AMSC (Nasdaq: AMSC), a leading system provider of

megawatt-scale power resiliency solutions

that orchestrate the rhythm and harmony of power on the

grid™ and protect and expand the capability and

resiliency of our Navy’s fleet, today reported financial

results for its second quarter of fiscal year 2024

ended September 30, 2024. The second quarter results include

results from NWL, Inc. beginning as of the acquisition date,

August 1, 2024.

Revenues for the second quarter of

fiscal 2024 were $54.5 million compared with $34.0

million for the same period of fiscal 2023. The year-over-year

increase was primarily driven by the acquisition of NWL,

Inc., increased shipments of new energy power systems and

electrical control system shipments, versus the year ago

period.

AMSC’s net income for

the second quarter of fiscal 2024 was

$4.9 million, or $0.13 per share, compared to a net loss

of $2.5 million, or $0.09 per share, for the same period of fiscal

2023. The Company’s non-GAAP net income for the second

quarter of fiscal 2024 was $10.0 million, or $0.27 per share,

compared with a non-GAAP net income of less than

$0.1 million, or $0.00 per share, in the same period of fiscal

2023. Please refer to the financial table below for a

reconciliation of GAAP to non-GAAP results.

Cash, cash equivalents, and restricted cash

on September 30, 2024, totaled $74.8 million, compared with

$95.5 million at June 30, 2024.

"AMSC delivered fiscal second quarter net income

of nearly $5 million and grew revenue by 60% when compared to

the same period last year,” said Daniel P. McGahn, Chairman,

President and CEO, AMSC. “During the second quarter of fiscal 2024

we booked nearly $60 million of new orders, with new energy power

systems orders coming in stronger than previously demonstrated. We

ended the quarter with over $200 million in 12-month backlog and

over $300 million in total backlog. We are very excited for the

second half of the fiscal year and remain focused on our execution

as well as improving the resiliency of the power grid."

Business OutlookFor

the third quarter ending December 31, 2024, AMSC expects

that its revenues will be in the range of $55.0 million to

$60.0 million. The Company’s net loss for

the third quarter of fiscal 2024 is expected not to

exceed $1.0 million, or $0.03 per share. The

Company's non-GAAP net income (as defined below) is

expected to exceed $2 million, or $0.05 per share.

Conference Call ReminderIn

conjunction with this announcement, AMSC management will

participate in a conference call with investors beginning at 10:00

a.m. Eastern Time on Thursday, October 31, 2024, to discuss the

Company’s financial results and business outlook. Those who wish to

listen to the live or archived conference call webcast should visit

the “Investors” section of the Company’s website

at https://ir.amsc.com. The live call can be accessed by

dialing 1-844-481-2802 or 1-412-317-0675 and asking to join

the AMSC call. A replay of the call may be accessed 2 hours

following the call by dialing 1-877-344-7529 and using

conference passcode 5836897.

About AMSC (Nasdaq: AMSC)AMSC

generates the ideas, technologies and solutions that meet the

world’s demand for smarter, cleaner … better energy™. Through its

Gridtec™ Solutions, AMSC provides the engineering planning services

and advanced grid systems that optimize network reliability,

efficiency and performance. Through its Marinetec™

Solutions, AMSC provides ship protection systems and is developing

propulsion and power management solutions designed to help

fleets increase system efficiencies, enhance power quality and

boost operational safety. Through its Windtec®

Solutions, AMSC provides wind turbine electronic controls and

systems, designs and engineering services that reduce the cost of

wind energy. The Company’s solutions are enhancing the performance

and reliability of power networks, increasing the operational

safety of navy fleets, and powering gigawatts of renewable energy

globally. Founded in 1987, AMSC is headquartered near Boston,

Massachusetts with operations in Asia, Australia, Europe and North

America. For more information, please visit www.amsc.com.

