TIDMSEPL

RNS Number : 9812C

Seplat Energy PLC

28 February 2022

Please see the Full Audited Results in attached PDF

http://www.rns-pdf.londonstockexchange.com/rns/9812C_1-2022-2-28.pdf

Seplat Energy Plc

Audited results for the year ended 31 December 2021

Lagos and London, 28 February 2022: Seplat Energy Plc ("Seplat

Energy" or "the Company"), a leading Nigerian independent energy

company listed on both the Nigerian Exchange Limited and the London

Stock Exchange, announces its audited results for the full year

ended 31 December 2021.

Operational highlights

-- Strong safety record extended, 28 million hours without LTI

from Seplat Energy operated assets

-- Delivered robust performance against challenging year for Nigerian

oil & gas industry

-- Working interest production averaged 47,693 boepd, impacted

by August and December FOT shut ins

-- Completed nine wells: five oil and four gas wells

-- Eland's OML 40: four wells drilled at a total gross cost of

US$60million, now delivering 15.5 kbopd (gross)

-- Sibiri exploration on OML40 drilled to TD in February with initial

indications it has encountered eight oil bearing reservoirs

with 353 ft of gross hydrocarbon pay, net pay of 229 ft; further

data acquisition and analysis are underway

Financial highlights

-- Revenues up 38% to $733 million ($747 million including $14

million underlift)

-- Adjusted EBITDA up 40% to $372 million,

-- Strong cash generation of $394 million against capex of $137

million (excluding cost of rig acquisitions)

-- Strong balance sheet with $341 million cash at bank, net debt

of $426 million and

-- Q4 dividend of US2.5 cents per share recommended

Corporate updates

-- Name changed to Seplat Energy to reflect evolving strategy

-- Proposed $1.28 billion MPNU acquisition adds transformational

shallow water portfolio with dedicated export routes

-- AEP mechanically completed in January, hydrocarbons introduced

into line as part of commissioning process,

commercial agreements to enable production into terminal being

finalised; injection expected in March

-- ANOH project mechanical completion expected H2 2022 (84% complete

at present, all materials in country), however delays to third-party

spur line likely to delay first gas to H1 2023

-- Related party transactions eliminated from 1 January 2022

Outlook for 2022 (excluding MPNU)

-- Production guidance of 50-60 kboepd, capex expected to be $160

million

-- MPNU next steps: focus on government approvals and transition

planning, completion expected H2

Roger Brown, Chief Executive Officer, said:

"Seplat Energy announced a major acquisition last week and

despite a challenging year for Nigerian oil and gas, the robust

results delivered today clearly show how our increasing financial

strength has made such an acquisition possible, without the need to

dilute shareholders, by giving international financial partners the

confidence to invest in our vision.

The addition of MPNU nearly trebles our production and doubles

our reserves on a pro forma 2020 basis, reinforcing our leadership

of Nigeria's indigenous energy sector and enabling us to generate

strong future cash flows that will underpin our investment in

Nigeria's energy transition and improve our overall stakeholder

returns.

Our 2021 performance was affected by outages at Forcados

Terminal that will no longer have such an impact when we switch to

the new Amukpe-Escravos Pipeline, which we expect to launch in

March. This is part of our strategy to diversify and derisk routes

to market, assuring higher revenues from significantly better

uptime and lower reconciliation losses. Furthermore, once we have

completed our acquisition of MPNU, we will add significant

production from offshore assets with dedicated export terminals

that also have higher availability and lower reconciliation

losses.

The addition of MPNU offers a significant undeveloped gas

resource base which, alongside our ANOH gas project development,

will underpin Nigeria's energy transition and drive domestic and

export revenues when developed.

Our financial strength is matched by the skills and ambitions of

our staff and we look forward to welcoming more than a thousand

highly trained colleagues from MPNU and working with them to ensure

their smooth onboarding into Seplat Energy. Together we will build

a sustainable, world-class company that generates attractive

returns for stakeholders and delivers energy transition for one of

the world's largest and most rapidly growing populations."

Summary of performance

$ million billion

------------------ --------- ------------------

FY 2021 FY 2020 % change FY 2021 FY 2020

-------- -------- --------

Revenue 733.2 530.5 38.2% 293.6 190.9

Gross profit 285.2 124.6 128.9% 114.2 44.8

Impairment of assets * 36.6 (144.3) 125.4% 14.6 (51.9)

EBITDA ** 371.8 265.8 39.9% 146.8 95.7

Operating profit (loss) 250.7 (31.7) 890.9% 100.4 (11.4)

Profit (loss) before tax 177.3 (80.2) 321.1% 71.0 (28.9)

Cash generated from operations 394.3 329.4 19.7% 157.9 118.6

Working interest production (boepd) 47,693 51,183 (6.8)%

Average realised oil price ($/bbl) 70.54 39.95 76.6%

Average realised gas price ($/Mscf) 2.85 2.87 (0.7)%

===================================== ======== ======== ========= ======== ========

* FY 2021 includes reversal of $74.7m impairment charge under

IAS 36; FY 2020 includes $114.4m impairment charge under IAS36

** Adjusted for impairment, fair value loss and

decommissioning

Responsibility for publication

The person responsible for arranging the release of this

announcement on behalf of Seplat Energy is

Emeka Onwuka, CFO, Seplat Energy Plc.

