Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

24 Octubre 2022 - 8:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2022

Commission

File Number: 001-36582

Altamira

Therapeutics Ltd.

(Exact

name of registrant as specified in its charter)

Clarendon

House,

2

Church Street

Hamilton

HM11, Bermuda

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

☐ No ☒

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes

☐ No ☒

On

October 24, 2022, Altamira Therapeutics Ltd. (the “Company”) announced that it will effect a 1-for-20 reverse share split

of its common shares. The Company anticipates that the reverse share split will be effective upon commencement of trading on the Nasdaq

Capital Market on October 25, 2022.

The

reverse share split was previously approved by the Company’s Board of Directors in accordance with Bermuda law. The reverse share

split will consolidate every 20 common shares into one common share, par value CHF 0.20 per share. As a result of the reverse share split,

the number of common shares outstanding will be reduced from approximately 21.5 million to approximately 1.1 million common shares, subject

to rounding down of all fractional shares to the nearest whole share and the payment to shareholders of cash in lieu of such fractional

shares. Shareholders who otherwise would be entitled to receive fractional shares because they hold a number of common shares not evenly

divisible by the 1-for-20 ratio will be entitled to receive cash in an amount equal to the product obtained by multiplying (i) the closing

price of our common shares on the business day immediately preceding the effective date of the reverse share split as reported on the

Nasdaq Capital Market by (ii) the number of common shares held by the shareholder that would otherwise have been exchanged for the fractional

share interest. No interest will be paid on any cash amount representing fractional shares between the effective date of the reverse

share split and the date of payment. In respect to the underlying common shares associated with any derivative securities, such as warrants

and options, the conversion and exercise prices and number of common shares issuable generally will be adjusted in accordance with the

1:20 ratio. The number of authorized common shares will be reduced to 5,000,000 common shares, par value CHF 0.20 per share. The number

of authorized preference shares of the Company will remain at 20,000,000 shares, and the par value thereof will remain CHF 0.02 per share.

No preference shares of the Company are currently issued and outstanding.

The

Company’s transfer agent, American Stock Transfer & Trust Company, LLC (“AST”), will also act as exchange agent

for the reverse share split. The Company understands from AST that all shareholders on AST’s records are book entry holders. As

such, book entry shareholders will not need to take any action in the reverse share split process. After the reverse share split takes

effect, shareholders that currently hold common shares in book entry form will receive updated statements of holding reflecting their

holdings referencing the reverse share split.

The

Company intends to treat shareholders holding common shares in “street name” (that is, held through a bank, broker or other

nominee) in the same manner as shareholders of record whose common shares are registered in their names. Banks, brokers or other nominees

will be instructed to effect the reverse stock split for their beneficial holders holding our common shares in “street name;”

however, these banks, brokers or other nominees may apply their own specific procedures for processing the reverse stock split.

The

Company’s common shares will begin trading on a split-adjusted basis when the market opens on October 25, 2022. The Company’s

common shares will continue to trade on the Nasdaq Capital Market under the symbol “CYTO” and under a new CUSIP number, G0360L209.

INCORPORATION

BY REFERENCE

This

Report on Form 6-K shall be deemed to be incorporated by reference into the registration statements on Form F-3 (Registration Numbers

333-228121, 333-249347, 333-261127 and 333-264298) and Form S-8 (Registration Numbers 333-232735 and 333-252141) of Altamira Therapeutics

Ltd. (formerly Auris Medical Holding Ltd.) and to be a part thereof from the date on which this report is filed, to the extent not superseded

by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Altamira

Therapeutics Ltd. |

| |

|

|

|

| |

By: |

/s/

Marcel Gremaud |

| |

|

Name: |

Marcel

Gremaud |

| |

|

Title: |

Chief

Financial Officer |

| |

|

|

|

| Date:

October 24, 2022 |

|

|

|

2

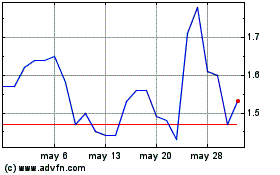

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025