TIDMSSIT

RNS Number : 3021Q

Seraphim Space Investment Trust PLC

17 October 2023

SERAPHIM SPACE INVESTMENT TRUST PLC

("SSIT" or "the Company")

Full Year Results

Seraphim Space Investment Trust plc (LSE: SSIT), the world's

first S paceTech investment company, announces its audited results

for the financial year ended 30 June 2023.

The annual report can be found at: here , and the summary is

below:

Financial Summary

30 June 2023 30 June 2022 Change

--------------------------- ------------- ------------- -------

NAV GBP222.4m GBP239.3m -7.1%

NAV per share(1) 92.90p 99.97p -7.1%

Portfolio valuation GBP187.4m GBP186.1m 0.7%

Fair value vs. cost(1) 98.5% 104.3%

Market capitalisation GBP64.6m GBP126.9m -49.1%

Share price(1) 27.0p 53.0p -49.1%

-Discount/+premium(1) -70.9% -47.0%

Ongoing charges(1) 1.89% 1.72%

Number of shares in issue 239.4m 239.4m 0.0%

Liquid resources GBP35.3m GBP57.7m -38.8%

---------------------------- ------------- ------------- -------

(1) Alternative performance measure - see Alternative

Performance Measures on pages 160 to 161 of the annual report

Full Year Highlights

-- During the year, GBP4.9m was invested in six new portfolio

companies. GBP4.2m into two new additions to the Company's main

portfolio, with GBP0.7m into early-stage companies.

-- The Company completed GBP12.2m of additional follow-on

investments in eight companies (five in the main portfolio

totalling GBP10.7m and three early-stage, non-material companies

totalling GBP1.5m).

-- The top 10 portfolio companies saw their bookings increase by

199% on average over the year, with the average revenue growth

increase 34% (both on a fair value weighted basis).

-- Seven of SSIT's portfolio companies closed funding rounds at

higher valuations relative to previous rounds, versus only one at a

lower valuation (the remaining rounds were unpriced convertible

loan note issues).

-- Investment activity was robust, with a total of 11 companies

successfully closing funding rounds.

-- The majority of rounds were led by new external investors,

with SSIT participating in two-thirds of the rounds with the other

rounds being able to access the required funding from other

investors due to the strength of their syndicates.

Transactions Completed during the Full Year

Segment Type Cost

Company Sub-sector HQ (GBPm)

-------------------------------------------- ------------- --------------------- ------- --------------- -------

Voyager Beyond Earth Space Infrastructure US New Investment 2.1

Taranis Analyse Data Analytics Israel New Investment 2.1

PlanetWatchers Analyse Data Analytics UK Follow-on 2.5

D-Orbit Launch In-orbit Services Italy Follow-on 4.4

SatVu Platform Earth Observation UK Follow-on 2.1

New

4 early-stage(1) investments Investment 0.7

2 early-stage(1) , material investments Follow-on 1.7

3 early-stage(1) , non-material investments Follow-on 1.5

Total 17.1m

(1) These are very early-stage companies in which small

(typically less than GBP1m) initial investments are made and

provide early access to companies which could become candidates for

substantial growth investment in subsequent rounds should they

progress strongly.

Post Period Highlights

-- Since 30 June 2023, the Company has invested a total of

GBP4.1m, with GBP3.3m in follow-on funding into three existing

portfolio companies and GBP0.9m into two new early-stage

investments.

-- On 13 July 2023, the Company announced a share repurchase

programme. In the period to 8 September 2023, the Company bought

back a total of 2,186,344 shares (0.9% of the shares in issue at 12

July 2023) at an aggregate cost of GBP1.0m or 45p per share.

Will Whitehorn, Chair of Seraphim Space Investment Trust plc,

commented : "The SSIT portfolio is well-positioned given the strong

global tailwinds of increased defence spending and the continued

investment into solutions to address the climate and sustainability

agenda. The top 10 portfolio companies saw their bookings increase

by 199% on a fair value weighted average basis over the year.

Therefore, these companies have solid contracted orders for the

years ahead, providing great confidence to investors.

Encouragingly, we have seen some well-known private equity

investors, such as KKR, Advent and BlackRock, entering the sector

to build their SpaceTech exposure and indicating interest from new

investor groups. Given their broad mandate to invest across

sectors, their focus on space gives us confidence of increasing

growth aspirations for the domain. Furthermore, with significant

amounts of dry powder (capital which has been committed to but not

yet invested by investment vehicles) sat in impact and climate

funds from across the globe, we remain confident that there is a

large and growing pool of motivated capital to support the needs of

companies in the SSIT portfolio in the years ahead.

We have reserved cash to support portfolio fundraisings as

required in the year ahead, leaving a modest sum for new investment

until the market improves and more capital can be raised. Some of

the best investments are undertaken at the bottom of the economic

cycle. The SSIT deal flow pipeline is healthy and, given cash

constraints, we are focused on participating in only the most

exceptional opportunities, carefully selecting those with a strong

growth premise that offer the highest returns for

shareholders."

James Bruegger, Chief Investment Officer, Seraphim Space Manager

LLP, said : "We are delighted with the progress the portfolio has

made during the period. The portfolio has proven itself adept at

successfully accessing capital at a time when the wider funding

raising environment has been challenging. It is particularly

gratifying that many of these companies have closed funding rounds

led by new investors and on improved terms relative to their

previous funding rounds. The success in capital raising across the

portfolio is in no small part due to the impressive commercial

traction achieved allied to the scale of the opportunities these

companies are addressing. With the majority of the portfolio now

well-funded through the next 12--18 months, we are excited to see

what will be achieved over the year ahead."

Mark Boggett, Chief Executive Officer, Seraphim Space Manager

LLP, said: "We remain confident with the outlook for the space

domain globally as well as the SSIT portfolio, consisting of

best-of-breed SpaceTech companies. We continue to enjoy the

privileged position of seeing the majority of the sector's global

deal flow. This provides an information asymmetry over the sector

that informs our every move.

With the secular trends relating to global security, food

security, climate change and sustainability expected to accelerate,

we believe the Company is well-positioned to take advantage of the

resultant opportunities. We anticipate that demand for the products

and services of the Company's portfolio companies, particularly

from governments, should result in the portfolio delivering strong

growth metrics.

As of 13 October 2023, cash was GBP29.4m, with a potential

further GBP3.0m of liquidity available in the holdings of listed

companies. We believe this liquidity should be sufficient to

provide the necessary levels of support to the portfolio over the

course of the next 12 months. Whilst we expect to continue to

diversify the portfolio with selective new investments, uncertainty

around the timing of market recovery (and, therefore, our ability

to raise new equity capital) means that the size of new investments

will likely be small, with investment activity expected to be more

weighted in favour of supporting the existing portfolio until a

time when the market provides the appropriate conditions to

fundraise."

A copy of the Annual Report has been submitted to the National

Storage Mechanism and will shortly be available for inspection here

.

Results Presentations

The Company will also be hosting a virtual presentation for

analysts at 9.00am today and an online presentation for retail

investors at 11.00am. To register for either event, please contact

SEC Newgate at seraphim@secnewgate.co.uk .

Capital Markets Day

The Company is hosting a Capital Markets Day in London for

institutional investors and equity analysts at 15:00pm on

Wednesday, 18 October 2023.

Institutional investors and equity analysts can register for the

in-person event by contacting Deutsche Bank/J.P. Morgan Cazenove or

by emailing SEC Newgate at seraphim@secnewgate.co.uk

Following the announcement of the results, no new material

information will be disclosed at the event.

