TIDMTRI

RNS Number : 5662F

Trifast PLC

11 July 2023

Tuesday, 11 July 2023 07.00hrs

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR. Upon the

publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Trifast plc

(Trifast, TR or the Company)

Annual results for the year ended 31 March 2023

Publication of the 2023 Annual report and financial

statements

Trifast publishes the Group's audited Annual report and

Financial statements for the year ended 31 March 2023. The

following information contained within this announcement is a

summary extracted from the Group's audited FY2023 Annual report and

financial statements. The publication can be read in full via this

link:

http://www.rns-pdf.londonstockexchange.com/rns/5662F_1-2023-7-10.pdf

"My role is not to fundamentally change the corporate strategy

but to align this strategy with greater focus. The task is building

on TR's reputation as a trusted and reliable partner by

accelerating the pace of execution and creating an aligned

leadership team with the skills and necessary capabilities, visions

and drive to maximise 50 more years of success"

Scott Mac Meekin, Interim CEO

Key operational highlights

* After a challenging period, TR is now focused on

continuing its momentum to deliver profitable growth

and its medium-term aspirations

* Strong revenue growth of 9.1% at Constant exchange

rate (CER) (organic: 7.3%; acquisition: 1.8%; 11.8%

at Actual exchange rate (AER))

* Pass through of inflationary cost successfully

concluded by January 2023 with some key customers

* Growth momentum sustained in FY23 Q4; along with

record level of contract wins for the year totalling

GBP25.6m

* Underlying profit before tax reduces to GBP9.3m at

AER resulting in underlying diluted earnings per

share of 5.13p

* Comprehensive UK operational improvement plan

developed, annualised savings in excess of GBP5m

* Gross stock levels reduced by more than GBP10m during

Q4 although flat year on year

* Reflecting confidence in the future, proposing final

dividend of 1.50p per share, up 7.1% over 2022

* Post year end - new banking facilities with a

combined limit of GBP120m

Group financial performance

CER CER AER AER AER

Underlying measures: FY23 change FY23 change FY22

------------------------------------- --------- -------- ---------- ---------- ----------

Revenue GBP238.5m 9.1% GBP244.4m 11.8% GBP218.6m

Gross profit % 25.3% (140)bps 25.3% (140)bps 26.7%

Underlying operating profit

(UOP)(1) GBP11.2m (24.1)% GBP12.0m (18.7)% GBP14.7m

Underlying operating profit

%(1) 4.7% (200)bps 4.9% (180)bps 6.7%

Underlying profit before tax(1) GBP8.6m (37.7)% GBP9.3m (32.4)% GBP13.8m

Underlying diluted earnings

per share (1) - - 5.13p (36.9)% 8.13p

Adjusted leverage ratio(1,3) - - 2.19x 0.92x 1.27x

Adjusted net debt(1,2) - - GBP(38.0)m GBP(14.2)m GBP(23.8)m

Return on capital employed (ROCE)(1) - - 5.4% (290)bps 8.3%

Total dividend - - 2.25p 7.1% 2.10p

------------------------------------- --------- -------- ---------- ---------- ----------

GAAP measures

Operating (loss) /profit - - GBP(0.0)m (100.1)% GBP11.6m

Operating (loss) / profit % - - (0.0)% (530)bps 5.3%

(Loss) / profit before tax - - GBP(2.7)m (125.4)% GBP10.6m

Diluted (loss) / earnings per

share - - (2.12)p (132.3)% 6.56p

1.Before separately disclosed items (see note 1)

2.Adjusted net debt is stated excluding the impact of IFRS 16 Leases.

Including right-of-use lease liabilities, net debt increases by GBP(15.8)m

to GBP(53.8)m (FY22: net debt increases by GBP(13.7)m to GBP(37.5)m)

3.Adjusted leverage ratio is calculated using adjusted net debt against

adjusted underlying EBITDA

Note:

Unless stated otherwise, amounts and comparisons with prior year are

calculated at constant currency (Constant Exchange Rate (CER)).

Where reference is made to 'underlying' this is defined as being before

separately disclosed items.

Reference links:

The Board believe that the 2023 Annual report gives a fair and

balanced review of the Trifast business and its strategy for the

future. For ease of reference, the following links will be of

interest:

To read more about: Refer

to:

------------------------------------------ -----------------------

Where we operate Page 3

Our strategy for growth Pages 8-15

Key strategic and performance Pages 18-21

indicators

Our business model Page 16-17

Our sectors Page 22

-23

Board and leadership structure Pages 68-70

Stakeholder engagement Page 24-31

Presentation of results webcast

The Company is holding a 'live' presentation via the Investor

Meet Company platform (IMC). The session will start at 11.30am

today. To register and join the event please follow the link:

https://www.investormeetcompany.com/trifast-plc/register-investor

About Trifast plc (TR)

Founded in East Sussex in 1973, TR is a leading international

specialist in the design, engineering, manufacture, and

distribution of high-quality industrial fastenings and Category 'C'

components principally to major global assembly industries.

The Group supplies to customers in c.70 countries across a wide

range of industries, including light vehicle, heavy vehicle, health

& home, energy, tech, & infrastructure (ET&I), general

industrial and distributors. As a full service provider to

multinational OEMs and Tier 1 companies spanning several sectors,

we deliver comprehensive support to our customers across every

requirement, from concept design through to technical engineering

consultancy, manufacturing, supply management and global

logistics.

As an international business we are able to provide 24/7

customer support from across key regions in the UK, Asia, Europe

and North America. In addition to our service locations we operate

a number of manufacturing facilities focused on high volume cold

forged fasteners and special parts. We have also established

Technical & Innovation Centres to support R&D and customer

collaboration across the world.

To read more on our 50 years of progress please refer to pages

4-5 of the 2023 Annual report.

The 2023 Sustainability Report is available on the Company

website.

For more information, visit:

TRIFAST PLC TRI Stock | London Stock Exchange

Our website: www.trifast.com

LinkedIn: www.linkedin.com/company/tr-fastenings

Twitter: www.twitter.com/trfastenings

Facebook: www.facebook.com/trfastenings

Note

Trifast, TR and TR Fastenings are registered trademarks of the

Company

LEI number: 213800WFIVE6RWK3CR22

Trifast plc

Annual results for the year ended 31 March 2023

Extracts from the letter to shareholders from the Non-executive

Chair, Jonathan Shearman

Introduction

In this, TR's 50th anniversary year, it is only right to express

our gratitude to 'the Mikes' (Timms and Roberts). We joined with

them on 4 June this year to celebrate the Company's 'birth' and it

is a privilege for me and the team to be involved in the business

today. Trifast has experienced a significant amount of change and

evolution since 1973. Over the last 12 months, we have once again

seen this, some of which has been encouraging and some of which has

been challenging but necessary for the business and its future.

