TIDMSAR

RNS Number : 0312P

Sareum Holdings PLC

09 October 2023

Sareum Holdings PLC

("Sareum" or the "Company")

Final Results for the Year Ended 30 June 2023

Cambridge, UK, 9 October 2023 - Sareum Holdings plc (AIM: SAR),

a biotechnology company developing next generation kinase

inhibitors for autoimmune disease and cancer, today announces its

audited financial results for the year ended 30 June 2023.

Additionally, Sareum announces that the Annual Report detailing

these financial results will be made available and posted in the

coming weeks.

Sareum also provides a broader update on operational activities

and pipeline progress.

OPERATIONAL HIGHLIGHTS - INCLUDING POST-PERIOD UPDATES

SDC-1801 (autoimmune disease)

-- SDC-1801 is a TYK2/JAK1 inhibitor being developed as a

potential new therapeutic for a range of autoimmune diseases with

an initial focus on psoriasis, an autoimmune condition affecting

the skin.

-- A Phase 1a clinical trial evaluating SDC-1801 in healthy

subjects was initiated in May 2023, and is progressing well at a

specialist clinical unit in Melbourne, Australia.

-- In September, after the period end, Sareum commenced dosing

in the multiple ascending dose (MAD) escalation phase of the Phase

1a trial. This followed approval by the safety review committee

granted upon review of preliminary data generated from the initial

three cohorts in the single ascending dose (SAD) part of the

study.

-- Full safety data from the Phase 1a trial are expected to be

available during the first half of 2024 and, provided satisfactory

results are obtained and subject to financing and regulatory and

recruitment preparations, the Company plans to initiate a Phase 1b

clinical study, aiming to recruit up to 24 psoriasis patients. This

study is expected to be completed before the end of 2024.

-- First patent relating to SDC-1801 was granted by the China

National Intellectual Property Administration, safeguarding the use

of SDC-1801 for medical applications treating inflammatory or

immune disorders.

SDC-1802 (cancer immunotherapy)

-- Sareum continues to work on the translational studies needed

to support its cancer immunotherapy candidate, SDC-1802, defining

the optimal cancer application prior to completing toxicology and

manufacturing studies.

-- New patent granted by the United States Patent and Trademark

Office (USPTO) covering the treatment of autoimmune diseases with

SDC-1802 and several analogues and extending protection for this

compound beyond immuno-oncology.

SRA737 (cancer)

-- Sierra Oncology, Inc, a subsidiary of GSK plc, completed the

return of the Clinical Study Reports and other associated documents

and data related to SRA737 to Sareum's co-development partner, the

CRT Pioneer Fund LP ("CPF").

-- CPF is taking the lead in evaluating potential further

development opportunities for SRA737 and further updates will be

provided as soon as possible.

FINANCIAL HIGHLIGHTS

-- The loss for the year to 30 June 2023 was GBP3.2 million

after tax, (2022: GBP2.2 million), in line with market expectations

and reflecting the increased costs associated with setting up and

commencing clinical studies with SDC-1801.

-- Sareum had a cash position of GBP1.0 million as at 30 June

2023 (cash of GBP 2.9 million as at 31 December 2022 and GBP4.3

million as at 30 June 2022).

-- As announced on 3 August 2023, after the period end, Sareum

agreed terms on an Equity Prepayment Facility (the "Facility") of

up to GBP5.0 million with RiverFort Global Opportunities PCC Ltd

("RiverFort"). The Company received an initial deposit of GBP2.0

million, net of associated costs, on 4 August 2023.

-- The Company intends to use the Facility, if fully drawn,

together with the receipt of anticipated tax incentives to the

amount of GBP1.6 million (of which GBP0.4m was received in

Australia post period end), to complete the Phase 1a/b clinical

development of the Company's lead candidate SDC-1801, which is

expected to be a primary catalyst for driving shareholder value,

and for general working capital to Q4 2024. With the current and

anticipated financing mechanisms in place, the Company is

positioned to ensure the completion of the Phase 1a study and to

support subsequent developments.

Dr Tim Mitchell, CEO of Sareum, commented:

"We are increasingly optimistic about the potential of TYK2/JAK1

inhibitors to address autoimmune disease and we remain fully

focused on progressing our lead programme, SDC-1801, through the

ongoing Phase 1 study underway in Australia.

