TIDMRUR

RNS Number : 8994N

Rurelec PLC

28 September 2023

28 September 2023

AIM: RUR

Rurelec PLC

("Rurelec" or "the Company"

And with its subsidiaries the "Group")

Interim results for the six months ended 30 June 2023

Rurelec PLC (AIM: RUR), the AIM rule cash shell and owner of

Turbines, today announces its unaudited interim results for the six

months ended 30 June 2023.

Financial Highlights:

-- Operating loss: GBP0.38 million (2022 GBP0.50 million)

-- Post tax (loss) / profit: (GBP0.45 million) (2022: profit

GBP0.70 million

-- (Loss) / profit per share: (0.08) pence (2022: profit 0.12

pence)

-- Net asset value per share: 1.7 pence (2022: 2.2 pence)

-- Net cash balance: GBP2.26 million (2022: GBP0.88 million)

Operational and Post Half-Year Highlights:

-- Post-Tax loss of GBP0.45 million, from a profit of GBP0.70

million last period, this was due to 2023 exchange rate losses of

GBP0.06 million compared to prior period exchange rate gains of

GBP1.19 million.

-- Administration expenses were 15 per cent. lower at GBP0.42 million (2022: GBP0.50 million).

-- Other income, 2023: GBP2.54 million (2022: GBPnil) comprises

GBP2.43 million Patagonia Energy Limited "PEL" sale receipt and

GBP0.11 million from the sale of scrap. Other expense GBP2.48

million (2022: GBPnil) related to the sale of PEL.

-- Discontinued operations, from 31 December 2022 operations in

Chile and Argentina are treated as discontinued operations no

longer included in Financial Statements. From which direct costs,

of GBP0.02 million are expensed in Rurelec PLC (the "Parent").

-- Cash increased from GBP0.88 million last period to GBP2.26

million at the end of the period under review, which is the result

of the initial consideration receipt from the sale PEL. This

balance is prior to the GBP1.12 million dividend payment made in

July 2023.

-- The Board continues to explore options for the disposal of its Chilean interests.

-- Discussions remain ongoing with regard to the disposal of two

Siemens Westinghouse 701 128 MW gas turbine generators

("701s").

Strategy update

Having reduced costs, stabilised the Company's financial

condition and disposed of the Argentinian interests, the Board's

main focus continues to be on maximising returns for shareholders

from the sale of the two Siemens 701 turbines. While we are

involved in a number of credible discussions, the timing of any

potential sale remains highly uncertain owing to the limited demand

and infrequent occurrence of projects into which the turbines could

be injected. Other initiatives are underway to simplify the Group

including the potential disposal of the assets in Chile.

In addition, following the sale of the Argentinian Assets on

9(th) June 2023, which was a fundamental change of business

pursuant to the AIM Rules, the Company was deemed to be an AIM Rule

15 Cash Shell. Accordingly the Company must make an acquisition or

acquisitions that constitutes a reverse takeover under AIM Rule 14

within 6 months of becoming an AIM Rule 15 Cash Shell. If this is

not achieved the Company's shares will be suspended from trading on

AIM on 11 December 2023 and ultimately delisted on 12 June 2024 if

a suitable acquisition constituting a Reverse Take-over has not

occurred. The Directors ideally wish to retain the listing as a

mechanism to maximise shareholder value, by making the Company

attractive to potential high-quality acquisitions. The priority is,

however, to maintain the resource necessary to preserve and realise

the value of the Turbines which are the Company's largest asset.

The directors will only pursue acquisition opportunities that are

both deliverable in the time frame available and which have a

compelling investment case.

One option under consideration is to ring fence the value of the

turbines for shareholders whilst at the same time making the

Company attractive for new business opportunities through which to

can create shareholder value. The Directors are reviewing potential

acquisition opportunities as they arise and assessing the cost and

benefit of Ringfencing the Turbines as part of those initiatives.

We have had held discussions with parties concerning potential

fundraisings and acquisition opportunities. It is likely that any

acquisition would need to be accompanied by a fundraising. There

can be no guarantee that any acquisition or fundraise will occur.