AMSC, American Superconductor, D-VAR, D-VAR VVO,

Gridtec, Marinetec, Windtec, Neeltran, NEPSI, Smarter, Cleaner …

Better Energy, and Orchestrate the Rhythm and Harmony of Power

on the Grid are trademarks or registered trademarks of

American Superconductor Corporation. All other brand names, product

names, trademarks or service marks belong to their respective

holders.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended (the "Exchange Act"). Any

statements in this release regarding execution of our goals and

strategies; backlog; expectations regarding the second half of

fiscal 2024; our expected GAAP and non-GAAP financial results for

the quarter ending December 31, 2024; and other

statements containing the words "believes," "anticipates," "plans,"

"expects," "will" and similar expressions, constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements represent management's current expectations and are

inherently uncertain. There are a number of important factors that

could materially impact the value of our common stock or cause

actual results to differ materially from those indicated by such

forward-looking statements. These important factors include, but

are not limited to: We have a history of operating losses, which

may continue in the future. Our operating results may

fluctuate significantly from quarter to quarter and may fall below

expectations in any particular fiscal quarter; We have a history of

negative operating cash flows, and we may require additional

financing in the future, which may not be available to us; Our

technology and products could infringe intellectual property rights

of others, which may require costly litigation and, if we are not

successful, could cause us to pay substantial damages and disrupt

our business; Changes in exchange rates could adversely affect our

results of operations; We may be required to issue performance

bonds or provide letters of credit, which restricts our ability to

access any cash used as collateral for the bonds or letters of

credit; If we fail to maintain proper and effective internal

control over financial reporting, our ability to produce accurate

and timely financial statements could be impaired and may lead

investors and other users to lose confidence in our financial data;

We may not realize all of the sales expected from our backlog of

orders and contracts; Our contracts with the U.S. government

are subject to audit, modification or termination by the U.S.