Simplifying and better aligning the business will provide the

foundations for a bright and rewarding future for all of our

stakeholders.

Dividend policy

Our focus on growth allows us to remain committed to a

progressive dividend policy that shares the benefit of ongoing

profitable growth with our shareholders.

Reflecting our confidence in the prospects for the business, the

Board is proposing an increased final dividend of 1.50p (FY22:

1.40p). This, together with the interim dividend of 0.75p (paid on

14 April 2023), brings the total for the year to 2.25p per share,

an increase of 7.1% on the prior year (FY22: 2.10p). The final

dividend, subject to shareholder approval at the AGM, will be paid

on 13 October 2023 to shareholders on the register at the close of

business on 29 September 2023. The ordinary shares will become

ex-dividend on 28 September 2023. The dividend cover is currently

2.3x, however the Board continues to consider that an appropriate

future level of dividend cover is in the range of 3.0x to 4.0x.

Board and Senior Management changes

In November 2022, we announced that Darren Hayes-Powell and

Louis Eperjesi were both joining the Board as Chief Financial

Officer and Non-Executive Director, respectively. The Company is

already benefiting from their contributions and counsel. In

addition, Dan Jack, who joined Trifast in June 2020, was promoted

to Chief Operating Officer. Scott Mac Meekin, previously a

Non-executive director, stepped in as interim Chief Executive

Officer in February 2023, following the resignation of Mark Belton.

Scott's pace, approach and immense sector knowledge is proving

extremely insightful, and feedback from customers, employees and

stakeholders has been positive.

In August our previous CFO, Clare Foster, also, left the

business. We take this opportunity to thank Clare and Mark for the

contributions to the Group and wish them well in their future

endeavours.

Annual General Meeting

The forthcoming AGM in September will be the final time I will

be seeking re-election. Together with the Board, I now feel that

the baton can be safely passed to the next Chair.

People

I acknowledge that this has been a year of change and

disruption, and it has resulted in some hard decisions having to be

made. Over the last 50 years, many colleagues have contributed to

TR's growth and I thank all of them around the world for their

personal and collective contribution, including during this

challenging period. They make Trifast what it is and they will

continue to drive us forward into our future.

Finally, having navigated the many challenges of the last few

years, I am encouraged that we now have a Board and leadership

structure with the experience and capabilities to support the

business and capitalise on the many opportunities that lie

ahead.

To read the Chair's letter in full please refer to page 4 of the

2023 Annual report.

Extracts from the Review by the Interim Chief Executive Officer,

Scott Mac Meekin

Introduction

When the Board asked me to step into this role in February this

year, I took the opportunity without hesitation. As interim CEO, my

role is not to fundamentally change the corporate strategy, but to

align this strategy with greater focus. I see my task as building

on TR's reputation as a trusted and reliable partner by

accelerating the pace of execution and creating an aligned

leadership team with the skills and necessary capabilities, visions

and drive to maximise 50 more years of success.

Operating background in FY23

Throughout the year we witnessed macroeconomic and geopolitical

elements impacting the business directly and through our suppliers

and customers. We encountered extraordinary input cost increases,

which combined to pressure several of our customer segments, in

particular the health & home sector.

This 'mixed' environment, coupled with a host of corrective

actions, implemented throughout the year, and a full year

contribution from our Falcon acquisition, resulted in a reasonable

start to FY23 across all regions in terms of volume.

However, during the first half, this was accompanied by

challenges specifically at TR VIC, our Italian operation, and the

loss of a full two months trading due to Covid-19 in our China

operations, both of which impacted our margins.

During the second half of the year, the business enjoyed a

gradual return towards more normal levels of lead times, freight

costs and raw material costs, though, by Q4, several of our

businesses were further affected by the changing

macroenvironments.

More detail on the operating background is contained within the

CFO's Financial review.

Significant changes in FY23

-- Global wins: The year under review saw new highs for both

revenue and contract wins, the latter, significantly within the

automotive and energy, tech & infrastructure sectors. This

momentum included both of our North American businesses.

-- Revenue growth : In FY23 we saw revenue growth in Europe and

North America. Asia operations recorded moderate growth in the year

and was even able to overcome the impacts of the national shutdown

in China.

-- Dynamic pricing : During the year, several major customers'

multi-year contracts were due for renegotiation. It is satisfying

to report that the team has, in partnership with these key

accounts, successfully renewed these contracts which now

incorporate a flexible price mechanism that will automatically

adapt for extraordinary up or downside changes in a broad basket of

input prices. This is a significant step towards building in a more

dynamic pricing model for the business as a whole.

-- Customer centricity : We have recently launched a global

programme designed to help us focus our resources more acutely on a

well-defined set of market segments and key customers. This

programme is a comprehensive review of our existing and potential

customer engagements, providing our teams across the Group with a

clear and standardised lens. This initiative will assist us in

determining the optimal customers and prospects for us to partner

with, and what are the most effective services and products for

each unique customer.

-- Our IT journey - beyond Atlas : I am happy to say that, after

a long period of transformation and learning, the Group has now

proven they are able to roll out our finance and operations

solutions using Microsoft D365 together with our standard operating

procedures (SOPs) and data templates. The availability of key data

from the completed implementations has provided the basis for many

of our recent decisions and will continue to be a key strategic

part of our development road map.

Going forward

Following my appointment, I agreed an initial 100-day plan with

the Board, which largely flowed from the key points instigated in

the previous quarter, namely reduction of working capital and

therefore debt and the execution of a cost reduction programme

focused on the UK.

By the end of the financial period, we had introduced quarterly

sprints, with Sprint 2 having started in June. A significant

objective of this process is to implement a much tighter focus

allowing us to postpone or sequence the many other, albeit

important, competing tasks, allowing for faster execution of those

tasks agreed as priorities within any sprint.

Most importantly, the people of TR

The most important part of Trifast is its people. They are

renowned worldwide for their tireless commitment to customer

service and reliability, priding themselves on delivering excellent

product, service and quality. As part of a key driver of our future

success, we intend to enhance our training and leadership efforts.

Our mission is to implement a 'winning team' programme over the

next 24 months consisting of three fundamental elements:

-- Building a climate for action

-- Competencies for success

-- Commitment to results

Outlook

As we said in April's update, the Group's business foundations

remain strong, and there is significant potential to be realised

during the coming years. We are also mindful that the short-term

macro-economic outlook remains challenging.

