false

0001141284

0001141284

2024-01-15

2024-01-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

January 15, 2024

Actelis Networks, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41375 |

|

52-2160309 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

4039 Clipper Court, Fremont, CA 94538

(Address of principal executive offices)

(510) 545-1045

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

ASNS |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Credit Agreement with Bank Mizrahi-Tefahot

On

January 15, 2024, Actelis Networks Israel, Ltd. (the “Company”), a wholly owned subsidiary of Actelis Networks, Inc.,

entered into a credit agreement (the “Credit Agreement”) with Bank Mizrahi-Tefahot (the “Lender”).

The Credit Agreement provides for a $1.5 million credit facility available to be used by the Company (“New Credit Facility”).

Under the New Credit Facility, which will be secured by the Company's customer invoices, the Company will pay an annual fixed fee of a

Federal SOFR rate plus 5.5% on any amount withdrawn under the New Credit Facility. The New Credit Facility expires on December 27, 2024,

subject to extension.

Under

the Credit Agreement, the Company is permitted to draw upon the New Credit Facility for so long as the following conditions continue to

be met:

| (a) | Throughout the duration of the New Credit Facility, the outstanding extended credit under it does not

exceed 80% of the aggregate amount of the open customer invoices securing the New Credit Facility; |

| (b) | customer invoices are payable within 90 days from the date of the Company’s monthly report to the

Lender; and |

| (c) | no single customer of the Company may account for open customer

invoices securing over 30% of the total borrowed amount under the New Credit Facility. |

In

addition, the Credit Agreement contains other standard affirmative and negative covenants, representations, and warranties of the Company.

Events of default under the Credit Agreement include, among other things, breaches of either the Credit Agreement or the Migdalor Loan

Agreement (as defined below).

The

foregoing description of the Credit Agreement is qualified in its entirety by reference to the full and complete terms of the Credit Agreement,

which is filed as Exhibit 4.1 to this Form 8-K and is incorporated herein by reference.

Migdalor and Lender

Agreement

Pursuant

to the terms of the loan agreement between Migdalor Business Investments Fund (“Migdalor”) and the Company, dated December

2, 2020, as amended (the “Migdalor Loan Agreement”), the Company gave Migdalor a first priority floating charge over

the Company’s customer invoices. On January 15, 2024, the Company entered into a new agreement with Migdalor whereby Migdalor agreed

to carve out from the aforesaid floating charge and allow Mizrachi to place its own first priority charge over the Company’s open

customer invoices to secure the New Credit Facility.

The

Company agreed to perform a partial early repayment of the Migdalor Loan Agreement in the amount of ILS 2,000,000 (approximately

$550,000).

The

foregoing description of the Migdalor Loan Agreement is qualified in its entirety by reference to the full and complete terms of the Migdalor

Loan Agreement, which is filed as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ACTELIS NETWORKS, INC. |

| |

|

| Dated: February 14, 2024 |

By: |

/s/ Yoav Efron |

| |

Name: |

Yoav Efron |

| |

Title: |

Chief Financial Officer |

Exhibit

4.1

*

Translated from Hebrew to english

credit

Agreement

Customer

Name: Actelis Networks Israel Ltd. (hereinafter: the “Borrower” or the “Company”,

“we”,

or any derivative word in the first person)

Date:

January 15, 2024

Company

No. 512703737

Address:

Bazal 25, Petah Tikva 4951038

Account

No.: 232483 at Bank Mizrahi-Tefahot Ltd. (429) (hereinafter: the Account)

To:

Bank Mizrahi-Tefahot Ltd. (hereinafter: the “Bank”) c.o. Re: Credit Framework

We hereby present the agreement between us regarding the credit framework

and the credit to be made available to the Company in accordance with the provisions of this agreement. In addition to the provisions

of this agreement, the terms of the credit framework and the credit made available to the Company (hereinafter: the “Credit”)

shall be subject to and in accordance with the “Account Opening Request” and/or “Account Changes” and also the

“Account Management Brochure” and “Commercial Borrower Credit Brochure” and all their appendices and amendments

that we have engaged with the Bank according to them, and also subject to any specific credit/loan agreement in which we have engaged

or will engage with the Bank (hereinafter, “Credit Documents”), and all that is stated in the Credit Documents, including

all their terms, shall apply and obligate in all matters relating to the Credit framework and the Credit.

| 1.1 | The

amount of the credit line: 1,500,000 U.S Dollars. |

The

establishment of the credit limit is conditional on the existence of all the prerequisites as detailed in Section 2 below (“Additional

Conditions”) subject to the Bank’s signature on this agreement.