In addition, the speculative costs associated with an acquisition,

while maintaining the listing of Rurelec's ordinary shares on AIM

will deplete cash at a significant rate. The alternative is to

delist the business in order to maximise the resource available for

the disposal of the Turbines. With the passage of time, this latter

route becomes more likely.

Given the Group is debt-free, a sale of the turbines should

enable Rurelec to maximise returns to its shareholders though, as

reported in the Audited Accounts for the year ended 31 December

2022, the ability of Rurelec to build up sufficient cash reserves

to fund further dividend payments will not be possible unless the

disposal of the turbines is achieved.

Commenting on the results, Andy Coveney, Rurelec's Executive

Director, said:

"I am pleased to report the disposal of the Group's Argentinian

investment, bringing cash into the Group and creating a position

whereby the Company was able in July 2023 to make a distribution of

GBP1.12 million to our shareholders who have waited many years for

such a dividend.

It is hoped that by concentrating resources on the disposal of

the turbines, Rurelec may be in a position to realise those assets

whilst reducing costs, although there can be no guarantee.

The Board is examining the optimal way in which the potential

value of these turbines can be realised and is considering all

options to reduce costs and simplify the Group .

In parallel the Directors have had held discussions with parties

concerning potential fundraisings and acquisition opportunities to

optimise the value of the cash shell for shareholders. These are

currently not progressing, and there can be no guarantee that any

transaction will occur but the Directors are continuing to keep all

options under review. Further update will be provided as

appropriate.

For further information please contact :

Rurelec PLC WH Ireland

Andrew Coveney Katy Mitchell

Executive Director James Bavister

+44 (0)7710 836312 +44 (0)20 7220 1666

Executive Directors' Statement

Review of Operations

701 Turbines

Rurelec continues to focus upon the sale of the 701 DU 125MW

Turbines. A number of separate discussions are ongoing with

credible third parties with a view to selling the Turbines to power

projects into power projects in Europe, Africa and the Middle East.

While these are encouraging, they remain at an early stage and

owing to the complex nature of power projects it is difficult to

predict whether these potential counterparties will be able to

secure the necessary finance such that a deposit can be paid.

Chile

As disclosed in the 2022 Financial Statements Chilean activities

are considered as 'Discontinued Operations' from 31 December 2022.

Consequently, they are no longer included in these Group Accounts.

Direct expenditure in Chile totalled GBP18k (2022: GBP87k), this

has been expensed in the Parent's accounts. Since the period end

discussions for the disposal of these companies have continued.

There can be no certainty that this will be successful, and it is

likely that the consideration will not be material, however there

will be direct and indirect cost savings for the simplified

Group.

Asset disposals

As previously announced the Group's interests in Argentina were

disposed of on 12 June 2023, on receipt of the initial

consideration of US$3.0 million. An additional US$2.0 million

becomes due should defined conditions be met. The economic outlook

In Argentina continues to be uncertain and it is by no means

certain that the conditions will be met within the defined

timeframes so there can be no guarantee that no additional

consideration will be paid.

AIM Rule 15

As previously announced the disposal of the Argentinean

Interests was a fundamental disposal pursuant to Rule 15 of the AIM

Rules for Companies. As such, Rurelec is now therefore regarded as

an AIM Rule 15 cash shell. Accordingly, before 11 December 2023,

being six months after Rurelec became an AIM Rule 15 cash, Rurelec

must make an acquisition or acquisitions which constitutes a

reverse takeover under Rule 14 of the AIM Rules for Companies

otherwise Rurelec's Ordinary Shares will be suspended from trading

on AIM. Furthermore, if a qualifying acquisition is not completed

by Rurelec by 12 June 2024, the admission of the Company's ordinary

shares to trading on AIM will be cancelled.

The Directors are keen, where possible, to retain the listing as

a mechanism to maximise shareholder value, by making the Company

attractive to potential high-quality acquisitions. The priority is,

however, to maintain the resource necessary to preserve and realise

the value of the Turbines which are the Company's largest

asset.

Head office

Tight controls continued to be maintained on overheads in the UK

and administration costs for the period were flat at GBP420k (2022:

GBP409k).

Cash flow

Rurelec remained free of any secured debt and was consequently

in the position of not having to pay any interest.

