TIDMBEH

RNS Number : 6472O

Bayfield Energy Holdings PLC

15 October 2012

Bayfield Energy Holdings plc

("Bayfield" or the "Company", AIM: BEH)

Proposed merger with Trinity Exploration & Production

Limited

Bayfield Energy Holdings plc ("Bayfield" or the "Company")

(Ticker Symbol: BEH), an upstream oil and gas exploration and

production company with interests in Trinidad & Tobago and

South Africa, today announces proposals for a merger with Trinity

Exploration & Production Limited ("Trinity").

Summary

-- The Boards of Bayfield and Trinity are pleased to announce

that they have reached agreement on the terms of a conditional

merger of Bayfield and Trinity (the "Merger").

-- The enlarged group will be named Trinity Exploration &

Production plc ("New Trinity" or the "Enlarged Group") and be led

by Bruce Dingwall CBE as Executive Chairman and Joel "Monty"

Pemberton as Chief Executive Officer (currently Executive Chairman

and Chief Executive Officer of Trinity respectively).

-- Trinity is a leading private independent oil and gas company

with onshore and offshore assets in Trinidad, headquartered in San

Fernando, Trinidad.

-- The Merger will create the largest Trinidad-focused

independent E&P company, with 11 operated fields, gross

production of approximately 4,650 bbl/d and net production of

approximately 3,800 bbl/d based on current production rates.

-- New Trinity will have a diversified portfolio of onshore,

West and East coast production, significant near-term production

growth opportunities from low risk developments and multiple

exploration prospects with the potential to deliver meaningful

reserves/resource growth through an active drilling programme.

-- In order to accelerate delivery of the significant upside

that exists in the combined portfolios, the Enlarged Group intends

to raise additional debt and/or equity capital in conjunction with

the Merger.

-- Under the terms of the Merger, which will be effected by the

acquisition of Trinity by Bayfield, Trinity Shareholders will own

55 per cent. of New Trinity and Bayfield Shareholders will own 45

per cent. (on a fully diluted basis, assuming Bayfield acquires 100

per cent. of the Trinity Shares and prior to raising any additional

equity capital).

-- The Merger constitutes a reverse takeover of Bayfield under

the AIM Rules and is conditional, inter alia, upon Bayfield

Shareholder approval, the approval by the Takeover Panel of the

Rule 9 Waiver, and the consent of the Ministry and Petrotrin.

Accordingly, trading in the Company's shares has been suspended

pending publication of an Admission Document.

-- Bayfield has received irrevocable undertakings to vote in

favour of the Resolutions to, inter alia, approve the Merger at the

Bayfield General Meeting from Bayfield Shareholders holding, in

aggregate, 109,415,867 Bayfield Shares, representing approximately

50.54 per cent. of the issued share capital of Bayfield.

-- An Admission Document containing details of the Merger and

New Trinity will be sent to Bayfield Shareholders in due

course.

-- The Boards of Bayfield and Trinity having reached agreement

on the Merger, Bayfield has terminated discussions with all other

parties regarding a potential offer for the Company and,

consequently, the Company is no longer in an offer period.

Commenting on the Merger, Bruce Dingwall CBE, the Executive

Chairman of Trinity, said:

"New Trinity will be the leading Trinidad-focused independent

E&P company offering investors an attractive balance of

existing production, near-term production growth from low risk

development opportunities and exciting exploration prospects."

Finian O'Sullivan, Chairman of Bayfield, said:

"The proposed merger offers shareholders the benefits of

diversification and scale from an enlarged producing asset base

while retaining significant exposure to material near-term

potential."

Enquiries

Bayfield Tel: +44 (0) 20 7920

Hywel John, Chief Executive Officer 2347

FirstEnergy Capital LLP (Financial Adviser Tel: +44 (0) 20 7488

& Joint Broker to Bayfield) 0200

Hugh Sanderson

David van Erp

Seymour Pierce (NOMAD & Joint Broker Tel: +44 (0)20 7107

to Bayfield) 8000

Jonathan Wright/Stewart Dickson

Richard Redmayne/David Banks

M:Communications (PR Adviser to Bayfield) Tel: +44 (0) 20 7920

Patrick d'Ancona 2347/43

Ann-marie Wilkinson

Trinity Tel: +44 (0) 20 7404

Monty Pemberton, Chief Executive Officer 5959

Robert Gair, Corporate Development Manager

RBC Capital Markets (Financial Adviser Tel: +44 (0) 20 7653

to Trinity) 4000

Tim Chapman

Matthew Coakes

Brunswick (PR Adviser to Trinity) Tel: +44 (0) 20 7404

Patrick Handley 5959

Catriona McDermott

Introduction

The Boards of Bayfield and Trinity are pleased to announce that

they have reached agreement on the terms of a conditional merger of

Bayfield and Trinity, details of which are set out below.