All

Credit must be repaid in full by: (a) a specific date, to the extent stipulated in the credit documents; and in the absence of a specific

date or (b) until December 27, 2024 (“Expiry Of The Framework”).

| 1.2 | Credit

line for financing customer debt (the “Credit Line”) |

The

Credit Line will be usable until and no later than the expiration of the limit.

| 1.2.1 | Each

loan from the credit framework will be calculated and approved in accordance with the following

cumulative rules and conditions: |

| A. | Invoices

for payment that have not yet been paid, which the borrower issued to its external customers

(without inter-social sales) for products or services provided to them, were financed at

a rate of 80% of the amount of each invoice. |

| Actelis Networks Israel Ltd. | 11 of 1 Page |

| B. | Invoices

due no later than 90 days from the date of the report will be paid as specified in Section

1.3.3 below. |

| C. | The

financing that will be provided for all the invoices issued to a particular customer, as

calculated according to this section (the exposure to each individual customer) shall not,

at any time, exceed 30% of the total loans to finance customer debt. |

The

loan amount calculated in accordance with the above rules will be called the “Derived Amount”.

| 1.2.2 | Loan

Period. Repayment date of loans to finance customer debt the repayment time of each loan

to finance customer debt shall not exceed 3 months from the date of its placement (the “Loan

Period”). |

| 1.2.3 | Interest

Rate. Each loan will carry fixed interest at an annual rate equal to the interest rate

of SOFR (on the basis of the Loan Period) as it will be at the time of its placement + 5.5%.

The interest will be charged in advance, for the entire Loan Period. |

| 1.2.4 | Report.

The Borrower will submit to the Bank, no later than 14 days after the end of each calendar

month , a report that includes the details of the invoices for the last day of the month

previous calendar that have not yet been paid by the reporting date as well as the calculation

of the Derived Amount. The report will be made in the format accepted by the Bank in the

form of the example shown in Annex 1.2.4 to this agreement the (the “Monthly Invoice

Report”). |

| 1.2.5 | Also, together with the creation of the monthly invoice report, the

Borrower will submit a collection report in relation to all the invoices that have been financed, detailing the amounts collected in the

last month and the invoices. The reports will be signed by the Company’s CEO or its CFO. The Bank may check the calculation of the

Derived Amount, request the presentation of the invoices, as well as disqualify any of the customers and / or the invoices detailed in

the report, at its discretion. |

| 1.2.6 | The amount of loans used by the actual Borrower from within the Credit

Line shall not exceed the Derived Amount at any time. The adjustment of the actual utilization to the Derived Amount will be carried out

within five days from the date of delivery of the report through the placement of loans or their early repayment . Notwithstanding the

foregoing, it is agreed that a reduction of up to 30% in the amount of the invoices in a certain month during the Loan Period compared

to the invoice report on which the loan was based, will not constitute grounds for paying the said difference. |

| Actelis Networks Israel Ltd. | 11 of 2 Page |

| 1.2.7 | It

is clarified that the Bank will not be obligated to provide loans under the credit, unless

it has approved the customers and the calculation of the Derived Amount at its discretion. |

The

Borrower will sign all the documents required by the Bank in order to carry out what is stated in this section.

| A. | Credit allocation fee. For the Credit Limit, the account will be charged

credit allocation fee at an annual rate of 1.5% on the full amount of the limit allocated to the Borrower as stated above, starting from

the date of signing this agreement. |

The

credit allocation fee will be calculated on a daily basis and charged once per quarter, at the beginning of each calendar quarter, for

the quarter preceding it.