"The funds raised as part of the RiverFort facility provide a

clear runway allowing us to focus on advancing this promising asset

through Phase 1 studies and we look forward to having full safety

data in the first half of 2024, potentially allowing us to move

towards an important Phase 1b study in psoriasis patients which

will focus more on efficacy .

"With our secured financing and anticipated resources, we

believe we're well positioned to complete the ongoing Phase 1a and

subsequently advance into the Phase 1b study.

"This progress, alongside growing scientific and commercial

validation in the TYK2/JAK1 space, supports our continued

confidence in this asset.

"We're also optimistic about the opportunity for SDC-1802 in

immuno-oncology and continue to believe that SRA737 has great

potential for the treatment of cancer."

For further information, please contact:

Sareum Holdings plc

Tim Mitchell, CEO 01223 497700

Lauren Williams, Head of Investor Relations ir@sareum.co.uk

Strand Hanson Limited (Nominated Adviser)

James Dance / James Bellman 020 7409 3494

Peel Hunt LLP (Joint Corporate Broker)

James Steel / Patrick Birkholm 020 7418 8900

Hybridan LLP (Joint Corporate Broker)

Claire Noyce

020 3764 2341

ICR Consilium (Financial PR)

Jessica Hodgson / Davide Salvi / Stella

Lempidaki 020 3709 5700

About Sareum

Sareum Holdings (AIM:SAR) is a clinical-stage biotechnology

company developing next generation kinase inhibitors for autoimmune

disease and cancer.

The Company is focused on developing next generation small

molecules which modify the activity of the JAK kinase family and

have best-in-class potential. Its lead candidate, SDC-1801,

simultaneously inhibits TYK2 and JAK1. SDC-1801 is a potential

treatment for a range of autoimmune diseases and has entered Phase

1a/b clinical development with an initial focus on psoriasis.

Sareum has an economic interest in SRA737, a clinical-stage Chk1

inhibitor which it originally developed in collaboration with

several Cancer Research UK-related organisations. SRA737 has shown

promising safety and efficacy in two Phase 1/2 clinical trials.

Sareum is also developing SDC-1802, a TYK2/JAK1 inhibitor with a

potential application for cancer immunotherapy.

Sareum Holdings plc is based in Cambridge, UK, and is listed on

the AIM market of the London Stock Exchange, trading under the

ticker SAR. For further information, please visit the Company's

website at www.sareum.com

CHAIRMAN'S STATEMENT

Sareum is making good progress with its lead programme,

SDC-1801, with a Phase 1a trial now underway in Australia.

The management team is convinced of the potential benefits that

dual inhibition of both TYK2 and JAK1 can offer to patients with

autoimmune diseases in terms of superior efficacy in comparison to

other small molecule approaches.

For the duration of this financial year, the team has been

focused on advancing the clinical development of SDC-1801. Despite

an initial setback with respect to Sareum's application to the UK's

MHRA, management rapidly pivoted and adapted its strategy,

fulfilling the necessary steps to enable the Phase 1a trial to be

conducted in Australia.

Australia offers state-of-the-art research facilities, an

efficient approval process and generous tax incentives for

companies undertaking research and development, making it an

attractive location for conducting clinical trials. The Phase 1a

trial of SDC-1801 started in May 2023 and is progressing well.

Following a review of the safety and pharmacokinetics data from the

first three cohorts in the SAD part of the study, MAD studies were

initiated in September after the period end. Sareum is on track to

receive full safety data from the Phase 1a trial during the first

half of 2024. Subject to satisfactory safety data, as well as

financing, regulatory and recruitment considerations, Sareum aims

to move SDC-1801 into the Phase 1b part of the trial in psoriasis

patients as soon as possible thereafter.

Our second dual TYK2/JAK1 inhibitor, SDC-1802, holds significant

potential in cancer and autoimmune disease. Translational studies

continue, in order to define the optimal application prior to

completing the necessary toxicology and manufacturing preparatory

work. We have been encouraged by the award of a patent, in June

2023, by the United States Patent and Trademark Office (USPTO),

which extends the potential scope of this compound beyond

immuno-oncology.

We continue to be optimistic about the potential for SRA737,

which has demonstrated promising clinical and preclinical efficacy,

particularly in combination settings, in earlier studies conducted

by Sierra Oncology. CPF is taking the lead in evaluating the

opportunity and next steps for this asset, and we await further

developments.