The period-end cash balance was GBP2.26 million (2022: GBP0.88

million) before the payment of a GBP1.12 million dividend in July

2023.

With the PEL receipt and continued focus on cost control, the

liquidity for the Group's short to medium term is secure. This

should allow a reasonable time frame to dispose of the

Turbines.

Given the cash balances held by the Group, the Directors believe

that there is currently sufficient headroom in existing working

capital resources to avoid the need to seek further sources of

working capital and accordingly continue to adopt the going concern

basis of accounting.

Board of Directors

There were no changes to the Board of Directors during the

period covered by these condensed financial statements.

Andy Coveney

Executive Director

RURELEC PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(unaudited)

for the half year ended 30 June 2023

(expressed in thousands of pounds)

________

Audited

Notes 6 months 6 months 12 months

to to to

30/06/23 30/06/22 31/12/22

GBP'000 GBP'000 GBP'000

------------------------------------- ------ --------- --------- ----------

Administrative expenses (420) (496) (998)

Other income 2,518 - 25

Other expense (2,479) - (1,924)

Operating loss (380) (496) (2,897)

Foreign exchange (losses)

/ gains (56) 1,194 661

Loss on discontinued operations (18) - =

Finance income 1 - -

Finance expense - - -

------------------------------------- ------ --------- --------- ----------

(Loss) / profit before tax (454) 697 (2,236)

Tax expense - - -

------------------------------------- ------ --------- --------- ----------

(Loss) / profit for the period (454) 697 (2,236)

(Loss) / profit per share 3 (0.08p) 0.12p (0.39p)

------------------------------------- ------ --------- --------- ----------

Other comprehensive income

Items that will be subsequently

reclassified to Profit & Loss:

Exchange differences on translation

of foreign operations - 269 (122)

Total other comprehensive

income / (expense) - 269 (122)

Total comprehensive (loss)

/ profit for the period (454) 965 (2,368)

RURELEC PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(unaudited)

at 30 June 2023

(expressed in thousands of pounds)

__

Audited

30/6/23 30/6/22 31/12/22

Notes GBP'000 GBP'000 GBP'000

------------------------------- --------- --------- --------- ---------

Assets

Non-current assets

Property, plant and equipment - 7,766 -

Investment in Joint Venture - 312 -

Trade and Other Receivables - 3,650 -

- 11,728 -

------------------------------- --------- --------- --------- ---------

Assets Held for Sale 7,773 - 10,108

Current assets

Trade and other receivables 133 269 91

Cash and cash equivalents 2,257 879 449

2,389 1,148 540

----------------------------------------- --------- --------- ---------

Total assets 10,162 12,876 10,648

------------------------------------------ --------- --------- ---------

Equity and liabilities

Shareholders' equity

Share capital 5,614 5,614 5,614

Share premium account - - -

Foreign currency reserve 956 1,347 956

Profit and loss reserve 3,128 5,711 3,582

------------------------------------------ --------- --------- ---------

Total equity 9,698 12,672 10,152

Current liabilities

Trade and other payables 460 200 496

Current tax liabilities 4 4 -

464 204 496

----------------------------------------- --------- --------- ---------

Total liabilities 464 204 496

------------------------------------------ --------- --------- ---------

Total equity and liabilities 10,162 12,876 10,648

------------------------------------------ --------- --------- ---------

RURELEC PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(unaudited)

for the half year ended 30 June 2023

(expressed in thousands of pounds)

Share Share Foreign Retained Other Total

capital premium currency earnings reserve equity

GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000

Balance at 01.01.22

- as restated 5,614 - 1,078 5,014 - 11,706

Profit for the first

6 months - - - 697 - 697

Exchange differences

on translation - - 269 - - 269

---------------------- ----------- ------------ ----------- ----------- ----------- ------------

Total comprehensive

profit - - 269 697 - 966

---------------------- ----------- ------------ ----------- ----------- ----------- ------------

Balance at 30.06.22 5,614 - 1,347 6,515 - 13,476

Loss for the Period - - - (2,933) - (2,933)

Exchange differences

on translation - - (391) - - (391)

---------------------- ----------- ------------ ----------- ----------- ----------- ------------

