31,721)

Corporation tax payable - (311) (28)

Total current liabilities (105,715) (118,139) (134,486)

Net current assets (7,600) 1,959 (19,049)

Total assets less current

liabilities 6,416 28,048 (3,083)

Non-current liabilities

Lease liabilities (708) (1,974) (954)

Deferred consideration 6 (16,137) (13,778) (9,098)

Deferred tax liabilities 91 (28) `-

Provisions 3 - (6,151) -

Total non-current liabilities (16,754) (21,931) (10,052)

Net assets (10,338) 6,117 (13,135)

Equity

Share capital 3,183 3,097 3,097

Share premium 103,487 103,487 103,487

Warrant reserve 7,239 7,239 7,239

Merger reserve 14,860 14,860 14,860

Translation reserve 1,275 (764) 446

Retained earnings (140,382) (121,802) (142,264)

Total equity (10,338) 6,117 (13,135)

Refer to Note 3 for detailed information on the correction of

prior period errors.

REVOLUTION BEAUTY GROUP PLC

CONSOLIDATED CONDENSED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEARED 31 AUGUST 2023

Share Share Warrant Merger Translation Retained Total

capital Premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 March 2022 - as restated 3,097 103,487 7,239 14,860 669 (108,921) 20,431

Loss for the period - as restated - - - - - (13,764) (13,764)

Other comprehensive income net of

taxation:

Foreign operations - foreign currency

translation

differences - - - - (1,433) - (1,433)

Total comprehensive loss for the period - - - - (1,433) (13,764) (15,197)

Transactions with owners in their

capacity as owners:

Share-based payments - - - - - 883 883

Total transactions with owners - - - - - 883 883

Balance at 31 August 2022 - as restated 3,097 103,487 7,239 14,860 (764) (121,802) 6,117

Refer to Note 3 for detailed information on the correction of

prior period errors.

REVOLUTION BEAUTY GROUP PLC

CONSOLIDATED CONDENSED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEARED 31 AUGUST 2023

Share Share Warrant Merger Translation Retained Total

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 March 2023 3,097 103,487 7,239 14,860 446 (142,264) (13,135)

Profit for the period - - - - - 345 345

Other comprehensive expense net of

taxation:

Foreign operations - foreign currency

translation

differences - - - - 829 - 829

Total comprehensive loss for the period - - - - 829 345 1,174

Transactions with owners in their

capacity

as owners:

Issue of shares, net of transaction

costs 86 - - - - - 86

Share-based payments - - - - - 1,537 1,537

Total transactions with owners 86 - - - - 1,537 1,623

Balance at 31 August 2023 3,183 103,487 7,239 14,860 1,275 (140,382) (10,338)

The above consolidated statement of changes in equity should be

read in conjunction with the accompanying notes

REVOLUTION BEAUTY GROUP PLC

CONSOLIDATED CONDENSED STATEMENT OF CASH FLOWS

FOR THE HALF-YEARED 31 AUGUST 2023

6 months 6 months Year ended

ended 31 ended 31 28 February

August 2023 August 2023

2022

As restated

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Loss for the financial period 345 (13,764) (33,646)

Adjustments for:

Taxation 21 111 (228)

Finance costs 1,464 1,192 3,294

Finance income (2,358) - (1)

Depreciation of property, plant and

equipment 2,100 2,638 8,369

Impairment of property, plant and

equipment - - 2,177

Amortisation of intangible assets 462 787 1,933

Impairment of intangible assets - - 3,388

Loss/(profit) on disposal of property,

plant and equipment 5 197 62

Equity settled share-based payment

expense 1,537 884 303

Provisions movement (245) 336 1,565

Movements in working capital:

Movement in inventories 5,285 (10,517) (2,923)

Movement in receivables 9,339 1,638 1,814

Movement in payables (18,346) 12,060 11,934

Cash used in operating activities (391) (4,438) (1,959)

Income tax refunded/(paid) (516) 1,564 1,898

Net cash used in operating activities (907) (2,874) (61)

Cash flows from investing activities

Purchase of intangible assets (128) (449) (1,018)

Purchase of property, plant and equipment (896) (2,767) (7,496)

Finance income - - 1

Net cash used in investing activities (1,024) (3,216) (8,513)

Cash flows from financing activities

Interest paid (1,199) (873) (1,175)

Proceeds from borrowings - 4,000 8,000

Payment of lease liabilities (1,102) (1,066) (2,127)