For

the amount of loan that was actually used by the Borrower, the Borrower will receive a full reduction of the credit allocation fee stated

above. The calculation will be made in relation to each credit applied from the day it was actually applied, on the balance used.

| B. | Document

editing fee. In the amount of 10,000 USD of which a total of USD 2,500 will be paid at the

time of signing this agreement and the balance by January 31, 2024. |

| C. | These

fees are not a substitute for the normal fees used in the Bank. |

| 3. | Prerequisites and General Conditions: |

The

establishment of the Credit Line and the credit from it will be carried out subject to the existence of all the conditions as follows:

| 3.1 | The

above Borrower signed the credit documents accepted by the Bank and on the relevant documents

required for the activity and/or the requested credit, and produced all protocols and attorney’s

approvals as accepted by the Bank. |

| 3.2.1 | The borrower provided the Bank with a written confirmation signed by

Migdalor - Business Investment Fund, Limited Partnership (“Migdalor”) and approved by the Company, Exceptions , among

other things, from the content of the encumbrance registered in favor of Migdalor the debt of the Company’s customers and confirms

a delay in taking the procedures. |

| Actelis Networks Israel Ltd. | 11 of 3 Page |

| 3.2.2 | The Company and Migdalor submitted to the Registrar of Companies a

lien amendment 17, created in its favor on 12.30.2020 and registered on 1.19.2021 which excludes the aforementioned customer debt |

| 3.3 | Capital

raising funds that the Company intends to carry out in the amount of at least 1,000,000 U.S

dollars have been deposited into the account, and this until January 1, 2024 (the “Capital

Raising”). |

| 3.4 | In

order to fully guarantee its debts and obligations, the Borrower provided the Bank with all

the following guarantees, signed a promissory note in the form accepted by the Bank and provided

all the documents, protocols and attorney’s certificates as accepted by the Bank: |

| 3.4.1 | The

Borrower created a floating lien, first in rank, without limitation in amount on all its

rights to receive funds from its customers and other debtors and a fixed first in rank lien,

without limitation in amount , in all its rights to receive funds from its customers and

other debtors listed in Appendix A to the promissory note, all as detailed in the promissory

note in the form attached as an Appendix 2. |

| 3.4.2 | The

Borrower has created a permanent lien, first in rank, with no limit on the amount of all

its funds, deposits, assets and rights in connection with the account, as well as any account

that will replace it, all as detailed in a deed of pledge of funds, deposits, assets and

rights in the account, dated June 2, 2022 registered on June 2, 2022 In the Companies Registry

as Encumbrance No. 22. |

| 3.5 | Absence of Legal Prohibition |

| 3.5.1 | There

will be no legal impediment to the provision of credit and the provision of credit will not

be contrary to the provisions of the law and/or contrary to the instructions of the supervisor

of banks (including Proper Banking Management Order No. 311 “Minimum Capital Ratio”

and Order No. 313 “Limitations on Companies of a Borrower and of a Group of Borrowers”

and /or any other provision that will replace and/or come in their place), including the

fact that it will result in exceeding the liability limits of a borrower and/or a group of

borrowers. |

| 3.5.2 | If this prerequisite is not met, and as a result it will not be possible

to provide the full credit amount from the Credit Limit, the terms of the Credit Limit will be adjusted by agreement between the Bank

and us. |

| Actelis Networks Israel Ltd. | 11 of 4 Page |

The

Borrower undertakes to submit the following reports to the Bank:

| 4.1 | The

Borrower’s annual financial statements immediately upon signing and no later than June 30

of each calendar year (or by September 30, if the Company’s articles of association

allow it). If the Borrower publishes additional consolidated or other financial statements

in Israel or abroad, audited or unaudited, the Borrower will deliver copies of them to the