- Ends -

Media Enquiries

Seraphim Space Manager LLP (via SEC Newgate)

Mark Boggett, CEO / James Bruegger, CIO / Rob Desborough

SEC Newgate (Communications advisers)

seraphim@secnewgate.co.uk

Emma Kane / Clotilde Gros / George Esmond

+44 (0) 20 3757 6767

Deutsche Numis

Mark Hankinson / Gavin Deane / Neil Coleman

+44 (0) 20 7545 8000

J.P. Morgan Cazenove

William Simmonds / Jérémie Birnbaum / Rupert Budge

+44 (0) 20 7742 4000

Ocorian Administration (UK) Limited

seraphimteam@ocorian.com

Lorna Zimny

+44 7387 971915

Notes to Editors:

About Seraphim Space Investment Trust plc

Seraphim Space Investment Trust plc (the "Company") is the

world's first listed fund focused on SpaceTech. The Company seeks

exposure predominantly to early and growth stage private financed

SpaceTech businesses that have the potential to dominate globally

and that are sector leaders with first mover advantages in areas

such as climate, communications, mobility and cyber security.

The Company is listed on the Premium Segment of the London Stock

Exchange.

Further information is available at:

https://investors.seraphim.vc

Please note that the Glossary below provides definitions for

defined terms used through the Annual Report.

Investment Manager

The Company is managed by Seraphim Space Manager LLP (the

'Investment Manager' or 'Seraphim Space'), the world's leading

SpaceTech investment group. The Investment Manager's team consists

of seasoned venture capitalists and some of the space sector's most

successful entrepreneurs who scaled their businesses to

multi-billion Dollar outcomes.

The Investment Manager has supported more than 100 SpaceTech

companies across its fund management and accelerator activities

since 2016 and has a proven track record of delivering value.

Positioned at the heart of the global SpaceTech ecosystem, the

Investment Manager has a unique model, using information asymmetry

generated from its global deal flow, partnerships with leading

industry players and primary research to back the most notable

emerging SpaceTech companies shaping a new industrial

revolution.

The Investment Manager is a signatory to the UN Principles for

Responsible Investment ('UN PRI'). Its first UN PRI report is due

in 2024.

Key Highlights

For the year ended 30 June 2023

Average portfolio company revenue growth (1) Average portfolio company bookings growth (1)

34% 199%

Investment into new portfolio companies Follow on investments

GBP4.9m GBP12.2m

Key Performance Indicators

For the year ended 30 June 2023

NAV per share movement (2) Share price movement (2)

-7.1% -49.1%

Discount (as at 30 June 2023) (2) Ongoing charges (2)

70.9% 1.89%

Fair value vs. initial cost (as at 30 June 2023) (2)

98.5%

1) Fair value weighted average (as defined in the Glossary)

year-on-year growth for the 12 months ended 30 June 2023 of the top

10holdings, representing 86% of fair value (72% of NAV) at the year

end. Source: Portfolio company data.

(2) Alternative performance measure - see Alternative

Performance Measures below.

Sector Highlights

The year ended 30 June 2023 was another year of breakthroughs

for the space sector. It was marked by new scientific boundaries

being pushed, SpaceTech's central role in geopolitics being

reinforced, Big Tech (the most dominant and largest technology

companies) further embracing satellite communications,

multi-billion Dollar mergers and acquisitions and concerted efforts

to protect the sustainability of space.

-- Jul-22: First images from James Webb Space Telescope

-- Sep22: NASA DART mission alters trajectory of asteroid

-- Oct-22: Construction of the Chinese Space Station completes

-- Nov-22: Apple/Globalstar deal establishes direct to smartphone satcoms

-- Nov-22: Successful first launch of NASA's Space Launch System

(SLS), marking the first step in the next era of lunar

exploration

-- Nov-22: Satcoms operator Eutelsat announces plans to merge

with 'mega constellation' OneWeb for $3.4bn

-- Dec-22: New US Federal Communication Commission rules on

de-orbiting all space craft within five years of end of life

-- Dec-22: Private Equity group, Advent International, acquires Maxar for $6.4bn

-- Apr-23: SpaceX attempts first launch of its next generation

Starship launch vehicle that is projected to decrease launch costs

by a further 10x

-- Apr-23: Virgin Orbit files for bankruptcy following its failed launch in Jan-23

-- May-23: Satellite operators Viasat and Inmarsat complete $7.3bn merger

Sizeable Markets Addressed by Space

Size of the Opportunity

The space industry has evolved beyond the confines of

traditionally being classified within 'aerospace and defence', with

the utilisation of space data in large, well-established

terrestrial markets. Telecommunications, navigation and

transportation represent the most significant opportunities, after

defence, in the near term, and have become increasingly reliant on

space-based assets to drive business.

With climate change taking centre stage among global priorities,

earth observation data has played a crucial role in monitoring the

planet. With meteorology heavily reliant on space technology for

weather forecasting, space data has also helped us better monitor

deforestation and the health of oceans and ecosystems. Satellites

equipped with multispectral and hyperspectral imaging sensors can

detect and map mineral deposits, oil reserves and vegetation

health.

As the applications of space data remain diverse, a common

factor among all of them is that SpaceTech has brought a welcome

move of modernisation to traditionally large markets slow to

innovate. From a venture perspective, large markets such as

telecommunications and navigation remain ripe for disruption by new

technologies.

The global space economy is valued at $386bn, with 72% of this

attributed to the satellite industry and its downstream

applications. This sub-sector is well-represented across SSIT's

portfolio with 57% of companies operating within satellite

services.

Investment Activity

Seraphim Space tracks global venture capital activity within the

SpaceTech market. Collating information drawn from both public and

private sources on individual transactions, Seraphim Space

publishes a quarterly SpaceTech venture capital index (the

'Seraphim Space Index') that provides insights into the latest

trends in the SpaceTech investment market. The charts in the annual

report are drawn from this index .

-- SpaceTech venture capital investment for the 12 months ending

June 2023 totalled $4.5bn, down from $9.2bn the previous year.

However, this decline is primarily attributable to unusually large

funding rounds in CY21 and CY22 such as those by SpaceX1 and Sierra

Space(2) . Excluding these, investment activity was down less than

one third compared to the previous period.

-- The sector has shown strong signs of recovery in the first

half of CY23, where there was a 57% increase in investment compared

to the second half of CY22.

-- The overall number of deals in the sector has increased this

year, underlining a robust early stage investment environment.

Early stage investments reached an all-time high, with 257 deals in

Q2 CY23, showing that investor interest remains strong at Seed and

Series A.

-- The number of late stage investments also saw a notable

uptick in H1 CY23, particularly in Series C deals in Q2 CY23,

reinforcing growing investor confidence in established SpaceTech

companies.

(1) SpaceX raised $1.16bn in Q2 CY21, $1.72bn in Q2 CY22 and

$750m in Q1 CY23.

(2) Sierra Space raised $1.4bn in Q4 CY21.

Trailing 12 Months Spacetech Investment Activity Index

-- The Seraphim Space Index serves as an investment activity

barometer, indexing global SpaceTech VC deals against Q1 CY18.

-- Investment activity peaked at an index value of 417 in Q2

CY21 and remained strong through Q3 CY22, declining to 178 in Q2

CY23 due to less growth investing.

-- Despite general market declines affecting SpaceTech,

underlying startup activity continues to reach new heights with 301

deals in Q2 CY23, indicating robust sector health.

Spacetech Annual Cumulative Investment Tracker ($bn

invested)

-- H1 CY23 showed a SpaceTech investment rebound, marked by a

resurgence in growth deals absent in H2 CY22.

-- Notable funding rounds included SpaceX's $750m, Astranis'

$200m, and Isar Aerospace's $165m, signaling renewed investor

interest.

-- Despite being down due to weak H2 CY22, trailing 12 months'

data shows early signs of recovery.