For now, the Company is focused on the encouraging clinical

progress of our lead programme, SDC-1801. The financing agreement

with RiverFort, announced in August 2023, provides us with a runway

to complete the Phase 1 element of the trial and we are excited to

see this move forward.

COMPANY STRATEGY

Sareum is a clinical-stage small molecule drug development

company which is focused on advancing inhibitors of the JAK kinase

family into clinical development for autoimmune disease and cancer.

It is led by a highly experienced team with expertise in kinase

inhibition and decades of experience in R&D and public company

management.

Sareum's pipeline is focused on TYK2/JAK1 inhibitors, which are

involved in signalling pathways that are deregulated in multiple

autoimmune diseases. Inhibition of TYK2 and JAK1 has the potential

to yield a superior efficacy compared with agents that block just

one of these two kinases and with a superior safety profile than

"first generation" JAK family inhibitors that also modulate JAK2

and JAK3.

Our approach is to discover and develop programmes to late

preclinical or early clinical stages before licensing or

partnering.

The Company maintains a lean cost base with a small, experienced

and specialised team and using trusted third-party providers, to

maximise its return on investment.

PROGRAMME UPDATES

SDC-1801

SDC-1801 is a TYK2/JAK1 inhibitor being developed as a potential

new therapeutic for a range of autoimmune diseases with an initial

focus on psoriasis, an autoimmune condition affecting the skin.

TYK2/JAK1 inhibition has demonstrated benefits in restoring a

healthy immune system and has strong clinical validation in

psoriasis and psoriatic arthritis.

Psoriasis is an autoimmune dermatological condition affecting

more than 125 million adults worldwide, with a market size for

potential treatments estimated to be worth US$27.0 billion. Sareum

believes that TYK2/JAK1 inhibition offers the potential for

increased efficacy in psoriasis, compared with existing approved

therapies.

Scientific and commercial interest in the application of

TYK2/JAK1 inhibition has been building recently. This momentum was

underscored by the approval in September 2022 of Sotyktu(TM)

(deucravacitinib), from Bristol Myers Squibb, a first-in-class,

oral, selective, allosteric TYK2 inhibitor for the treatment of

adults with moderate-to-severe plaque psoriasis.

SDC-1801 is undergoing a Phase 1a clinical trial designed to

investigate the safety, tolerability, pharmacokinetics and

pharmacodynamics of an oral formulation of SDC-1801 in healthy

subjects (trial ID ACTRN12623000416695p). This is a randomised,

placebo-controlled trial, with single and multiple ascending oral

dose studies, and a food effect study, which is taking place at a

clinical unit in Melbourne, Australia.

The single ascending dose (SAD) part of the trial was initiated

in May and, in September, Sareum confirmed after the period end

that it had commenced dosing the first subjects in the multiple

ascending dose (MAD) part of the trial. Dosing in the MAD part of

the study followed approval by the safety review committee based on

preliminary data generated from the initial three cohorts in the

SAD part of the study. These were deemed satisfactory for the MAD

part of the study to commence, alongside continued dose escalation

in the SAD part of the study.

A food effect study, which will examine how the pharmacokinetic

profile of SDC-1801 changes when capsules are dosed with food, or

following a fasting period, is planned to commence in Q423 and is

expected to report in early 2024.

Provided satisfactory safety data are obtained from the Phase 1a

study and s ubject to financing, regulatory and recruitment

considerations, Sareum aims to move SDC-1801 into the Phase 1b part

of the trial in psoriasis patients as soon as possible.

SDC-1802

SDC-1802 is a TYK2/JAK1 inhibitor being developed for cancer and

cancer immunotherapy applications.

Sareum continues to work on the translational studies needed to

define the optimal cancer application prior to completing

toxicology and manufacturing studies.

In June 2023, a patent was granted by the United States Patent

and Trademark Office (USPTO) covering the treatment of autoimmune

diseases with SDC-1802 and several analogues and extending

protection for this compound beyond immuno-oncology.

This strengthens the intellectual property protection around

this molecule: in April 2022, the Company was granted a patent

protecting the SDC-1802 molecule and pharmaceutical preparations

thereof as a therapeutic to treat T-cell acute lymphoblastic

leukaemia (T-ALL - a cancer of a particular type of white blood

cell called a T lymphocyte) and other cancers that are dependent on

TYK2 kinase for survival.

SRA737

SRA737 is a clinical-stage oral, selective Chk1 inhibitor that

targets cancer cell replication and DNA damage repair

mechanisms.