We continue to take meaningful steps across a range of

operational and financial initiatives, including an on-going

reduction in working capital, a focus of Sprint 2 being further

integration of Asia into the Group and improved utilisation of our

in-house manufacturing.

We have added further new contract wins in the year to date,

especially in our North American and European regions, alongside an

increasingly healthy pipeline. These, together with the initial

benefits from our operational improvement programmes, support the

Board's continued expectation in delivering an improvement in

performance in FY24, albeit weighted towards the second half of the

year.

The Company looks forward to updating shareholders of further

progress over the coming year.

To read the CEO review in full please refer to page 6 of the

2023 Annual report.

Trifast plc

Annual results for the year ended 31 March 2023

Financial review by the Chief Financial Officer, Darren

Hayes-Powell

FY23 presented well-documented challenges for the Group,

however, our focus on our immediate priorities in Q4 showed a

positive boost. This, combined with robust growth in the second

half, enabled us to deliver revenues up 9.1% CER to GBP238.5m (AER:

11.8% to GBP244.4m; FY22: GBP218.6m). 7.3% of that growth was

organic, with the remaining 1.8% reflecting five months' trading

from TR Falcon.

By the end of FY23, we had successfully achieved most of our

price increase programme, incorporating a flexible pricing

mechanism with our key customers, and we are pleased to report that

in March 2023 our margins improved.

This growth reflected persistent demand in most of our

underlying markets and was achieved through focused sales

initiatives across a number of sectors.

Gross profit has reduced to 25.3% (AER: 25.3%; FY22: 26.7%) as

the positive impact of higher revenues has been offset by the lag

in pass-through of cost factors due to freight, higher electricity

and raw material cost deltas. During the final quarter of 2023 the

flexible pricing mechanisms with key customers were agreed to

ensure costs were fairly passed on to our end customer. Supply

chain and energy challenges are now stabilising across most of the

world allowing a normalisation of our cost deltas we have faced in

HY1, although this is still working its way through stock holdings

in the first half of FY24.

Underlying operating profit reduced by GBP3.5m to GBP11.2m (AER:

GBP12.0m; FY22: GBP14.7m) due to investments in overheads relating

to recruitment, Project Atlas (Microsoft D365) BAU costs as well as

inflationary cost impacts. As a result of the increased overhead

levels, we commenced a strategic review of operations and function

costs that is anticipated during FY24 to start delivering savings

in excess of GBP5m per annum.

Gross inventory levels at c.GBP97m (AER: c.GBP99m; FY22:

c.GBP98m) are back in line with FY22, reflecting a more balanced

trade position and a significant reduction from HY1 levels of

GBP107m. The continued reduction in gross stock levels will remain

a key focus in FY24. The inventory provision in FY23 was c.GBP8m

(FY22: c.GBP9m).

Adjusted net debt has risen to GBP38.0m (HY23: GBP40.4m; FY22:

GBP23.8m) as underlying cash inflow of GBP11.5m has been more than

offset by a reduction in creditors (GBP11.7m), capex, Atlas

investments (GBP7.3m) and other amounts including interest, tax,

dividends and FX.

Following these cash movements, our leverage ratio, calculated

in line with the banking agreement, at 31 March 2023 was 2.19x

(FY22: 1.27x). Whilst this is higher than historically, it remains

within our covenant range of < 3.0x and therefore continues to

provide flexibility. Facility headroom as of 31 March 2023 was

GBP10.2m (FY22: c.GBP29.3m), as stated before an additional GBP40m

accordion option.

Revenue

We have seen a mixed performance across the regions with Europe

and North America showing strong growth whilst the UK remains flat

and Asia has shown small growth. Across our key market sectors, the

majority have seen strong growth, most notably in light vehicle,

with only distributors and health & home showing reductions

year-on-year.

Europe has seen a 10.4% increase to GBP89.0m (AER: 9.8% to

GBP88.4m; FY22: GBP80.6m). This was driven by strong growth across

the heavy vehicle sector, predominantly in our Swedish operation,

as well as robust growth in light vehicle driven by our entities in

Holland and Spain. Germany continues to grow strongly in the

general industrial sector supported by transfer of business from

the UK in the distributors sector. TR VIC, Italy, has seen a

reduction in revenue year-on-year, mostly from the health &

home sector due to the downturn in customer sentiment and the

indirect impact the Ukraine conflict is having on some of our

customers.

In Asia, we have seen a revenue increase of 2.6% to GBP56.8m

(AER: 9.1% to GBP60.4m; FY22: GBP55.4m). Growth in the region was

hampered by China imposing Covid-19 lockdowns at the start of FY23,

impacting our operations in Shanghai, a key health & home

customer in our Singaporean entity undertaking a significant

de-stocking exercise which resulted in a flat year-on-year position

for the sector. The light vehicle sector has shown a significant

uplift in business in Malaysia and Thailand.

Trading levels in the UK businesses have been impacted

differently, with light vehicle showing strong growth, offset by a

reduction in distributors due to the transfer of business to TR

Kuhlmann, Germany. In our biggest trading entity, TR Fastenings,

UK, we have seen strong growth in energy, tech & infrastructure

and general industrial offset by a fall in health & home.

We have seen the highest growth from our North American

business, 50.3% to GBP26.6m (AER: 68.8% to GBP29.9m; FY22:

GBP17.7m) with investment in new leadership quickly helping to

co-ordinate our legacy and acquired businesses. Organic growth has

driven 28.5% of this as new platform builds in the light vehicle

sector come online and energy, tech & infrastructure sales gain

momentum. TR Falcon has provided 21.8% acquisition growth to the

region. It has also performed well organically in the period, with

revenues running ahead of expectation. Whilst this has started from

a low base, the ability to now take advantage of global customers

has enabled this business to perform.

Underlying operating profit

Underlying operating margins reduced by 200bps, to 4.7% (FY22:

6.7%) resulting in operating profit of GBP11.2m (AER: GBP12.0m;

FY22: GBP14.7m).

As a Group we have been impacted by the macroeconomic

environment, most notably raw material, freight and energy deltas,

but as we finished FY23 the positive impact of stronger sales and

aligned pricing gives us a good base moving forward. Key

investments include Project Atlas business-as-usual costs now

roll-out is underway (including amortisation of GBP0.5m), further

investments into our Group functions and targeted recruitment into

our commercial and compliance teams.