-- Even though H1 CY23 investment lagged behind CY21 and CY22,

it still outpaced all previous years, confirming enduring market

strength.

Trailing 12 Months Spacetech Investment by Sub-Sector ($bn)

-- From CY17 to CY22, the Platform segment led in venture

capital investment, primarily funding next-gen communications and

earth-sensing networks.

-- Investment is now more diversified across the SpaceTech

ecosystem, with rising interest in newly emerging sectors like

Beyond Earth.

Number of Spacetech Deals by Region (12 Months Ended Q2 CY)

-- Europe surpassed the US in Q1 CY23 investment, marking an early recovery in the region.

-- The US regained its lead in Q2 CY23, but Europe still saw a

60% surge in deal numbers year-over-year.

-- Asian investment also showed robust growth, increasing by 79% over the prior year.

SpaceTech VC activity compared to general technology VC

activity

-- Compared to the broader technology venture capital landscape,

SpaceTech has shown superior performance when indexed against Q1

CY18.

-- Despite a 50% drop in investment from CY22 peaks, SpaceTech

investment is still over twice its Q1 CY18 levels, whereas general

technology VC investment is at 1.25x.

-- SpaceTech has demonstrated greater resilience amid

macroeconomic uncertainty, contrasting with broader technology VC

trends.

-- The sector's resilience is evident in its growing deal

activity, in stark contrast to five quarters of decline in general

technology.

Chair's Statement

'SSIT addresses two of the biggest threats we collectively face

over this decade: firstly, geopolitical tensions and the

ever-present potential for escalation of war and, secondly, the

growing symptoms of climate change, including increasing instances

and severity of wildfires, flooding and hurricanes. Our portfolio

companies are delivering innovative ways to gather unique datasets

about our planet in high resolution from space and then applying AI

to create insightful solutions. The portfolio is largely

well-capitalised following robust fundraising activity, with a

total of 11 companies successfully closing funding rounds, the

majority led by external investors and priced higher than previous

rounds. This positive activity demonstrates the continued strength

of the SSIT portfolio and the increasing market recognition of its

potential.

In July 2023, the Board commenced a share repurchase programme

which has resulted in a share price recovery to a discount level

comparable to our broader peer group. We have confidence that

underlying portfolio performance will instil confidence in investor

sentiment going forward.'

Will Whitehorn

Chair

I am pleased to present the Annual Report of Seraphim Space

Investment Trust PLC for the year ended 30 June 2023.

I would like to thank all shareholders for their continued

support during the challenging macroeconomic climate of

2022/23.

Progress in the Year

GBP4.9m was invested in six new portfolio companies during the

year, two of which were sourced through accelerator programmes

managed by an affiliate of the Investment Manager. In addition, a

further GBP12.2m was deployed as follow-on investments in eight

existing portfolio companies during the year.

Highlights include the following:

-- World firsts : Several portfolio companies achieved major

milestones showcasing new capabilities that set the path for the

space sector's future:

o AST SpaceMobile (NASDAQ: ASTS) successfully demonstrated its

ability to deliver space-based cellular communications at 4G speeds

direct to unmodified smartphones, marking a major development in

the convergence of space-based and terrestrial connectivity.

o SatVu (formerly Satellite Vu) successfully launched 'HOTSAT

1', its first smallsat capable of measuring the thermal footprint

of any building on the planet. This marked an important step in

space's critical role in helping the world achieve Net Zero.

o Tomorrow.io successfully launched its first two miniaturised

radar satellites for collecting real time precipitation data to

turbo charge global weather forecasting capabilities.

o Xona was the first private company ever to launch a GPS

satellite which demonstrated its ability to provide

centimetre-level user positioning with its proprietary satellite

hardware and software stack.

-- Traction : Buoyed by a spike in demand by governments for

commercial space capabilities to enhance global security and combat

climate change, several portfolio companies witnessed record

contract wins:

o ICEYE's deal with Bayanat to provide five of its SAR

satellites to the United Arab Emirates.

o D-Orbit closing multi-million Euro contracts with the European

and Italian Space Agencies.

-- New additions, new horizons : The six new companies invested

in during the year have reinforced the Company's focus on the

intersection of space technology and climate change, alongside

first forays into the opportunities presented by space to the life

sciences sector.

At the year-end, the Company's portfolio consisted of 30 active

SpaceTech companies with an aggregate fair value of GBP187.4m and

its cash reserves were GBP35.3m.

The war on Ukraine and the global macroenvironment have had a

significant impact on global capital markets. As a consequence, the

Company continued to implement its decision to reserve cash by

deliberately slowing the pace of deployment in order to follow its

rights in key existing portfolio companies whilst also continuing

to actively seek to invest smaller ticket sizes in new target

companies. As outlined in the Investment Manager's Report, overall,

the portfolio continues to be well-capitalised, with a significant

number of portfolio companies completing funding rounds during the

year.

NAV

A reduction in the fair value of the portfolio caused the NAV

per share to decrease by 7.1% over the year, from 99.97p to 92.90p

at 30 June 2023.

The private companies in the portfolio, which accounted for

86.7% by number and 97.4% by fair value of the portfolio (2022:

87.1% by number, 90.0% by fair value), represented GBP182.6 million

of NAV (2022: GBP167.5 million) and continued to be relatively

stable in aggregate over the year, despite the challenging

macroeconomic environment. 11 completed funding rounds during the

year, only one of which was priced at a lower price than the

previous round. The fair value of the private companies in the

portfolio was 119.2% of cost (2022: 122.5%) or 122.9% excluding FX

impact (2022: 117.1%). A combination of underperformance against

expectations, limited cash runways and lower priced funding rounds

led to write downs of PlanetWatchers, ALL.SPACE, Altitude Angel,

Edgybees, Xona Space Systems and LeoLabs, which was more than

offset by mark-ups of SatVu, D-Orbit, ICEYE, Astroscale and HawkEye

360 in the main portfolio and also two early stage companies. The

Investment Manager's Report includes a more detailed review of the

performance of portfolio companies.

The listed element of the portfolio (13.0% in fair value vs.

cost (2022: 44.7%)) continued to experience reducing share prices.

We continue to believe that this is distinct from the performance

of the private portfolio, and continues to be in line with other

companies which went public via mergers with special purpose

acquisition companies ('SPACs'), precipitated by rising interest

rates, global energy prices, high inflation and the war on Ukraine,

as well as being driven by fundraises at two of the companies which

put pressure on their share prices.

Continued strengthening of Sterling against the US Dollar over

the year resulting in GBP6.8m in FX loss in the year (2022:

GBP16.8m gain).

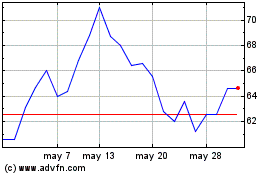

Share Price

The Company's share price continued to fall over the year driven

by significant volatility experienced by global stock markets in

2022/23. In particular, the heavy falls suffered by growth and

smaller technology stocks and alternative investment vehicles,

which continue to be depressed, has also impacted the broader peer

group. The NAV per share has remained more resilient, in line with

performance of the underlying private portfolio companies which

continue to develop their products and services. At 30 June 2023,

the share price was 27.0p, a decrease of 49.1% from 53.0p at 30

June 2022.

SSIT underperformed the peer group, particularly in relation to

its share price, over the period, although the share price recovery

since the year-end has led to significant improvement, with SSIT

outperforming its peer group since early August 2023, as shown in

the chart in the annual report.

The share price as at 30 June 2023 represented a 70.9% discount

to NAV, a further decline from the 47.0% discount as at 30 June

2022, and an implied 84.2% discount to the fair value of the

portfolio (once cash on balance sheet is discounted) (2022: 62.8%).

