0001439222FALSE00014392222024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2024

Agios Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-36014 | | 26-0662915 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| | | | | |

| 88 Sidney Street, | Cambridge, | MA | | 02139 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (617) 649-8600

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 per share | | AGIO | | Nasdaq Global Select Market |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On October 31, 2024, Agios Pharmaceuticals, Inc. issued a press release announcing its results for the quarter ended September 30, 2024 and other business highlights. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AGIOS PHARMACEUTICALS, INC. |

Date: October 31, 2024 | By: | /s/ Brian Goff |

| Brian Goff Chief Executive Officer |

Agios Reports Business Highlights and Third Quarter 2024 Financial Results

– Completed Enrollment of the Phase 3 RISE UP Study of Mitapivat in Sickle Cell Disease; Topline Data from 52-Week Study Expected in Late 2025 –

– Received $1.1 Billion in Payments from Royalty Pharma and Servier, Following FDA Approval

of Vorasidenib –

– Commenced Enrollment of the Phase 2b Study of Tebapivat in Lower-Risk Myelodysplastic Syndromes (LR-MDS); Granted FDA Orphan Drug Designation for Treatment of MDS –

– PYRUKYND® (Mitapivat) Net Revenue of $9.0 Million in Q3; Cash, Cash Equivalents and Marketable Securities of $1.7 Billion as of September 30, 2024 –

CAMBRIDGE, Mass., October 31, 2024 – Agios Pharmaceuticals, Inc. (Nasdaq: AGIO), a leader in cellular metabolism and pyruvate kinase (PK) activation pioneering therapies for rare diseases, today reported business highlights and financial results for the third quarter ended September 30, 2024.

“We had a strong quarter, marked by several important advancements across our pipeline. We completed enrollment of our Phase 3 RISE UP study of mitapivat in sickle cell disease, on our way to sharing topline results in late 2025. Our Phase 2b study of tebapivat in lower-risk MDS was initiated and we received orphan drug designation from the FDA to support the development of tebapivat in this indication,” said Brian Goff, chief executive officer of Agios. “Our cash position was further strengthened by the receipt of $1.1 billion in payments. This will allow us to maintain this great momentum and fuel our next phase of growth, building towards a franchise with multi-billion dollar potential. We remain focused on progressing our promising clinical programs to address the critical needs of rare disease patients and look forward to sharing our progress in the coming months.”

Third Quarter 2024 and Recent Highlights

•PYRUKYND® Revenues: Generated $9.0 million in net revenue for the third quarter of 2024, a 4 percent increase from the second quarter of 2024, primarily driven by increased patient demand. A total of 211 unique patients have completed prescription enrollment forms, representing an increase of 5 percent over the second quarter of 2024. A total of 127 patients are on PYRUKYND® therapy, inclusive of new prescriptions and continued therapy.

•Sickle cell disease: Completed enrollment of the 52-week Phase 3 RISE UP study of mitapivat in sickle cell disease, with more than 200 patients enrolled worldwide, and topline data expected in late 2025.

•Lower-risk Myelodysplastic Syndromes:

◦Initiated patient enrollment in the Phase 2b study of tebapivat (AG-946).

◦Granted Orphan Drug Designation from the FDA to tebapivat for the treatment of myelodysplastic syndromes (MDS).

•Presented topline data from Agios’ Phase 3 ACTIVATE-KidsT trial of mitapivat in pediatric patients with PKD

◦Observed transfusion reduction response rates were higher in the mitapivat arm compared to placebo and were clinically meaningful despite not meeting prespecified statistical criterion for the primary endpoint; Secondary endpoints of transfusion free response and normal hemoglobin response were observed only in the mitapivat arm.

◦Safety was consistent with the profile observed in adults with PK deficiency who are regularly transfused.

•Presented data from the Phase 3 ENERGIZE trial as an encore session at the 19th Annual Academy for Sickle Cell and Thalassemia (ASCAT) Conference

•Corporate Development:

◦The FDA approved Servier’s vorasidenib for the treatment of IDH-mutant diffuse glioma. As a result, Agios received a $200 million milestone payment from Servier and a $905 million payment from Royalty Pharma in connection with the purchase agreement announced in May 2024.

◦Entered into a distribution agreement with NewBridge Pharmaceuticals to advance commercialization of PYRUKYND® in the Gulf Cooperation Council (GCC) region. NewBridge, a leading specialty company headquartered in Dubai, will commercialize PYRUKYND® in Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates.

Key Upcoming Milestones & Priorities

Agios expects to achieve the following key milestones by the end of 2024:

•Thalassemia: File sNDA for mitapivat in thalassemia based on the positive results from the Phase 3 ENERGIZE and ENERGIZE-T clinical trials.