Net cash generated from financing

activities (2,301) 2,061 4,698

Cash and cash equivalents

Net (decrease) in the period (4,232) (4,029) (3,876)

Cash and cash equivalents at the

beginning of the period 11,044 15,619 15,619

Effects of exchange rate changes 1,194 164 (699)

Cash and cash equivalents at the

end of the period 8,006 11,754 11,044

REVOLUTION BEAUTY GROUP PLC

NOTES TO THE CONSOLIDATED CONDENSED INTERIM FINANCIAL

STATEMENTS

FOR THE HALF-YEARED 31 AUGUST 2023

1. General information

Revolution Beauty Group Plc ("the Company") is a company limited

by shares and is registered and incorporated in England and Wales.

The registered office is 201 Temple Chambers, 3-7 Temple Avenue,

London EC4Y 0DT.

The group ("the Group") consists of Revolution Beauty Group Plc

and all of its subsidiaries.

The Board of Directors approved this unaudited interim financial

information on 13 November 2023.

2. Significant accounting policies

These consolidated condensed financial statements for the

interim half-year reporting period ended 31 August 2023 have been

prepared in accordance with IAS 34 'Interim Financial Reporting'.

These interim financial statements do not constitute full financial

statements and do not include all the notes of the type normally

included in annual financial statements. Accordingly, these

financial statements are to be read in conjunction with the annual

report for the year ended 28 February 2023. The FY 23 numbers

included in this report are not statutory accounts for that year

(but have been derived from the statutory accounts). The FY 23

statutory accounts contain a qualified audit report which can be

found on the Group's website

https://revolutionbeautyplc.com/results-and-reports/ .

The annual financial statements of the Group are prepared in

accordance with UK-adopted International Accounting Standards

("IFRSs"). The Group has applied the same accounting policies and

methods of computation in its interim consolidated financial

statements as in its 28 February 2023 annual financial statements.

There are no new and amended standards and/or interpretations that

will apply for the first time in the next annual financial

statements that are expected to have a material impact on the

Group.

Tax charged within the 6 months ended 31 August 2023 has been

calculated by applying the effective rate of tax which is expected

to apply to the Group for the year ending 28 February 2024 as

required by IAS 34.

The financial statements have been prepared on the historical

cost basis except for, where disclosed in the accounting policies,

certain financial instruments that are measured at fair value. The

financial statements are prepared in Sterling, which is the

functional currency and presentational currency of the parent

Company and primary operating subsidiary. Monetary amounts in these

financial statements are rounded to the nearest GBP1,000.

Going concern

As reported in note 2 of the FY 23 Annual Report and Accounts,

the Directors have completed a full assessment of forecast and

banking arrangements to consider going concern.

The Group's revenue growth, margin improvement and return to

positive adjusted EBITDA in H1 all represent key improvement in the

Group's financial stability since the previous assessment. Steps

taken with regard to the deferral and renegotiation of the Medichem

consideration and the amendment of the Group's lending arrangements

and reductions in payables are significant in strengthening

liquidity and providing a base from which to grow.

Having considered the information available and recent changes

to the business, the directors are satisfied that the base case

supports the application of the going concern assumption in

preparation of the financial statements.

However, the directors also recognise the challenges the

business has faced since its listing on AIM and the

underperformance of sales versus previous expectations, as well as

the uncertainty in the wider economy. The strength of the Group's

brand and recent reductions in expenditure and a more refined stock

purchasing process have enable continued growth through a

challenging period. The Directors are working to build on this

period of stabilisation with a renewed strategy that keeps the

Group on a stable financial footing on a long term basis.

In the event that revenue falls below the level forecast in the

base case scenario, the Directors are also confident that they are

able to take mitigating actions to reduce controllable costs

further on a timely basis, in order to maintain compliance with the

Adjusted EBITDA and minimum liquidity covenant tests.

The Directors acknowledge that, in the event either a financial

or non-financial covenant were to be breached, due to either a

downturn in operational activity or the impact or timing of

settlement of any financial commitments, known or otherwise,

arising from legacy issues, the Group would be reliant on its

lenders not requiring immediate repayment of the outstanding loan

or obtaining alternative finance in order to continue to operate as

a going concern. The lenders have provided a waiver in respect of

the covenant relating to the Auditors qualifications of their audit

report on the FY 23 financial statements. Notwithstanding that the

audit for the year ending 28 February 2024 has not yet commenced,

the Directors anticipate that certain qualifications will be

carried into the Auditors opinion on the FY2 4 financial

statements. The Lenders have also confirmed their present intention

to waive any further Event of Default which might occur as a result

of the audit report to be issued by the Parent's Auditor in respect

of the financial year of the Group ending 28 February 2024

containing qualifications which are substantially the same as

qualifications on these financial statements.