The Board continues to believe this does not reflect the

performance of the portfolio or how downside protections in

well-capitalised companies are effectively protecting shareholder

value (see the Investment Manager's Report for more detail). Post

the year-end, the share price decline continued, reaching a low of

26.1p on 12 July 2023. The Company announced a share repurchase

programme on 13 July 2023 and the share price has improved to 39.5p

on 13 October 2023.

Earnings and Dividend

The Company made a revenue loss after tax of GBP4.5m for the

year, equal to -1.88p per share.

The Company is focused on achieving capital growth over the long

term. Given the nature of the Company's investments, we do not

anticipate recommending to pay a dividend in the foreseeable

future.

Responsible Investment

The Board is keen to demonstrate the Company's commitment to

responsible investing through objective reporting metrics for ESG

factors. The Investment Manager continues to use its proprietary

due diligence tool in order to assess sustainability opportunities

and ESG risks associated with each potential investment, and has

been able to identify risks that have led it to turn down

opportunities in the year, as well as to identify opportunities

that portfolio companies can take advantage of in order to deliver

positive ESG and sustainability impacts.

Board

From the Annual General Meeting which took place on 13 November

2022, Angela Lane succeeded Christina McComb as Chair of the Audit

Committee and Christina succeeded me as Chair of the Management

Engagement Committee.

Availability of Annual Reports

In the interests of the environment and for ease of access,

Annual Reports are available on the Company's website and can be

viewed and downloaded at https://investors.seraphim.vc/ . Copies of

Annual Reports will only be available on request.

Annual General Meeting

The AGM of the Company will be held at 12.00 p.m. on 20 November

2023 at Seraphim Space's offices, 1 Fleet Place, London, EC4M 7WS

(GPS postcode EC4M 7RA). The AGM will include a presentation from

the Investment Manager (a video of the presentation will be added

to the website as soon as practicable after the AGM). Details of

the resolutions to be proposed at the AGM, together with

explanations, will be included in the notice of meeting to be

distributed to shareholders on 19 October 2023. As a matter of good

practice, all resolutions will be conducted on a poll and the

results will be announced to the market as soon as possible after

the AGM.

The Directors and representatives of the Investment Manager will

be available at the AGM (either in person or via video conference)

to answer shareholder questions. We do recognise that some

shareholders may be unable to come to the AGM and, if you have any

questions about the Annual Report, the investment portfolio or any

other matter relevant to the Company, please write to us via email

at seraphimteam@ocorian.com or by post to The Company Secretary,

Seraphim Space Investment Trust PLC, 5(th) Floor, 20 Fenchurch

Street, London, EC3M 3BY. If you are unable to attend the AGM, I

urge you to submit your proxy votes in good time for the meeting,

following the instructions on the proxy form. If you vote against

any of the resolutions, we would be interested to hear from you so

that we can understand the reasons behind any objections.

Events After the Year End

As mentioned under 'Share Price' above, the Company announced a

share repurchase programme on 13 July 2023. The weighted average

share price at which the shares were brought back represents a

discount of 51% to the NAV per share at 30 June 2023. In the period

to 13 October 2023, the Company bought back a total of 2,186,344

shares (0.9% of the shares in issue on 12 July 2023) at an

aggregate cost of GBP1.0m. The shares bought back are being held in

treasury. The closing share price on 13 October 2023 was 39.5p, an

increase of 51% from the closing share price of 26.1p on 12 July

2023.

Since 30 June 2023, five further investments (two new

investments and three follow-on investments) have been concluded

for an aggregate cost of GBP4.1m, and terms have been agreed on

another potential addition to the portfolio. A further additional

potential investment is in due diligence.

On 7 October 2023, conflict broke out between Israel and

Palestine. We are working with the Israeli companies in the

portfolio to support them as necessary, but there has been limited

impact to date.

Outlook

The Board continues to believe that the SSIT portfolio is

well-positioned given the strong global tailwinds of increased

defence spending and an openness to adopt solutions to address the

climate and sustainability agenda. The top 10 companies saw their

bookings increase by 199% on average1 over the year. Therefore,

these companies have solid contracted orders for the years ahead,

providing great confidence to investors.

Encouragingly, we have seen some well-known private equity

investors, such as KKR, Advent and BlackRock, entering the sector

to build their SpaceTech exposure and indicating interest from new

investor groups. Given their broad mandate to invest across

sectors, their focus on space gives us confidence of increasing

growth aspirations for the domain. Furthermore, with significant

amounts of dry powder (capital which has been committed to but not

yet invested by investment vehicles) sat in impact and climate

funds from across the globe, we remain confident that there is a

large and growing pool of motivated capital to support the needs of

companies in the SSIT portfolio in the years ahead.

We have reserved cash to support portfolio fundraisings as

required in the year ahead, leaving a modest sum for new investment

until the market improves and more capital can be raised.

Experience demonstrates that some of the best investments are

undertaken at the bottom of the economic cycle. The SSIT deal flow

pipeline is healthy and, given cash constraints, we are focused on

participating in only the most exceptional opportunities, carefully

selecting those with a strong growth premise that offer the highest

returns for shareholders.

Will Whitehorn

Chair

16 October 2023

(1) Fair value weighted average (as defined in the Glossary)

year-on-year growth for the 12 months ended 30 June 2023 of the top

10 holdings, representing 86% of fair value (72% of NAV) as at 30

June 2023. Source: Portfolio company data.

Investment Manager's Report

'In a challenging and volatile macroeconomic environment, our

portfolio companies have demonstrated resilience and leadership,

resulting in strong revenue (+34%) and bookings growth (+199%).

We've been heartened by the support from both existing

co-shareholders and new investors, reflecting a flight to quality

during uncertain times. This year, 11 portfolio companies

successfully raised funding, with the majority led by new external

investors, and we actively participated in two-thirds of these

rounds. Our portfolio's valuations have remained robust, with a

fair value of GBP187.4m, experiencing a marginal 0.7% year-on-year

increase. The structuring of investments using a combination of

preference shares and anti-dilution protection has made us less

susceptible to short-term fluctuations in enterprise value.

During the year, the Company invested GBP4.2m into two additions

to the Company's main portfolio, Taranis and Voyager. We also

continued to support the portfolio companies in which we have the

highest conviction, investing GBP12.2m in eight companies, split

between our main portfolio (GBP10.7m) and early stage, non-material

positions (GBP1.5m). The cash position within the portfolio is

robust with 20 months of cash runway on average in the private

portfolio. Looking ahead we remain focused on essential follow-on

investments and smaller transactions, as we prioritise cash

preservation in the current economic climate. Overall, we remain

committed to our strategy and are confident in the performance

outlook of our portfolio.'

Mark Boggett

CEO , Seraphim Space

Overview

We moved to a slower rate of deployment in Q1 CY22 and

established a framework to preserve cash, support the portfolio and

continue to make limited new investments. This strategy has played

out in line with expectations, and we have been encouraged by both

the performance of the underlying portfolio companies and the

continued appetite of co-shareholders and new investors to support

the capital needs of the portfolio companies. In challenging times

there is always a flight to quality, and we can confidently assert

that many portfolio companies have extended their leadership

positions during this more challenging and volatile macroeconomic

period and are delivering strong revenue and bookings growth, as

they address strong demand for their products and services. The

value of the Company's investments has been robust, with the

portfolio fair value at GBP187.4m, up 0.7% year-on-year. As

explained below, 11 portfolio companies raised funding, with the

majority of rounds led by new external investors. SSIT participated

in two-thirds of the rounds. Seven of the rounds were made at

higher valuations relative to previous rounds, one was flat and one

was lower, with the remainder being unpriced convertible loan

notes. This positive investment activity demonstrates the continued

strength of the portfolio companies and the increasing market

recognition of their potential.