Signed:

Mr. Emeka Onwuka

Chief Financial Officer

Investor call

At 09:00 GMT / 10.00 WAT on Monday 28 February 2022, the

Executive Management team will host a conference call and webcast

to present the Company's results.

The presentation can be accessed remotely via a live webcast

link and pre-registering details are below. After the meeting, the

webcast recording will be made available and access details of this

recording are also set out below.

A copy of the presentation will be made available on the day of

results on the Company's website at https://seplatenergy.com/ .

Event title: Seplat Energy Plc: Full year results

Event date 9:00am (London) 10:00am (Lagos) Monday 28 February 2022

Webcast Live Event Link https://secure.emincote.com/client/seplat/seplat012

Conference call and pre-register Link: https://secure.emincote.com/client/seplat/seplat012/vip_connect

Archive Link: https://secure.emincote.com/client/seplat/seplat012

======================================= ================================================================

The Company requests that participants dial in 10 minutes ahead

of the call. When dialling in, please follow the instructions that

will be emailed to you following your registration.

Enquiries:

Seplat Energy Plc

Emeka Onwuka, Chief Financial Officer +234 1 277 0400

Carl Franklin, Head of Investor Relations

Ayeesha Aliyu, Investor Relations

Chioma Nwachuku, Director External Affairs & Sustainability

============================================================= ================================

FTI Consulting

Ben Brewerton / Christopher Laing +44 203 727 1000

seplatenergy@fticonsulting.com

============================================================= ================================

Citigroup Global Markets Limited

Tom Reid / Luke Spells +44 207 986 4000

============================================================= ================================

Investec Bank plc

Chris Sim / Jarrett Silver +44 207 597 4000

============================================================= ================================

Notes to editors

Seplat Energy Plc is Nigeria's leading indigenous energy

company. It is listed on the Nigerian Exchange Limited (NGX:

SEPLAT) and the Main Market of the London Stock Exchange (LSE:

SEPL).

Seplat Energy is pursuing a Nigeria-focused growth strategy

through participation in asset divestments by international oil

companies, farm-in opportunities, and future licensing rounds. The

Company is a leading supplier of gas to the domestic power

generation market. For further information please refer to the

Company website, http://seplatenergy.com/

Important notice:

The information contained within this announcement is unaudited

and deemed by the Company to constitute inside information as

stipulated under Market Abuse Regulations. Upon the publication of

this announcement via Regulatory Information Services, this inside

information is now considered to be in the public domain

Certain statements included in these results contain

forward-looking information concerning Seplat Energy's strategy,

operations, financial performance or condition, outlook, growth

opportunities or circumstances in the countries, sectors, or

markets in which Seplat Energy operates. By their nature,

forward-looking statements involve uncertainty because they depend

on future circumstances and relate to events of which not all are

within Seplat Energy's control or can be predicted by Seplat

Energy. Although Seplat Energy believes that the expectations and

opinions reflected in such forward-looking statements are

reasonable, no assurance can be given that such expectations and

opinions will prove to have been correct. Actual results and market

conditions could differ materially from those set out in the

forward-looking statements. No part of these results constitutes,

or shall be taken to constitute, an invitation or inducement to

invest in Seplat Energy or any other entity and must not be relied

upon in any way in connection with any investment decision. Seplat

Energy undertakes no obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise, except to the extent legally required.

Operating review

HSE performance

Safe and responsible operations are critical to the delivery of

Seplat Energy's strategy. Staff and contractors worked a total of

8.0 million man-hours with no fatalities, lost-time injuries, or

major injuries in the period.

The Company has achieved 28 million hours without LTI on its

operated assets. There were 88 HSE incidents in total, compared to

107 in 2020, including two reportable spills and six gas leaks, all

of which were remediated with limited environmental impact. The

Group established appropriate processes and safeguards for its

people and operations against Covid-19.

By the end of December, we had conducted 14,319 Covid-19 tests,

with a positivity rate of 3.3%. We have a vaccination policy for

Covid-19 management and continue to enforce all Covid-19 control

protocols at our field operations and offices, with no major

Covid-19 related incidents.

Reserves

Seplat Energy's portfolio comprises direct interests in seven

oil and gas blocks and a revenue interest in one other block. This

portfolio provides us with a robust platform of oil and gas

reserves and production capacity, as well as material upside

opportunities to add reserves through future development.

Working interest reserves for the 2021 financial year

2P reserves at 31/12/2021 2P reserves at 31/12/2020

------------------------------ ------------------------------

Liquids(1) Gas Total Liquids Gas Total

-----------

Seplat % MMbbl Bscf MMboe MMbbl Bscf MMboe

================= ============== ============== ===== ======= =========== ======= ========

OMLs 4, 38 & 41 45% 144 651 256 156 693 275

OPL 283 40% 5 68 17 5 66 17

OML 53 40% 39 660 153 44 742 172

OML 55 Fin. interest 4 - 4 5 0 5

OML 40 45% 25 - 25 27 0 27

Ubima 82% 2 - 2 4 0 4

----------------- -------------- -------------- ----- ------- ----------- ------- --------

Total 219 1379 457 241 1501 499

-------------- -------------- ----- ------- ----------- ------- --------

1. Eland has a 45% working interest in OML40 until the Westport

loan is fully repaid in accordance with the loan agreement,

reverting to 20.25%.

2. Eland has an 82% Working Interest in the Ubima marginal field

until the carry has been reached, reverting to 40%.