Bank as soon as possible after their publication. |

| 4.2 | The

Borrower’s quarterly financial statements will be submitted to the Bank within 60 days of

the end of each calendar quarter. |

| 4.3 | The

Company will deliver to the Bank the reports specified in Section 1.2.4 above. |

| 4.4 | In

addition, the Company will provide the Bank from time to time, as required by the Bank, additional

information on the Company’s business data and financial situation. |

| 4.5 | The Borrower will notify the Bank in writing within seven (7) business

days after being informed: (a) that there has been a material change for the worse in the Borrower’s situation, resulting from a

change in its business, operations or financial situation; (b) any information that may indicate that the financial statements provided

pursuant to this letter are not accurate or correct and the information provided to the Bank by the borrower is no longer accurate in

any material respect; and (c) any material matter relating to the securities delivered and/or to be delivered to secure debts to the Bank. |

| 4.6 | The

Borrower undertakes to report to the Bank in writing as soon as it becomes aware of the occurrence

of any violation event. |

| 4.7.1 | “The

Borrower’s Financial Statements” means: |

| A. | The

Borrower’s annual financial statements when they are prepared in accordance with any law

and accepted accounting principles that include a balance sheet, a profit and loss statement,

a cash flow statement and a statement of changes in equity, including the notes thereto;

the annual statements will be audited by an auditor external, according to principles, reporting

rules and acceptable accounting regulations established and/or to be established from time

to time by the Chamber of Accountants and/or according to any law; also |

| B. | Quarterly

reports that include a balance sheet and a profit and loss statement, which are not surveyed

or audited, signed by the management. |

| 4.7.2 | “Violation

Event,” which of the events in which the Bank is entitled to immediately repay

the credit or any part of it. For the avoidance of doubt, granting a correction period, if

given in relation to the violation event, does not postpone the date or occurrence of the

violation event and the violation event will be considered as such starting from the occurrence

of the circumstances that constitute it before the lapse of the correction period and regardless

of any other passage of time. |

| Actelis Networks Israel Ltd. | 11 of 5 Page |

The

Borrower declares and undertakes to the Bank that:

| |

5.1 |

All obligations of the Borrower according to this agreement are valid obligations of the borrower, binding and enforceable on the Borrower. |

| 5.2 | The

Borrower’s signing of this agreement and its existence by the Borrower: (1) will not cause

and will not cause a breach by the Borrower of any agreement to which the Borrower is a party

and/or give any person or entity a right and/or reason to demand immediate repayment of the

Borrower’s debts and obligations; and/or (2) do not constitute and will not constitute a

violation of and/or an exception to any legal provision; and/or (3) do not cause and will

not cause a violation of any license and/or permit of the Borrower. |

| 5.3 | At

the time of signing this agreement, no event of breach has occurred or any event which, after

only a period of time or upon giving notice, or both, will constitute an event of breach. |

| 5.4 | As

of the date of signing this agreement: (a) there is no legal proceeding, claim arbitration,

litigation or administrative proceeding pending against the Borrower and to the best of the

Borrower’s knowledge, there are no such proceedings that are expected against it; (b) there

is no application for the appointment of a receiver and/or liquidator has been submitted

against it and no order has been issued against it regarding these matters, and to the best

of its knowledge no such application or order is about to be submitted against it or given

against it; and (c) they did not make a decision on voluntary dissolution. |

| 5.5 | The Borrower’s audited financial statements as of 12.31.22 (hereinafter

in this section 4.5 “The Financial Statement”) were prepared in accordance with accepted accounting rules and principles and

they faithfully, correctly, completely and accurately reflect the Borrower’s financial position, assets, debts and liabilities for

the period to which they refer. |

From the date to which the financial statements

refer to until the date of signing this agreement, the Borrower’s business was conducted in the normal course of business and no

event occurred that would materially adversely affect its business and/or financial situation and/or its assets and/or its liabilities

and/or its obligations and/or or on the Borrower’s equity.

| 5.6 | Because

the Borrower has not taken credit and/or issued guarantees upon its signature of any kind

and type to another, except for commercial guarantees in the normal course of business and

except as specified in Appendix 4.6 to this agreement. |

| Actelis Networks Israel Ltd. | 11 of 6 Page |

| |

5.7 |

The Borrower submitted on time to all the relevant tax authorities all the reports that must submit according to any law, paid on time all the taxes and other payments that they must pay or made an appropriate provision in connection with them in her books in accordance with the customary accounting rules. To the best of the Borrower’s knowledge and except as specified in the Appendix 4.7, the Borrower is not expected to incur any tax liability with the exception of taxes for which a legal provision was made if any, in the Borrower’s current financial statements. |