The Group's Revolving Credit Facility matures in October 2024.

The Group is currently in discussion with its banking partners to

extend the facility on terms consistent with the existing agreement

for a period of 12 months beyond the current maturity. The board is

confident that the discussion will result in an extension of the

facility. Whilst the board has confidence in the process and

lenders remain supportive, there is uncertainty in the extension of

the current facility until a further agreement is signed. Were an

agreement for an extension not to be reached the Group would need

to find additional financing upon maturity of the RCF, the board is

confident that this would be achievable.

These factors, in conjunction with the sensitivity identified in

the severe but plausible downside scenario with respect to the

recently agreed Adjusted EBITDA covenant, represent material

uncertainty which may cast significant doubt over the Group's

ability to continue to operate as a going concern. The financial

statements do not include the adjustments that would be required

should the going concern basis of preparation no longer be

appropriate.

3. Correction of prior period errors

The Directors have determined that a provision which was

previously disclosed as a contingent liability should have been

recognised as a provision during the period ended 31 August 2022 as

the process of reaching a settlement of the case had reached a

stage whereby it had been established that a material settlement

was likely, and a value could have been accurately estimated.

The Group has posted or reposted social media video clips which

contain sound recordings and musical compositions from the music

library of the relevant social media platform. A letter was

received in Autumn 2020 from two music owners, claiming copyright

infringement. Letters raising such allegations are common in other

business sectors involved in social media. The Group, funded by its

insurers, is robustly defending the allegations and, taking a

cautious approach, has sought to remove any allegedly offending

posts over which the Group has control. Despite the time that has

passed, no court proceedings have been brought by the music

owners.

The Directors have taken formal legal advice from specialist US

intellectual property attorneys and engaged in a mediation process

with the claimants. Based on that advice and the ongoing mediation

process and settlement offers made to date, the Group believes that

a liability of GBP4.9m should have been provided for at 31 August

2022.

In addition, it has been determined that reimbursement assets of

GBP3.6m should have been recognised in respect of insurances and

reimbursements the Group will receive when a settlement is

ultimately paid. The reimbursement assets recognised relate to an

insurance policy and indemnities. GBP2.3m has been recognised in

respect of the indemnities. Further detail relating to the

indemnities has not been disclosed on the grounds that such

disclosure is considered to be seriously prejudicial.

The impact on the Statement of Profit or Loss for the period

ended 31 August 2022 is a net charge in respect of the legal case

of GBP336k. In addition, GBP0.2m in legal costs were settled on

behalf of the Group by its insurance during the period ended 31

August 2022. Deferred tax assets totalling GBP432k should have been

recognised as a result, with a corresponding credit in the

Statement of Profit or Loss.

Impact on the Statement of Profit or Loss and Other

Comprehensive Income

6 month 6 month

period ended period ended

Extract 31 August 31 August

2022 2022

Reported Adjustments Restated

GBP'000 GBP'000 GBP'000

Administrative expenses (16,346) (336) (16,682)

Loss before taxation (13,317) (336) (13,653)

Loss for the period (13,428) (336) (13,764)

Total comprehensive loss

for the period (14,861) (336) (15,197)

Earnings per share (p) (4.3) (0.1) (4.4)

Diluted earnings per share

(p) (4.3) (0.1) (4.4)

Adjusted EBITDA (7,531) (336) (7,867)

Impact on the Statement of Financial Position

31 August 31 August

Extract 2022 2022

Reported Adjustments Restated

GBP'000 GBP'000 GBP'000

Reimbursement Asset - 3,586 3,586

Provisions (non-current) (1,210) (4,941) (6,151)

Deferred tax liabilities (460) 432 (28)

Net assets/(liabilities) 7,040 (923) 6,117

Retained earnings (120,879) (923) (121,802)

Total equity 7,040 (923) 6,117

4. Segmental reporting

IFRS 8 Operating Segments requires that operating segments be

identified on the basis of internal reporting and decision-making.