At 31 December 2021, total working interest 2P reserves, as

assessed independently by Ryder Scott Company, L.P., stood at 457.1

MMboe, comprising 219.2 MMbbls of oil and condensate and 1,379.4

Bscf of natural gas (237.8 MMboe). The change represents an organic

decrease in overall 2P reserves of 8.4% year-on-year, due to

production of 10.6 MMbbls of liquids and 39.3 Bscf of gas, and

reclassification and revisions of previous estimates.

2C resources at 31/12/2021 2C resources at 31/12/2020

-------------------------------- -------------------------------

Liquids(1) Gas Total Liquids Gas Total

------------

Seplat % MMbbl Bscf MMboe MMbbl Bscf MMboe

================= ========= =============== ====== ======= ============ ======= ========

OMLs 4, 38 & 41 45% 28 162 56 48 167 77

OPL 283 40% 4 21 8 4 21 8

OML 53 40% 4 14 6 3 15 6

OML 40 45% 3 0 3 3 0 3

Ubima 82% 2 0 2 1 0 1

----------------- --------- --------------- ------ ------- ------------ ------- --------

Total 41 197 75 60 203 95

--------- --------------- ------ ------- ------------ ------- --------

Working interest 2C resources stood at 74.9 MMboe, comprising

40.9 MMbbls of oil and condensate and 197.1 Bscf of natural gas

compared to 94.8 MMboe in 2020. The 21.1% decrease is mostly due to

the inability to prove producibility in Mosogar following the

unsuccessful Drill Stem Test (DST). Consequently, the Group's

working interest 2P reserves and 2C resources stood at 531.9 MMboe

at 31 December 2021, comprising 260.1 MMbbls oil and condensate and

1,576.5 Bscf of natural gas (197 MMboe).

Production

Our oil and gas assets are in the onshore land and swamp areas

of the prolific Niger Delta in Nigeria. Principal areas of

production are Edo, Delta, Imo and Rivers States with evacuation

for export through the Forcados, Bonny and Brass oil terminals.

Seplat Energy has significant opportunities within its reserves

base to grow production and extend field life through infill

drilling, well intervention programmes, and innovation through

technology deployment.

Working interest production for the 2021 financial year

2021 2020

----------------------------------- ----------------------------

Liquids(1) Gas Total Liquids Gas Total

--------

Seplat % bopd MMscfd boepd bopd MMscfd boepd

================= ========= =========== ========== ========== ======== ======= =========

OMLs 4, 38 & 41 45.0% 18,243 107.9 36,844 21,249 101 38,718

OPL 283 40% 1,012 - 1,012 970 - 970

OML 53 40% 3,164 - 3,164 2,639 - 2,639

OML 40 45% 5,923 - 5,923 7,884 - 7,884

Ubima 82% 749 - 749 971 - 971

----------------- --------- ----------- ---------- ---------- -------- ------- ---------

Total 29,091 107.9 47,693 33,714 101 51,183

--------- ----------- ---------- ---------- -------- ------- ---------

Liquid production volumes as measured at the LACT unit for OMLs

4, 38 and 41; OML 40 and OPL 283 flow station.

Volumes stated are subject to reconciliation and may differ from

sales volumes within the period.

Full-year total working interest production for 2021 averaged

47,693 boepd. Within this, liquids production was down 13.7%

year-on-year. Delays in replacing the MT Harcourt storage vessel on

OML40 reduced exports from the asset in the first quarter of 2021.

In addition, volumes were impacted by decreased production from the

Western Assets owing to the disruption caused by the suspension of

exports at the Forcados Oil Terminal (FOT) for significant periods

in the year. The impact of unplanned downtime in the second half of

the year amounted to a deferment of working interest production of

c.1.0 MMbbls of oil from OMLs 40, 4, 38 and 41. There was a 75%

production uptime for the Trans Forcados System during the year.

The impact of future FOT outages will be alleviated by our use of

the new Amukpe-Escravos Pipeline, the launch of which is imminent

following mechanical completion and introduction of hydrocarbons,

with only commercial agreements pending.

Gas volumes were up 6.9% year-on-year to 107.9 MMscfd.

Drilling activities

During the period, we drilled and completed eight wells, with an

additional well completed early January 2022.

In OML 4 we completed the Oben-50 and Oben-51 gas wells, which

are now producing at a combined gross rate of

c. 60 MMscfd of gas and 4,000 bpd of condensates. We also

completed the workover of Oben-44 and 46 gas wells in the fourth

quarter with combined gross production rate of 70 MMscfd and 1,200

bpd.

In OPL 283, the Umuseti-07 well was successfully completed in

August and is producing ca.2,000 bopd gross.

The three-well Gbetiokun drilling campaign was completed ahead

of schedule with cost savings of 25%, achieved through efficient

execution, underpinned by the optimisation of drilling parameters

and logistics. The wells were drilled in tandem and batch drilled.

The Gbetiokun-06, 07 and 08 wells have commenced production, with

gross production of approximately 12,000 bopd combined. An

additional well, Gbetiokun-09, was drilled in December 2021, hooked

up in January 2022 and is producing approximately 3,500 bopd gross.

Given the strong production of the new Gbetiokun wells, we deployed

a larger evacuation vessel, MT Hampden, in November to improve

evacuation of crude.

Project activities associated with preparation for drilling the

high-impact, near-field Sibiri (formerly Amobe) exploration well in

OML 40 were completed in 2021 and the well was drilled in Q1 2022.