| |

5.8 |

Except as specified in Appendix 4.8 to this agreement, the Borrower has not entered into and is not a party to any agreement with any of its stakeholders, and there is no agreement, commitment, understanding, oral or in an agreement, on any subject between the Borrower and its stakeholders and/or entities related to the Borrower and/or to its stakeholders, they were not offered any loans by the Borrower and were not given any benefit. |

| |

5.9 |

All the information provided by the borrower to the Bank is correct and faithfully reflects the business situation of the Borrower as of the date of signing this agreement. Also, the Borrower does not have any information in connection with the Borrower, which was not brought to the Bank’s attention, and which, if it had been brought to its attention, would have caused a reasonable lender to refrain from extending credit to the Borrower and/or to result in a reasonable lender not agreeing to rely on the collateral to ensure repayment of the credit, or has the purpose of limiting in any way the ability to realize the collateral, all or any part of it. |

| 6. |

It is agreed that among the other cases in which the Bank has a reason to set the credit for immediate repayment, and in addition to them, the Bank will be entitled to set the credit for immediate repayment if any of the following events occur: |

| |

6.1 |

The Company will breach an obligation according to this agreement and/or if it turns out that any of its statements in this agreement are incorrect. |

| |

6.2 |

If Migdalor requires the borrower to prepay the Company’s debts to it, all or part of themor if legal proceedings were taken by Migdalor against the Borrower and/or if Migdalor violated its obligations to the Bank. |

| 7. |

The Bank will be entitled at any time and from time to time, immediately giving notice to the borrower, to reduce or cancel the unused credit limit and/or to postpone the provision of any credit, in whole or in part, or to delay it, all this if a violation event as defined above occurs, or if there are other conditions that require an immediate reduction or cancellation of the credit limit or in other cases permitted by law. |

| 8. |

It is clarified that in order to ensure the complete and accurate settlement of all the Borrower’s debts and obligations towards the Bank (including the credit) the Bank will stand by all collateral and guarantees of any kind and type given and/or to be given to the Bank by the Borrower and/or by any third party on its behalf. |

| Actelis Networks Israel Ltd. | 11 of 7 Page |

| 9. |

The Borrower’s rights under this agreement are not assignable or transferable in any way. |

| 10. |

All the appendices to this document form an integral part of it and everything stated in the appendices comes to complete and add to what is stated in this document. |

| 11. |

This agreement will enter into force subject to its signature by the Borrower and its return to the bank no later than __ January 2024 and subject to the Bank’s signature. |

| 12. |

In any case of conflict between the provisions of this agreement and the provisions of the credit documents, the provisions of this agreement will prevail. In any other case, the provisions of this agreement and the provisions of the credit documents will be considered to complement each other. |

Sincerely,

Actelis Networks Israel Ltd.

We confirm the above.

| Actelis Networks Israel Ltd. | 11 of 8 Page |

Agreement to Encumber

Bank

Mizrahi Tefahot Ltd

| WHEREAS | and

on 12.30.2020 Actelis Networks Israel Ltd. P.O. 512703737 (hereinafter: “the Company”) for our benefit , Migdalor

- a Business Investment Fund, Limited Partnership, lien floating first in rank , with no restriction in the amount , on all her property

, property and rights And yes, sea servitude fixed , first in rank, without limit in amount, on the issued and unpaid share capital of

the Company on its reputation, on the equipment and assets detailed in the list attached as Appendix A to the promissory note, as well

as on all of its rights to receive funds from its customers by virtue of the agreements detailed in Appendix B to the promissory note

and this to ensure its full obligations and commitments towards us. The bond was registered on January 19, 2021 in the Registrar of Companies

as a lien No. 17 ( below: ”the bond the lien in our favor“ and ”the debt”, respectively ). |

| And WHEREAS: | And

according to terms of the bond , _ Actelis is undertake any additional encumbrances without our consent the early one for that in writing

in advance; |

| and WHEREAS: |

And the company applied to us with a request to exclude from the contents of the lien in our favor all its rights to receive funds from its customers (the customer’s debt) and other debtors, in order to be able to create a first rank lien on the customer’s debt in favor of you, Bank Mizrahi Tefahot Ltd. (”the Bank”). And this is to guarantee credit, which was and/or will be offered to the company by the Bank. |