The Group identifies operating segments based on internal

management reporting that is regularly reported to and reviewed by

the board of directors, which is identified as the chief operating

decision maker. Management information is reported as one operating

segment, being revenue from sales of products.

5. Revenue

6 month 6 month

period ended period ended Year ended

An analysis of the Group's revenue 31 August 31 August 28 February

is as follows: 2023 2022 2023

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Revenue analysed by class of

business

Digital 18,098 18,486 51,008

Store Groups 72,301 56,787 136,834

90,399 75,273 187,842

Revenue analysed by geographical

location

United Kingdom 31,397 28,231 66,974

United States of America 23,619 22,704 51,961

Rest of World 35,383 24,338 68,907

90,399 75,273 187,842

6. On 7 March 2023 the Group announced that it had reached an

agreement in respect of the timing of payments of deferred

consideration for its acquisition of Medichem Manufacturing

Limited.

A Deed of Variation dated 7 March 2023 was signed which amends

the terms of the deferred consideration and completion net asset

adjustment, adjusting the timing of the payments as outlined

below.

-- GBP3.625 million payable on 21 October 2025 (being the

GBP5.125 million consideration reduced by the GBP1.5 million loan

due from one of the Sellers companies, Walbrook Investments

Ltd)

-- GBP5.125 million payable on 21 October 2026

-- GBP5.125 million payable on 21 October 2027

-- GBP5.125 million payable on 21 October 2028 Interest accrues

on outstanding balances at a rate of 2.5% per annum

The modification was deemed by management to be substantial.

This was determined by recalculating the amortised cost of the

modified deferred consideration by discounting the modified

contractual cash flows using the original effective interest rate

and resulting in a movement in amortised cost of greater than 10%

of the original. The variance between the fair value of the

modification and the amortised cost of the original deferred

consideration resulted in a net gain of GBP2,370k, which has been

recognised in the profit or loss as finance income at the date of

the modification.

7. Earnings per share

The Group reports basic and diluted earnings per common share.

Basic earnings per share is calculated by dividing the profit

attributable to common shareholders of the Company by the weighted

average number of common shares outstanding during the period.

Diluted earnings per share is determined by adjusting the profit

attributable to common shareholders by the weighted average number

of common shares outstanding, taking into account the effects of

all potential dilutive common shares, including options.

6 month 6 month

period ended period ended Year ended

31 August 31 August 28 February

2023 2022 2023

Unaudited Unaudited

Loss attributable to shareholders

(GBP'000) 345 (13,764) (33,646)

Weighted average number of

shares 311,776,151 309,737,250 309,737,250

Basic earnings per share (p) 0.0 (4.4) (10.9)

Total comprehensive expense

attributable to the owners

of the company (GBP'000) 345 (13,764) (33,646)

Weighted average number of

shares 311,776,151 309,737,250 309,737,250

Dilutive effect of share options - - -

Diluted earnings per share

(p) 0.0 (4.4) (10.9)

Pursuant to IAS 33, options whose exercise price is higher than

the value of the Company's security were not taken into account in

determining the effect of dilutive instruments. The calculation of

diluted earnings per share does not assume conversion, exercise, or

other issue of potential ordinary shares that would have an

antidilutive effect on earnings per share.

8. Adjusted performance measures

The Group uses a number of Alternative Performance Measures

("APMs") in addition to those measures reported in accordance with

IFRS. Such APMs are not defined terms under IFRS and are not

intended to be a substitute for any IFRS measure. The Directors

believe that the APMs are important when assessing the underlying

financial and operating performance of the Group.

The APMs are used internally in the management of the Group's

business performance, budgeting and forecasting, and for

determining Executive Directors' remuneration and that of other

management throughout the Group. The APMs are also presented

externally to meet investors' requirements for further clarity and

transparency of the Group's financial performance. Where items of

profits or costs are being excluded in an APM, these are included

elsewhere in our reported financial information as they represent

actual income or costs of the Group.

The Group's Alternative Performance Measures are set out

below.

Adjusted EBITDA

Adjusted EBITDA is defined as Operating Profit adjusted for

depreciation and amortisation, impairments and reversals of

impairment, profits and losses on the disposal of assets, share

based charges and releases and exceptional items.