Total comprehensive

loss - - (391) (2,933) - (3,324)

---------------------- ----------- ------------ ----------- ----------- ----------- ------------

Balance at 31.12.22 5,614 - 956 3,582 - 10,152

Loss for the first 6

months - - - (454) - (454)

Exchange differences - - - - - -

on translation

---------------------- ----------- ------------ ----------- ----------- ----------- ------------

Total comprehensive

loss - - - (454) - (454)

---------------------- ----------- ------------ ----------- ----------- ----------- ------------

Balance at 30.06.23 5,614 - 956 3,128 - 9,698

---------------------- ----------- ------------ ----------- ----------- ----------- ------------

RURELEC PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (unaudited)

for the half year ended 30 June 2023

(expressed in thousands of pounds)

Audited

6 months 6 months 12 months

to to to

30/06/23 30/06/22 31/12/22

----------------------------------- --------- --------- ----------

Result for the period before

tax (454) 697 (2,147)

from operations

Net finance expense - - -

Adjustments for:

Unrealised exchange losses

/ (gains) 56 (1,194) (160)

Write down on loans/investments - - 1,679

Discontinued operations 18 - -

Change in trade and other

receivables (90) 189 (309)

Change in trade and other

payables 32 (232) 25

----------------------------------- --------- --------- ----------

Cash used in operating activities (438) (540) (912)

----------------------------------- --------- --------- ----------

Taxation paid - - -

----------------------------------- --------- --------- ----------

Net cash used in operating

activities (438) (540) (912)

----------------------------------- --------- --------- ----------

Cash flows from investing

activities

Repayments from joint venture

company - 674 599

Net proceeds from sale of 2,246 - -

Joint Venture

Net cash generated from investing

activities 2,246 674 599

----------------------------------- --------- --------- ----------

Net cash inflow before

financing activities 1,808 134 (313)

----------------------------------- --------- --------- ----------

Cash flows from financing

activities

Loan Principal Repayments - - -

Loan Interest Repayments - - -

----------------------------------- --------- --------- ----------

Net cash used in financing - - -

activities

----------------------------------- --------- --------- ----------

Increase / (decrease) in

cash

and cash equivalents 1,808 134 (313)

-----------------------------------

Cash and cash equivalents

at start of period 432 745 745

----------------------------------- --------- --------- ----------

Cash and cash equivalents

at end of period 2,257 879 432

RURELEC PLC

Notes to the Interim Statement

for the six months ended 30 June 2023

1. Basis of preparation

These condensed consolidated interim financial statements do not

constitute statutory accounts within the meaning of Section 435 of

the Companies Act 2006. The comparative figures for the year ended

31 December 2022 were derived from the statutory accounts for that

year which have been delivered to the Registrar of Companies. The

financial information contained in this interim statement has been

prepared in compliance with International Financial Reporting

Standards ("IFRSs") and in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 and expected to apply to the Group's results for the year

ending 31 December 2023 and on interpretations of those Standards

released to date.

2. Accounting policies

These condensed consolidated interim financial statements have

been prepared in accordance with the accounting policies set out in

the Group's financial statements for the year ended 31 December

2022.

3. Earnings per share

6 months 6 months 12 months

to to to

30/6/23 30/6/22 31/12/22

----------- --------- -----------

Basic and diluted

Average number of shares 561m 561m 561m

in issue during the period

(Loss) / Profit attributable (GBP0.45m) GBP0.70m (GBP2.24m)

to equity holders of the parent

from continuing operations

Basic and diluted (loss) /

profit per share on continuing

operations (0.08p) 0.12p (0.39p)

----------- --------- -----------

There are no financial instruments in issue (2022: none) that

could be settled by the delivery of shares.

4. The Board of Directors approved this interim statement on 27

September 2023. This interim statement has not been audited.

5 . Copies of this statement are available at the Company's

website www.rurelec.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCRSDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

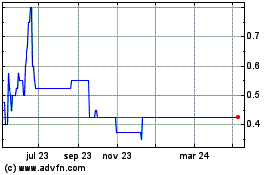

Rurelec (LSE:RUR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Rurelec (LSE:RUR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024