government and include certain other provisions in favor of the

government. The continued funding of such contracts remains subject

to annual congressional appropriation, which, if not approved,

could reduce our revenue and lower or eliminate our profit; Changes

in U.S. government defense spending could negatively impact our

financial position, results of operations, liquidity and overall

business; Pandemics, epidemics or other public health crises may

adversely impact our business, financial condition and results of

operations; We rely upon third-party suppliers for the components

and subassemblies of many of our Grid and Wind products, making us

vulnerable to supply shortages and price fluctuations, which could

harm our business; Uncertainty surrounding our prospects and

financial condition may have an adverse effect on our customer

and supplier relationship; Our success is dependent upon attracting

and retaining qualified personnel and our inability to do so could

significantly damage our business and prospects; A significant

portion of our Wind segment revenues are derived from a single

customer. If this customer’s business is negatively affected, it

could adversely impact our business; Our success in addressing the

wind energy market is dependent on the manufacturers that license

our designs; Our business and operations would be adversely

impacted in the event of a failure or security breach of our or any

critical third parties' information technology infrastructure and

networks; We may acquire additional complementary businesses or

technologies, which may require us to incur substantial costs for

which we may never realize the anticipated benefits; Failure to

comply with evolving data privacy and data protection laws and

regulations or to otherwise protect personal data, may adversely

impact our business and financial results; Many of our revenue

opportunities are dependent upon subcontractors and other business

collaborators; If we fail to implement our business strategy

successfully, our financial performance could be harmed; Problems

with product quality or product performance may cause us to incur

warranty expenses and may damage our market reputation and prevent

us from achieving increased sales and market share; Many of our

customers outside of the United States may be either directly or

indirectly related to governmental entities, and we could be

adversely affected by violations of the United States Foreign

Corrupt Practices Act and similar worldwide anti-bribery laws

outside the United States; We have had limited success marketing

and selling our superconductor products and system-level solutions,

and our failure to more broadly market and sell our products and

solutions could lower our revenue and cash flow; We or third

parties on whom we depend may be adversely affected by natural

disasters, including events resulting from climate change, and our

business continuity and disaster recovery plans may not adequately

protect us or our value chain from such events; Adverse changes in

domestic and global economic conditions could adversely affect our

operating results; Our international operations are subject to

risks that we do not face in the United States, which could have an

adverse effect on our operating results; Our products face

competition, which could limit our ability to acquire or retain

customers; We have operations in, and depend on sales in, emerging

markets, including India, and global conditions could negatively

affect our operating results or limit our ability to expand our

operations outside of these markets. Changes in India’s political,

social, regulatory and economic environment may affect our

financial performance; Our success depends upon the commercial

adoption of the REG system, which is currently limited, and a

widespread commercial market for our products may not develop;

Industry consolidation could result in more powerful competitors

and fewer customers; Increasing focus and scrutiny on environmental

sustainability and social initiatives could increase our costs, and

inaction could harm our reputation and adversely impact our

financial results; Growth of the wind energy market depends largely

on the availability and size of government subsidies, economic

incentives and legislative programs designed to support the growth

of wind energy: Lower prices for other energy sources may reduce

the demand for wind energy development, which could have a material

adverse effect on our ability to grow our Wind business; We may be

unable to adequately prevent disclosure of trade secrets and other

proprietary information; Our patents may not provide meaningful or

long-term protection for our technology, which could result in us

losing some or all of our market position; There are a number of

technological challenges that must be successfully addressed before

our superconductor products can gain widespread commercial

acceptance, and our inability to address such technological

challenges could adversely affect our ability to acquire customers

for our products; Third parties have or may acquire patents that

cover the materials, processes and technologies we use or may use

in the future to manufacture our Amperium products, and our success

depends on our ability to license such patents or other proprietary

rights; Our common stock has experienced, and may continue to

experience, market price and volume fluctuations, which may prevent

our stockholders from selling our common stock at a profit and

could lead to costly litigation against us that could divert our

management’s attention; Unfavorable results of legal proceedings

could have a material adverse effect on our business, operating

results and financial condition; and the other important

factors discussed under the caption "Risk Factors" in Part 1. Item

1A of our Form 10-K for the fiscal year ended March 31, 2024, and

our other reports filed with the SEC. These important factors,

among others, could cause actual results to differ materially from

those indicated by forward-looking statements made herein and

presented elsewhere by management from time to time. Any such

forward-looking statements represent management's estimates as of

the date of this press release. While we may elect to update such

forward-looking statements at some point in the future, we disclaim

any obligation to do so, even if subsequent events cause our views

to change. These forward-looking statements should not be relied

upon as representing our views as of any date subsequent to the

date of this press release.

