TIDMRKH

RNS Number : 5028I

Rockhopper Exploration plc

19 April 2022

19 April 2022

Rockhopper Exploration plc

("Rockhopper" or the "Company")

Sea Lion Update: Signature of Definitive Documentation

&

Other Corporate Updates

Rockhopper Exploration plc (AIM: RKH), the oil and gas

exploration and production company with key interests in the North

Falkland Basin, is pleased to announce that, further to the heads

of terms notified on 8 December 2021, Rockhopper, Harbour Energy

plc ("Harbour") and Navitas Petroleum LP ("Navitas") have signed

legally binding definitive documentation in relation to Harbour

exiting and Navitas entering the North Falkland Basin (the

"Transaction").

The Transaction remains subject to completion pending, inter

alia, regulatory approvals.

Highlights

-- Navitas will acquire Premier Oil Exploration and Production

Limited ("POEPL"), the Company in which Harbour holds all of its

Falkland Islands licences

-- Rockhopper and Navitas will seek to align working interests

across all their North Falkland Basin petroleum licences -

Rockhopper 35% / Navitas 65% - subject to all necessary

consents

-- Rockhopper and Navitas to jointly develop and agree a

technical and financing plan to enable the development of the Sea

Lion project to achieve first oil on a lower cost and expedited

basis post sanction

-- Navitas to provide loan funding to Rockhopper:

o The majority of Rockhopper's share of Sea Lion phase one

related costs from Transaction completion up to Final Investment

Decision ("FID") will be funded through a loan from Navitas with

interest charged at 8% per annum (the "Pre-FID Loan"). Certain

costs, such as licence costs, are excluded

o Subject to a positive FID, Navitas will provide an interest

free loan to Rockhopper to fund two-thirds of Rockhopper's share of

Sea Lion phase one development costs (for any costs not met by

third party debt financing). Certain costs, such as licence costs,

are excluded

o Funds drawn under the loans will be repaid from 85% of

Rockhopper's working interest share of free cash flow

-- In the event that material progress towards FID has not

occurred within five years of completion of the Transaction,

Rockhopper can elect to remove Navitas from the Falkland Islands

petroleum licences (should the licences still be in effect at that

time) by repaying the Pre-FID Loan. Should material progress have

been made, but FID not achieved, then the five year period can be

extended by 12 months and then a further six months if certain

project milestones have been achieved

Benefits of the Transaction

-- Greater alignment and simplified commercial arrangements across the joint venture

-- Rockhopper retains a higher working interest in the Sea Lion project than under the previous Premier-Navitas transaction announced in January 2020

-- The Transaction continues to materially satisfy Rockhopper's

proportion of both pre-FID and post-FID costs for Sea Lion

-- Introduction of a new and committed Operator for Sea Lion -

Sea Lion becomes Navitas' largest operated development asset

-- Access to Navitas' expertise in executing and financing large scale oil field developments

-- Clean exit for Harbour

-- Optionality for Temporary Dock Facility - scope to upgrade for Sea Lion development or future decommissioning

Forward plan for Sea Lion

-- Transaction completion is subject to receipt of various

agreements, consents and approvals by the Falkland Islands

Government ("FIG")

-- Technical work to commence by Rockhopper and Navitas jointly

in relation to a lower-cost, alternative development for Sea Lion

utilising the existing extensive design and engineering work

undertaken for the project in recent years

-- Navitas to become Operator at completion

-- Potential for an additional project partner dependent upon

funding requirements - to be defined through ongoing development

and financing processes - should an additional partner be required,

Rockhopper does not intend to reduce its working interest

-- Navitas committed to strengthen its offshore operating

capability with a focus on safe and efficient developments

Licence Ownership post Transaction completion

The table below shows the revised licence ownership post

completion of the Transaction:

North Falkland Basin

Licence Rockhopper Navitas as Operator

PL003 35% 65%

PL004 35% 65%

PL005 35% 65%

PL0032 35% 65%

PL0033 35% 65%

South Falkland Basin

Rockhopper

Licence as Operator

PL011 100%

PL012 100%

PL014 100%

Further details regarding the Transaction are provided in

Appendix 1

Other corporate updates

On 28 March 2022, the Company received the following update from

the Chairman of the Panel considering the Ombrina Mare

arbitration:

"The Tribunal anticipates that the proceedings will be closed in

the next few weeks."