Towards the end of FY23 we commenced a strategic review of

operations and functions to identify specific measures that could

support profitability without adversely impacting our growth

momentum or customer service levels. The output of this review

shows expected savings during FY24 rising to an annualised saving

in excess of c.GBP5m.

In North America we have seen an improvement in year-on-year

margins from a negative position of (0.4)% in FY22 to a positive

margin of 3.9% (AER: 4.2%), as very strong sales growth has driven

operational gearing gains, and following the acquisition of TR

Falcon in August 2021.

Our European region has fallen, recording a reduction of 140bps

to 3.4% margin (AER: 3.3%; FY22: 4.8%), as sales growth gains are

more than offset by gross margin pressures due to the delays in the

pass-through of inflationary cost pressures, most notably energy.

Cost increases have impacted underlying operating profits across

all regions and are now stabilising as pricing negotiations are

becoming an everyday and key part of doing business.

The UK businesses fell by 310bps to 6.6% margin (FY22: 9.7%) as

it has been impacted greatly by the macroeconomic slowdown combined

with stock write-downs and the transfer of distribution business to

Germany. As the inventory is coming back to lower levels, we do not

expect this to continue. We anticipate the margin recovering

towards the medium term target as costs reduce due to operational

improvement programme.

All of our regions are showing underlying operating profits,

with Asia continuing to bring in the highest returns at 15.5% (AER:

15.7%; FY22: 12.9%). The majority of this improvement has come from

trading and efficiencies in our distribution and contract

business.

Operating profit (at AER)

At a Group level, operating profit reduced by GBP11.6m to a loss

of <GBP0.1m (FY22: GBP11.6m). Outside of the factors mentioned

in underlying operating profit (GBP2.7m), the reduction is caused

by the recognition of a restructuring and related charges

(GBP4.2m), the impairment of goodwill in TR VIC (GBP2.9m),

settlement for loss of office (GBP1.1m) and an increase in Project

Atlas costs (GBP0.7m).

The restructuring and related charges relates to the

centralisation of multi-site distribution centres into a National

Distribution Centre (NDC) in the Midlands and the closure of our UK

manufacturing site in Uckfield, for TR Fastenings, our largest

subsidiary. Costs within the figure of GBP4.2m include redundancy

costs in respect of a downsizing of personnel and impairment of

non-current assets due to the closure of certain offices and

warehouses. This was approved by the Board in March 2023 and is

expected to be completed by March 2024. We have excluded these

costs from our underlying results, to reflect the size and one-off

nature of this project. Further details can be found in Note 1 to

this announcement.

Net financing costs (at AER)

Net interest costs have increased to GBP2.7m (FY22: GBP1.0m) as

average gross debt (including IFRS 16) has increased to GBP80.9m

(FY22: average GBP44.4m). Net marginal interest rates (net of

commitment fees) have increased. Post year-end the Group has signed

a new revolving credit facility (RCF) agreement, supported by a UK

export finance - export development guarantee (UKEF - EDG)

agreement to allow the Group flexibility on future cash

investments.

This combined facility limit of GBP120m, with the same lenders,

provides strength and support to enable the Group to meet its

future strategic growth plans. Interest margins have increased in

line with market conditions and will now be within a range of

2.10-3.60% compared to 1.10-2.20% under the previous RCF.

Taxation (at AER)

The underlying effective tax rate (ETR) is higher at 25.6%

(FY22: underlying effective tax rate: 19.1%). The main reason for

this is an increase in the amount of tax on dividends. Despite

recording a loss before tax at statutory level, there still remains

a tax charge as some significant accounting entries in the year

(e.g. TR VIC impairment of goodwill and aborted acquisition costs)

have no tax credit associated to them. Removing these one-off

accounting entries, the effective tax rate is 35.7%, which is still

high due to the low profit before tax relative to the increase in

the amount of tax on dividends. Subject to future tax changes and

excluding prior year adjustments, our normalised underlying ETR is

expected to remain in the range of c.20-25% going forward.

Underlying diluted earnings per share (AER)

Reflecting the challenging performance as explained above, our

underlying PBT at AER is down 32.4% to GBP9.3m (FY22: GBP13.8m).

This, coupled with the increase in our underlying effective tax

rate, has resulted in a reduction in underlying diluted earnings

per share (EPS) of 36.9% to 5.13p at AER (FY22: 8.13p).

Net debt (AER)

The Group's adjusted net debt has increased by GBP14.2m to

GBP38.0m (FY22: GBP23.8m). An increase in working capital

contributed to GBP7.2m of this as a decrease in creditors, due to

ongoing stock reductions, was only partially offset by other

working capital movements. A major focus will remain on working

capital management, reducing the inventory levels and managing

debtors accordingly.

Capital expenditure in the period amounted to GBP7.3m (FY22:

GBP6.3m), including GBP3.0m in relation to increasing capacity at

our Italian operations as well as GBP2.6m on Project Atlas.

Including the impact of IFRS 16 Leases, the Group's net debt

position was GBP53.8m (FY22: GBP37.5m).

Return on capital employed (at AER)

As at 31 March 2023, the Group's shareholders' equity decreased

to GBP135.9m (FY22: GBP139.1m). The GBP(3.2)m reduction reflects a

decrease in retained earnings of GBP(6.1)m, a movement on own

shares held reserve of GBP0.5m, and a foreign exchange reserve gain

of GBP2.4m. With this reduced asset base and lower profits, our

ROCE has reduced by 290bps to 5.4% (FY22: 8.3%). At 31 March 2023,

the number of ordinary shares held by the Employee Benefit Trust

(EBT) to honour future equity award commitments was 1,896,098

shares (FY22: 2,194,470 shares).

Outlook

There can be no doubt that this has been a very challenging

year, particularly with macro-level supply chain issues and

inflationary cost pressures. However, the recent performance,

together with renewed focus, starts to give us confidence on

achieving our plans in FY24.

In Q4 FY23, the Group achieved its key immediate priorities

together with robust future orders received. Our record-breaking

order book of GBP25.6m together with a focused, customer engagement

programme allows us to work towards our medium-term objectives.

Our price increase programme for some of our key customers

ensures price mechanisms are in place to manage future key cost

drivers as our ongoing way of doing business. This, combined with

our focused drive on working capital, especially inventory

management, ensures we manage our customer expectations at

controlled and appropriate levels. Our target for FY24 is to

achieve a balanced inventory level with a continued focus to reduce

further through innovative tools.