The well has been drilled to TD, with initial indications it has

encountered eight oil-bearing reservoirs with 353 ft of gross

hydrocarbon pay, net pay of 229 ft. Further data acquisition and

analysis on the well is underway.

Despite persistent adverse weather, we progressed preparation of

the Owu appraisal well in OML 53. However, the two wells (OHS KBAM1

and Owu appraisal) planned for OML 53 in 2021 were deferred to 2022

due to partner recommendation and rig contracting challenges.

We continue to exercise discretion over drilling investments and

selectively consider opportunities in our existing portfolio with a

view to capturing the highest cash return investment opportunities,

whilst diligently preserving a liquidity buffer.

Focus on asset integrity

At the core of Seplat Energy's operations is a focus on asset

integrity, process safety and maintenance culture, to ensure and

improve the safety, reliability, and availability of our

facilities. This also promotes higher revenue assurance. We are

making progress towards an ISO 55001 Certification with full

implementation of the ISO standards by 2023. As defined in our July

2021 Capital Markets Day (CMD), and as part of our commitment to

continuous improvement, Seplat Energy's goal through various

initiatives is to reduce deferment by c.120kbbl annually, which

will increase revenue assurance and profitability.

Other capital projects

As indicated in our CMD, we initiated projects targeting cost

reduction that are also expected to increase production in the long

term.

At OML 4, 38 and 41, we decommissioned the leased pumps at

Amukpe and started the installation of seven NOV pumps. The pump

replacements will reduce deferment of crude oil and improve

produced water disposal. We undertook a delivery line re-routing

project for the Sapele-Amukpe pipeline to reduce the risk of

pipeline failure on the heavily encroached right of way and

extended the life span of the pipeline. We completed and secured

5.1 km of the re-routed section and are reviewing tie-in

options.

The optimisation of the Jisike Flow Station Debottlenecking and

Gaslift Compressor Station commenced in the period to provide lift

gas for secondary recovery of crude oil from existing weak wells.

This includes an upgrade of the capacity of the flowstation from 10

kbpd to 15 kbpd to handle future increased production from the

asset and a 6 MMscfd associated gas (AG) compressor station to

optimise gas lifting of oil wells and reduce flaring.

Oil business performance

Seplat Energy's liquids (oil and condensate) operations produced

10.6 MMbbls on a working interest basis in 2021

(2020: 12.3 MMbbls). The average realised price per barrel in

the period was $70.54 (2020: $39.95), following a recovery of Brent

prices on the receding threat from the Covid-19 pandemic and the

resultant return of global economic activity.

The lower-than-expected oil production for the year was

primarily due to the curtailment of production and suspension of

export operations from OMLs 4, 38, 41 and 40, after Shell Petroleum

Development Company Limited (SPDC) declared a month-long force

majeure at the Forcados Oil Terminal (FOT) on 13 August because of

a failure of the loading buoy at the FOT. This was exacerbated by a

12-day shut in of the flow stations due to technical fault at the

FOT in December. Previously, delays in siting a new storage vessel

at OML 40 to replace the MT Harcourt, which was damaged in November

2020, resulted in significantly lower volumes in the first

quarter.

In December 2020, Seplat Energy signed a Crude Purchase

Agreement (CPA) with Waltersmith Petroman Oil Limited (Waltersmith)

for the supply of between 2,000 and 4,000 bopd from existing

working interest production from the Ohaji South Field within OML

53, for Waltersmith's 5,000 bopd modular refinery at Ibigwe, in Imo

State. We commenced the supply of 2,000 bopd to the Waltersmith

Refinery in October with 172 kbbls supplied during 2021 and no

pipeline losses recorded.

OPEC+ quotas

During the period, Nigeria's quota stood at 1.6 million barrels

per day, excluding condensates. However, the country's production

has trended below allocated production, largely because of downtime

on major pipelines, crude oil theft and several operational

challenges leading to production capacity constraints in the

assets. Seplat's OPEC quota is currently 68,554 bopd for the

Western Assets and 13,007 bopd for the Eastern Assets. Seplat has

lifted below the OPEC quota for the past 6 months due to the

reasons highlighted above. Following its July meeting, OPEC+ agreed

an increased oil output of 1.8 million bopd for Nigeria, which

restores all the production cuts imposed when the Covid-19 pandemic

started in 2020. The new quota, which excludes condensates, will

take effect in 2022.

Amukpe-Escravos pipeline commissioning

Following the introduction of hydrocarbons into the pipeline in

December 2021 as part of the start-up and testing process,

mechanical completion has now been achieved and we are finalising

crude handling and offtake agreements to enable flowing of oil into

the Escravos terminal, expected in March. Oil Lifting from the

terminal will be undertaken by the terminal operator - Chevron,

expected in Q2.

The 67km, mostly underground pipeline, provides a reliable and

secure export route for liquids from Seplat Energy's major assets

OML 4, 38 and 41, connecting them with the Chevron-operated

Escravos Terminal. Until now, we have relied on the Trans Forcados

System, which has experienced numerous disruptions due to

maintenance and vandalism. The Amukpe-Escravos pipeline has a

capacity of 160,000 bpd, into which the Seplat Energy / NPDC joint

venture is entitled to inject 40,000 bpd.

Including the Warri Refinery, Seplat Energy now has access to

three independent export routes for production from OMLs 4, 38 and

41. It is our intention to utilise all three to ensure there is

adequate redundancy in evacuation routes, reducing downtime that

has adversely affected revenues over a number of years, and

significantly de-risking the distribution of products to

market.