The asset was originally developed by Sareum in collaboration

with several Cancer Research UK-related organisations, including

CPF, with whom the Company entered a co-development agreement in

2013. Under the terms of the agreement, Sareum is entitled to a

27.5% share of any commercialisation revenues.

As announced in March 2023, Sierra Oncology, Inc, now a

subsidiary of GSK plc, has completed the return of the Clinical

Study Reports and other associated documents and data related to

SRA737 to Sareum's co-development partner, the CPF.

As the major partner, CPF is taking the lead in evaluating

potential further development opportunities for SRA737 and further

updates will be provided as and when appropriate.

Sierra reported positive preliminary efficacy and safety data in

two clinical trials evaluating it as a monotherapy and in

combination with chemotherapy in 2019, and preclinical data have

been reported that support the potential for SRA737 in combination

against hard-to-treat cancers.

We continue to believe that, based on preclinical and early

clinical data, SRA737 holds strong promise for the treatment of

cancer, particularly in combination settings and are confident in

the potential of this molecule.

FINANCIAL REVIEW (INCLUDING POST PERIOD EVENTS)

The loss for the year to 30 June 2023 was GBP3.2 million after

tax (2022: GBP2.2 million), in line with market expectations and

reflecting the increased costs associated with setting up and

commencing clinical studies with SDC-1801.

Sareum had a cash position of GBP1.0 million as at 30 June 2023

(cash of GBP 2.9 million as at 31 December 2022 and GBP4.3 million

as at 30 June 2022).

In August 2023, after the period end, Sareum agreed terms on an

Equity Prepayment Facility of up to GBP5.0 million with RiverFort.

The Company received an initial deposit of GBP2.0 million, net of

associated costs, on 4 August 2023.

The Company intends to use the Facility, if fully drawn,

together with the receipt of anticipated tax credits to the amount

of GBP1.6 million (of which GBP0.4m was received from the

Australian government post period end), to complete the Phase 1a/b

clinical development of the Company's lead candidate SDC-1801,

which is expected to be a primary catalyst for driving shareholder

value, and for general working capital to Q4 2024.

OUTLOOK

Sareum is focused on progressing the Phase 1 trial of its lead

clinical programme, SDC-1801. This trial moved into the MAD part of

the Phase 1a trial in August 2023 and dose escalation continues in

the SAD.

Initial safety data from the Phase 1a trial are expected to be

available in 1H 2024. Subject to satisfactory safety, additional

funding and relevant regulatory and recruitment preparations, we

plan to commence a Phase 1b trial of SDC-1801 in psoriasis patients

shortly thereafter, with a readout from this part of the study

expected by the end of 2024.

The continued good progress of the Phase 1a trial and our

supporting preclinical work, combined with growing commercial and

scientific momentum building around the TYK2/JAK1 class, underpins

our continued confidence around the commercial potential for this

molecule.

We continue to advance translational studies for SDC-1802, which

we believe has attractive potential in cancer immunotherapy.

The Board and management of Sareum continue to apply a rigorous

approach to capital allocation to the development of our assets,

particularly in the current challenging economic environment, and

maintain a clear focus on bringing these medicines to patients as

efficiently as possible, while maximising value for

shareholders.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 JUNE 2023

Note 2023 2022

GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue - -

Administrative expenses (4,048) (2,577)

Share of loss of associates (18) (3)

-------------- --------------

OPERATING LOSS (4,066) (2,580)

Finance income 4 41 1

LOSS BEFORE TAXATION 5 (4,025) (2,579)

Taxation 6 833 407

LOSS FOR THE YEAR (3,192) (2,172)

TOTAL COMPREHENSIVE EXPENSE FOR THE

YEAR (3,192) (2,172)

Loss attributable to owners of the

parent (3,192) (2,172)

======== ========

Total comprehensive income attributable

to owners of the parent (3,192) (2,172)

Basic and diluted loss per share expressed

in pence per share 7 (4.7) (3.2)

The accompanying notes form part of these financial

statements.