This also brings into sharp focus the underlying investment

structuring employed across the portfolio, including liquidation

preference and anti-dilution clauses, which is an important part of

our investment toolset. This approach to structuring makes SSIT

less vulnerable to short-term negative fluctuations in the

enterprise value of a portfolio company. In the case of liquidation

preference, the last monies invested stand first in line to get

back the original subscription price paid before any other prior

round shareholders are paid. Anti-dilution provides for additional

shares to be issued to rebalance the stake in a company in the

event that future rounds are undertaken at a lower share price.

Portfolio valuation methodologies

92.6% of the portfolio by fair value is valued using either

available market price or an enterprise value that has been

recalibrated in the last three months.

Downside protection

An important consideration in relation to valuation is the

structuring of individual investments. We routinely seek to obtain

downside protection measures across the private companies within

the portfolio via preference shares, rather than common equity. All

the top 10 private companies in the portfolio are structured via

preference shares with weighted average anti-dilution protection

and/or liquidation preference.

Preference shares sit above common equity in the capital

structure in the event of a liquidity event, but below creditors

such as banks. Preference shares offer more defensive exposure to

an asset with their 'liquidation preference'. Liquidation

preference provides a prioritised return ahead of other previously

issued share classes, which means value can be preserved even in

scenarios where a business is sold at a far lower valuation than

that used to make the investment.

Anti-dilution rights retrospectively amend the price paid or the

number of shares owned where a subsequent funding round is done at

a lower valuation (a down round). These measures can help mitigate

dilution in the event of a down round, but it rarely results in no

dilution. Additional shares are often issued at par to ensure that

the shareholdings of existing investors are at least partially

protected in a down round. We typically apply weighted average

dilution, which provides a proportion of adjustment and less

protection, but still a better outcome than if no anti-dilution

measures were applied in the event of a down round.

Downside protection afforded by liquidation preferences means

that, relative to the most recent valuation event used to calculate

fair value, valuations within the top 10 holdings would on average

need to fall by more than 30.0% before fair value would fall below

cost (on a fair value weighted basis). The chart in the annual

report shows how much the enterprise value of each company in the

top 10 private companies (on an anonymised basis) would need to

fall in order to return cost. In order to deliver cost, companies 9

and 10 need to see an increase in enterprise value, as their

enterprise values are currently below cost.

Applying sensitivities of a 10-50% reduction in the enterprise

values of the top 10 holdings results in an implied NAV per share

of 70p to 93p.

Preference shares

What are they?

-- Class of shares that rank senior to ordinary shares/common stock.

-- 'Liquidation preference' provides for priority return ahead

of other previously issued classes of shares.

How do they work?

-- Ranks junior to debt and, typically, future issues of

preference shares, but senior to ordinary shares/other classes of

existing shares.

-- At exit, holder receives amount - normally equivalent to 1x

return - ahead of any other proceeds being distributed to junior

ranking shares.

What is their purpose?

-- Protect value of investment.

-- Provide downside protection by potentially delivering 1x return in low exit scenarios.

Enterprise value recalibrations

Proportion of fair value where EV was recalibrated in Top 10 private companies' EV change 1 in the year

the 3 months to 30 June 2023 4.8%

92.6%

Number of portfolio companies that were existing Number of portfolio companies that were existing

portfolio companies at the start of the year portfolio companies at the start of the year

and raised a priced round in the year and raised a priced round post the year end

9 4

(1) Fair value weighted average (as defined in the Glossary)

year-on-year change for the 12 months ended 30 June 2023 of the top

10 holdings, representing 86% of fair value (72% of NAV) as at 30

June 2023

The chart in the annual report shows, on an anonymised basis,

the percentage change in the underlying EV of each of these

companies for the year ended 30 June 2023. Changes in EV relate to

either new funding rounds or adjustments from quarterly valuation

recalibration exercises. It is worth noting that, as a result of

the downside protections in place, most particularly liquidation

preferences, where there were reductions in underlying EV, these

have not necessarily translated directly into commensurate

reductions in fair value. Therefore, while the underlying EV of the

private companies within the top 10 holdings has increased by 4.8%,

the aggregate fair value has increased more, 8.5% (both on a fair

value weighted average basis).

The chart in the annual report shows the fair value changes for

the top 10 holdings from 1 July 2022 to 30 June 2023. Amounts below

the axis are reductions in fair value.

As explained above, more recently we have seen an uptick in the

number of new funding rounds being raised. Portfolio companies

representing more than 60% of the fair value of the portfolio were

existing companies at the start of the year and managed to raise a

priced round during the year or post the year end. Of the nine

priced funding rounds completed during the year, seven were priced

higher than the previous round, one was priced lower and one was

flat. We believe this indicates improvement in the market.

Investment Activity

Year ended 30 June 2023

In light of global markets and the continued share price

discount restricting the ability to raise additional capital, we

slowed down the pace of investment significantly from the beginning

of 2022. The chart in the annual report shows the number of deals

done in the year ended 30 June 2023 vs. the previous year. The

number of follow-on investments remained relatively constant. New

investments and late stage (Series B+) deals were both lower than

in the year ended 30 June 2022 as we focused on required follow-on

investments and favoured smaller transactions due to the need to

preserve cash in the current environment.

New investments

During the year, the Company invested GBP4.2m into two additions

to the Company's main portfolio (Taranis and Voyager) and funded

the investment in Tomorrow.io which had closed at the end of the

previous financial year. In addition, there were four new

investments into early stage portfolio companies for a total of

GBP0.7m.

Taranis is an agriculture-focused AI company that uses earth

observation data to optimise crop yields and increase global food

supply. Taranis is improving agricultural efficiency by providing

insights to growers on field health. Taranis uses satellite and

drone imagery, in combination with its extensive library of crop

health indicators, for early detection of disease or nutrient

deficiencies. These accurate and local assessments improve crop

yields by better tailoring the use of fertilisers and pesticides.

In August 2022, the Company completed a $2.5m (GBP2.1m) investment

in Taranis' Series B investment round. Taranis received investment

from numerous top Israeli venture and growth investors. With this

round, Taranis will build out its US sales capability, and gain

early traction with its new carbon monitoring product.

Voyager is a next generation Space Prime that is developing

Starlab, a free flying space station. Starlab will provide the

facilities to host public and private astronauts, as well as

forming the critical infrastructure required to support research,

development and manufacturing in space. The Company completed a

$2.5m (GBP2.1m) investment into Voyager's Series B investment round

in July 2022. Voyager intends to use the funds raised to continue

to finance the development of Starlab and expand its capabilities

through strategic M&A.

New investment case study: Tomorrow.io

Investment Tomorrow.io is revolutionising weather forecasting

thesis by enabling companies across industries to easily

build, standardise and automate weather-related

operating protocols. This is possible through high-accuracy,

hyperlocal short-term forecasts that are unrivalled

within the industry.

Round New investment: Convertible Loan Note Pre-Series

E round.

------------------------------------------------------------------

SSIT investment

/ round

size $5m / $87m.

------------------------------------------------------------------

Co-investors Activate Capital, Canaan Partners, Clearvision Ventures,

Pitango, Square Peg, Stonecourt Capital.

------------------------------------------------------------------

Problem Billon Dollar industries, including aviation, logistics

and utilities, are adversely impacted by weather

events. Traditional weather forecasts are not sufficient

to translate into operational decisions.

------------------------------------------------------------------

Solution Tomorrow.io provides industry-specific actionable

weather insights via APIs/platforms that are embedded

into the operational processes of its customers.

Insights are based on both proprietary weather models

and satellite data.

------------------------------------------------------------------

Market Global spend on weather was estimated to be $56bn

in 2015 1 . Assuming growth has continued at the

historic 8% CAGR, the market would have been valued

at roughly $104bn in 2022.