Gas business performance

Alongside the oil business, we have also prioritised the

development and commercialisation of the substantial gas reserves

identified in our assets, to pursue new market opportunities.

Today, Seplat Energy is a leading supplier of processed natural gas

to the Nigerian domestic market, which is independent of global oil

and gas market dynamics. With 100% of volumes dedicated to

supplying key demand centres within the domestic market, our

customers include power generation companies and the National Gas

Marketing and Distribution Company, which serves the power

generation, industrial and agricultural sectors. Seplat Energy is

therefore strategically important to the security of Nigeria's

current and future gas supply.

Seplat Energy maintained a reliable and increased gas supply to

customers during the year. Working interest gas production for the

period was 107.9 MMscfd at an average selling price of $2.85/Mscf

(2020: 101 MMscfd, $2.87/Mscf). The Gas business contributed 41.2%

of the Group's volumes on a boepd basis.

Gas pricing

The price of gas for power generation (Domestic Supply

Obligation), which accounts for about 30% of our gas volumes, was

reduced from $2.50/Mscf to $2.18/Mscf in July 2021 (implemented in

August 2021) following a review of the gas pricing framework by the

Federal Government (FGN). As part of the process to stabilise the

sector, the Government has taken various measures to address

challenges with domestic gas utilisation as well as pricing and

fiscal policy issues limiting adoption. It is expected that the

lower gas price will translate to a reduced electricity tariff for

the end consumer and will improve collection for the entire value

chain, as well as stimulate growth in demand.

The regulated Domestic Supply Obligation (DSO) gas-to-power

price of $2.18/Mscf is expected to remain until a transition to a

'willing buyer/willing seller' regime in 2023 (latest 2025) for a

fully deregulated market. We have assessed the business and

economic impact of the price reduction on Seplat Energy's gas

portfolio and this price review will result in a temporary

reduction of the average weighted gas price to around $2.7/Mscf in

2022. With the FGN's "Decade of Gas" programme promoting gas as

Nigeria's transition fuel towards Net Zero, we are confident of the

growth of gas demand and a corresponding adjustment in the pricing

regime.

Oben Gas Plant

Despite the impact on oil volumes following the force majeure at

the Forcados Oil Terminal in the third quarter, disruption to gas

volumes was minimal because the associated condensate volumes were

stored in the Amukpe buffer tanks, ensuring continuity of gas

production. However, our Associated Gas (AG) station units were put

on standby due to FOT outage.

To ensure the delivery of on-specification gas to our customers,

we completed the installation of heat exchanger trains 1 and 2;

piping installation works on heat exchangers 3, 4 and 5 are ongoing

with commissioning expected in the first quarter of 2022.

Additional third-party volumes

Seplat Energy is focused on developing third-party gas

processing opportunities that can utilise the remaining processing

capacity at Oben. Securing additional volumes from counterparties

will secure long-term supplies of raw natural gas from which we can

optimise the plant's utilisation and generate tolling revenues. We

progressed discussions with targeted third-party gas producers

during the year and expect to conclude terms shortly.

Sapele Gas Plant

Work continues on the new Sapele Gas Plant with project progress

at 45%. Upon completion, the processing capacity will be 85 MMscfd.

The upgraded facility will produce gas that meets export

specifications, and the LPG processing unit module will enhance the

economics of the plant, as well as ensure that gas flaring is

eliminated.

ANOH Gas Processing Plant

We have made good progress on the ANOH plant but have seen some

delays in shipments and releasing equipment from the ports. To

date, we have achieved 84% overall project completion at the gas

plant site. Our government partner, the Nigerian Gas Company, (NGC)

is delivering the pipelines that will take the gas from ANOH to

Oben, namely the 23km spur line and the Obiafu-Obrikom-Oben (OB3)

pipeline.

The OB3 pipeline project has seen a number of failed attempts to

complete the 1.85km river crossing, which is needed to complete the

pipeline. However, the latest contractor is making progress and the

HDD drilling stands at 20% complete. We do not anticipate the OB3

pipeline to delay the completion of the overall ANOH project.

The Spur Line project has seen significant delays due to

contracting issues and payments. We have been informed that the

milling of the line pipes, which is being undertaken in China, will

now commence in Q2 and therefore will not arrive Nigeria until

later this year. The latest schedule provided by NGC shows

completion in Q4 2022 / Q1 2023.

We had earlier communicated a first gas date by mid-year 2022,

but based on our current risking, we now expect further delays of

between 9-12 months to the original timeline, with the spur line

expected to be the last piece of infrastructure delivered.

The upstream development, including the drilling of six

production wells, will be delivered by the upstream unit operator

SPDC. We expect that the two wells on which drilling commenced in

2021 will be completed this year.

Located at OML 53 (in a unitised field between Seplat JV's OML

53 and SPDC JV's OML 21), the ANOH Gas Processing Plant development

will drive the next phase of growth for Seplat Energy's core

Midstream Gas business. The 300 MMscfd midstream gas processing

plant is the most advanced of the FGN's seven critical gas projects

and is central to the National Gas Master Plan to develop and

expand the indigenous domestic gas market for additional power and

industrial projects.