Bayfield proposes to acquire 100 per cent. of Trinity's issued

and to be issued share capital. Trinity Shareholders will receive

approximately 7,478 new Ordinary Shares for each Trinity Share held

and Trinity's options and warrants will be converted to options and

warrants for Bayfield shares at the same exchange ratio. The

consideration at Completion will be satisfied by the issue,

credited as fully paid, of up to 255,623,207 Consideration

Shares.

The Merger will constitute a reverse takeover of Trinity by

Bayfield for the purposes of the AIM Rules and, accordingly,

trading in the Company's shares has been suspended pending

publication of an Admission Document (which will provide further

detailed information on the Merger and New Trinity) which will be

posted to Bayfield Shareholders in due course.

Background on Trinity

Overview

Trinity is a private independent oil & gas company with

onshore and offshore assets in Trinidad. It is led by an executive

team with significant Trinidadian and international operating

expertise and a track record of value creation for shareholders in

the international E&P industry.

Trinity was formed in 2005 when a group of founding shareholders

led by Bruce Dingwall CBE acquired Venture Production plc's

Trinidad operations. Since then, the business has grown through

organic drilling and further acquisitions.

Trinity is headquartered in San Fernando, Trinidad, where the

senior management team is based, and has significant local

ownership. Trinity employs more than 200 staff and this team has an

excellent understanding of the local operating environment and

business culture including strong government, supply chain and

other stakeholder relationships.

Operations

Trinity operates ten licenses in Trinidad, including two

licenses in the Gulf of Paria, offshore Trinidad's West coast, and

eight onshore licenses. Trinity's portfolio offers a balance of

current production (approximately 2,370 bbl/d net), low risk

development opportunities and exploration/appraisal upside.

A map detailing Trinity's licences in Trinidad may be found by

clicking here:

http://www.rns-pdf.londonstockexchange.com/rns/6472O_-2012-10-12.pdf

For the year ended 31 December 2011, Trinity made a profit

before tax of US$13.4m on turnover of US$53.9m. As at 31 December

2011, Trinity has net assets of US$55.4m.

Background to and reasons for the Merger

During May and June 2012, Bayfield sought to execute an equity

financing to strengthen its cash position and fund its ongoing

drilling commitments. Despite success in securing a measure of

institutional support, Bayfield was unable to complete the

fund-raising to the level required at the time due to the

deterioration in market conditions. Consequently, the Company

commenced a strategic review of its options which has culminated in

the Merger.

Completion of the Merger will establish New Trinity as the

largest independent Trinidad-focused oil and gas group and, in

particular, will:

-- create a diversified onshore, West coast and East coast

portfolio of 11 operated fields, gross production of approximately

4,650 bbl/d and net production of approximately 3,800 bbl/d based

on current production rates;

-- provide investors with exposure to a balanced mix of existing

production, significant near-term production growth opportunities

from low risk developments and exposure to multiple exploration

prospects with potential to deliver meaningful reserves/resource

upside;

-- enable New Trinity to generate operational and commercial synergies; and

-- position New Trinity for further growth through new bid rounds and M&A activity.

Principal terms of the Merger

Pursuant to the Transaction Agreement, the Company has

conditionally agreed to purchase Trinity Shares from certain

Trinity Shareholders (including all of the executive directors of

Trinity) holding, in aggregate, approximately 24.75 per cent. of

the current Trinity Shares in issue. The Trinity Shares held by the

remaining Trinity Shareholders are proposed to be acquired by the

Company upon Admission pursuant to conditional short form

acquisition agreements to be entered into between the Company and

such Trinity Shareholders. The Merger is conditional, inter alia,

upon Bayfield acquiring at least 90 per cent. of the Trinity Shares

in issue. As at the date of this announcement, the Company has

entered into a short form acquisition agreement with Trinity

Shareholders holding, in aggregate, 52.41 per cent. of the Trinity

Shares. Accordingly, pursuant to that short form acquisition

agreement and the Transaction Agreement, the Company has

conditionally agreed to acquire 77.16 per cent. of the Trinity

Shares in issue. It is intended that, prior to the date on which

the Admission Document is posted to Bayfield Shareholders, one or

more additional short

form agreements will be entered into between Bayfield and the

remaining Trinity Shareholders under which Bayfield will

conditionally agree to acquire those remaining Trinity Shares that

constitute the remaining 22.84 per cent. of the Trinity Shares.