Therefore, we would like to inform you as

follows:

| 1. |

We approve the removal of the lien registered in our favor over the Customer’s debt and other obligors and the exclusion of the customer’s debt from the content of the lien in our favor. |

In addition to this letter of consent,

a letter of amendment of the bond signed by us and by the Company, which will be submitted by us to the Registrar of Companies shortly

after the company signs the lien as stated below in your favor.

| Actelis Networks Israel Ltd. | 11 of 9 Page |

For the avoidance of doubt, we hereby

confirm that in order to secure all the company’s debts and obligations to the Bank, the company may create the following liens

for the benefit of the Bank:

| |

● |

A first degree permanent lien on all the company’s rights to receive funds due and/or to be received, from time to time, to the Company by the customers and/or by the debtors listed below (hereinafter: ”the Customers”), including and without detracting from the generality of the said, all the Company’s existing and/or rights or the future, to receive funds from the Customers according to any framework agreement and/or contract for their repairs (as they may be from time to time), and/or according to a commitment and/or order, which the Company will receive from time to time, from any of the Customers or by virtue of any other document and/or commitment or additional and/or that you replace them, as well as the right to receive funds by virtue of invoices that we issue and/or that the company issues, from time to time, to Customers. |

| |

● |

A first-degree floating lien on all rights, existing and future, of any kind and type, to receive funds from all the Company’s Customers and/or other obligors and/or the Company’s insurers in connection with the above rights, due or to be due to the company pursuant to any order, service, agreement, commitment, insurance policy, contract, invoice, and any reason that exists whether it exists and/or whether it will exist in the future, as it will be from time to time. |

It is clarified that the above liens

will also apply to the rights to receive indemnity or insurance funds in respect of and request with the above rights as well as the funds

for them.

| 2. |

We undertake to inform you in writing of any event entitling us to demand from the Company the repayment of the debt. Furthermore, we undertake not to take legal action against the Company, except after a period of three months from the date of sending such notice as mentioned, unless the third party, the Company, or you have taken action against the Company in insolvency proceedings or debt enforcement proceedings. |

| 3. |

In addition, for the avoidance of doubt, we agree that the pledge registered under No. 22 in the Companies Registry on June 26, 2022, for the benefit of the Bank, shall serve as security for all the obligations and commitments of the Company to the Bank. |

| Actelis Networks Israel Ltd. | 11 of 10 Page |

| 4. | Our consent is given on the condition that you will also be able in

the future to create securities for our benefit of any kind, without the need for the Bank’s approval (except for anything related

to assets encumbered for the benefit of the Bank), and with your approval in the margins of this agreement. |

| 5. | Except

as stated above, our consent herein does not diminish or impair any arrangements that the

Company has made for our benefit or its obligations towards us. |

| |

Sincerely, |

| |

|

| |

Migdalor - Business Investment Fund Limited Partnership |

To:

Migdalor - Business Investment Fund, Limited Partnership

Bank

Mizrahi Tefahot Ltd

We

confirm that we have read the aforementioned consent letter and we agree to its contents

| |

Sincerely,

|

| |

|

| |

Actelis Networks Israel Ltd. |

| Actelis

Networks Israel Ltd. |

11

of 11 Page |

Exhibit 10.1

| * | TRANSLATED FROM HEBREW

TO ENGLISH |

FIXED LIEN AGREEMENT

Bank Mizrahi Tefahot Ltd.

WHEREAS, on 12.30.2020 Actelis Networks Israel

Ltd. P.O. 512703737 (“the Company “) created, for the benefit of Migdalor Business Investments Fund, a limited partnership (“us”

or “Migdalor”), a floating lien, first in rank, with no restriction in the amount, on all the Company’s property, without limit

in amount, on the issued and unpaid share capital of the Company, on its reputation, on the equipment and assets detailed in the list

attached as Appendix A in connection with a promissory note, as well as on all of its rights to receive funds from its customers

by virtue of the agreements detailed in Appendix B to such promissory note and this to ensure its full obligations and commitments

towards us. The bond was registered on January 19, 2021 in the Registrar of Companies of Israel as a lien No. 17.