CONSOLIDATED BALANCE SHEET

30 JUNE 2023

Note 2023 2022

GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 8 1 2

Investment in associate 9 46 23

47 25

CURRENT ASSETS

Trade and other receivables 10 979 500

Cash and cash equivalents 11 994 4,261

1,973 4,761

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 12 (867) (455)

NET CURRENT ASSETS 1,106 4,306

NET ASSETS 1,153 4,331

SHAREHOLDERS' EQUITY

Called up share capital 15 851 851

Share premium 16 20,925 20,925

Share-based compensation

reserve 16 325 325

Foreign exchange reserve 16 14 -

Retained earnings 16 (20,962) (17,770)

TOTAL EQUITY 1,153 4,331

The accompanying notes form part of these financial

statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 JUNE 2023

Share-based

Called up compensation

share capital Share premium reserve

GBP'000 GBP'000 GBP'000

Balance at 1 July 2021 833 17,235 362

Issue of share capital 18 3,690 -

Transfer for options exercised / expired - - -

Total comprehensive income - - (37)

Balance at 30 June 2022 851 20,925 325

Issue of share capital - - -

Total comprehensive income - - -

Transfer for options exercised / expired - - -

Balance at 30 June 2023 851 20,925 325

Foreign exchange Retained

reserve earnings Total equity

GBP'000 GBP'000 GBP'000

Balance at 1 July 2021 - (15,635) 2,795

Issue of share capital - - 3,708

Transfer for options exercised / expired - 37 -

Total comprehensive income - (2,172) (2,172)

Balance at 30 June 2022 - (17,770) 4,331

Issue of share capital - - -

Transfer for options exercised / expired - - -

Arising on consolidation 14 - 14

Total comprehensive income - (3,192) (3,192)

Balance at 30 June 2023 14 (20,962) 1,153

The accompanying notes form part of these financial

statements.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 30 JUNE 2023

Note 2023 2022

GBP'000 GBP'000

Cash flows from operating activities

Cash used in operations 19 (3,676) (2,349)

Tax received 409 218

Net cash outflow from operating activities (3,267) (2,131)

Cash flows from investing activities

Purchase of tangible fixed assets - (3)

Investment in associate (41) -

Interest received 41 1

Net cash inflow from investing activities - (2)

Cash flows from financing activities

Share issue - 3,708

Net cash inflow from financing activities - 3,708

------------- -------------

(Decrease)/increase in cash and cash

equivalents (3,267) 1,575

Cash and cash equivalents at beginning

of year 4,261 2,686

------------ ------------

Cash and cash equivalents at end

of year 994 4,261

======= =======

The accompanying notes form part of these financial

statements.

1. BASIS OF PREPARATION

The financial statements of Sareum Holdings plc ("the Company")

have been prepared in accordance with UK-adopted international

accounting standards, and in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006, with IFRIC interpretations. On 1 January 2022

the UK-adopted IAS and EU-adopted IFRS were identical. Since this

date timing differences in endorsement have arisen, however no

amendments would be required to these financial statements if they

were prepared in accordance with EU-adopted IFRS as at 30 June

2023.

The financial statements have been prepared under the historical

cost convention.

Going concern

The Group made losses after tax of GBP3.2 million (2022: GBP2.2

million), as they continued to progress their research and

development activities. These activities, and the related

expenditure, are in line with the budgets previously set and are

funded by regular cash investments.

The Directors consider that the cash held at the year-end,

together with that subsequently received and projected to be

received, will be sufficient for the Group to meet its forecast

expenditure for at least one year from the date of signing the

financial statements. If there is a shortfall the Directors will

implement cost savings to ensure that the cash resources last for

this period of time.

For these reasons the financial statements have been prepared on

a going concern basis.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries and an associate, together, "the Group") made up

to 30 June each year. Control is achieved where the Company has the

power to govern the financial and operating policies of another

entity or business, so as to obtain benefits from its activities.

The consolidated financial statements present the results of the

Company and its subsidiary as if they formed a single entity.

Inter-company transactions and balances between group companies are

eliminated on consolidation.

2. ACCOUNTING POLICIES

The principal accounting policies applied are set out below.

Property, plant and equipment

Depreciation is provided on a straight-line basis over three

years in order to write off each asset over its estimated useful

life.

Financial instruments

Financial instruments are classified and accounted for,

according to the substance of the contractual arrangement, as

either financial assets, financial liabilities or equity

instruments. An equity instrument is any contract that evidences a

residual interest in the assets of the Company after deducting all

of its liabilities.

Cash and cash equivalents

Cash and cash equivalents comprise cash in hand and demand

deposits and other short term highly liquid investments that are

readily convertible to a known amount of cash and are subject to

insignificant risk of change in value.