The Company will update the market once it is informed that

proceedings are closed. Under the International Centre for

Settlement of Investment Disputes rules, the final decision should

then be rendered within a four month period, although there is the

potential for this to be extended to six months at the arbitrators'

request.

Rockhopper continues to believe it has strong prospects of

recovering very significant monetary damages - on the basis of lost

profits - as a result of the Republic of Italy's breaches of the

Energy Charter Treaty.

The Company also provides an update on the current cash balance

which, as at 31 March 2022, was US$3.9 million (unaudited). The

Company will require further funding for working capital and to

achieve Sea Lion FID.

Samuel Moody, CEO, commented:

"We are delighted to have signed definitive documentation to

bring Navitas into the North Falkland Basin. Subject to regulatory

consents, we believe this marks the start of a new exciting chapter

for the Falklands, and for the Sea Lion project in particular.

Navitas' US$1 billion Shenandoah financing in 2021 proved their

ability to fund challenging offshore oil and gas developments.

Given this, coupled with a more positive oil price environment, we

are very excited to have them as new partners and look forward to

pushing ahead with Sea Lion, a world class resource."

Enquiries:

Rockhopper Exploration plc

Sam Moody - Chief Executive

Tel. +44 (0) 20 7390 0234 (via Vigo Consulting)

Canaccord Genuity Limited (NOMAD and Joint Broker)

Henry Fitzgerald-O'Connor/James Asensio

Tel. +44 (0) 20 7523 8000

Peel Hunt LLP (Joint Broker)

Richard Crichton

Tel. +44 (0) 20 7418 8900

Vigo Consulting

Patrick d'Ancona/Ben Simons

Tel. +44 (0) 20 7390 0234

The information contained within this Announcement is deemed by

Rockhopper Exploration plc to constitute inside information as

stipulated under the Market Abuse Regulation (EU) No. 596/2014 as

it forms part of UK law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR").

Appendix

Further details of the Transaction

Navitas will buy all the shares in POEPL, an indirectly held

Harbour subsidiary, through which Harbour holds its rights in the

North Falkland Licences (being PL003, PL004, PL005, PL032, PL033)

(the "Licences"). Rockhopper will additionally transfer sufficient

interests in the Licences such that all those Licences will be held

65% Navitas and 35% Rockhopper, with Navitas as Operator. The

Transaction is subject to certain precedent conditions, the most

important of which are certain consents from FIG which include, but

are not limited to, a two year extension on the Licences being

acquired, Navitas being approved as an Operator and certain tax

clearances from FIG.

About Sea Lion and the North Falkland Basin

Rockhopper was admitted to AIM in 2005 with its principal asset

being prospective oil and gas acreage in the North Falkland Basin.

During 2010 - 2012, Rockhopper, as operator, successfully

evaluated, drilled and appraised its acreage culminating in the

discovery of Sea Lion and its satellite fields. Further exploration

drilling occurred during 2015 and 2016. Sea Lion and its satellite

fields are independently estimated to hold approximately 520 mmbbls

of 2C Contingent Resources.

Rockhopper's Board remain confident the Sea Lion project

benefits from robust economics (at $65/bbl Brent - NPV10@FID

$1.8bn; break-even $42/bbl; life of project free cash flow $4.2bn

with material upside at higher oil prices) and that it compares

favourably to other investment opportunities which may be available

in the current environment.

As disclosed in the Company's unaudited half-year results for

the six months to 30 June 2021, the loss for the period, related to

the Company's Falkland Islands interests, was US$270,000. Reported

Segmental Assets and Liabilities, related to the Company's Falkland

Islands interests, were US$244 million and US$80 million

respectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBKFBKKBKBDQD

(END) Dow Jones Newswires

April 19, 2022 02:01 ET (06:01 GMT)

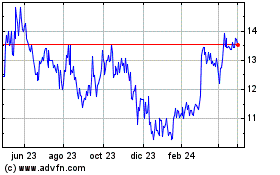

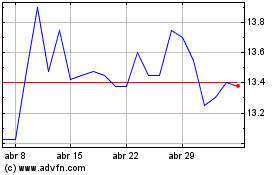

Rockhopper Exploration (LSE:RKH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rockhopper Exploration (LSE:RKH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024