------------------------------------------------------------------

Latest news

* Successfully closed $87m Series E in June 2023.

* Launched its first two weather radar satellites in Q2

CY23 to provide proprietary global precipitation

data.

* Released new Unified Precipitation (UP) solution to

provide real-time and nowcast (0-6 hours) global

precipitation with unparalleled accuracy.

------------------------------------------------------------------

(1) Global disparity in the supply of commercial weather and

climate information services by Lucien Georgeson, Mark Maslin and

Martyn Poessinouw, 24 May 2017

New investment case study: Voyager

Investment The commercial and government ecosystem in low earth

thesis orbit is experiencing sustained growth that will

create sufficient demand for a new Space Prime akin

to incumbent defence prime contractors such as Lockheed

Martin. The most agile and adaptable companies are

expected to be competitive given existing primes

are hampered by engrained procedures and operations,

making them ill-suited for the prime contracts of

tomorrow.

Round New investment: Series B.

------------------------------------------------------------------

SSIT investment $2.5m / $92m.

/ round

size

------------------------------------------------------------------

Co-investors Walleye Capital, Senvest, Juniper, Scout.

------------------------------------------------------------------

Problem Today, the only organisations capable of delivering

cutting edge space infrastructure, like space stations

and CisLunar missions are the existing base of large

defence primes. These organisations are notoriously

slow moving, costly and regularly subject to delays

and cost overruns due to outdated working practices.

They are unsuited to the evolving and dynamic needs

of the in-space economy.

------------------------------------------------------------------

Solution Voyager's lean, fast-moving organisation, with a

strong commercial mindset, will provide the next

generation hardware demanded by the evolving userbase

of space. Voyager will be best positioned to capitalise

on the demand from a customer base increasingly

prioritising commercial considerations for the businesses

which they operate in space.

------------------------------------------------------------------

Market With Voyager's Starlab space station, the business

is well-placed to address the approximately $4bn

annual spend on the International Space Station.

Furthermore, new markets of in-space manufacturing

and R&D at maturity are expected to be worth $5bn

annually.

------------------------------------------------------------------

Latest news

* Acquired its (7t) h subsidiary, ZIN Technologies. ZIN

Technologies brings decades of experience in

engineering, design and integration of human-rated

spaceflight systems.

* Announced its $80m Series B raise.

* Announced a joint venture with Airbus to build and

operate the Starlab space station.

------------------------------------------------------------------

Follow-on investments

The Company continues to invest in line with the strategy

articulated at the time of its IPO, seeking to increase the level

of support for those portfolio companies which we have the greatest

conviction in. During the year, the Company invested GBP12.2m of

additional funding in eight companies (five in the main portfolio

totalling GBP10.7m and three early stage, non-material positions

totalling GBP1.5m). The main follow-ons are outlined below.

In August 2022, the Company completed a $3m (GBP2.5m) follow-on

investment in PlanetWatchers, acting as co-lead alongside Creative

Ventures as part of Planet Watchers' Series A investment round.

With this round, PlanetWatchers is looking to invest in automation

and fuel its commercial growth through expanded sales efforts.

PlanetWatchers uses synthetic aperture radar data to tell the story

of every field, helping crop insurers and farmers to automate data

capture and claims validation.

In December 2022, the Company invested a further EUR5m (GBP4.4m)

alongside other shareholders in D-Orbit to help consolidate its

position as the market leader within the in-space transportation

market. D-Orbit is the market leader in space logistics, providing

last-mile satellite delivery, space cloud computing and hosted

payload operations.

In March 2023, the Company completed a EUR1.0m (GBP0.9m)

follow-on investment in QuadSAT as part of the company's EUR6.3m

Series A investment round led by IQ Capital. QuadSAT will utilise

this funding to execute on its increasingly strong commercial

pipeline. QuadSAT provides satellite operators, antenna

manufacturers and service providers with a flexible and

cost-efficient solution to test and validate the performance of

antennas. Its drones, equipped with specialised instruments,

collect data efficiently and accurately without the need for manual

labour.

In May 2023, the Company completed a GBP2.1m follow-on

investment in SatVu as part of the company's GBP13m Series A2

round. Shortly after the closing of this round, SatVu launched its

first satellite (HOTSAT1). This funding round will allow the

business the runway to start executing on over GBP100m of

commercial interest and provide meaningful headway to the launch of

the second satellite in its constellation. SatVu is deploying a

constellation of infrared sensing satellites. Using this

constellation, the business will be able to monitor the temperature

of any building on the planet in near real time to determine

valuable insights about economic activity, energy efficiency and

carbon footprint.

Follow-on study: SatVu

Investment Finding a way to pinpoint the worst energy-wasting

thesis buildings on a global scale is a pressing issue

if the world is to achieve Net Zero.

By measuring the thermal footprint of any building

on the planet, SatVu's high resolution, high revisit

infrared satellite constellation holds the key to

resolving this issue.

Round GBP13m Series A2.

-----------------------------------------------------------------

SSIT investment Total: GBP6.7m (Seed, Series A and Series A2).

Series A2: GBP2.1m.

-----------------------------------------------------------------

Co-investors Molten Ventures, AO Proptech, Lockheed Martin, In-Q-Tel.

-----------------------------------------------------------------

Problem Infrared (IR) has a unique capability to 'see' inside

buildings/objects. This holds vast potential for

gathering intelligence for defence, economic activity

and energy efficiency applications. Existing IR

satellites are government-operated, cost hundreds

of millions of Dollars and lack the resolution or

revisit required for these applications.

-----------------------------------------------------------------

Solution SatVu is developing the world's first constellation

of mid-wave IR small satellites that represent a

10-100x reduction in cost and weight versus existing

government satellites.

-----------------------------------------------------------------

Market Defence, intelligence, industrial monitoring, climate.

-----------------------------------------------------------------

Latest news

* First satellite launched by SpaceX on 12 June 2023.

* Closed GBP13m Series A2 round, extending cash runway

until at least September 2024.

* Gathered pipeline of 50+ pre-contracts with options

to purchase GBP100m+ in imagery.

-----------------------------------------------------------------

Follow-on study: D-Orbit

Investment D-Orbit is the leader in the nascent 'space taxi'

thesis market offering last mile delivery services for

customers' satellites. Beyond its pioneering space

taxi services, the company innovates with high-margin

ancillary offerings, including using its ION spacecraft

for on-orbit cloud computing and in-space logistics,

carving a path to become a cornerstone in the new

space economy. Leveraging its unique capabilities

and vision, D-Orbit is on track not only to dominate

the space taxi sector but also to explore lucrative

avenues in space servicing and cloud infrastructure,

promising substantial growth and value.

Round Convertible loan bridge round.

-----------------------------------------------------------------

SSIT investment Total: GBP10.7m.

Bridge round: EUR5m.

-----------------------------------------------------------------

Co-investors Large Ventures, Indaco, Neva.

-----------------------------------------------------------------

Problem Rideshare models, like SpaceX, are limited in the

orbits they can achieve. The rapidly growing smallsat

market lacks reliable, efficient means to deliver

satellites to specific orbits.

-----------------------------------------------------------------

Solution D-Orbit's breakthrough IONs combine low-cost rideshare

with targeted, quick satellite delivery. After launch,

IONs form a 'pseudo constellation', adaptable for

varied high-margin applications and potential in-orbit

services.

-----------------------------------------------------------------

Market Space logistics (EUR1bn+), in-space computing (EUR3bn+).

-----------------------------------------------------------------

Latest news

* Launched 11(th) successful mission.

* Delivered over a hundred payloads in total to orbit.

* Won EUR26m contract from ESA for IRIDE, an earth

observation programme. D-Orbit will design and build

a synthetic aperture radar satellite with an

additional EUR24m option.