Pension contributions

The Group does not operate a pension scheme for the benefit of

its employees but instead makes contributions to their personal

pension plans. The contributions due for the period are charged to

the profit and loss account.

Employee share schemes

The Group has in place a share option scheme for employees,

which allows them to acquire shares in the Company. Equity settled

share-based payments are measured at fair value at the date of

grant. The fair value of options granted is recognised as an

expense spread over the estimated vesting period of the options

granted. Fair value is measured using the Black-Scholes model,

taking into account the terms and conditions upon which the options

were granted.

Research and development

Expenditure on research and development is written off in the

year in which it is incurred.

Research expenditure is written off in the period in which it is

incurred. Development expenditure incurred is capitalised as an

intangible asset only when all of the following criteria are

met:

- It is technically feasible to complete the intangible asset so

that it will be available for use or sale;

- There is the intention to complete the intangible asset and use or sell it;

- There is the ability to use or sell the intangible asset;

- The use or sale of the intangible asset will generate probable future economic benefits;

- There are adequate technical, financial and other resources

available to complete the development and to use or sell the

intangible asset; and

- The expenditure attributable to the intangible asset during

its development can be measured reliably.

Expenditure that does not meet the above criteria is expensed as

incurred.

Taxation

Current taxes are based on the results shown in the financial

statements and are calculated according to local tax rules, using

tax rates enacted or substantially enacted by the balance sheet

date.

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed at the balance sheet date

where transactions or events have occurred at that date that will

result in an obligation to pay more, or a right to pay less or to

receive more tax, with the following exception:

Deferred tax is measured on an undiscounted basis at the tax

rates that are expected to apply in the periods in which timing

differences reverse, based on the tax rates and laws enacted or

substantively enacted at the balance sheet date. Deferred tax

assets are recognised only to the extent that the Directors

consider that it is more likely than not that there will be

suitable taxable profits from which the future reversal of the

underlying timing differences can be deducted.

Revenue recognition

Revenue is measured as the fair value of the consideration

received or receivable in the normal course of business, net of

discounts, VAT and other sales related taxes and is recognised to

the extent that it is probable that the economic benefits

associated with the transaction will flow to the Group. Revenues

from licensing agreements are recognised in line with the

performance obligations being met, as outlined in the terms of the

agreement. Grant income is recognised as earned based on

contractual conditions, generally as expenses are incurred. Such

income is recognised as Other Operating Income.

Critical accounting estimates and areas of judgement

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances. Actual results may differ from these estimates. The

estimates and assumptions that have the most significant effects on

the carrying amounts of the assets and liabilities in the financial

information are considered to be research and development costs and

equity settled share-based payments.

Investment in associates

An associate is an entity over which the Company has significant

influence. Significant influence is the power to participate in the

financial and operating policy decisions of the Investee but is not

control or joint control over those policies. Investments in

associates are accounted for using the equity method, whereby the

investment is initially recognised at cost and adjusted thereafter

for the post-acquisition change in the associate's net assets with

recognition in the profit and loss of the share of the associate's

profit or loss.

Impairment of assets

At the date of the statement of financial position, the Group

reviews the carrying amounts of its non-current assets to determine

whether there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any).

Recoverable amount is the higher of fair value less cost to sell

and value in use. In assessing value in use, the estimated future

cash flows are discounted to their present value using a pre-tax

discount rate that reflects current market assessments of the time

value of money and the risks specific to the asset for which the

estimates of future cash flows have not been adjusted. If the

recoverable amount of an asset is estimated to be less than its

carrying amount, the carrying amount of the asset is reduced to its

recoverable amount. An impairment loss is recognised as an expense

immediately, unless the relevant asset is carried at a revalued

amount, in which case the impairment loss is treated as a

revaluation decrease.

New or revised accounting standards

Certain new accounting standards and interpretations have been

published that are not mandatory for 30 June 2023 reporting periods

and have not been early adopted by the Company or the Group. These

standards are not expected to have a material impact on the entity

in the current or future reporting periods and on foreseeable

future transactions.

3. EMPLOYEES AND DIRECTORS

2023 2022

GBP'000 GBP'000

Directors' remuneration

Directors' emoluments 523 450

Directors' pension contributions to money

purchase schemes 29 26

GBP'000 GBP'000

Remuneration of the highest paid

Director

Directors' emoluments 193 175

Director's pension contributions to money

purchase schemes 15 14

There are two (2022: two) Directors who are members of third

party held money purchase retirement benefits schemes.