The ANOH plant is being built by AGPC, which is an Incorporated

Joint Venture (IJV) owned equally between Seplat Energy and the

NGC, a wholly owned subsidiary of the Nigerian National Petroleum

Corporation ("NNPC"). In February 2021, AGPC successfully raised

$260 million in debt to fund the completion of the ANOH project.

The project is now fully funded following completion of equity

investments of $210 million by each partner ($420 million

combined). The plant construction cost is expected to be no more

than $650 million, inclusive of financing costs and taxes, which is

significantly lower than the original projected cost at Final

Investment Decision (FID) of $700 million.

Net Zero by 2050

Seplat Energy supports the goals of the Paris Agreement and is

in step with society's objective to get the world to net zero

carbon emissions by 2050, if not before. Around 90% of the

Company's Scope 1 and 2 emissions come from flaring of associated

gas. Through investments in decarbonisation projects over the next

two years, we plan to focus on maximising gas-to-grid options,

which will capture and monetise gas for productive use, drive LPG

production and put the Group on track to end routine flaring by

2024.

Aside from ending routine flares, we are investing in other ways

to decarbonise our operations such as replacing diesel with LPG or

LNG and onsite solar energy generation. Longer-term, as part of

Nigeria's energy transition, we will selectively target

opportunities in solar energy projects, which alongside our

gas-to-power developments, will be critical to providing an

alternative to Nigeria's expensive and extensive diesel generated

electricity.

Outlook and plans for 2022

Full-year production guidance for 2022 is set at 50,000 to

60,000 boepd on a working interest basis, comprising 30,000 to

35,000 bopd liquids and 116 to 150 MMscfd (20,000 to 25,000 boepd)

gas production. This guidance does not include any contribution

from MPNU and the ANOH Gas Plant.

We expect production uptime of 75% for evacuation through the

TFS and 90% for evacuation via the AEP, the latter being our

preferred export route from OMLs 4, 38, & 41.

Capital expenditure for 2022 is expected to be around $160

million. We expect to drill a minimum of ten wells, including the

Sibiri exploration well and one appraisal well, complete ongoing

projects, invest in maintenance capex to secure the existing assets

and continue investments in gas. The 2022 drilling programme is

designed to address production decline and along with completion of

maintenance activities, will support long-term production levels

from the assets. With the recovery in oil prices, rig-based and

other project activities activity will ramp-up in 2022.

Facilities and engineering projects will focus on delivery of an

upgraded integrated gas processing facility at Sapele and further

upgrades to the liquid treatment facility to enable increased

deliveries of dry crude. Towards our goal to end routine flaring by

2024, we will focus on Oben, Amukpe, Sapele & Jisike end of

routine flaring projects, which will capture and monetise gas for

productive use.

In OML 53, in addition to drilling, we plan to complete the

Jisike flow station debottlenecking and gaslift compressor station

and installation of the Ohaji South Lease Automatic Custody

Transfer (LACT) Unit.

For the non-operated assets, in OML 40, in additional to the

drilling plans, facilities and engineering work will focus on the

Gbetiokun facilities upgrade to optimise the Gbetiokun barging

operations; whilst we complete all front-end activities for the

Gbetiokun to Adagbasa pipeline which will replace the barging of

the produced crude. In OPL 283, we have planned one gas well

re-entry for production testing and the Igbuku gas plant design

(FEED). The delivery of the 2022 workplan will be underpinned by a

strong commitment to safety, asset integrity, GHG emissions

reduction and operational excellence.

Financial review

Revenue and other income

Revenue from oil and gas sales in 2021 was $733.2 million, a

38.2% increase from the $530.5 million achieved in 2020.

Crude oil revenue was $618.4 million (2020: $417.9 million),

48.0% higher than 2020, largely reflecting higher average realised

oil prices of $70.54/bbl for the period (2020: $39.95/bbl). The

total volume of crude lifted in the year was 8.8 MMbbls, lower than

the 10.5 MMbbls lifted in 2020, due to the decrease in production

following the suspension of exports at the FOT. In addition, the

Group's 2021 produced liquid volumes were subject to reconciliation

losses of 14.5%, compared to less than 10% in the corresponding

period in 2020. We expect these to improve significantly when we

evacuate the bulk of our crude through the Amukpe-Escravos

underground pipeline.

Gas sales revenue increased by 2.0% to $114.8 million (2020:

$112.5 million), due to higher gas sales volumes of 39.4 Bscf

compared to 37.1 Bscf in 2020, which reflects new gas wells coming

onstream during the period. The average realised gas price was

slightly lower, at $2.85/Mscf (2020: $2.87/Mscf) and reflects the

reduction applied to the DSO gas-to-power volumes from August

2021.

Other income of $20.1 million includes an underlift $13.9

million (shortfalls of crude lifted below Seplat's share of

production, which is priced at the date of lifting and recognised

as other income) representing 152 kbbls and $5.2 million tariff

income generated from the use of the Company's pipeline. In

addition, there was a $5.4 million reversal of decommissioning

obligation no longer required for Eland operations in the

period.

Gross profit

Gross profit increased by 128.9% to $285.2 million (2020: $124.6

million). The non-production costs primarily consisting of

royalties and DD&A totalled $270.9 million, compared to $228.9

million in the prior year. The higher royalties were the result of

higher oil prices, and the DD&A charge for oil and gas assets

increased to $141.1 million (2020: $127.5 million), because of a

higher depletion rate applied following a reclassification and

revision of previous 2P estimates compared to the prior year.