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except per share

data) |

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grid |

|

$ |

46,936 |

|

|

$ |

28,515 |

|

|

$ |

79,272 |

|

|

$ |

54,251 |

|

|

Wind |

|

|

7,535 |

|

|

|

5,489 |

|

|

|

15,489 |

|

|

|

10,007 |

|

| Total revenues |

|

|

54,471 |

|

|

|

34,004 |

|

|

|

94,761 |

|

|

|

64,258 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

38,858 |

|

|

|

25,418 |

|

|

|

66,923 |

|

|

|

49,390 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

15,613 |

|

|

|

8,586 |

|

|

|

27,838 |

|

|

|

14,868 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,646 |

|

|

|

1,641 |

|

|

|

4,931 |

|

|

|

3,493 |

|

|

Selling, general and administrative |

|

|

10,525 |

|

|

|

7,946 |

|

|

|

19,423 |

|

|

|

15,815 |

|

|

Amortization of acquisition-related intangibles |

|

|

433 |

|

|

|

538 |

|

|

|

845 |

|

|

|

1,076 |

|

|

Change in fair value of contingent consideration |

|

|

2,762 |

|

|

|

850 |

|

|

|

6,682 |

|

|

|

2,200 |

|

|

Restructuring |

|

|

— |

|

|

|

(20 |

) |

|

|

— |

|

|

|

(14 |

) |

|

Total operating expenses |

|

|

16,366 |

|

|

|

10,955 |

|

|

|

31,881 |

|

|

|

22,570 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(753 |

) |

|

|

(2,369 |

) |

|

|

(4,043 |

) |

|

|

(7,702 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income, net |

|

|

979 |

|

|

|

194 |

|

|

|

2,099 |

|

|

|

368 |

|

| Other expense, net |

|

|

(329 |

) |

|

|

(204 |

) |

|

|

(489 |

) |

|

|

(321 |

) |

| Loss before income tax expense

(benefit) |

|

|

(103 |

) |

|

|

(2,379 |

) |

|

|

(2,433 |

) |

|

|

(7,655 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax (benefit)