Average monthly number of persons Number Number

employed

Office and management 4 4

Research 1 1

5 5

GBP'000 GBP'000

Staff costs during the year

Wages and salaries 520 450

Social security costs 71 48

Pension costs 29 26

620 524

4. NET FINANCE INCOME

2023 2022

GBP'000 GBP'000

Deposit account interest 41 1

5. LOSS BEFORE INCOME TAX

The loss before income tax is stated 2023 2022

after charging: GBP'000 GBP'000

Depreciation - owned assets 1 2

Research and development 2,909 1,780

Other operating leases 21 19

Foreign exchange differences 24 6

Auditor's remuneration 16 13

Auditor's remuneration for non-audit work

- taxation services - 1

* other work - -

6. INCOME TAX

2023 2022

GBP'000 GBP'000

Current tax

Adjustment to prior years - (1)

Overseas taxation credit 395 -

UK corporation tax credit on losses for the

period 438 408

------------ ------------

833 407

The credit for the year can be reconciled to 2023 2022

the accounting loss as follows: GBP'000 GBP'000

Loss before tax (3,192) (2,579)

Notional tax credit at average rate of 20.5%

(2022: 19%) 825 490

Effects of:

Capital allowances more than depreciation - 7

Other timing differences (234) (1)

Unutilised tax losses (293) (258)

Losses surrendered for research and development

tax credits (298) (239)

Research and development tax credits claimed 833 408

Actual current tax credit in the year 833 407

The tax rate of 20.5% used above is the average corporation tax

rate applicable in the United Kingdom.

A potential deferred tax asset as at 30 June 2023 of GBP2.8

million (2022: GBP2.8 million) calculated using the expected

corporation tax rate of 25% (2022: 25%), has not been recognised,

as there remains a significant degree of uncertainty that the Group

will make sufficient profits in the foreseeable future to justify

recognition.

7 EARNINGS PER SHARE

The calculation of loss per share is based 2023 2022

on the following data:

Loss on ordinary activities after tax GBP3,192,000 GBP2,172,000

Weighted average number of shares in issue 68,069,416 67,679,329

Basic and diluted loss per share (pence) (4.7) (3.2)

As the Group has generated a loss for the period, there is no

dilutive effect in respect of share options.

8. PROPERTY PLANT & EQUIPMENT

Fixtures

and computers

GBP'000

Cost

At 1 July 2022 and 30 June 2023 13

Depreciation

At 1 July 2022 11

Charge for the year 1

At 30 June 2023 12

Carrying amount

At 30 June 2022 1

=======

At 30 June 2023 2

9. INVESTMENTS

Interest in

associate

GBP'000

Cost

At 1 July 2022 1,176

Additions 41

At 30 June 2023 1,217

Provision for impairment

At 1 July 2022 1,153

Impairment for year 18

At 30 June 2023 1,171

Net book value

At 30 June 2022 46

At 30 June 2023 23

The investment in associate represents the investment by the

Group in the partnership with the Cancer Research Technology

Pioneer Fund to advance the SRA737 programme and has been accounted

for using the equity method. Sareum's interest in the associate

partnership is 27.5%. As at 30 June 2023 the partnership had net

assets of GBP19,000 (2022: GBP83,000) and had incurred cumulative

losses of GBP0.8 million (2022: GBP0.7 million).

10. TRADE AND OTHER RECEIVABLES

2023 2022

GBP'000 GBP'000

Amounts falling due within one year:

Corporation tax 823 408

Other taxation receivable 75 47

Prepayments and accrued income 81 45

979 500

11. CASH AND CASH EQUIVALENTS

2023 2022

GBP'000 GBP'000

Bank deposit accounts 994 4,261

12. TRADE AND OTHER PAYABLES

Group

2023 2022

GBP'000 GBP'000

Amounts falling due within one year:

Trade creditors 694 387

Social security and other taxes 22 18

Other creditors 5 5

Accrued expenses 146 45

867 455

Trade payables and accruals principally comprise amounts

outstanding for trade purchases and ongoing costs. The average

credit term agreed with suppliers is 30 days and payment is

generally made within the agreed terms.

13. LEASING AGREEMENTS

The lease on the office occupied by the Company is of low value,

expiring in December 2023. The rent payments in the year are also

not material to the financial statements.