We have prepared for the future by renegotiating debt

facilities, which will allow us to grow through organic and

acquisition investments. This is in two forms: first, renegotiation

of our RCF to GBP70m; and second, with a new UKEF-EDG supported

debt facility of GBP50m. This combined facility will allow us the

flexibility to invest and grow the business in the key sectors on a

global basis.

In support of our ongoing growth journey and developing the

foundations for the future we are targeting our capex on

sustainable opportunities combined with short financial payback

periods. FY24 is key to complete the revised roll-out for our

business transformation D365 project by the end of the year.

As a result of this we are confident in the medium term that we

can return to our KSI targets for both UOP% and ROCE.

There can be no doubt that the macroeconomic, finance markets

and geopolitical environment continue to present challenges in the

short term. Notwithstanding this, we are confident with the

fundamentals of the business and our position across the globe to

deal with macro-level issues, while continuing to invest for growth

for the medium term. Consequently, the Board remains committed to

the Group's strategic journey and medium-term profitable growth

aspirations.

To read the Financial review in full please refer to page 50 of

the 2023 Annual report.

Trifast plc

The notes on pages 139-197 of the 2023 Annual Report form part

of these financial statements.

Consolidated income statement

Annual results for the year ended 31 March 2023

Annual 2023 2022

report note GBP000 GBP000

------------------------------------------ ------------ --------- ---------

Continuing operations

Revenue 3, 35 244,391 218,618

Cost of sales (182,462) (160,189)

------------------------------------------ ------------ --------- ---------

Gross profit 61,929 58,429

Other operating income 4 510 565

Distribution expenses (6,727) (5,296)

------------------------------------------ ------------ --------- ---------

Administrative expenses before separately

disclosed items (43,728) (38,952)

Acquired intangible amortisation 2, 13 (1,798) (1,593)

Project Atlas 2 (1,722) (1,041)

Restructuring and related charges 2 (4,235) -

Impairment of goodwill 2, 13 (2,926) -

Settlement for loss of office 2 (1,050) -

Aborted acquisition costs 2 (261) -

Acquisition costs 2, 36 - (508)

------------------------------------------ ------------ --------- ---------

Total administrative expenses (55,720) (42,094)

Operating (loss) / profit 5, 6, 7 (8) 11,604

------------------------------------------ ------------ --------- ---------

Financial income 8 158 31

Financial expenses 8 (2,842) (1,018)

------------------------------------------ ------------ --------- ---------

Net financing costs (2,684) (987)

------------------------------------------ ------------ --------- ---------

(Loss) / profit before taxation 3 (2,692) 10,617

Taxation 9 (174) (1,640)

------------------------------------------ ------------ --------- ---------

(Loss) / profit for the year

(attributable to equity shareholders of

the Parent Company) (2,866) 8,977

------------------------------------------ ------------ --------- ---------

(Loss) / earnings per share

Basic 25 (2.12)p 6.61p

Diluted 25 (2.12)p 6.56p

------------------------------------------ ------------ --------- ---------

Consolidated statement of comprehensive income

for the year ended 31 March 2023

2023 2022

GBP000 GBP000

---------------------------------------------------------- ------- ------------

(Loss) / profit for the year (2,866) 8,977

Other comprehensive income for the year:

Items that may be reclassified subsequently to profit

or loss:

Exchange differences on translation of foreign operations 4,053 2,907

Loss on a hedge of a net investment taken to equity (1,655) (147)

---------------------------------------------------------- ------- ------------

Other comprehensive income recognised directly

in equity 2,398 2,760

---------------------------------------------------------- ------- ------------

Total comprehensive (expense) / income recognised

for the year

(attributable to the equity shareholders of the

Parent Company) (468) 11,737

---------------------------------------------------------- ------- ------------

Consolidated statement of changes in equity

for the year ended 31 March 2023

Share Share Merger Own Translation Retained Total

capital premium reserve shares held reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Balance at 31 March 2022 6,804 22,512 16,328 (3,487) 12,284 84,704 139,145

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Total comprehensive expense for the year:

Loss for the year - - - - - (2,866) (2,866)

Other comprehensive income for the year - - - - 2,398 - 2,398

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Total comprehensive expense recognised for the

year - - - - 2,398 (2,866) (468)

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Issue of share capital 1 18 - - - - 19

Share-based payment transactions (net of tax) - - - - - 5 5

Movement in own shares held - - - 470 - (470) -

Dividends - - - - - (2,812) (2,812)

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Total transactions with owners 1 18 - 470 - (3,277) (2,788)

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Balance at 31 March 2023 6,805 22,530 16,328 (3,017) 14,682 78,561 135,889

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Consolidated statement of changes in equity

for the year ended 31 March 2022

Share Share Merger Own Translation Retained Total

capital premium reserve shares held reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Balance at 31 March 2021 6,802 22,461 16,328 (595) 9,524 77,284 131,804

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Total comprehensive income for the year:

Profit for the year - - - - - 8,977 8,977

Other comprehensive income for the year - - - - 2,760 - 2,760

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Total comprehensive income recognised for the

year - - - - 2,760 8,977 11,737

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Issue of share capital 2 51 - - - - 53

Share-based payment transactions (net of tax) - - - - - 742 742

Movement in own shares held - - - (2,892) - (143) (3,035)

Dividends - - - - - (2,156) (2,156)

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Total transactions with owners 2 51 - (2,892) - (1,557) (4,396)

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Balance at 31 March 2022 6,804 22,512 16,328 (3,487) 12,284 84,704 139,145

---------------------------------------------- ------- ------- ------- ----------- ----------- -------- -------

Note: Company statement of changes in equity can be found on

pages 134 to 135 of the Annual report.