expense |

|

|

(4,990 |

) |

|

|

106 |

|

|

|

(4,796 |

) |

|

|

228 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

4,887 |

|

|

$ |

(2,485 |

) |

|

$ |

2,363 |

|

|

$ |

(7,883 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.13 |

|

|

$ |

(0.09 |

) |

|

$ |

0.07 |

|

|

$ |

(0.28 |

) |

| Diluted |

|

$ |

0.13 |

|

|

$ |

(0.09 |

) |

|

$ |

0.06 |

|

|

$ |

(0.28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

36,952 |

|

|

|

28,828 |

|

|

|

36,317 |

|

|

|

28,545 |

|

|

Diluted |

|

|

37,499 |

|

|

|

28,828 |

|

|

|

36,951 |

|

|

|

28,545 |

|

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands, except per share

data) |

|

| |

|

September 30, 2024 |

|

|

March 31, 2024 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

72,131 |

|

|

$ |

90,522 |

|

|

Accounts receivable, net |

|

|

40,059 |

|

|

|

26,325 |

|

|

Inventory, net |

|

|

70,880 |

|

|

|

41,857 |

|

|

Prepaid expenses and other current assets |

|

|

10,806 |

|

|

|

7,295 |

|

|

Restricted cash |

|

|

1,201 |

|

|

|

468 |

|

|

Total current assets |

|

|

195,077 |

|

|

|

166,467 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

38,765 |

|

|

|

10,861 |

|

|

Intangibles, net |

|

|

7,329 |

|

|

|

6,369 |

|

|

Right-of-use assets |

|

|

3,744 |

|

|

|

2,557 |

|

|

Goodwill |

|

|

48,950 |

|

|

|

43,471 |

|

|

Restricted cash |

|

|

1,454 |

|

|

|

1,290 |

|

|

Deferred tax assets |

|

|

1,201 |

|

|

|

1,119 |

|

|

Equity-method investments |

|

|

1,245 |

|

|

|

— |

|

|

Other assets |

|

|

683 |

|

|

|

637 |

|

|

Total assets |

|

$ |

298,448 |

|

|

$ |

232,771 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

25,158 |

|

|

$ |

24,235 |

|

|

Lease liability, current portion |

|

|

555 |

|

|

|

716 |

|

|

Debt, current portion |

|

|

— |

|

|

|

25 |

|

|

Contingent consideration |

|

|

— |

|

|

|

3,100 |

|

|

Deferred tax liabilities, current portion |

|

|

16 |

|

|

|

— |

|

|

Deferred revenue, current portion |

|

|

69,356 |

|

|

|

50,732 |

|

|

Total current liabilities |

|

|

95,085 |

|

|

|

78,808 |

|

| |

|

|

|

|

|

|

|

|

|

Deferred revenue, long term portion |

|

|

11,915 |

|

|

|

7,097 |

|

|

Lease liability, long term portion |

|

|

2,814 |

|

|

|

1,968 |

|

|

Deferred tax liabilities |

|

|

1,591 |

|

|

|

300 |

|

|

Other liabilities |

|

|

28 |

|

|

|

27 |

|

|

Total liabilities |

|

|

111,433 |

|

|

|

88,200 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

398 |

|

|

|

373 |

|

|

Additional paid-in capital |

|

|

1,253,168 |

|

|

|

1,212,913 |

|

|

Treasury stock |

|

|

(3,765 |

) |

|

|

(3,639 |

) |

|

Accumulated other comprehensive income |

|

|

1,509 |

|

|

|

1,582 |

|

|

Accumulated deficit |

|

|

(1,064,295 |

) |

|

|

(1,066,658 |

) |

|

Total stockholders' equity |

|

|

187,015 |

|

|

|

144,571 |

|

|

Total liabilities and stockholders' equity |

|

$ |

298,448 |

|

|

$ |

232,771 |

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(In thousands) |

|

| |

|

Six Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

2,363 |

|

|

$ |

(7,883 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operations: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

2,395 |

|

|

|

2,234 |

|

|

Stock-based compensation expense |

|

|

2,072 |

|

|

|

2,468 |

|

|

Provision for excess and obsolete inventory |

|

|

780 |

|

|

|

1,070 |

|

|

Amortization of operating lease right-of-use assets |

|

|

546 |

|

|

|

122 |

|

|

Deferred income taxes |

|

|

(5,165 |

) |

|

|

— |

|

|

Change in fair value of contingent consideration |

|

|

6,682 |

|

|

|

2,200 |

|

|

Other non-cash items |

|

|

(15 |

) |

|

|

273 |

|

|

Changes in operating asset and liability accounts: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