The Transaction Agreement and the short form acquisition

agreements referred to above are conditional, inter alia, upon the

following matters:

-- Bayfield Shareholder approval of the Merger;

-- Bayfield acquiring not less than 90 per cent. of the Trinity Shares;

-- certain approvals being received from Petrotrin and the Ministry;

-- the approval by the Takeover Panel of the Rule 9 Waiver; and

-- Admission.

Irrevocable undertakings have been received from Finian

O'Sullivan, Andrey Pannikov, Alta Limited, Brian Thurley and

Jonathan Cooke to vote and to procure that their associates vote in

favour of the Merger at the Bayfield General Meeting in respect of

their aggregate holdings of 109,415,867 Ordinary Shares,

representing approximately 50.54 per cent. of the current issued

ordinary share capital of the Company.

Directors and Proposed Directors

Upon Admission, the board of directors of New Trinity will

comprise six directors. Five directors are identified below, with

an additional Independent Non-Executive Director to be appointed

prior to Admission.

Name Proposed Role Current Role

----------------------- ----------------------- -------------------------------

Bruce Dingwall Executive Chairman Executive Chairman of Trinity

CBE

----------------------- ----------------------- -------------------------------

Joel "Monty" Pemberton Executive Director Executive Director of Trinity

----------------------- ----------------------- -------------------------------

Finian O'Sullivan Non-Executive Director Executive Chairman of Bayfield

----------------------- ----------------------- -------------------------------

Jon Murphy Non-Executive Director Non-Executive Director of

Trinity

----------------------- ----------------------- -------------------------------

Anthony Brash Non-Executive Director Non-Executive Director of

Trinity

----------------------- ----------------------- -------------------------------

Details of the Board of New Trinity are set out below.

Bruce Dingwall CBE

Bruce has over 30 years' experience in the oil and gas industry.

Bruce began his career with Exxon as a geophysicist in the North

Sea before moving to Lasmo where he held numerous senior management

roles in their South East Asian operations. In 1997, Bruce founded,

and was Chief Executive Officer of, Venture Production which grew

to production of 55,000 boepd and was sold to Centrica in 2009 for

US$2.5 billion. A Trinidadian national, Bruce founded Trinity in

2004 with the acquisition of Venture Production's Trinidad assets.

Bruce is a geologist having studied at Aberdeen University.

Joel "Monty" Pemberton

Monty joined Trinity in 2005 as Chief Financial Officer and

became Chief Executive Officer in 2009. Under Monty's leadership

Trinity has significantly grown its business, through attracting

external capital and undergoing a period of rapid organic and

M&A- led growth. Monty began his career with Ernst &

Young's audit team where he qualified as a Chartered Certified

Accountant and worked in both Trinidad and the UK with a focus on

energy clients. Monty then moved back to Trinidad working in the

Energy finance division of RBTT Merchant Bank prior to joining

Trinity. Monty is a Fellow Chartered Certified Accountant from the

Association of Certified Chartered Accountants.

Finian O'Sullivan

Finian holds an honours degree in Geology from University

College Galway. Finian has pursued an international career in the

oil industry spanning 32 years with Chevron, Geophysical Systems,

Olympic Oil and Gas and Burren Energy. Finian founded Burren Energy

in 1994 and developed its business in Turkmenistan and West Africa

leading to Burren's flotation on the London Stock Exchange with a

market capitalisation of GBP175 million in 2003. As Chief

Executive, Finian expanded Burren's activities with successful

exploration and steady growth in production. In 2008, Burren Energy

was sold to Eni for GBP1.7 billion.

Jon Murphy

Jon joined Trinity's Board at the time of acquisition from

Venture Production in 2004 and brings with him over 30 years of

experience in mid-cap E&P companies. Jon's career includes

several years with Lasmo where he held various positions in

geology, planning and new business, based in the UK and Asia. In

1999, Jon joined Venture Production as COO and played a key role in

its growth to become one of the leading oil and gas companies in

the North Sea. Jon holds a BSc. Geology from the University of

London and is also a Non-Executive Director of Hurricane

Exploration.

Anthony Brash

Anthony has been involved in the oil and gas industry for over

25 years and is Managing Director of the Well Services Group. Well

Services Group is the owner of the largest drilling rig fleet in

Trinidad and offers a wide range of other oilfield services as well

as being a material onshore oil producer. Anthony has directly

negotiated and managed service contracts with BP, EOG, Repsol and

Petrotrin. Anthony holds a BA in Management and a MBA in General

Business from St. Edward's University in Austin, Texas.

The Takeover Code

End of offer period

The Boards of Bayfield and Trinity having reached agreement on

the Merger, Bayfield has terminated discussions with all other

parties regarding a potential offer for the Company and,

consequently, the Company is no longer in an offer period.