Statements of financial position

at 31 March 2023

Group Company

---------------- ----------------

Annual report note 2023 2022 2023 2022

------------------

GBP000 GBP000 GBP000 GBP000

-------------------------------------------- ------------------ ------- ------- ------- -------

Non-current assets

Property, plant, and equipment 10, 11 19,417 20,297 6 2,216

Right-of-use assets 12 14,395 12,757 36 40

Intangible assets 13, 14 40,451 42,981 7,854 7,027

Equity investments 15 - - 42,298 42,298

Non-current trade and other receivables 19 - - 76,848 66,344

Deferred tax assets 16, 17 4,289 2,787 998 724

-------------------------------------------- ------------------ ------- ------- ------- -------

Total non-current assets 78,552 78,822 128,040 118,649

-------------------------------------------- ------------------ ------- ------- ------- -------

Current assets

Inventories 18 90,948 88,933 - -

Trade and other receivables 19 61,906 60,520 3,754 1,888

Assets classified as held for sale 10, 11 2,130 - 2,130 -

Cash and cash equivalents 26 31,798 26,741 640 604

-------------------------------------------- ------------------ ------- ------- ------- -------

Total current assets 186,782 176,194 6,524 2,492

-------------------------------------------- ------------------ ------- ------- ------- -------

Total assets 3 265,334 255,016 134,564 121,141

-------------------------------------------- ------------------ ------- ------- ------- -------

Current liabilities

Trade and other payables 21 35,332 45,249 2,395 1,569

Right-of-use liabilities 12, 20, 26 3,498 3,028 21 19

Provisions 23 2,809 - 396 -

Tax payable 2,560 2,455 - -

-------------------------------------------- ------------------ ------- ------- ------- -------

Total current liabilities 44,199 50,732 2,812 1,588

-------------------------------------------- ------------------ ------- ------- ------- -------

Non-current liabilities

Other interest-bearing loans and borrowings 20, 26 69,825 50,507 69,825 50,507

Right-of-use liabilities 12, 20, 26 12,315 10,683 17 23

Provisions 23 1,443 1,088 - -

Deferred tax liabilities 16, 17 1,663 2,861 - -

-------------------------------------------- ------------------ ------- ------- ------- -------

Total non-current liabilities 85,246 65,139 69,842 50,530

-------------------------------------------- ------------------ ------- ------- ------- -------

Total liabilities 3 129,445 115,871 72,654 52,118

-------------------------------------------- ------------------ ------- ------- ------- -------

Net assets 135,889 139,145 61,910 69,023

-------------------------------------------- ------------------ ------- ------- ------- -------

Equity

Share capital 6,805 6,804 6,805 6,804

Share premium 22,530 22,512 22,530 22,512

Merger reserve 16,328 16,328 16,328 16,328

Own shares held (3,017) (3,487) (3,017) (3,487)

Reserves 14,682 12,284 - -

Retained earnings 78,561 84,704 19,264 26,866

-------------------------------------------- ------------------ ------- ------- ------- -------

Total equity 135,889 139,145 61,910 69,023

-------------------------------------------- ------------------ ------- ------- ------- -------

The loss after tax for the Company is GBP4.3m (FY22:

GBP4.1m).

Statements of cash flows

for the year ended 31 March 2023

Group Company

------------------- ------------------

Annual

report

note 2023 2022 2023 2022

-------

GBP000 GBP000 GBP000 GBP000

---------------------------------------------- ------- --------- -------- -------- --------

Cash flows from operating activities

(Loss) / profit for the year (2,866) 8,977 (4,325) (4,106)

Adjustments for:

10, 11,

Depreciation and amortisation 13, 14 5,471 4,125 638 84

Right-of-use asset depreciation 12 3,640 3,131 23 19

Unrealised foreign currency gain (50) (34) (43) (45)

Financial income 8 (158) (31) (1,268) (155)

Financial expense (excluding right-of-use

liabilities) 8 2,412 692 2,383 683

Right-of-use liabilities' financial

expense 8, 12 430 326 1 -

Loss on sale of property, plant,

and equipment, intangibles and

investments 149 6 9 145

Dividends received - - (7,434) (3,358)

Equity settled share-based payment

charge 24 772 (398) 325

Impairment of goodwill 2, 13 2,926 - - -

Impairment of right-of-use assets

and property, plant, and equipment 2, 10,

on restructuring 11, 12 1,426 - - -

Taxation expense / (income) 9 174 1,640 (300) (13)

---------------------------------------------- ------- --------- -------- -------- --------

Operating cash inflow / (outflow)

before changes in working capital

and provisions 13,578 19,604 (10,714) (6,421)

Change in trade and other receivables 1,644 (5,950) (536) 916

Change in inventories 215 (31,716) - -

Change in trade and other payables (11,739) 2,922 661 299

Change in provisions 2,792 - 396 -

---------------------------------------------- ------- --------- -------- -------- --------

Cash generated from / (used in)

operations 6,490 (15,140) (10,193) (5,206)

---------------------------------------------- ------- --------- -------- -------- --------

Tax paid (3,529) (2,757) - -

---------------------------------------------- ------- --------- -------- -------- --------

Net cash generated from / (used

in) operating

activities 2,961 (17,897) (10,193) (5,206)

---------------------------------------------- ------- --------- -------- -------- --------

Cash flows from investing activities

Proceeds from sale of property,

plant, and equipment 27 36 - -

Interest received 138 31 366 196

Acquisition of property, plant 10, 11,

and equipment and intangibles 13, 14 (5,625) (5,248) (1,394) (1,481)

Acquisition of subsidiary, net

of cash acquired - (5,847) - -

Lending to subsidiary undertakings - - (9,897) (21,638)

Repayment by subsidiary undertakings - - 2,125 -

Dividends received - - 7,434 3,358

---------------------------------------------- ------- --------- -------- -------- --------

Net cash used in investing activities (5,460) (11,028) (1,366) (19,565)

---------------------------------------------- ------- --------- -------- -------- --------

Cash flows from financing activities

Purchase of own shares 24 - (3,035) - (3,035)

Proceeds from the issue of share

capital 24 19 53 19 53

Proceeds from new loan 16,423 32,980 16,423 32,980

Repayment of loans from subsidiaries - - - (4,248)

Repayment of right-of-use liabilities 12 (3,792) (2,977) (24) (19)

Dividends paid 24 (2,812) (2,156) (2,812) (2,156)

Interest paid (2,477) (805) (2,011) (456)

---------------------------------------------- ------- --------- -------- -------- --------

Net cash generated from financing

activities 7,361 24,060 11,595 23,119

---------------------------------------------- ------- --------- -------- -------- --------

Net change in cash and cash equivalents 4,862 (4,865) 36 (1,652)

Cash and cash equivalents at 1

April 26,741 30,265 604 2,256

Effect of exchange rate fluctuations

on cash held 195 1,341 - -

---------------------------------------------- ------- --------- -------- -------- --------

Cash and cash equivalents at

31 March 31,798 26,741 640 604

---------------------------------------------- ------- --------- -------- -------- --------

Notes to the Annual Results Announcement

1. Underlying profit before tax and separately disclosed

items

FY23 Annual report Note 2023 2022

note GBP000 GBP000

----------------------------------------------------------- ----------------------- ------- -------

Underlying profit before tax 9,300 13,759

Separately disclosed items within administrative expenses:

Acquired intangible amortisation 13 (1,798) (1,593)