2,538 |

|

|

|

3,152 |

|

|

Inventory |

|

|

(6,672 |

) |

|

|

(11,935 |

) |

|

Prepaid expenses and other assets |

|

|

(2,082 |

) |

|

|

8,015 |

|

|

Operating leases |

|

|

(1,048 |

) |

|

|

(123 |

) |

|

Accounts payable and accrued expenses |

|

|

(4,455 |

) |

|

|

(9,399 |

) |

|

Deferred revenue |

|

|

18,182 |

|

|

|

8,458 |

|

|

Net cash provided by (used in) operating activities |

|

|

16,121 |

|

|

|

(1,348 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(852 |

) |

|

|

(430 |

) |

|

Cash paid to settle contingent consideration liabilities |

|

|

(3,278 |

) |

|

|

— |

|

|

Cash paid for acquisition, net of cash acquired |

|

|

(29,577 |

) |

|

|

— |

|

|

Change in other assets |

|

|

218 |

|

|

|

(10 |

) |

|

Net cash used in investing activities |

|

|

(33,489 |

) |

|

|

(440 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

Repurchase of treasury stock |

|

|

(126 |

) |

|

|

— |

|

|

Repayment of debt |

|

|

(25 |

) |

|

|

(33 |

) |

|

Cash paid related to registration of common stock shares |

|

|

(148 |

) |

|

|

— |

|

|

Proceeds from exercise of employee stock options and ESPP |

|

|

157 |

|

|

|

136 |

|

|

Net cash (used in) provided by financing activities |

|

|

(142 |

) |

|

|

103 |

|

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes on cash |

|

|

16 |

|

|

|

(10 |

) |

| |

|

|

|

|

|

|

|

|

| Net decrease in cash, cash

equivalents and restricted cash |

|

|

(17,494 |

) |

|

|

(1,695 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

|

|

92,280 |

|

|

|

25,675 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

$ |

74,786 |

|

|

$ |

23,980 |

|

|

RECONCILIATION OF GAAP NET INCOME (LOSS) TO NON-GAAP NET

INCOME (LOSS)(In thousands, except per share

data) |

|

| |

|

Three Months Ended September 30, |

|

|

Six Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income (loss) |

|

$ |

4,887 |

|

|

$ |

(2,485 |

) |

|

$ |

2,363 |

|

|

$ |

(7,883 |

) |

| Stock-based compensation |

|

|

843 |

|

|

|

1,111 |

|

|

|

2,072 |

|

|

|

2,468 |

|

| Acquisition costs |

|

|

850 |

|

|

|

— |

|

|

|

1,080 |

|

|

|

— |

|

| Amortization of

acquisition-related intangibles |

|

|

608 |

|

|

|

538 |

|

|

|

1,020 |

|

|

|

1,082 |

|

| Change in fair value of

contingent consideration |

|

|

2,762 |

|

|

|

850 |

|

|

|

6,682 |

|

|

|

2,200 |

|

| Non-GAAP net income

(loss) |

|

$ |

9,950 |

|

|

$ |

14 |

|

|

$ |

13,217 |

|

|

$ |

(2,133 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income (loss) per

share - basic |

|

$ |

0.27 |

|

|

$ |

- |

|

|

$ |

0.36 |

|

|

$ |

(0.07 |

) |

| Non-GAAP net income (loss) per

share - diluted |

|

$ |

0.27 |

|

|

$ |

- |

|

|

$ |

0.36 |

|

|

$ |

(0.07 |

) |

| Weighted average shares

outstanding - basic |

|

|

36,952 |

|

|

|

28,828 |

|

|

|

36,317 |

|

|

|

28,545 |

|

| Weighted average shares

outstanding - diluted |

|

|

37,499 |

|

|

|

28,828 |

|

|

|

36,951 |

|

|

|

28,545 |

|

|

Reconciliation of Forecast GAAP Net Loss to Non-GAAP Net

Income(In millions, except per share

data) |

| |

|

Three Months Ending |

|

| |

|

December 31, 2024 |

|

|

Net loss |

|

$ |

(1.0 |

) |

| Stock-based compensation |

|

|

2.3 |

|

| Amortization of

acquisition-related intangibles |

|

|

0.7 |

|

| Non-GAAP net income |

|

$ |

2.0 |

|

| Non-GAAP net income per

share |

|

$ |

0.05 |

|

| Shares outstanding |

|

|

38.5 |

|

Note: Non-GAAP net income (loss) is defined by the Company as

net loss before; stock-based compensation; amortization

of acquisition-related intangibles; acquisition costs; change in

fair value of contingent consideration, other non-cash or unusual

charges, and the tax effect of adjustments calculated at the

relevant rate for our non-GAAP metric. The Company believes

non-GAAP net income (loss) and non-GAAP net income (loss) per share

assist management and investors in comparing the Company’s

performance across reporting periods on a consistent basis by

excluding these non-cash, non-recurring or other charges that it

does not believe are indicative of its core operating

performance. Actual GAAP and non-GAAP net loss for the fiscal

quarter ending December 31, 2024, including the above adjustments,

may differ materially from those forecasted in the table above.

Generally, a non-GAAP financial measure is a numerical measure of a

company's performance, financial position or cash flow that either

excludes or includes amounts that are not normally excluded or

included in the most directly comparable measure calculated and

presented in accordance with GAAP. The non-GAAP

measure included in this release, however, should be

considered in addition to, and not as a substitute for or superior

to, operating income or other measures of financial performance

prepared in accordance with GAAP. A reconciliation of GAAP to

non-GAAP net loss is set forth in the table above.

AMSC ContactsInvestor Relations Contact:LHA

Investor RelationsCarolyn Capaccio(212) 838-3777amscIR@lhai.com

Public Relations Contact:RooneyPartnersJoe Luongo(914)

906-5903

AMSC Director, Communications:Nicol

Golez978-399-8344Nicol.Golez@amsc.com

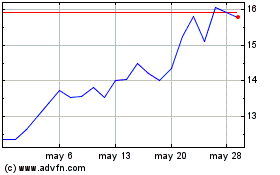

American Superconductor (NASDAQ:AMSC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

American Superconductor (NASDAQ:AMSC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024