TIDMSBSI

RNS Number : 2158X

Schroder BSC Social Impact Trust

19 December 2023

Schroder BSC Social Impact Trust plc

Q3 2023 Quarterly Net Asset Value - 30 September 2023

The Board of Schroder BSC Social Impact Trust plc (the

"Company"), which provides a unique investment opportunity to help

address UK social challenges, today announces its unaudited net

asset value ("NAV") as of 30 September 2023.

Key Highlights

-- NAV of GBP87.8m or 104.22p per share as of 30 September 2023,

a decrease of 0.65% relative to the NAV per share as of 30 June

2023 (104.90p).

o The High Impact Portfolio detracted 0.56p from returns, mainly

due to a valuation reduction of an investment in the Bridges

Evergreen portfolio, partially offset by income and some capital

gains from the other High Impact investments, which continued to

perform in line with their respective targets.

o The Liquidity Assets portfolio contributed 0.13p to NAV /

share.

o Fees and expenses accounted for 0.31p per share for the

quarter (equivalent to an ongoing charges ratio of 1.19% annualised

/ FY2023 OCR: 1.27% ).

o Share buy-backs were slightly accretive to NAV / share in the

period.

-- Total NAV/share return since inception of 7.91%.

-- As of 30 September 2023, 96% of our capital was committed to

High Impact Investments, and 84% was deployed. During the

quarter:

o GBP0.9m of capital was drawn down during the quarter, mainly

into Debt and Equity for Social Enterprises investments via the

Charity Bank co-investments and capital recycled into the Community

Investment Fund (CIF).

o GBP1.9m of capital was repaid, mainly via distributions from

the Social Outcomes Contracts portfolio and a net distribution from

the Community Investment Fund (CIF).

For further information, please contact:

Schroders

Augustine Chipungu (Press) 0207 658 2016

Kerry Higgins (Schroder Investment

Management Limited, Company Secretary) 0207 658 6189

Big Society Capital

Emma Hickinbotham, Ehickinbotham@bigsocietycapital.com

Managing Director, Communications

Winterflood Securities Limited 020 3100 0000

Neil Langford

About Schroder BSC Social Impact Trust plc

The Company was launched in December 2020, with the objective to

enable access to high social impact investment opportunities in

private markets - tackling social challenges across the UK. The

Company aims to build a diversified portfolio across asset classes,

targeting sustainable returns, demonstrable social impact, and low

correlation to traditional public markets.

Further information about the Company can be found on its

website at www.schroders.com/SBSI

About Big Society Capital

Big Society Capital is the UK's leading social impact investor.

Our mission is to grow the amount of money invested in tackling

social issues and inequalities in the UK. We do this by investing

our own capital and helping others invest for impact too.

Since 2012, we have helped build a market that has directed over

GBP9 billion into social purpose organisations tackling issues from

homelessness and mental health, to childhood obesity and fuel

poverty, a more than ten-fold increase.

Further information about Big Society Capital can be found at www.bigsocietycapital.com

About Schroders plc

Schroders is a global investment management firm with GBP726.1

billion (EUR846.1 billion; $923.1 billion) assets under management,

as at 30 June 2023. Schroders continues to deliver strong financial

results in ever challenging market conditions, with a market

capitalisation of circa GBP7 billion and over 6,100 employees

across 38 locations. Established in 1804, the founding family

remains a core shareholder, holding approximately 44% of Schroders'

shares.

Schroders has benefited from a diverse business model by

geography, asset class and client type. It offers innovative

products and solutions across four core growing business areas;

asset management, solutions, Schroders Capital (private assets) and

wealth management. Clients include insurance companies, pension

schemes, sovereign wealth funds, high net worth individuals and

foundations. Schroders also manages assets for end clients as part

of its relationships with distributors, financial advisers and

online platforms.

Schroders aims to provide excellent investment performance to

clients through active management. It also channels capital into

sustainable and durable businesses to accelerate positive change in

the world. Schroders' business philosophy is based on the belief

that if we deliver for clients, we will deliver for our

shareholders and other stakeholders.

Issued by Schroder Investment Management Limited. Registration

No 1893220 England. Authorised and regulated by the Financial

Conduct Authority. For regular updates by e-mail please register

online at www.schroders.com for our alerting service.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVVVLFFXLLZFBQ

(END) Dow Jones Newswires

December 19, 2023 02:00 ET (07:00 GMT)

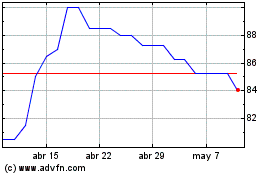

Schroder Bsc Social Impact (LSE:SBSI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Schroder Bsc Social Impact (LSE:SBSI)

Gráfica de Acción Histórica

De May 2023 a May 2024