Direct operating costs, which include crude-handling fees,

rig-related costs and operations and maintenance costs amounted to

$172.1 million in 2021, 2.6% higher than $167.7 million in 2020.

The increase was primarily because of the higher operational and

maintenance costs of $107.9 million that include unaccrued late

charges of $13.8 million related to the OML 40 asset operated by

NPDC. On a cost-per-barrel equivalent basis, production opex was

higher at $9.9/boe (2020: $8.9/boe) due to the additional costs

detailed above and the average working interest production reducing

in 2021 compared to 2020. However, a continuous cost reduction

drive for production evacuation from the Gbetiokun and Ubima fields

resulted in a 26.4% reduction in barging and trucking costs, to

$11.7 million (2020: $15.9 million).

IAS impairments reversal

As previously reported, under IAS 36 the Company identified the

need to revalue its assets due to the significant economic

uncertainty of the Covid-19 crisis in 2020 and booked a non-cash

provision of $114.4 million across non-financial assets in the

period. Following a reassessment of the business models and

assumptions at the end of 2021, a reversal of $74.7 million was

recognised to reflect the current and expected higher oil price

environment.

Operating profit

The operating profit for the year was $250.7 million, compared

to an operating loss of $31.7 million in 2020 (which resulted

mainly from the $160.9 million impairment charges).

During the year, the Group recognised impairment losses

totalling $38.1 million, which include financial asset charges of

$22.6 million for outstanding receivables and non-financial asset

charges of $15.2 million for the rigs. This was offset by the $74.7

million impairment reversal described above.

General and administrative expenses increased by 5.4% to $80.1

million (2020: $76.0 million) and reflect the increase in

administrative activities across the business compared to the

previous year, which was more heavily impacted by the Covid-19

pandemic and its associated reduction in activities.

An EBITDA of $371.8 million adjusts for non-cash items which

include impairment, abandonment, and exchange losses, equating to a

margin of 50.7% for the year (2020: $265.8 million; 50.1%).

Taxation

The income tax expense of $60.2 million reflects a higher

assessable profit driven by higher accounting profit compared to

the prior year, and represents an effective tax rate of 34% (2020:

$5.1 million; 6%). The tax charge comprises a deferred tax charge

of $22.6 million and a current tax charge of $37.6 million. The

deferred tax charge is mainly driven by the unwinding of previously

unutilised capital allowances.

Net result

The profit before tax was $177.3 million (2020: $80.2 million

loss before tax) and profit for the year was $117.2 million (2020:

$85.3 million net loss). The resultant basic earnings per share was

$0.24 in 2021, compared to $0.13 basic loss per share in 2020.

Cash flows from operating activities

Cash generated from operations in 2021 was $394.3 million (2020:

$329.4 million). Net cash flows from operating activities were

$369.8 million (2020: $308.7 million), after accounting for tax

payments of $12.9 million (2020: $10.4 million) and a hedge premium

of $9.0 million ($8.4 million). Free cash flow for the period

amounted to $200 million (2020: $163.9 million).

The Group received $235 million from the major JV partner

towards the settlement of cash calls. The major JV receivable

balance now stands at $83.9 million, down from $107.1 million at

the end of 2020.

Cash flows from investing activities

Net capital expenditure of $136.4 million consisted of $37.7

million towards completing five development oil wells (Umuseti 07,

GB-06, 07, 08, 09) and $26.3 million for completing two new gas

wells (Oben 50, 51) and two workover wells (Oben 44, 46).

Associated facilities and engineering costs amounted to $72.4

million. We realised significant cost savings from drilling in the

period because of the relatively lower cost workover operations

compared to new drills carried out for two Oben gas wells in

addition the optimisation of drilling parameters and logistics

applied in the execution of the Gbetiokun wells.

Payments for non-oil and gas assets amounting to $33.5 million

relates to the net effect of consideration for the four Cardinal

rigs at $36 million purchased in October 2021 and $3.5 million for

spares classified as inventory. The rigs were funded out of already

restricted funds (excluded from previous cash flow statements) held

at Access Bank and the Federal High Court of Nigeria, as previously

disclosed.

Seplat Energy received $4.9 million in the period through the

allocation of 94.2 kbbls of crude oil from OML 55. Recovery in the

period is below expectations and impacted by significant sabotage

along the NCTL and TNP pipelines, with a theft factor of up to 60%

recorded. The next lifting due to Seplat Energy is scheduled for

March 2022 (previously December 2021 but delayed because of

evacuation challenges) and we continue to work with BelemaOil to

optimise production and sustain recovery of the remaining discharge

amount. Out of $330 million to be paid to Seplat Energy, $129.9

million has been recovered with $200.1m outstanding.

Cash flows from financing activities

Net cash outflows from financing activities were $100.8 million

(2020: $217.4 million). Proceeds from loans and borrowings of

$671.0 million reflects the debt restructuring where the Group

offered senior notes of $650 million. The gross proceeds of the

notes were used to redeem the existing $350 million senior notes

and to repay in full drawings of the $250 million RCF. It also

reflects a further $10.0 million drawn from the Westport RBL

facility and $11.0 million drawn on the $50 million off-take

facility to support drilling operations at Elcrest. Payments for

other financing charges, which include $20.4 million transaction

costs on the debt facilities and interest paid on loans, totalled

$89.6 million (2020: $65 million). The dividend payment for the

period totalled $73.4 million (2020: $58.3 million), net of

withholding taxes is $15.1 million higher because of timing of

quarterly dividend distribution introduced in 2021.