Proposed Rule 9 Waiver

The Takeover Code governs, inter alia, transactions which may

result in a change of control of a publiccompany to which the

Takeover Code applies. Under Rule 9, any person who acquires an

interest (as defined in the Takeover Code) in shares which, taken

together with shares in which he is already interested or in which

persons acting in concert with him are interested, carry 30 per

cent. or more of the voting rights of a company which is subject to

the Takeover Code, is required to make a general offer to all the

remaining shareholders to acquire their shares.

Similarly, when any person, together with persons acting in

concert with him, is interested in shares which, in aggregate,

carry more than 30 per cent. of the voting rights of such company,

but does not hold shares carrying 50 per cent. or more of such

voting rights, a general offer will normally be required if any

further interest in shares is acquired by any such person.

An offer under Rule 9 must be in cash and must be at the highest

price paid by the person required to make the offer, or any person

acting in concert with him, for any interest in shares of the

company in question during the 12 months prior to the announcement

of the offer.

Persons acting in concert comprise persons who, pursuant to an

agreement or understanding (whether formal or informal), co-operate

to obtain or consolidate control of a company or to frustrate the

successful outcome of an offer for a company. A person and each of

its affiliated persons will be deemed to be acting in concert all

with each other.

Since it is expected that all the Trinity Shareholders will

comprise a concert party for the purposes of the Takeover Code, the

Company will request the Takeover Panel to waive the obligation to

make a general offer that would otherwise be required as a result

of the Merger, subject to the approval of independent shareholders

of Bayfield on a poll. The Admission Document will contain further

information on the Rule 9 Waiver.

The following definitions apply in this announcement, unless the

context otherwise requires:

"Admission" admission of the Enlarged Share

Capital to trading on AIM becoming

effective in accordance with the

AIM Rules;

"Admission Document" admission document relating to the

Enlarged Group to be prepared in

accordance with the AIM Rules by

the Company and posted to Bayfield

Shareholders in due course;

"AIM" the AIM market operated by the London

Stock Exchange;

"AIM Rules" rules for companies whose securities

are admitted to trading on AIM published

by the London Stock Exchange;

"bbl/d" barrels of oil per day;

"Bayfield General Meeting" general meeting of the Company to

be convened in due course at which

the Resolutions will be proposed

to, inter alia, approve the Merger;

"Bayfield Shareholders" holders of Ordinary Shares;

"Company" or "Bayfield" Bayfield Energy Holdings plc, a

company registered in England and

Wales with company number 07535869;

"Completion" completion of the Merger in accordance

with the terms of the Transaction

Agreement and short form acquisition

agreements to be entered into by

certain Trinity Shareholders and

the Company;

"Consideration Shares" new Ordinary Shares to be issued

to the Trinity Shareholders upon

Completion;

"Enlarged Group" or "New the Company and its subsidiaries

Trinity" (including Trinity) following the

Merger;

"Enlarged Share Capital" Existing Ordinary Shares and the

Consideration Shares;

"Existing Ordinary Shares" the existing 216,479,442 issued

Ordinary Shares;

"London Stock Exchange" London Stock Exchange plc;

"Ministry" Republic of Trinidad and Tobago

Ministry of Energy and Energy Affairs;

"Merger" the Company's proposed conditional

acquisition of Trinity;

"Ordinary Shares" ordinary shares of US$0.10 each

in the capital of the Company;

"Petrotrin" Petroleum Company of Trinidad and

Tobago Limited, a state owned oil

company in Trinidad and Tobago;

"Resolutions" resolutions to be proposed at the

Bayfield General Meeting;

"Rule 9 Waiver" waiver of the obligations of the

Trinity Shareholders to make an

offer for Bayfield under Rule 9

of the Takeover Code, to be sought

from the Takeover Panel;

"Takeover Code" procedures by which takeovers occur

as prescribed by the Takeover Panel;

"Takeover Panel" The Panel on Takeovers and Mergers;

"Transaction Agreement" share purchase agreement between

the Company and certain Trinity

Shareholders relating to the Merger;

"Trinidad" Trinidad, one of the islands making

up Trinidad and Tobago;

"Trinity" Trinity Exploration & Production

Limited, a company registered in

England and Wales with company number

SC396945;

"Trinity Shareholders" holders of Trinity Shares;

"Trinity Shares" issued ordinary shares of US$1.00

each in the capital of Trinity;

and

"UK" United Kingdom.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQFFMFWEFESEDS

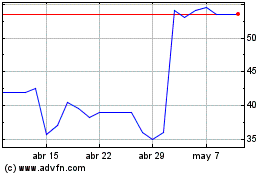

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024