•Present additional clinical data at the 66th Annual American Society of Hematology (ASH) Congress, taking place December 7-10, 2024, in San Diego.

Third Quarter 2024 Financial Results

Revenue: Net product revenue from sales of PYRUKYND® for the third quarter of 2024 was $9.0 million, compared to $7.4 million for the third quarter of 2023.

Cost of Sales: Cost of sales for the third quarter of 2024 was $0.8 million.

Research and Development (R&D) Expenses: R&D expenses were $72.5 million for the third quarter of 2024, compared to $81.8 million for the third quarter of 2023. The year-over-year decrease was primarily driven by the $17.5 million up-front payment associated with the license agreement with Alnylam, which was recorded in the prior year.

Selling, General and Administrative (SG&A) Expenses: SG&A expenses were $38.5 million for the third quarter of 2024 compared to $25.8 million for the third quarter of 2023. The year-over-year increase was primarily attributable to an increase in commercial-related activities as we prepare for the potential approval of PYRUKYND® in thalassemia.

Net Income (Loss): Net income was $947.9 million for the third quarter of 2024 compared to a net loss of $91.3 million for the third quarter of 2023, reflecting the milestone and royalty agreement income recorded in the third quarter of 2024.

Cash Position and Guidance: Cash, cash equivalents and marketable securities as of September 30, 2024, were $1.7 billion compared to $806.4 million as of December 31, 2023. Agios expects that its cash, cash equivalents and marketable securities together with anticipated product revenue and interest income, will provide the financial independence to prepare for potential PYRUKYND® launches in thalassemia and sickle cell disease, advance existing programs, and to opportunistically expand its pipeline through both internally and externally discovered assets.

Conference Call Information

Agios will host a conference call and live webcast with slides today at 8:00 a.m. ET to discuss third quarter 2024 financial results and recent business highlights. The live webcast can be accessed under “Events & Presentations” in the Investors section of the company’s website at www.agios.com. The archived webcast will be available on the company's website beginning approximately two hours after the event.

About Agios

Agios is the pioneering leader in PK activation and is dedicated to developing and delivering transformative therapies for patients living with rare diseases. In the U.S., Agios markets a first-in-class pyruvate kinase (PK) activator for adults with PK deficiency, the first disease-modifying therapy for this rare, lifelong, debilitating hemolytic anemia. Building on the company's deep scientific expertise in classical hematology and leadership in the field of cellular metabolism and rare hematologic diseases, Agios is advancing a robust clinical pipeline of investigational medicines with programs in alpha- and beta-thalassemia, sickle cell disease, pediatric PK deficiency, myelodysplastic syndromes (MDS)-associated anemia and phenylketonuria (PKU). In addition to its clinical pipeline, Agios is advancing a preclinical TMPRSS6 siRNA as a potential treatment for polycythemia vera. For more information, please visit the company’s website at www.agios.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those regarding the potential benefits of PYRUKYND® (mitapivat), tebapivat (AG-946), TMPRSS6 siRNA and AG-181, Agios’ PAH stabilizer; Agios’ plans, strategies and expectations for its preclinical, clinical and commercial advancement of its drug development, including PYRUKYND®, tebapivat, and AG-181; Agios’ use of proceeds from the transaction with Royalty Pharma; potential U.S. net sales of vorasidenib and potential future royalty payments; Agios’ strategic vision and goals, including its

key milestones for 2024 and 2025; and the potential benefits of Agios’ strategic plans and focus. The words “anticipate,” “expect,” “goal,” “hope,” “milestone,” “plan,” “potential,” “possible,” “strategy,” “will,” “vision,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from Agios’ current expectations and beliefs. For example, there can be no guarantee that any product candidate Agios is developing will successfully commence or complete necessary preclinical and clinical development phases, or that development of any of Agios’ product candidates will successfully continue. There can be no guarantee that any positive developments in Agios’ business will result in stock price appreciation. Management's expectations and, therefore, any forward-looking statements in this press release could also be affected by risks and uncertainties relating to a number of other important factors, including, without limitation: risks and uncertainties related to the impact of pandemics or other public health emergencies to Agios’ business, operations, strategy, goals and anticipated milestones, including its ongoing and planned research activities, ability to conduct ongoing and planned clinical trials, clinical supply of current or future drug candidates, commercial supply of current or future approved products, and launching, marketing and selling current or future approved products; Agios’ results of clinical trials and preclinical studies, including subsequent analysis of existing data and new data received from ongoing and future studies; the content and timing of decisions made by the U.S. FDA, the EMA or other regulatory authorities, investigational review boards at clinical trial sites and publication review bodies; Agios’ ability to obtain and maintain requisite regulatory approvals and to enroll patients in its planned clinical trials; unplanned cash requirements and expenditures; competitive factors; Agios' ability to obtain, maintain and enforce patent and other intellectual property protection for any product candidates it is developing; Agios’ ability to establish and maintain key collaborations; uncertainty regarding any royalty payments related to the sale of its oncology business or any milestone or royalty payments related to its in-licensing of TMPRSS6 siRNA, and the uncertainty of the timing of any such payments; uncertainty of the results and effectiveness of the use of Agios’ cash and cash equivalents; and general economic and market conditions. These and other risks are described in greater detail under the caption "Risk Factors" included in Agios’ public filings with the Securities and Exchange Commission. Any forward-looking statements contained in this press release speak only as of the date hereof, and Agios expressly disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| | | | | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheet Data |