* Won another 3 multi-million Euro contracts with ESA

and ASI.

* Completed 10-month in-orbit cloud computing

demonstration with AWS.

-----------------------------------------------------------------

Disposals

In the year, the Company received GBP3.3m in proceeds from

disposals. During a rally in November 2022, we took the opportunity

to sell down some of the Arqit holding at an average price of $8.48

per share in order to provide some additional liquidity to support

private portfolio companies. In addition, we sold one of the early

stage portfolio companies which had been fully written down back to

its founder for a diminimis sum.

Portfolio Performance

Year ended 30 June 2023

Portfolio cash runway

During the year, a number of the Company's investments completed

funding rounds supported by new investors, which provides strong

external validation of the valuation progression of individual

investments. 11 portfolio companies that were in the portfolio at

the start of the period raised 12 rounds. SSIT participated in the

rounds of seven of these portfolio companies.

The companies in the portfolio at the start of the year which

raised rounds during the year largely experienced positive

valuations in those rounds as outlined in the annual report.

The average cash runway of the private portfolio from 30 June

20231 is 20 months. 87% of the fair value of the private holdings

has a cash runway to 30 June 2024 or beyond. The chart in the

annual report shows the material holdings' cash runways and their

syndicates' strength and ability to support future capital needs of

the businesses. Syndicate strength is an area we assess prior to

investment. We note that some of the larger holdings with 12

months' or less cash runway are in the advanced stages of closing

significant additional capital before the end of 2023 which will

materially extend their cash runways. In addition, some of the

larger holdings are now forecasting that they will become cashflow

positive without requiring additional funding.

(1) Fair value weighted average (as defined in the Glossary)

number of months of cash runway from 30 June 2023 for the private

holdings representing 97% of fair value, taking into account cash

as at 30 June 2023 and any funding raised post period end. Source:

Portfolio company data.

Listed portfolio

Continued share price reductions of three of the listed

portfolio companies (Arqit, Spire Global and AST SpaceMobile) led

to an aggregate fair value decrease of GBP9.1m for the listed

portfolio (GBP8.0m excluding FX losses) over the year. In

aggregate, the listed portfolio represented just 2% of NAV and 3%

of portfolio fair value at the end of the year (fair value vs.

cost: 13.0%, down from 44.7% at 30 June 2022). These listed

companies continue to experience depressed share prices, similar to

that experienced by other companies which went public via mergers

with special purpose acquisition companies ('SPACs'), as shown on

the chart in the annual report by the DeSPAC Index. We believe that

the greater reductions seen by the listed portfolio companies'

share prices than that experienced by the DeSPAC Index is likely

driven by the fact that both Arqit and AST SpaceMobile were able to

raise additional funding in the year (albeit at a discount to their

share prices which would have caused further downward pressure).

Positively, there appear to be some signs of improvement in the IPO

market, with the venture capital-backed and private equity-backed

IPO indices both up at the year end and since.

On 18 November 2022, Nightingale listed on the Australian Stock

Exchange raising AUD5m (ASX: NGL; fair value vs. cost: n/m). The

Company had previously fully provided against this portfolio

company, which had been acquired for zero consideration from

Seraphim Space LP as part of the Initial Portfolio, and the fair

value was GBP0.1m as at 30 June 2023. Nightingale offers an

autonomous drone perimeter security service designed to enhance

physical security at large, sensitive facilities, including

critical infrastructure such as ports and nuclear power facilities

through to Fortune 500 companies.

Private portfolio

The private portfolio, which comprises the main part of the

Company's investments representing 97% of fair value and 82% of

NAV, continued to deliver robust performance, with its fair value

closing the year at 119% vs. cost (123% excluding FX losses), down

from 122% on 30 June 2022 (117% excluding FX). These businesses

continue to deliver solid revenue and bookings growth driven by

solid fundamentals in their core focus areas (especially global

security and climate change/ sustainability).

As explained above, a number of portfolio companies raised

funding at flat or higher prices than their previous rounds. This

led to increasing underlying fair value for a number of the main

portfolio companies, SatVu (fair value vs. cost: 218%), D-Orbit

(fair value vs. cost: 183%), Astroscale (fair value vs. cost:

105%), QuadSAT (fair value vs. cost: 150%) and Pixxel (fair value

vs. cost: 153%). In addition, the recalibration exercise and

sustained strong performance led us to mark up the value of ICEYE

(fair value vs. cost: 115%). This was more than offset by the

combined impact of FX losses and portfolio companies which saw

reducing fair value driven by reductions in enterprise values due

to a combination of underperformance against expectations, limited

cash runways and lower priced rounds, including PlanetWatchers

(fair value vs. cost: 86%), ALL.SPACE (fair value vs. cost: 109%),

Altitude Angel (fair value vs. cost: 167%), Edgybees (fair value

vs. cost: 0%), Xona Space Systems (fair value vs. cost: 84%) and

LeoLabs (fair value vs. cost: 106%).

Valuation policy

In respect of private company valuations, fair value is

established by using recognised valuation methodologies, in

accordance with the International Private Equity and Venture

Capital Valuation ('IPEV') Guidelines. The Company has a valuation

policy for unquoted securities to provide an objective, consistent

and transparent basis for estimating their fair value in accordance

with IFRS as well as the IPEV Guidelines. The unquoted securities

valuation policy and the associated valuation procedures are

subject to review on a regular basis, and updated as appropriate,

in line with industry best practice.

In summary, the Company determines fair value in accordance with

the IPEV Guidelines by focusing on updating the enterprise value

(either through there being a new funding round or through a

valuation calibration exercise or adjustment for milestones) and

then applying the implied equity value (based on adjustments for

new debt, etc) to the company's capital structure (i.e. preference

stack). In the event of commercial (or technical) underperformance

of a portfolio company, a write down can then also be applied,

typically in increments of 25% to reduce fair value.

All valuations are considered on a quarterly basis and

calibrated against the price of the last funding round. However,

given valuation volatility during 2022/23, to ensure appropriate

NAV reporting, the Board initiated a process to recalibrate, across

an increased number of datapoints, the material portfolio companies

(i) whose last funding rounds took place more than 12 months

earlier or (ii) which had experienced a significant milestone event

or material under- or over-performance (each a 'recalibration

event'). This process entails assessing the enterprise value

following the most recent round against a composite of four

elements: observable market data (where possible), recent relevant

private investment transactions, public market valuations of

comparable companies and the company's internal metrics and

performance. This exercise further strengthens the valuation

process with the goal of preserving shareholder confidence in the

NAV during volatile market conditions and will be conducted when a

recalibration event occurs and every quarter thereafter until a new

priced funding round is completed.

Performance of the Company

Year ended 30 June 2023

Portfolio Attribution

-- GBP4.9m in new investments (2022: GBP117.5m) and GBP12.2m of

follow-ons in the year (2022: GBP32.5m).

-- GBP3.3m in proceeds from disposals in the year (2022: GBP0.0m).

-- GBP2.0m realised loss from partial sale of Arqit and the exit

of one of the early stage portfolio companies.

-- Reduction in unrealised fair value of GBP3.7m during the year

(2022: GBP9.2m) and a GBP6.8m unrealised FX loss (2022: GBP16.8m

gain).

-- GBP187.4m fair value of portfolio at the end of the year (2022: GBP186.1m).

-- 576bps decrease in closing portfolio fair value vs. portfolio

cost, including FX movements (2022: 429bps increase).

NAV

-- GBP16.9m decrease in NAV (7.1% decrease) over the year to

GBP222.4m (30 June 2022: GBP239.3m).

-- GBP35.3m liquid resources (15.9% of NAV) at 30 June 2023 (30 June 2022: GBP57.7m).