Project Atlas (1,722) (1,041)

Restructuring and related charges (4,235) -

Impairment of goodwill 13 (2,926) -

Settlement for loss of office (1,050) -

Aborted acquisition costs (261) -

Acquisition costs 36 - (508)

----------------------------------------------------------- ----------------------- ------- -------

(Loss) / profit before tax (2,692) 10,617

----------------------------------------------------------- ----------------------- ------- -------

FY23 Annual report Note 2023 2022

note GBP000 GBP000

----------------------------------------------------------- ----------------------- ------- -------

Underlying EBITDA 19,297 20,409

Separately disclosed items within administrative expenses:

Project Atlas (1,722) (1,041)

Restructuring and related charges (4,235) -

Impairment of goodwill 13 (2,926) -

Settlement for loss of office (1,050) -

Aborted acquisition costs (261) -

Acquisition costs 36 - (508)

----------------------------------------------------------- ----------------------- ------- -------

EBITDA 9,103 18,860

----------------------------------------------------------- ----------------------- ------- -------

Acquired intangible amortisation 13 (1,798) (1,593)

Depreciation and non-acquired amortisation (7,313) (5,663)

----------------------------------------------------------- ----------------------- ------- -------

Operating (loss) / profit (8) 11,604

----------------------------------------------------------- ----------------------- ------- -------

In addition to the above, there were GBP0.4m separately

disclosed items in relation to VIC patent box claims set against

the tax charge in FY22.

Recurring items

Intangible amortisation relating to acquisitions has been

separately disclosed so as to present the trading performance of

the respective entities with a charge on a comparable basis to

other entities in the Group.

Event-driven items

Project Atlas is a multi-year investment into our IT

infrastructure and underlying business processes. As a consequence

of the work undertaken to date on this project, we have incurred

direct costs of GBP1.7m in FY23 (FY22: GBP1.0m), largely relating

to the project team and the ongoing roll out. We have excluded

these costs from our underlying results, to reflect the unusual

scale and one-off nature of this project. The cost has been

excluded in order to provide shareholders with a better

understanding of our underlying trading performance during this

period of investment. This investment will be recorded as a

combination of capital expenditure and separately disclosed items,

dependent on accounting convention. The financial impact of the

work undertaken to date on this project totals direct costs of

GBP2.6m in FY23 (cumulatively GBP17.4m) of which GBP0.9m has been

recognised (cumulatively GBP7.9m) as intangible assets on the

balance sheet. Out of the GBP7.9m recognised as intangible assets

on the balance sheet, GBP6.6m has been capitalised in relation to

the sites which have gone live on the new IT system.

Restructuring and related charges of GBP4.2m are a result of a

strategic review of operations and functions initiated in Q4 FY22

and approved by the Board on 28 March 2023. The charges include

costs in respect of a down-sizing of personnel primarily within the

UK due to the centralisation of multi-site distribution centres

into a national distribution centre (NDC) in the Midlands and the

closure of our UK manufacturing site in Uckfield. These efficiency

initiative results in restructuring costs including redundancies.

The charges also include impairment of non-current assets due to

the closure of certain offices and warehouses within the UK

directly related to the restructuring programme initiative and

setting up the NDC. The closure of the offices/warehouses and

redundancies would happen over the financial year FY24 and is

planned to be completed by 31 March 2024. We have excluded these

costs from our underlying results, to reflect the size and one-off

nature of this project.

Impairment of goodwill of GBP2.9m relates to the TR VIC SPA cash

generating unit. We have excluded these costs from our underlying

results both due to their size and incidence.

Settlement for loss of office costs of GBP1.0m (FY22: GBPnil)

were recognised in the year due to the CFO and CEO leaving the

Group with immediate effect on 31 August 2022 and 18 February 2023

respectively. The costs include payment in lieu of notice,

compensation for loss of office and loss of contractual benefits.

We have excluded these costs from our underlying results both due

to their size and incidence.

Aborted acquisition costs of GBP0.3m (FY22: GBPnil) were

incurred in the year in relation to a potential target which was

aborted in July 2022. They are excluded from underlying results to

help provide a better understanding of the trading performance of

the Group.

Acquisition costs of GBPnil (FY22: GBP0.5m) were incurred in the

year. In FY22, GBP0.5m of costs were incurred in relation to the

acquisition of TR Falcon on 31 August 2021. They were excluded from

underlying results to help provide a better understanding of the

trading performance of the Group in relation to the acquisition of

Falcon on 31 August 2021.

Management removes the event-driven costs and certain

non-trading items discussed above to allow the reader of the

accounts to understand the underlying trading performance of the

Group. Further reconciliations of underlying measures to GAAP

measures can be found in note 32 in the Annual report.

2. Operating segmental analysis

Segment information is presented in the consolidated financial

statements in respect of the Group's geographical segments. This

reflects the Group's management and internal reporting structure,

and the operating basis on which individual operations are reviewed

by the Chief Operating Decision Maker (the Executive Committee).

Performance is measured based on each segment's underlying

operating result as included in the internal management reports

that are reviewed by the Chief Operating Decision Maker. This is

used to measure performance as management believes that such

information is the most relevant in evaluating the results of

certain segments relative to other entities that operate within the

industry.

Inter-segment pricing is determined on an arm's length basis.

Segment results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated on

a reasonable basis.

Goodwill and intangible assets acquired on business combinations

are included in the region to which they relate.

Geographical operating segments:

The Group is comprised of the following main geographical

operating segments:

UK

Europe: includes Norway, Sweden, Hungary, Ireland, Holland,

Italy, Germany, Spain and Poland

North America: includes USA and Mexico

Asia: includes Malaysia, China, Singapore, Taiwan, Thailand,

India and Philippines.

In presenting information on the basis of geographical operating

segments, segment revenue and segment assets are based on the

geographical location of our entities across the world and are

consolidated into the four distinct geographical regions, which the

Executive Committee (the "EC") uses to monitor and assess the

Group. Interest is reported on a net basis rather than gross as

this is how it is presented to the Chief Operating Decision Maker.

All material non-current assets are located in the country the

relevant Group entity is incorporated in.