14. FINANCIAL INSTRUMENTS

The Group's principal financial instruments are trade and other

receivables, trade and other payables and cash. The main purpose of

these financial instruments is to finance the Group's ongoing

operational requirements. The Group does not trade in derivative

financial instruments.

The major financial risks faced by the Group, which remained

unchanged throughout the year, are interest rate risk, foreign

exchange risk and liquidity risk. Policies for the management of

these risks are shown below and have been consistently applied.

MARKET RISKS

Interest rate risk

The Group is exposed to interest rate risk as cash balances in

excess of immediate needs are placed on short term deposit. The

Group seeks to optimise the interest rates received by continuously

monitoring those available. The value of the Group's financial

instruments is not considered to be materially sensitive to these

risks and therefore no sensitivity analysis has been provided.

Foreign exchange risk

The Group's activities expose it to fluctuations in the exchange

rate for the Euro and the US dollar. Funds are maintained in

sterling and foreign currency is acquired on the basis of committed

expenditure. The value of the Group's financial instruments is not

considered to be materially sensitive to these risks and therefore

no sensitivity analysis has been provided.

NON-MARKET RISKS

Liquidity risk

The Board has responsibility for reducing exposure to liquidity

risk and ensures that adequate funds are available to meet

anticipated requirements from existing operations by a process of

continual monitoring. The value of the Group's financial

instruments is not considered to be materially sensitive to these

risks and therefore no sensitivity analysis has been provided.

15. SHARE CAPITAL

Called up, allotted and fully paid 2023 2022

GBP GBP

68,069,416 (2022: 68,069,416) Ordinary Shares

of 1.25p each 850,867 850,867

The Ordinary Shares carry equal rights in respect of voting at a

general meeting of shareholders, payment of dividends and return of

assets in the event of a winding up.

16. RESERVES

Reserve Description and purpose

Share capital Amount of the contributions made by shareholders

in return for the issue of shares.

Share premium Amount subscribed for share capital in

excess of nominal value.

Retained earnings Cumulative net gains and losses recognised

in the consolidated and the Company Balance

Sheet.

Foreign exchange reserve Arising on consolidation of the overseas

subsidiary

Share-based compensation Cumulative fair value of share options

reserve granted and recognised as an expense

in the Income Statement.

Details of movements in each reserve are set out in the

Consolidated Statement of Changes in Equity.

17. PENSION COMMITMENTS

The Group makes contributions to its employees' own personal

pension schemes. The contributions for the period of GBP29,000

(2022: GBP26,000) were charged to the profit and loss account. At

the balance sheet date contributions of GBP5,000 (2022: GBP4,000)

were owed and are included in creditors.

18. CONTINGENT LIABILITIES

There are no contingent liabilities (2022: GBPnil).

19. RECONCILIATION OF LOSS BEFORE INCOME TAX TO CASH GENERATED FROM OPERATIONS

Group 2023 2022

GBP'000 GBP'000

Operating loss from continuing operations (4,024) (2,580)

Adjustments for:

Depreciation 1 2

Share of loss of associate 18 3

Foreign exchange differences 24 -

Finance income (41) (1)

Operating cash flows before movements in

working capital (4,022) (2,576)

Decrease/(increase) in receivables (65) 56

Increase in payables 411 171

Cash used in operations (3,676) (2,349)

======= =======

20. POST BALANCE SHEET EVENTS

In August 2023, after the period end, Sareum agreed terms on an

Equity Prepayment Facility (the "Facility") of up to GBP5.0 million

with RiverFort Global Opportunities PCC Ltd and received an initial

deposit of GBP2.0 million, net of associated costs, on 4 August

2023.

The Company intends to use the Facility, if fully drawn,

together with the receipt of anticipated tax incentives to the

amount of GBP1.6 million (of which GBP0.4m was received in

Australia in September 2023), to complete the Phase 1a/b clinical

development of the Group's lead candidate SDC-1801

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFESIVLRIIV

(END) Dow Jones Newswires

October 09, 2023 02:00 ET (06:00 GMT)

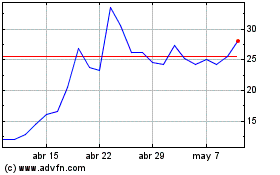

Sareum (LSE:SAR)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Sareum (LSE:SAR)

Gráfica de Acción Histórica

De May 2023 a May 2024