6 month 6 month

period ended period ended Year ended

31 August 31 August 28 February

2023 2022 2023

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Operating loss (528) (12,461) (30,581)

Amortisation of intangible

assets 462 787 1,933

Impairment of intangible assets - - 3,388

Depreciation of property,

plant and equipment 2,100 2,638 8,369

Impairment of property, plant

and equipment - - 2,177

Loss on disposal of asset 5 - 62

Share-based payments 1,640 884 303

Operating exceptional items:

Acquisition costs - 76 262

Restructuring costs 440 209 1,310

Provision for settlement of

legal cases - - 1,474

Exceptional legal fees 2,319 - 3,528

Exceptional audit fees - - 300

Adjusted EBITDA 6,438 (7,867) (7,475)

Operating exceptional items

As announced on 23 September 2022, the Company's auditor wrote

to the Board on 21 September 2022 to identify a number of serious

concerns that had arisen during the course of its work on the audit

of the Company's accounts for the year ended 28 February 2022. The

Board appointed independent external advisors to undertake an

independent investigation, and the Company appointed Macfarlanes

(lawyers), Rosenblatt (lawyers) and FRA (forensic accountants) on

23 September 2022. As a result of issue identified through this

process, exceptional legal and professional fees were incurred at a

cost of GBP896k (FY 23: GBP3.5m).

During the period a major shareholder of the Group, boohoo Group

Plc ("boohoo"), requisitioned a General Meeting with certain

resolutions to be voted upon, the details of which are available on

the Group's website. On 18 July 2023, prior to the General Meeting

taking place, the Group announced a settlement agreement with

boohoo. The terms of the settlement included the resignation of

directors Bob Holt and Derek Zissman and the appointment of

Alistair McGeorge, Neil Catto, Rachel Horsefield and Peter Hallet.

Included within exceptional legal fees are GBP577k of cost

associated with legal and professional support associated with this

process.

On 20 June 2023 the Group announced that it had sent a letter of

claim to one of its former directors, the claim alleges that the

director breached his fiduciary, statutory, contractual and/or

tortious duties to the Company, included within exceptional legal

fees are GBP670k associated with advice in relation to this

claim.

During the period the Group settled legal claims in the US

totalling GBP176k.

During the period the Group incurred GBP440k in restructuring

and redundancy costs. Thes included GBP211k paid to Bob Holt, the

former CEO, GBP76k of costs incurred in closing one of the Group's

warehouse units and GBP153k on restructuring undertaken at

Revolutions Beauty Labs, the Group's manufacturing subsidiary.

9. Borrowings

31 August 31 August 28 February

2023 2022 2023

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Bank revolving credit facility 31,807 27,637 31,721

31,807 27,637 31,721

Payable within one year 31,807 27,637 31,721

10. Inventories

31 August 31 August 28 February

2023 2022 2023

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Finished goods and goods for

resale 42,320 55,200 47,606

Stock written down/(written

back) during period (14,926) 3,510 (5,986)

The total cost of inventories recognised as an expense in cost

of sale in the period was GBP45,673,000 (Period ended August 2022:

GBP43,984,000, full year ended February 2023: GBP111,861,000).

11. Trade and Other Receivables

31 August 31 August 28 February

2023 2022 2023

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Trade Receivables 40,909 46,016 50,715

Other Receivables 364 2,527 452

Prepayments 2,097 4,601 1,541

43,370 53,144 52,708

12. Trade and Other Payables

31 August 31 August 28 February

2023 2022 2023

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Trade Payables 38,995 59,295 56,233

Other Taxation and Social

Security 1,044 1,467 826

Other Payables 60 503 51

Accruals and Contract Liabilities 25,790 21,797 25,597

65,889 83,062 82,707

13. Contingent Liabilities

In February 2023 the Group terminated an arrangement with its

Polish agent. The agent has submitted a claim for lost commission

and costs as a result of the termination. The Group believes that

is has performed its obligation under the arrangement and that no

further commission is payable. The directors have taken legal

advice with regard to this matter and currently believe that it is

not probable that a material liability will arise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCBDBUDBDGXX

(END) Dow Jones Newswires

November 14, 2023 02:00 ET (07:00 GMT)

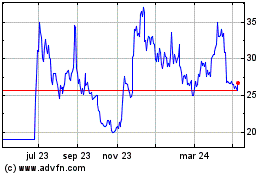

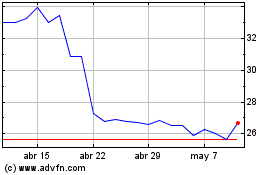

Revolution Beauty (LSE:REVB)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Revolution Beauty (LSE:REVB)

Gráfica de Acción Histórica

De May 2023 a May 2024