Common

UK Europe North America Asia amounts Total

March 2023 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ -------- -------- ------------- -------- -------- ---------

Revenue

Revenue from external

customers 77,857 85,362 29,657 51,515 - 244,391

Inter-segment revenue 6,032 3,077 271 8,893 - 18,273

------------------------------ -------- -------- ------------- -------- -------- ---------

Total revenue 83,889 88,439 29,928 60,408 - 262,664

------------------------------ -------- -------- ------------- -------- -------- ---------

Underlying operating

result 5,509 2,915 1,256 9,473 (7,169) 11,984

Net financing costs (367) (643) (593) 28 (1,109) (2,684)

------------------------------ -------- -------- ------------- -------- -------- ---------

Underlying segment

result 5,142 2,272 663 9,501 (8,278) 9,300

Separately disclosed

items (11,992)

------------------------------ -------- -------- ------------- -------- -------- ---------

Loss before tax (2,692)

------------------------------ -------- -------- ------------- -------- -------- ---------

Specific disclosure

items

Depreciation and amortisation (2,279) (3,500) (902) (1,770) (660) (9,111)

Government support

income - - - - - -

Assets and liabilities

Non-current asset additions 1,101 5,832 1,082 2,222 1,412 11,649

Segment assets 74,423 82,259 27,426 69,475 11,751 265,334

Segment liabilities (23,247) (16,817) (3,612) (13,608) (72,161) (129,445)

------------------------------ -------- -------- ------------- -------- -------- ---------

Common

UK Europe North America Asia amounts Total

March 2022 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ -------- -------- ------------- -------- -------- ---------

Revenue

Revenue from external

customers 77,056 78,482 17,535 45,545 - 218,618

Inter-segment revenue 6,805 2,089 191 9,805 - 18,890

------------------------------ -------- -------- ------------- -------- -------- ---------

Total revenue 83,861 80,571 17,726 55,350 - 237,508

------------------------------ -------- -------- ------------- -------- -------- ---------

Underlying operating

result 8,122 3,858 (72) 7,123 (4,285) 14,746

Net financing costs (125) (169) (107) (58) (528) (987)

------------------------------ -------- -------- ------------- -------- -------- ---------

Underlying segment

result 7,997 3,689 (179) 7,065 (4,813) 13,759

Separately disclosed

items (3,142)

------------------------------ -------- -------- ------------- -------- -------- ---------

Profit before tax 10,617

------------------------------ -------- -------- ------------- -------- -------- ---------

Specific disclosure

items

Depreciation and amortisation (2,184) (2,731) (554) (1,685) (102) (7,256)

Government support

income - - - 76 8 84

Assets and liabilities

Non-current asset additions 1,962 3,269 1,381 54 1,481 8,147

Segment assets 74,479 81,125 22,472 65,593 11,347 255,016

Segment liabilities (25,929) (20,339) (4,389) (13,243) (51,971) (115,871)

------------------------------ -------- -------- ------------- -------- -------- ---------

There were no material differences in Europe and North America

between the external revenue based on location of the entities and

the location of the customers. Of the UK external revenue, GBP12.0m

(FY22: GBP16.2m) was sold into the European market. Of the Asian

external revenue, GBP5.8m (FY22: GBP9.0m) was sold into the North

American market and GBP7.6m (FY22: GBP9.8m) was sold into the

European market.

Within Europe, TR VIC has revenue of GBP27.3m (FY22: GBP28.3m)

and non-current assets of GBP11.7m (FY22: GBP13.1m).

Within Asia, TR Formac Singapore has revenue of GBP20.4m (FY22:

GBP20.3m) and non-current assets of GBP4.5m (FY22: GBP4.4m).

Revenue is derived solely from the manufacture and logistical

supply of industrial fasteners and Category 'C' components.

3. 2023 Annual report

The Annual report and financial statements for the year ended 31

March 2023 were approved by the Board of Directors on 10 July

2023.

In addition to the link on the front of this announcement to a

pdf of the 2023 Annual report, a copy together with the Notice of

Meeting will in due course be available to view and download from

the Company website at www.trifast.com .

The documents will also be uploaded to the National Storage

Mechanism at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The financial information set out in this release does not

constitute the Group's statutory Report and Accounts for the years

ended 31 March 2023 or 2022. However, it is derived from the 2023

Report and Accounts

http://www.rns-pdf.londonstockexchange.com/rns/5662F_1-2023-7-10.pdf

.

The Report and Accounts for 2022 has been delivered to the

Registrar of Companies and those for 2023 will be delivered in due

course. The external auditor has reported on the 2023 Report and

Accounts; the report was (i) unqualified, (ii) did not include

references to any matters to which the external auditor drew

attention by way of emphasis without qualifying the reports and

(iii) did not contain statements under section 498(2) or (3) of the

Companies Act 2006.

The Independent auditor's report to the members of Trifast plc

can be read on pages 122 to 129 of the 2023 Annual report.

4. Annual General Meeting (AGM)

The Annual General Meeting will be held at 11.30am on Friday, 15

September 2023 at Peel Hunt LLP, 100 Liverpool Street, London, EC2M

2AT.

The Notice of Meeting, which includes special business to be

transacted at the AGM together with an explanation of the

resolutions to be considered at the meeting, will be made available

on the Company website around 18 July, and communicated directly to

shareholders.

Any questions relating to the 2023 Annual report can be sent to:

The Company Secretary, Trifast plc, Trifast House, Bellbrook Park,

Uckfield, East Sussex TN22 1QW, alternatively email:

Companysecretariat@trifast.com .

Further enquiries please contact:

Trifast plc

Scott Mac Meekin, Interim Chief Executive Tel: +44 (0) 1825 747630

Officer Email: corporate.enquiries@trifast.com

Darren Hayes-Powell, Chief Financial Shareholders: Companysecretariat@trifast.com

Officer

Christopher Morgan, Company Secretary

Peel Hunt LLP (Stockbroker & financial adviser)

Mike Bell Tel: +44 (0) 20 7418 8900

TooleyStreet Communications, (IR & media relations)

Fiona Tooley Tel: +44 (0)7785 703523

Email: fiona@tooleystreet.com

Forward Looking Statement

This document may contain certain forward-looking statements.

The forward-looking statements reflect the knowledge and

information available to the Company during the preparation and up

to the publication of this document. By their very nature, these

statements depend upon circumstances and relate to events that may

occur in the future thereby involve a degree of uncertainty.

Therefore, nothing in this document should be construed as a profit

forecast by the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GPURWMUPWGRU

(END) Dow Jones Newswires

July 11, 2023 02:00 ET (06:00 GMT)

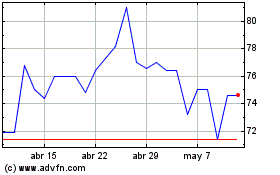

Trifast (LSE:TRI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Trifast (LSE:TRI)

Gráfica de Acción Histórica

De May 2023 a May 2024