| (in thousands) |

| (Unaudited) |

| | | | | | |

| | | | September 30, 2024 | | December 31, 2023 |

| Cash, cash equivalents, and marketable securities | | | | $ | 1,660,646 | | | $ | 806,363 | |

| Accounts receivable, net | | | | 3,118 | | | 2,810 | |

| Inventory | | | | 26,429 | | | 19,076 | |

| Total assets | | | | 1,791,794 | | | 937,118 | |

| Stockholders' equity | | | | 1,626,672 | | | 811,019 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Operations Data |

| (in thousands, except share and per share data) |

| (Unaudited) |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Product revenue, net | $ | 8,964 | | | $ | 7,399 | | | $ | 25,768 | | | $ | 19,720 | |

| | | | | | | |

| Total revenue | 8,964 | | | 7,399 | | | 25,768 | | | 19,720 | |

| Operating expenses: | | | | | | | |

| Cost of sales | $ | 783 | | | $ | 633 | | | $ | 2,905 | | | $ | 2,295 | |

| Research and development | 72,455 | | | 81,841 | | | 218,476 | | | 218,037 | |

| Selling, general and administrative | 38,537 | | | 25,822 | | | 105,087 | | | 84,598 | |

| Total operating expenses | 111,775 | | | 108,296 | | | 326,468 | | | 304,930 | |

| Loss from operations | (102,811) | | | (100,897) | | | (300,700) | | | (285,210) | |

| Gain on sale of contingent payments | 889,136 | | | — | | | 889,136 | | | — | |

| Milestone payment from gain on sale of oncology business | 200,000 | | | — | | | 200,000 | | | — | |

| Interest income, net | 13,059 | | | 8,375 | | | 30,068 | | | 24,720 | |

| Other income, net | 1,651 | | | 1,198 | | | 4,864 | | | 4,342 | |

| Net income (loss) before taxes | 1,001,035 | | | (91,324) | | | 823,368 | | | (256,148) | |

| Income tax expense | 53,120 | | | — | | | 53,120 | | | — | |

| Net income (loss) | $ | 947,915 | | | $ | (91,324) | | | $ | 770,248 | | | $ | (256,148) | |

| | | | | | | |

| | | | | | | |

| Net income (loss) per share - basic | $ | 16.65 | | | $ | (1.64) | | | $ | 13.58 | | | $ | (4.61) | |

| Net income (loss) per share - diluted | $ | 16.22 | | | $ | (1.64) | | | $ | 13.38 | | | $ | (4.61) | |

| Weighted-average number of common shares used in computing net income (loss) per share – basic | 56,939,403 | | | 55,803,663 | | | 56,709,318 | | | 55,559,766 | |

| Weighted-average number of common shares used in computing net income (loss) per share – diluted | 58,432,796 | | | 55,803,663 | | | 57,581,382 | | | 55,559,766 | |

Contacts:

Investor Contact

Chris Taylor, VP, Investor Relations and Corporate Communications

Agios Pharmaceuticals

IR@agios.com

Media Contact

Eamonn Nolan, Senior Director, Corporate Communications

Agios Pharmaceuticals

media@agios.com

v3.24.3

Cover

|

Oct. 31, 2024 |

| Cover [Abstract] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001439222

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 31, 2024

|

| Entity Registrant Name |

Agios Pharmaceuticals, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36014

|

| Entity Tax Identification Number |

26-0662915

|

| Entity Address, Address Line One |

88 Sidney Street,

|

| Entity Address, City or Town |

Cambridge,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02139

|

| City Area Code |

617

|

| Local Phone Number |

649-8600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.001 per share

|

| Trading Symbol |

AGIO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

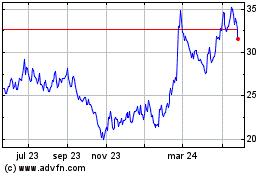

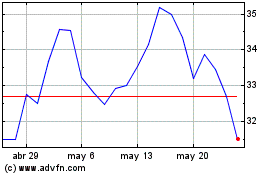

Agios Pharmaceuticals (NASDAQ:AGIO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Agios Pharmaceuticals (NASDAQ:AGIO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025