Tatton Asset Management PLC Trading Update and Notice of Results (5729Q)

19 Octubre 2023 - 1:00AM

UK Regulatory

TIDMTAM

RNS Number : 5729Q

Tatton Asset Management PLC

19 October 2023

19 October 2023

Tatton Asset Management plc

("TAM plc" or the "Group")

AIM: TAM

Trading Update and Notice of Results

AUM/AUI annual increase of GBP2.441bn or 19.8% to

GBP14.784bn

Tatton Asset Management plc (AIM:TAM), the investment management

and IFA support services business, is today providing an unaudited

Period end update on the Group's performance for the six months

ended 30 September 2023 ("H1 24" or the "Period"). The unaudited

results for the Period will be announced on Thursday, 16 November

2023.

The Group is performing well and results are in line with the

Board's expectations for the Period, with continued growth in both

revenue and profits driven by strong net inflows.

Tatton has continued to maintain consistent high levels of

organic net inflows averaging GBP152m per month in the Period

(FY23: GBP150m per month). Total net inflows in the Period were

GBP0.910bn, marginally ahead of both the final six months of the

prior financial year (H2 23: GBP0.887bn) and the same Period last

year (H1 23: GBP0.907bn).

These strong organic net inflows were supported by a positive

market performance of GBP0.100bn. The total AUM at the end of the

Period was GBP13.720bn (30 September 2022: GBP11.343bn), an annual

increase of 21.0% or GBP2.377bn. The increase in this six month

Period was 7.7% or GBP0.985bn (AUM at 31 March 2023:

GBP12.735bn).

Including 8AM Global Limited ("8AM") assets of GBP1.064bn,

AUM/AUI increased over the last twelve months by 19.8% or

GBP2.441bn to GBP14.784bn (30 September 2022: GBP12.343bn). The

increase in this six month Period was 6.6% or GBP0.913bn (AUM at 31

March 2023: GBP13.871bn). We anticipate that AUM/AUI will exceed

our three year strategic "Road Map to Growth" target of GBP15.0bn

by March 2024.

We continue to attract support from new firms and have increased

the total number of supporting IFAs by 5.2% to 914 since the end of

the prior year (31st March 23: 869).

Total GBPbn

----------------------------------- ------------

Opening AUM 1 April 2023 12.735

Organic net inflows 0.910

Market and investment performance 0.100

Disposal of AIM portfolio (0.025)

Closing AUM 30 September 2023 13.720

8AM - AUI(1) 1.064

----------------------------------- ------------

Total closing combined AUM /

AUI 30 September 2023 14.784

----------------------------------- ------------

(1)Assets under influence 100% of the 8AM Global AUM

Paradigm, the Group's IFA support services business, has

delivered a resilient performance in the Period. Paradigm Mortgages

participated in mortgage completions totalling GBP6.9 billion (H1

23: GBP7.3 billion). We have continued to deliver a strong volume

of completions in this challenging economic climate, although as

anticipated the nature and distribution of these completions

reflected the wider market and shifted towards lower margin product

transfers rather than new mortgages or buy-to-let completions.

Mortgage member firms in the Period increased to 1,798 (31 March

2023: 1,751) and Consulting member firms were 437 at the end of the

Period (31 March 2023: 431).

Paul Hogarth, Founder and CEO of Tatton Asset Management plc,

said:

"The Group continues to make good progress amidst the continuing

backdrop of persistently volatile economic and market

conditions.

"It has been very pleasing to see Tatton's sustained strong

organic net inflows in an environment where in general, asset

managers have been suffering redemptions. In fact, over the past 18

months, we have consistently achieved an average of GBP150 million

in net inflows per month, reaffirming our progress and we now

expect to exceed our GBP15 billion 'Road Map to Growth' strategy by

March 2024.

"Our Paradigm Mortgage business participated in GBP6.9bn of

mortgage completions in a Period which saw increasing interest

rates and uncertainty in the housing market. As expected, the mix

of completions shifted to lower margin products, but overall we are

pleased with the resilient performance in H1 23. Paradigm

Consulting continues to perform in line with our expectations.

"We look forward to making further progress over the rest of the

year, while remaining acutely aware of the continuing macroeconomic

turbulence and market volatility. The Board remains confident in

the future prospects of the Group."

For further information please contact:

Tatton Asset Management plc

Paul Hogarth (Chief Executive Officer)

Paul Edwards (Chief Financial Officer)

Lothar Mentel (Chief Investment Officer) +44 (0) 161 486 3441

Zeus Capital - Nomad and Broker

Martin Green (Investment Banking)

Dan Bate (Investment Banking and QE) +44 (0) 20 3829 5000

Singer Capital Markets - Joint Broker

Peter Steel / Charles Leigh-Pemberton (Investment

Banking) +44 (0) 20 7496 3000

Belvedere Communications - Financial PR +44 (0) 7407 023147

John West / Llew Angus (media) +44 (0) 7715 769078

Cat Valentine / Keeley Clarke (investors) tattonpr@belvederepr.com

Trade Media Enquiries

Roddi Vaughan Thomas (Head of Communications) +44 (0) 7469 854 011

For more information, please visit:

www.tattonassetmanagement.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBUBDGXGBDGXI

(END) Dow Jones Newswires

October 19, 2023 02:00 ET (06:00 GMT)

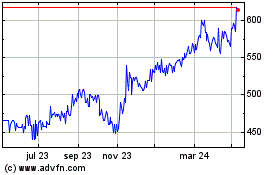

Tatton Asset Management (LSE:TAM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

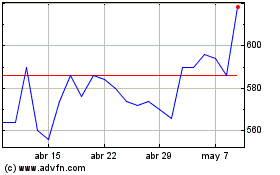

Tatton Asset Management (LSE:TAM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024