NAV Per Share: 99.97p 92.90p

NAV decreased from GBP239.3m to GBP222.4m during the year. This

decrease of GBP16.9m was primarily a result of a portfolio fair

value decrease (including FX movements), with a GBP6.8m FX loss

across the portfolio and a GBP8.0m reduction in the underlying fair

value of listed companies in aggregate more than offsetting a

GBP4.3m increase in the underlying fair value of private

companies.

The other movements consist of a realised loss for the year

(GBP2.0m) from the sale of some of the Arqit holding and one of the

early stage companies, management fees (GBP2.9m) and operating

expenses (GBP1.9m), partially offset by interest received

(GBP0.3m).

The NAV per share decreased from 99.97p to 92.90p over the

year.

The Company is targeting an annualised total return on the

Company's portfolio of at least 20% over the long term. The Company

has no formal benchmark index but has tracked its NAV per share and

share price movements against the following indices for

reference.

-- MSCI World Aero and Defence Index (GBP) - a significant

proportion of portfolio companies' revenues are derived from the

broader aerospace and defence industry and/or have governments as

significant customers.

-- MSCI World Climate Change Index (GBP) - a significant

proportion of portfolio companies' revenues are derived from

climate change products and services.

-- FTSE All-Share Index (GBP) - the Company is listed on the London Stock Exchange.

-- NASDAQ (GBP) - the Company invests in SpaceTech, a subset of

the broader technology market, and two of its listed holdings are

listed on NASDAQ.

-- Dow Jones Global Technology Index (GBP) - the Company invests

globally in SpaceTech, a subset of the broader technology

market.

-- S&P Kensho Space Index (GBP)- the Company invests

globally in SpaceTech, a subset of the broader space sector.

-- Goldman Sachs Future Tech Leaders Equity ETF (GBP) - the

Company invests globally in SpaceTech, a subset of the broader

technology market.

On 30 June 2023, all indices were up year-on-year other than

NASDAQ.

As explained in the Share Price section, the Company's share

price has been significantly more volatile than its NAV per

share.

Quarterly valuation changes

In the three months ended 30 June 2023

During the quarter ended 30 June 2023, the fair value (adjusted

for acquisitions and disposals over the quarter) rose by GBP3.9m,

increasing fair value to 98.5% vs. cost (101% excluding FX

losses).

An FX loss of GBP4.2m and fair value reductions at Altitude

Angel (GBP3.6m), Xona Space Systems (GBP1.1m) and PlanetWatchers

(GBP0.9m), driven by underperformance, were more than offset by

fair value increases driven by new funding rounds at D-Orbit

(GBP3.8m), LeoLabs (GBP3.5m), Pixxel (GBP1.2m) and SatVu (GBP0.7m),

as well as a premium being applied to ICEYE's enterprise value due

to strong performance leading to a GBP4.1m increase in fair

value.

Post Year End Developments

Investment activity has continued since the end of the year,

with a further GBP4.1m invested. One follow-on investment of

GBP2.8m was made into ALL.SPACE, an existing portfolio company in

the main portfolio. In addition, there were two follow-on

investments, totalling GBP0.5m, and two new investments, totalling

GBP0.9m, into early stage companies.

Team Update

Investment team members Andre Ronsoehr, Maureen Haverty and

Lewis Jones were all promoted recently to Investment Partner,

Investment Principal and Investment Vice President, respectively.

In addition, Zainab Qasim joined the investment team as an

Investment Analyst on 1 April 2023 having previously worked at the

affiliated Seraphim Space Accelerator.

Outlook

We remain confident with the outlook for the space domain

globally and SSIT's portfolio of best-of-breed SpaceTech companies.

We continue to enjoy the privileged position of seeing the majority

of the sector's global dealflow. This provides an information

asymmetry over the sector that informs our every move.

With the secular trends relating to global security, food

security, climate change and sustainability expected to accelerate,

we believe the Company is well-positioned to take advantage of the

resultant opportunities. We anticipate that demand for the products

and services of the portfolio companies, particularly from

governments, should result in the portfolio delivering strong

growth metrics.

As at 13 October 2023, cash was GBP29.4m, with a potential

further GBP3.0m of liquidity available in the holdings of listed

companies. We believe this liquidity should be sufficient to

provide the necessary levels of support to the portfolio over the

course of the next 12 months. Whilst we expect to continue to

diversify the portfolio with selective new investments, uncertainty

around the timing of market recovery (and, therefore, our ability

to raise new equity capital) means that the size of new investments

will likely be small, with investment activity expected to be more

weighted in favour of supporting the existing portfolio until a

time when the market provides the appropriate conditions to

fundraise .

Mark Boggett

CEO

Seraphim Space Manager LLP

Investment Manager

16 October 2023

Portfolio at 30 June 2023

Portfolio Snapshot

Fair value Top 10 investments

GBP187.4m as % of fair value

(2022: GBP186.1m) 85.7%

(2022: 87.0%)

Private portfolio Listed portfolio

fair value vs. initial fair value vs. initial cost

cost 13.0%

119.2% (2022: 44.7%)

(2022: 122.5%)

Average portfolio company Average portfolio company

revenue growth(1) bookings growth(1)

34% 199%

Average cash runway of the

Total money raised by private portfolio from 30

private portfolio companies(2) June 2023(3)

$>360m 20 months

(1) Fair value weighted average (as defined in the Glossary)

year-on-year growth for the 12 months ended 30 June 2023 of the top

10 holdings, representing 86% of fair value (72% of NAV) at the

year end. Source: Portfolio company data.

(2) Between 1 July 2022 and 30 June 2023. Source: Portfolio

company data.

(3) Fair value weighted average (as defined in the Glossary)

number of months of cash runway from 30 June 2023 for the private

holdings representing 97% of fair value, taking into account cash

as at the year end and any funding raised post period end. Source:

Portfolio company data.

Portfolio Highlights

'We are delighted with the progress the portfolio has made

during the year. The portfolio has proven itself adept at

successfully accessing capital at a time when the wider fundraising

environment has been challenging. It is particularly gratifying

that many of these companies have closed funding rounds led by new

investors and on improved terms relative to their previous funding

rounds. The success in capital raising across the portfolio is in

no small part due to the impressive commercial traction achieved,

allied to the scale of the opportunities these companies are

addressing. With the majority of the portfolio now well-funded

through the next 12-18 months, we are excited to see what will be

achieved over the year ahead.'

James Bruegger

CIO , Seraphim Space

ICEYE signed contract to service the government of Astroscale successfully closed $76m Series E funding in

Ukraine by providing access to constellation; early 2023. Awarded $25.5m contract

the only company to make such a deal. Signed five by US Space Systems Command and $80m SBIR from Japanese

satellite deals with Bayanat in UAE. Announced Government after the end of the year.

partnership to provide radar imaging satellite for BAE

Systems' new multi-sensor satellite

constellation. Awarded multi-year purchase agreement by

NASA.

ALL.SPACE started deliveries of its game-changing Altitude Angel announced the development of 265km of

antennas and announced a strategic partnership drone super highways in the UK and received

with Kratos Defense & Security Solutions, Inc. (NASDAQ: GBP5m in backing from BT.

KTOS).

HawkEye 360's cluster 7 of satellites launched to orbit LeoLabs accelerated coverage in Europe with the

in April, bringing its constellation commissioning of its Azores Space Radar and

to 21 satellites. In July 2023, it announced a new $58m now has global radar coverage , with 7 operational radars

funding round led by BlackRock (NYSE: achieving c75% market share in LEO.

BLK).

D-Orbit secured four multi-million Euro contracts with PlanetWatchers won new customers and grew its footprint

the European and Italian Space Agencies across the North American crop insurance