A charge of $4.9 million relates to the share buy-back programme

for Seplat Energy's Long-Term Incentive Plan. The programme

commenced on 1 March 2021 and shares are held by the Trustees under

the Trust for the benefit of Seplat Energy employee beneficiaries

covered under the Trust.

Liquidity

The balance sheet continues to remain healthy with a solid

liquidity position.

Net debt reconciliation at 31 December 2021 $ million Coupon Maturity

Senior notes* 648.1 7.75% April 2026

Westport RBL* 108.8 Libor+8% March 2026

Off-take facility* 9.7 Libor+10.5% April 2027

Total borrowings 766.6

Cash and cash equivalents 340.5

Net debt 426.1

* including amortised interest

Seplat Energy ended the year with gross debt of $766.6 million

(with maturities in 2026 and 2027) and cash at bank of $340.5

million, leaving net debt at $426.1 million. Liquidity, which

includes the $350 million RCF available for drawing, a $39 million

undrawn offtake facility plus the cash balance, was more than $700

million at the end of the period.

Dividend

In line with the quarterly dividend policy announced in 2021,

Seplat distributed four dividend payments in 2021 and paid out

$73.4 million. The Board has recommended a final dividend of US2.5

cents per share for the financial year 2021, which will bring the

total dividend declared for 2021 to $0.10 per share (2020: $0.10

per share).

Subject to approval of shareholders, the recommended dividend

will be paid shortly after the Annual General Meeting, which will

be held in Lagos, Nigeria, on 18 May 2022.

Hedging

Seplat's hedging policy aims to guarantee appropriate levels of

cash flow assurance in times of oil price weakness and volatility.

For 2021, the Group had in place dated Brent put options as

follows: (i) for Q1, 1.0 MMbbls at a strike price of $30/bbl and

1.0 MMbbls at a strike price of $35/bbl; (ii) for Q2, 2.0 MMbbls at

a strike price of $35/bbl; and (iii) for Q3, 1.0 MMbbls at a strike

price of $35/bbl and 1.0 MMbbls at a strike price of $40/bbl. The

$11.1 million hedging costs were recognised as fair value charges

in the period.

This hedging programme has been continued in 2022 with put

options for 5.0 MMbbls through Q3 2022 at an average premium of

$1.41/bbl as follows: (i) for Q1, 1.0 MMbbls at a strike price of

$50/bbl and 1.0 MMbbls at a strike price of $55/bbl; (ii) for Q2,

2.0 MMbbls at a strike price of $55/bbl; and (iii) for Q3, 1.0

MMbbls at a strike price of $55/bbl.

The Board and management team continue to closely monitor

prevailing oil market dynamics and will consider further measures

to provide appropriate levels of cash flow assurance in times of

oil price weakness and volatility.

Credit ratings

Seplat maintains corporate credit ratings with Moody's Investor

Services (Moody's), Standard & Poor's (S&P) Rating Services

and Fitch. The current corporate ratings are as follows: (i)

Moody's B2 (stable); (ii) S&P B (stable) and (ii) Fitch B

(stable).

Elimination of related-party transactions

In our continuous efforts to promote world-class governance, all

related-party transactions (RPT) were eliminated from

1 January 2022.

Petroleum Industry Act 2021

Nigeria's Petroleum Industry Bill was signed into law on 16

August 2021, shortly after the bill received legislative approval

from both the Senate and the House of Representatives. The assent

by the Executive enacts the Petroleum Industry Act, 2021 (PIA 2021)

as the superseding policy to provide legal, governance, regulatory

and fiscal frameworks for the Nigerian petroleum industry, the

development of host communities, and related matters. The PIA 2021

also repeals existing Acts and makes transitional and savings

provisions to accommodate instances of licensees that may choose

not to convert until their current license expires.

We have reviewed the fiscal provisions of the Act, and a

multi-disciplinary project team has been commissioned to review the

impact of Seplat Energy business entering the new PIA regime,

versus the benefits of remaining in the current fiscal regime until

the expiry of our licenses. The analyses will be based on the

life-cycle data of all the assets and the result of the review will

inform management's decision on whether Seplat Energy converts to

the PIA regime or remains in the current tax regime.

Climate change and financial disclosures

Seplat Energy Plc recognises that climate change and the

decarbonisation of the global economy, within the context of the

energy transition, present significant risks and opportunities to

the company's strategy, operations, and financial planning, and to

the delivery of long-term shareholder value. Accordingly, Seplat

Energy will, in the near future:

1. Adopt climate change as a Principal Risk within the company's

risk management framework; and

2. Carry out an assessment of the impact of climate change on

the company's financial statements using scenario analysis as

recommended by the Taskforce on Climate-related Financial

Disclosures (TCFD). Seplat Energy aims to publish an inaugural

TCFD-aligned report in mid-2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAFAPALAAEEA

(END) Dow Jones Newswires

February 28, 2022 02:00 ET (07:00 GMT)

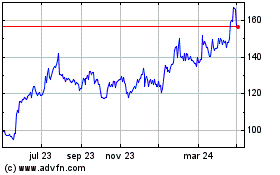

Seplat Energy (LSE:SEPL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

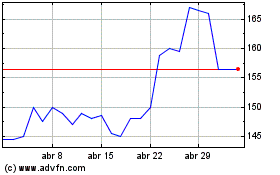

Seplat Energy (LSE:SEPL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024