WHEREAS, and according to terms of the bond

the Company may not incur additional collateral without advance consent from Migdalor; and

WHEREAS, the Company wishes to request from

Migdalor to exclude certain contents of the lien in our favor all its rights to receive funds from its customers (the “Customer’s

Debt”) and other debtors, in order to be able to create a first rank lien on the Customer’s Debt in favor of Bank Mizrahi Tefahot

Ltd. (“the Bank”).

NOW, THEREFORE, we would like to inform you as follows:

1. Migdalor

approves the removal of the lien registered in our favor over the Customer’s Debt and other obligors and the exclusion of the Customer’s

Debt from the content of the lien in our favor.

In addition to this letter of consent, a letter of

amendment of the bond signed by us and by the Company, which will be submitted by us to the Registrar of Companies shortly after the Company

signs the lien as stated below in your favor.

For the avoidance of doubt, we hereby confirm that

in order to secure all the Company’s debts and obligations to the Bank, the Company may create the following liens for the benefit of

the Bank:

| ● | A first degree permanent lien on all the Company’s

rights to receive funds due and/or to be received, from time to time, to the Company by the customers and/or by the debtors listed below

(“the Customers”), including and without detracting from the generality of the said, all the Company’s existing and/or

rights or the future, to receive funds from the Customers according to any framework agreement and/or contract for their repairs (as

they may be from time to time), and/or according to a commitment and/or order, which the Company will receive from time to time, from

any of the Customers or by virtue of any other document and/or commitment or additional and/or that you replace them, as well as the

right to receive funds by virtue of invoices that we issue and/or that the company issues, from time to time, to Customers . |

| ● | A first-degree floating lien on all rights, existing and

future, of any kind and type, to receive funds from all the Company’s Customers and/or other obligors and/or the Company’s

insurers in connection with the above rights, due or to be due to the company pursuant to any order, service, agreement, commitment ,

insurance policy, contract, invoice, and any reason that exists whether it exists and/or whether it will exist in the future, as it will

be from time to time. |

It is clarified that the above liens will also apply

to the rights to receive indemnity or insurance funds in respect of and request with the above rights as well as the funds for them.

2. We undertake

to inform you in writing of any event entitling us to demand from the Company the repayment of the debt. Furthermore, we undertake not

to take legal action against the Company, except after a period of three months from the date of sending such notice as mentioned, unless

the third party, the Company, or you have taken action against the Company in insolvency proceedings or debt enforcement proceedings.

3. In addition,

for the avoidance of doubt, we agree that the pledge registered under No. 22 in the Companies Registry on June 26, 2022, for the benefit

of the Bank, shall serve as security for all the obligations and commitments of the Company to the Bank.

4. Our consent

is given on the condition that you will also be able in the future to create securities for our benefit of any kind, without the need

for the Bank’s approval (except for anything related to assets encumbered for the benefit of the Bank), and with your approval in the

margins of this agreement.

5. Except

as stated above, our consent herein does not diminish or impair any arrangements that the Company has made for our benefit or its obligations

towards us.

| |

Sincerely, |

| |

|

| |

Migdalor Business Investments Fund, a limited partnership |

To:

Migdalor Business Investments Fund, a limited partnership

Bank Mizrahi Tefahot Ltd

We confirm that we have read the aforementioned consent

letter and we agree to its contents

| |

Sincerely, |

| |

|

| |

Actelis Networks Israel Ltd. |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

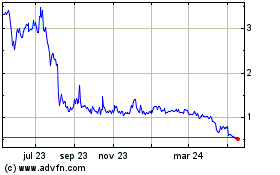

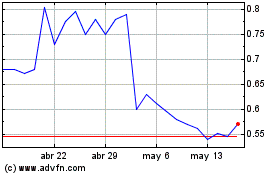

Actelis Networks (NASDAQ:ASNS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Actelis Networks (NASDAQ:ASNS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024